Shawn Bolton

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Shawn Bolton

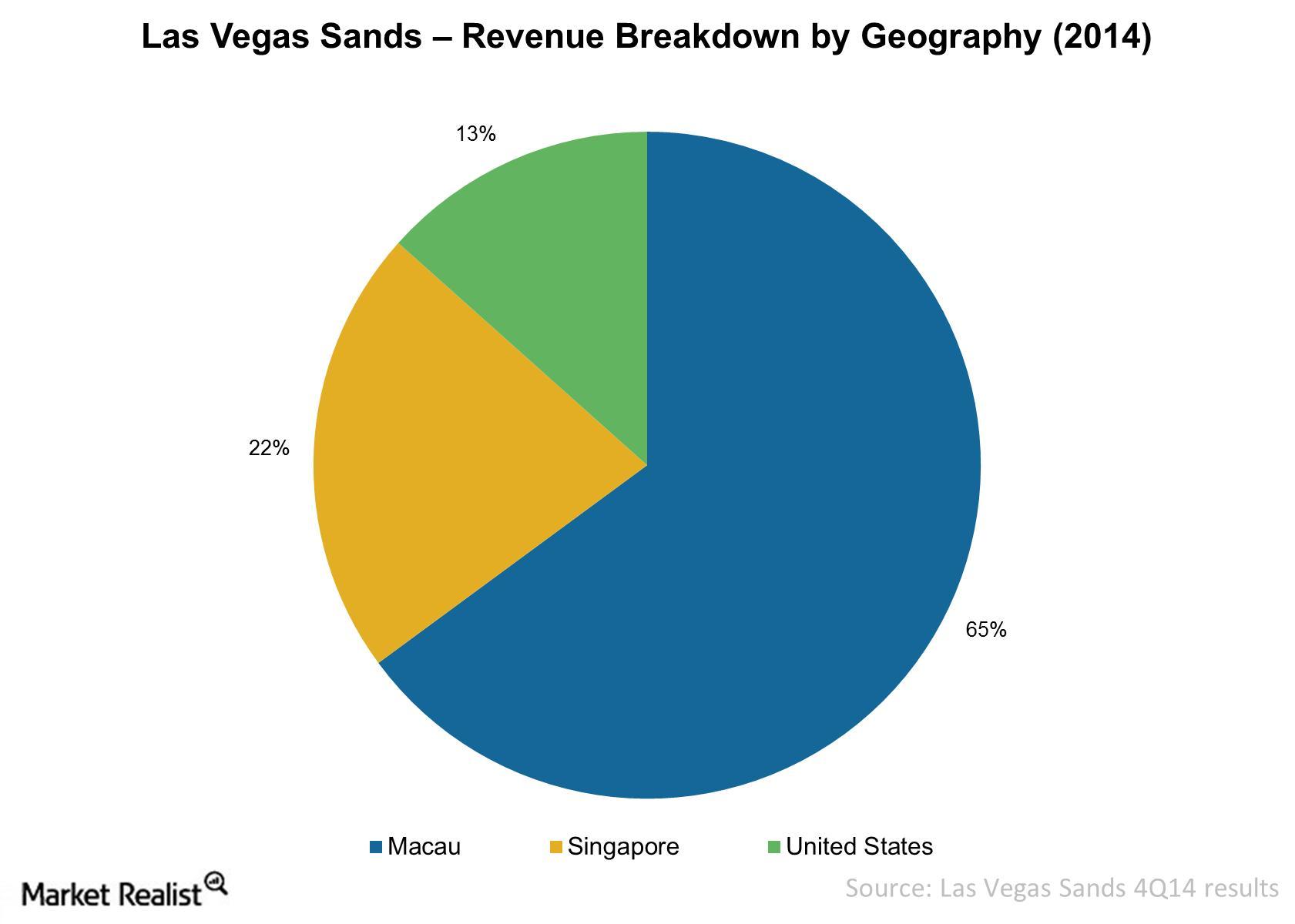

Must-know: A breakdown of Las Vegas Sands’ revenue

Las Vegas Sands (LVS) earns revenue through casinos, hotels, food and beverages, and convention or retail operations. The company’s main revenue driver is casino revenue. It’s generated from slot machines and table games. Casino revenue represents ~79% of the total revenues.

Must-know: Important performance metrics for casino resorts

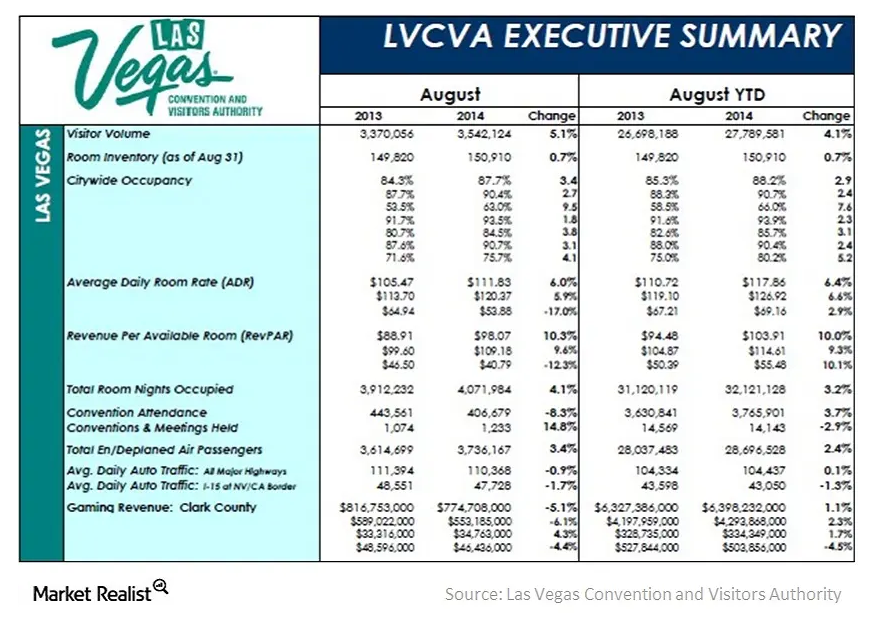

The occupancy rate is very important for casino resorts. The occupancy rate shows the relationship between the number of occupied rooms and the total number of rooms.

Must-know: The most popular casino games

Casinos’ popularity is growing. This suggests that people like to gamble occasionally. Unfortunately, they don’t always win. For most of the people, the real fun is playing the game—not necessarily winning.

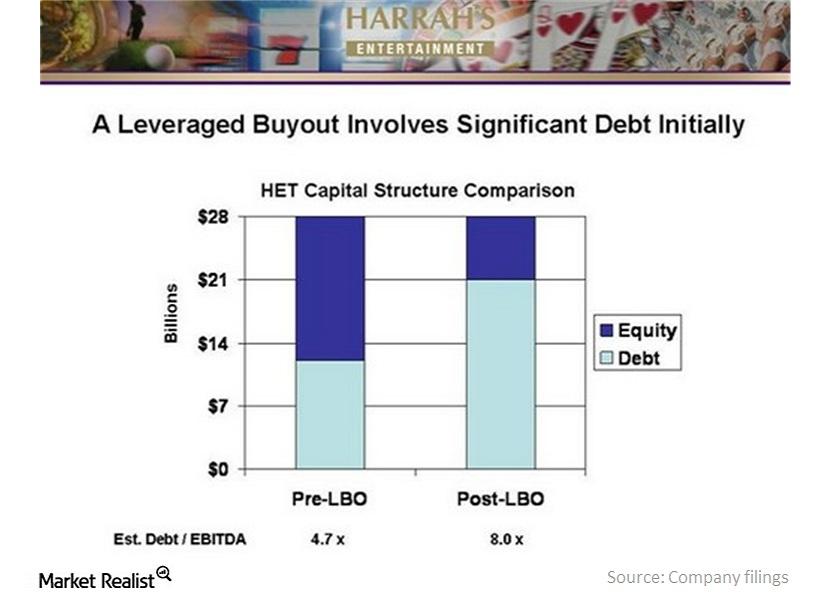

Why Caesars Entertainment has a massive $24 billion debt

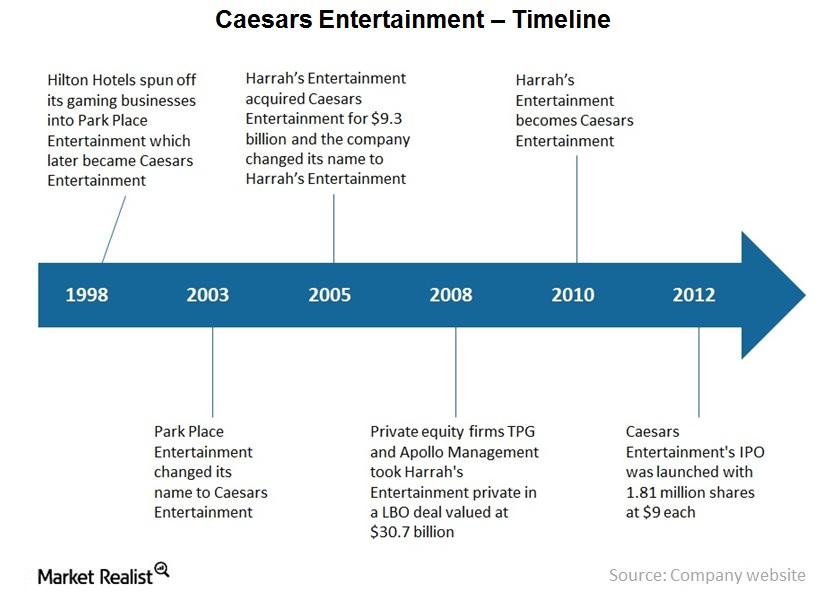

Texas Pacific Group and Apollo Management took Harrah’s Entertainment, now Caesars Entertainment, private in a leveraged buyout deal valued at $30.7 billion in 2008.

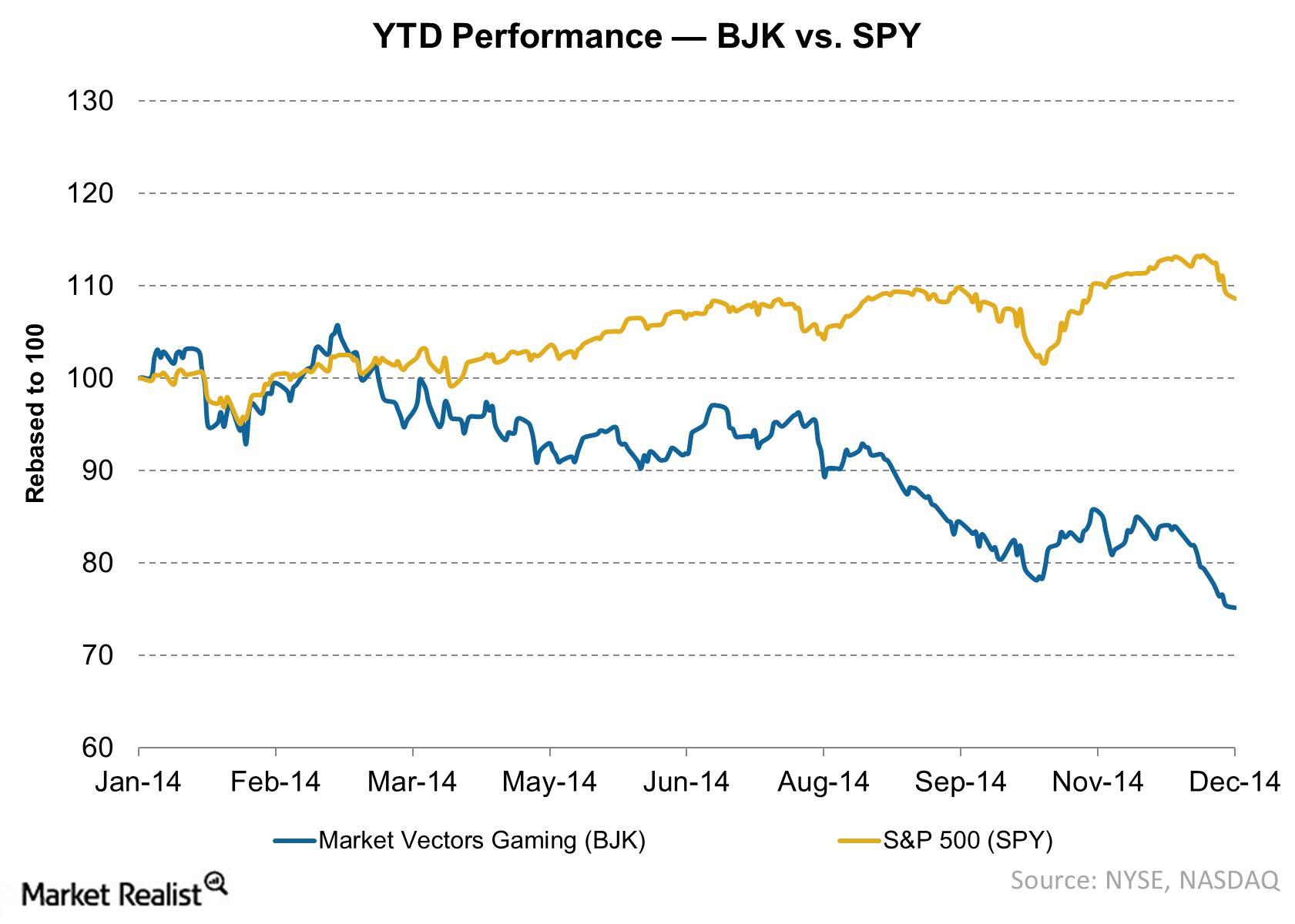

Key Indicators And Recent Trends In The Casino Industry

Casino gambling is spread across major destinations around the world. Casinos, at major destinations, are being influenced by certain factors. This is hampering industry growth.Consumer Must-know: Key performance metric tracked by Las Vegas Sands

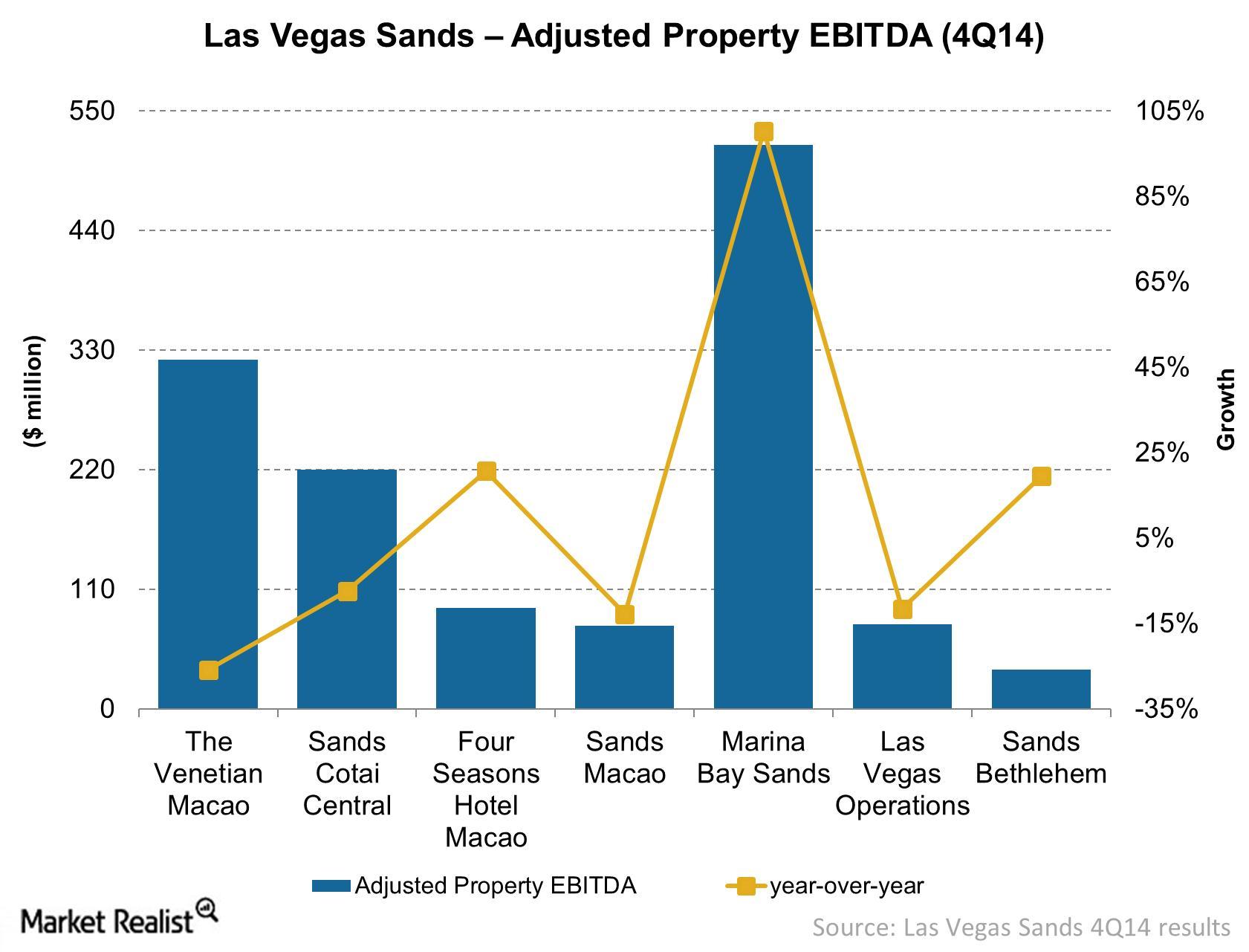

Adjusted property EBITDA shouldn’t be regarded as an alternative to looking at income from operations, which indicates operating performance. Nor is it an alternative to looking at cash flow from operations, which measures liquidity.

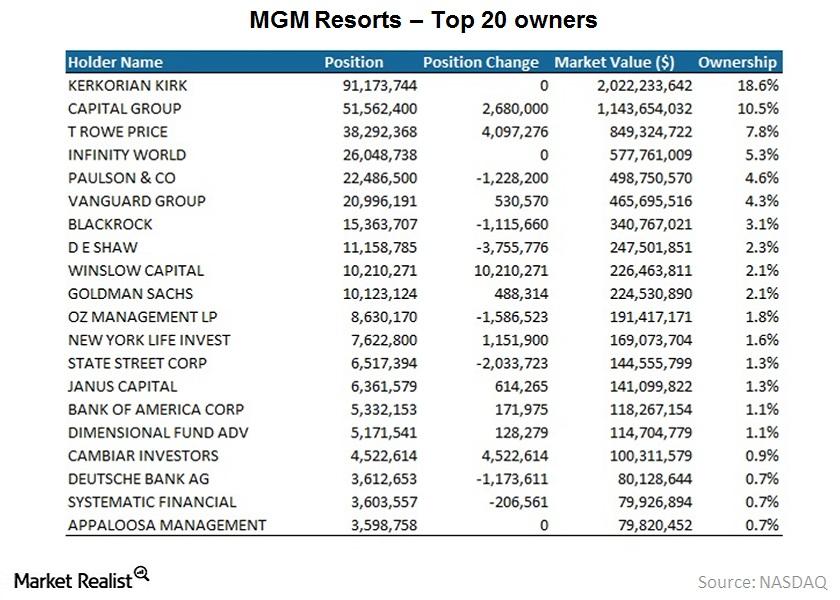

Why investors should learn about MGM’s top shareholders

As an investor, you should know whether or not MGM’s (MGM) management is committed to its future. Management shows its commitment by owning shares.

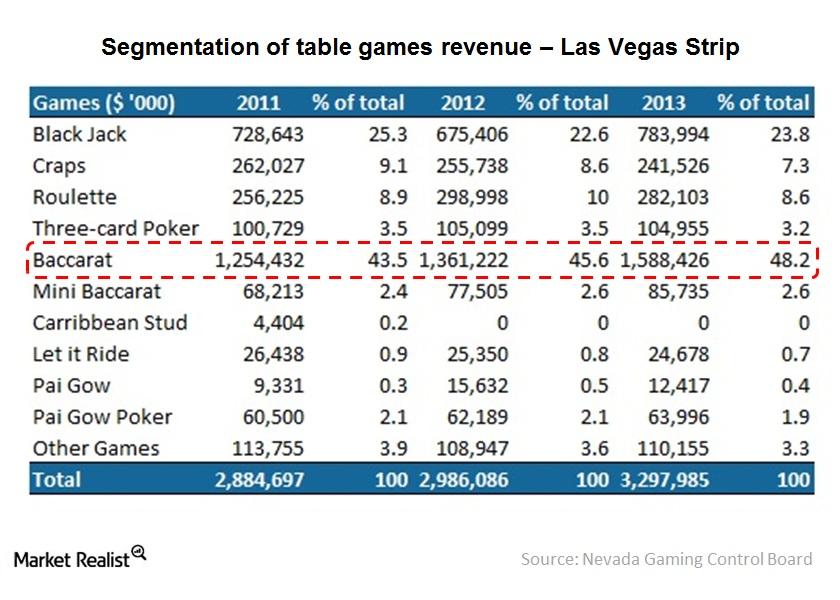

Why Baccarat gambling provides revenue for the Las Vegas Strip

The casinos in the Las Vegas Strip clearly benefit from high-end Baccarat play. Over the last four years, Baccarat revenue ranged from 43.5% of table games revenue in 2011 to 48.2% in 2013.

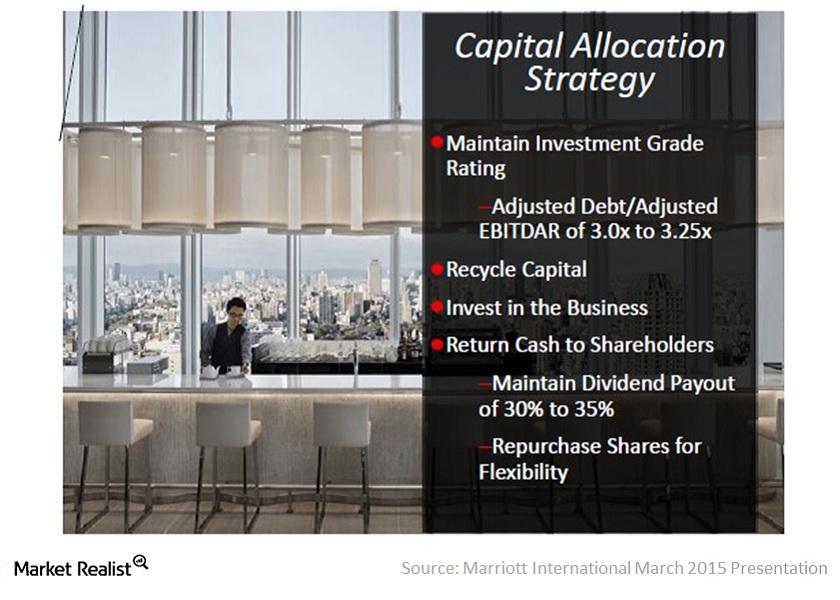

Why Marriott is Buying Back Its Own Shares

Marriott repurchased 7.7 million shares of common stock valued at $544 million in 4Q14 and 24 million shares for $1.5 billion in 2014.

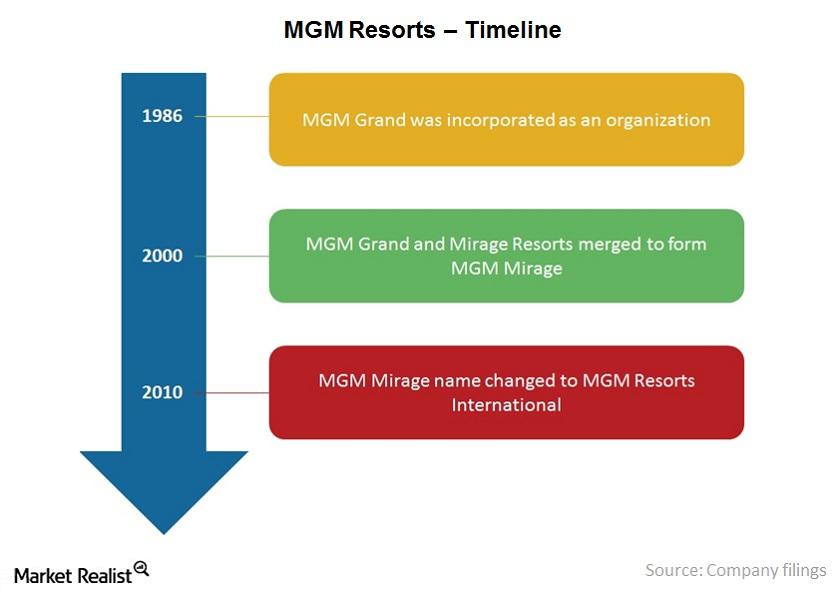

Must-know: An overview of MGM Resorts

MGM Resorts (MGM) was founded in 1986. MGM is based in Nevada. It’s one of the leading global hospitality and entertainment companies.

Overview of Caesars Entertainment and its complicated past

Caesars Entertainment has 51 casinos in 13 U.S. states and five countries. 38 are in the U.S. and primarily consist of land-based and riverboat casinos.

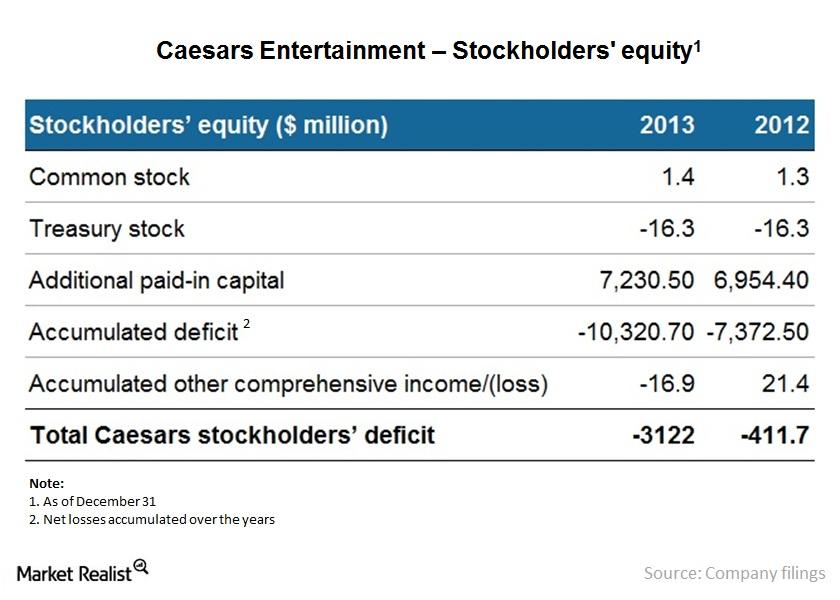

Why Caesars Entertainment’s stockholders’ equity is negative

Caesars Entertainment’s (CZR) stockholders equity is negative, according to its latest balance sheet. Stockholder equity consists of capital contributed and retained earnings.

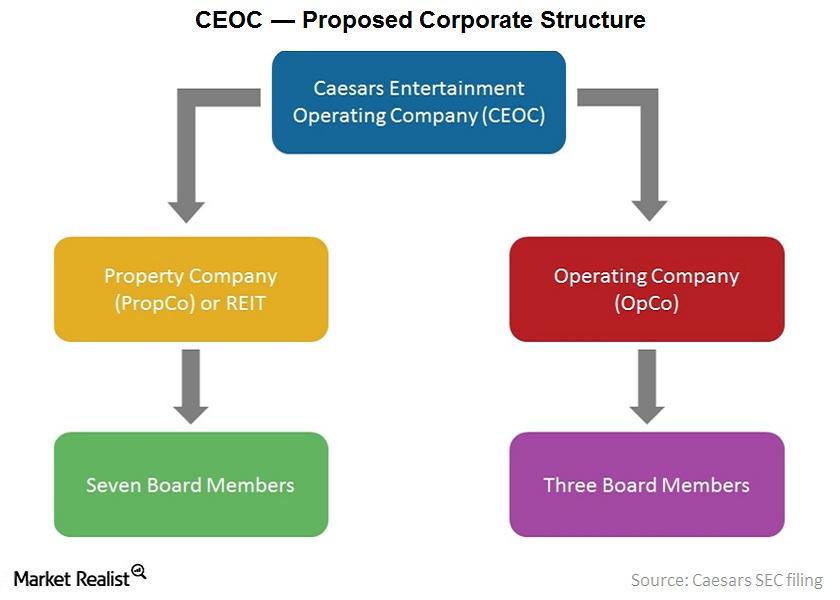

Caesars Entertainment’s New Corporate Structure and Governance

On December 22, 2014, CZR and Caesars Acquisition Company (CACQ) entered into a definitive agreement to merge in an all-stock transaction.

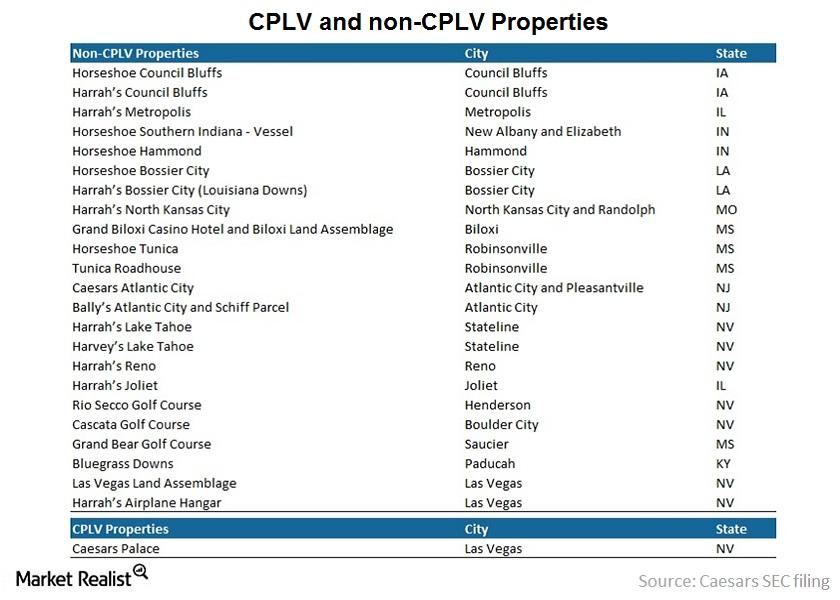

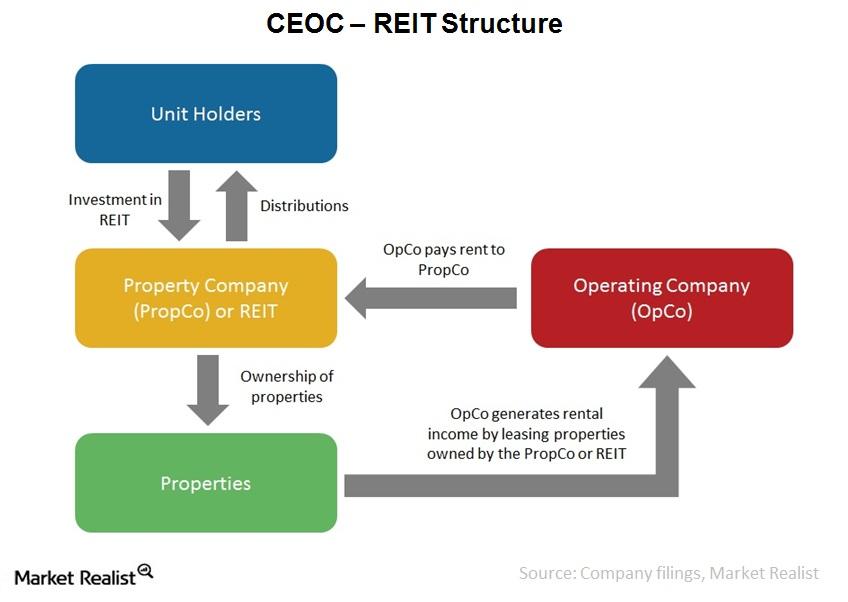

A Quick Guide To The Bifurcation Of Caesars’s Operating Leases

The initial term of each lease will be for 15 years with four five-year renewals. CZR will guarantee payments and performance of the OpCo’s obligations.

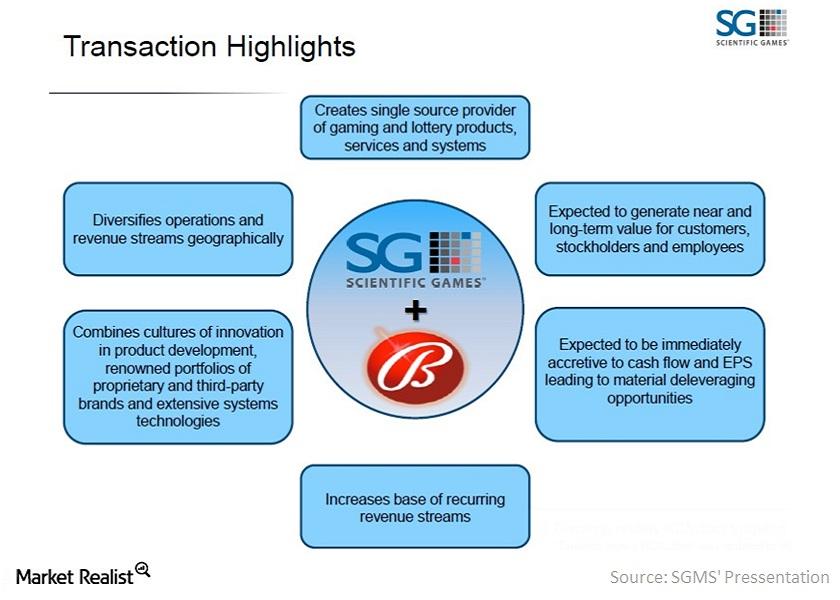

Scientific Games: Strategic Acquisition of Bally Technologies

In its merger agreement with Bally Technologies, Scientific Games agreed to acquire all outstanding Bally common stock for $83.3 cash per share.

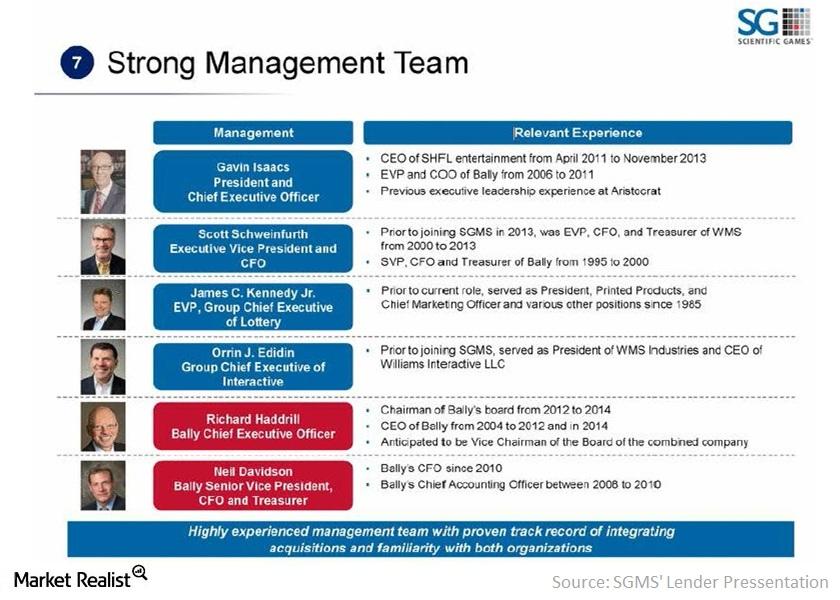

Consolidated Scientific Games: A Stronger Management Team

The executive management team of SGMS includes President and CEO Gavin Isaacs and Executive Vice President and CFO Scott Schweinfurth.

Las Vegas Sands’ adjusted property earnings double in Singapore

Las Vegas Sands’ adjusted property EBITDA at Marina Bay Sands in Singapore doubled, reaching a property record of $518.5 million, up ~100% year-over-year.

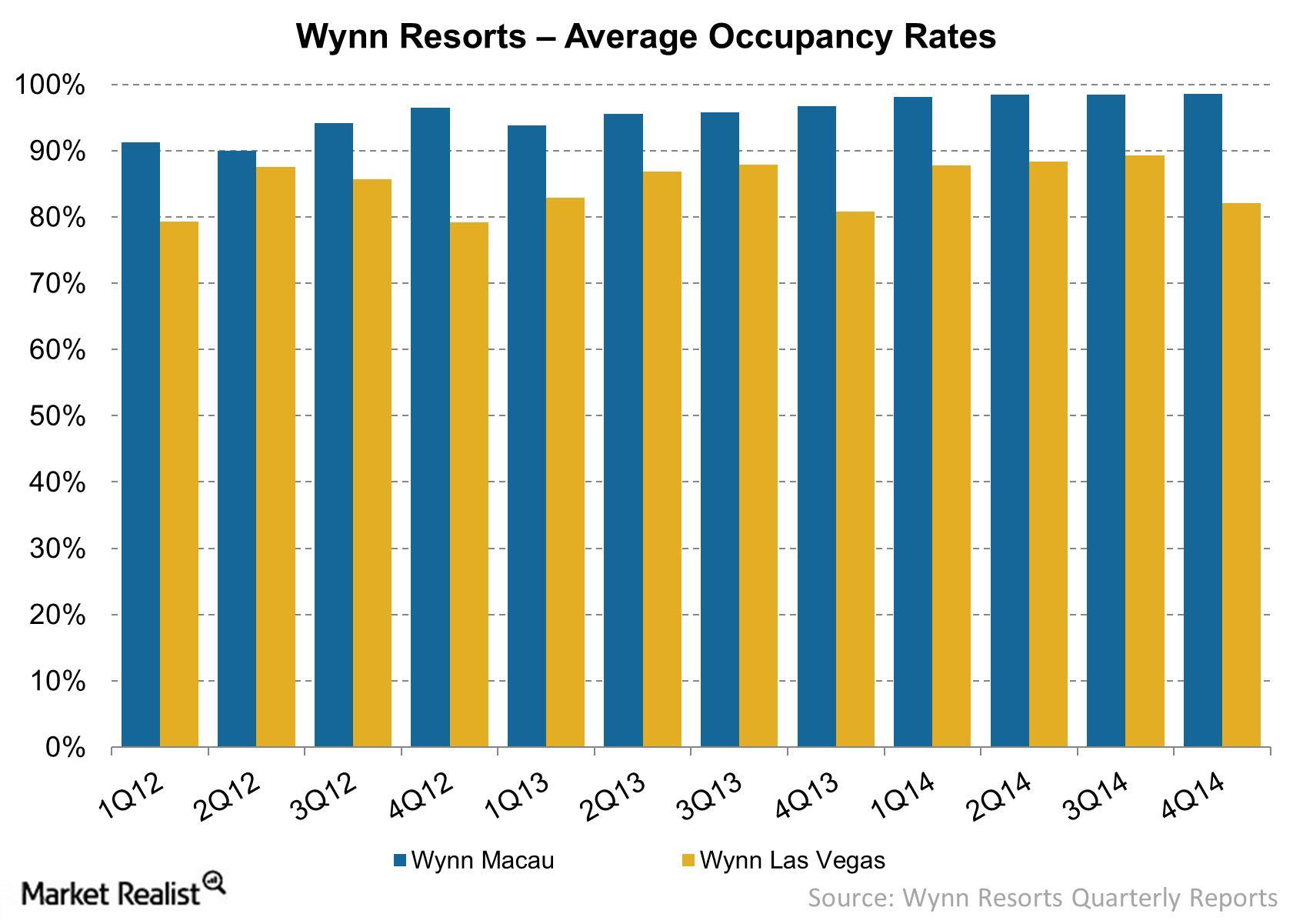

Hotel occupancy is way up at Wynn Macau and Wynn Las Vegas

WYNN’s hotel occupancy increased at Macau and Las Vegas in 4Q14. Macau had 98.6% and Las Vegas had 82.1% compared to 96.7% and 80.8%, respectively, in 4Q13.

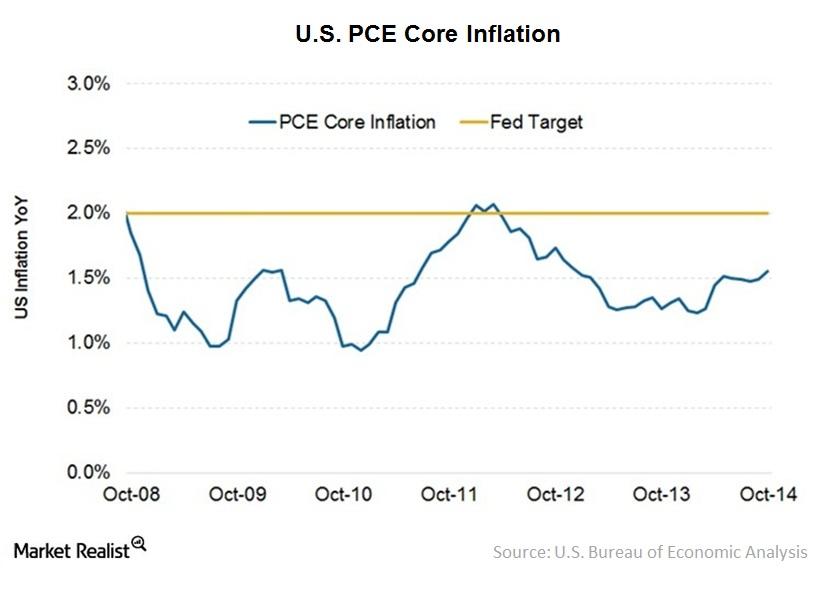

Why The Casino Business Is Affected By Inflation

When inflation is low, consumers have greater purchasing power. They have a higher spending capacity. Greater purchasing power is a positive sign for casino resort companies.

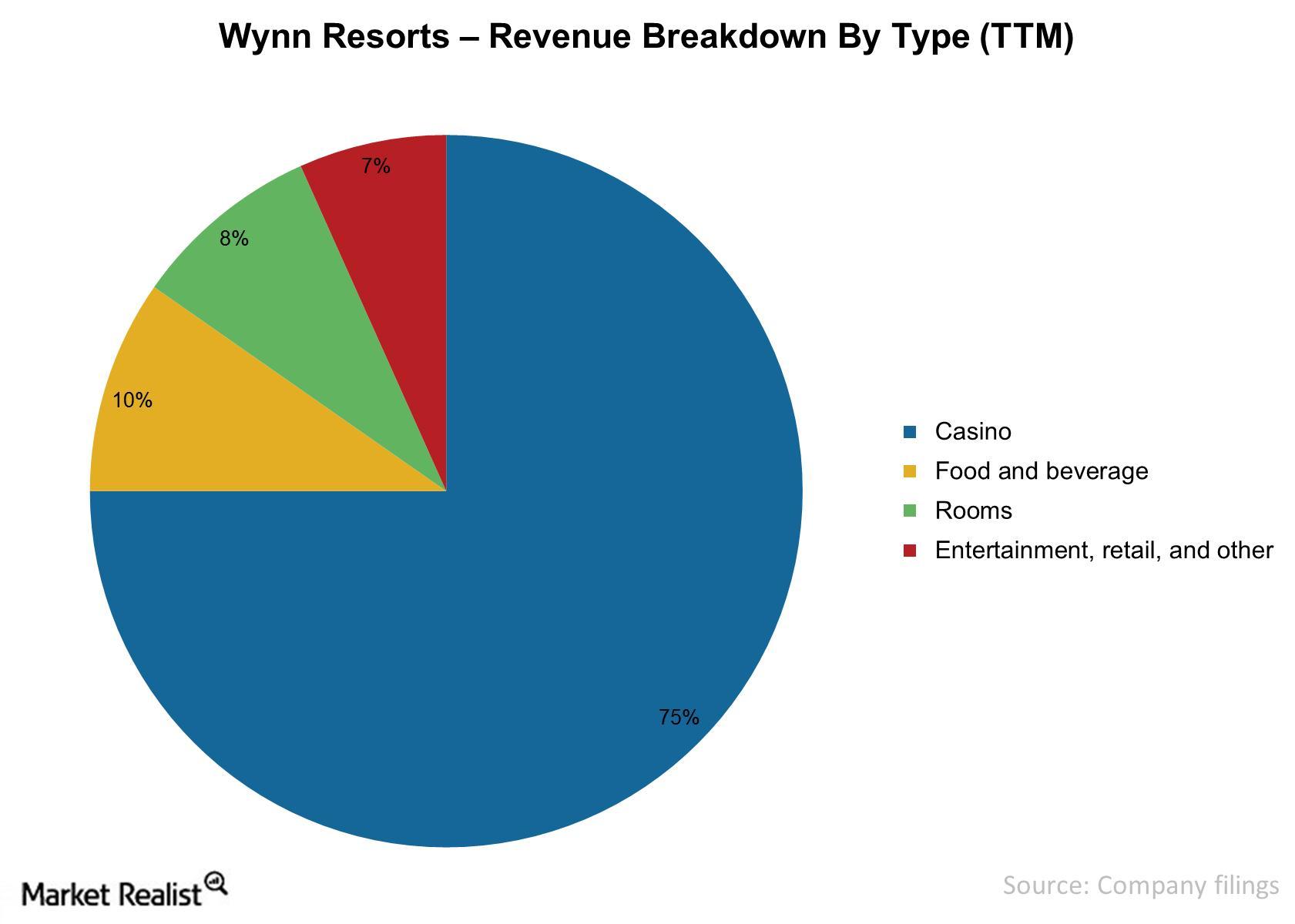

Wynn Resorts: A revenue breakdown

Wynn Resorts (WYNN) earns its revenues through casinos, hotels, food and beverages, and entertainment and retail operations.

Recent developments for Wynn Resorts

Wynn Resorts (WYNN) is currently constructing Wynn Palace, a fully integrated resort in the Cotai area of Macau.

Caesars plans to restructure its largest operating unit as a REIT

REITs generate income by collecting rent and pay out at least 90% of taxable income in the form of dividends to shareholders. By converting CEOC into a REIT, the beneficial holders of CEOC’s senior secured credit facilities would receive a 100% recovery in cash and debt.Consumer Must-know: Penn National Gaming’s performance metrics

Performance metric Penn National Gaming, Inc. (PENN) defines adjusted EBITDA as earnings before interest, taxes, stock compensation, debt-extinguishment charges, impairment charges, insurance recoveries and deductible charges, depreciation and amortization, gain or loss on disposal of assets, and other income or expenses. Adjusted EBITDAR is adjusted EBITDA excluding rent expenses such as those associated with PENN’s […]

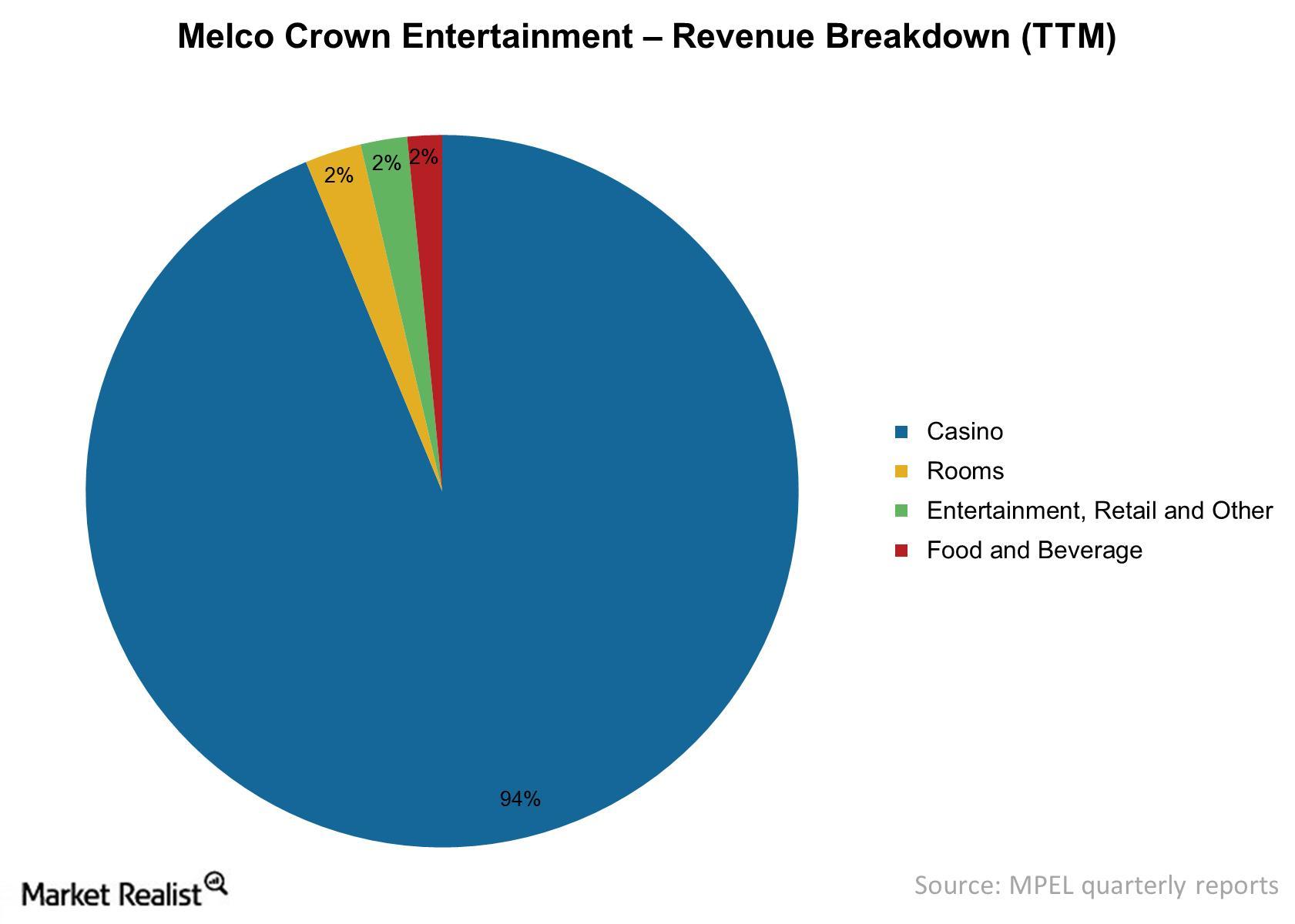

Why Melco Crown Is Profitable In The Casino Space

MPEL derives ~94% of revenues from casino operations. Its casino business gross margin is 50% for the trailing 12-month period ending September 30, 2014.

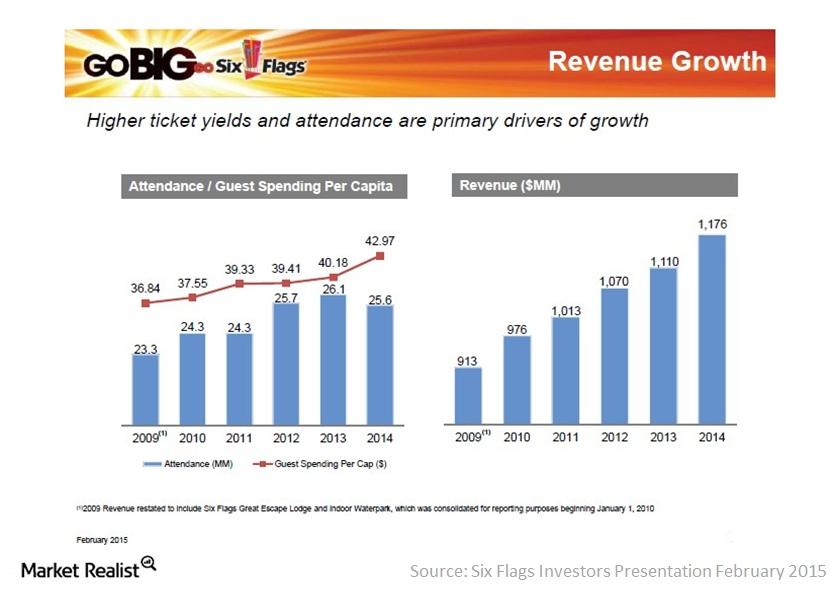

Six Flags Entertainment: An overview of the largest theme park

Six Flags Entertainment Corp. (SIX) is the world’s largest regional theme park company with $1.1 billion in revenue and 18 parks across North America.

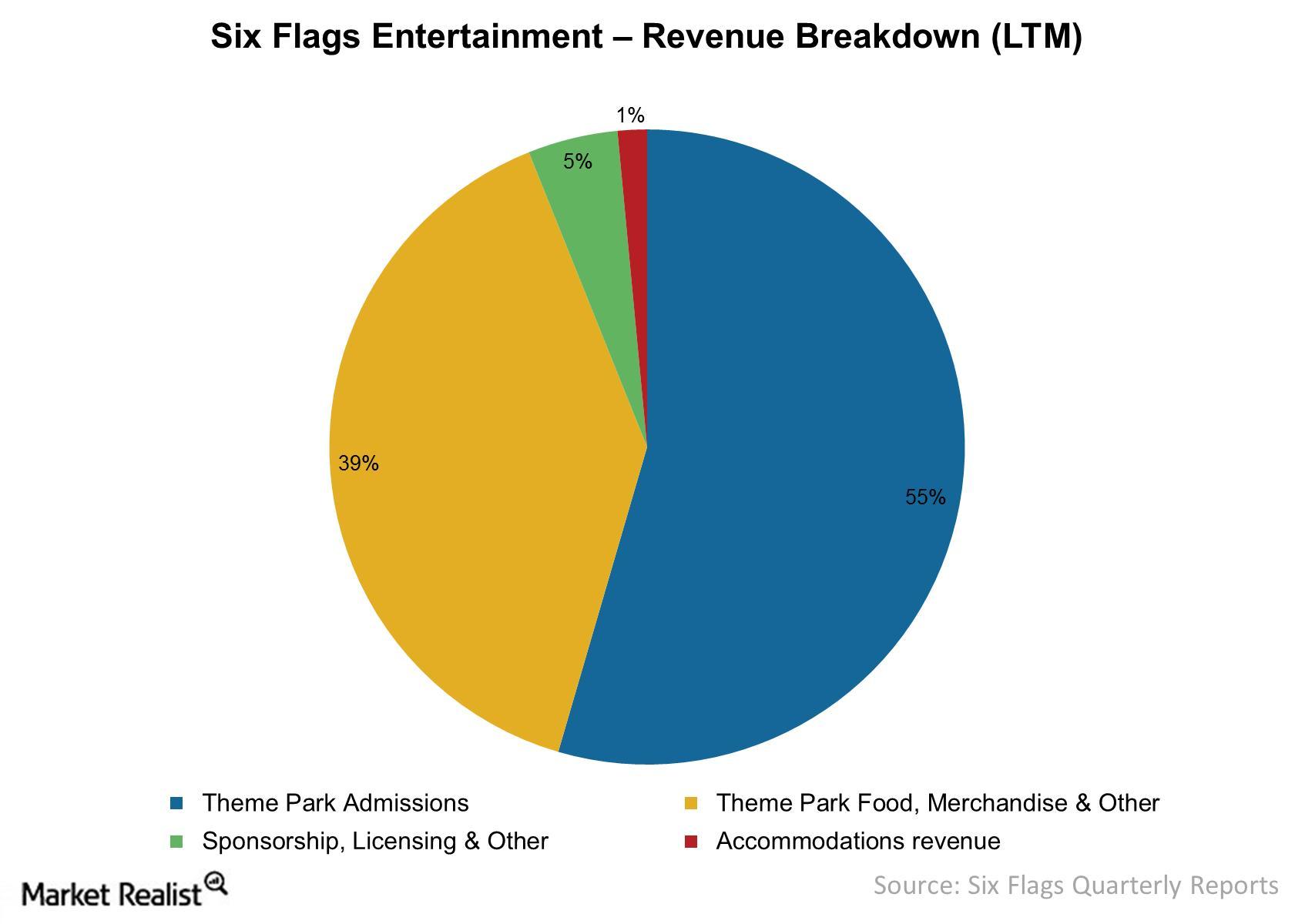

Must-know: How Six Flags generates its revenues

Six Flags derived 55% of its revenues from theme park admissions for the last 12 months ended September 30, 2014.

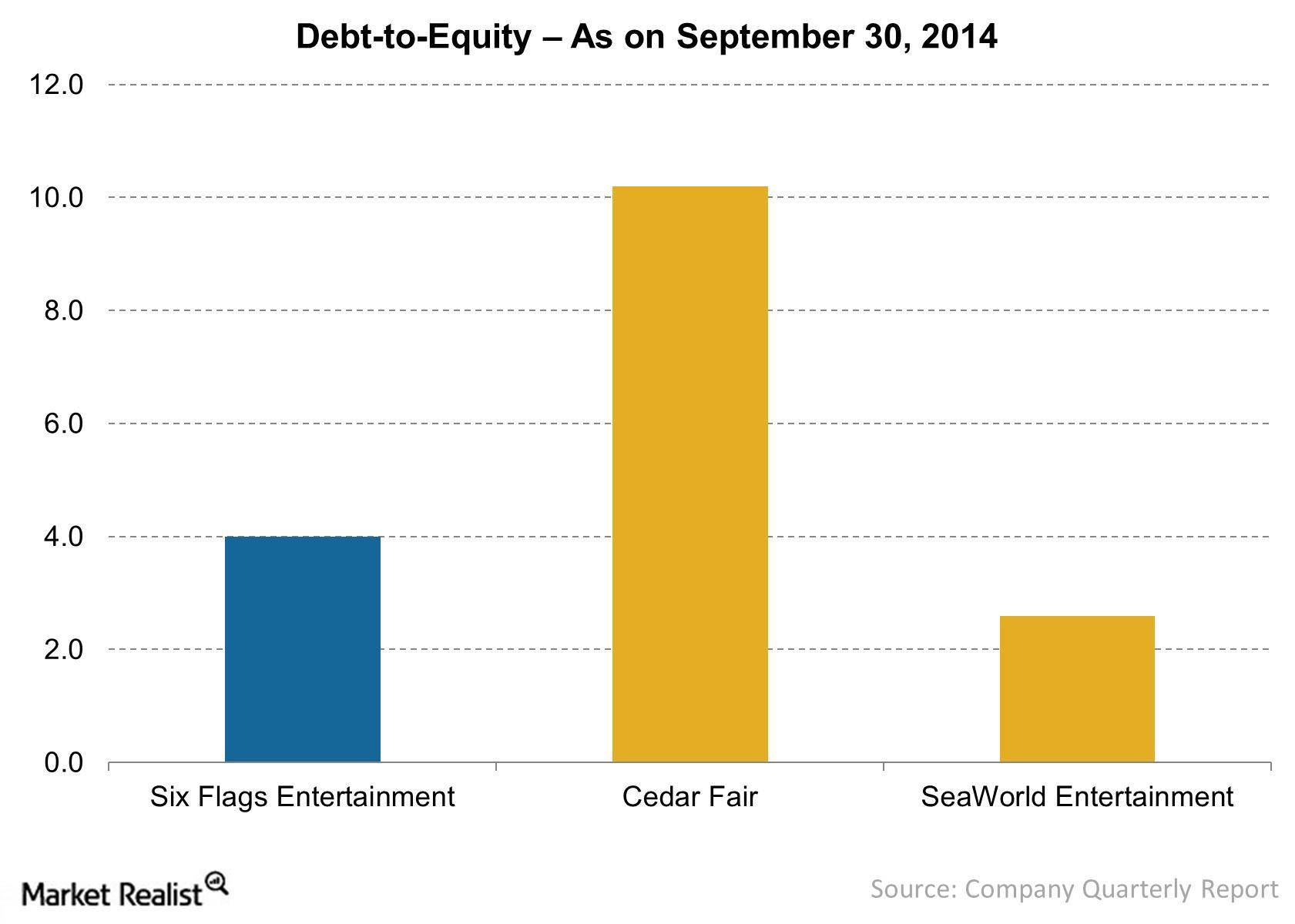

Must-know: A look into Six Flags’ debt-to-equity ratio

Industry debt-to-equity ratio is about 5.5. Six Flags’ debt-to-equity ratio of 4.0 shows the company aggressively finances operations with debt capital.

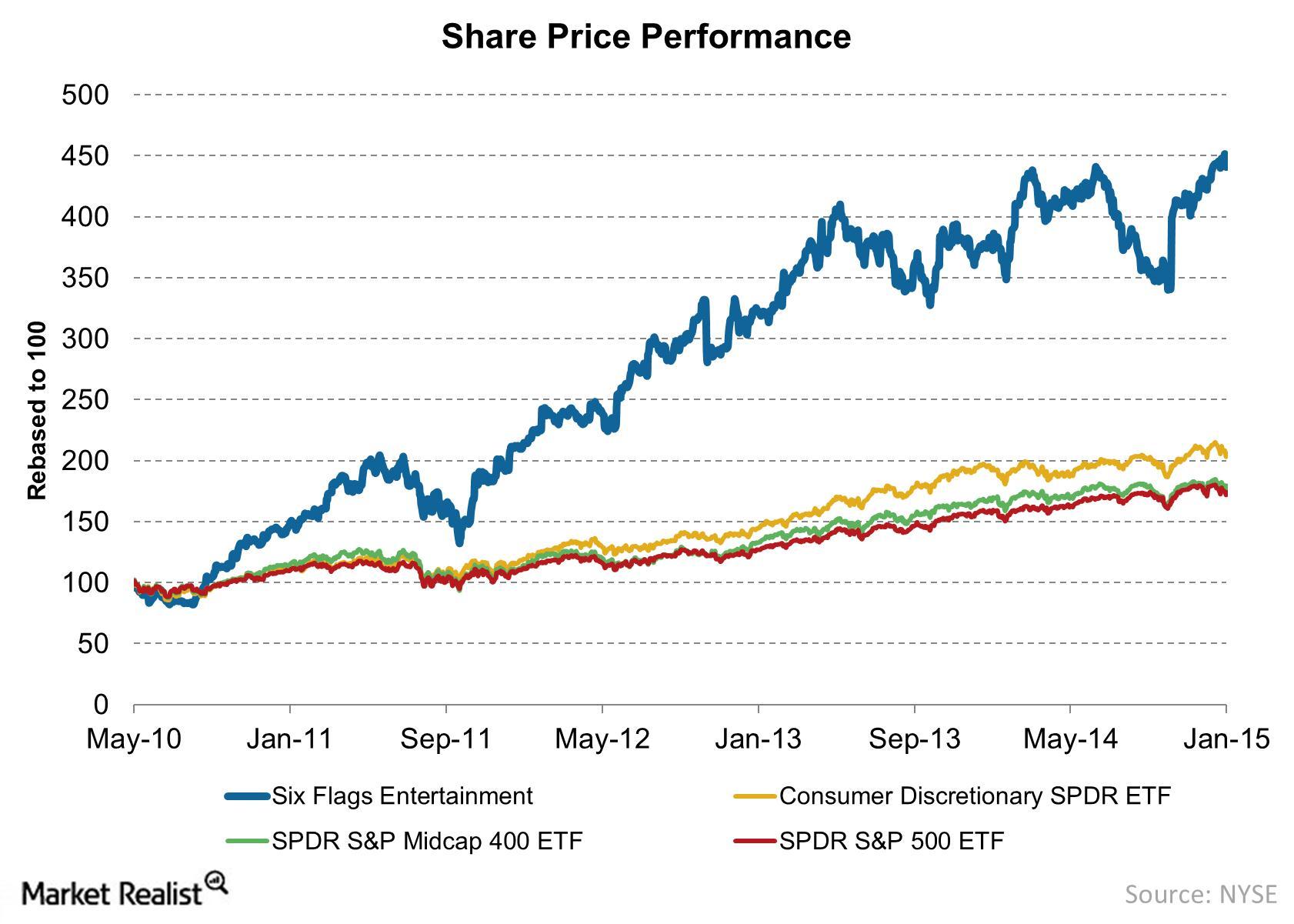

Share price performance for Six Flags since bankruptcy recovery

Six Flags’ share price on May 10, 2010, reflects $7.36 per share, the price of new common stock upon the company’s emergence from bankruptcy.

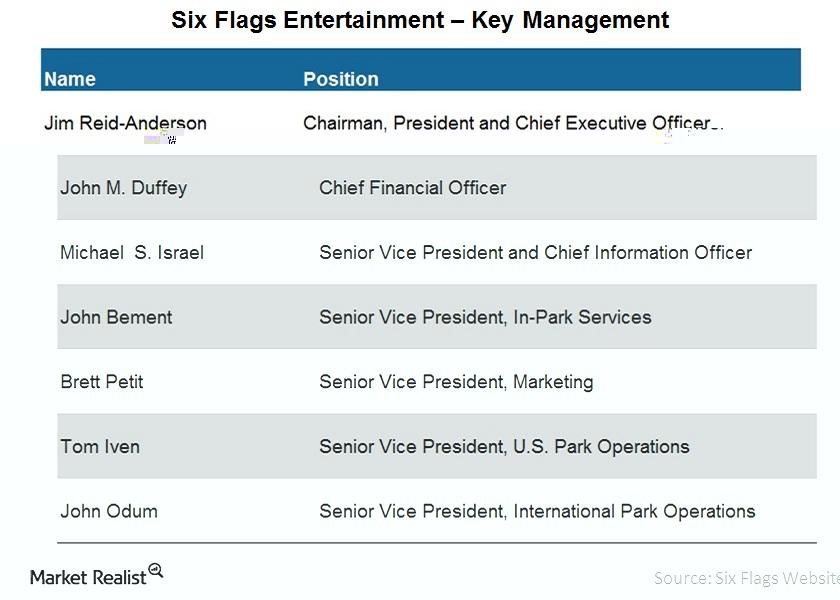

A brief overview of Six Flags’ management

Six Flags’ management plays a vital role in shaping the company and leading it in the desired direction. This article reviews three management positions.

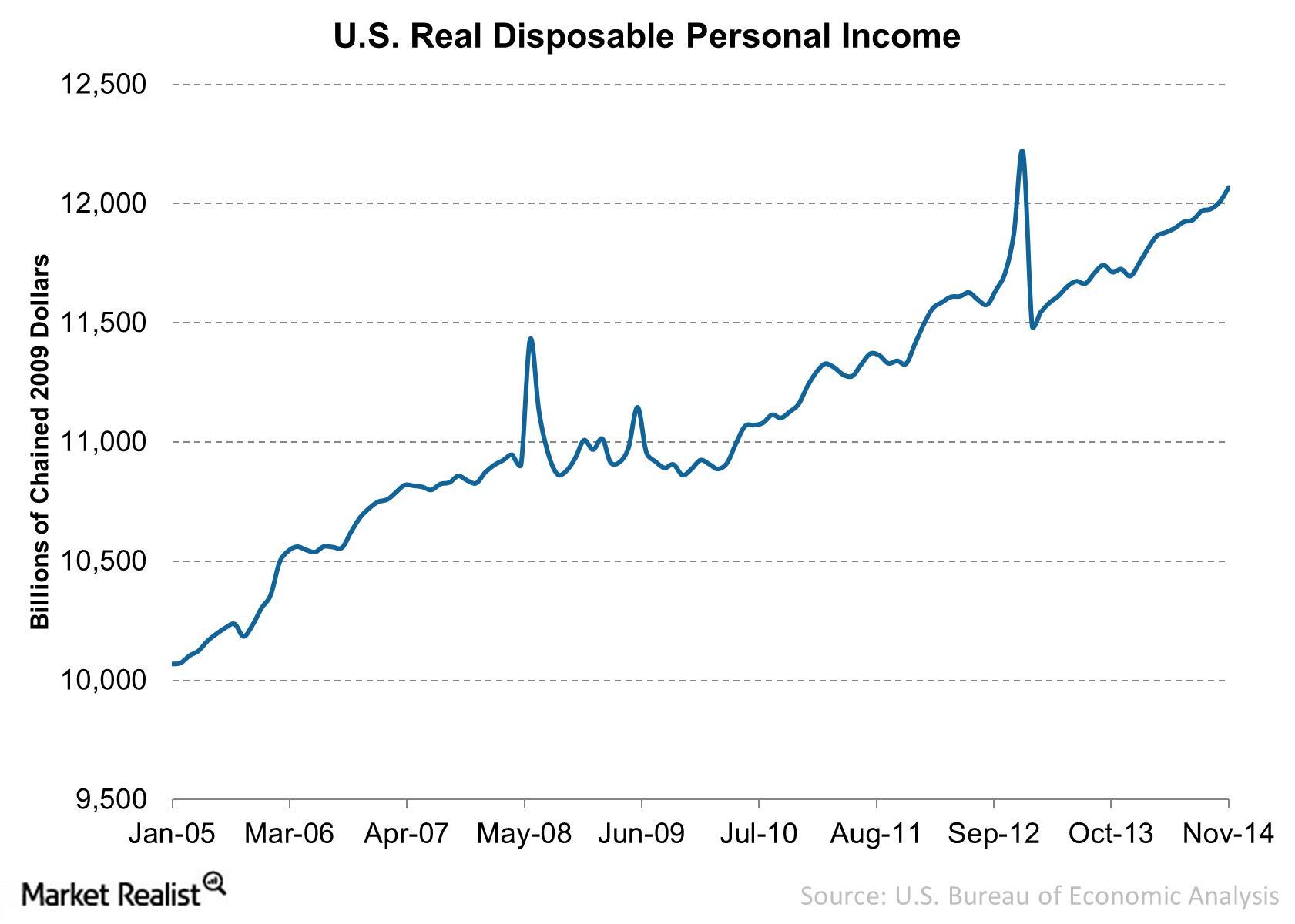

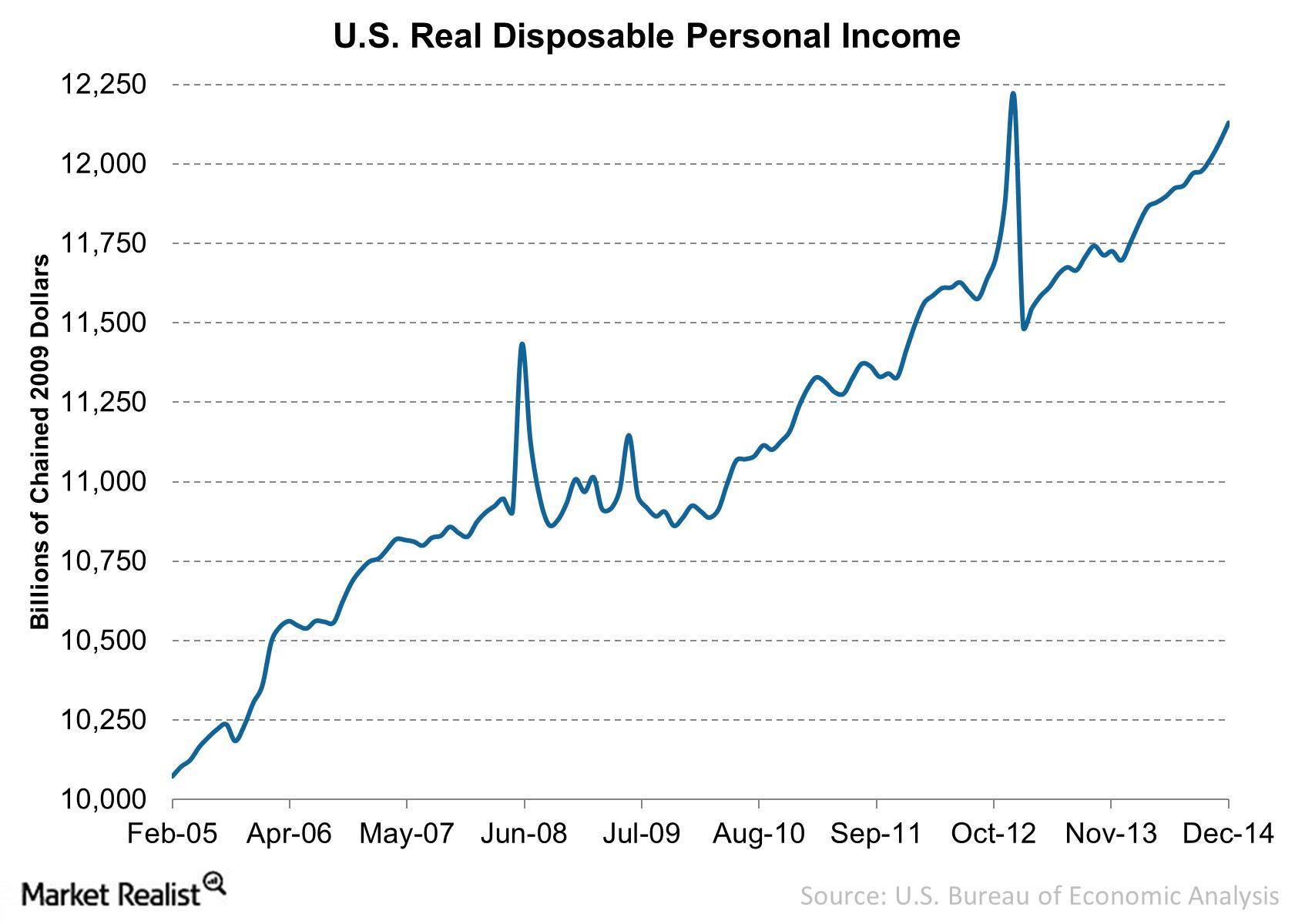

Why Casinos Rely On Disposable Income

On a year-over-year basis, real disposable income increased 2.9%. More disposable income boosts consumer buying power.

An important overview of Las Vegas Sands, a casino company giant

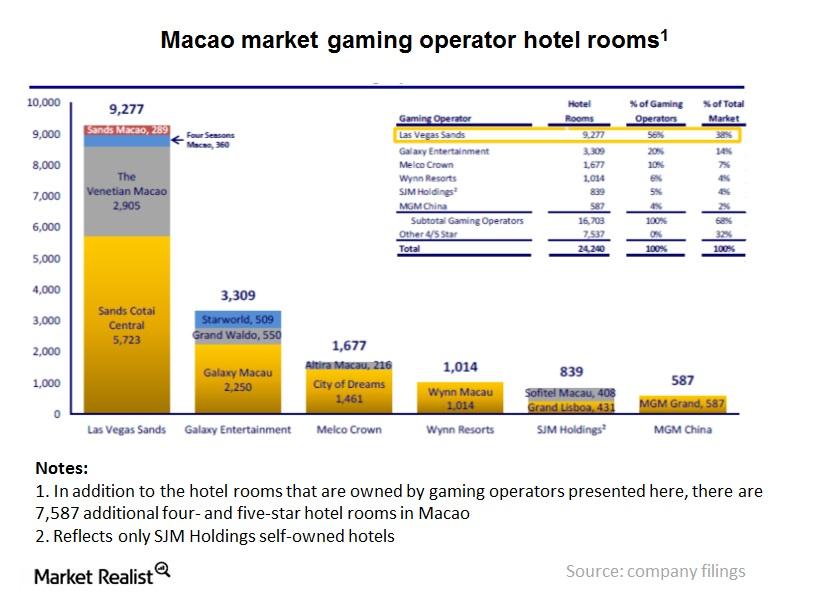

An overview of Las Vegas Sands (LVS) shows that the company currently owns 70.1% of Sands China Ltd., which operates LVS’s four Macao properties.

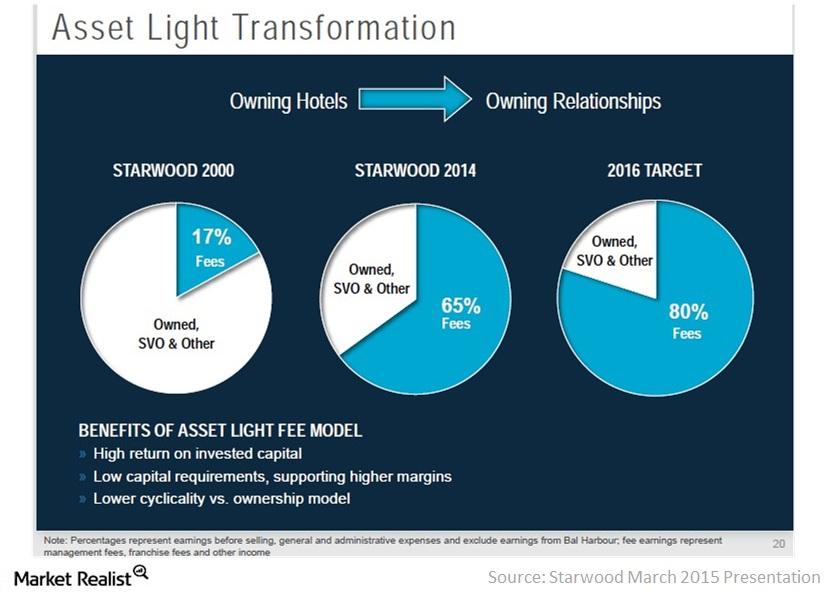

Analyzing Starwood’s Asset-Light Strategy

In 2006, Starwood’s management embarked on an asset-light strategy. It decided to sell a significant portion of Starwood’s owned hotel portfolio.

Starwood’s Vacation Ownership Business Spin-Off

On February 10, 2015, Starwood Hotels and Resorts announced plans to spin off its vacation ownership business into a separate publicly traded company.

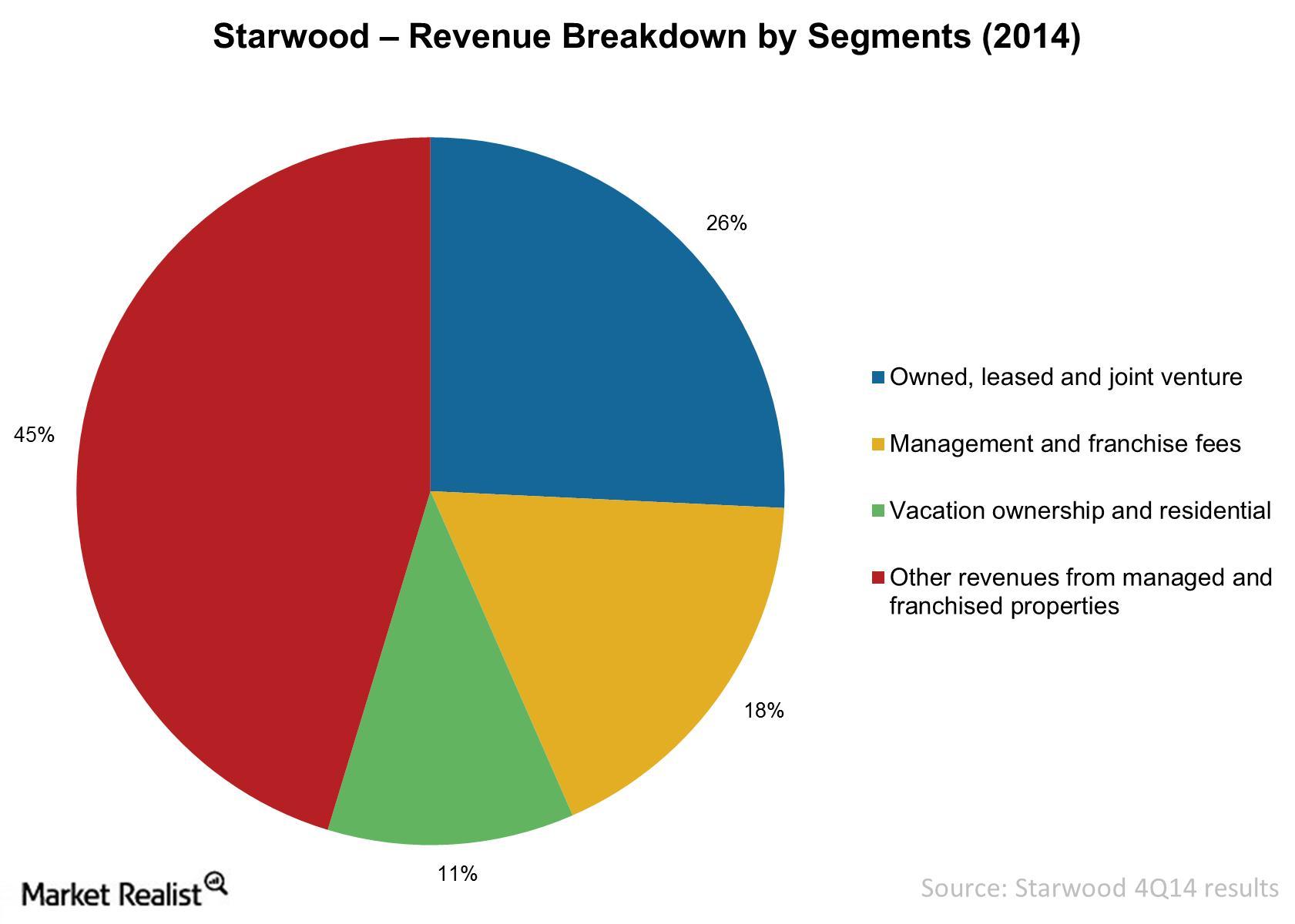

What Are Starwood’s Revenue Sources?

The revenue from owned, leased, and consolidated joint ventures is primarily derived from hotel operations. This includes room rentals and food and beverage sales.

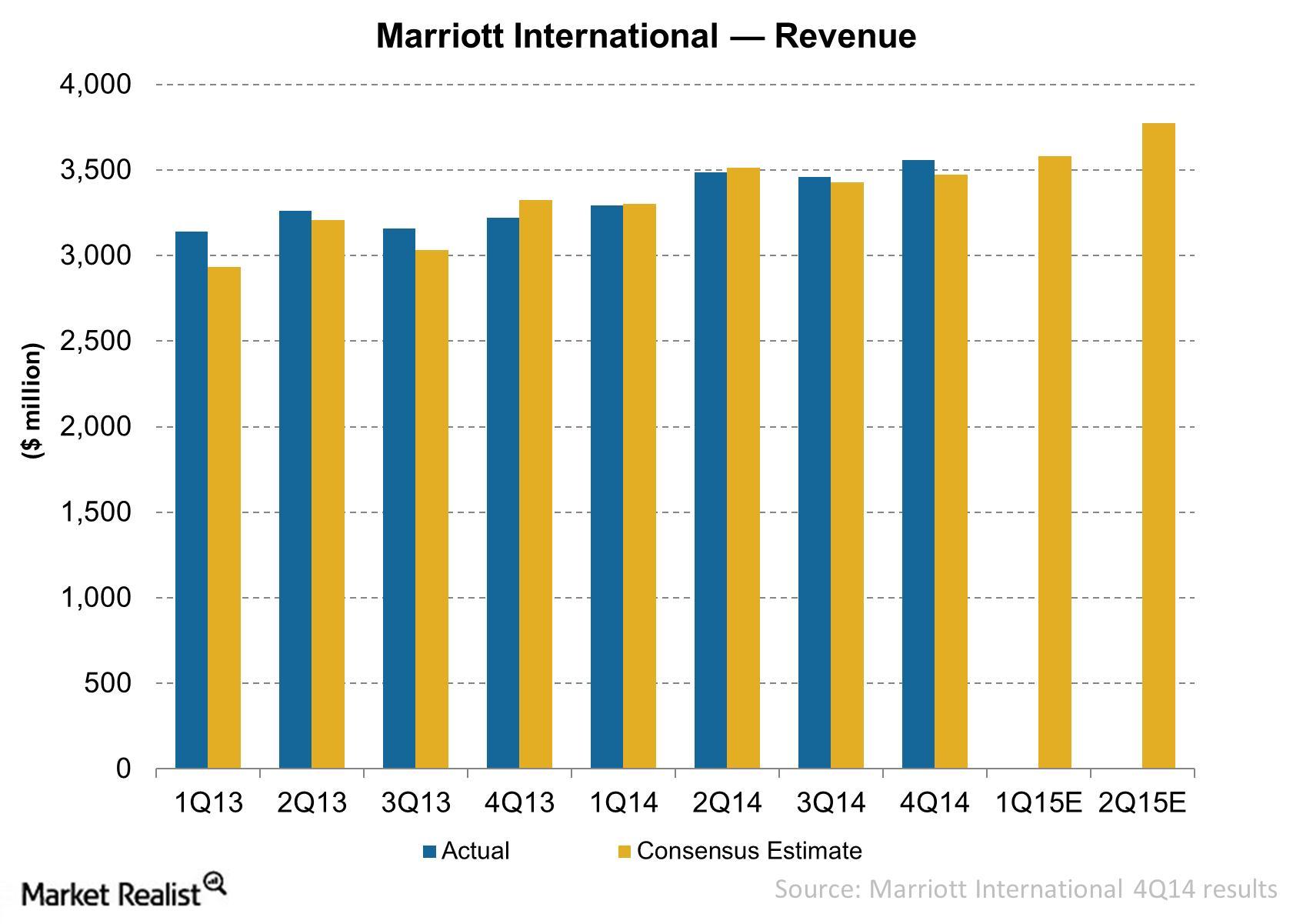

Why Marriott’s Revenue Increased in 2014

Marriott’s revenues totaled nearly $3.6 billion in the fourth quarter of 2014, compared to $3.2 billion in the fourth quarter of 2013.

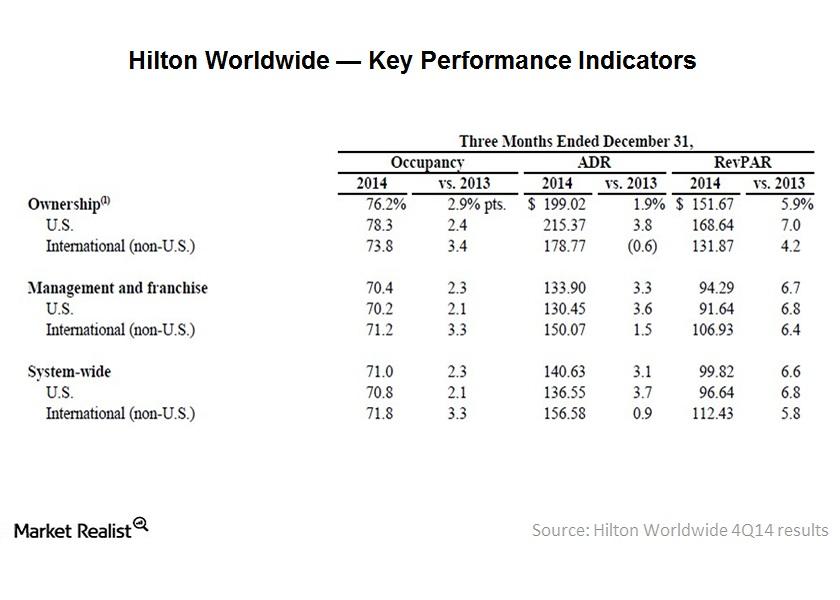

Hilton’s revenue was driven by occupancy and room pricing

Hilton Worldwide (HLT) generates revenue from its hotel operations. Hilton’s system-wide occupancy increased 2.3% YoY to 71% in 4Q14.

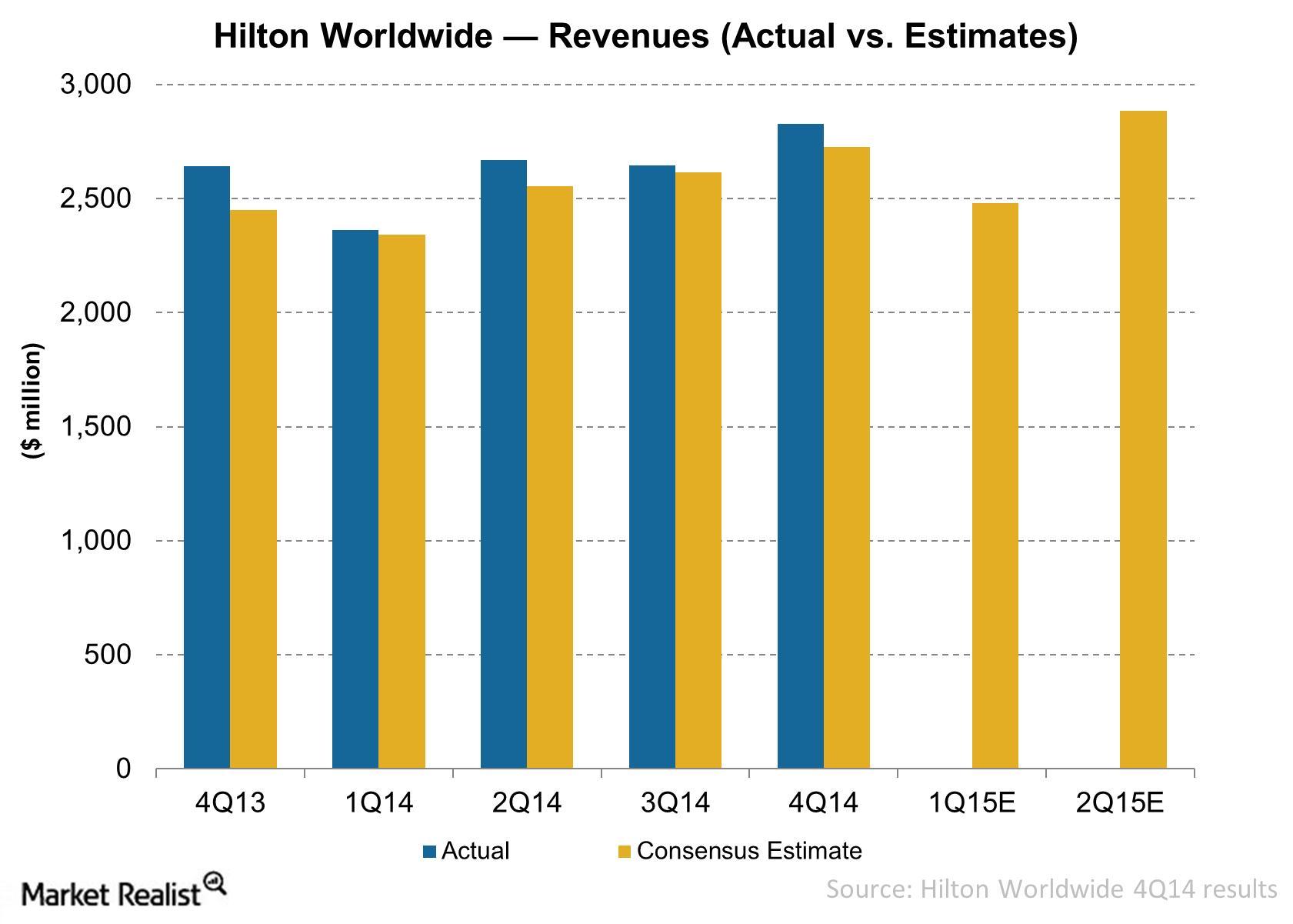

Why did Hilton’s revenue increase in 2014?

Hilton’s 4Q14 revenue increased 7% YoY to $2,828 million. For 2014, its revenue increased by 10.5 billion, or 7.9%—compared to 2013.

Disposable income increases, drives demand for leisure

Real disposable income increased 3.7% year-over-year. This boosts consumer buying power and means consumer spending in leisure activities may increase.

Why Six Flags’ guest spending per capita improved

Six Flags’ per capita guest spending increased $2.79, or 7%, to $42.97 in 2014, primarily due to improved admissions pricing and new offerings in the parks.

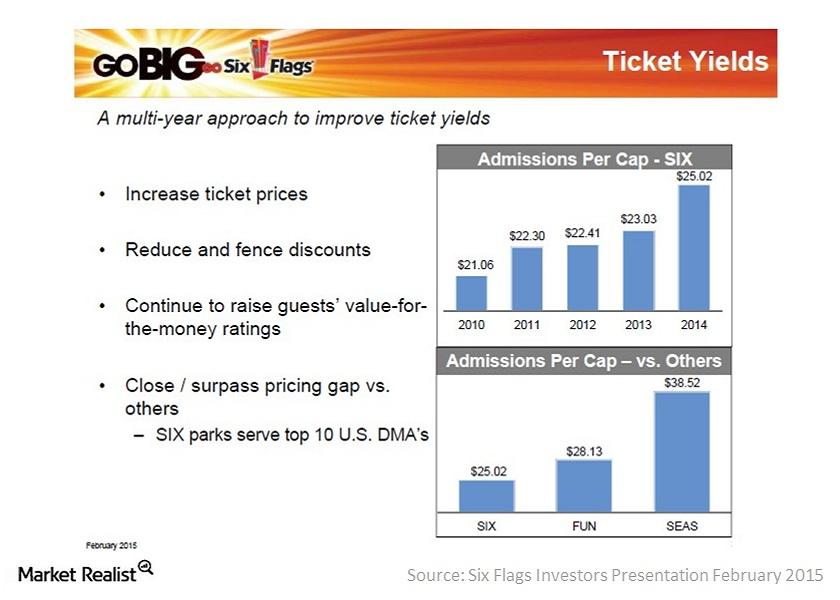

Ticket pricing pushes Six Flags’ admissions revenue up

Six Flags’ (SIX) admissions revenue per capita increased by 9% in 2014, primarily driven by pricing improvements on multi- and single-use ticket offerings.

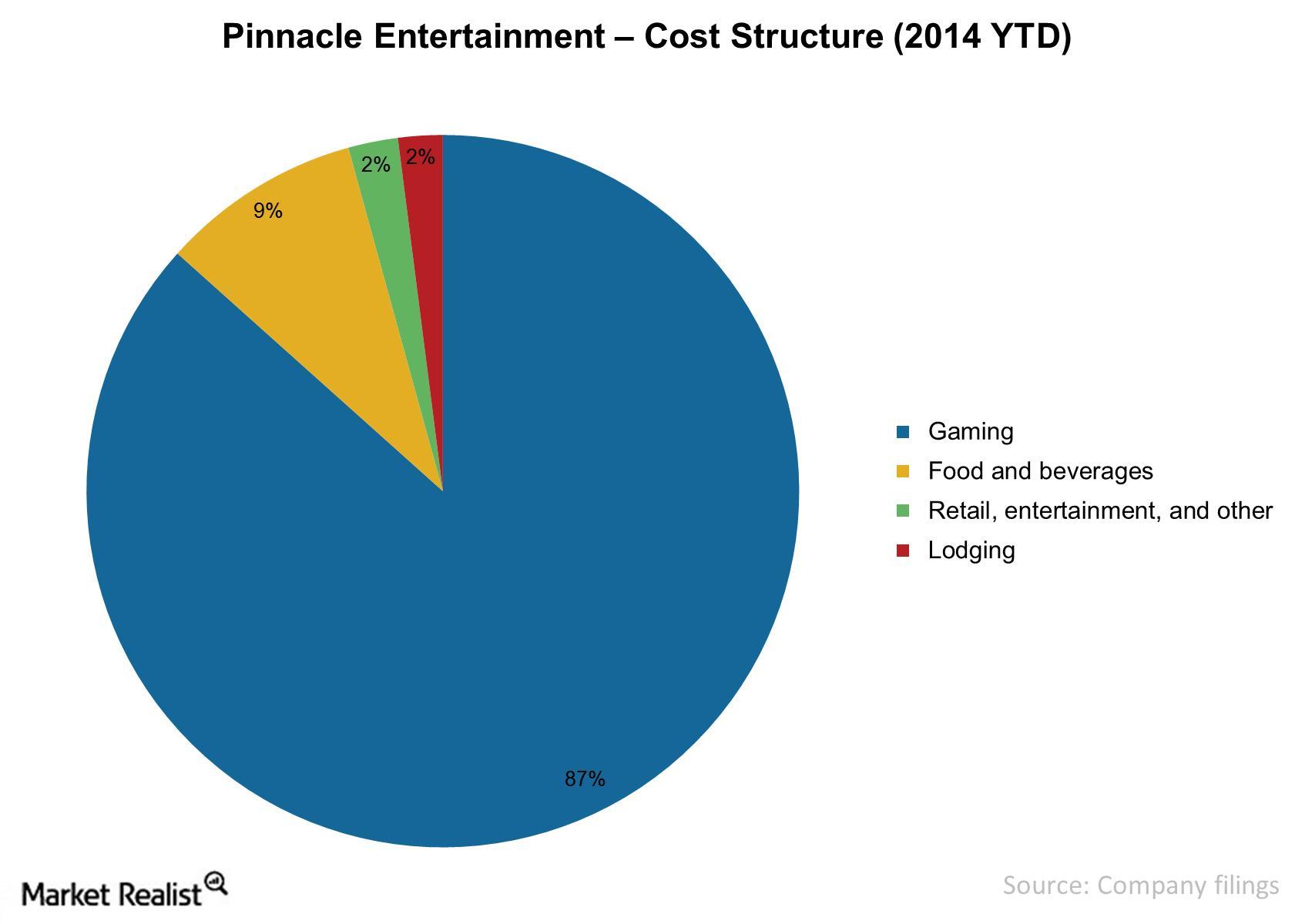

Pinnacle Entertainment’s cost structure

Pinnacle Entertainment (PNK) incurs direct costs in gaming, food and beverage, lodging, retail, entertainment, and other areas.Consumer Must-know: A SWOT analysis of Las Vegas Sands

The strengths, weaknesses, opportunities, and threats (or SWOT) analysis is a useful tool for decision-making in businesses and organizations. It helps companies identify the positive and negative factors inside and outside an organization.Consumer Must-know: The casino industry’s key revenue drivers

Gaming revenues are more volatile than consumer staples. Customers in markets outside of Las Vegas usually travel short distances to reach casinos. This is a major component of casino revenue. How much money gamblers bring is determined by their discretionary income.Consumer Why new entrants haven’t been a threat for the casino industry

The casino industry has heavy capital expenditures in gaming machines. This contributes significantly to the total output that’s generated by a casino operator. This is why the threat of new entrants to the industry has been low.Consumer Why the casino industry is rapidly expanding into new markets

The international gaming industry is growing quickly. It’s expanding to new jurisdictions. Many U.S. commercial casino companies, including Las Vegas Sands (LVS) and Wynn Resorts (WYNN), have helped the industry become an important part of the global economy.Consumer Why the commercial gaming market is increasing for casinos

Casino gaming is the largest part of the commercial gaming market. It continues to grow in popularity. There has been a surge in demand for casino games. As a result, new casino destinations have been created. Existing casinos have also been expanded.