Why did Hilton’s revenue increase in 2014?

Hilton’s 4Q14 revenue increased 7% YoY to $2,828 million. For 2014, its revenue increased by 10.5 billion, or 7.9%—compared to 2013.

March 10 2015, Updated 6:14 a.m. ET

Hilton’s results

On February 18, 2015, Hilton Worldwide (HLT) released its fourth quarter and fiscal year results ending in December 2014. In 2014, Hilton’s fourth quarter revenue and operating profits beat consensus estimates. In this part of the series, we’ll discuss Hilton’s revenue.

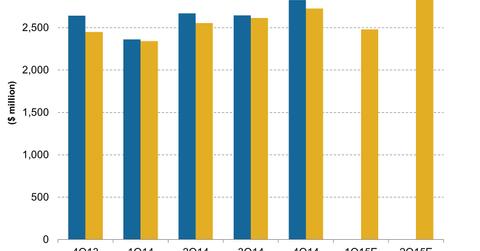

Hilton’s 4Q14 revenue increased 7% year-over-year, or YoY, to $2,828 million. For 2014, its revenue increased by 10.5 billion, or 7.9%—compared to 2013. The revenue growth was positively impacted by an increase in RevPAR (revenue per available room). It was driven by an increase in the occupancy rate and the ADR (average daily rate). We’ll discuss these metrics later in this series.

The above chart shows that Hilton’s actual revenue beat consensus estimates by 3.8% in the fourth quarter. Consensus revenue estimates for 1Q15 and 2Q15 are $2,480 million and $2,885 million, respectively.

Overview of Hilton

Hilton was established in 1919. It’s based in Texas. Hilton is a leading global hospitality company. It operates luxury and full-service hotels and resorts. It also operates extended-stay suites and focused-service hotels.

Hilton Worldwide operates through three business segments:

- Management and Franchise

- Ownership and Leased

- Timeshare

As of March 3, 2015, it had ~4,322 managed, franchised, owned, and leased hotels as well as timeshare properties with 715,062 rooms in 94 countries and territories.

Other companies in the industry include Marriott International (MAR), Starwood Hotels & Resorts Worldwide (HOT), Hyatt Hotels, and Wyndham Worldwide Corporation (WYN).

ETFs like the PowerShares Dynamic Leisure and Entertainment Portfolio (PEJ) and the Consumer Discretionary Select Sector SPDR Fund (XLY) invest in these hotel companies.

To learn more about Hilton read Must-know: An overview of Hilton Worldwide Holdings Inc.

Series overview

In this series, we’ll discuss Hilton’s 4Q14 and fiscal year 2014 earnings. We’ll look at how Hilton creates a huge return from minimum capital investment. We’ll also discuss Hilton’s plans to control its leverage for exploring capital return options and its current valuation.