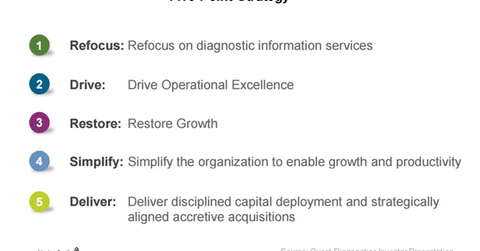

Quest Diagnostics Is Making Steady Progress in 5-Point Strategy

Since 2012, Quest Diagnostics (DGX) has been working on a five-point strategy to boost revenue growth and improve quality, service, and efficiency.

April 26 2017, Updated 7:36 a.m. ET

5-point strategy

Since 2012, Quest Diagnostics (DGX) has been working on a five-point strategy to boost its revenue growth and improve the parameters of quality, service, and efficiency. This targeted strategy has enabled the company to compete effectively with peers such as Laboratory Corporation of America Holdings (LH), DaVita HealthCare Partners (DVA), and Idexx Laboratories (IDXX). To know more about the progress of the company in implementing this strategy, please refer to Why Quest Diagnostics’ Five Point Business Strategy Matters in 2016.

Implementation milestones

To refocus on its diagnostic information services business, Quest Diagnostics has divested its product businesses. It has also entered into a joint venture deal with Quintiles to launch a clinical trials laboratory services organization, Q2 Solutions. Since 2014, this organization has played a pivotal role in the development of about half of the oncology precision medicine drugs approved by the FDA (U.S. Food and Drug Administration). These developments enabled the company to generate $1.0 billion in proceeds.

Quest Diagnostics has already generated cost savings worth $1.1 billion in 2016 and expects to save up to $1.3 billion in 2017. That highlights the progress of the company in implementing operational excellence as a core strategy.

The company has also managed to restore its year-over-year revenue growth to about 2.0%–3.0% in 2017, which is significantly higher than the -4.6% growth reported in 2013. Quest Diagnostics is currently focused on organic growth as well as growth through acquisitions.

Quest Diagnostics has also changed its organizational structure since 2012. It involved taking advantage of the scale of the company as a single enterprise, build capabilities of clinical franchises to capture growth opportunities, and become a robust geographic organization. To achieve these goals, it removed three layers of senior management and achieved savings worth $100.0 million.

As Quest Diagnostics continues to effectively implement its five-point strategy, it may have a positive impact on its stock as well as the SPDR S&P 500 ETF (SPY). Quest Diagnostics makes up about 0.07% of SPY’s total portfolio holdings.

In the next part, we’ll look at Quest Diagnostics’ focus areas to accelerate growth in 2017.