Sam Matthews

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Sam Matthews

Understanding Marriott International’s Valuation Multiple

In fiscal 2014, Marriott had forward EV-to-EBITDA multiple of 15.3. It was trading at 11.2 as of January 1, 2016, which was the highest among peers.

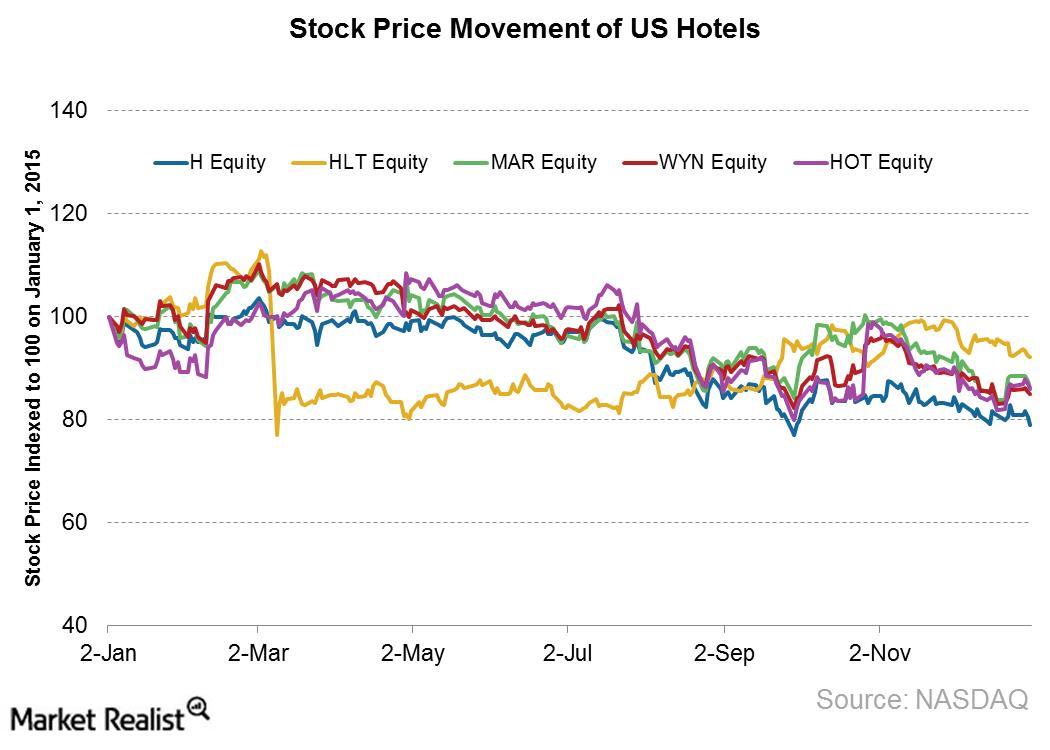

Big Hotels on the Block: Sizing up Wyndham Worldwide’s Competitors

Since 2010, Wyndham’s stock has outperformed all its peers, growing by over 270%. In that time, Marriot grew by ~176%, Starwood by 102%, and Hyatt by 67%.

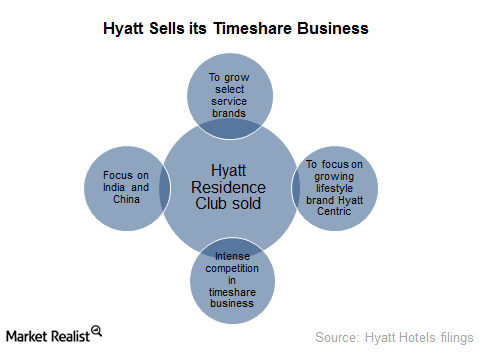

Why Did Hyatt Sell Its Vacation Ownership Segment?

Hyatt is focusing on increasing its presence to under-penetrated markets. The company believes that its presence in emerging markets such as India and China is essential for its growth.

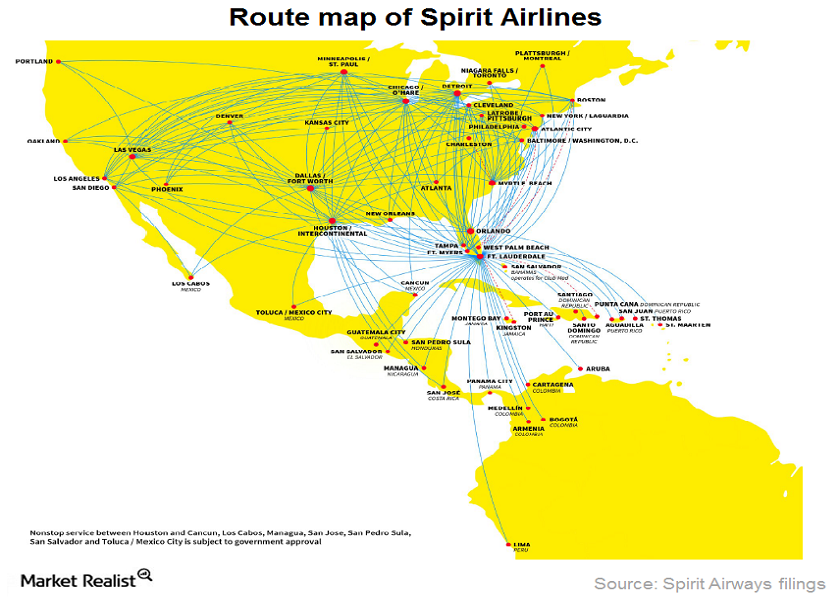

Spirit Airlines: An Introduction to a Low-Cost Pioneer

Spirit Airlines (SAVE) is headquartered in Miramar, Florida. It’s a pioneer of ultra-low-cost carrier or ULCC airlines.

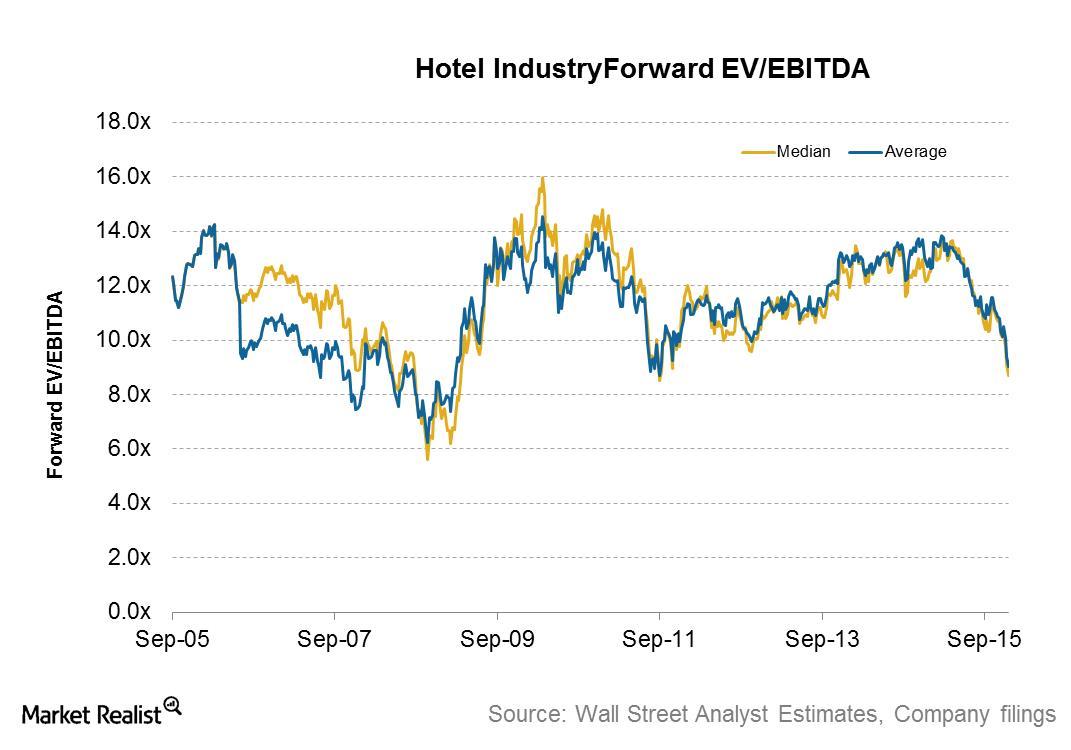

Understanding the Hotel Industry Valuation Multiple

The forward EV-to-EBITDA multiple for the hotel industry currently stands at 9. It has declined from 13.1, which was recorded at the beginning of 2015.

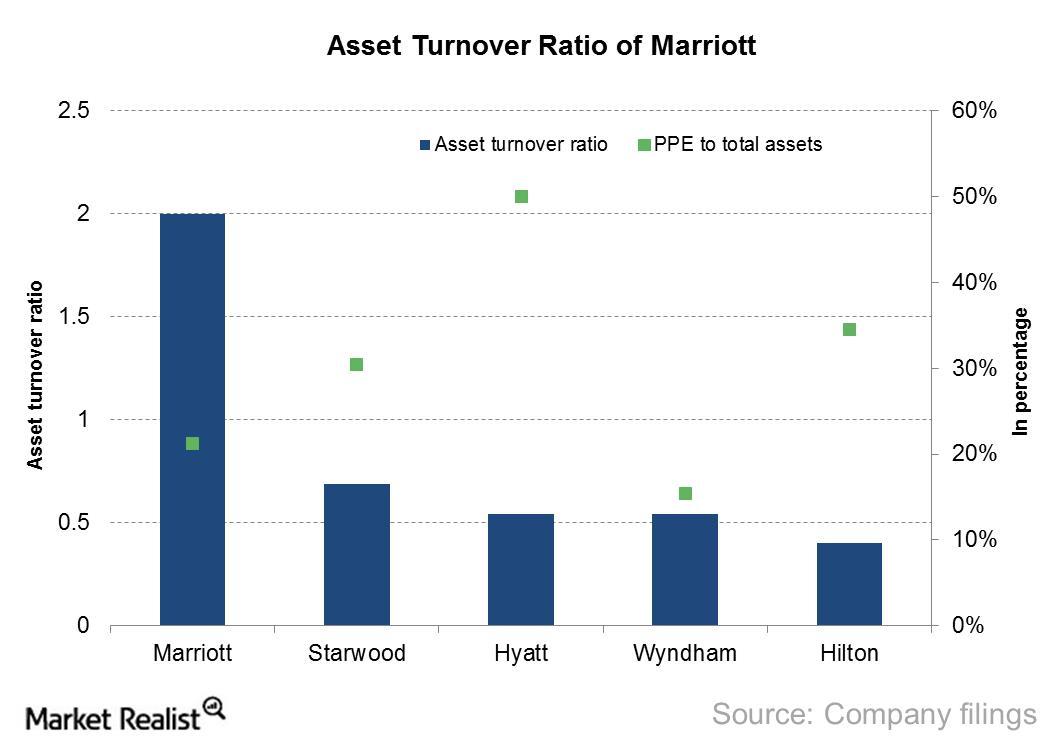

What You Ought to Know about Marriott International’s Asset Utilization

Marriott has one of the lowest asset bases among its industry peers, having reduced its PPE-to-total-assets ratio from 24% in 2012 to 21.2% in 2014.

Marriott International’s Expansion in the Franchise Model Is Bearing Fruit

Marriott’s operating margin increased from 5.9% in 2010 to 8.4% in 2014. Its operating income grew from $695 million in 2010 to $1,159 million in 2014.

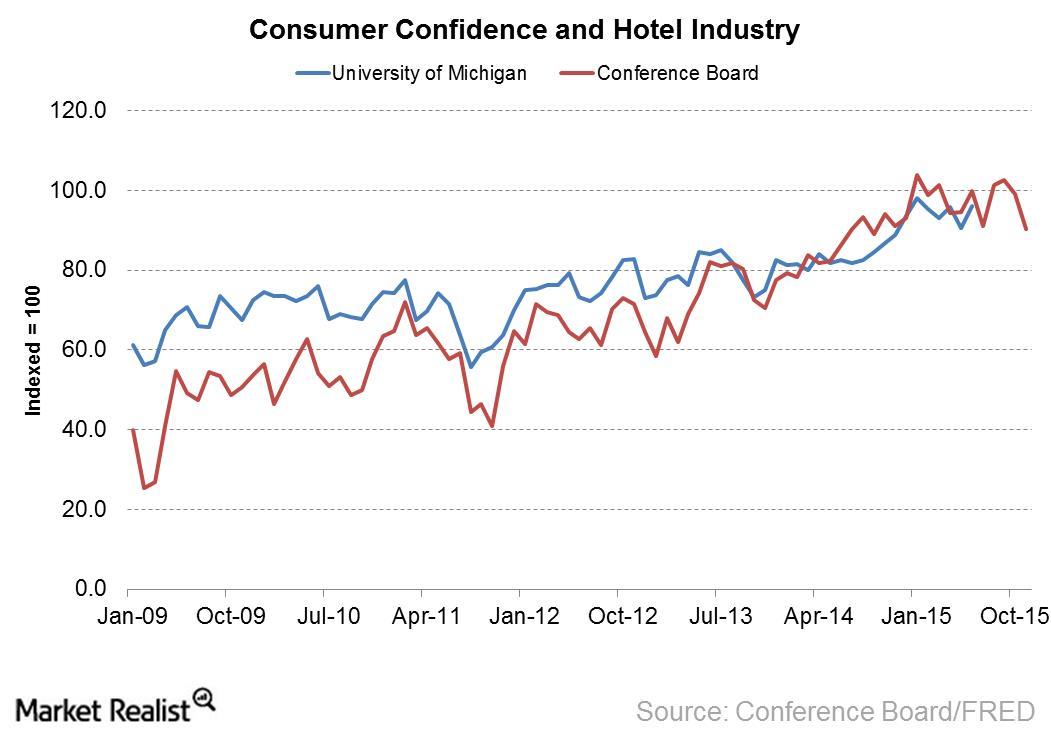

How Could Falling Consumer Confidence Affect the Hotel Industry?

The Conference Board Consumer Confidence Index as of November 2015 was 90.4 compared to 102.6 in September 2015.

An Investor’s Introduction to the US Hotel Industry

Hotel investors can use the indicators discussed in this series to gauge the industry’s general trends. Leisure travelers make up ~60% of the total hotel room sales, and business travelers account for 40% of total sales.

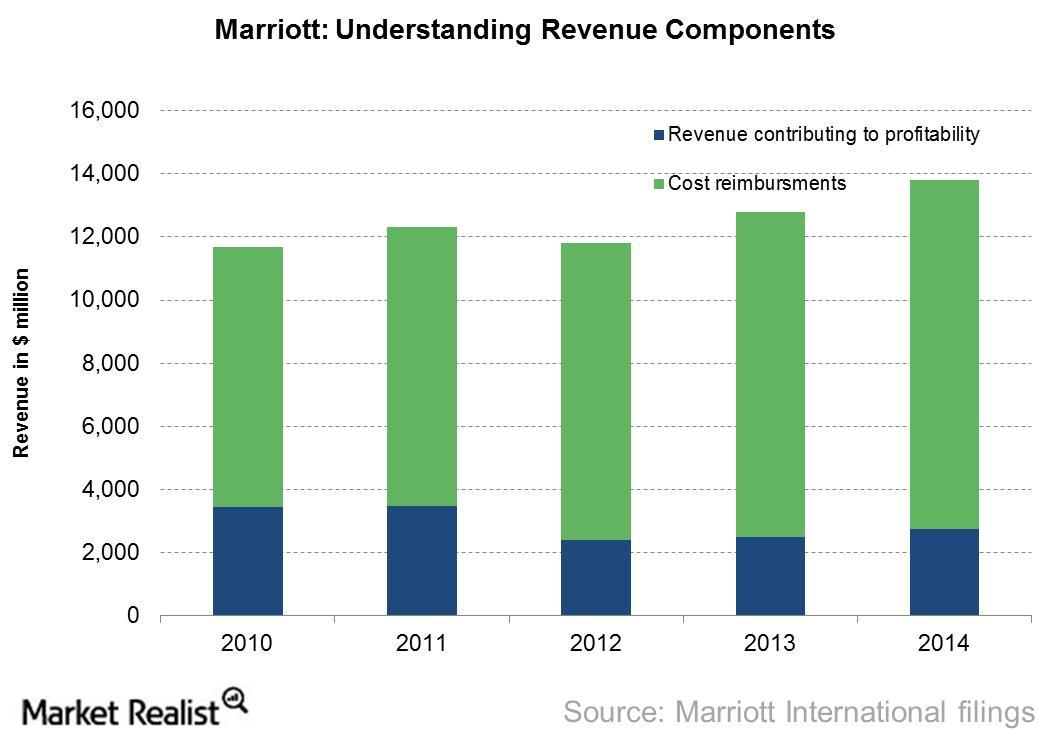

Understanding Cost Reimbursements as a Key Part of Marriott International’s Revenues

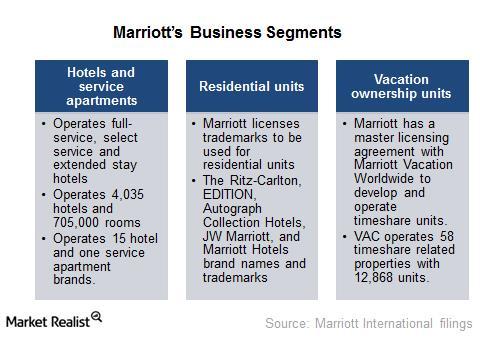

Cost reimbursements make up a major component of Marriott’s revenues and mostly consist of salaries paid to employees working in Marriott-managed hotels.

Why Marriott Relies Heavily on Its Franchise Model for Growth

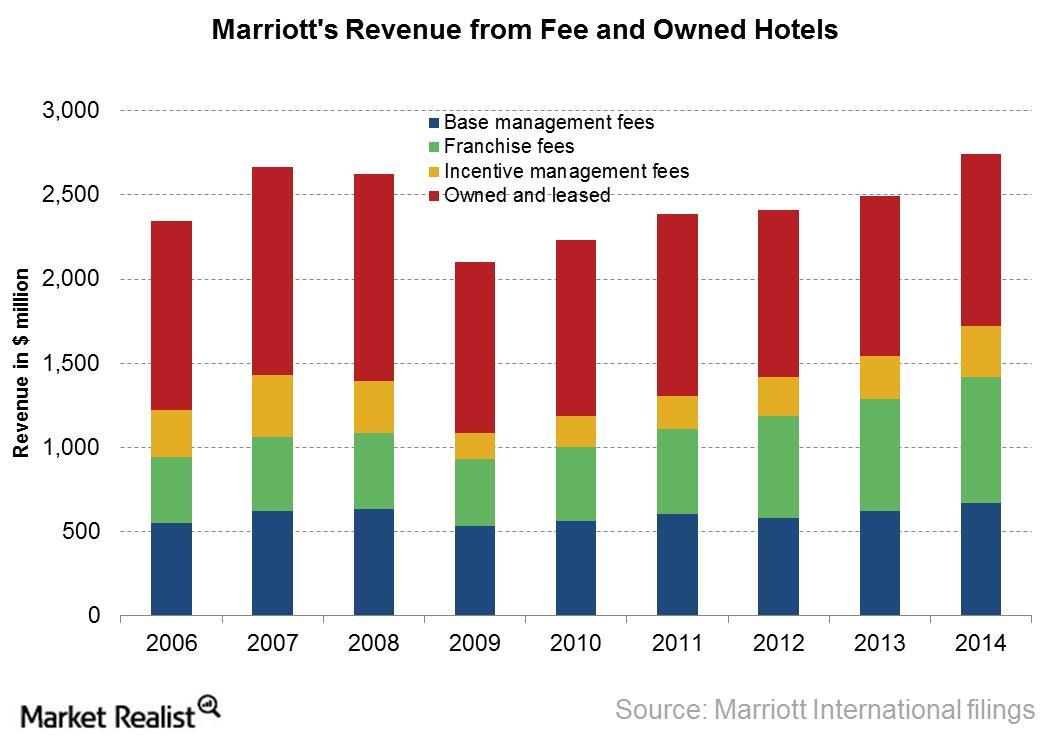

Marriott now focuses on capital-light segments like franchised properties. Its fee incomes rose from $1.2 billion to $1.7 billion between 2006–2014.

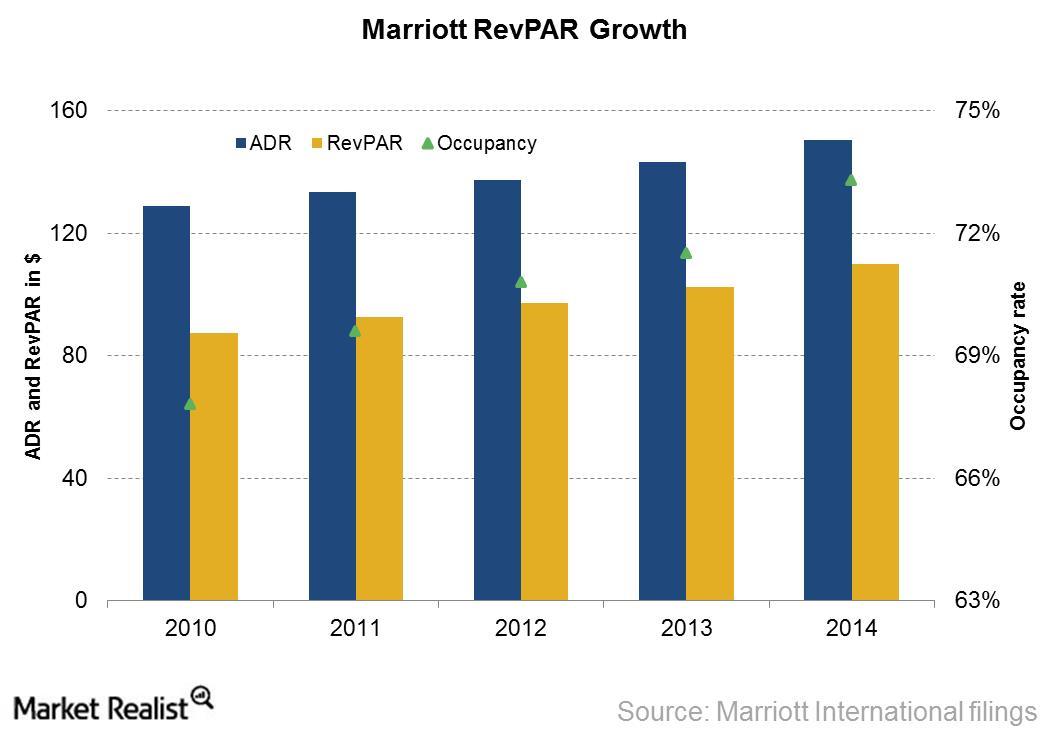

Industry-Wide Demand Growth Drives Marriott International’s RevPAR

Marriott International saw strong increases in RevPAR—from $87 to $110—between 2010 and 2014.

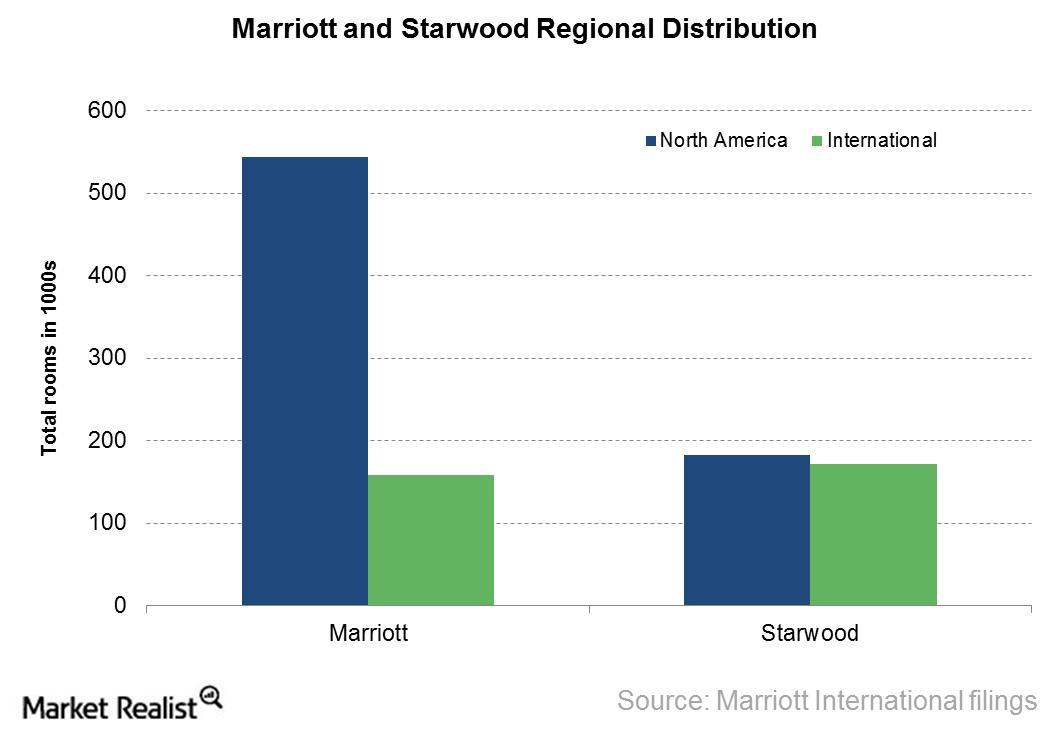

Just How Much Does Marriott International Stand to Benefit from the Starwood Acquisition?

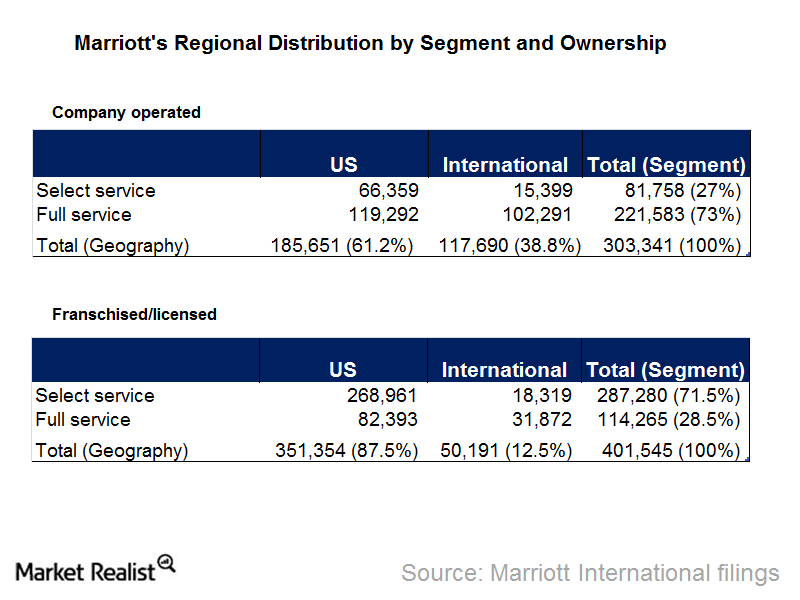

Marriott’s acquisition of Starwood will likely help Marriott double its international portfolio while diversifying its global presence.

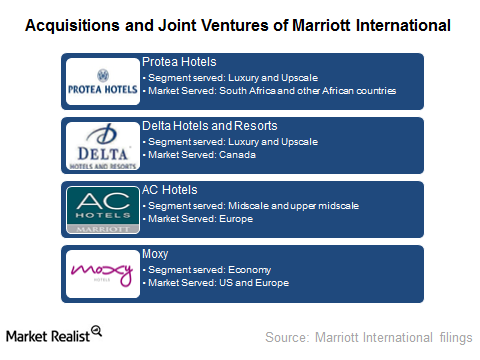

Acquisitions and Joint Ventures Drive Marriott’s International Expansions

Marriott has been able to expand its international business by both acquiring and creating brands that enable it to enter new markets and market segments.

Marriott International in the Eyes of Customers: Outside Looking In

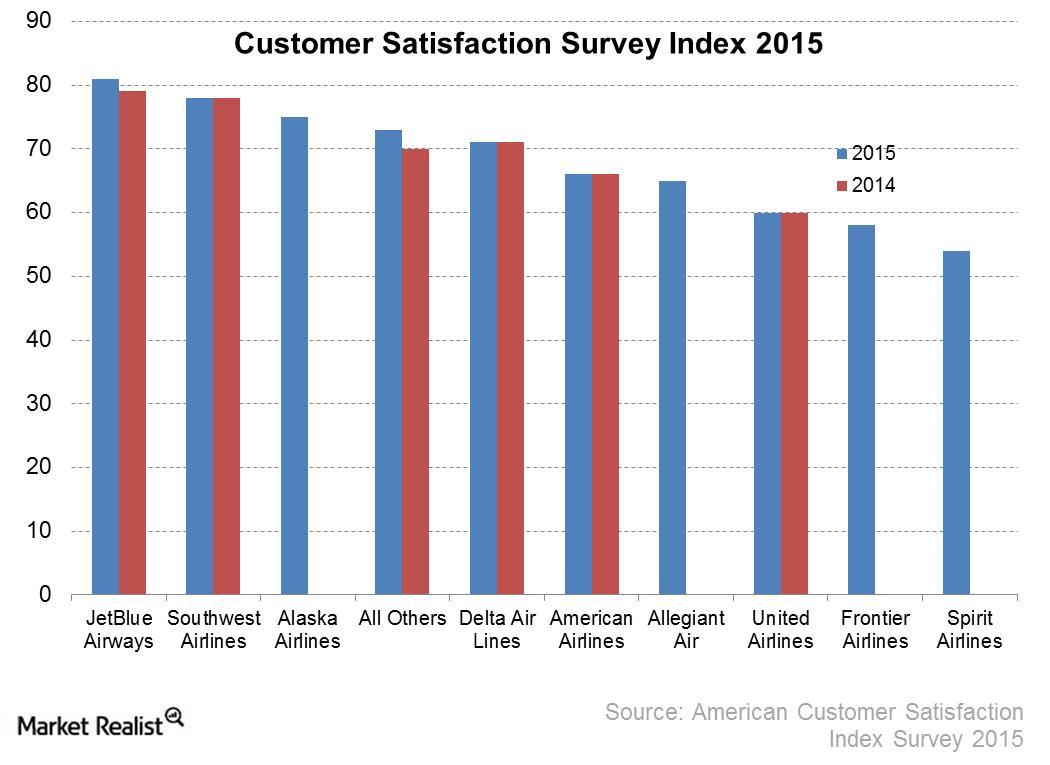

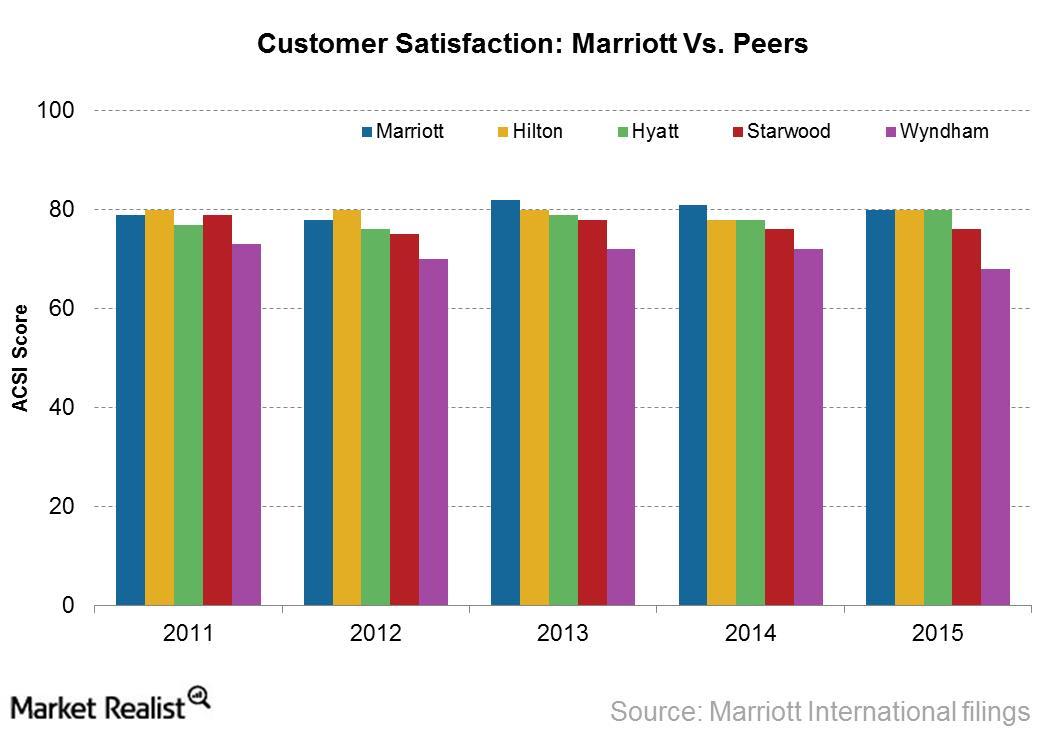

In 2015, Marriott topped the ACSI survey with a score of 80. It also topped the survey in 2014 and 2013, with scores of 83 and 81, respectively.

Marriott International’s Business Model by Service Category: Key Investor Takeaways

At the end of 2014, Marriott had around 2,882 franchised hotel properties, with 388,670 rooms under the franchise model.

Sizing up Marriott International’s Competition in a Tough Industry

Marriott operates hotels under not just under the management model but also under the franchise model and the owned and leased model.

Introducing Marriott International: Your Key Company Overview

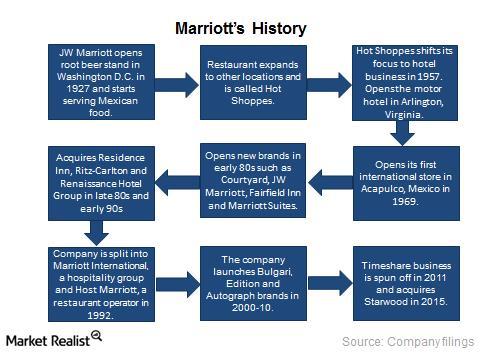

Marriott International is known for its wide range of budget and luxury hotels. Its acquisition of Starwood will make it the world’s largest hotel chain.

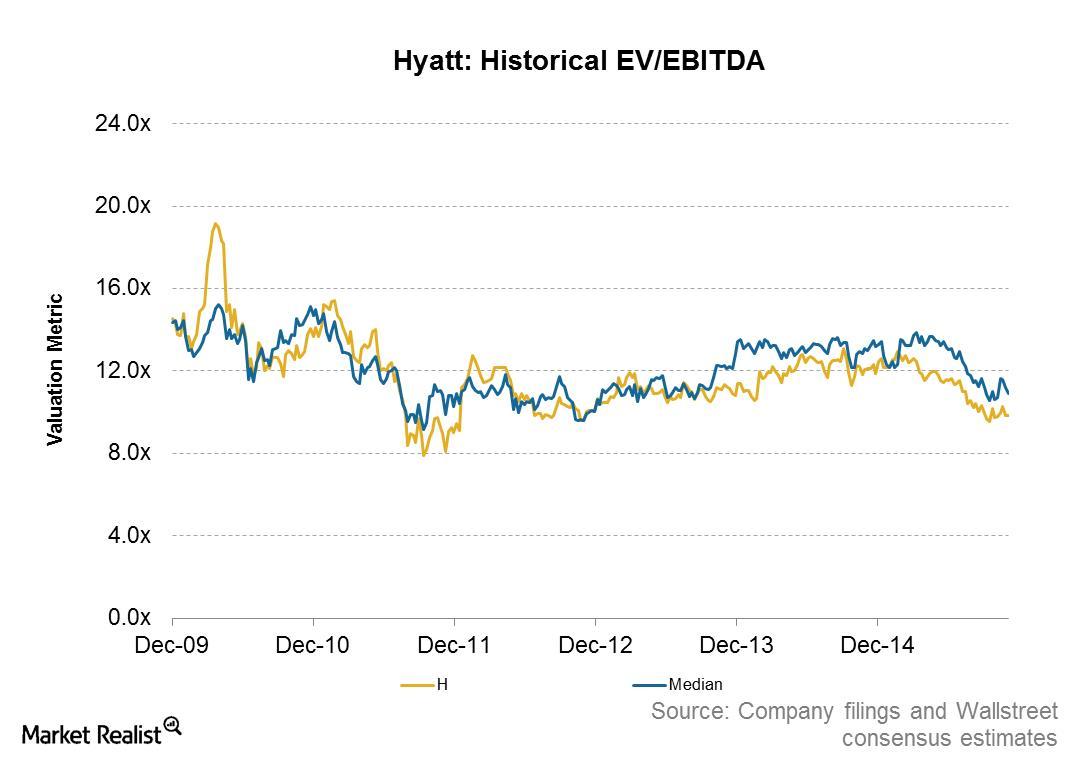

Investor Essentials: Understanding Hyatt’s Valuation Multiple

Hyatt’s EV/EBITDA has moved in line with the median valuation multiple of its peers. Hyatt, with rare exceptions, has always traded at a discount to the median valuation multiple of its peers.

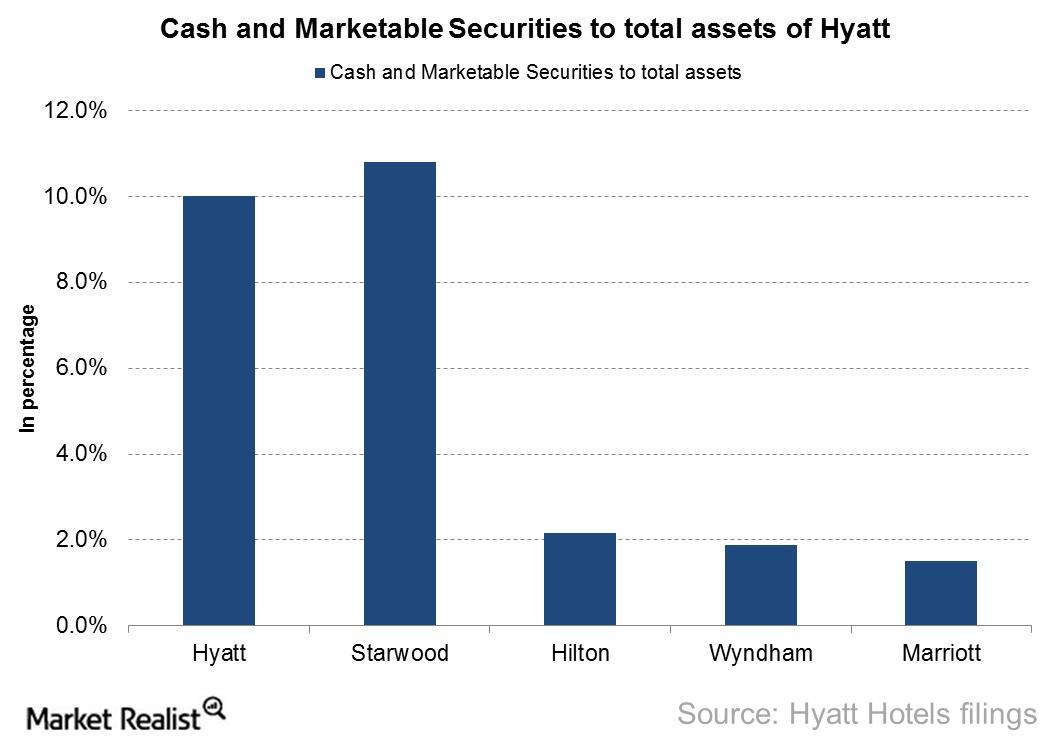

Why Hyatt Has High Liquid Assets Compared to Its Peers

As of December 31, 2014, Hyatt’s cash, cash equivalents, and marketable securities as a percentage of total assets is one of the highest among its peers, at 10%.

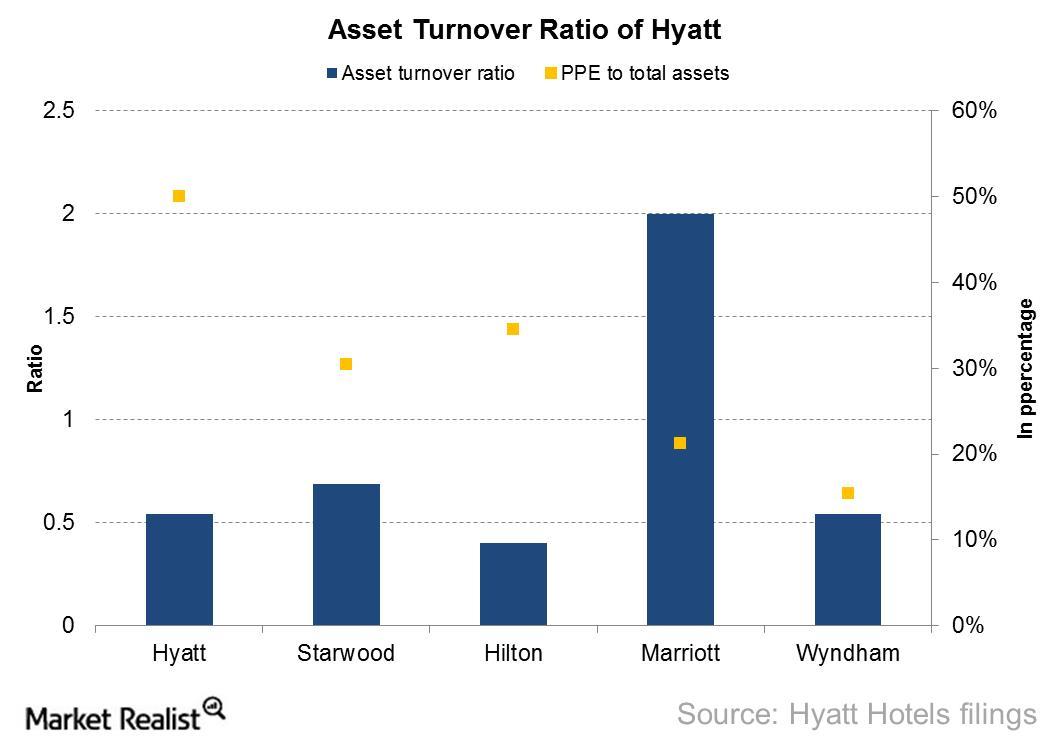

Asset Utilization by Hyatt Hotels

Hyatt had the lowest return on assets (or ROA) ratio among its peers at 4.6% for fiscal 2014 due to lower profits generated from its assets.

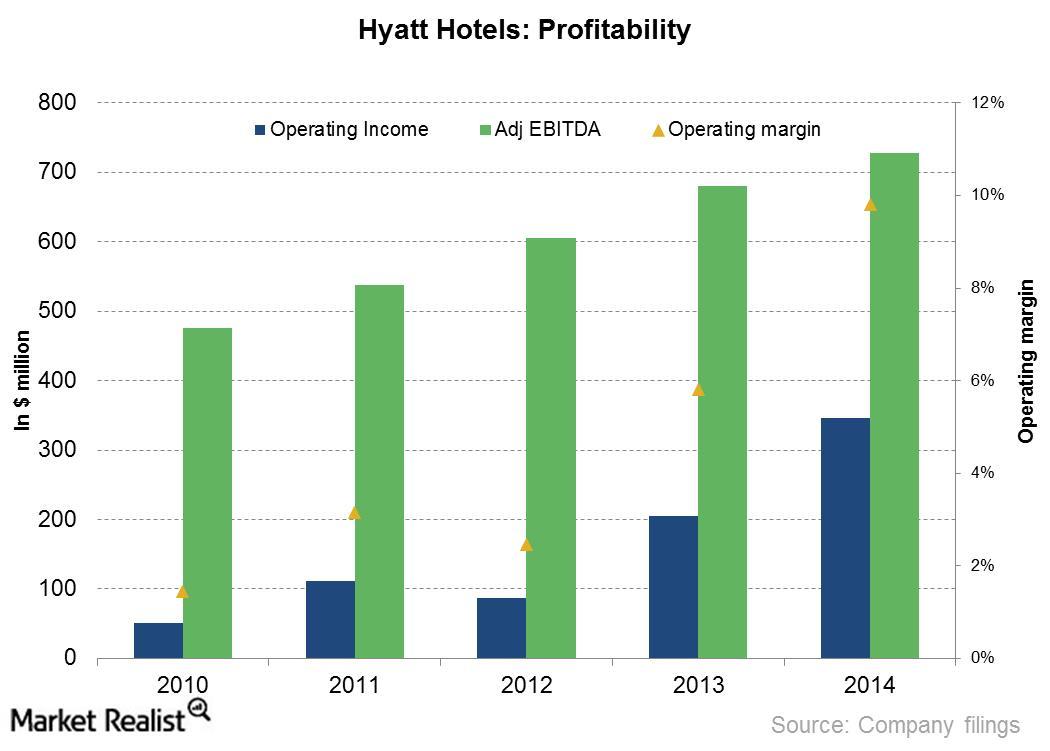

Profitability Margins Grew for Hyatt Hotels

Operating margins for Hyatt Hotel (H) increased from 1.4% in 2010 to 6.3% in 2014. The growth in margins was largely driven by steady growth in revenue and declining expenses from the owned and leased hotels segment.

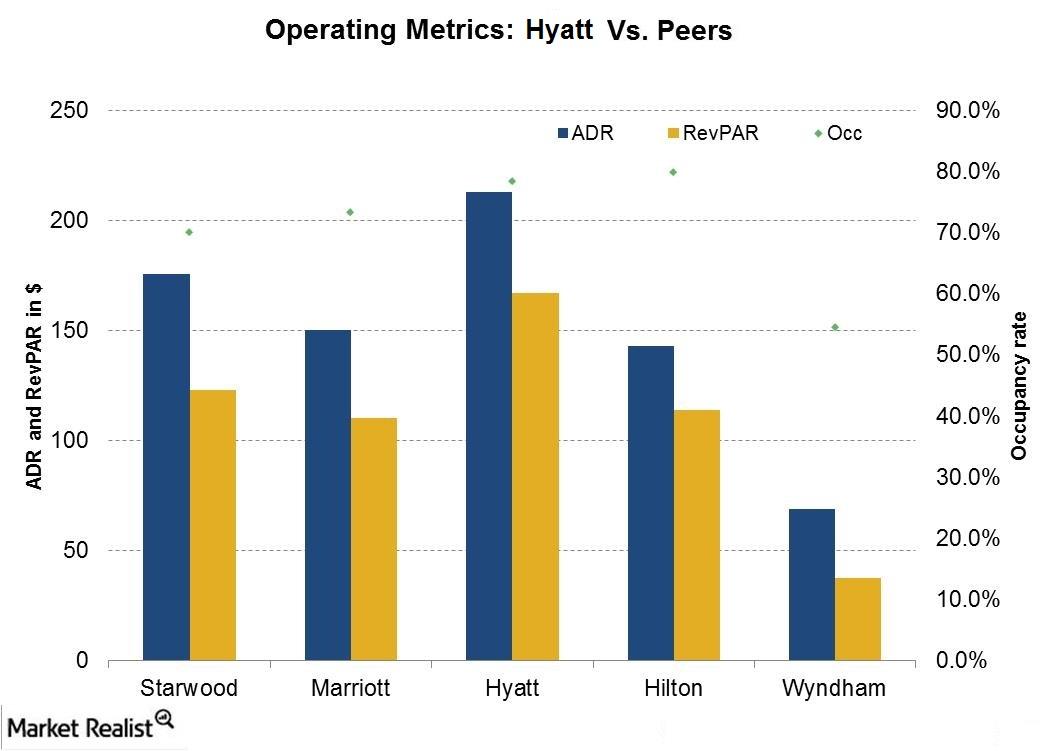

Why Hyatt Has the Highest ADR and Occupancy Rate Among Its Peers

At 76.2%, Hyatt Hotels (H) had one of the highest occupancy rates among its peers for its owned and leased hotels in 2014.

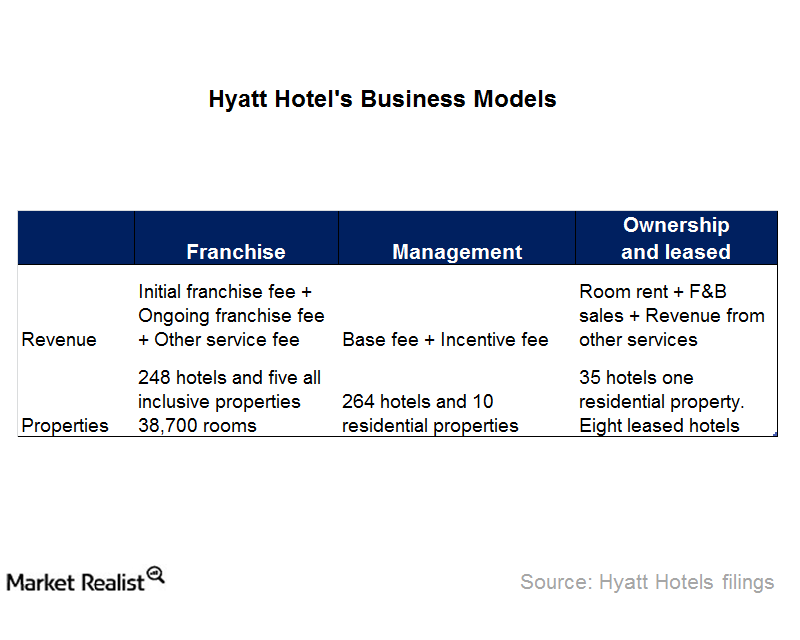

How Does Hyatt Make Money from Its Hotels?

Hyatt (H) operates its hotels and other business segments under three models: franchise, management, and ownership models.

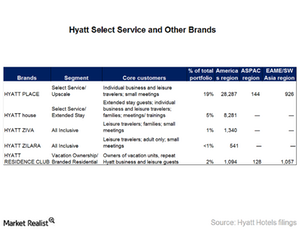

Introduction to Hyatt’s Select Service Brands and Other Brands

Hotels that offer accommodation with limited services and amenities are called select service hotels. Hyatt (H) operates about 37,500 rooms and two brands under this segment.

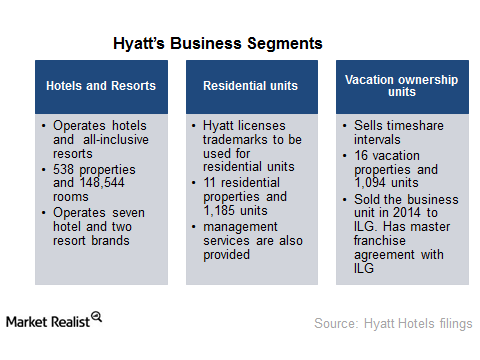

An Overview of Hyatt Hotels’ Competition

Some of Hyatt’s competitors—Hilton (HLT), Marriott (MAR), Wyndham (WYN), and Starwood (HOT)—compete in all the segments: Hotels and Resorts, Residential Units, and Vacation Ownership Units.

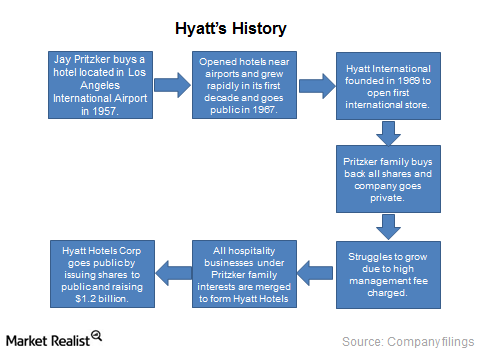

The Investor’s Introduction to Hyatt Hotels

A global hospitality group, Hyatt (H) operates industry-leading brands such as Park Hyatt, Andaz, Hyatt, Grand Hyatt, and Hyatt Regency. As of December 31, 2014, the company operated 587 properties with more than 155,000 rooms.

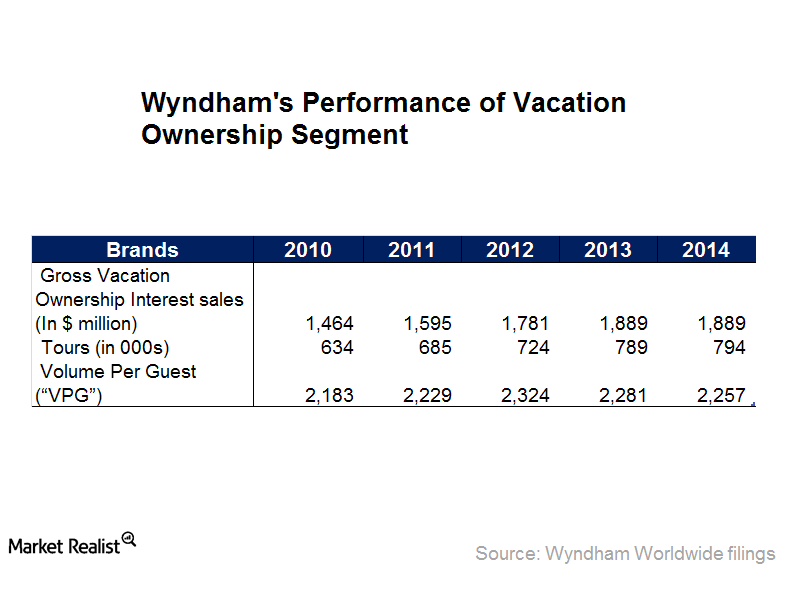

What’s Driving the Revenues of Wyndham Worldwide’s Vacation Ownership Segment?

Vacation unit sales rely on disposable income available to customers. The stable US economy and growing household incomes have positive impacts on Wyndham.

How Wyndham Uses Technology to Offer Greater Value to Its Clients

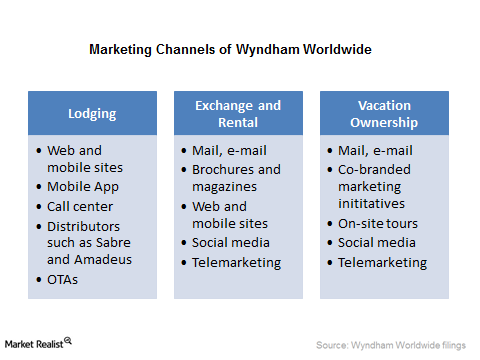

Wyndham invests in technology to improve its e-commerce capabilities and marketing abilities and to help it differentiate itself from competitors.

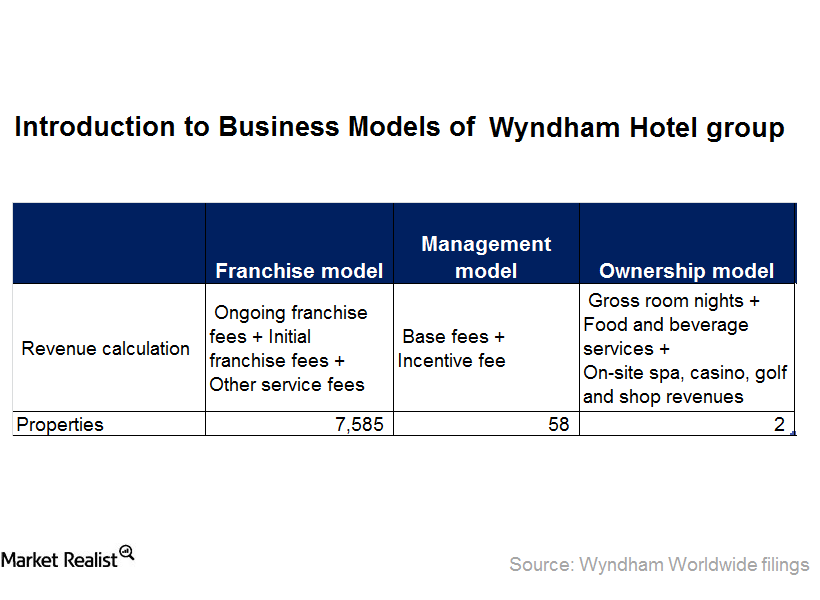

A Rundown of Wyndham Worldwide’s Wyndham Hotel Group Segment

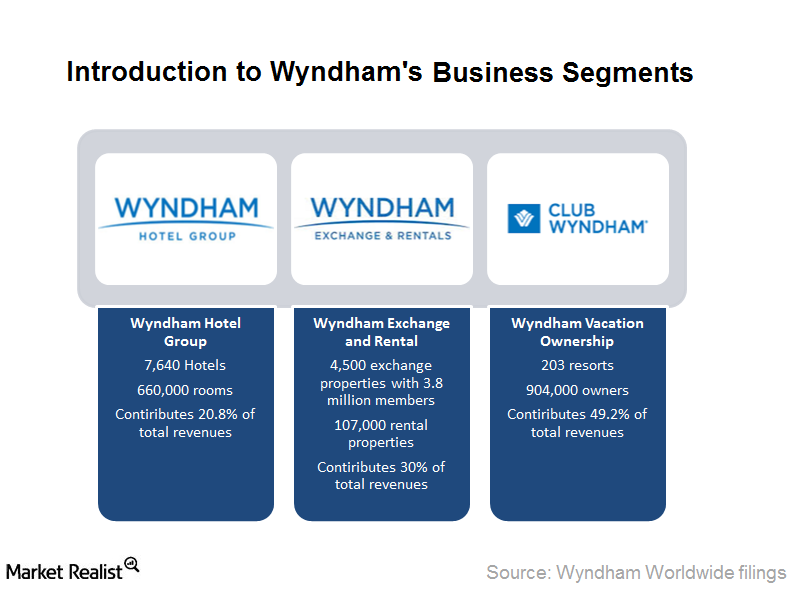

Wyndham Hotel Group provides services under a franchise model but also offers professional oversight and operations support under a management model.

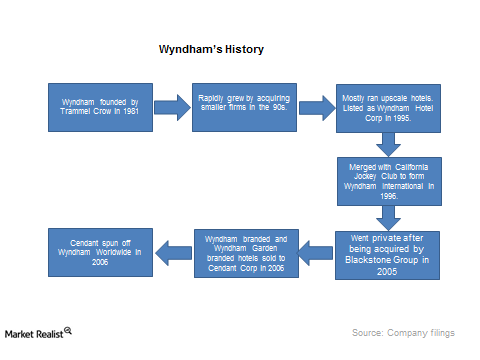

Introducing Wyndham Worldwide, a Hotel Super Power

Wyndham Worldwide is considered the world’s largest hotel franchiser. It owns the world’s largest vacation ownership and exchange network.

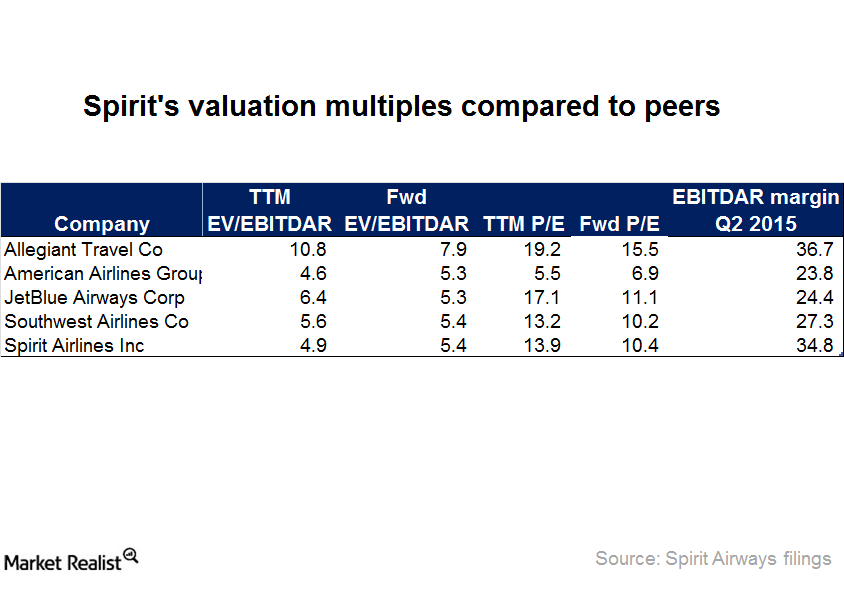

Spirit Airlines’ Valuation Ratio: How Does It Stack Up?

Spirit and its competitors have seen their EV/EBITDA decrease in the last six months due to the fear of a large increase in available seat miles.

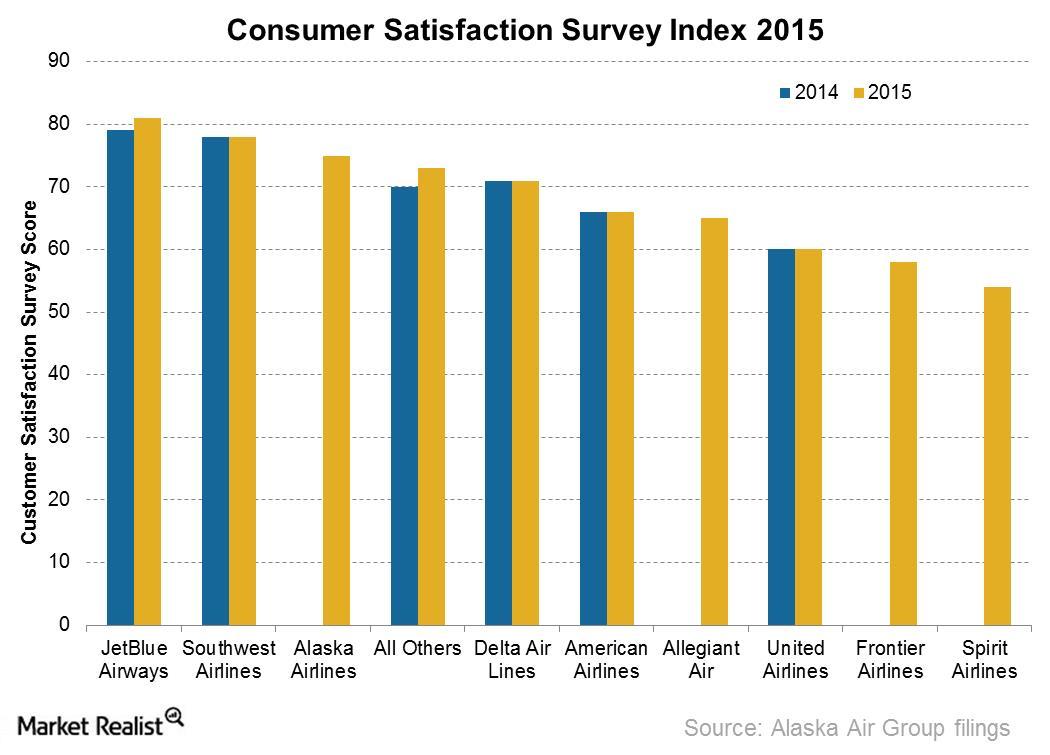

Alaska Airlines’ Keys to High Customer Satisfaction

For the seventh consecutive year, Alaska Airlines held the top spot in Customer Satisfaction among the Traditional Network Carriers survey conducted by J.D. Power.

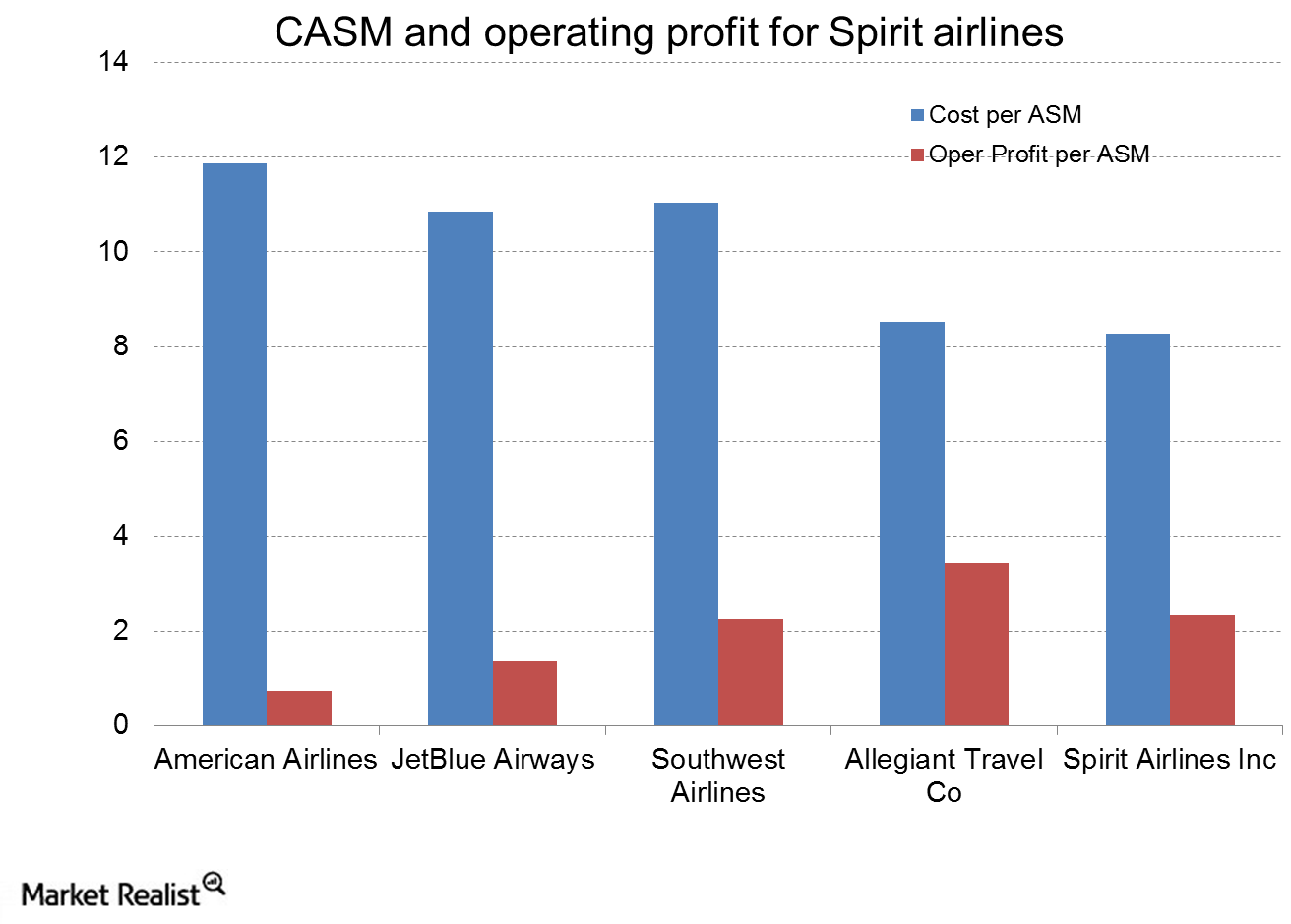

How Does Spirit Airlines Manage Its Low-Cost Structure?

Spirit (SAVE) ranks first in profitability among seven airlines in the United States. The main driver for this ranking comes from its exceptional ability to manage costs.

Understanding Spirit Airlines’ Low-Cost Business Model

Spirit Airlines (SAVE) follows a simple business model of reducing base airfares as much as possible. All its other services are charged separately.