Why Marriott Relies Heavily on Its Franchise Model for Growth

Marriott now focuses on capital-light segments like franchised properties. Its fee incomes rose from $1.2 billion to $1.7 billion between 2006–2014.

Jan. 20 2016, Updated 10:06 a.m. ET

Marriott International’s emphasis on capital-light segments

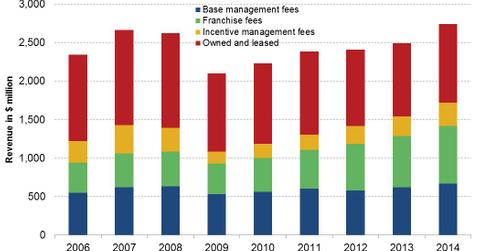

Marriott International (MAR) has been increasing its focus on capital-light segments like managed and franchised properties. Marriott has been able to increase its fee incomes from $1.2 billion in 2006 to $1.7 billion in 2014. In the same period, revenues from its owned and leased hotels decreased from $1.1 billion to about $1 billion. Marriott increased its rooms under franchise model by over 20.9% in 2010–2014, whereas it increased by only 2.4% in its management model and decreased by only 3% for owned and leased model.

Low risk and quick growth

Using a franchise model offers a low-risk growth strategy for Marriott. The hotel sector is generally capital-intensive and has high fixed costs. A small change in revenue during the economic downturn will likely have a much larger impact on the company’s bottom line.

We should note that a lighter asset base allows Marriott International to run with lower fixed costs, which lowers the company’s operating leverage. This results in less volatile profits. Moreover, Marriott plans to expand to those places where previously it had little or no presence, and using the franchise method is a quicker way to do it.

The appeal of the franchise model

For hotel owners who are interested in owning a Marriott franchise hotel, Marriott offers a wide range of brands that operate in various segments. Moreover, most of Marriott’s brands are well-recognized all over the world. The company also appeals to hotel owners as it has one of the best loyalty programs among industry peers.

Moreover, the franchise model also offers a quick way to expand its operations. Peers such as Hyatt Hotels Corporation (H), Starwood Hotels & Resorts Worldwide (HOT), and Hilton Worldwide Holdings (HLT) are also adapting this same capital-light model of growth. Investors can gain exposure to these companies by investing in the Consumer Discretionary Select Sector SPDR Fund (XLY) and the PowerShares Dynamic Leisure & Entertainment Portfolio (PEJ).

Continue to the next part for an analysis of Marriott International’s profitability over the past five years.