SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

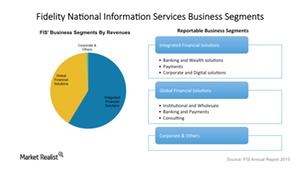

How Are FIS’s Business Strategies Driving Growth?

FIS plans to build stronger client relationships through multidimensional offerings. Its SunGard acquisition should also help expand client relationships.

Why Your Portfolio Needs More Carry

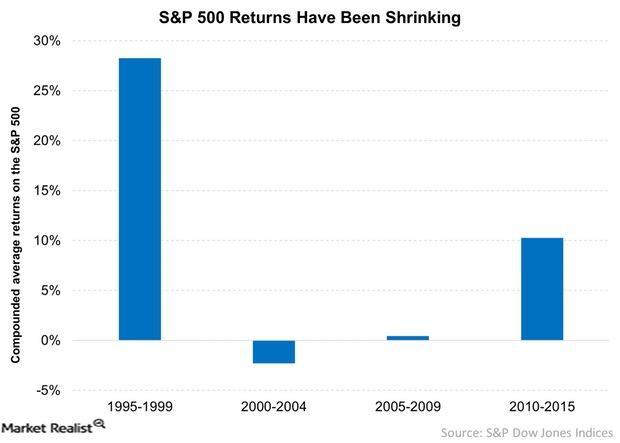

Since 2009, equities have staged a comeback. Between 2010 and 2015, the S&P 500 index has risen 10.3% on a CAGR basis. Most of the comeback is due to multiple expansion.

Inside FIS’s Operating Model

In 2015, FIS reorganized and began reporting its results under three segments. But after the SunGard acquisition, another restructuring process is underway.

Introducing Fidelity National Information Services

Headquartered in Florida, Fidelity National Information Services is a big hitter in software solutions and innovations in the financial services industry.

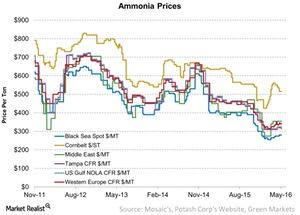

How Did Ammonia Prices Trend Last Week?

Ammonia prices for Tampa CFR (cost and freight) moved down 1.6% to $315 per metric ton compared to $320 per metric ton in the previous week.

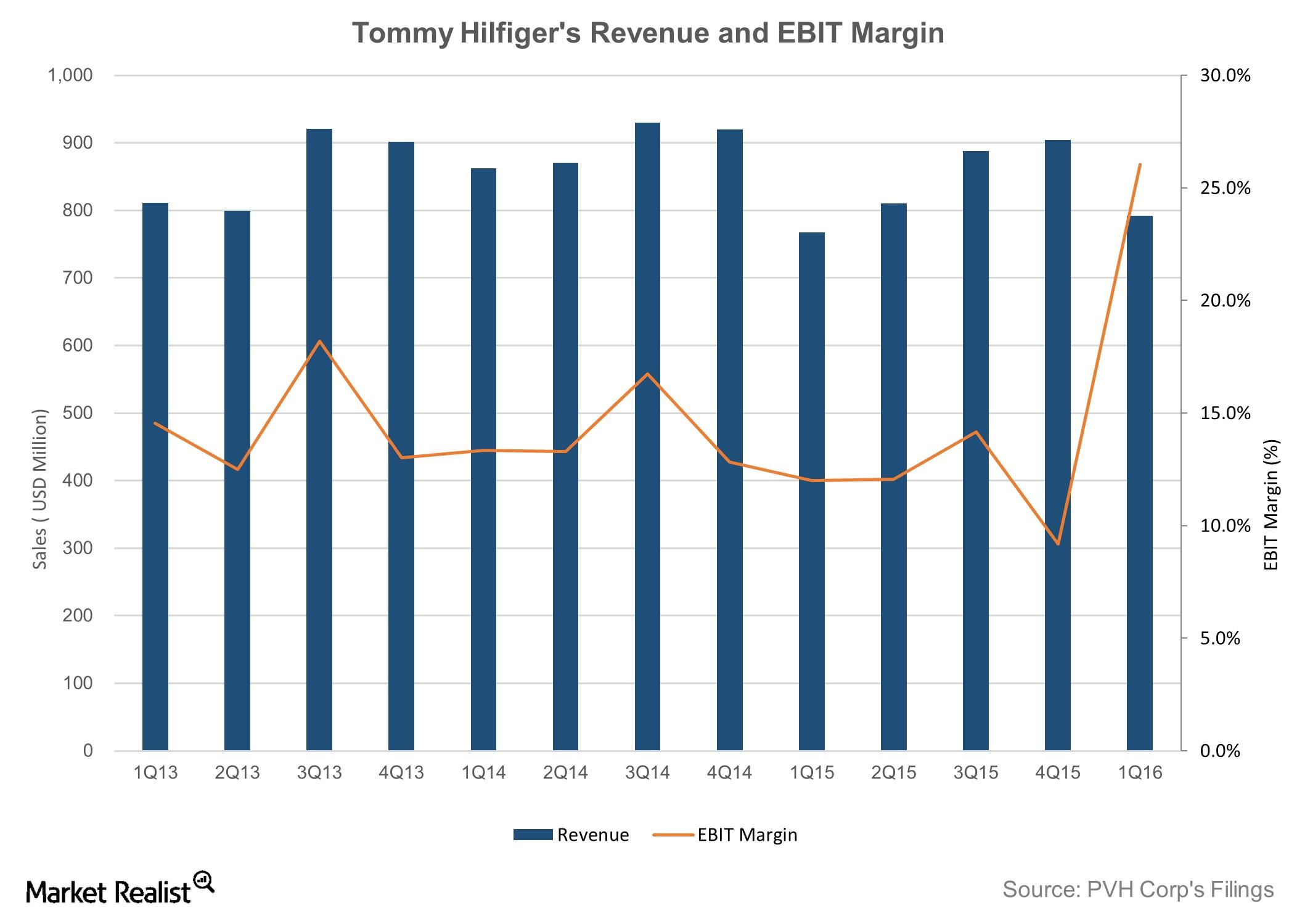

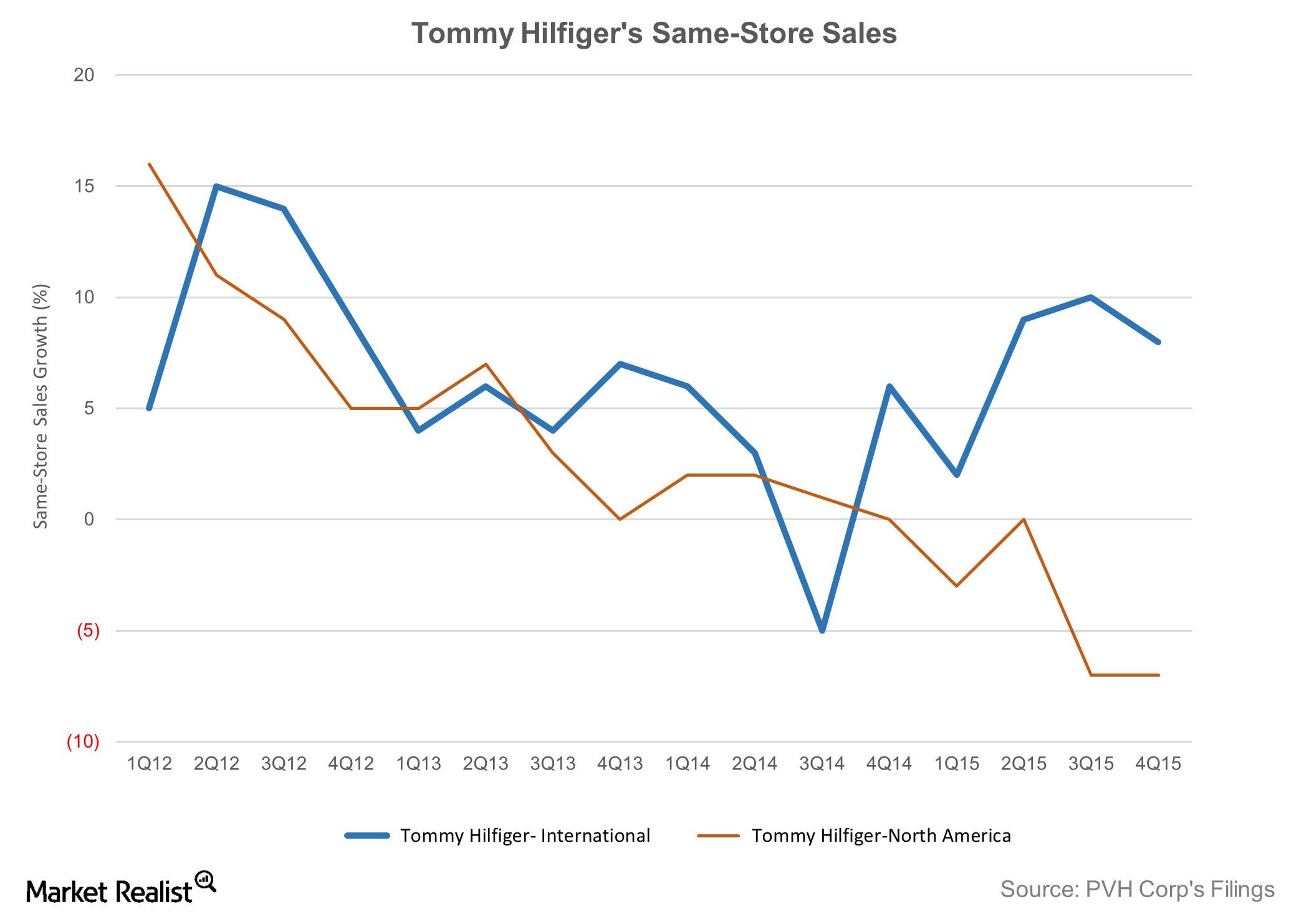

PVH’s Tommy Hilfiger Gets Boost from Strong International Sales

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

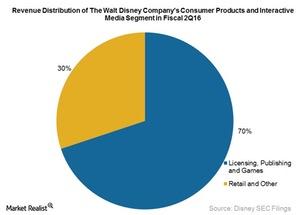

How Is Disney’s Acquisition Strategy Reaping Rewards?

On May 20, The Walt Disney Company announced that Marvel’s Captain America: Civil War was set to surpass $1 billion in earnings at the global box office.

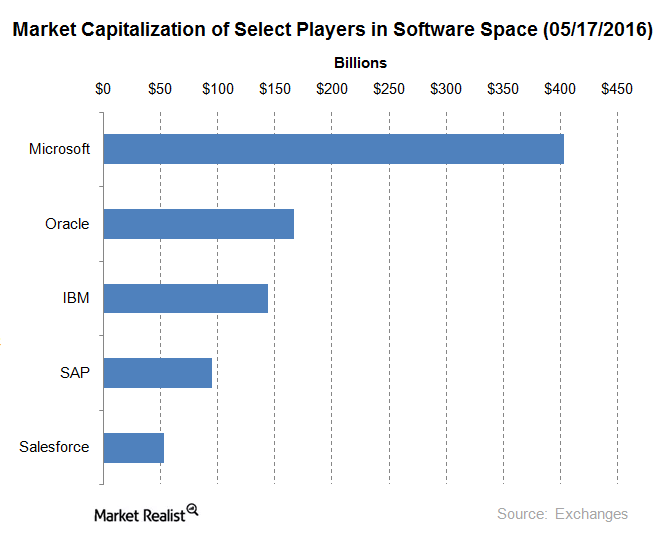

What Is Salesforce’s Value Proposition in the Software Space?

Earlier in this series, we discussed Salesforce’s (CRM) recently announced fiscal 1Q17 earnings. Now, let’s look at the company’s value proposition.

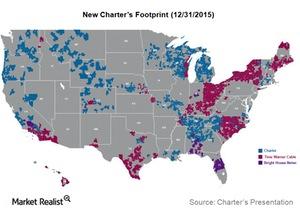

Charter Completes Merger with Bright House and Time Warner Cable

The merger of Charter Communications (CHTR), Time Warner Cable (TWC), and Bright House Networks was completed on May 18, 2016.

How Icahn Enterprises Turned Its Home Fashion Segment Around

Icahn Enterprises (IEP) conducts its Home Fashion business through its indirect wholly owned subsidiary, WestPoint Home.

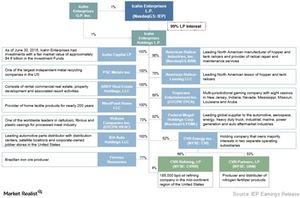

A Look at Icahn Enterprises’ Business Model

Icahn Enterprises’ investment strategy involves identifying and purchasing undervalued businesses and assets at distressed prices.

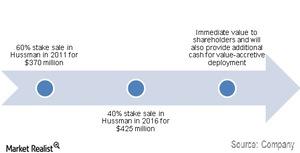

The Brass Tacks of the Ingersoll Rand-Hussmann Deal

Ingersoll Rand has agreed to sell its remaining equity interest of 40% in Hussmann to Panasonic. Panasonic will buy 100% shares according to the agreement.

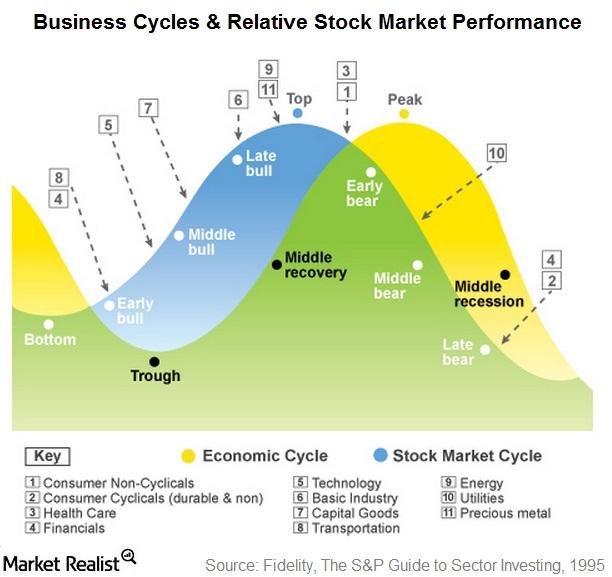

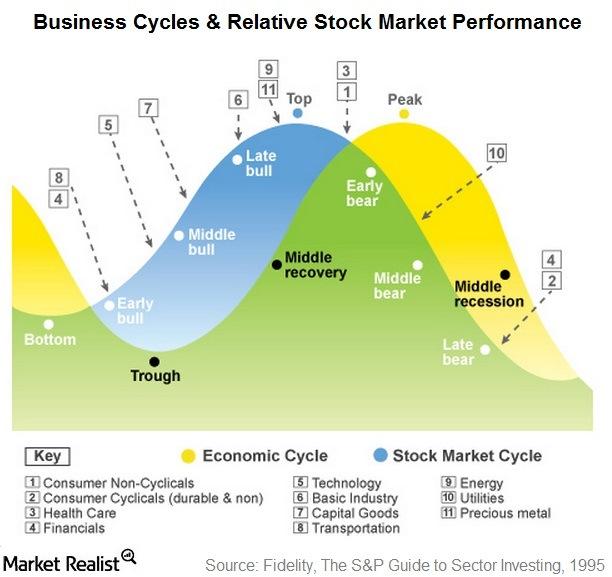

What Phase of the Business Cycle Are We In?

Studied in conjunction, stock market and economic conditions give clear indications of the business cycle phase we are in.

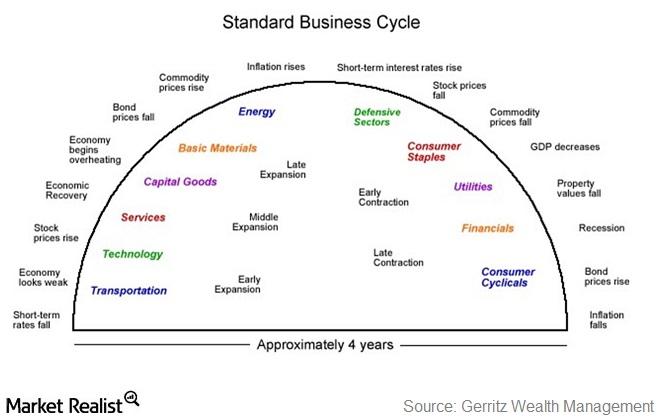

Business Cycle Investing? Here Are the Sectors You Should Look At

We’ve moved from a phase in the business cycle where defensive stocks do well to the phase where utilities outperform.

Positioning Your Portfolio According to the Business Cycle

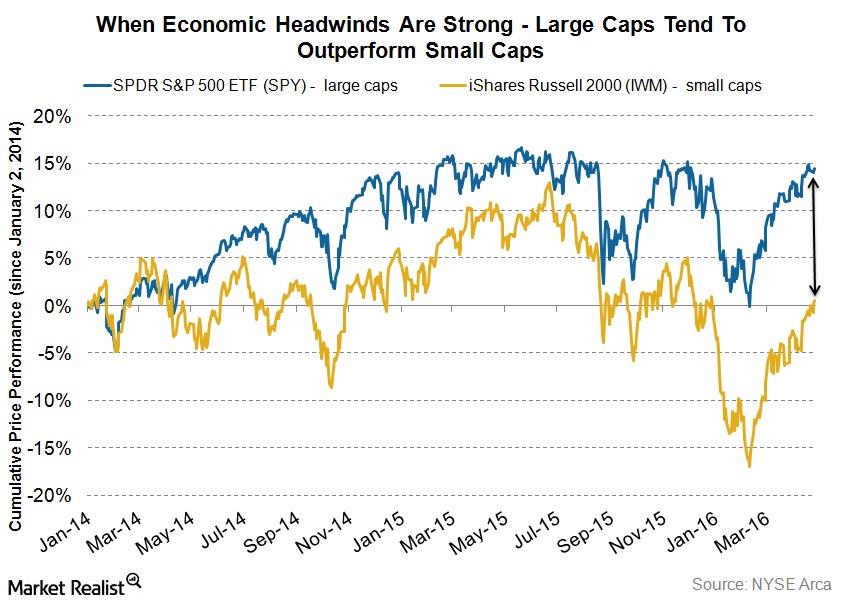

Style investing involves selecting a particular asset class that should outperform during a business cycle phase and positioning your portfolio accordingly.

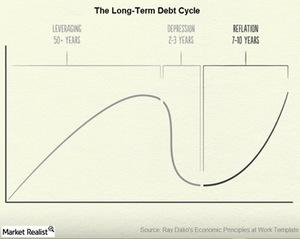

Where Are We in the Long-Term Debt Cycle? Ray Dalio Weighs In

According to Ray Dalio, the Fed needs to study the long-term debt cycle in order to understand the huge downside risks that currently face the US economy.

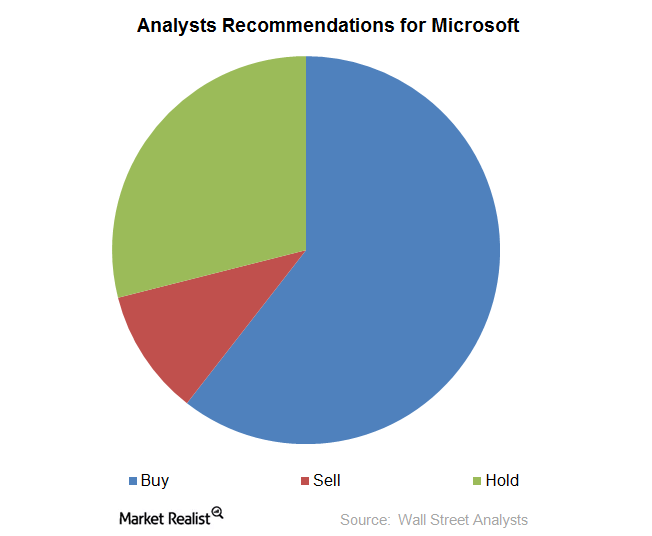

What Are the Analysts’ Recommendations for Microsoft?

Of the 38 analyst recommendations on Microsoft’s stock, 60.5% were “buys” as of April 6. Meanwhile, ~29% of recommendations were “holds.” The remaining ~10.5% of recommendations on the stock were “sells.”

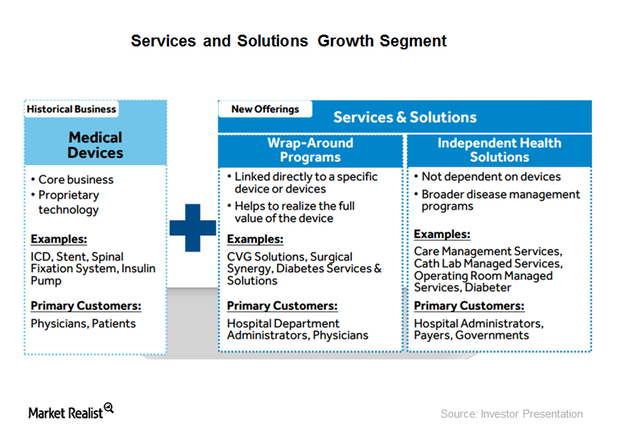

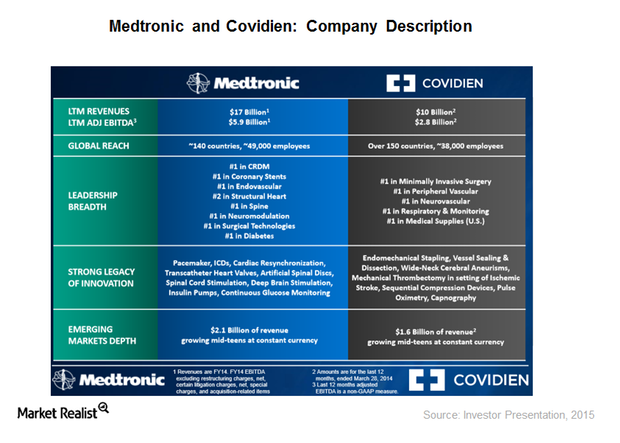

Why Medtronic Is Diversifying beyond Medical Devices

Medtronic established a services and solutions growth vector as one of its core strategies. It contributed ~20 basis points to Medtronic’s growth in 3Q16.

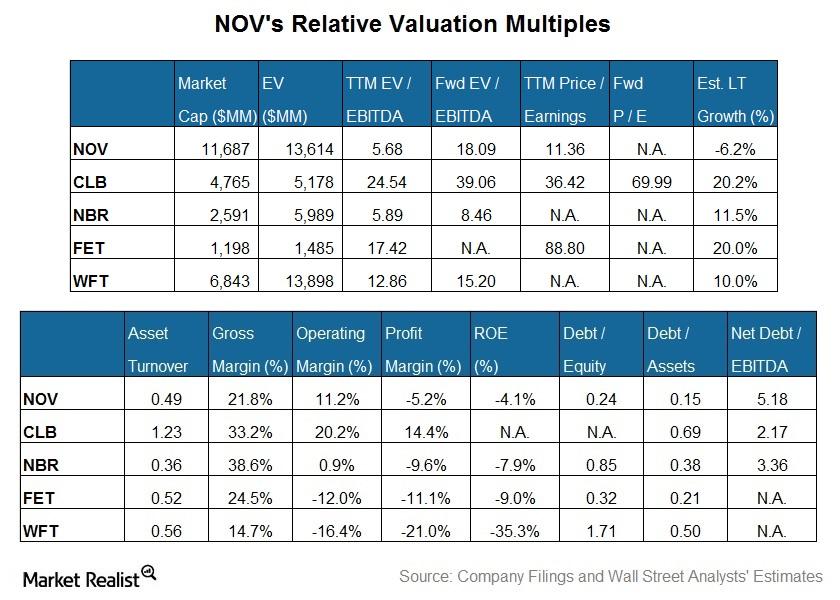

What Is NOV’s Valuation Compared to Its Peers’?

NOV’s enterprise value, when scaled by trailing-12-month adjusted EBITDA, is lower than the peer average.

What Is the Market Outlook for Underground Mining Equipment?

The global underground mining industry is expected to grow at a compound annual growth rate of approximately 7% from 2015 to 2019.

Business Cycle Perspective: Has the Healthcare Sector Hit Bottom?

This year, the healthcare sector seems to be receding, and the utilities sector seems to be in good gear. This is a sign that the early bear phase is over.

Sizing up Medtronic-Covidien, the Biggest Deal in the Medical Device Industry

On January 26, Medtronic completed the acquisition of Covidien for $42.9 billion in cash and Medtronic stocks and assumed Covidien’s debt of ~$5 billion.

Challenging Apparel Market Dampened Tommy Hilfiger’s Performance

Tommy Hilfiger is one of the world’s leading designer lifestyle brands. PVH reports its business under the North America and International segments.

Key Valuation Metrics for Disney: How Do They Compare?

Disney stands out from its competitors in the media industry because of its vast intellectual property.

What’s the Significance of T-Mobile’s Low-Band Spectrum?

T-Mobile has been adding low-band spectrum holdings.

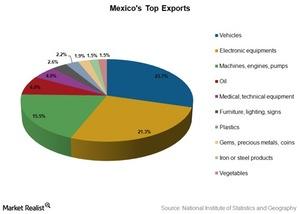

Consumerism Abroad to Drive Growth in Mexico

Mexico is known for its industrial base. In 2015, vehicles constituted about 23.7% of Mexican exports, followed by electronic equipment at 21.3% of exports.

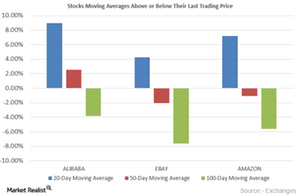

What Are Analysts’ Recommendations for Alibaba?

As of March 4, 2016, Alibaba (BABA) has generated returns of -16.1% for the trailing 12 months and -15.3% in the trailing-one-month period.

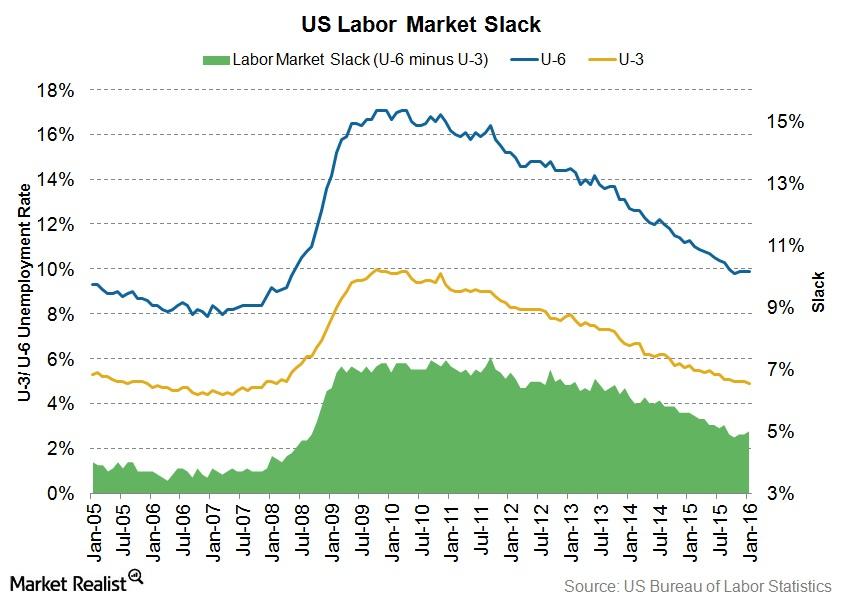

What Is Labor Market Slack?

The unemployment rate doesn’t help us gauge the extent of labor market slack. The actual employment gap that exists also consists of a slack component.

Understanding Resilient Systems: IBM’s Latest Acquisition in the Security Space

Resilient Systems, a heavy hitter in the cybersecurity space, is best known for its “incident response” platform and is IBM’s most recent acquisition.

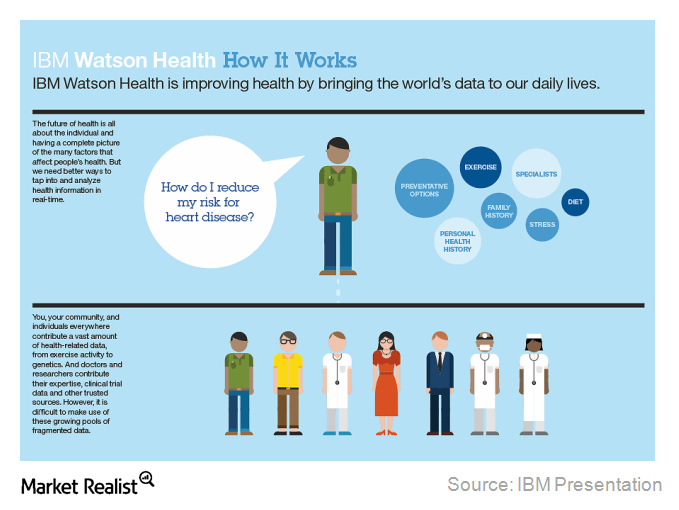

Truven: IBM’s Latest Buy, Attempt to Push Watson

On February 18, 2016, IBM announced the acquisition of Truven Health Analytics for $2.6 billion. Truven provides cloud-based healthcare data and analytics.

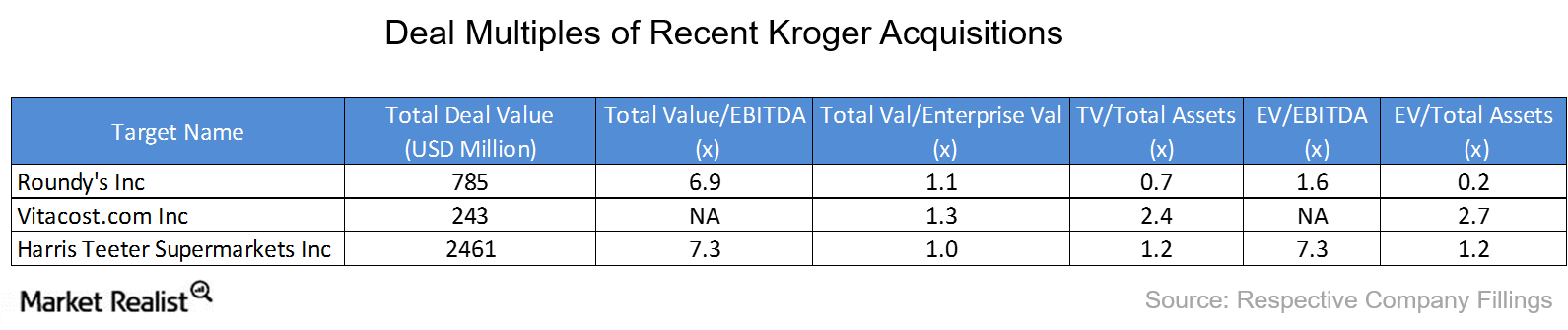

Looking Ahead: Kroger Continues Its Aggressive Acquisition Strategy

Taking The Fresh Market (TFM) under its fold would enhance Kroger’s (KR) expansion in Florida and North Carolina, where TFM has 40 and 20 stores, respectively.

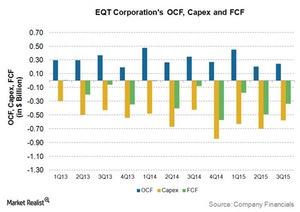

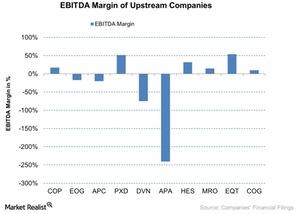

The Downward Trend of EQT’s Free Cash Flow

EQT has been reporting negative free cash flows since 2Q13. In 3Q15, EQT’s free cash flow was -$334 million.

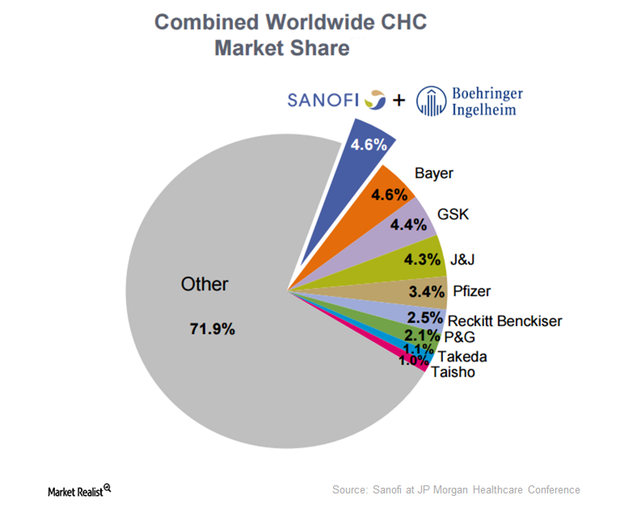

Can Consumer Healthcare Drive Sanofi’s Revenue?

The CHC (consumer healthcare) market forms a part of Sanofi’s (SNY) pharmaceutical segment.

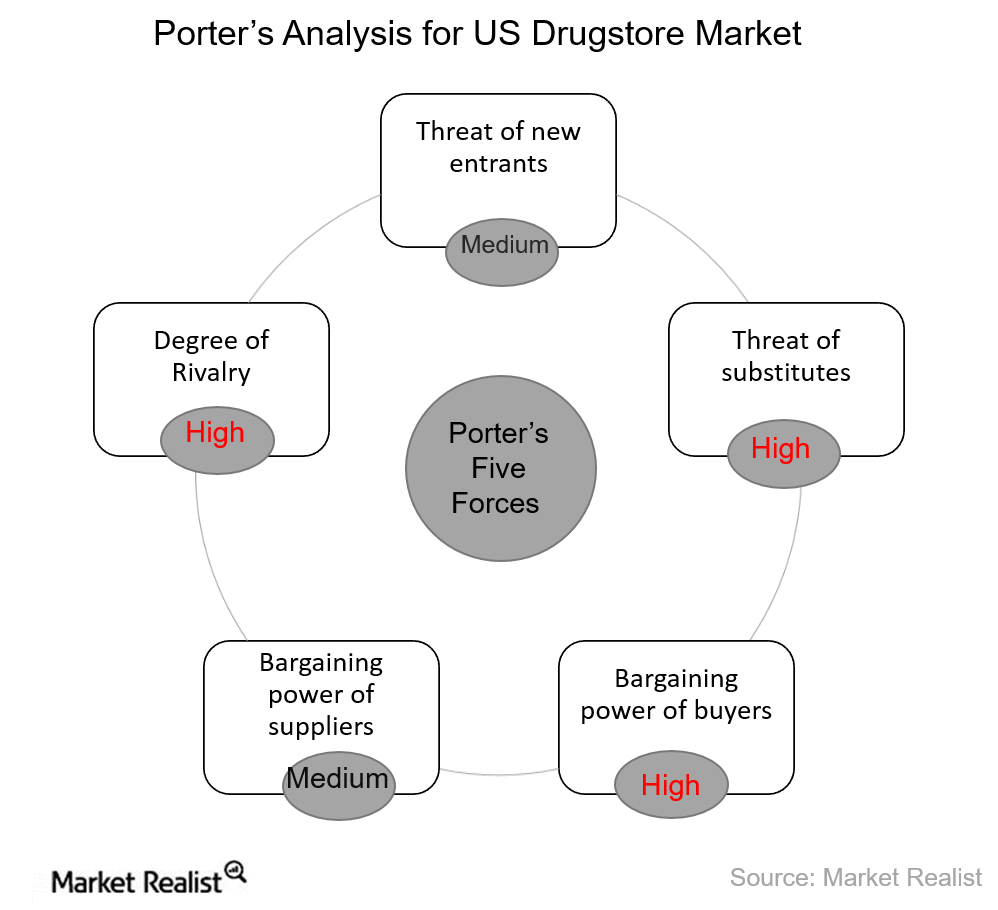

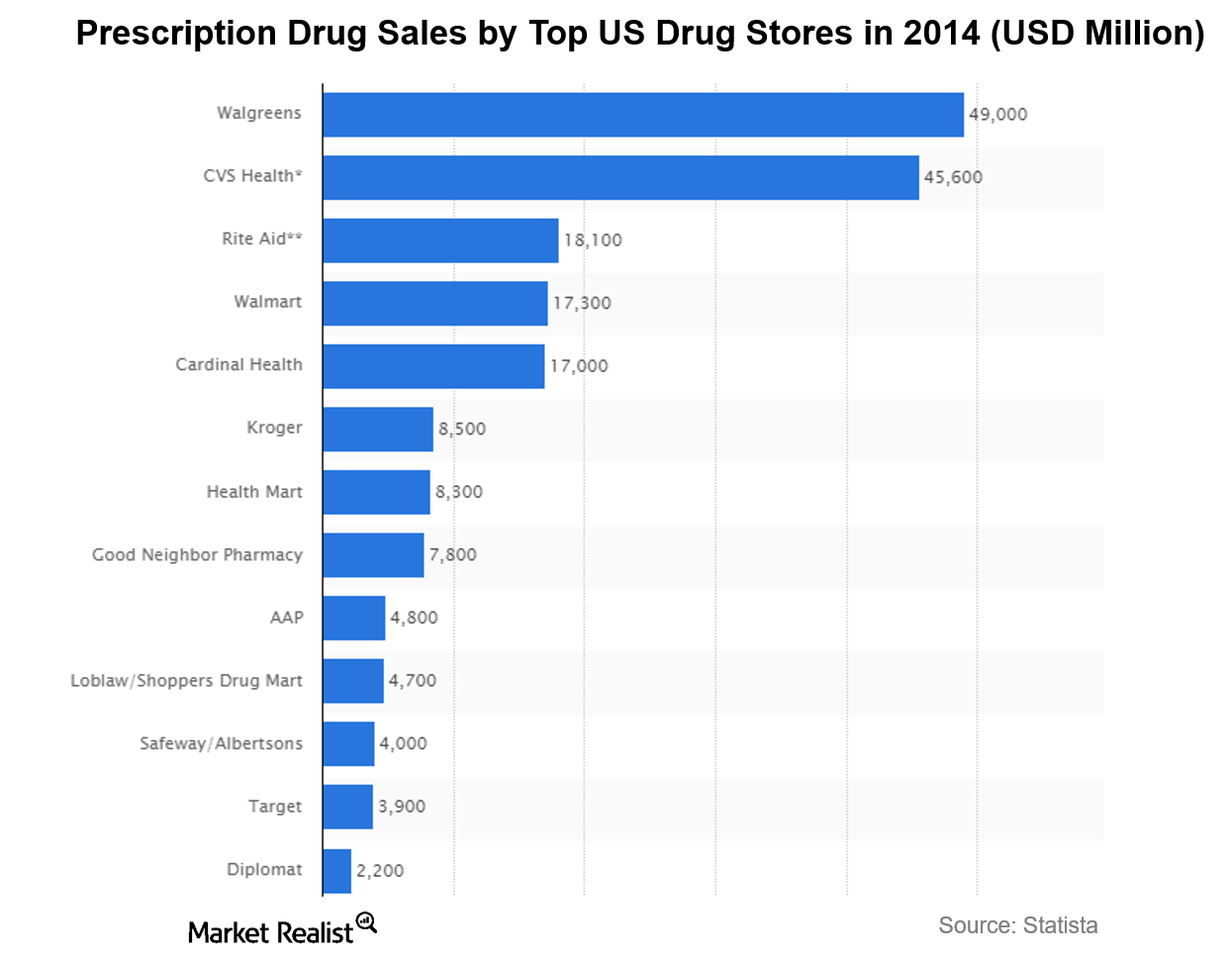

Porter’s Five Forces Analysis of the US Drugstore Industry

Porter’s five forces model is used to assess the nature of competition and attractiveness of an industry.

An Overview of the US Drugstore Industry

US drugstores typically generate revenues by selling prescription drugs, over-the-counter medications, health and beauty products, and general merchandise.

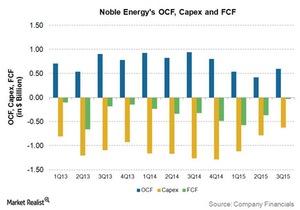

A Look at Noble Energy’s Free Cash Flow Trends

Noble Energy reported negative but improving free cash flows in 2015.

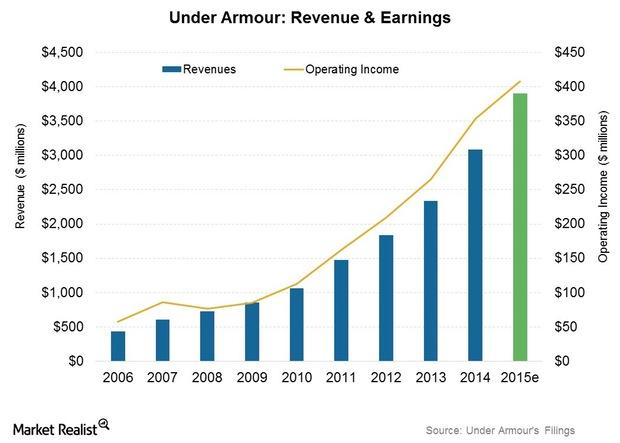

Under Armour Projects a ~26% Revenue Growth Rate for 2015

Under Armour is scheduled to declare its earnings for 4Q15 and full-year 2015 on January 28, 2016. It has projected revenue of $3.9 billion for 2015.

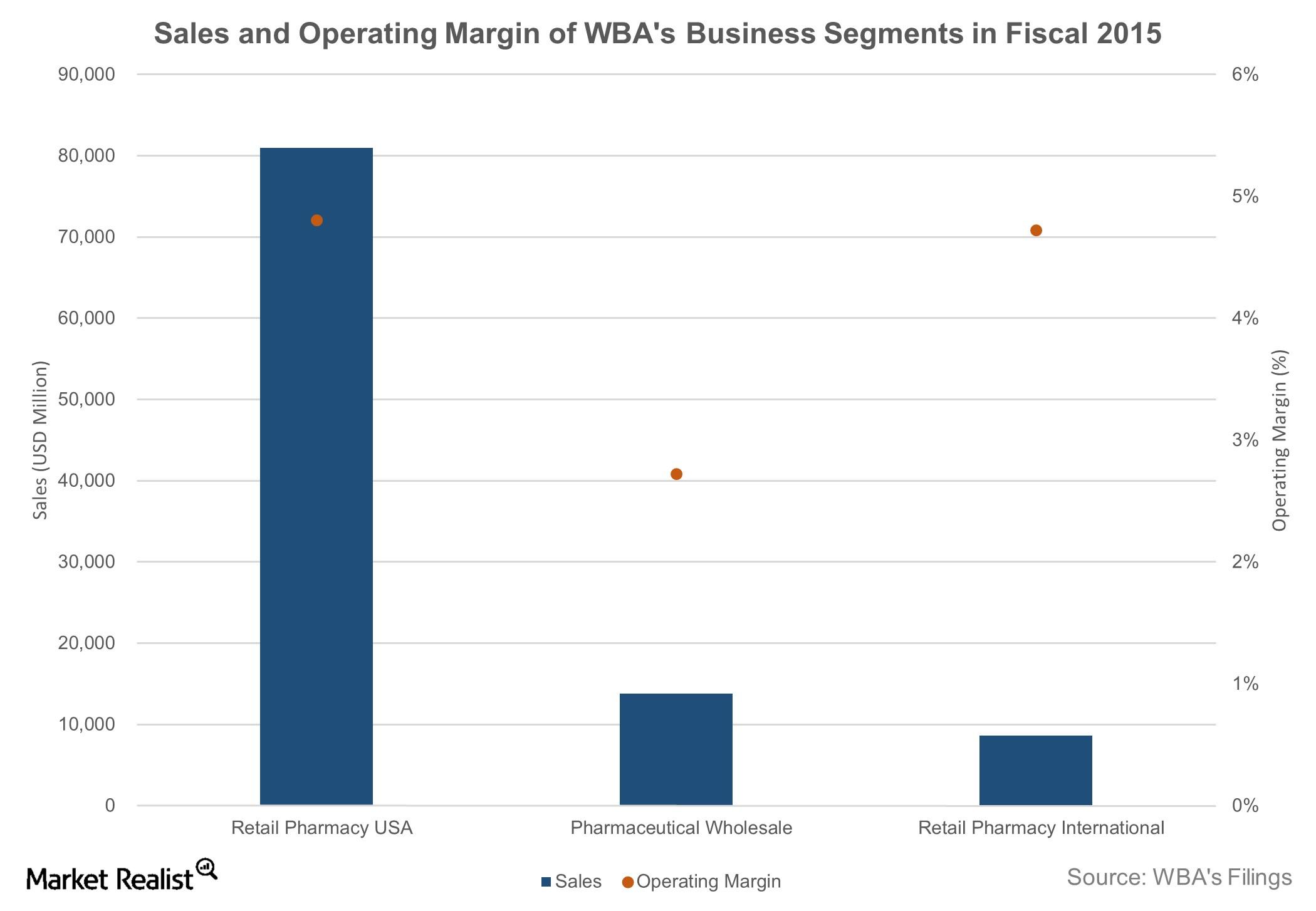

Walgreens Boots Alliance: Segments and Geographic Footprint

Following the completion of the second-step transaction on December 31, 2014, Walgreens Boots Alliance reorganized its operations into three segments.

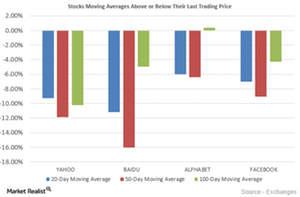

What Are Analysts’ Recommendations for Yahoo?

Out of 43 analysts covering Yahoo, 26 have “buy” recommendations, none have “sell” recommendations, and 17 have “hold” recommendations on the stock.

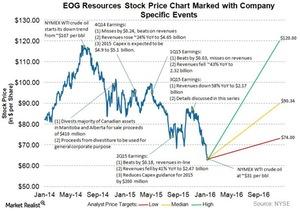

EOG Resources Failed to Hold above Its 200-Day Moving Average

In 3Q15, excluding the one-time items, EOG reported a profit of $0.02 per share, $0.32 better than the analyst consensus for a loss of $0.30 per share. Its revenues fell ~58% year-over-year to ~$2.17 billion.

Analyzing EOG Resources’ 3Q15 Earnings Call

Currently, ~67% of Wall Street analysts rate EOG as a “buy” and ~31% of analysts rate it as a “hold.” Only ~2% rate the stock a “sell.”

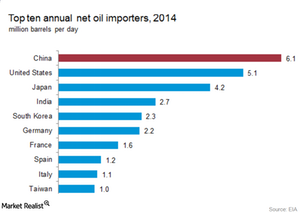

Top Crude Oil Importers’ Role in 2016

China and the United States are the largest crude oil importers in the world. In 2015, they consumed about 30.5 MMbpd (million barrels per day) of crude oil and liquid fuels, per the EIA.

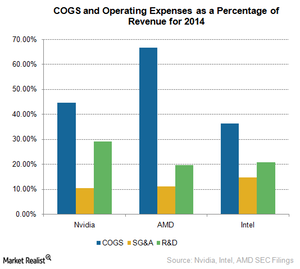

Is Nvidia’s Cost Structure Favorable for Investors?

Nvidia’s cost of goods sold is around 40% of its revenue, whereas Advanced Micro Devices’ COGS is more than 65%. Intel’s (INTC) COGS is below 40%.

What Kind of Value Does Verizon See in Quad-Play Services?

Verizon’s (VZ) Marni Walden talked about how the company currently views quad-play offerings.

What Risks Does a Limited Customer Base Pose for Nvidia?

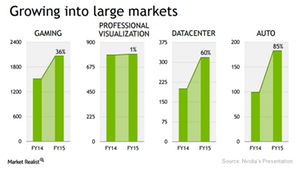

Nvidia is looking to diversify its revenue stream by targeting customers in the automotive market. In fiscal 3Q16, its revenue from automotive rose 52% YoY.

Fall in Crude Oil Demand Could Impact Saudi Arabia the Most

Crude exports account for more than 85% of Saudi Arabia’s revenue. The economy still isn’t diversified. Saudi Arabia is already experiencing high fiscal deficit.

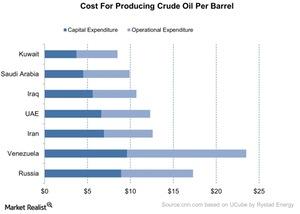

What’s the Break-Even Cost for the Top Oil Exporters?

Venezuela accounted for 17.5% of the world’s total proved crude oil reserves in 2014. BP (BP) conducted a study. It’s break-even cost is ~$23.50.

Operating Margins for Upstream Companies Rose

The operating margin of the US-based (SPY) upstream companies rose by an average of 16%.

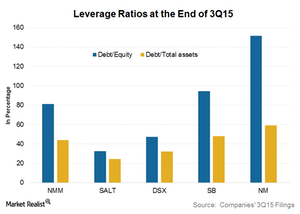

An Analysis of Financial Leverage for Dry Bulk Companies

Scorpio Bulkers (SALT) has the lowest financial leverage with debt-to-assets of 31.8% and debt-to-equity of 42.6% as of September 30, 2015. But this doesn’t give the full picture.

Assessing Stryker’s Major Risks at the Dawn of 2016

Stryker is a leading medical technology company and subject to big challenges impacting the medical technology industry, both systematic and unsystematic.