Why Caesars Entertainment has a massive $24 billion debt

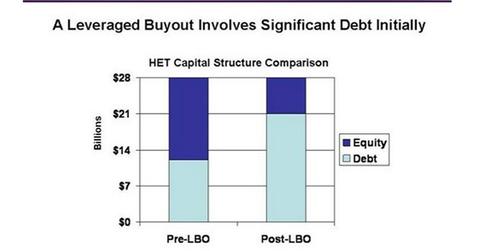

Texas Pacific Group and Apollo Management took Harrah’s Entertainment, now Caesars Entertainment, private in a leveraged buyout deal valued at $30.7 billion in 2008.

Dec. 4 2020, Updated 10:52 a.m. ET

Caesar’s leveraged buyout in 2008

Private equity firms Texas Pacific Group and Apollo Management took Harrah’s Entertainment, now Caesars Entertainment (CZR), private in a leveraged buyout (or LBO) deal valued at $30.7 billion amid financial meltdown in 2008. The LBO doubled Harrah’s debt, which stood at $19.8 billion as of June 30, 2010.

The above chart shows how CZR’s debt to earnings before interest, taxes, depreciation and amortization (or EBITDA) almost doubled after the LBO deal. This is an inherent risk in a LBO that entails significant usage of debt.

This LBO deal serves as an example to show how the credit bubble that preceded the financial crisis of 2008 resulted in over-leveraged deals that left their financial sponsors struggling to get their money back. CZR has been struggling to stay afloat.

ETFs like VanEck Vectors Gaming (BJK) and Consumer Discretionary Select Sector SPDR Fund (XLY) give exposure to the leisure industry.

The next article in the series will explain why bondholders accused CZR.

Management comments

In reference to fluctuating bond and stock markets, Gary Loveman, Chairman, CEO and President of CZR, said “the company has an enterprise value that is second only to Las Vegas Sands (LVS) or MGM Resorts (MGM) depending upon the day. The company is one of the most valuable casino companies in the world, but the split between debt and equity is disproportionately debt versus equity.”