General Electric Co

Latest General Electric Co News and Updates

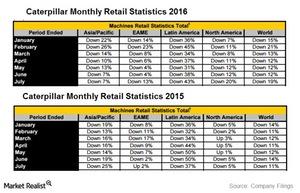

Investors Shouldn’t Expect Near-Term Optimism from Caterpillar

Caterpillar (CAT) released its retail statistics for July on a three-month rolling basis on August 18. However, Caterpillar’s retail sales fell in July.

How 3M Company’s Acquisition Strategy Has Changed

3M Company’s (MMM) acquisition strategy for the last ten years can be classified as “BI” (before Inge) and “AI” (after Inge).

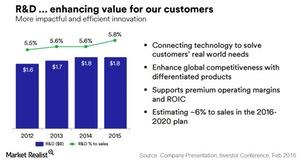

What Are the Financial Objectives of 3M Company’s 5-Year Plan?

In February 2016, 3M Company (MMM) set financial objectives for the five-year period from 2016 to 2020 that were slightly below its previous expectations.

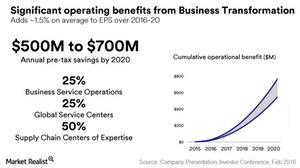

What Strategy Is 3M Company Using to Increase Cost Savings?

Realizing that its capital structure was sub-optimal and was leading to a high cost of capital, 3M Company started adding leverage.

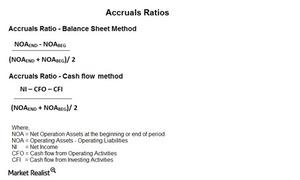

How Good Is the Quality of 3M Company’s Earnings?

3M Company’s (MMM) accruals ratios using the balance sheet and the cash flow methods rose considerably in 2015.

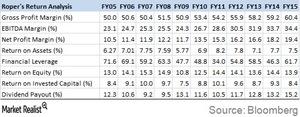

Understanding Roper Technologies’ Business Transformation

Roper Technologies’ Industrial Technology segment’s revenue stood at 21% of its sales in 2015. This segment’s revenue was 41% of its sales in 2014.

3M Consumer Products: Your Everyday Kitchen and Office Companions

3M Company’s (MMM) Consumer Solutions segment is made up of four diverse businesses, which garnered a combined annual revenue of $4.4 billion in 2015.

What Strengths Differentiate 3M Company from the Competition?

3M Company is generating a massive 30%–32% of its annual revenue from products it’s introduced in the last five years.

How 3M Company Differs from Other Industrial Conglomerates

While 3M’s peer group includes industrial conglomerates such as Honeywell and General Electric, these companies hardly share any similarities with 3M.

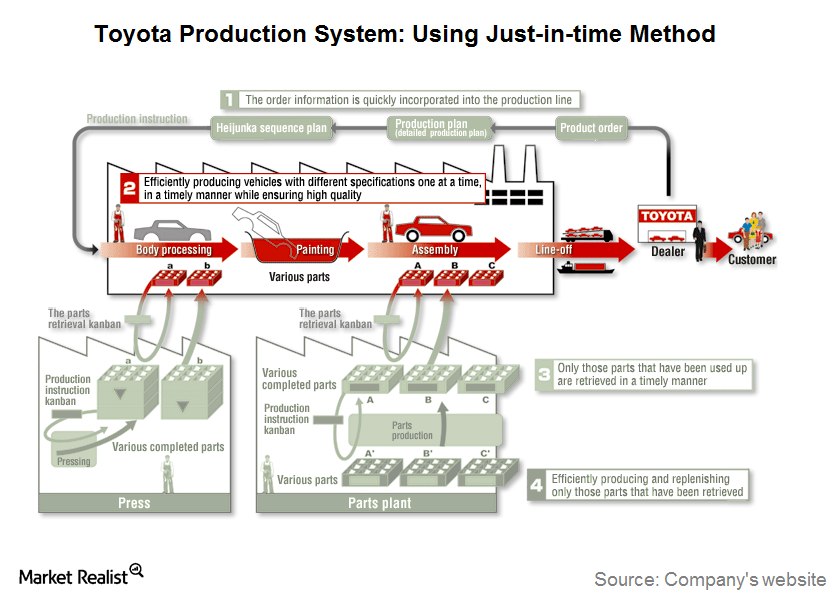

Why Toyota’s Just-in-Time Method Is Critical to Its Success

Toyota began using the Just-in-Time method in 1938. However, the true potential of this strategy was realized when it integrated this strategy with TPS.

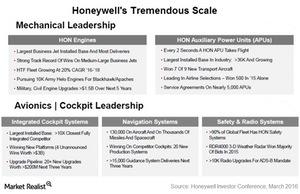

Essentials of the SaaS Business Model in Honeywell’s ACS Unit

Honeywell’s ACS unit uses the software-as-a-service (or SaaS) business model. In the SaaS model, software is licensed on a subscription basis to users.

Understanding Dover Corporation’s Corporate Profile and History

Dover Corporation (DOV) is a machinery manufacturer that operates in four diverse segments: Energy, Engineered Systems, Fluids, and Refrigeration & Food Equipment.

Honeywell Operating System: From ‘Honey Hell’ to Honeywell

David Cote, who took over as chairman and CEO of Honeywell, helped shape the Honeywell Operating System (or HOS) for production, which integrated several management theories.

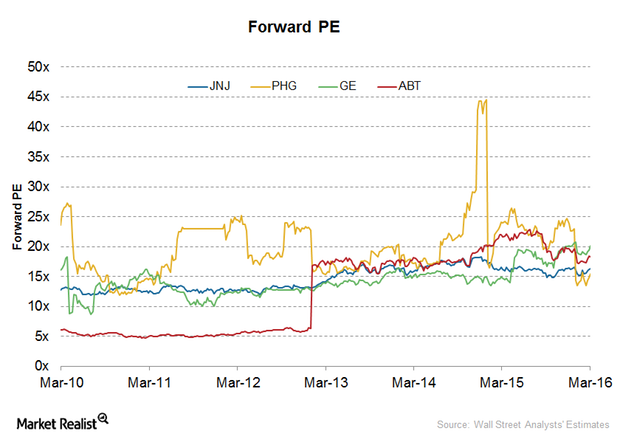

How Do Johnson & Johnson’s Valuations Compare to Peers?

On March 17, 2016, Johnson & Johnson (JNJ) was trading at a forward PE (price-to-earnings) multiple of ~16.5x compared to the industry average of ~19.6x.

A Closer Look at Honeywell Aerospace’s Business Model

Honeywell has an installed base of 6,000 integrated cockpits, which is ten times greater than the next competitor.

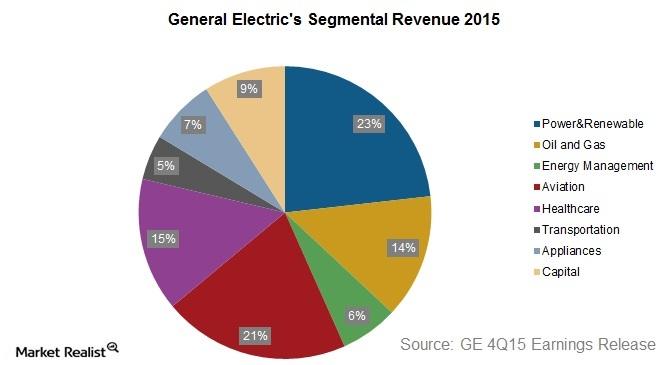

Why General Electric Is Focusing on Industrials?

Originally incorporated in 1892, General Electric is one of the largest and most diversified industrials and financial services corporations in the world.

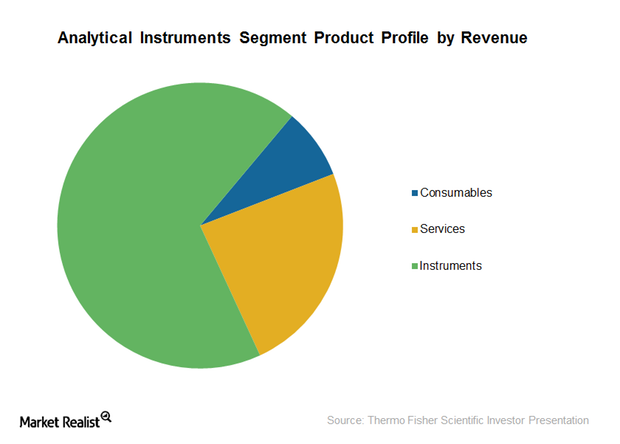

Thermo Fisher Scientific’s Analytical Instruments Business Segment

Thermo Fisher Scientific’s Analytical Instruments segment earned revenues of ~$3.3 billion in 2014, representing organic growth of around 4%.

History of Comcast

In 1969, American Cable Systems was renamed Comcast Corporation.

How Comcast Acquired NBCUniversal

The advertising revenues for Comcast’s NBCUniversal Cable Networks and Broadcasting Television segment are susceptible to advertising cyclicality and program ratings.

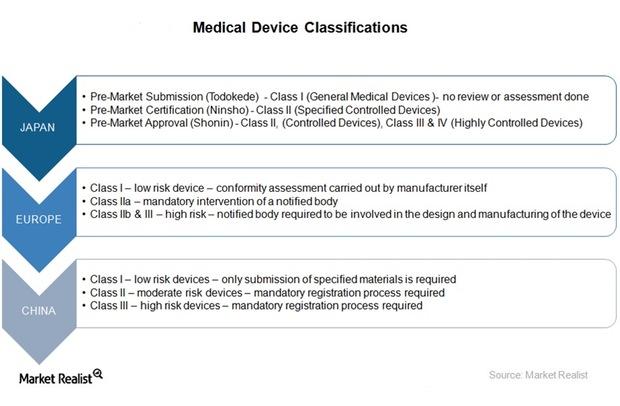

What Are the Medical Device Approval Processes in Major Markets?

In most countries, the approval process varies across different categories of devices classified as per their risk profiles.

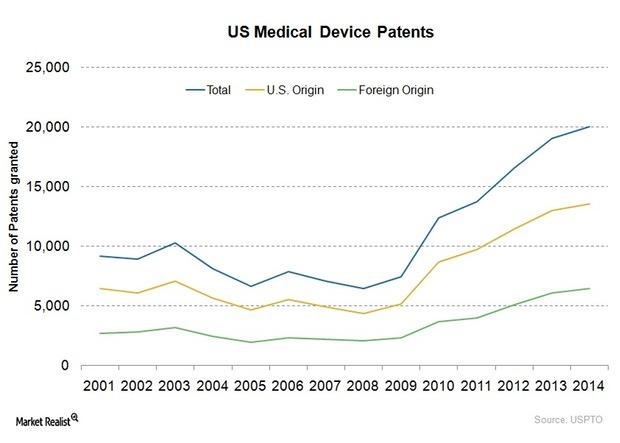

Why Are Patents Necessary for Medical Device Companies?

Medical device companies are driven by innovation and inventions that involve high research and development (or R&D) costs.

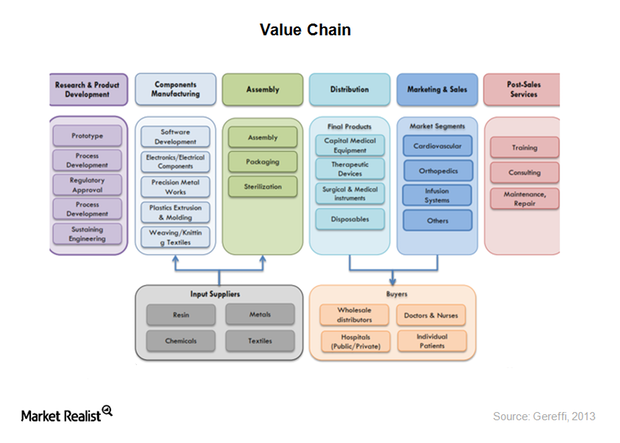

Analyzing Value Chain and Business Models in Medical Device Industry

The US medical device industry has been working on traditional business models based on R&D and innovation where physicians have been the target audience.

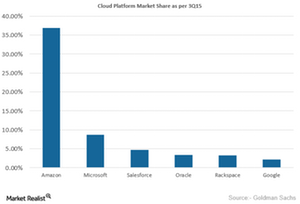

Can AWS and Microsoft Reach 50% Market Share in the Cloud?

Amazon has outperformed the big technology giants in cloud computing, whereas Microsoft is tightening its grip on the cloud market by leveraging Azure.

A Must-Read Overview of the Medical Device Industry

The US medical device market is projected to grow at a compound annual growth rate of 6.1% between 2014 and 2017.

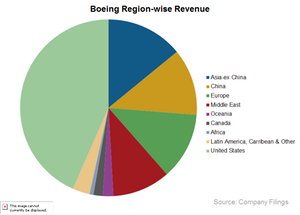

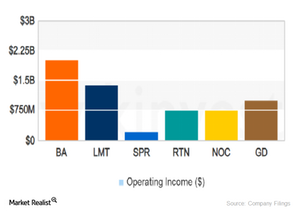

Boeing: A Wide Diversification Wingspan

When Boeing bought McDonnell Douglas in 1996, the acquisition helped Boeing overtake Lockheed Martin as the largest defense contractor.

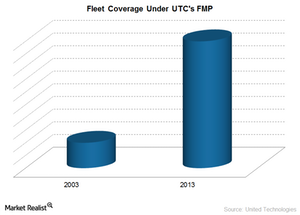

How Did UTC Improve Its Aftermarket Business?

Pratt & Whitney (UTX) originally focused only on selling airplane engines and spare parts. It covered only 10% of its engines under its aftermarket program.

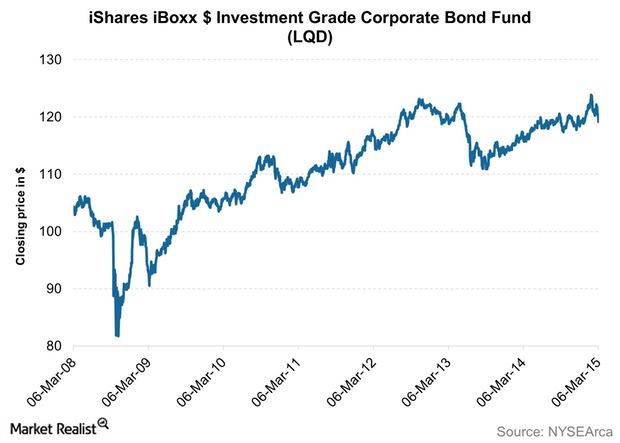

What are investment-grade bonds?

Investment-grade bonds are both U.S. Treasuries issued by the U.S. Treasury Department and corporate bonds issued by high-quality corporate borrowers.

Boeing – a leader in the aerospace industry

Boeing (BA) is one of the world’s largest aerospace companies. The company is a top US exporter. It’s focused on innovation.

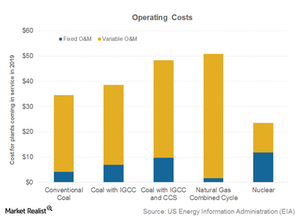

Nuclear power plants are cheaper to operate

Nuclear power plants have the lowest variable costs among the three fuel types, at $11.8 per MWh (for plants coming online in 2019).

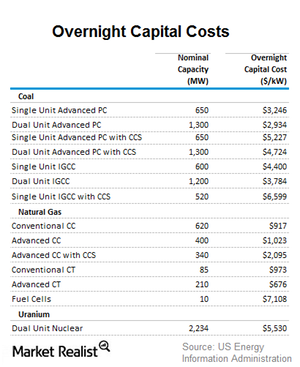

Natural gas–fired power plants are cheaper to build

Natural gas–fired power plants are clearly the cheapest to build due to lower land requirements and faster, cheaper construction.

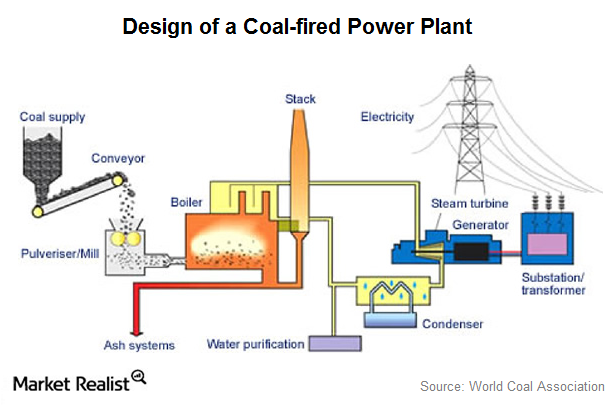

Industry structure analysis: Coal-fired power generation equipment

Coal (KOL) has fired much of the development in the US and other OECD economies in the 20th century. It’s firing growth in economies like China and India.

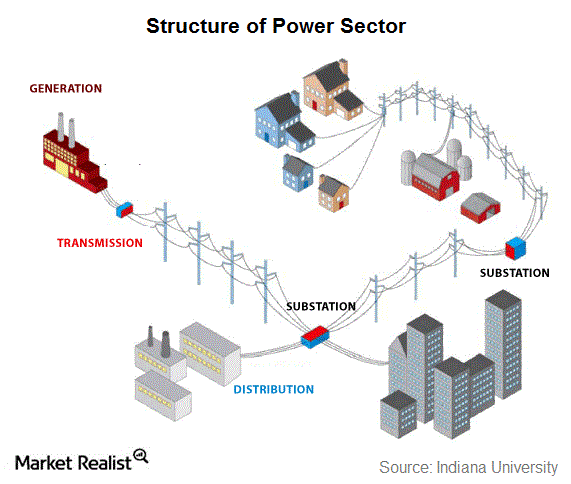

Understanding the structure of the global power sector

While the power sector differs country by country, the operational structure of the sector across the world is pretty much the same.

Boeing’s competitive advantages

One of Boeing’s competitive advantages is that it enjoys strong relations with many companies, even its competitors.

Overview: The four major components used for calculating the GDP

While calculating the GDP estimate, the Bureau first takes into account the sum of an individual’s personal consumption expenditures, that is, durable goods, non-durable goods, and services.Industrials The ADP jobs report: A must-know guide for ETF investors

The ADP National Employment Report (also popularly known as “the ADP Jobs Report” or “ADP Employment Report”) is a monthly report summarizing the employment situation.Industrials Must-know: Do credit spreads only represent credit risk?

While credit spreads do give you a good picture of the credit risk of one bond compared to another, it’s not the only factor they represent.

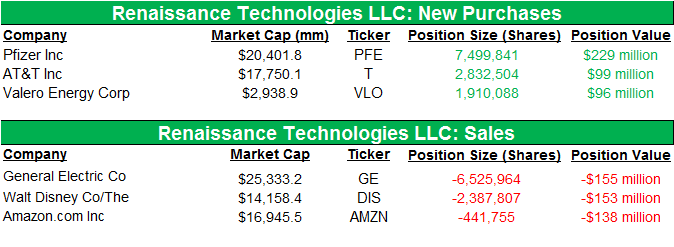

Renaissance Technologies’ 4Q13 positions in Disney and more

The fund initiated positions in Pfizer Inc. (PFE), AT&T Inc. (T), and Valero Energy Corp. (VLO). It sold stakes in General Electric Co. (GE), The Walt Disney Co. (DIS), and Amazon.com Inc. (AMZN).

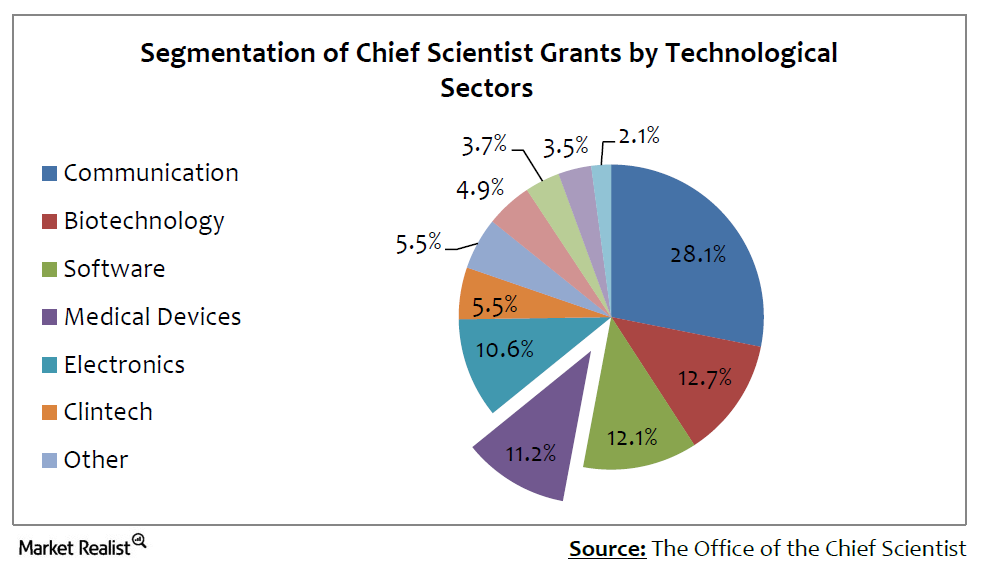

Why Israel is poised to soon lead medical device industry growth

Espicom Business Intelligence forecasts the Israeli market to be valued at $1.096 billion in 2016—a 20% increase over five years. The country looks to the medical device industry for a significant amount of growth.