Should You Buy or Sell GE Stock Ahead of the 1:8 Reverse Split?

GE has outperformed the markets in 2021. What’s the forecast for GE stock and should you buy or sell before the reverse stock split?

July 29 2021, Published 1:02 p.m. ET

General Electric (GE) announced a reverse stock split that will come into effect on July 30. The stock will trade on a split-adjusted basis on Aug. 2. The stock has outperformed the markets in 2021 — so, what’s the forecast for GE stock in 2021 and should you buy or sell before the reverse stock split?

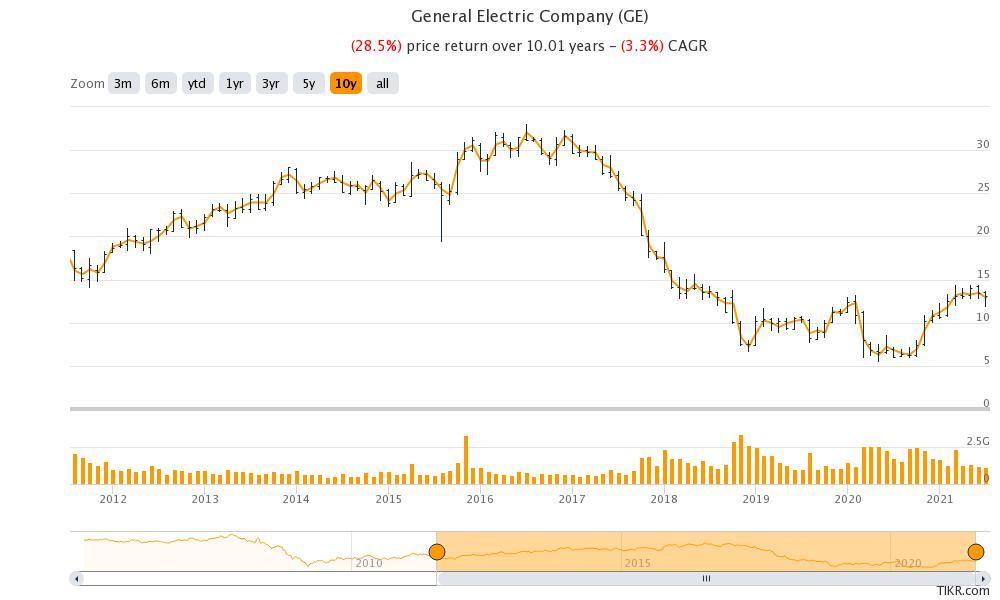

While GE has outperformed the S&P 500 in 2021, the long-term picture has not been good for the stock. GE shares have fallen 58 percent over the last five years. The stock has delivered a negative CAGR of 3.3 percent over the last 10 years.

Warren Buffett sold his GE shares in 2017

In 2017, Warren Buffett, who usually has “diamond hands,” also exited GE stock. He invested in the company at the height of the global financial crisis in October 2008. However, the Oracle of Omaha sold the shares after almost nine years. Later, he advised the company to deleverage.

GE stock has underperformed

GE has been taking several measures to deleverage and has been exiting non-core assets under CEO Larry Culp. From too much diversification, the company now wants to focus on some key businesses.

Why GE is going for a reverse stock split now.

Usually, companies do a reverse stock split when their stock price falls too low and falls below the minimum listing threshold. Also, like Ashford Hospitality (AHT) recently did, companies do a reverse stock split to escape the tag of penny stock, which the SEC classifies as the stock price below $5.

As for GE, neither is the case. Nevertheless, despite being an industrial powerhouse with a market cap in excess of $100 billion, GE stock trades in the low teens, which looks unbecoming for the company. That said, while the reverse stock split would inflate the stock price, it doesn't change anything fundamentally for the company.

GE stock forecast

GE has a median target price of $15, according to the estimates compiled by CNN Business, which implies an upside of 12.8 percent over the next 12 months. The stock has 13 buy and eight hold ratings.

On July 28, Citi reiterated its buy rating on GE stock. “With Aviation end markets continuing to show signs of recovery underway, we see increasing visibility to ongoing growth runway for GE in ’21 and beyond and are also encouraged by upside revenue/profitability in Power vs. our model that we view as a good sign that long-term operational improvements in the business appear to be gaining traction,” it said in its release.

GE released its Q2 2021 earnings earlier this week which were ahead of estimates. The company also raised its guidance for 2021. The company posted positive free cash flows in the quarter while analysts were expecting it to burn cash. For 2021, it increased the free cash flow guidance to $3.5-$5 billion.

Should you buy or sell GE stock before the reverse merger?

The reverse stock split can have a short-term impact on GE stock. However, looking at the medium-term picture, the outlook for GE stock looks positive. The company’s aviation segment should see a rebound as air travel picks up. While leisure travel has recovered to a great extent, business travel is still sagging.

Also, the continuous stimulus and the resultant economic recovery in the US bodes well for industrial names like General Electric. The company is a good bet on the industrial recovery at the macro level. At the company-specific level, it is a good turnaround play. The valuations also look reasonable with an NTM (next-12 months) enterprise value-to-EBITDA multiple of 18.3x.