Challenging Apparel Market Dampened Tommy Hilfiger’s Performance

Tommy Hilfiger is one of the world’s leading designer lifestyle brands. PVH reports its business under the North America and International segments.

March 29 2016, Updated 4:07 p.m. ET

Tommy Hilfiger brand overview

Acquired by PVH (PVH) in 2010, Tommy Hilfiger is one of the world’s leading designer lifestyle brands. PVH reports the Tommy Hilfiger business under two segments:

- Tommy Hilfiger North America

- Tommy Hilfiger International

Tommy Hilfiger’s top line in fiscal 2015

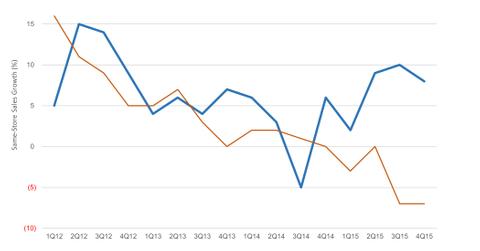

The Tommy Hilfiger North America segment, which accounted for ~51% of Tommy Hilfiger’s fiscal 2015 revenue, saw a 1% fall on a GAAP (generally accepted accounting principles) basis during the year. The fall was the result of a 5% fall in comparable retail store sales, primarily due to lower traffic and consumer spending in Tommy Hilfiger’s US stores in international tourist locations.

Tommy Hilfiger International’s revenue rose 5% on a constant currency basis, driven by 8% growth in comparable retail store sales in Europe and mid-single-digit percentage growth in the wholesale business on a constant currency basis.

The company gained market share from its peers in almost all markets throughout Europe. However, after considering currency impact, this segment saw a 10% fall in sales in fiscal 2015.

Overall, the sales of the Tommy Hilfiger business in fiscal 2015 were 6% lower than in the previous fiscal year and stood at $3.4 billion. However, on a constant currency basis, the Tommy Hilfiger business generated a sales rise of 4% compared to the previous fiscal year.

A Look at Tommy’s profitability

Tommy Hilfiger’s earnings before interest and tax fell 6% on a constant currency basis due to the weak performance of Tommy Hilfiger’s US stores located in international tourist locations. After considering the impact of foreign currency exchange rates, the fall in sales stood at 21% compared to the previous fiscal year.

Index and ETF exposure

PVH is a part of the S&P 500 Apparel and Accessories Index, along with Coach (COH), Hanesbrands (HBI), Michael Kors (KORS), and Ralph Lauren (RL). Investors seeking to add exposure to PVH and the above-mentioned companies can consider the SPDR S&P 500 ETF (SPY) which invests 0.25% of its portfolio in these companies.