SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

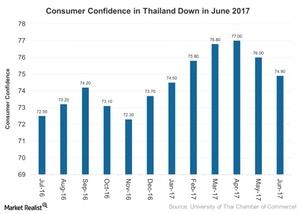

Why Consumer Confidence in Thailand Is Low

Consumer confidence in Thailand (THD) seems to be in a downtrend, as it continued to fall for two consecutive months as of June 2017.

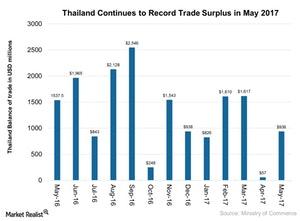

Why Thailand’s Trade Surplus Rose in June 2017

Thailand’s trade balance continues to expand due to improvement in external demand and tourism in May 2017.

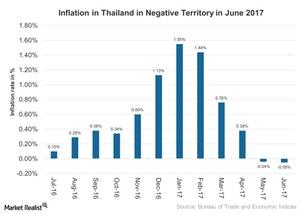

Is Negative Inflation Suggesting Contraction in Thailand in 2017?

Thailand’s (EEM) inflation in June 2017 exceeded the market estimate of a 0.1% drop.

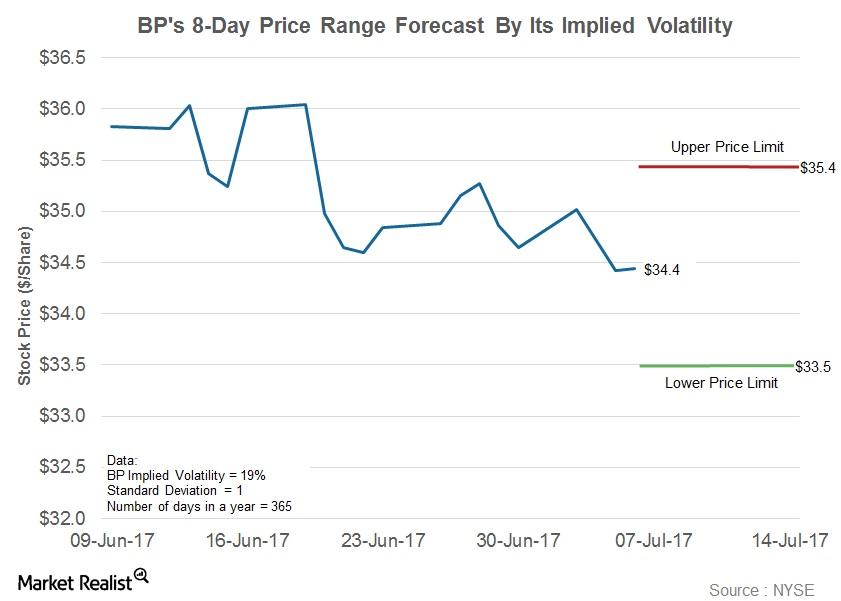

Estimating BP’s Stock Price Using Implied Volatility

What is implied volatility? Volatility gauges changes in a stock’s return over a period. When estimated based on historical stock prices, it is called historical volatility. We can estimate the future volatility, or implied volatility, of security using an option pricing model. A high implied volatility would indicate that a stock price is expected to move […]

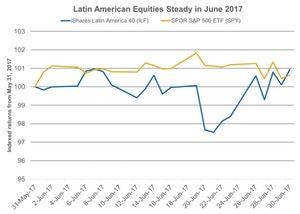

Performance of Latin American Equities Steady in June 2017

Latin American (ILF) equities in June 2017 remained steady amid the political turmoil among its member nations.

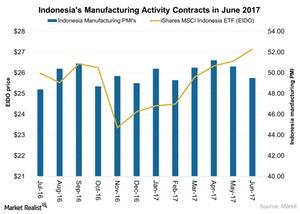

Why Indonesia’s Manufacturing Activity Contracted in June 2017

The Nikkei Manufacturing PMI in Indonesia (EIDO) fell to 49.5 in June 2017 from 50.6 in May 2017.

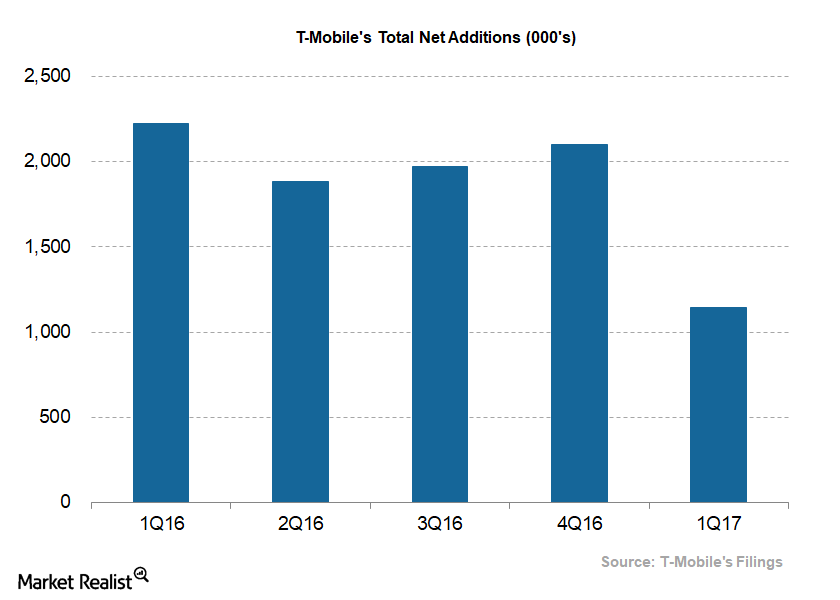

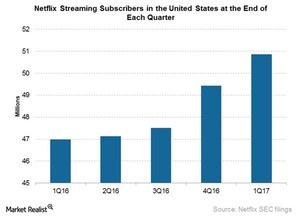

What Are the 2 Major Growth Opportunities for T-Mobile?

T-Mobile (TMUS) ended the first quarter of 2017 with approximately 72.6 million subscribers, a growth of ~1.1 million compared to the previous quarter.

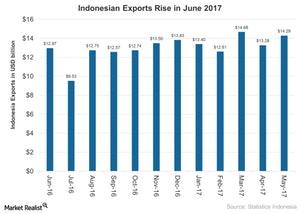

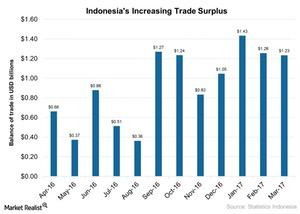

Improved Global Trade Supports Indonesia’s Economy

Several external factors are expected to impact Indonesia’s economy in 2017. The US government’s protectionist stance is expected to influence global trade.

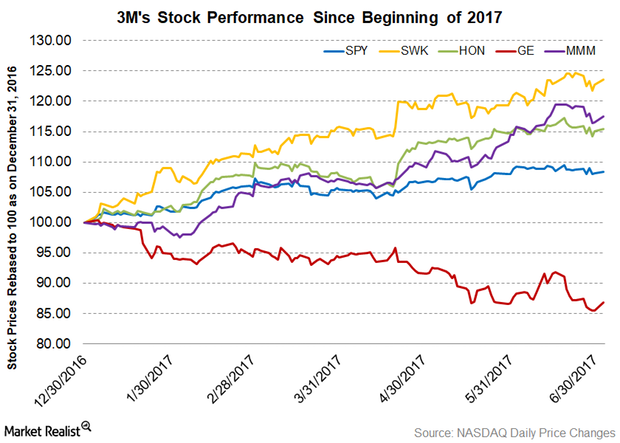

How Does 3M Company Compare to Its Industrial Peers?

Among 3M Company’s (MMM) industrial peers, MMM stock has been the second-best performer since the beginning of 2017.

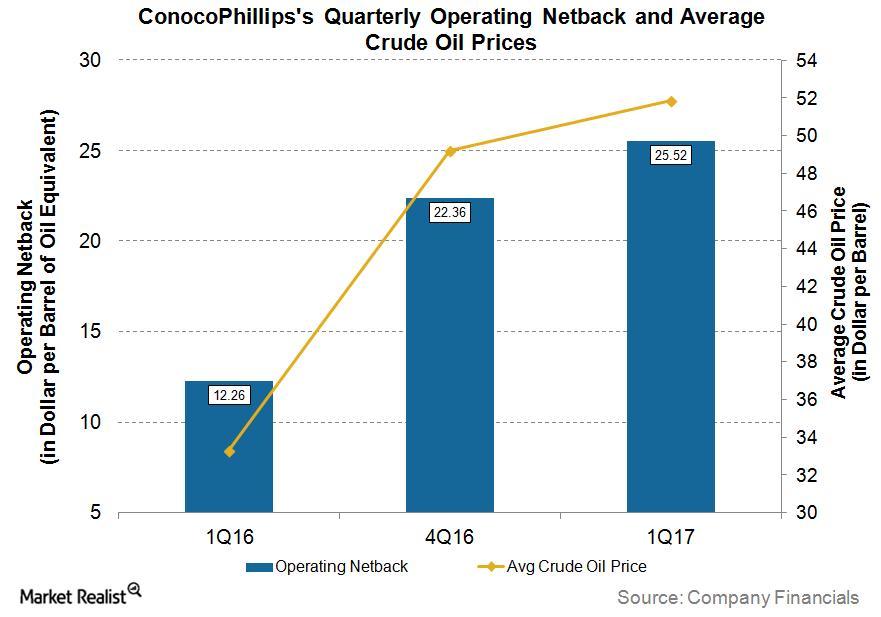

Chart in Focus: ConocoPhillips’s Operating Netback

What is the operating netback? The operating netback (also referred as production netback) is oil and gas revenue realized per boe (barrel of oil equivalent) after all costs to bring one boe to the market are subtracted from the realized price. The operating netback is derived by subtracting production expenses (or field operating expenses), production taxes, […]

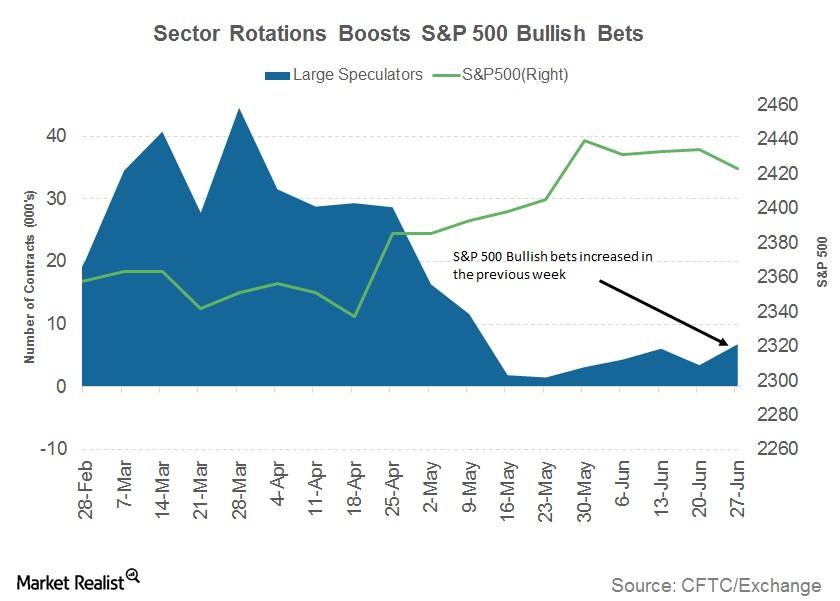

Sector Rotation Could Be the New Theme for the S&P 500

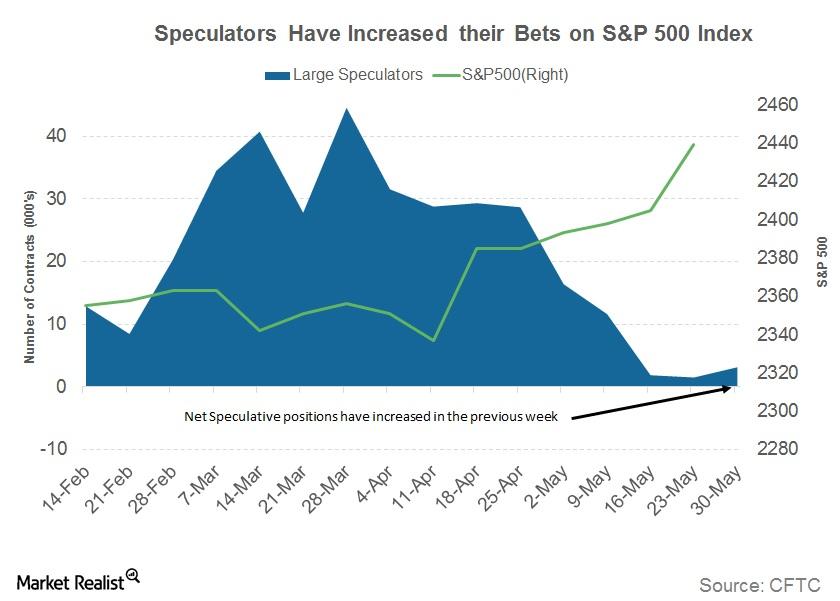

According to the latest Commitment of Traders report, large speculators have increased their net bullish positions in the S&P 500 futures.

Why China Is Becoming an Important Market for Disney

Popularity of English-language content in China Media companies in the United States (SPY) are increasingly looking at the Chinese (FXI) market as Hollywood movies become popular there. However, there have also been concerns about box office success in the country. On June 27, The Wall Street Journal reported, citing an unknown source, that the six […]

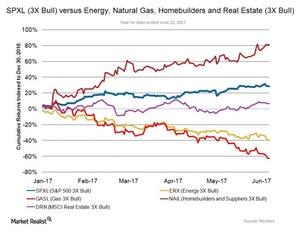

Interesting Options for Summer Investments

Summer is finally here after only nine months of waiting. Now might be a good time to look at investments that have to do with the summer months.

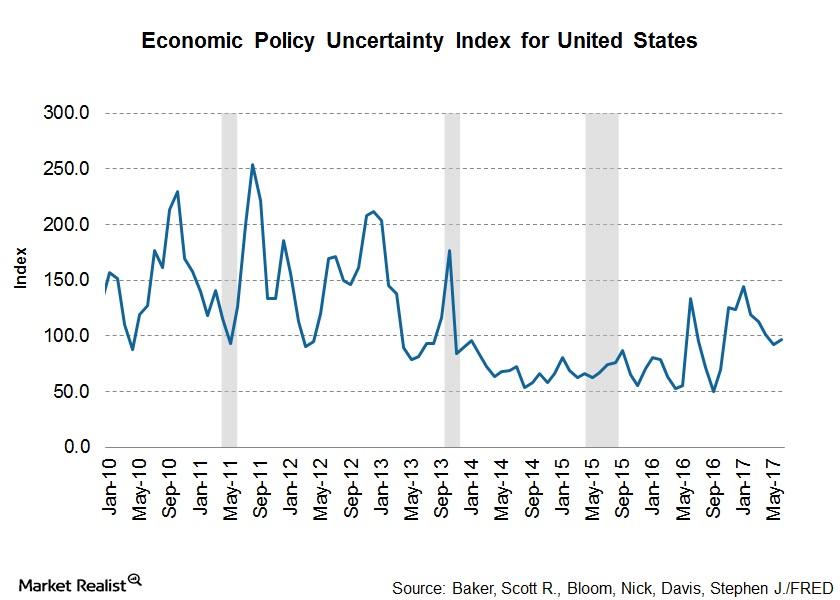

Dallas’s Kaplan Discusses the Biggest Headwind for the US Economy

Dallas’s Federal Reserve president, Robert S. Kaplan, said that the rebound in the US economy is likely to continue for the rest of 2017.

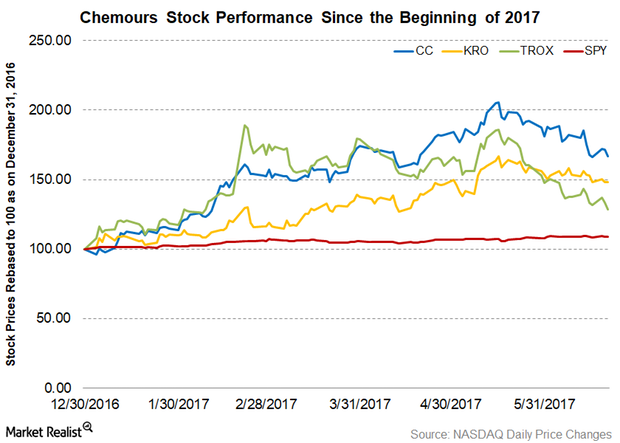

Understanding the Recent Rise in Chemours Stock

Since the beginning of 2017, Chemours (CC) stock has given a tremendous performance, gaining 66.6% YTD as of June 22.

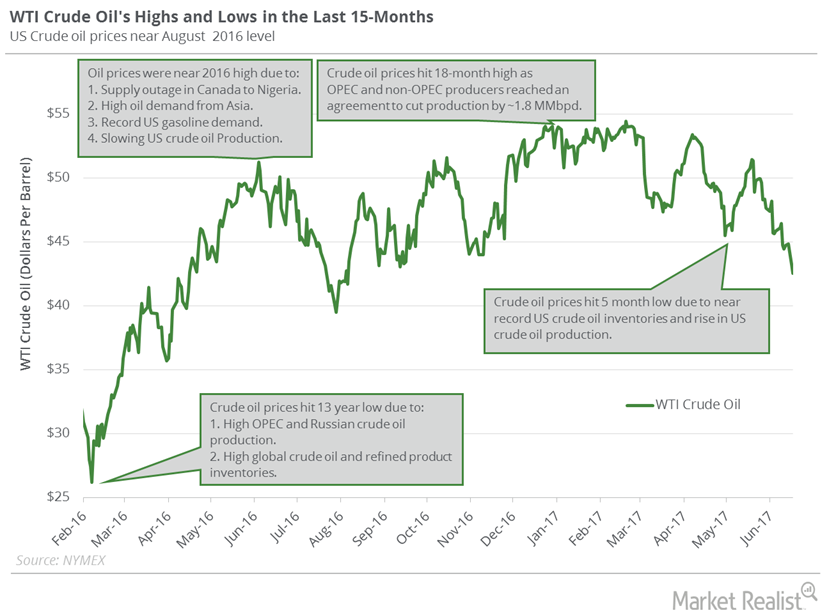

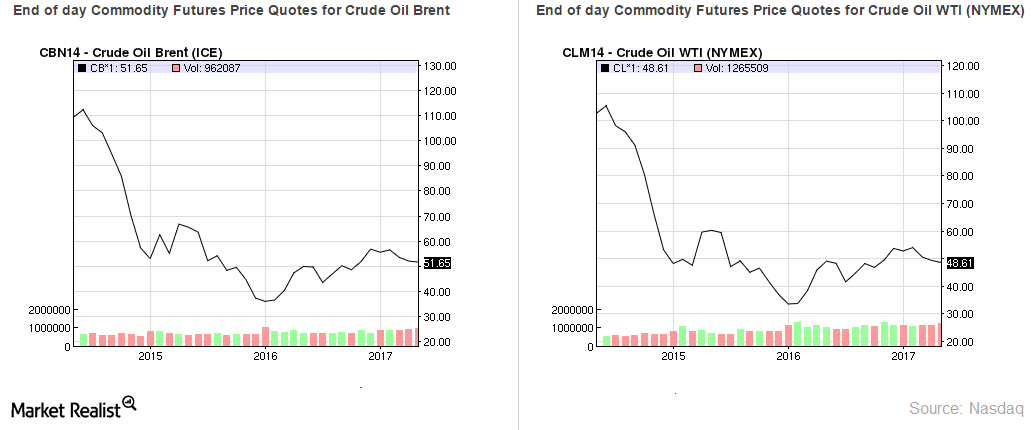

US Crude Oil Prices Could Be Range Bound Next Week

August WTI (West Texas Intermediate) crude oil (XOP) (VDE) (RYE) futures contracts rose 0.5% and closed at $42.74 per barrel on June 22, 2017.

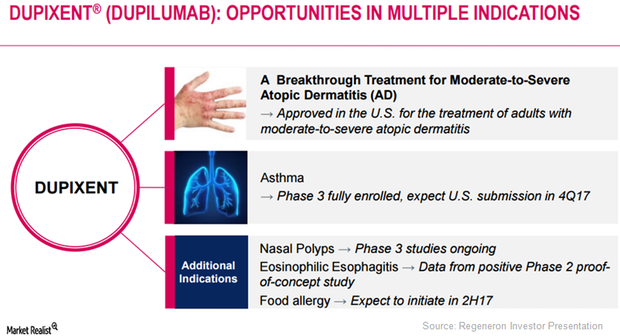

Eosinophilic Esophagitis: Major Market Opportunity for Dupixent?

Regeneron (REGN) has obtained positive results from its Phase 2 proof-of-concept study evaluating Dupixent in eosinophilic esophagitis.

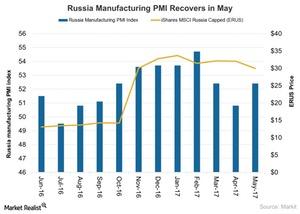

Is Russia’s Manufacturing Activity Back on Track in May 2017?

The Markit Russia manufacturing PMI increased to 52.4 in May 2017 compared to 50.8 in April 2017.

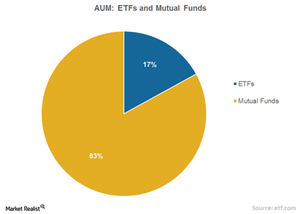

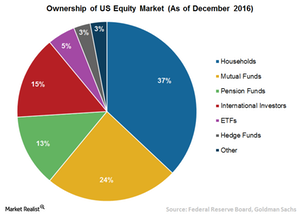

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.

Jury Hasn’t Decided on ETFs’ Role in Stock Market Rise

Although ETF (VTV) ownership increased substantially during the last 20 years, it still isn’t high enough to meaningfully impact stock prices.

What’s ahead for Frac Sand Producers?

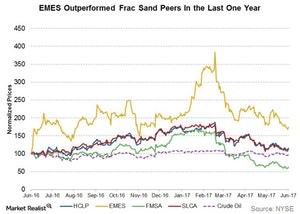

Frac sand producers Emerge Energy Services (EMES) and Hi-Crush Partners (HCLP) rose nearly 44% and 16%, respectively, over the last 12-month period.

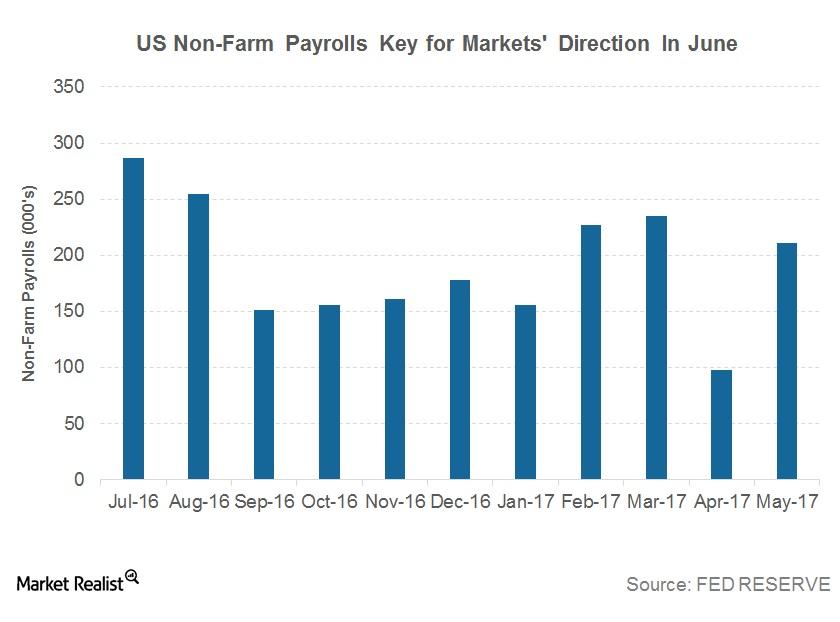

Can the S&P 500 Index Keep Rallying amid Slow Job Growth?

SPY recorded yet another lifetime high of 2,440.04 on Friday, June 2, gaining 0.96% for the week and continuing its 1.43% gain from the previous week.

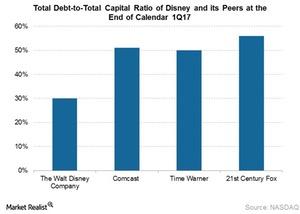

Understanding Disney’s Capital Allocation Strategy

Disney stated at the conference that it will keep investing in its businesses not just for growth but also to give superior returns to shareholders.

Salesforce’s EV-to-EBITDA Multiple Compared to Its Peers

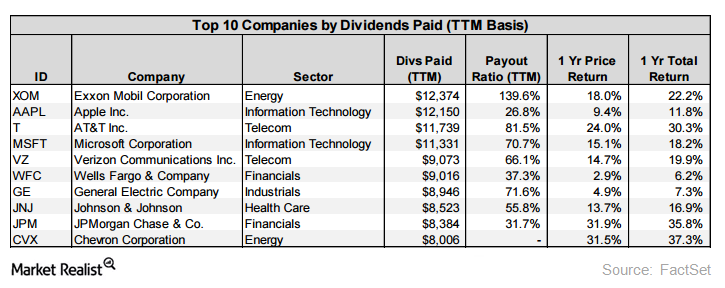

Microsoft’s forward annual dividend yield was ~2.3% on May 15, 2017, and Oracle’s and IBM’s yields were ~1.7% and ~4.0%, respectively.

Using Asian Markets’ Low Correlation with US Markets

The correlation between US and international markets varies depending on market cycles.

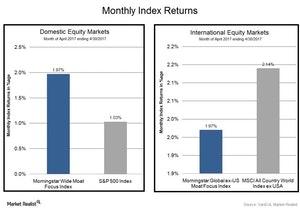

How Does Moat Investing Provide a Competitive Advantage?

Morningstar helps investors choose companies with economic moats. “Economic moats” refers to companies’ ability to obtain an advantage over competitors.

What to Look Forward to in June

In recent weeks, we’ve witnessed volatile behavior in the markets (SCHB) due to political turbulence in the United States and increased investor impatience.

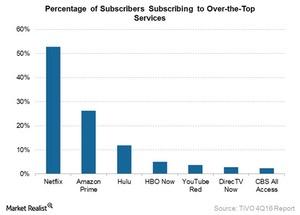

Understanding Disney’s Digital Distribution Strategy for ESPN

Disney (DIS) has been looking more and more at the distribution of its content in digital format—specifically for ESPN.

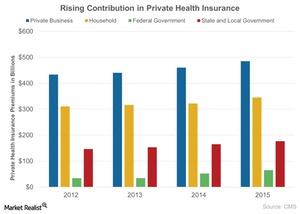

Rising Costs Are a Major Issue in the Healthcare Sector

The US economy is dealing with rising healthcare costs. The national healthcare expenditure grew 5.8% to $3.2 trillion in 2015 or $9,990 per person.

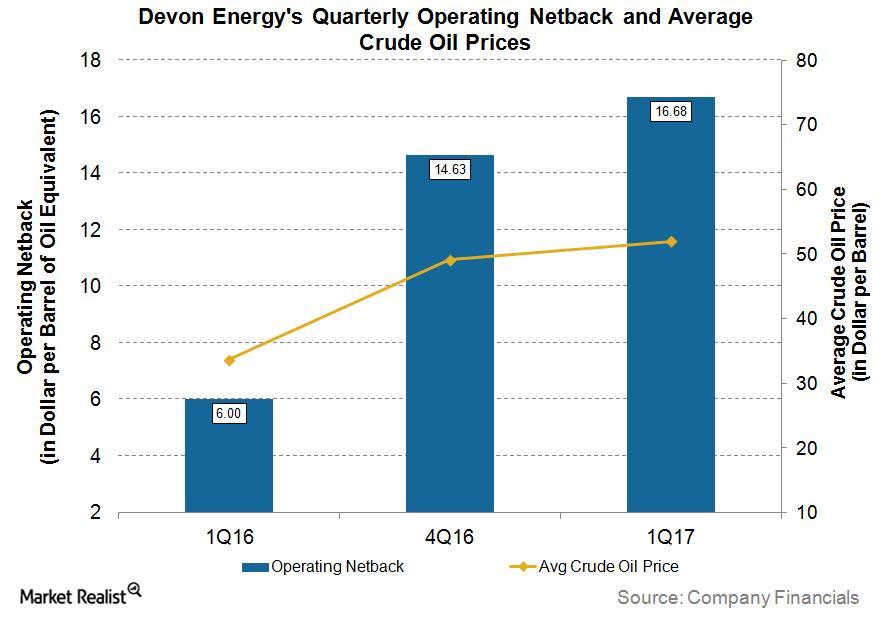

Devon Energy’s Operating Netbacks

In 1Q17, Devon Energy’s (DVN) reported operating netback was ~$16.68 per boe (barrel of oil equivalent), which is ~178% higher than in 1Q16.

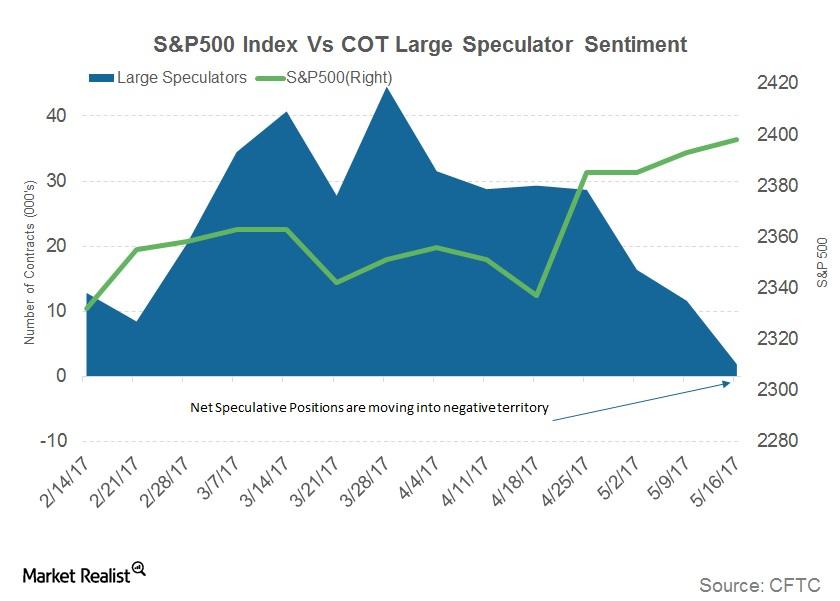

Why S&P 500 Speculative Bets Are off the Table

CFTC data released on Friday indicated that commercial traders maintained a net position of 5,756 contracts in the previous week.

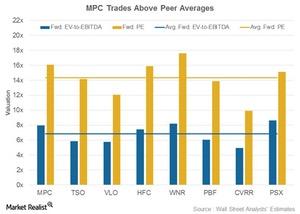

Why MPC’s Valuation Commands a Premium over the Peer Average

MPC’s valuations are above the peer averages likely because it’s now in the process of restructuring its organization to unlock value.

Will Fallen Angel Bonds Continue to Capture Solid Returns?

VanEck How fallen angels may complement high yield portfolios Income investors may want to consider fallen angels as a complement to their high yield bond allocations given their higher credit quality. Fallen angels’ higher average credit quality than original-issue high yield bonds may help absorb more of the potential broader market volatility that may occur […]

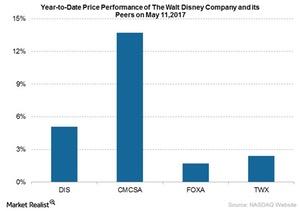

Disney’s Stock Price: Identifying the Key Drivers

The Walt Disney Company (DIS) announced its fiscal 2Q17 results on May 9. The company’s stock price closed at $109.58 on May 11, 2017.

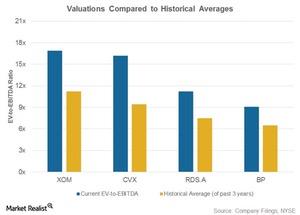

Energy Stock Valuations and Their Historical Averages

EV-to-EBITDA multiples in 1Q17 for ExxonMobil (XOM), Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) were above their historical averages.

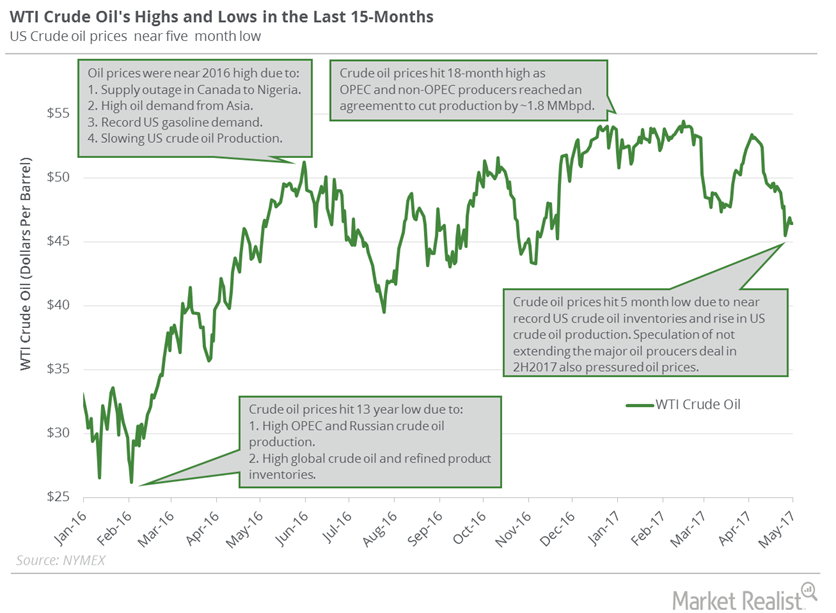

Could Crude Oil Prices Hit Lows from 2016?

WTI (West Texas Intermediate) crude oil (FXN) (SCO) (FENY) futures contracts for June delivery are near a five-month low as of May 9, 2017.

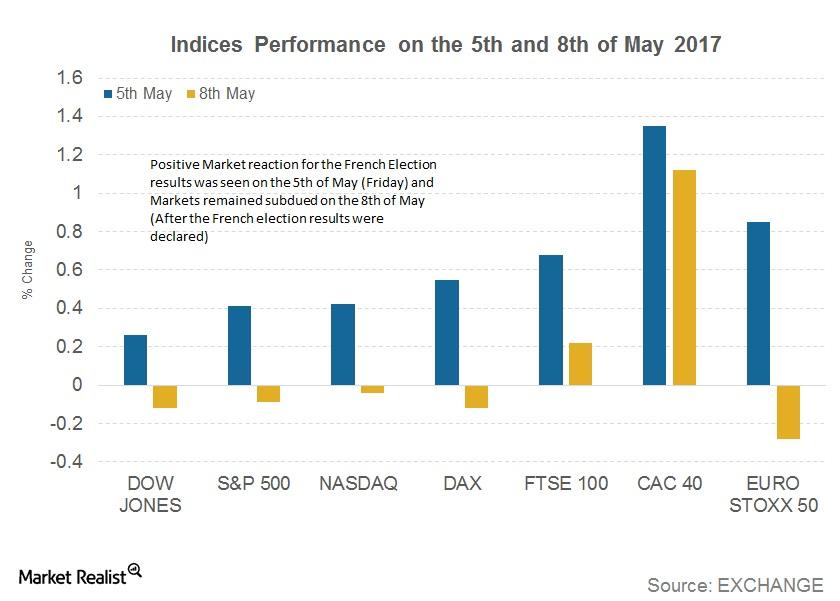

Will Market Optimism Continue after the French Election Results?

The celebration of Emmanuel Macron’s victory in the French election began when the markets opened in Asia on May 8, 2017. Asian markets excluding China (YINN) rose.

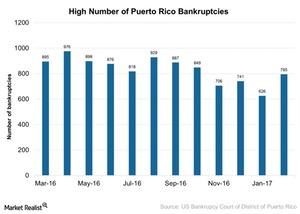

Puerto Rico’s Increasing Defaults Lead to Bankruptcy in 2017

The board overseeing Puerto Rico (PZT) (HYMB) filed for bankruptcy protection in a much-anticipated move in 2017.

How the Changing Regulatory Environment Could Impact Disney

Disney said in an earnings call that the US corporate tax policy needs to be changed because American companies are no longer competitive.

Understanding Fiscal Reforms in Indonesia: The Impact of a New Administration in Jakarta

Investment climate reforms have improved Indonesia’s Ease of Doing Business rank, which has had a positive impact on its trade surpluses.

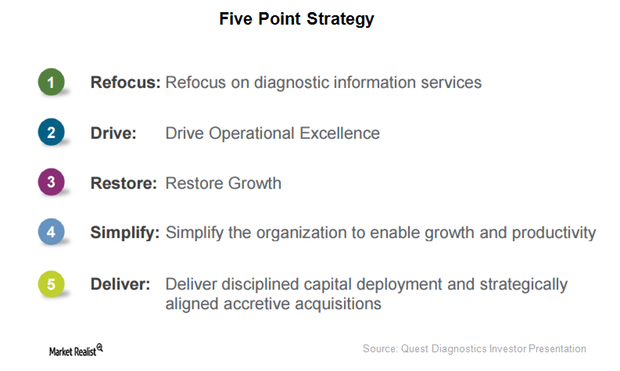

Quest Diagnostics Is Making Steady Progress in 5-Point Strategy

Since 2012, Quest Diagnostics (DGX) has been working on a five-point strategy to boost revenue growth and improve quality, service, and efficiency.

Colgate-Palmolive’s Regional Trends Are Now Headed This Way

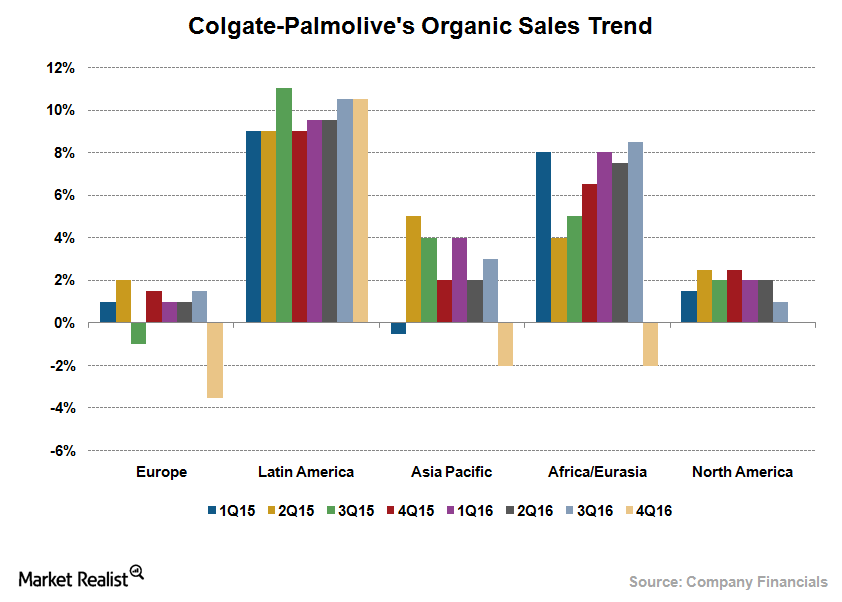

CL’s organic sales in its North American segment remained flat in 4Q16. Volume gains in toothpaste were offset by a fall in toothbrushes and liquid hand soap.

Colgate-Palmolive’s Sales Growth: Understanding Analyst Expectations

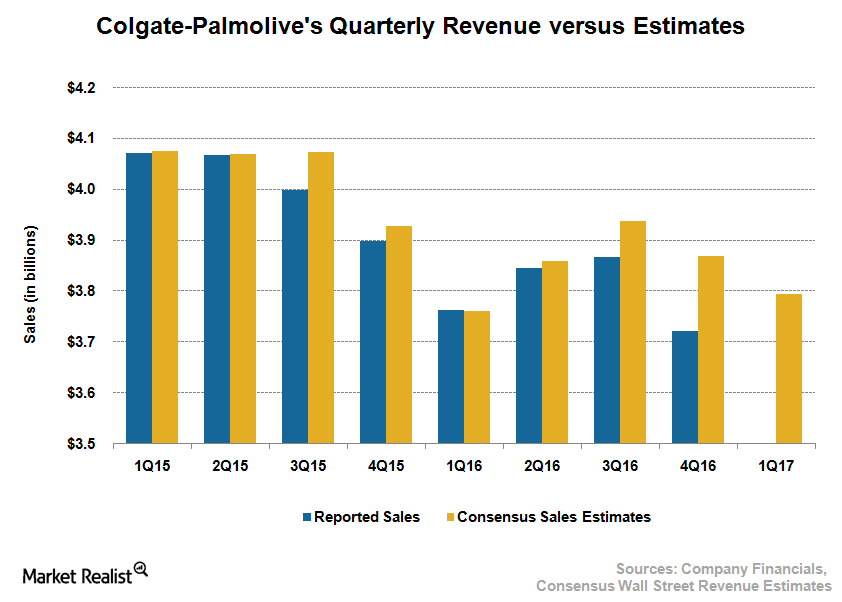

Analysts expect Colgate-Palmolive (CL) to post revenue of $3.8 billion in 1Q17, which would represent a YoY (year-over-year) growth of 0.8%.

Bill Gross and High-Yield Bonds: Priced for Too Much Growth

Investors generally invest in high-yield bonds (BND) when there are expectations for higher growth in the economy.

Why High Yield Bonds Are an Effective Match with Equities

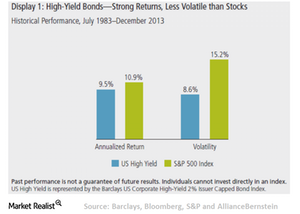

AB Keeping Pace with Equity Returns over Time In fact, when we widen the lens to take in the last three decades, high-yield bonds have nearly matched equity performance. And they’ve done it with much lower volatility. Since July 1983, stocks have produced an annualized return of 10.9% (Display 1). High-yield bonds have nearly equaled […]

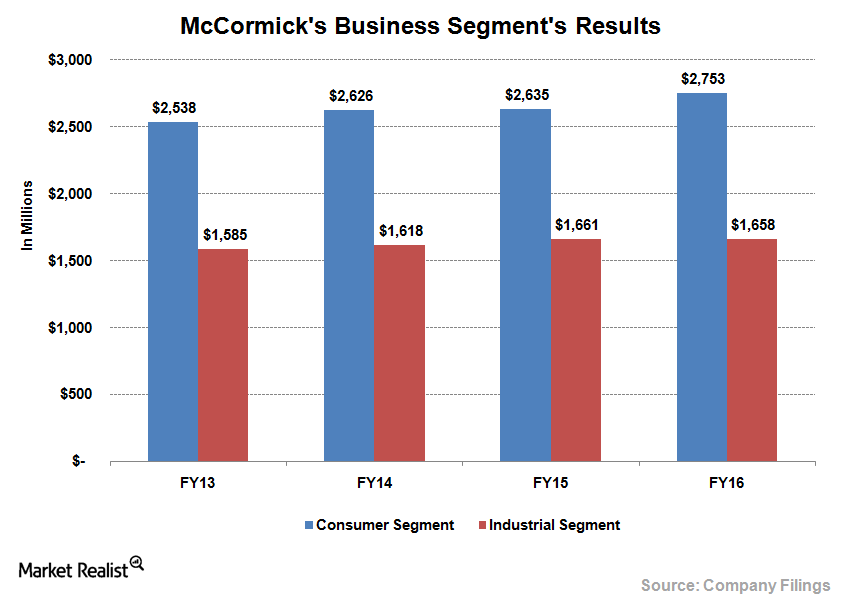

A Look at McCormick’s Strategic Initiatives

McCormick’s (MKC) strategic acquisitions have been one of the key components of the company’s sales and margin growth.

Can March’s Manufacturing PMI Boost Germany’s Business Climate?

The Markit Germany manufacturing PMI stood at 58.3 in March 2017 compared to 56.8 in February.

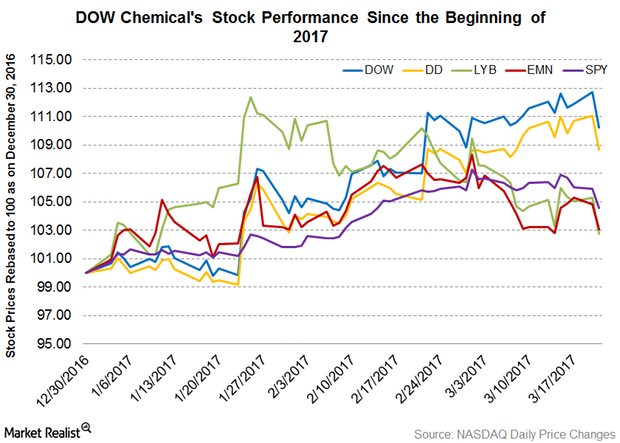

Analyzing How Dow Chemical Stock Has Performed in 2017

From the beginning of 2017 to March 21, 2017, Dow Chemical (DOW) has been an outstanding performer. It rose 10.20% and outperformed SPY.

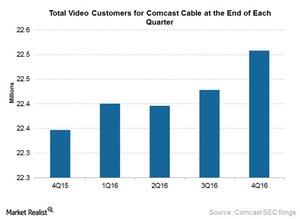

How Will Competitive Landscape in Media Industry Affect Comcast?

Comcast stated that the key to getting ahead of the competition has been the company’s strategy to offer products based on market segmentation.

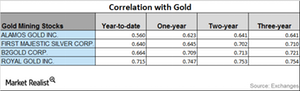

These Mining Stocks Have Downward Trending Correlations with Gold

Uncertainty in the market significantly affects the performances of precious metals. It also affects precious metals mining stocks, which are known to closely track precious metals.