SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

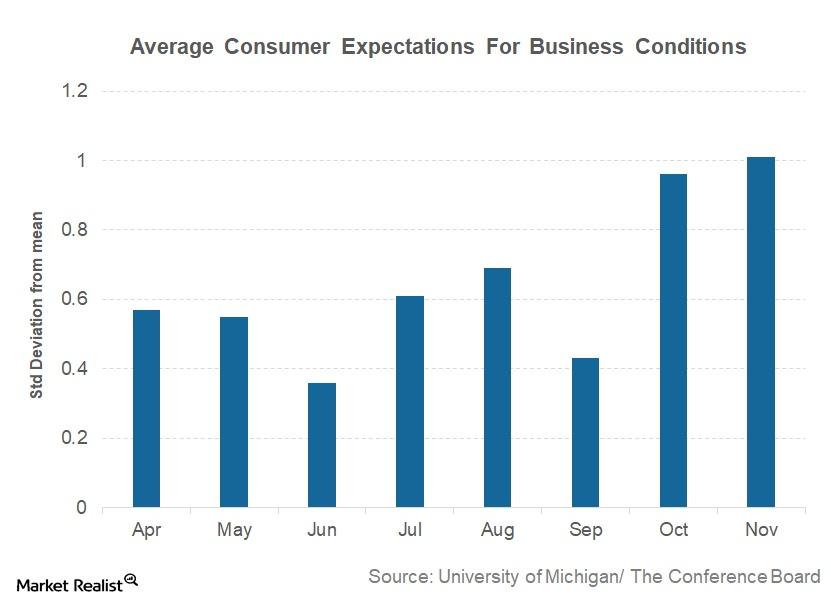

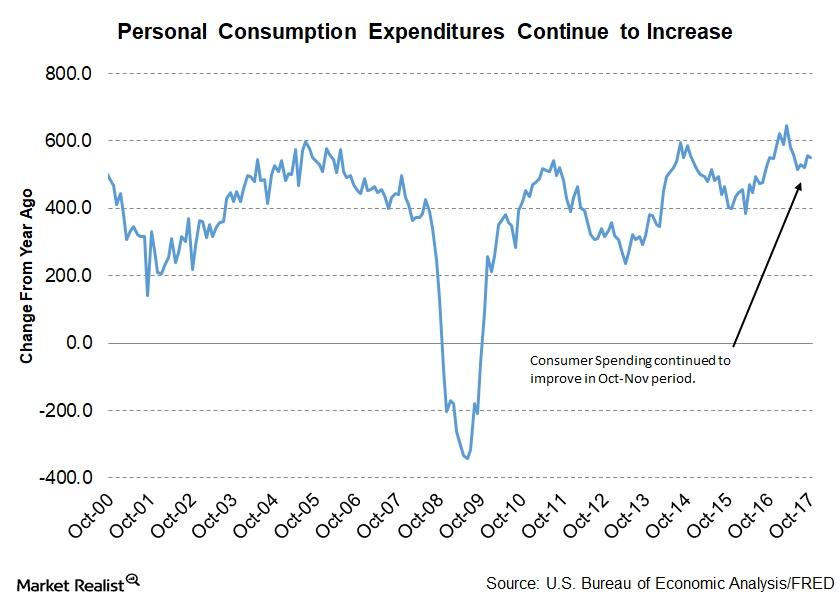

Why Consumer Expectations Continued to Increase in November

Consumer expectations for business conditions Average consumer expectations for business conditions form the only component of the Conference Board LEI (Leading Economic Index) that is not a leading indicator. Consumer expectations are based on two separate surveys. One survey is conducted by the University of Michigan and Reuters, while the second survey is conducted by […]

Crude Oil Inventories Fell, Refinery Utilization Hit 12-Year High

US crude oil futures contracts for February delivery fell 0.1% to $61.95 per barrel at 1:05 AM EST on January 5, 2018—the highest level since December 2014.

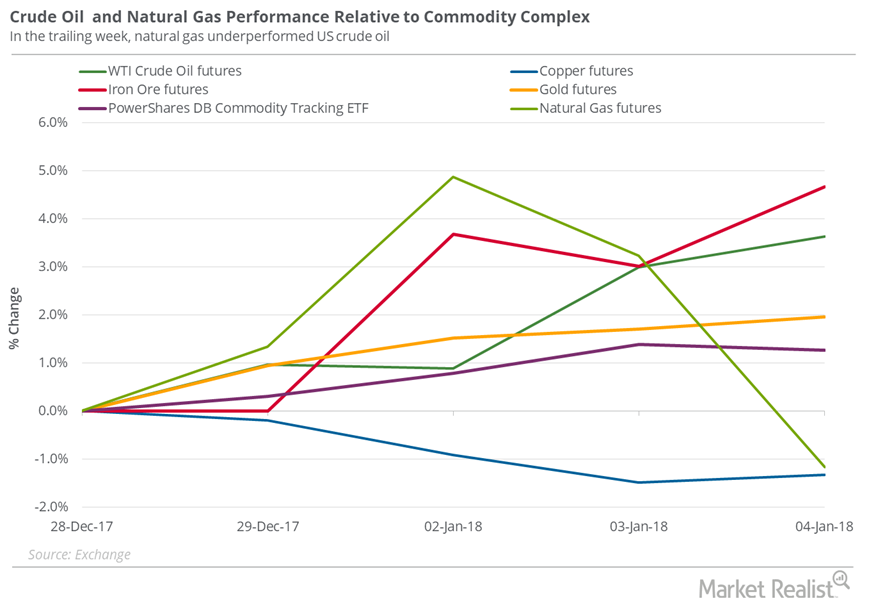

Why Oil Reached a 3-Year High

On January 4, 2018, US crude oil (USO) (USL) February 2018 futures rose 0.6% and closed at $62.01 per barrel—a three-year high.

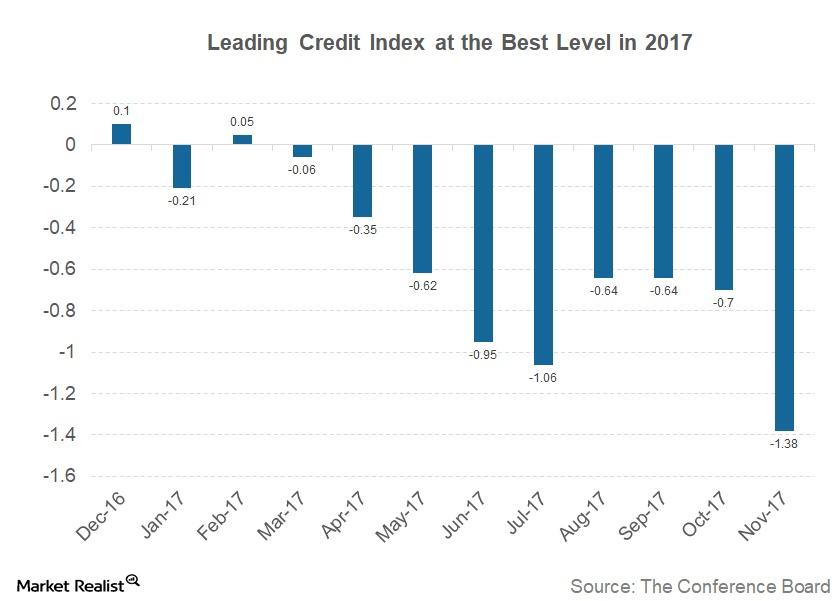

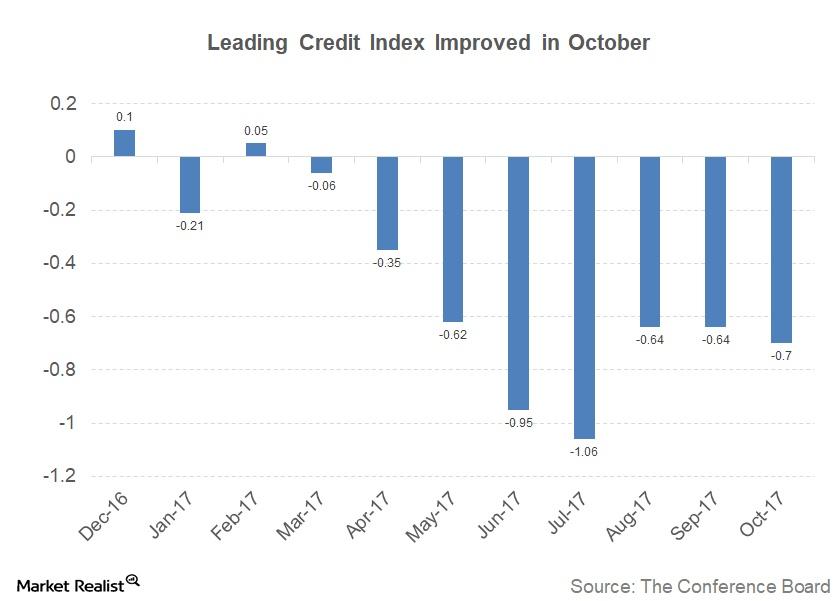

How the Leading Credit Index Tracks US Credit Conditions

Understanding the Leading Credit Index The Conference Board LCI (Leading Credit Index), a constituent in the LEI (Leading Economic Index), is published every month and tracks credit conditions in the US economy by following changes in six financial market instruments: the two-year swap (SHY) spread (real time) the three-month LIBOR[1.Intercontinental Exchange London Interbank Offered Rate] (SCHO) […]

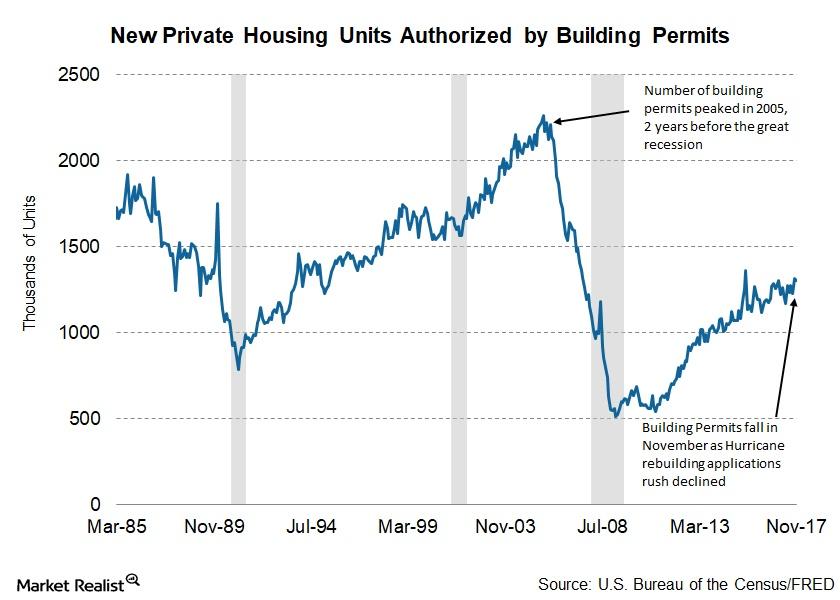

Building Permits Fall in November: Should We Worry?

Building permits and the economy The number of building permits issued each month is a constituent of the Conference Board LEI (Leading Economic Index). The construction and housing industry (PKB) is a major job provider in the economy, and changes in activity in the sector affect employment conditions and aggregate demand. A higher number of building permits is a leading […]

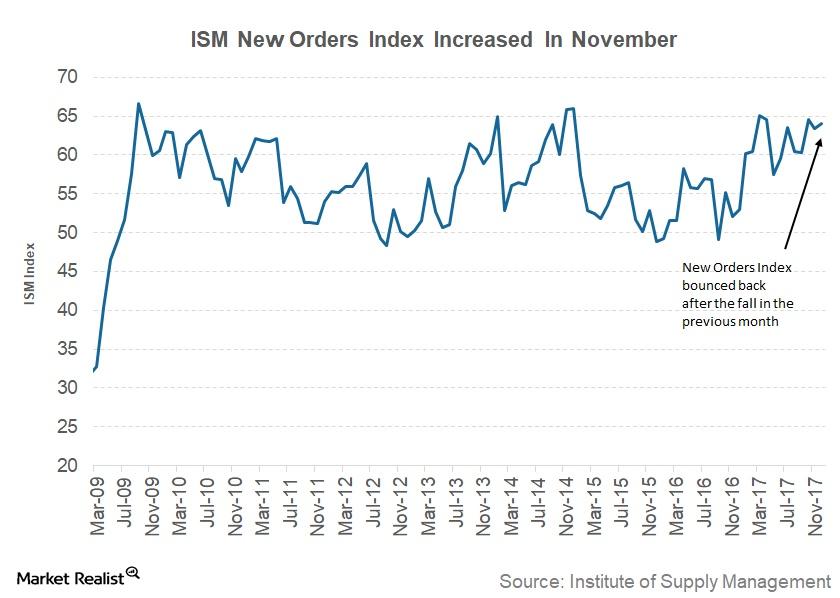

Analyzing the Institute of Supply Management’s New Orders Index

The Institute of Supply Management’s New Orders Index The ISM’s (Institute of Supply Management) New Orders Index is a monthly report on changes in new orders, supplier deliveries, inventories, production, and employment. New orders are a measure of future activity in any industry (VIS), as companies’ production depends on incoming orders. The ISM’s New Orders […]

US Crude Oil Closed at 2017 High: Will the Ride Continue?

On December 22–29, US crude oil (USO) (USL) February futures rose 3.3%. On December 29, US crude oil February 2018 futures closed at $60.42 per barrel.

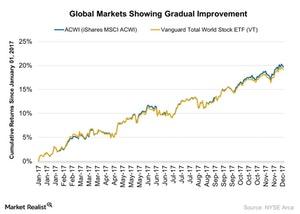

Will 2018 Be a Smooth Road for Investors?

2018 also brings with it many geopolitical events that could bring uncertainty and turn the market around.

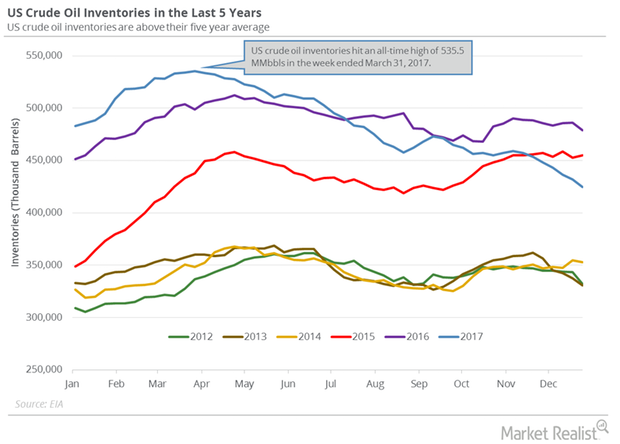

US Crude Oil Inventories Have Fallen ~10.6% in 2017

February WTI crude oil futures (DWT)(SCO) contracts rose 0.8% to $60.3 per barrel at 12:45 AM EST on December 29, 2017—the highest level since June 2015.

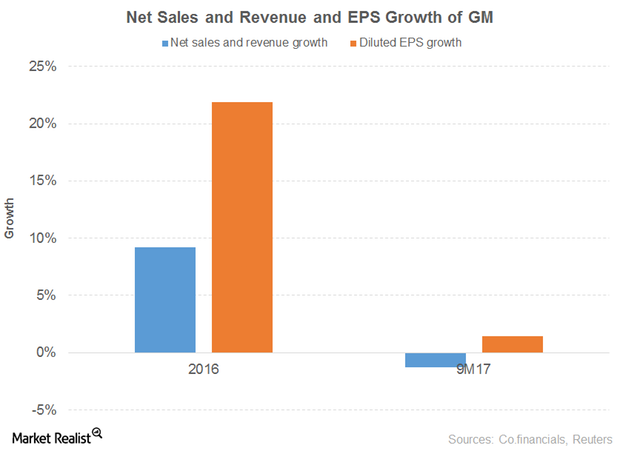

A Look at GM’s Stock Performance

In this part of our focus on the top 18 cheap S&P 500 stocks, we’ll discuss another six stocks: General Motors (GM), Ford Motor (F), Owens-Illinois (OI), The Goodyear Tire & Rubber Company (GT), Navient (NAVI), and Brighthouse Financial (BHF).

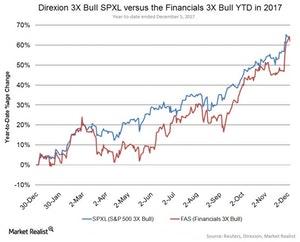

What Helped the Financial Sector in 2017?

Interestingly for all the talk about financials this year, the S&P 500 GICS Level 1 Financial Sector is only up 19% vs. 17%+ for the S&P500 as a whole.

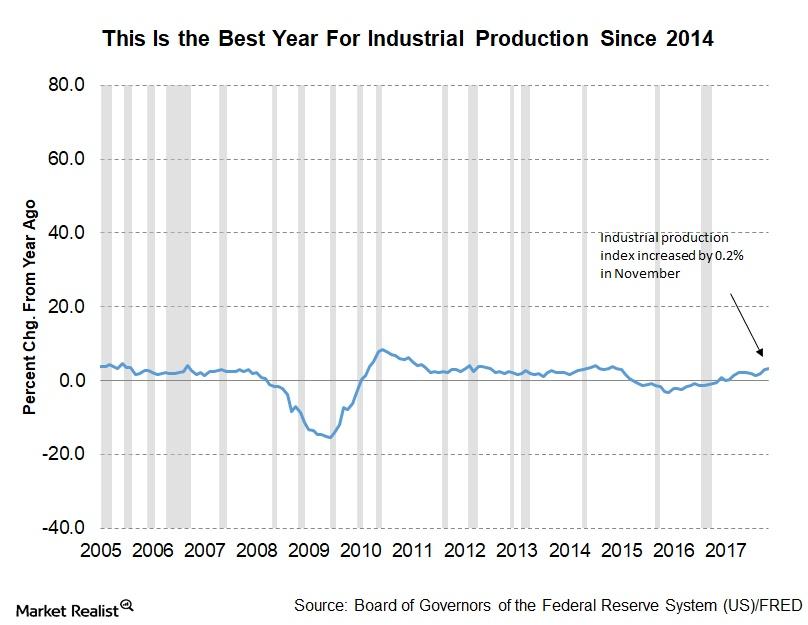

Why Industrial Production Fell from 1.2% to 0.2% in November

The Federal Reserve released its November industrial production report on December 15, 2017. The report indicated that industrial production improved 0.2% in November.

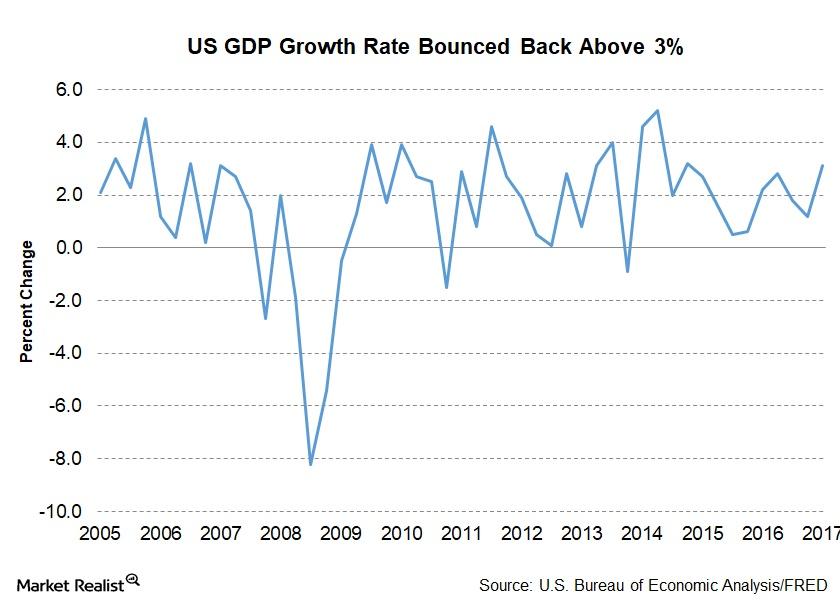

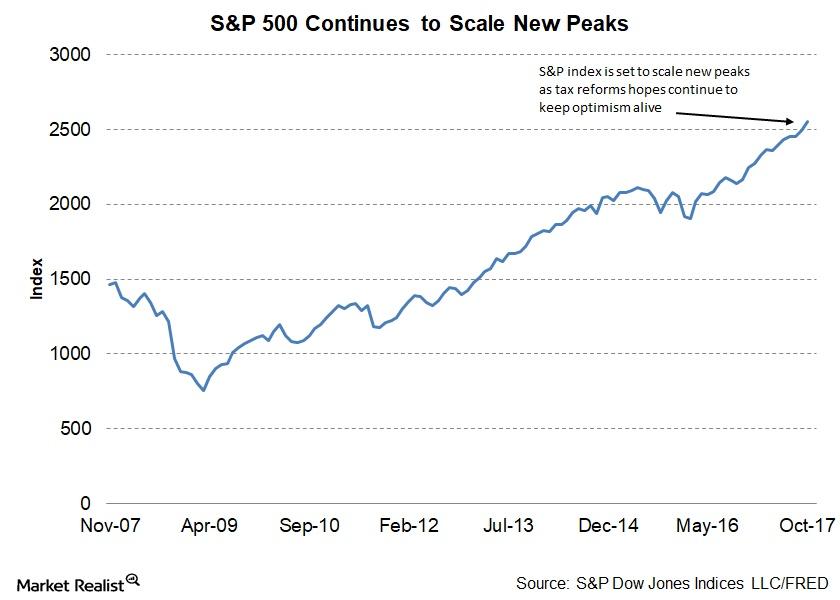

How the US Economy Performed in 2017

This year has been a year to watch the US economy. Hopes for change, tax reform, and industry-friendly policies drove the markets (SPY) higher.

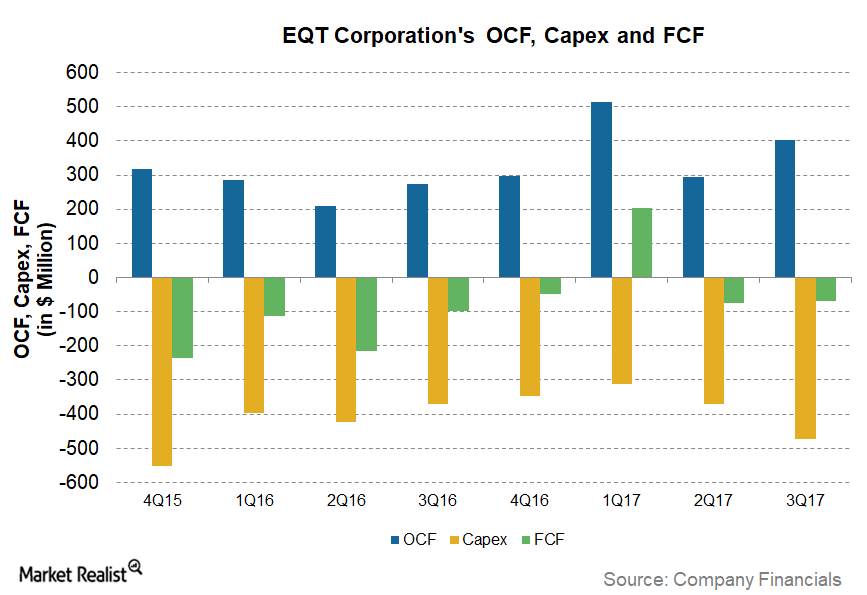

Why EQT’s Normalized Free Cash Flow Is Improving

As we saw in part one of this series, EQT (EQT) had normalized free cash flows of ~5% in the first nine months of 2017, the fifth highest among crude oil (USO) and natural gas (UNG) (UGAZ) producers we have been tracking.

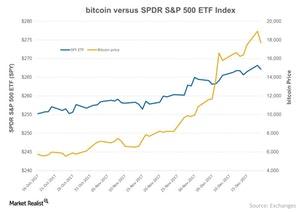

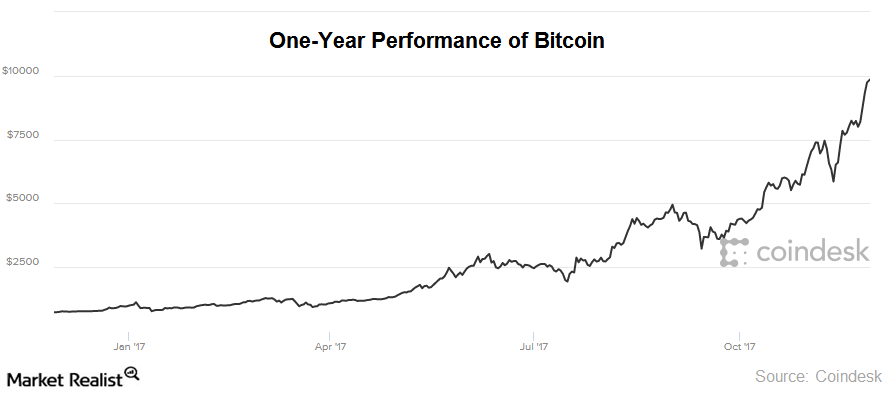

How Bitcoin Has Performed versus SPY

Bitcoin was trading at $17,000 on Wednesday, December 20, while the SPY Index was at $268.

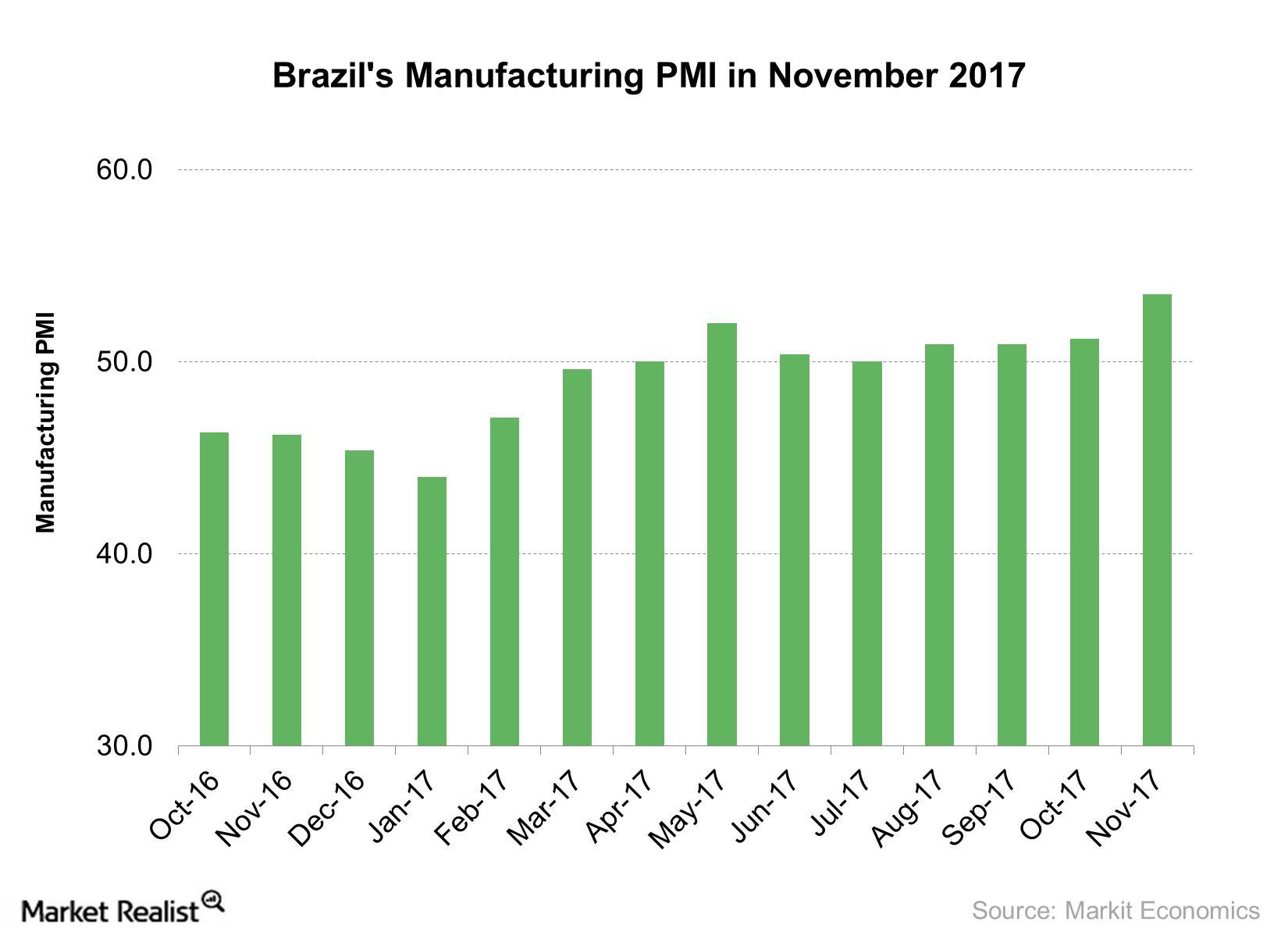

Brazil’s Manufacturing Activity Improves in November 2017

Brazil’s manufacturing activity in November According to data provided by Markit Economics, Brazil’s manufacturing PMI (purchasing managers’ index) rose to 53.5 in November from 51.2 in October, beating the estimate of 52.5 and marking the strongest rise in five years. November’s improvement in manufacturing activity was mainly due to the following factors: production output and volume […]

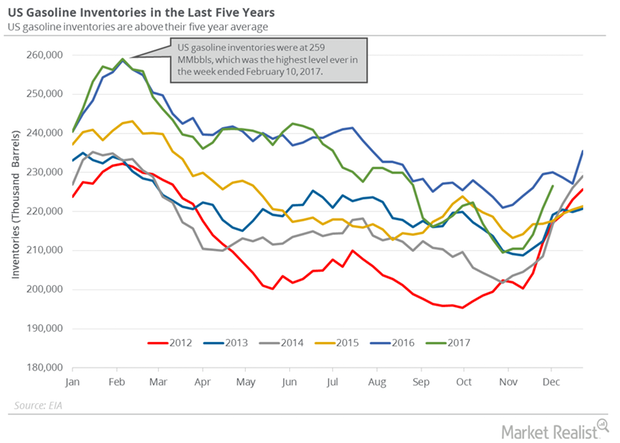

Analyzing the API’s Gasoline and Distillate Inventories

On December 19, 2017, the API released its crude oil inventory report. US gasoline inventories rose by 2 MMbbls (million barrels) on December 8–15, 2017.

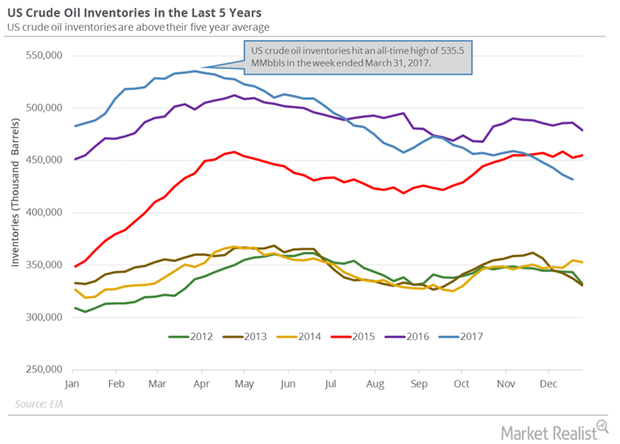

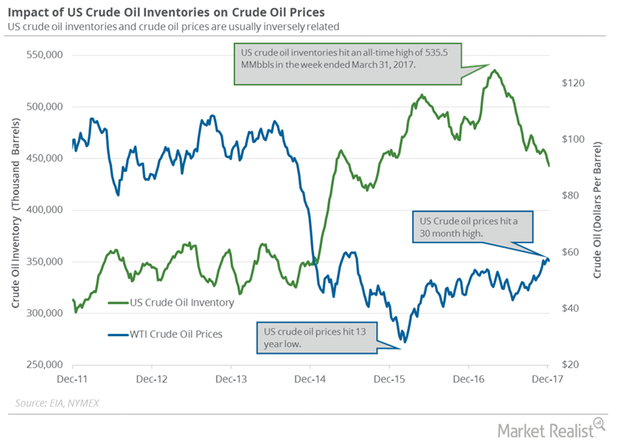

Will US Crude Oil Inventories Push Crude Oil Prices Higher?

US crude oil inventories fell 17.3% from their peak. So far, they have fallen 8.3% in 2017. Similarly, oil (DWT) (UCO) prices have risen ~9% in 2017.

Can US Crude Oil Break Below $57 Next Week?

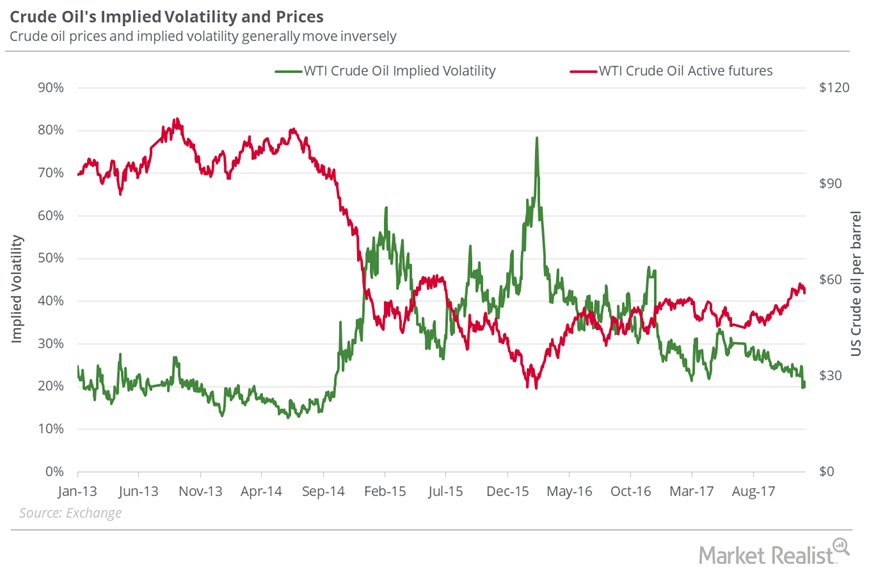

On December 14, 2017, the implied volatility of US crude oil futures was 18.1%. It was 14.8% below its 15-day average.

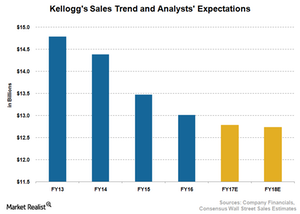

Why Analysts Expect Kellogg’s Sales to Fall

Kellogg (K) estimates a 3% decline in its top line for fiscal 2017, reflecting weakness in the cereal category and challenges in several markets.

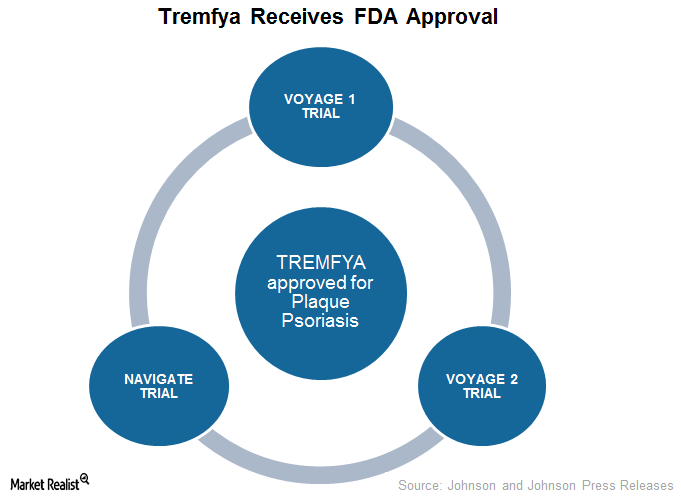

Johnson & Johnson’s Tremfya Approved to Treat Plaque Psoriasis

In July 2017, the US FDA (Food and Drug Administration) approved Johnson & Johnson’s (JNJ) Tremfya (guselkumab) for the treatment of individuals with moderate to severe plaque psoriasis.

November Services PMIs: What They Say about Developed Markets

In this series, we’ll analyze the November performances of the services PMIs for developed economies, including the United States, the United Kingdom, the Eurozone, Germany, France, Spain, and Japan.

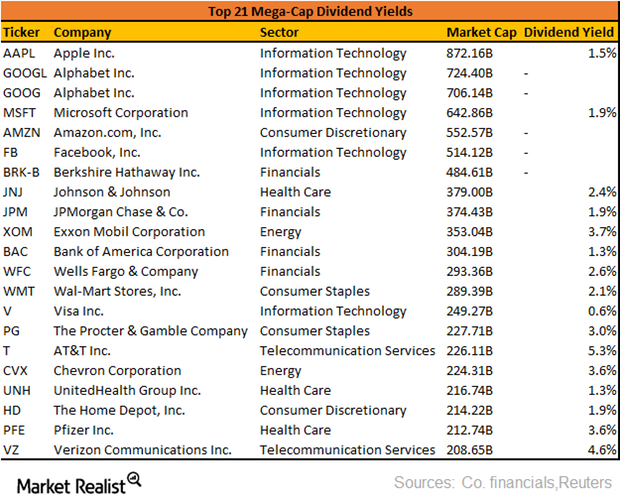

What Are the Dividend Yields of the Top 10 Mega-Cap Stocks?

Donald Trump’s promises of financial deregulation, infrastructure spending, and tax cuts played a major role in the stock market rally this year.

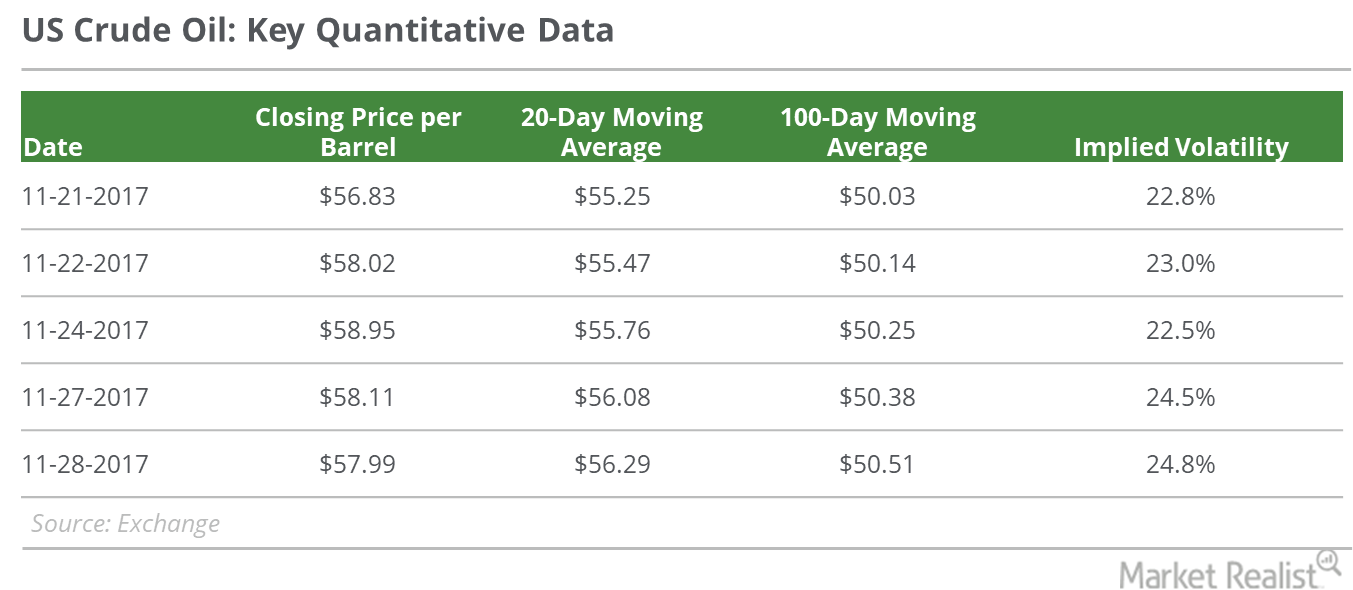

US Crude Oil Prices Could Remain below $58 Next Week

On December 7, 2017, US crude oil’s implied volatility was 20% or ~1.1% less than its 15-day average. On December 1, the implied volatility fell to 19.8%.

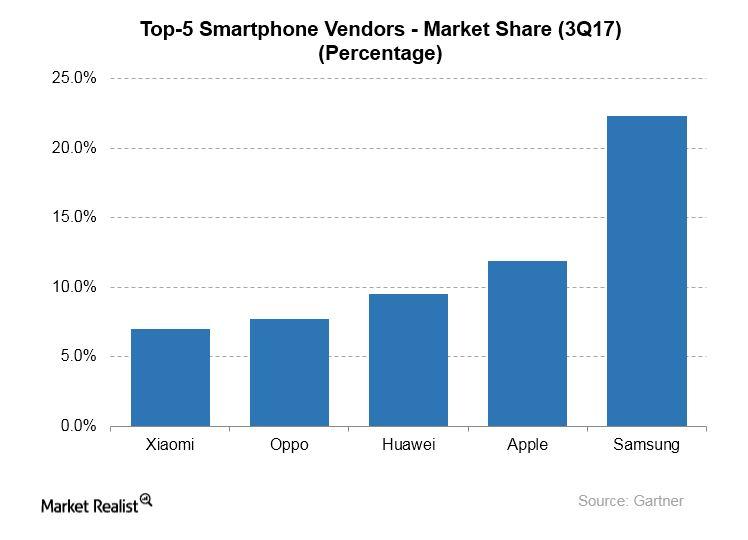

Making Sense of Samsung’s SmartThings Initiative

A few months ago, Samsung said that it would bundle its pre-existing IoT services into a new unified IoT platform named SmartThings Cloud.

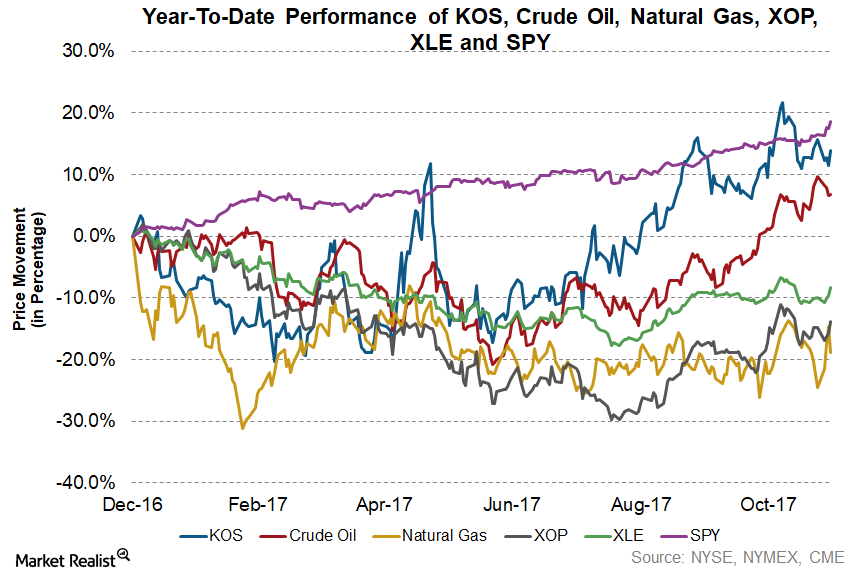

The Fourth-Best-Performing Upstream Stock Year-to-Date

In 9M17, KOS’s production increased ~107.0% to ~7.8 million barrels when compared with 9M16.

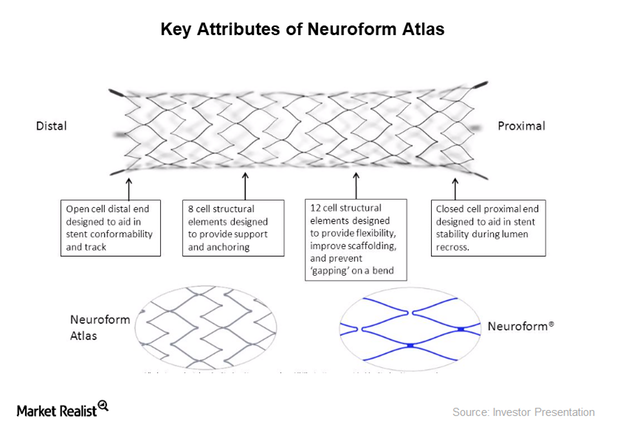

Stryker’s FDA Approval Accelerates Neck Aneurysm Treatments

On November 9, 2017, Stryker (SYK) announced FDA approval for the Neuroform Atlas Stent System, which is approved for marketing under an HDE.

New China Is All about Technology

One of the biggest trends in the global economy over the past two years is the reduction in manufacturing capacity in China (FXI) (MCHI).

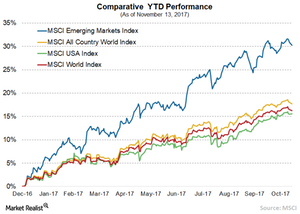

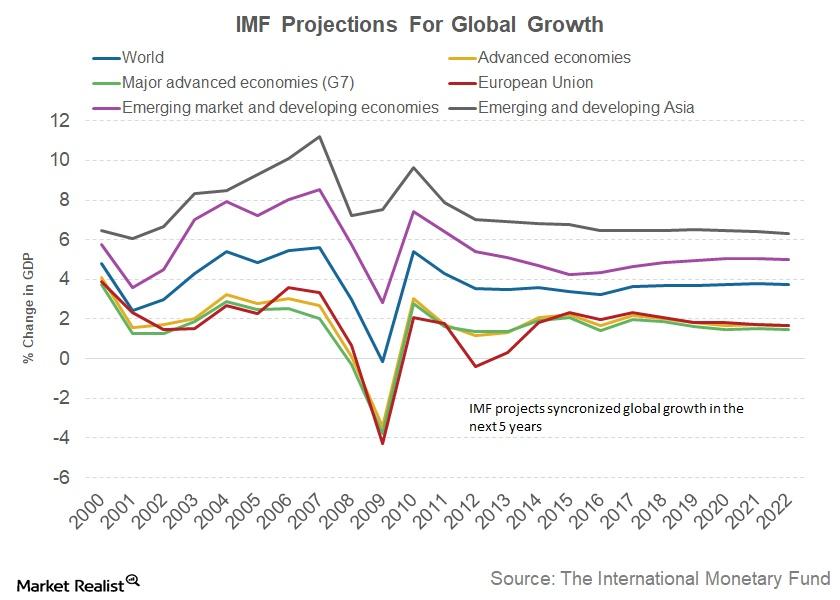

Why Emerging Markets Are Rallying

There are a lot of reasons behind the sharp rally in EMs (SCHE). The prominent reason is that the GDP growth in many of these nations has improved in the last few quarters partially on the back of the rise in commodity prices like copper and oil.

The Economic Indicators Covered by the Fed’s Beige Book

Comparing the economic performance with economic expectations and the previous cycles gives investors an idea of whether the economy is expanding or contracting.

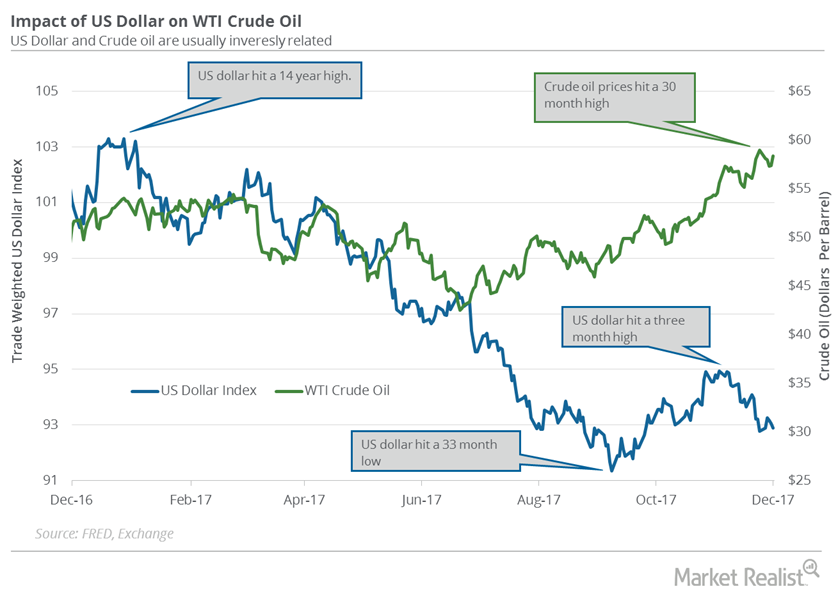

How Could US Tax Bill Affect Dollar and Crude Oil Prices?

The US Dollar Index advanced 0.1% to 92.8 last week. Consequently, it pressured oil prices during the week.

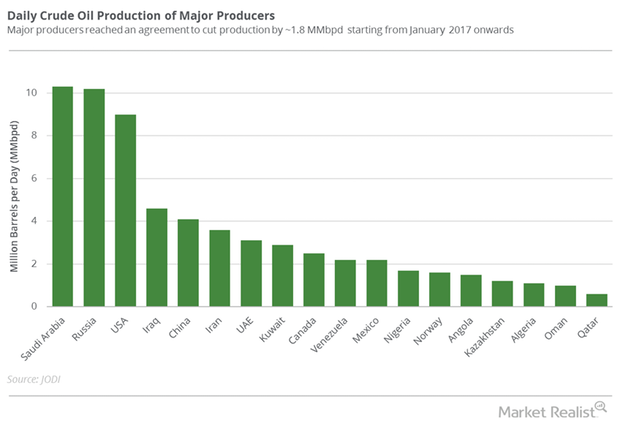

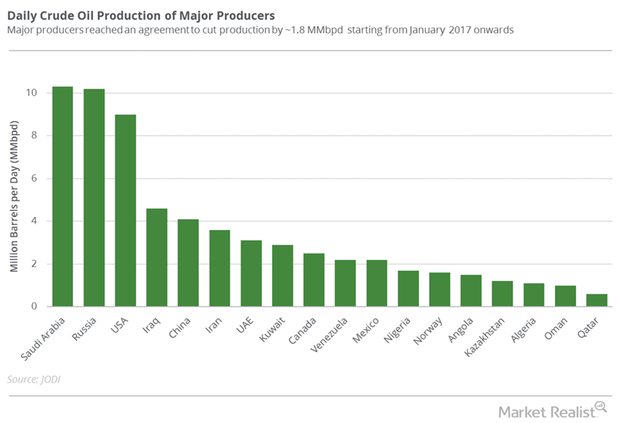

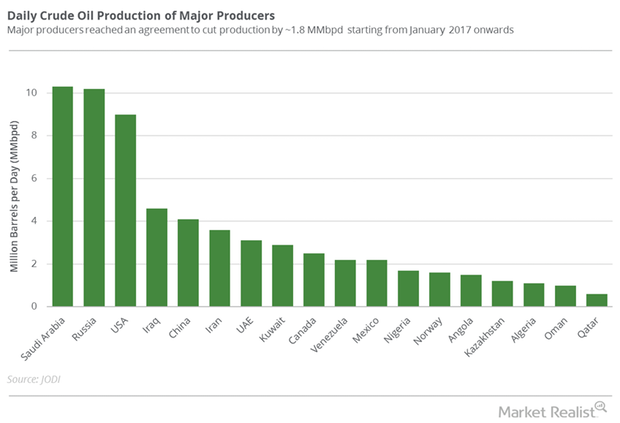

How OPEC and Russia Are Helping US Crude Oil Producers

January West Texas Intermediate (or WTI) crude oil (USO) (SCO) futures contracts fell 0.65% and were trading at $57.98 per barrel at 1:10 AM EST on December 4, 2017.

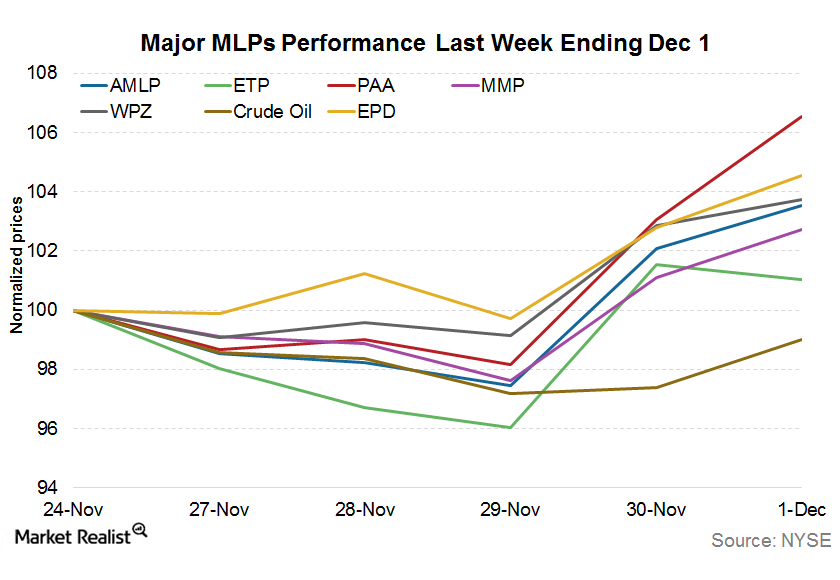

Understanding the Slight Recovery among MLPs Last Week

MLPs (master limited partnerships) recovered slightly last week (ended December 1, 2017), after three weeks of sluggishness.

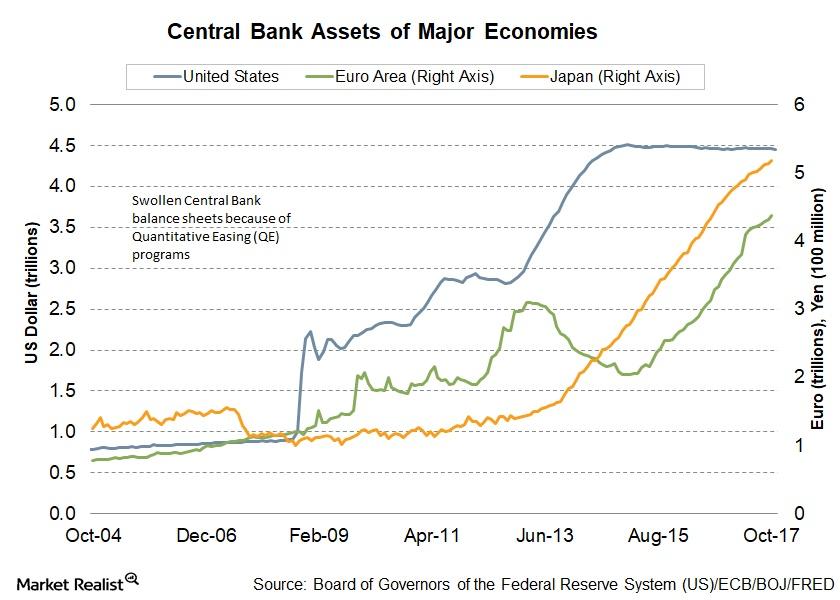

When the United States Sneezes, Will the World Catch a Cold?

Williams suggested that the monetary policy framework should be designed considering the global scenario rather than central banks looking at their economies in isolation.

San Francisco Fed John Williams and Monetary Policy Challenges

John Williams, president and CEO of the Federal Reserve Bank of San Francisco, spoke on November 16, 2017, at the 2017 Asia Economic Policy Conference in San Francisco.

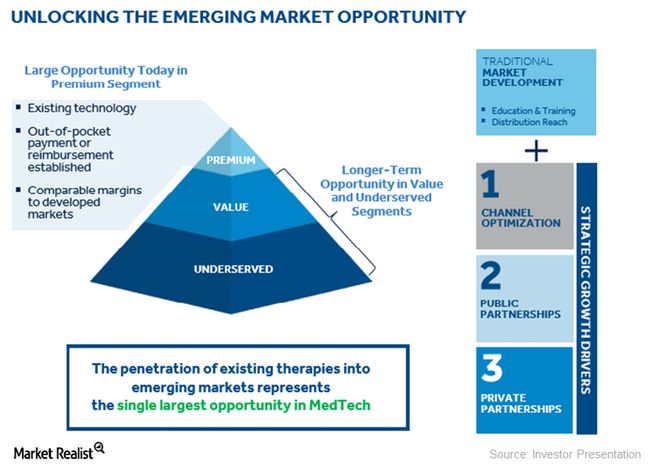

Emerging Markets Growth Is Driving Medtronic’s Geographic Strategy

In fiscal 2Q18, Medtronic registered sales of ~$1.1 billion from emerging markets.

The Leading Credit Index: October Update

The Leading Credit Index for October was reported to be -0.70, improving from the revised September reading of -0.64.

Crude Oil Prices Are Positive before OPEC’s Meeting

US crude oil futures for January delivery rose 0.3% to $57.47 per barrel at 1:10 AM EST on November 30, 2017. Prices rose ahead of OPEC’s meeting.

Why the S&P 500 Index Is Considered a Leading Indicator

The S&P 500 Index has risen 2.2% in October and is en route to its eighth straight positive monthly close.

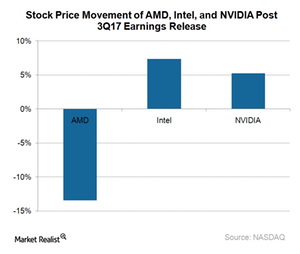

Why Did AMD’s Stock Price Fall after Its Fiscal 3Q17 Earnings?

AMD reported better-than-expected fiscal 3Q17 earnings. Despite this, its stock fell 13.5% in just one day after its earnings were released.

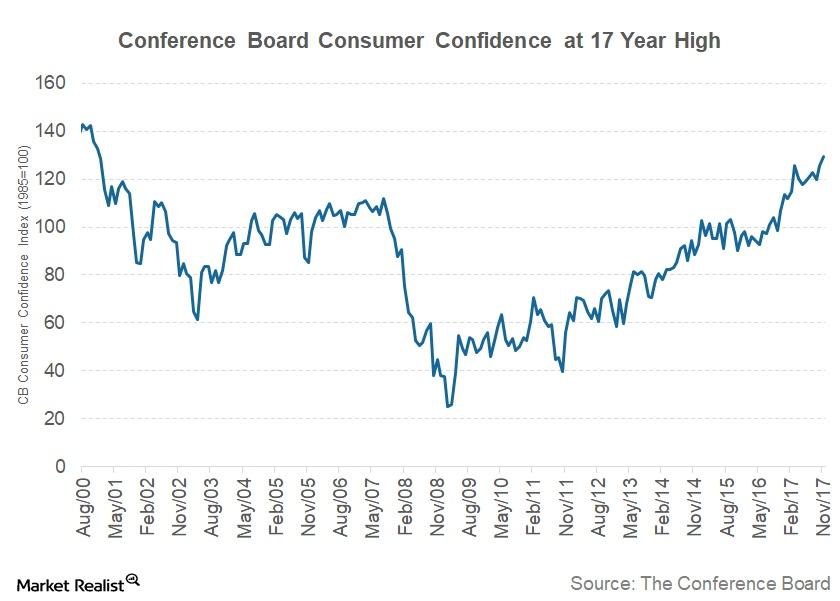

Conference Board Consumer Confidence Rose in November

The Conference Board Consumer Confidence Index for November came in at 129.5, up from 126.2 in October.

Why Gorman Doesn’t Think Bitcoin Deserves So Much Attention

James Gorman thinks that investment in bitcoin could be risky.

Is Oil’s Rise Coming to a Halt?

On November 28, 2017, US crude oil (USO) (USL) active futures fell 0.2% and closed at $57.99 per barrel. All eyes are on the outcome of OPEC’s meeting.

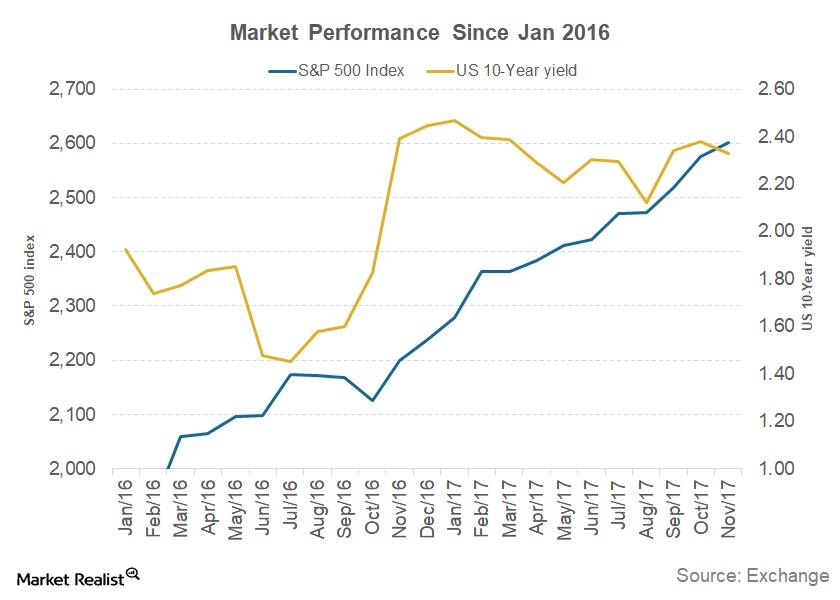

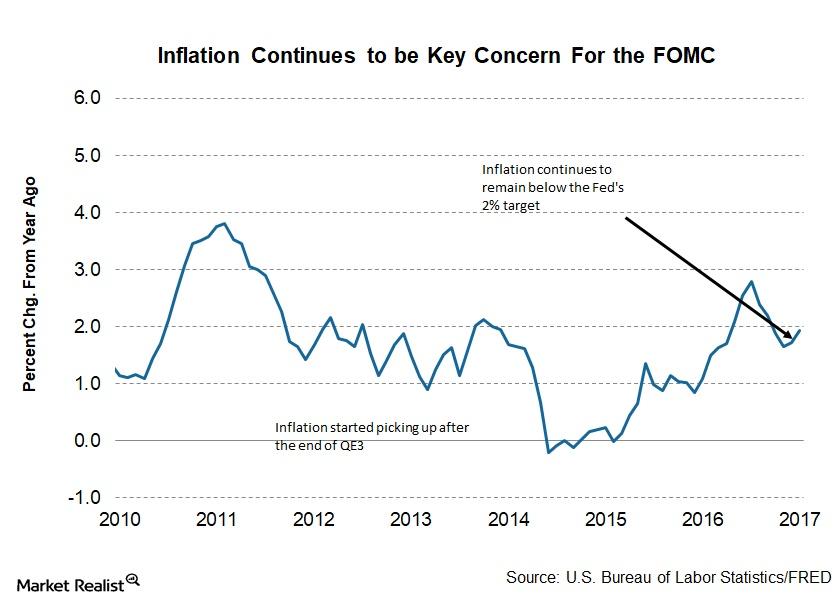

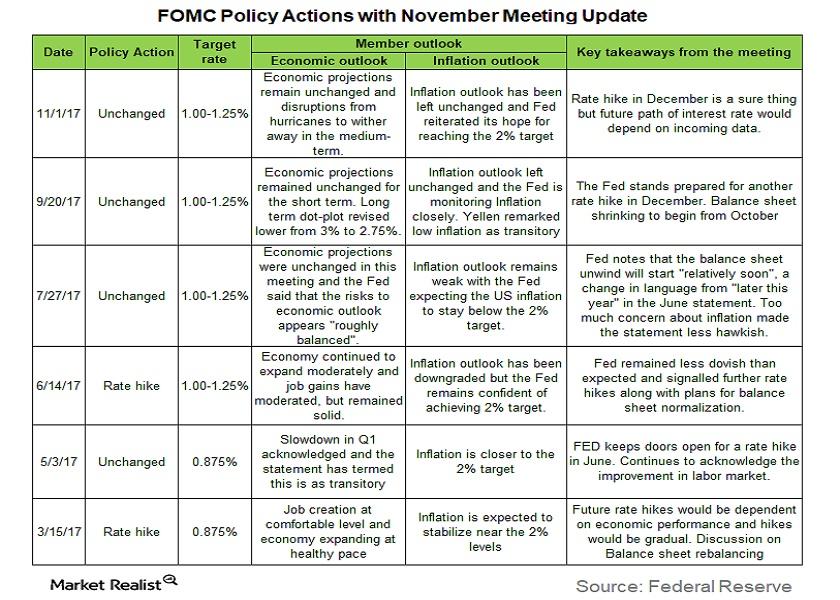

The FOMC’s View of the Equity and Bond Markets

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

The FOMC’s Outlook for the US Economy

As per economic projections prepared by the FOMC, US real GDP is expected to improve in the final quarter of this year.

The November FOMC Meeting Minutes: Must-Knows

The last Federal Open Market Committee (or FOMC) meeting took place on October 31–November 1. The target range for the federal funds rate stayed unchanged at 1%–1.25%.

A Look at Key Economic Indicators Released Last Week

In this series, we’ll take a look at US inflation, US retail sales, and China’s retail sales for October 2017. We’ll also analyze some economic indexes and the Eurozone’s consumer confidence in November 2017.

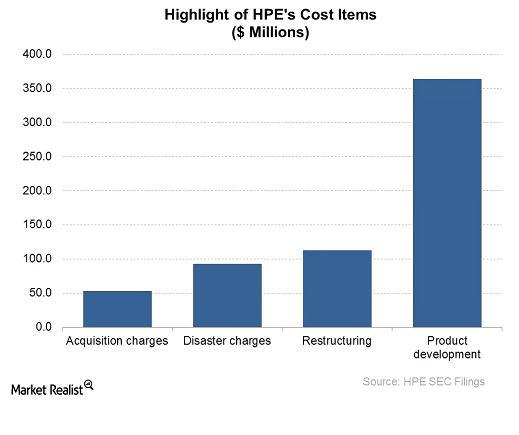

How Hurricanes Affected HPE’s Earnings

Perhaps US-based (SPY) IT vendor Hewlett Packard Enterprise (HPE) would have generated better profits in fiscal 4Q17 if not for the impact of natural disasters.

Will OPEC’s Meeting Help Crude Oil Bulls or Bears?

OPEC’s meeting will be held on November 30, 2017. Reuters said that OPEC might extend the production cuts for nine more months.

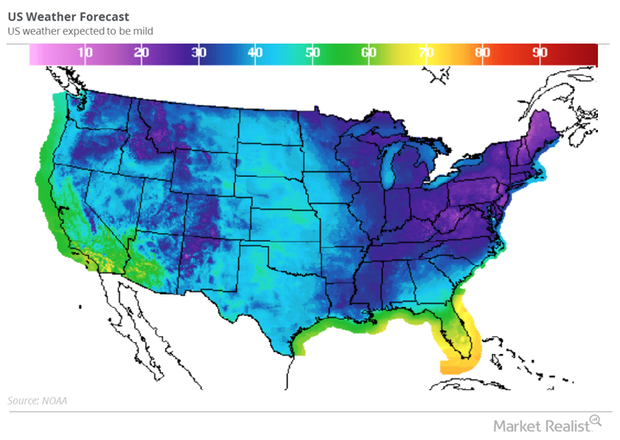

Weather Impacts the US Natural Gas Market

January US natural gas (DGAZ) (UNG) futures contracts fell 1.4% to $3.01 per MMBtu in electronic trading at 1:05 AM EST on November 24, 2017.