Caesars Entertainment Corp

Latest Caesars Entertainment Corp News and Updates

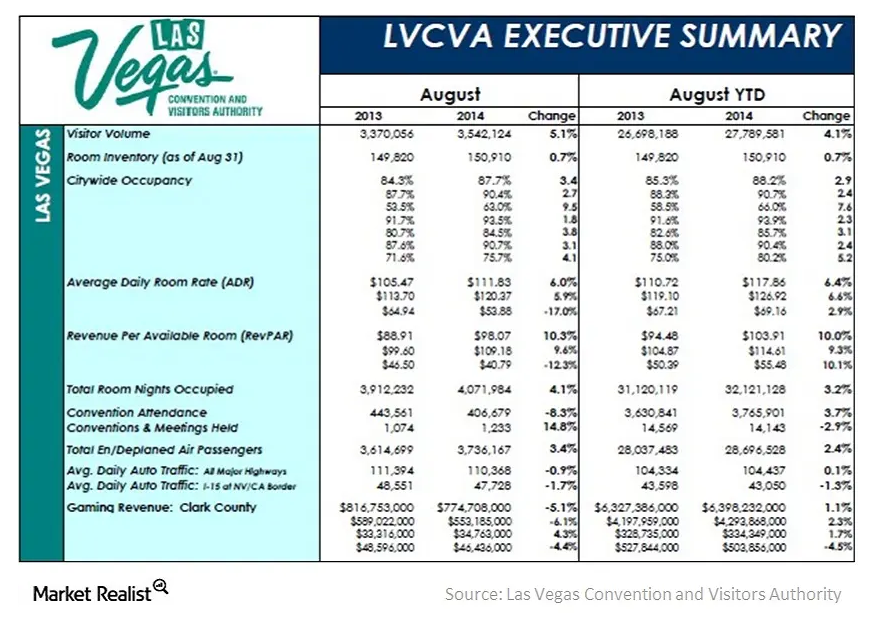

Must-know: Important performance metrics for casino resorts

The occupancy rate is very important for casino resorts. The occupancy rate shows the relationship between the number of occupied rooms and the total number of rooms.

Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

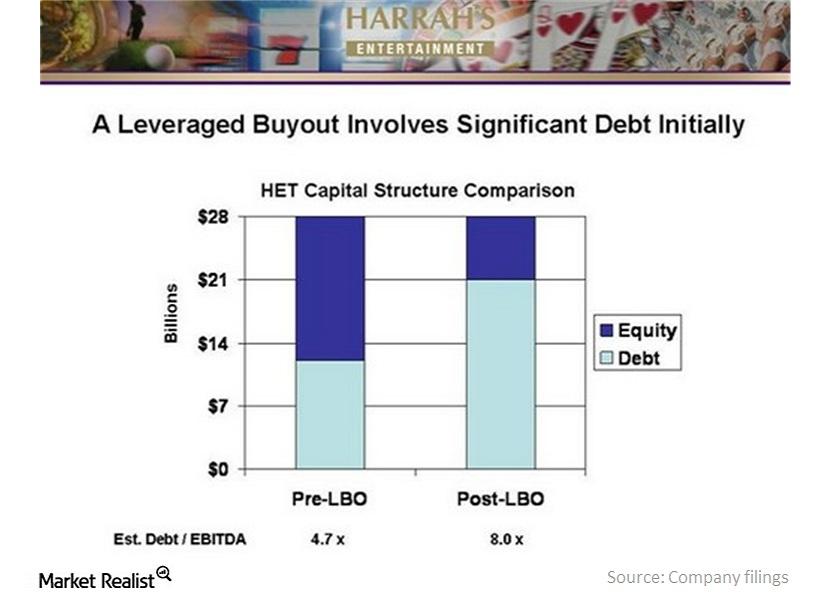

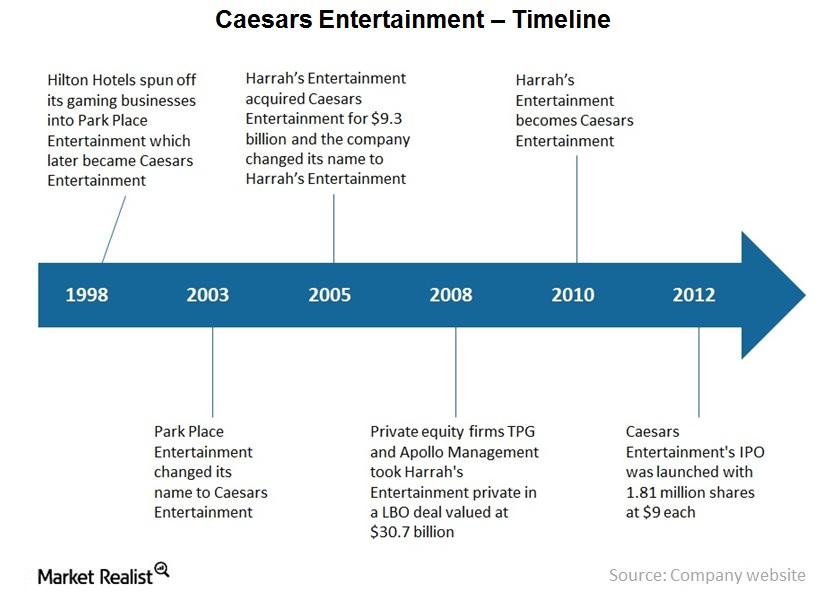

Why Caesars Entertainment has a massive $24 billion debt

Texas Pacific Group and Apollo Management took Harrah’s Entertainment, now Caesars Entertainment, private in a leveraged buyout deal valued at $30.7 billion in 2008.

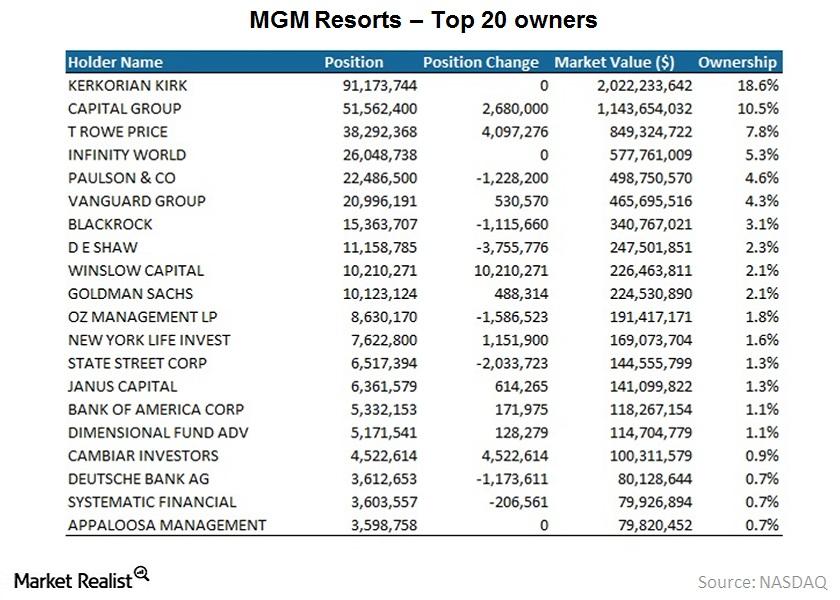

Why investors should learn about MGM’s top shareholders

As an investor, you should know whether or not MGM’s (MGM) management is committed to its future. Management shows its commitment by owning shares.

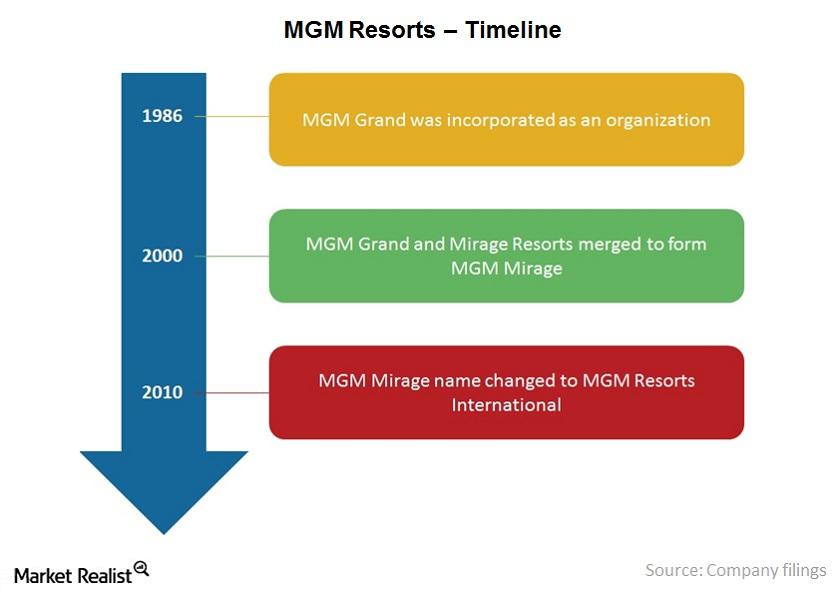

Must-know: An overview of MGM Resorts

MGM Resorts (MGM) was founded in 1986. MGM is based in Nevada. It’s one of the leading global hospitality and entertainment companies.

Overview of Caesars Entertainment and its complicated past

Caesars Entertainment has 51 casinos in 13 U.S. states and five countries. 38 are in the U.S. and primarily consist of land-based and riverboat casinos.

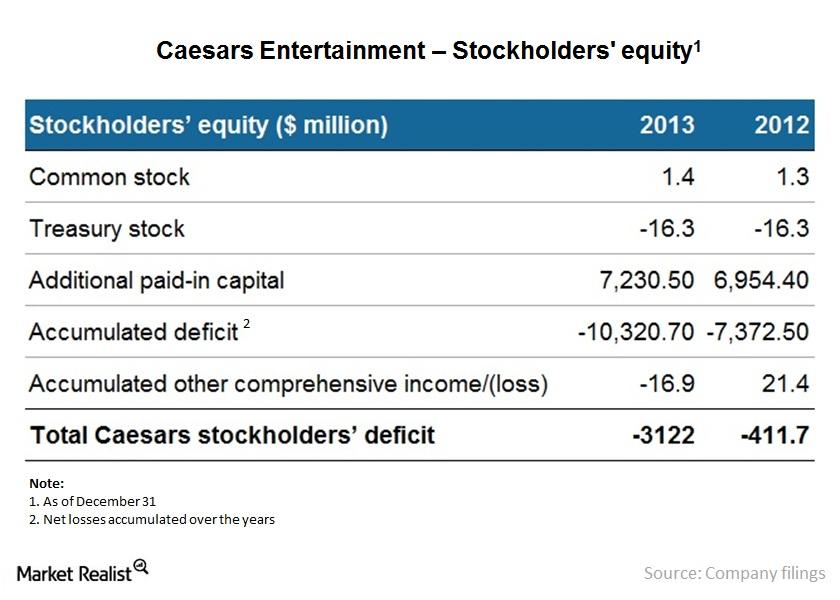

Why Caesars Entertainment’s stockholders’ equity is negative

Caesars Entertainment’s (CZR) stockholders equity is negative, according to its latest balance sheet. Stockholder equity consists of capital contributed and retained earnings.

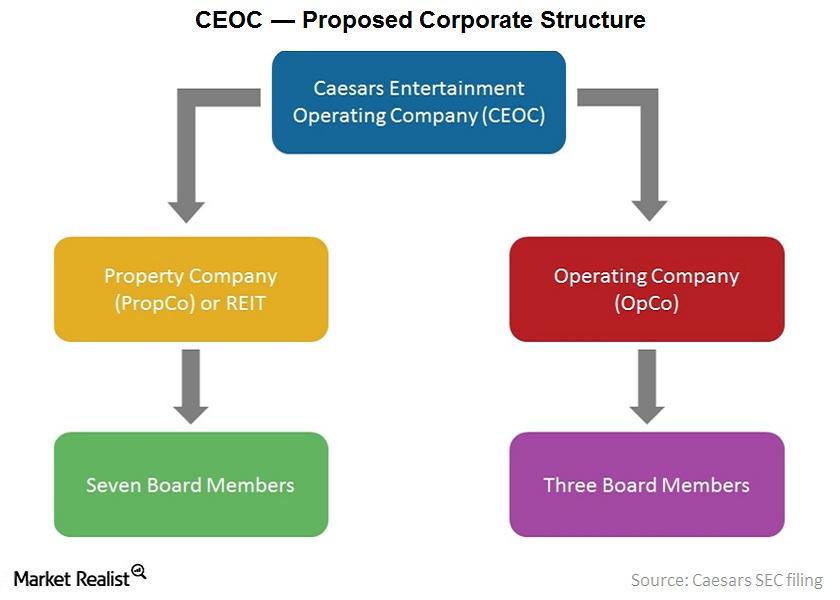

Caesars Entertainment’s New Corporate Structure and Governance

On December 22, 2014, CZR and Caesars Acquisition Company (CACQ) entered into a definitive agreement to merge in an all-stock transaction.

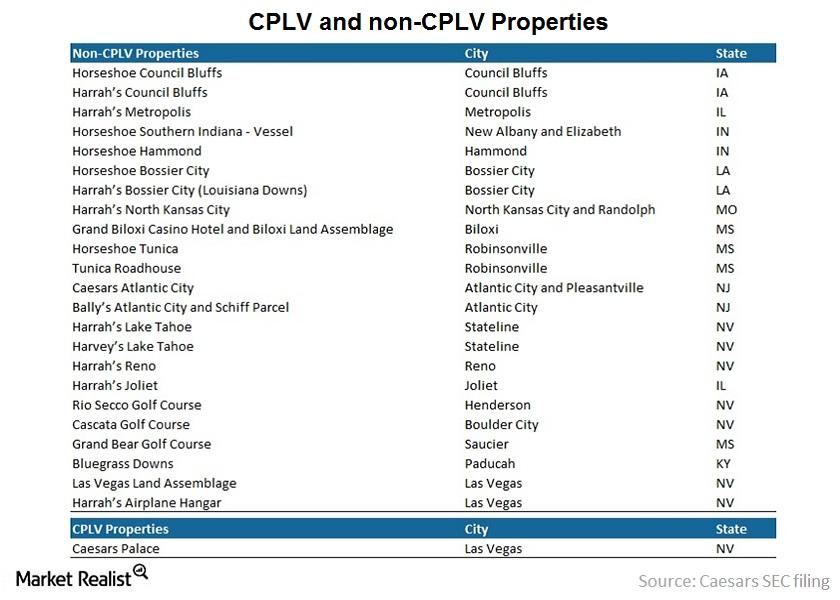

A Quick Guide To The Bifurcation Of Caesars’s Operating Leases

The initial term of each lease will be for 15 years with four five-year renewals. CZR will guarantee payments and performance of the OpCo’s obligations.

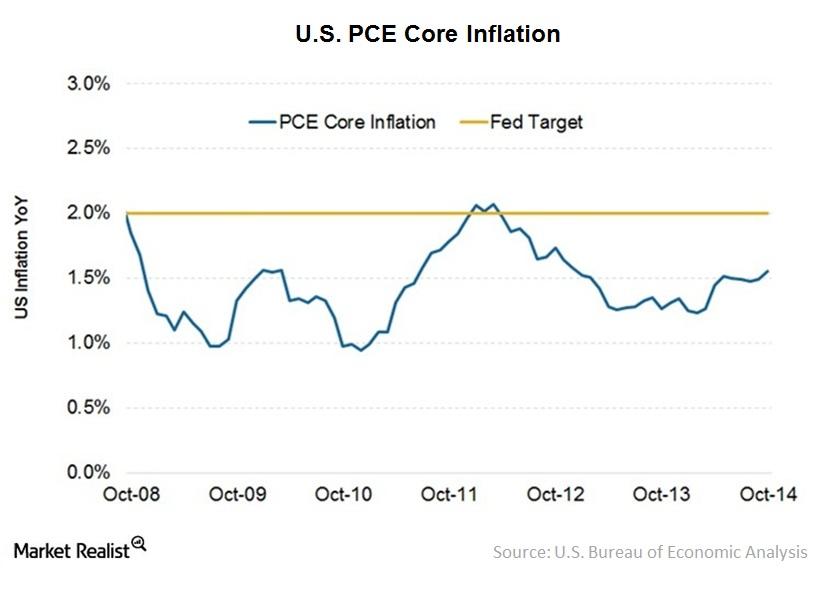

Why The Casino Business Is Affected By Inflation

When inflation is low, consumers have greater purchasing power. They have a higher spending capacity. Greater purchasing power is a positive sign for casino resort companies.

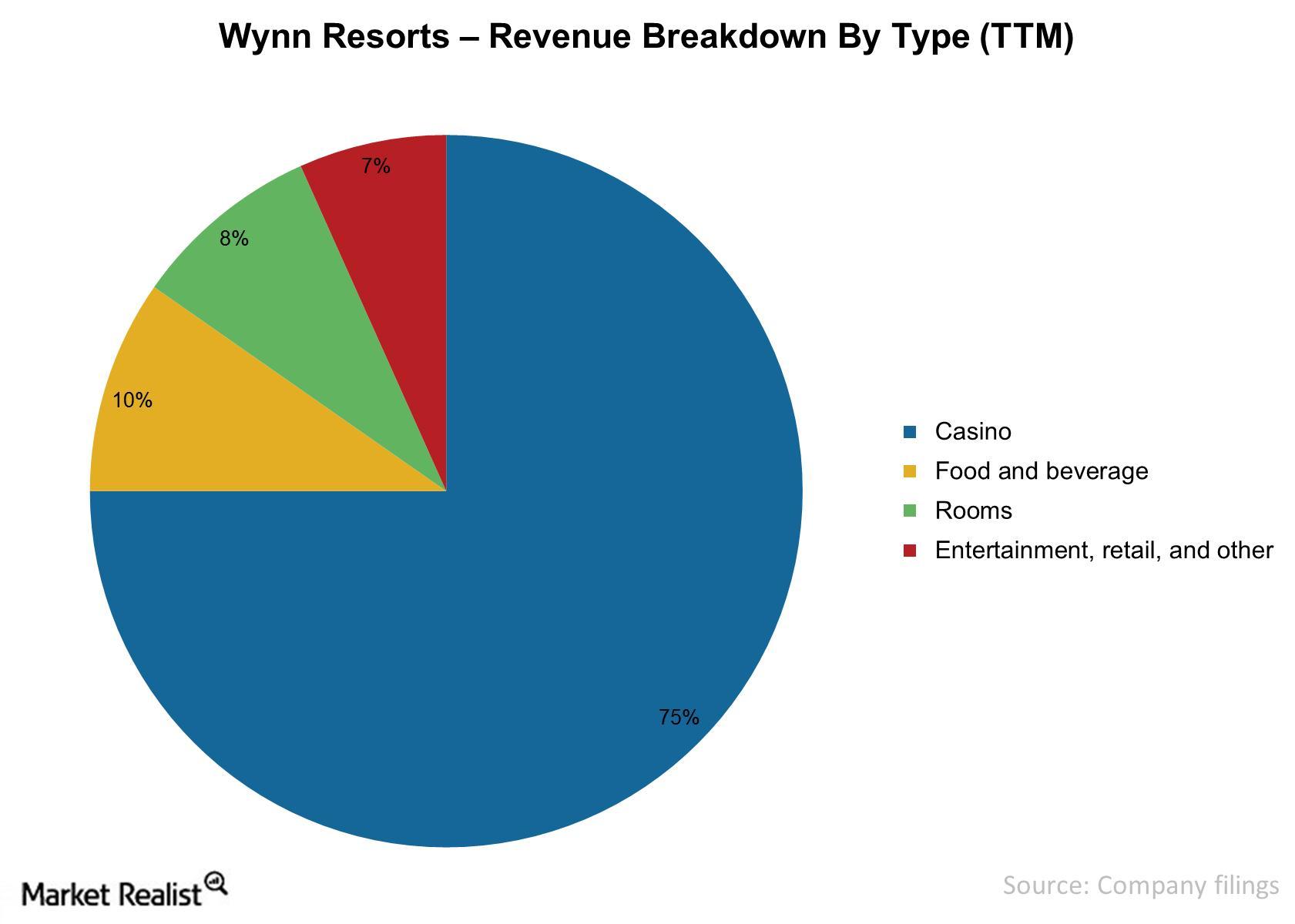

Wynn Resorts: A revenue breakdown

Wynn Resorts (WYNN) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations.

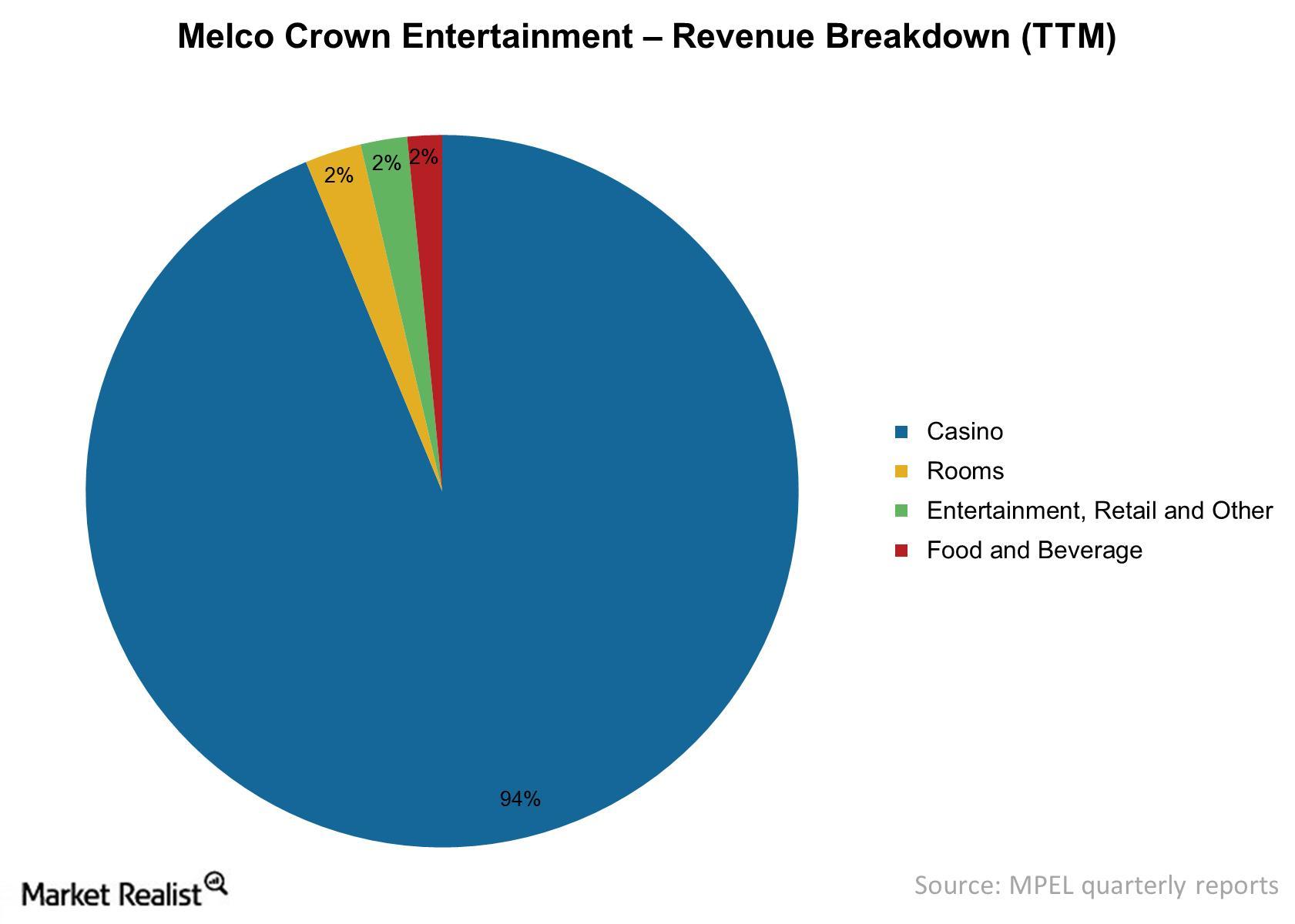

Why Melco Crown Is Profitable In The Casino Space

MPEL derives ~94% of revenues from casino operations. Its casino business gross margin is 50% for the trailing 12-month period ending September 30, 2014.Consumer Must-know: A SWOT analysis of Las Vegas Sands

The strengths, weaknesses, opportunities, and threats (or SWOT) analysis is a useful tool for decision-making in businesses and organizations. It helps companies identify the positive and negative factors inside and outside an organization.Consumer Why new entrants haven’t been a threat for the casino industry

The casino industry has heavy capital expenditures in gaming machines. This contributes significantly to the total output that’s generated by a casino operator. This is why the threat of new entrants to the industry has been low.Consumer Why the casino industry is rapidly expanding into new markets

The international gaming industry is growing quickly. It’s expanding to new jurisdictions. Many U.S. commercial casino companies, including Las Vegas Sands (LVS) and Wynn Resorts (WYNN), have helped the industry become an important part of the global economy.Consumer Why the commercial gaming market is increasing for casinos

Casino gaming is the largest part of the commercial gaming market. It continues to grow in popularity. There has been a surge in demand for casino games. As a result, new casino destinations have been created. Existing casinos have also been expanded.