SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

US Non-Farm Payroll Disappoints: Whose Fault Is It?

Today, the Bureau of Labor Statistics released the US non-farm payroll data for August. The US economy added fewer-than-expected jobs last month.

Coupa Index Flashes Red Light on Economy after PMI

Today, the third-quarter Coupa Business Spend Index was released. It’s a relatively new economic indicator that offers insights into corporate spending.

Is Trump Hinting at a Currency War?

The currency can be weakened by the central bank or government intervention. If President Trump is reelected, a currency war seems obvious.

JPMorgan and Bank of America: Time to Buy Stocks

In August, JPMorgan Chase (JPM) and Bank of America Merrill Lynch (BAC) suggested that investors not buy just yet. Their opinions are now changing.

Where Is US Crude Oil Headed? An Energy Update

On August 30, US crude oil October futures settled at $55.1 per barrel. On a week-over-week basis, US crude oil prices rose 1.7%.

Trade War: Are Trump and Xi Jinping Taking Buffett’s Advice?

Over the last few days, the trade war de-escalated. President Trump said that the US-China trade talks are resuming “at a different level.”

Trump, Trade War, Powell: More Upside for Gold Prices?

Gold hit a fresh six-year high on Friday as trade tensions between the US and China escalated. The SPDR Gold Shares ETF (GLD) closed up 2%.

Energy Stocks Fall: Right Time to Invest?

The recent slump in energy stocks provides investors with an opportunity to invest in well-placed stocks. Shell looks like an attractive investment option.

Investors’ Obsession with Yield Curve Inversion

You’ve likely heard about it in the financial press recently: this ominous, notorious thing called the “yield curve inversion.”

How the Stock Market Is Being Supported by Consumption

Despite the trade war and the inverted yield curve, the S&P 500 Index is down 1.8% this month. Its resiliency reflects the US consumer sector’s strength.

Kudlow Doesn’t See a Recession, Trump Might Fear One

White House economic advisor Larry Kudlow doesn’t see a looming recession. However, recession fears grew as the yield curve inverted last week.

JPMorgan and BofA: Don’t Buy the Market Dip Just Yet

JPMorgan Chase suggests waiting until September before returning to stocks. The markets will likely make new all-time highs in the first half of 2020.

The Dollar Is Strengthening: How Will It Affect Markets?

The US Dollar Index, which measures the strength of the dollar against a basket of other currencies, has risen 2.2% in the past month.

Where the Stock Market Could Be Headed Soon

The stock market has seen big moves both ways this week. The S&P 500 (SPY) has surged 1.3% today as bond yields have risen.

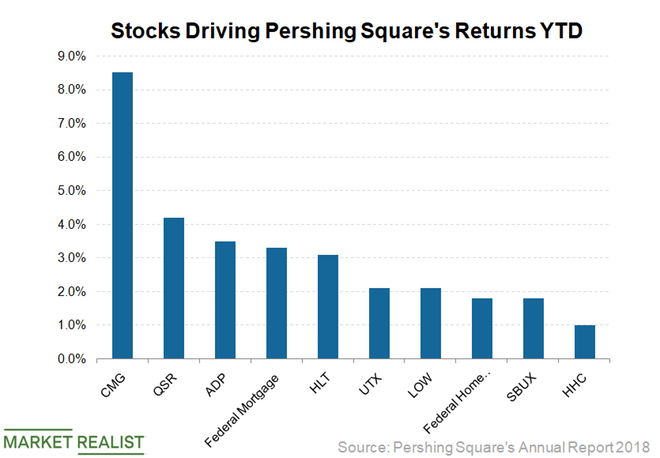

Ackman Makes Berkshire Bet: What It Means for Investors

According to the regulatory filing from Bill Ackman’s Pershing Square Capital, the fund has taken a new stake in Berkshire Hathaway (BRK.B).

Dow Jones, Boeing, and GE Fall: Hard Landing Ahead?

On Wednesday, US stock indexes fell due to recession signals. The Dow Jones Industrial Average (DIA) was the worst performer with a 3.05% fall.

US Economy: Is It as ‘Great’ as Trump’s Touting?

On multiple occasions, Trump has said the US economy is doing phenomenally well, calling it “the greatest economy in the HISTORY of America.”

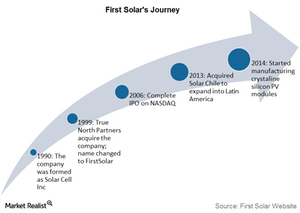

First Solar: A key player in the global solar power industry

First Solar was the first solar power company to join the S&P 500 (SPY). We’ll take a look at the company’s operations before moving on to greater details.

Can the US-China Trade War Spiral into a Crude Oil War?

Although the US doesn’t export much crude oil to China, the additional supply of cheap Iranian oil could pressure both Brent and WTI crude prices.

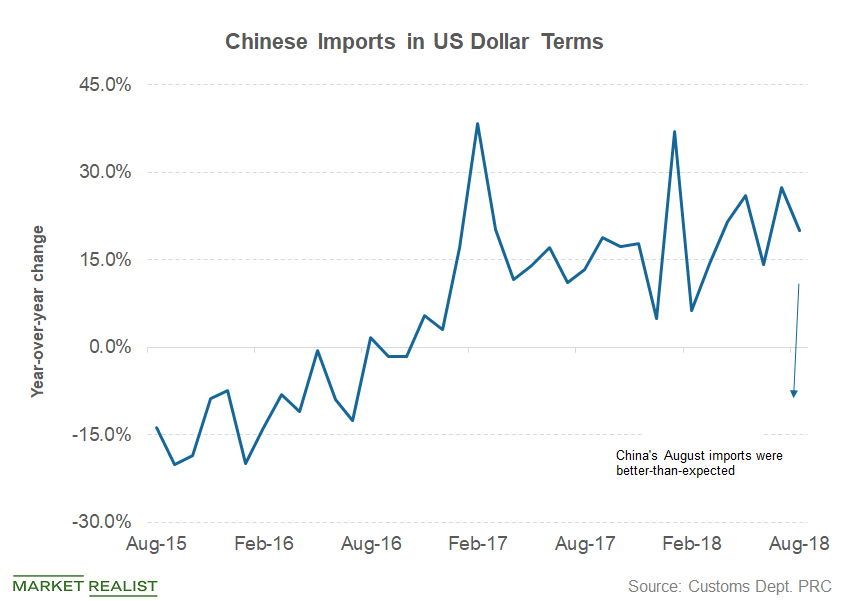

Is the Chinese Economy Crumbling? Trump’s Advisor Says So

President Trump’s economic advisor, Larry Kudlow, said in an interview with CNBC today that the Chinese economy is “crumbling.”

Crude Oil’s Outlook based on Chart Indicators

On Friday, WTI crude oil active futures rose 3.2% to $55.66 per barrel. The day before, they saw their largest single-day fall in more than four years.

ExxonMobil Stock: JPMorgan Chase Cut Its Target Price

ExxonMobil’s (XOM) earnings fell in the second quarter. After the earnings, JPMorgan Chase cut its target price on ExxonMobil stock from $85 to $83.

Why MPC Stock Fell despite Earnings Beat

MPC stock performed in line with the equity market and its peers on Thursday. The SPDR S&P 500 ETF (SPY), which represents the S&P 500 Index, fell 0.9%.

Beyond Meat Stock Starting to Lose Some Steam

Although the S&P 500 and Nasdaq have recovered by 1.05% and 1.55% today, Beyond Meat stock (BYND) was down 9.6% this morning.

Consumer Sector Wasn’t Impressive in the Last Week of May

Last week, the S&P 500 (SPY) fell 2.6% due to a drastic fall in the energy, retail, consumer staples, and financial sectors.

US-China Trade Talks: Trump’s Comments Impact Markets

On Tuesday, in-person US-China trade talks resumed in Shanghai. The two sides have been talking on the phone since the truce last month.

Morgan Stanley Is Skeptical about the S&P 500’s Upside

Morgan Stanley doesn’t believe the S&P 500’s current breakout above 3,000 will last. It also doesn’t expect Fed rate cuts to rekindle growth.

Why Ray Dalio’s Bridgewater Is Underperforming in 2019

Pure Alpha, the flagship fund of Ray Dalio’s Bridgewater Associates, fell 4.9% in the first half, the Financial Times reported.

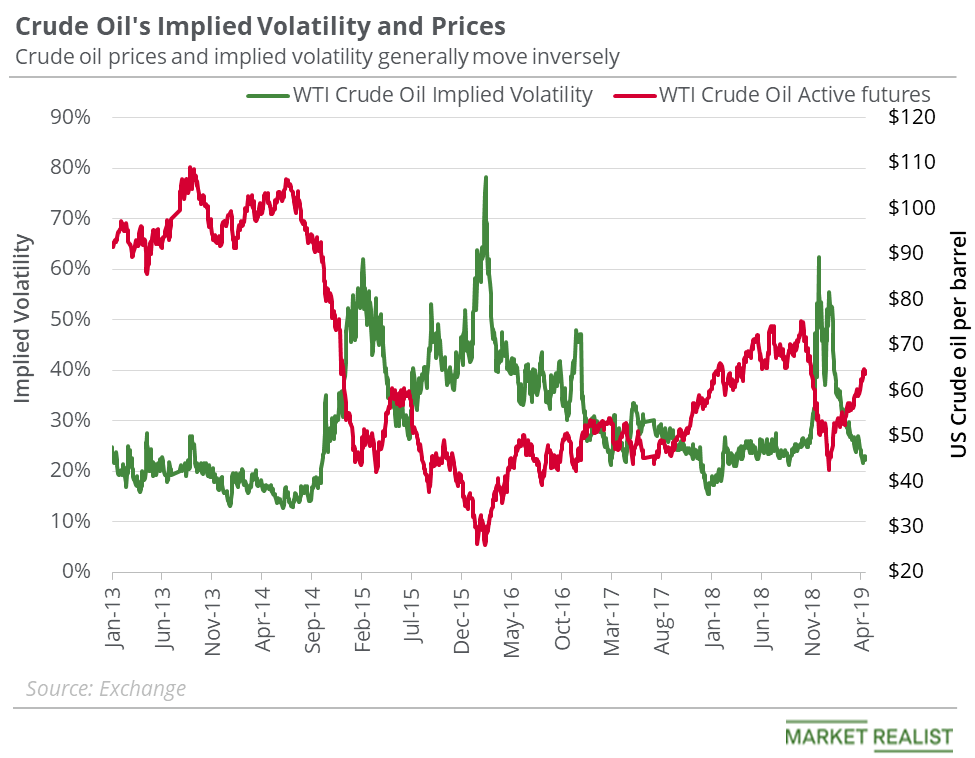

Oil Prices: Implied Volatility Suggests Upside Is Intact

On June 27, US crude oil’s implied volatility was 33.7%—12.7% below its 15-day average. Lower implied volatility might support oil prices.

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

Crude Oil’s Implied Volatility and Price Forecast

On April 17, US crude oil’s implied volatility was 22.1%, which is 5.5% below its 15-day average.

How Tech Stocks Performed in the First Quarter

FAANG stocks performed pretty well in the first quarter of 2019 and outperformed the S&P 500 Index.

How Do Gold Miners’ Leverage Ratios Look?

Barrick has reduced its debt more than 57% in the last four years from $13.4 billion at the end of 2014 to $5.7 billion at the end of 2018.

How Does Warren Buffett View Cannabis Companies?

Buffett sees companies as businesses and not just tickers. Buffett avoids businesses that he doesn’t understand.

Can Newmont Mining Outperform Its Peers in 2019?

Newmont Mining (NEM) reported its fourth-quarter earnings results before the market opened on February 21.

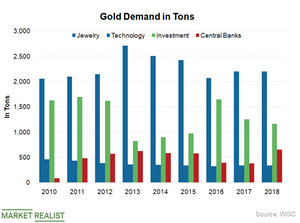

Central Banks Purchased the Most Gold in 50 Years in 2018

According to the gold demand trend released by the World Gold Council on January 31, annual gold demand increased by 4% in 2018.

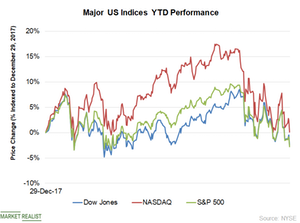

Should You Have Taken President Trump’s Advice in December?

Today, US President Donald Trump tweeted, “Best January for the DOW in over 30 years.”

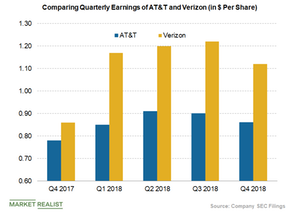

Verizon Beats, AT&T Meets Earnings Expectations in Q4

AT&T (T) posted fourth-quarter EPS of $0.86, in line with analysts’ estimates, on January 30.

Investing Defensively Can Lose You a Fortune

I bet you may have heard a lot about investing defensively while the market faded.

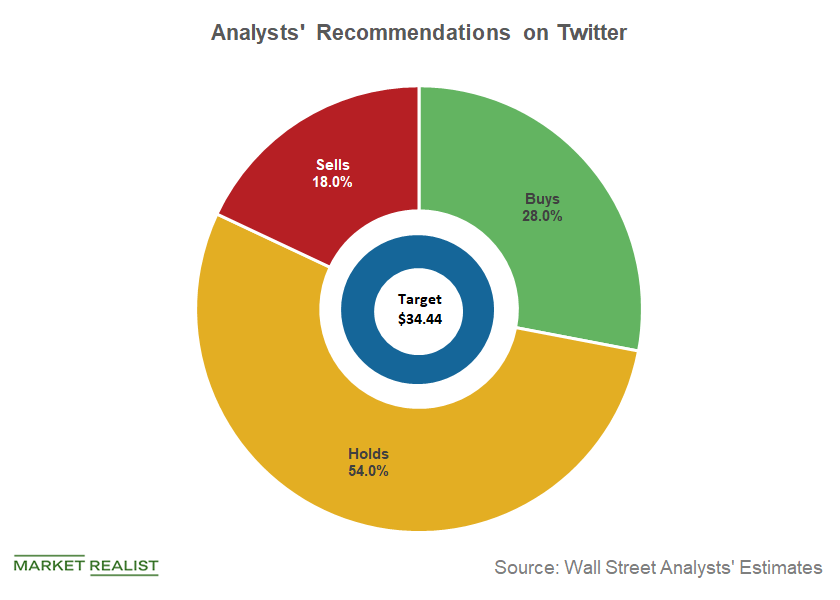

Bezos Invested in Twitter about Ten Years Ago: Should You Now?

Jeff Bezos invested about $15 million in Twitter (TWTR) just over a decade ago.

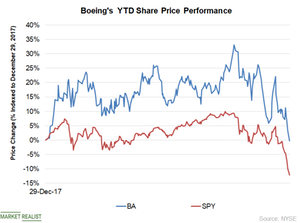

How Boeing Stock Has Fared in 2018

Boeing (BA) stock started 2018 on a positive note and carried this momentum forward up to November 7, with a return of ~26%.

Remember Peter Lynch? When the King Tells, You Should Buy

We saw a sharp rally in US stocks on December 26. President Trump’s comments on US markets could have been the main driver.

What Triggered the Broader Market Sell-Off in December?

The broader market sell-off started on December 1 when Huawei Technologies’ CFO Meng Wanzhou was arrested by Canadian authorities.

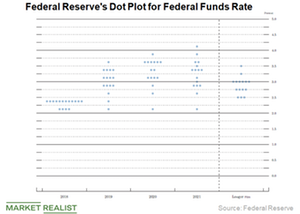

Powell’s Speech Ignites a Rally in Equities and Metals

Markets had been worried about the Fed’s continued aggressive stance on rate hikes, which could shorten economic expansion.

Is China the Land of the Setting Sun?

China’s major indices are still down 25-30% this year alone.

Is the Market Worried about an Overheating US Economy?

Federal Reserve Chair Jerome Powell’s speech did little to assuage investors’ concerns regarding the overheating of the US economy.

Cold War 2.0: Why It Looks Like a Real Possibility

The trade war is expected to be a long-term affair, according to several observers including Alibaba’s (BABA) Jack Ma.

PPG Industries Stock since Its Q1 2018 Earnings

PPG Industries (PPG) has announced that it will announce its second-quarter earnings on July 19 before the market opens.

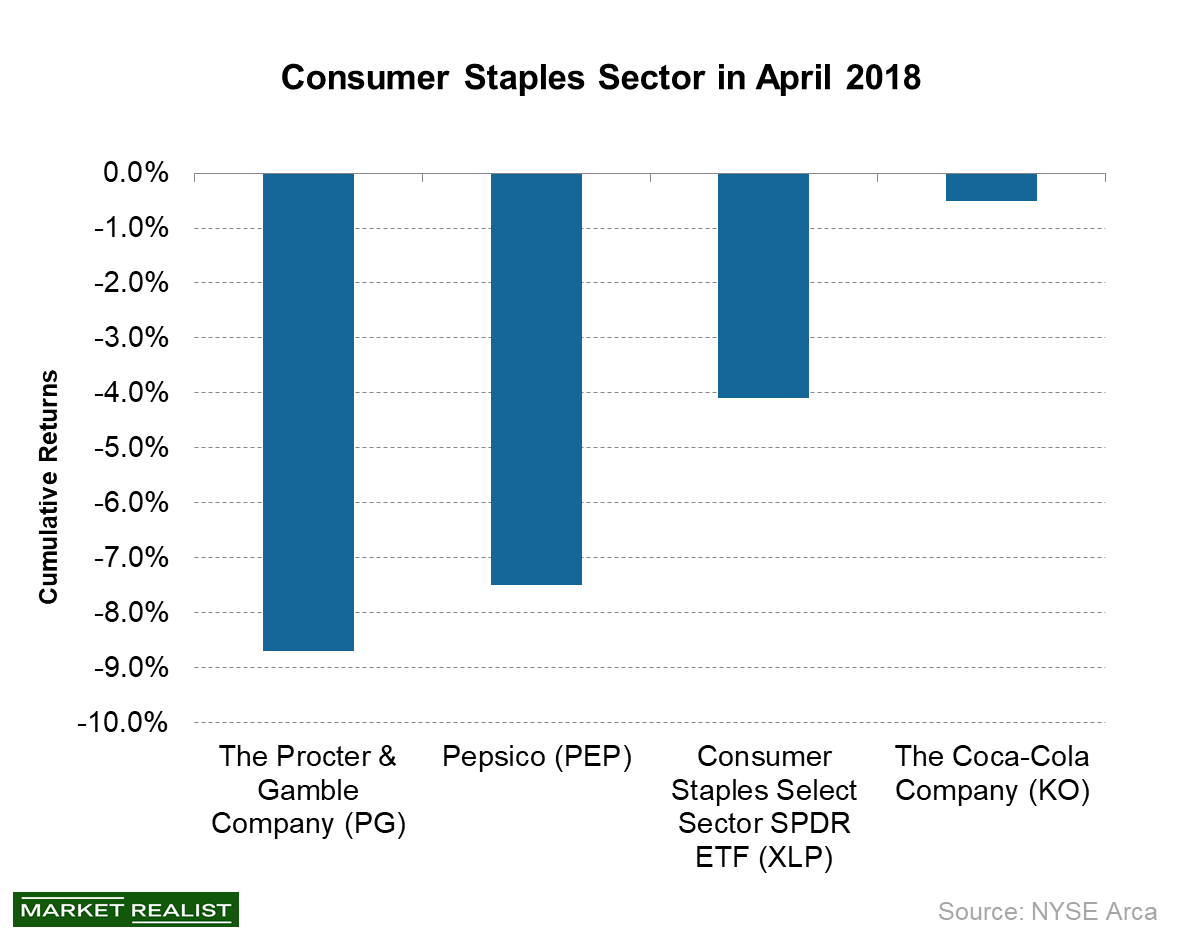

Is Higher Inflation Hurting the Consumer Staples Sector?

The consumer staples sector is an important sector in the S&P 500 Index (SPY).

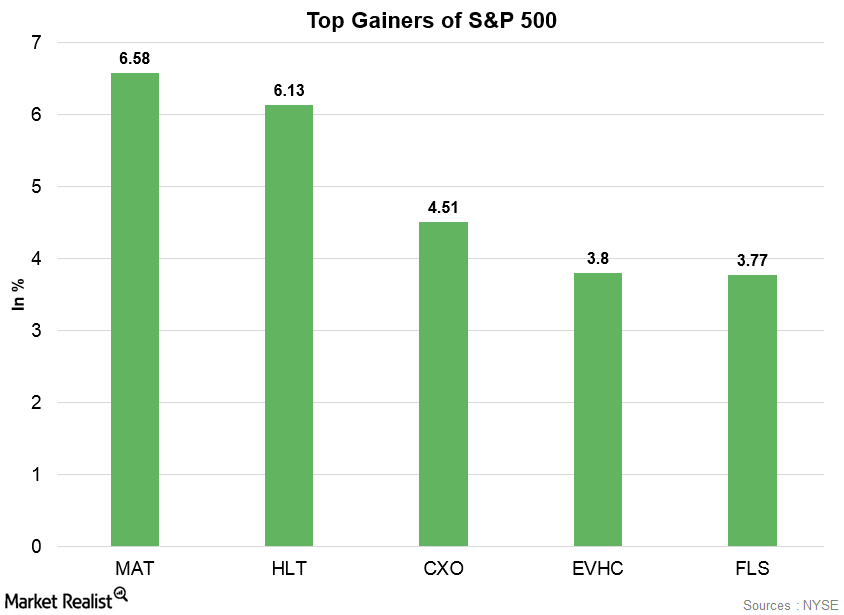

Mattel: S&P 500’s Top Gainer on April 11

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on Wednesday.