Should You Buy or Sell GE Stock Ahead of the Spin-Off?

GE is splitting into three unique companies. Here's what that means for your investment. Is GE stock a buy or sell?

Nov. 10 2021, Published 12:06 p.m. ET

General Electric Company (NYSE:GE) is poised to break into three distinct companies. Following the news, there hasn't been a shortage of trading activity for GE stock on the public market. For some, the answer of whether to buy, hold, or sell your stake feels cloudy.

Here's what the spin-off means for investors and whether you should load up on GE stock or exit your position.

What's going on with the GE spin-off, explained

In July, GE conducted a 1:8 reverse stock split. The move inflated the value of each individual stock and simultaneously lowered the number of outstanding shares in the market at a one-to-eight ratio.

Looking back, that corporate event is nothing compared to what's happening with GE stock now. The home appliance and electronics company is splitting its conglomerate into three distinct companies that will operate in their own sectors.

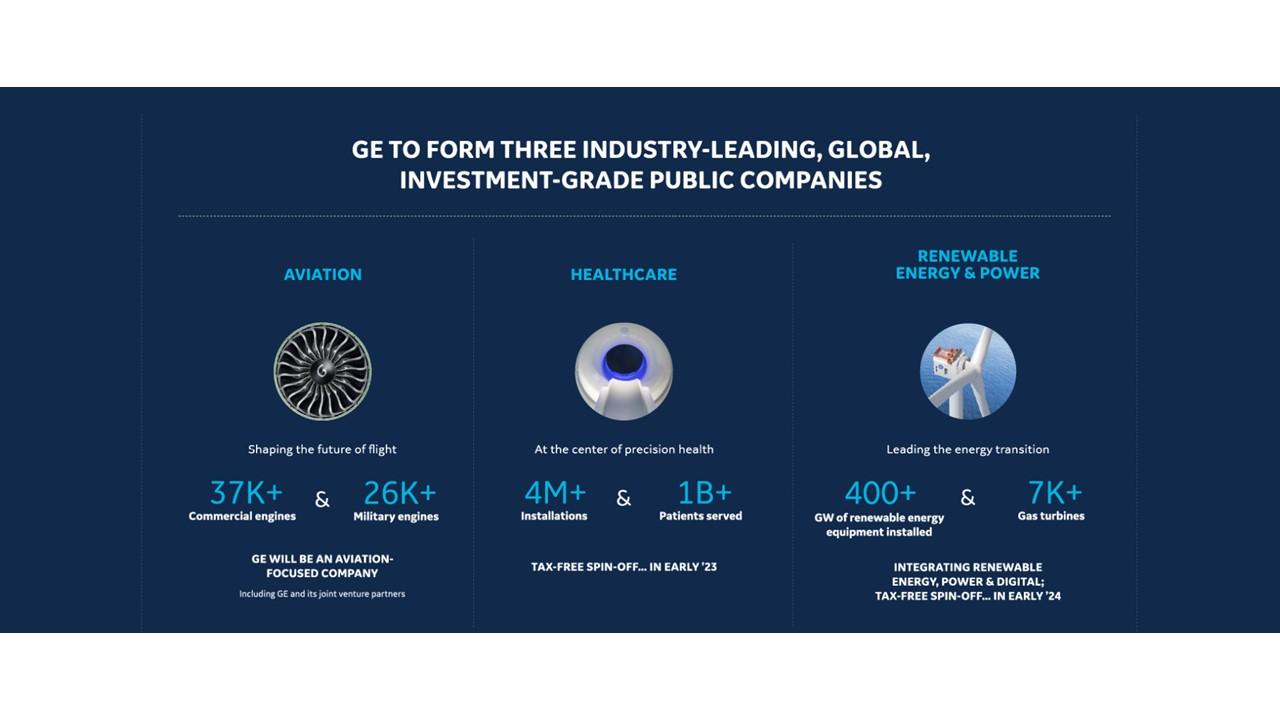

GE's upcoming energy business will focus on renewable energy, fossil-fuel power, and digital units. A healthcare company will also spin off. Meanwhile, an aviation company will keep the GE name.

When is GE completing the spin-off?

GE will begin its series of tax-free spin-offs in 2023, starting with the healthcare unit. The company hopes to launch the energy unit in 2024, while the remaining GE business will start operating as an aviation business.

What will happen to GE shares after the company spins off?

GE shareholders have contributed to the company's $121.52 billion market cap over the last four decades as the stock has continued to operate on the public market. The stock hasn't been able to beat its peak from 2000 when the shares were trading around $480 a pop.

As of Nov. 10, the stock is at $110.63 a few months out of a 1:8 reverse stock split that brought the security up from a market value in the teens.

Following the spin-off news, GE stock rose nearly 6 percent before faltering off approximately 3.5 percent. Still, GE shares are solidly in the green for the month with a 6.3 percent increase.

Once the spin-offs actually go into effect, shareholders will transition to owning an equivalent position in the new company. However, the new GE (operating as the aviation arm) will have a markedly lower book value.

Is it smart to sell GE stock ahead of the spin-offs?

Experts expect GE stock to drop dramatically during both spin-offs, one in 2023 and one in 2024. This is because the stock's book value will decrease. While investors can choose to invest in up to all three companies once they're officially spun off, the route there could be bumpy.

However, some experts say that the value of GE's individual operations is on the up-and-up, with the aviation unit set to increase revenue growth by 20 percent YoY next year. As for the electric arm, the fiscal 2022 net income is estimated to reach $4.36 billion (or double that of 2021 income). With that in mind, some experts say that investors should hold on.

Should you buy GE stock?

Holding on to a subset of GE shares could be beneficial for an otherwise liquid investor, but buying additional stock might not be necessary. Growth or not, turbulence lies ahead.