Wynn Resorts: A revenue breakdown

Wynn Resorts (WYNN) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations.

Nov. 27 2019, Updated 5:19 p.m. ET

Revenue breakdown

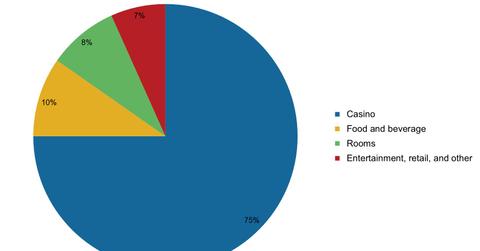

Wynn Resorts (WYNN) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations. Below is a detailed breakdown of the company’s revenue.

Casino revenues

Casino revenues are measured by the aggregate net difference between gaming wins and losses. The above chart shows that Wynn Resorts’ casino revenues represent 75% of the total revenues generated by Wynn Resorts for the trailing 12 months (or TTM) ending September 30, 2014. Wynn Resorts’ gross margin in the casino business is 38% for the TTM. Gross margin in the casino business for companies like Caesars Entertainment (CZR) and MGM Resorts (MGM) is 41% and 38%, respectively.

Hotel room revenues

Hotel room revenues represent 8% of Wynn Resorts’ total revenues, as shown in the above chart. Gross margins for room revenues were 73% for the TTM ending September 30, 2014. This means Wynn Resorts is more profitable in the hotel business compared to other operations. Performance indicators in the hotel industry are occupancy rate, average daily room rate (or ADR), and revenue per available room (or RevPAR). RevPAR is ADR times the occupancy rate. Wynn Resorts’ recorded occupancy rate was 98.3% in Macau hotels with ADR and RevPAR of $333 and $327, respectively, in 2014 year-to-date. Occupancy rate for Wynn Resorts’ Las Vegas operations stood at 88.5% with ADR and RevPAR of $275 and $243, respectively, in the same period.

Food and beverage revenues

Wynn Resorts’ food and beverage revenues contribute 10% of the total revenues generated for the TTM ending September 30, 2014. Gross margin on Wynn Resorts’ food and beverage products stood at 44% in the same period. Wynn Resorts’ Las Vegas resorts consist of 34 food and beverage outlets.

Investors willing to hold a diversified portfolio in casino companies may invest in exchange-traded funds (or ETFs) like Consumer Discretionary Select Sector Standard and Poors depositary receipt (or SPDR) fund (XLY) and VanEck Vectors Gaming (BJK).