Idexx Laboratories, Inc.

Latest Idexx Laboratories, Inc. News and Updates

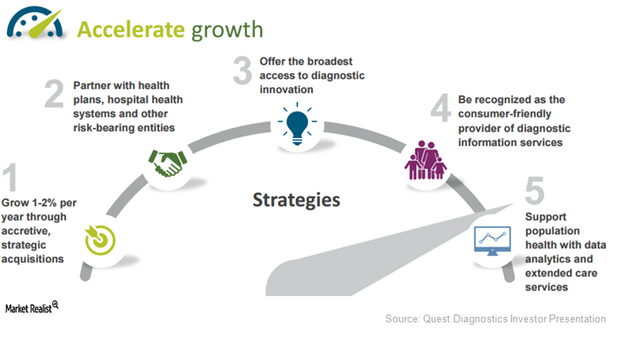

Quest Diagnostics’ Multi-Pronged Strategy to Accelerate Growth

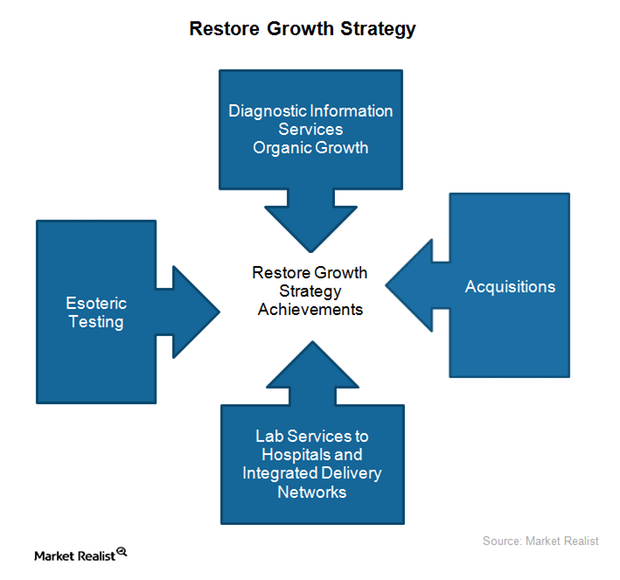

Quest Diagnostics (DGX) expects to witness a 3.0%–5.0% long-term revenue growth rate in the future with earnings growth of 5.0%–9.0%.

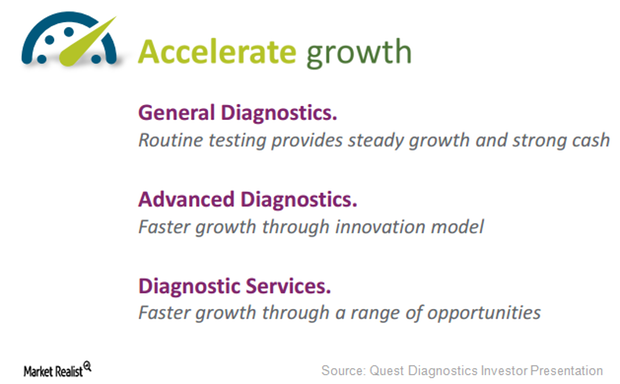

Quest Diagnostics Is Targeting 3 Focus Areas to Accelerate Growth

Since 2012, Quest Diagnostics (DGX) has spent about $1.0 billion on capital investments and $1.0 billion on ten acquisitions to support inorganic growth.

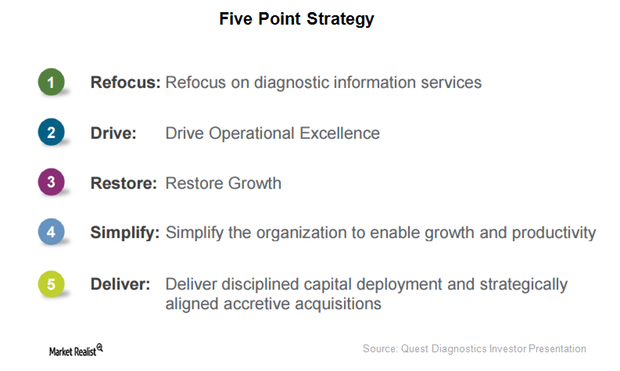

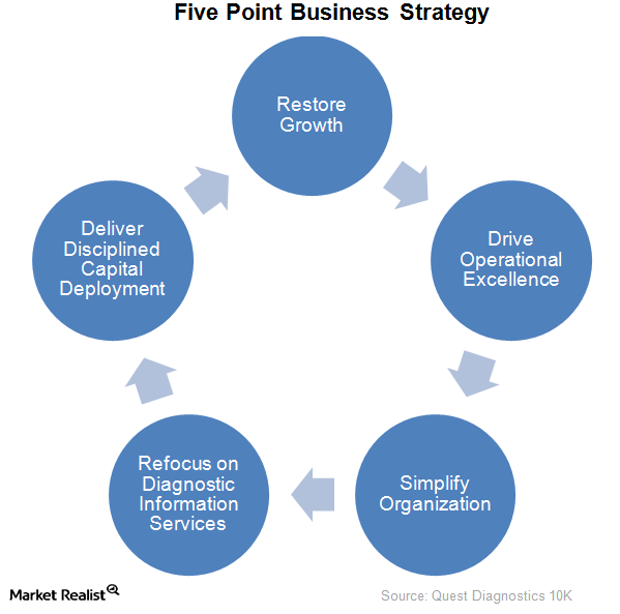

Quest Diagnostics Is Making Steady Progress in 5-Point Strategy

Since 2012, Quest Diagnostics (DGX) has been working on a five-point strategy to boost revenue growth and improve quality, service, and efficiency.

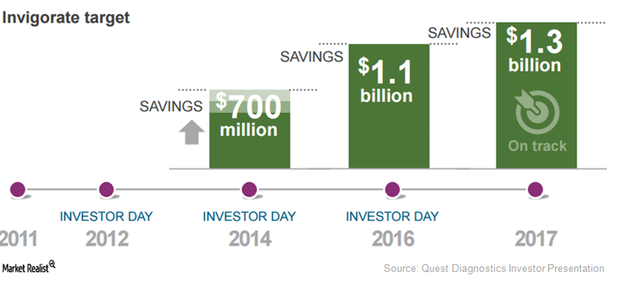

Quest Diagnostics Projects Run Rate Savings by End of 2017

Quest Diagnostics (DGX) has projected a run rate savings worth $1.3 billion by the end of 2017. In 2016, it managed to save up to $1.1 billion.

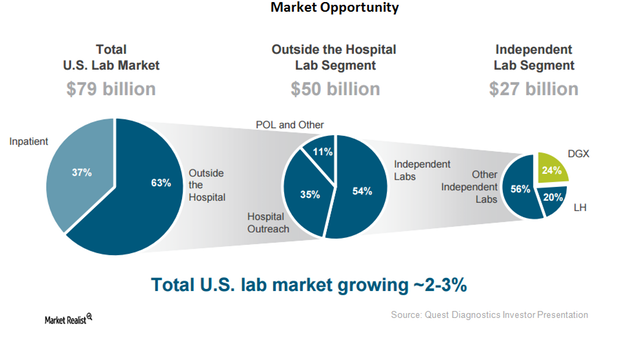

Quest Diagnostics Could Get Greater Share of Laboratory Segment

With around 50.0% of hospitals being served by Quest Diagnostics (DGX), the company has become a leading player in the fragmented US laboratory market.

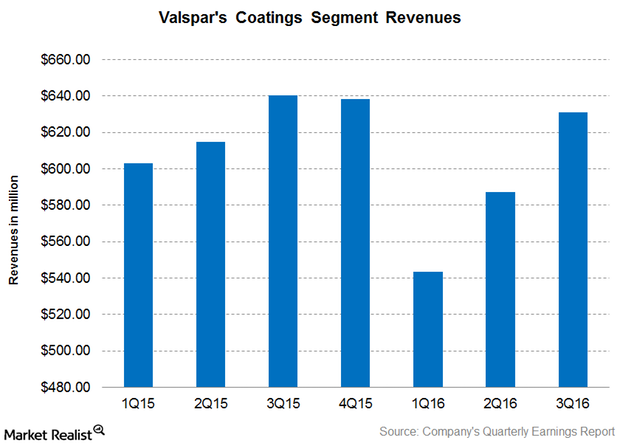

Why Did Valspar’s Coatings Segment Revenue Fall in 3Q16?

Valspar (VAL) reports its revenue under two segments, namely: the coatings segment and paints segment.

Why Quest Diagnostics’ Five Point Business Strategy Matters in 2016

If Quest Diagnostics succeeds in implementing its five-point business strategy going forward, it should boost the company’s share price and USMV.

Inside Quest Diagnostics’ Growth Restoration Strategy

Quest Diagnostics has been focusing on developing sales and marketing expertise, increasing esoteric testing, and building relationships with hospitals.

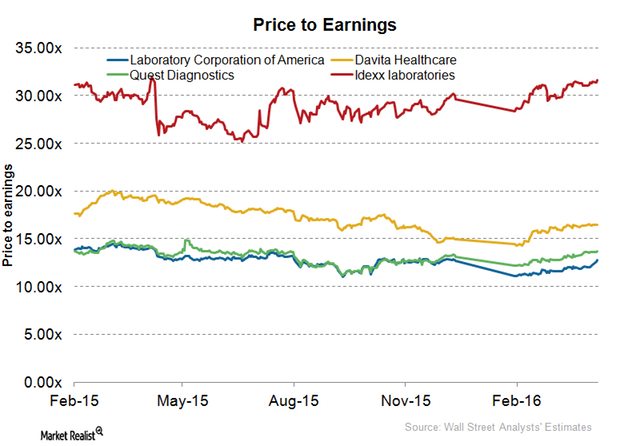

Understanding Quest Diagnostics’ Valuation Multiple Compared to Those of Peers

Quest Diagnostics trades at a premium multiple compared to Lab Corp of America and at a big discount compared to peers Davita Healthcare and IDEXX Labs.