Hanesbrands Inc

Latest Hanesbrands Inc News and Updates

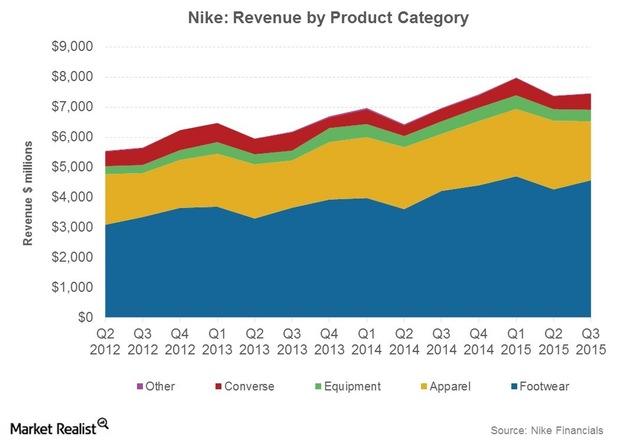

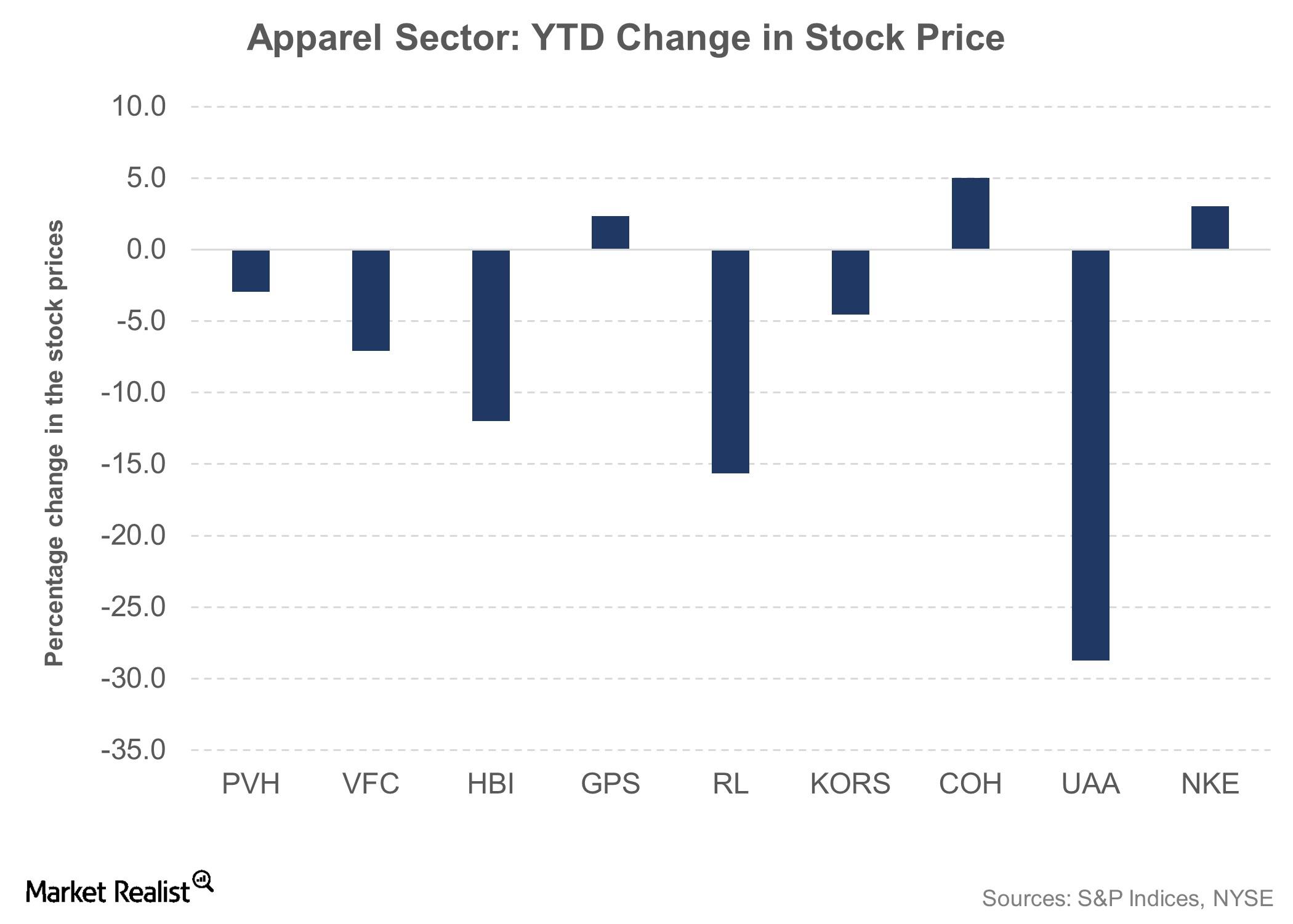

Nike Market Share Gets the High Score in Activewear

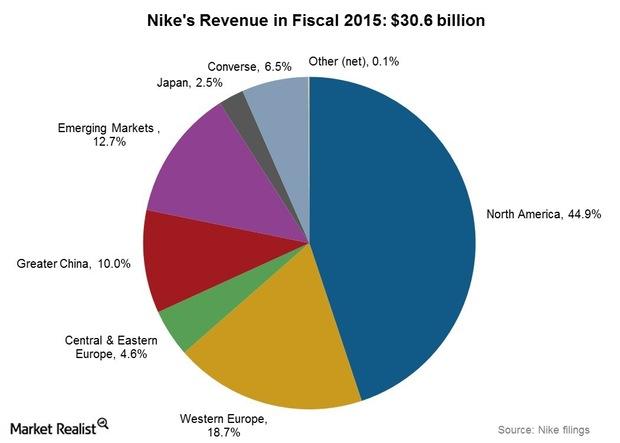

UA’s market share came in at 6%, and ADDYY’s came in at 3%. Hanes (HBI) took 3% of the market in 1Q15 .Nike (NKE) was the market leader for activewear overall.

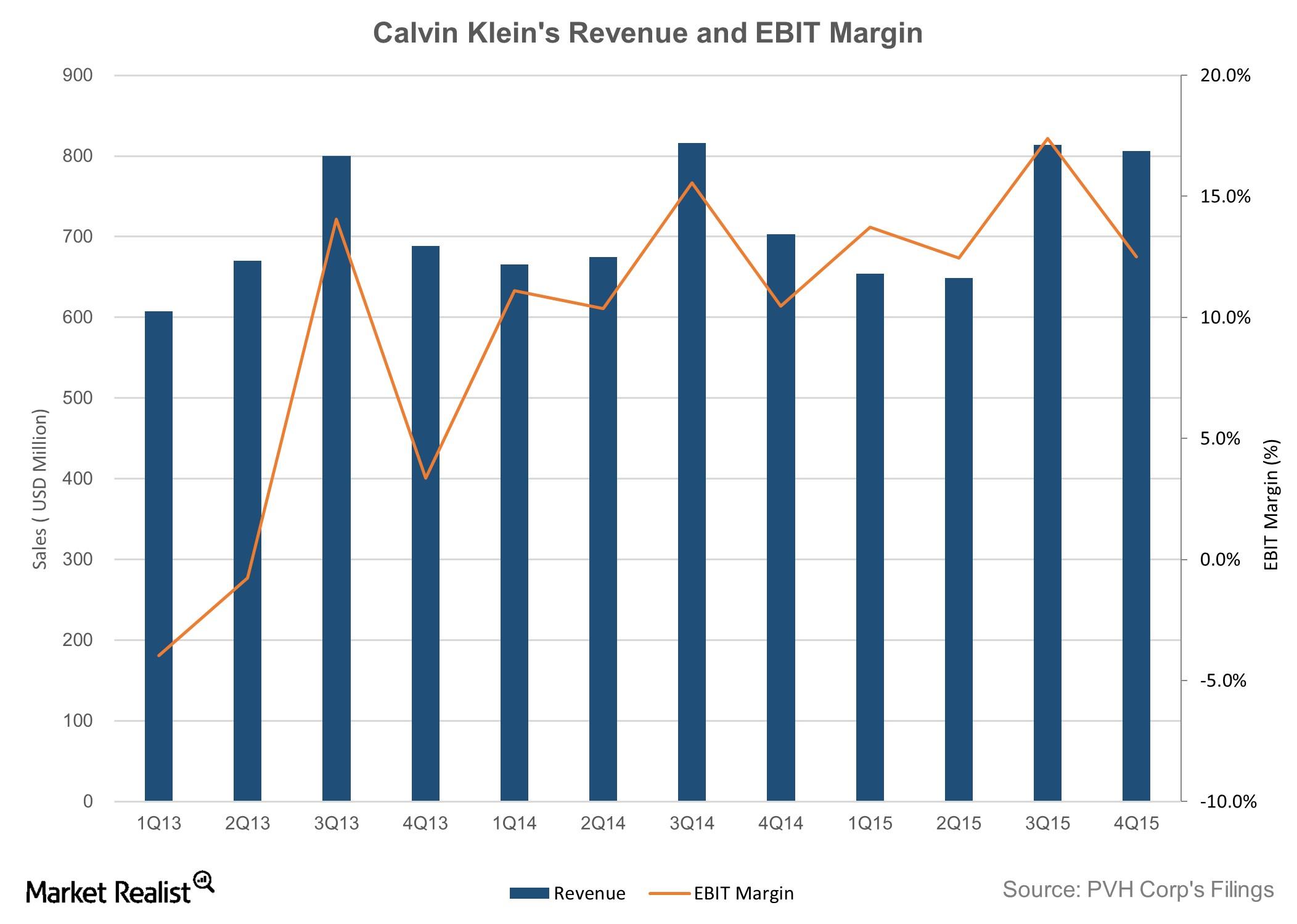

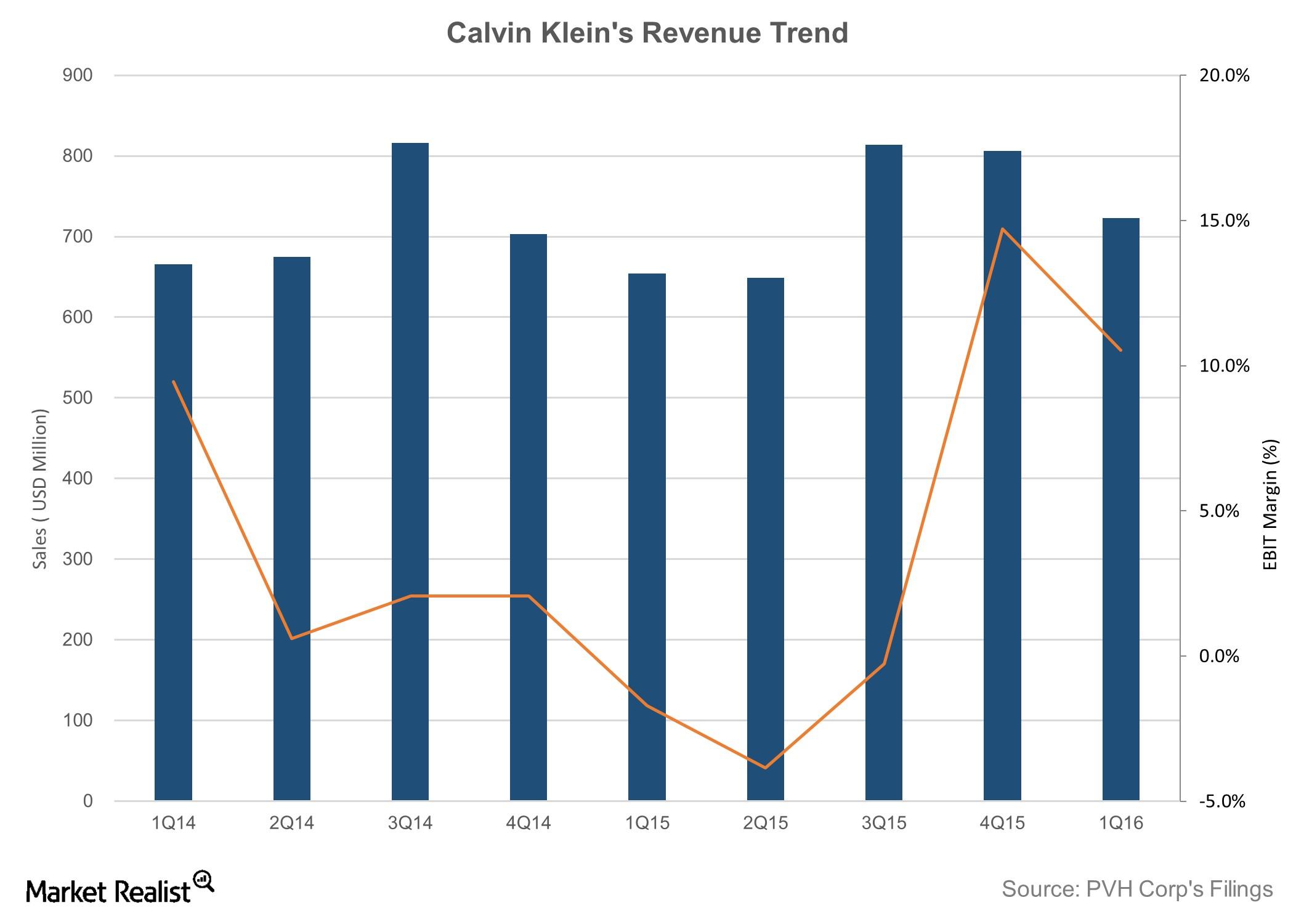

How Calvin Klein Navigated through Tough Macro Conditions

The company derived 46% of its operating income from the Calvin Klein business in fiscal 2015 compared to 37% in fiscal 2014.

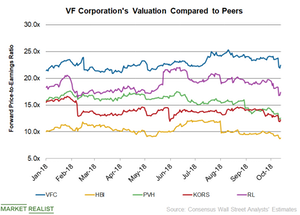

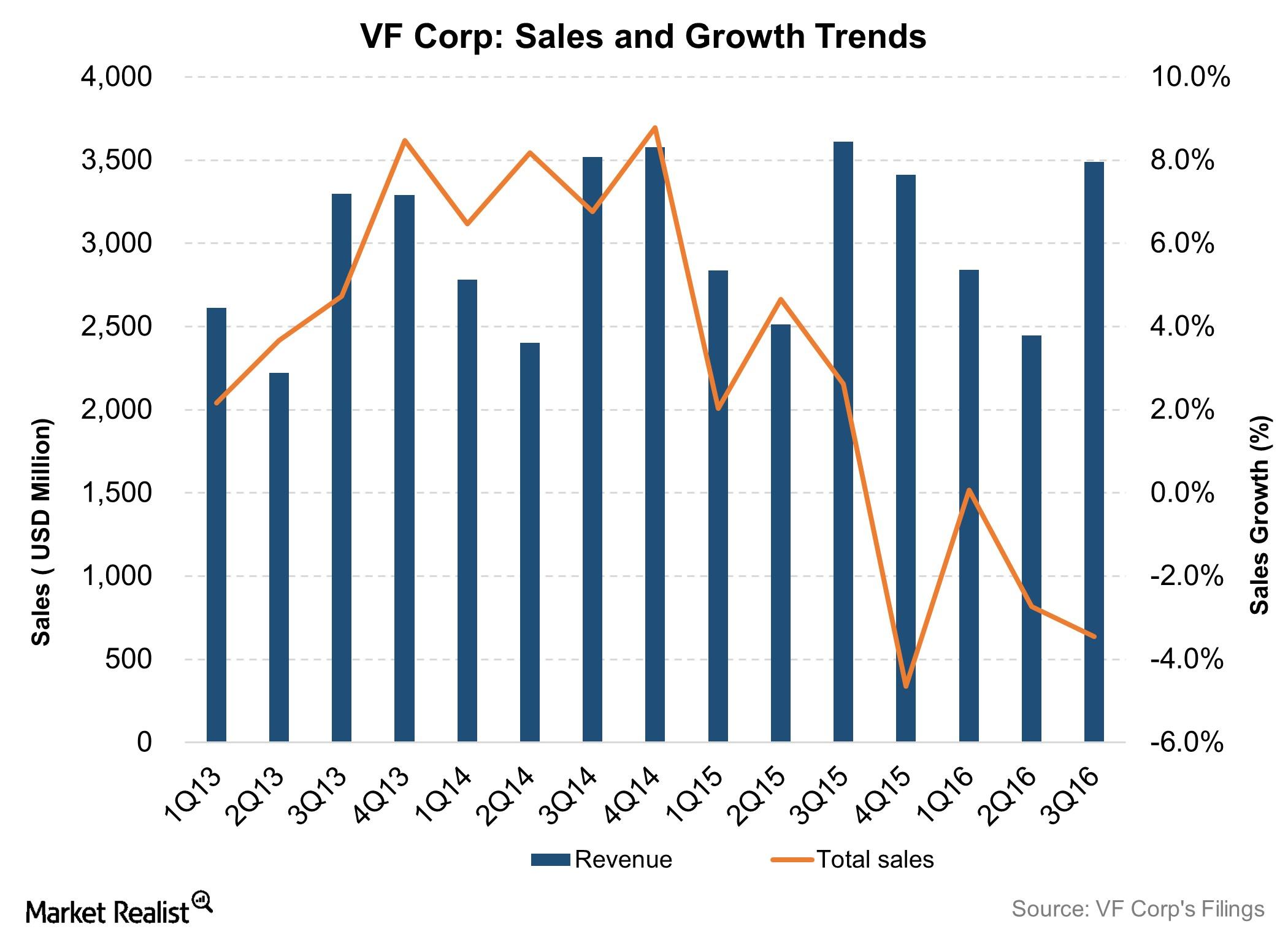

How VFC’s Valuation Compares with Peers

On October 12, VF Corporation’s (VFC) 12-month forward PE (price-to-earnings) ratio was 22.4x.

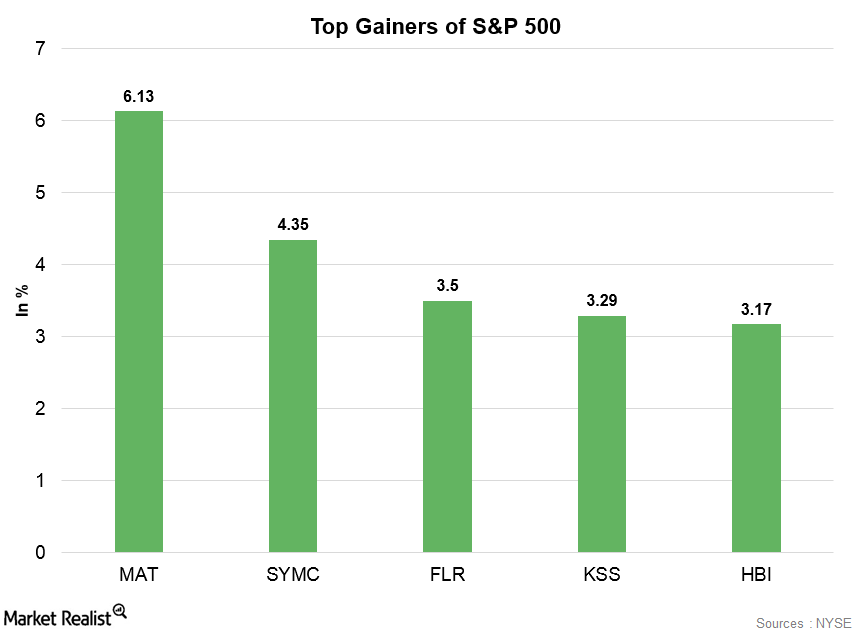

Mattel: S&P 500’s Top Gainer on May 15

Mattel, which is an American multinational toy manufacturing company, was the S&P 500’s top gainer on May 15.

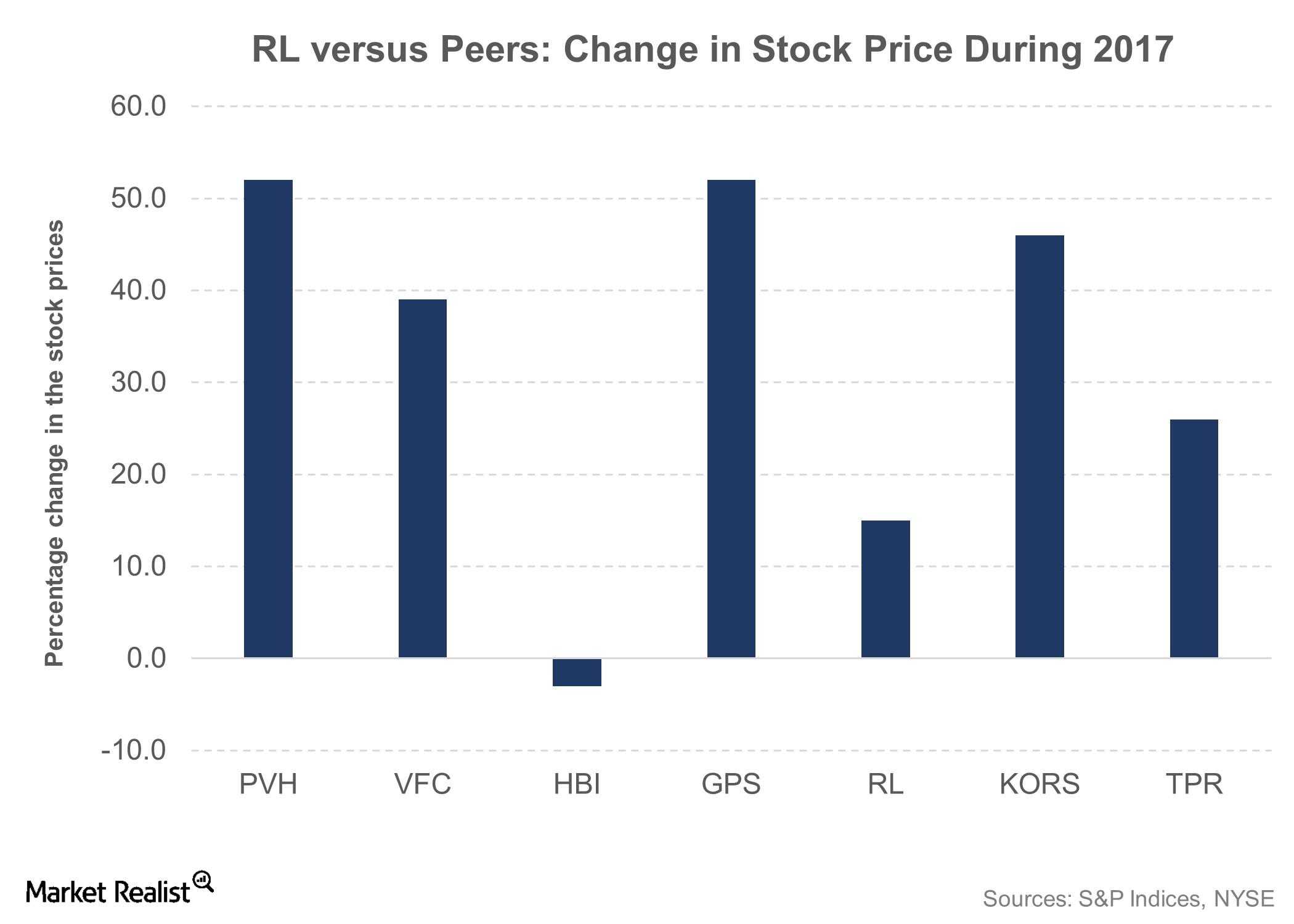

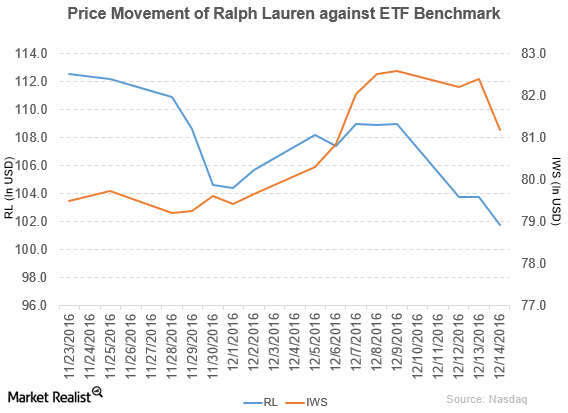

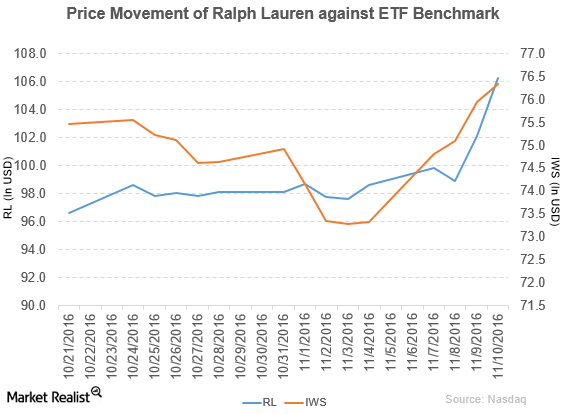

Ralph Lauren: Stock Returns and Valuations

Though Ralph Lauren (RL) has been having a tough time attracting customers, it has been able to impress investors with its stock market gains.

PVH Stock Rises 5% following Its 1Q17 Results

PVH Corporation (PVH) reported a strong 1Q17 on May 24, 2017, beating analysts’ consensus estimate on both its top and bottom lines.

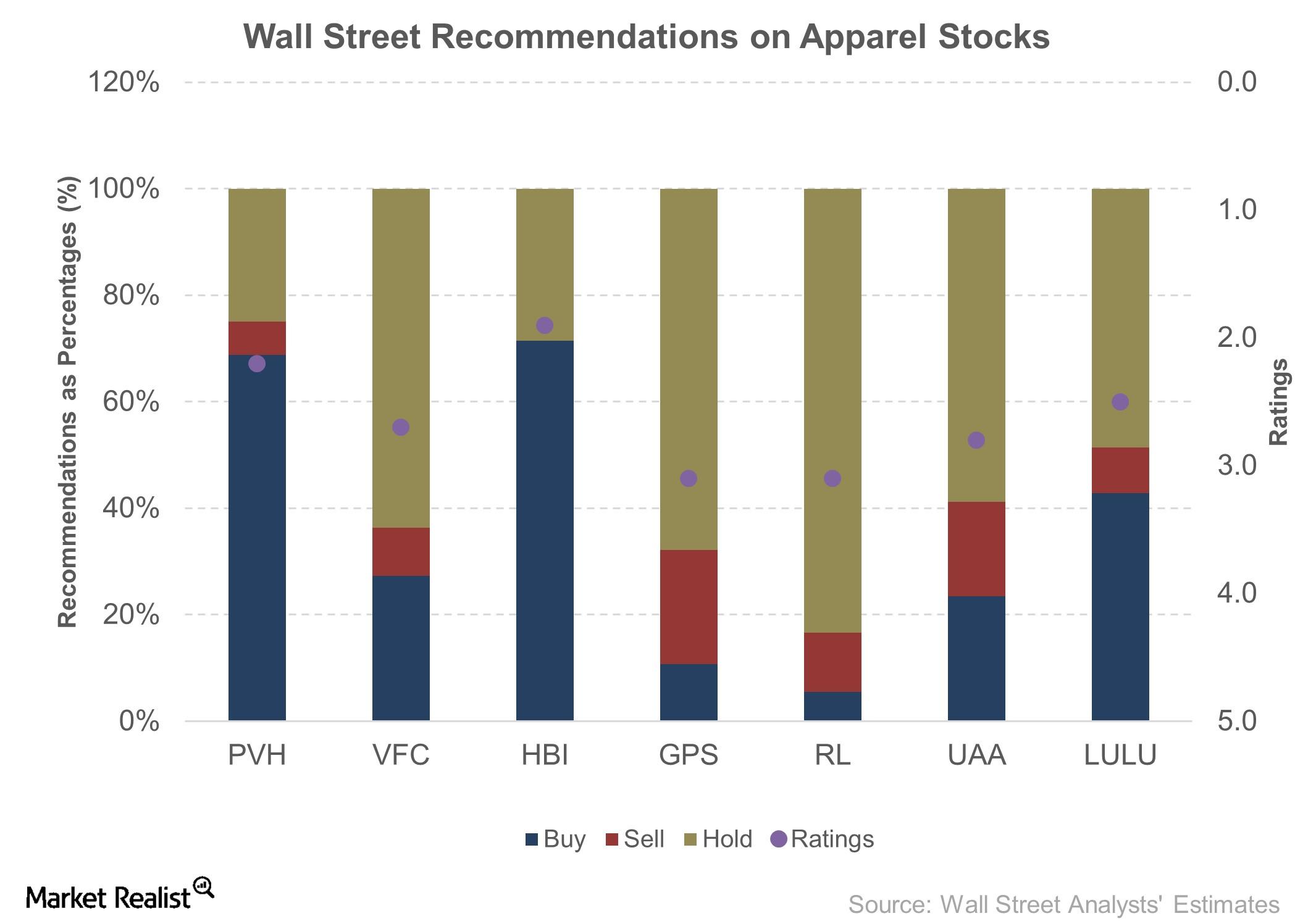

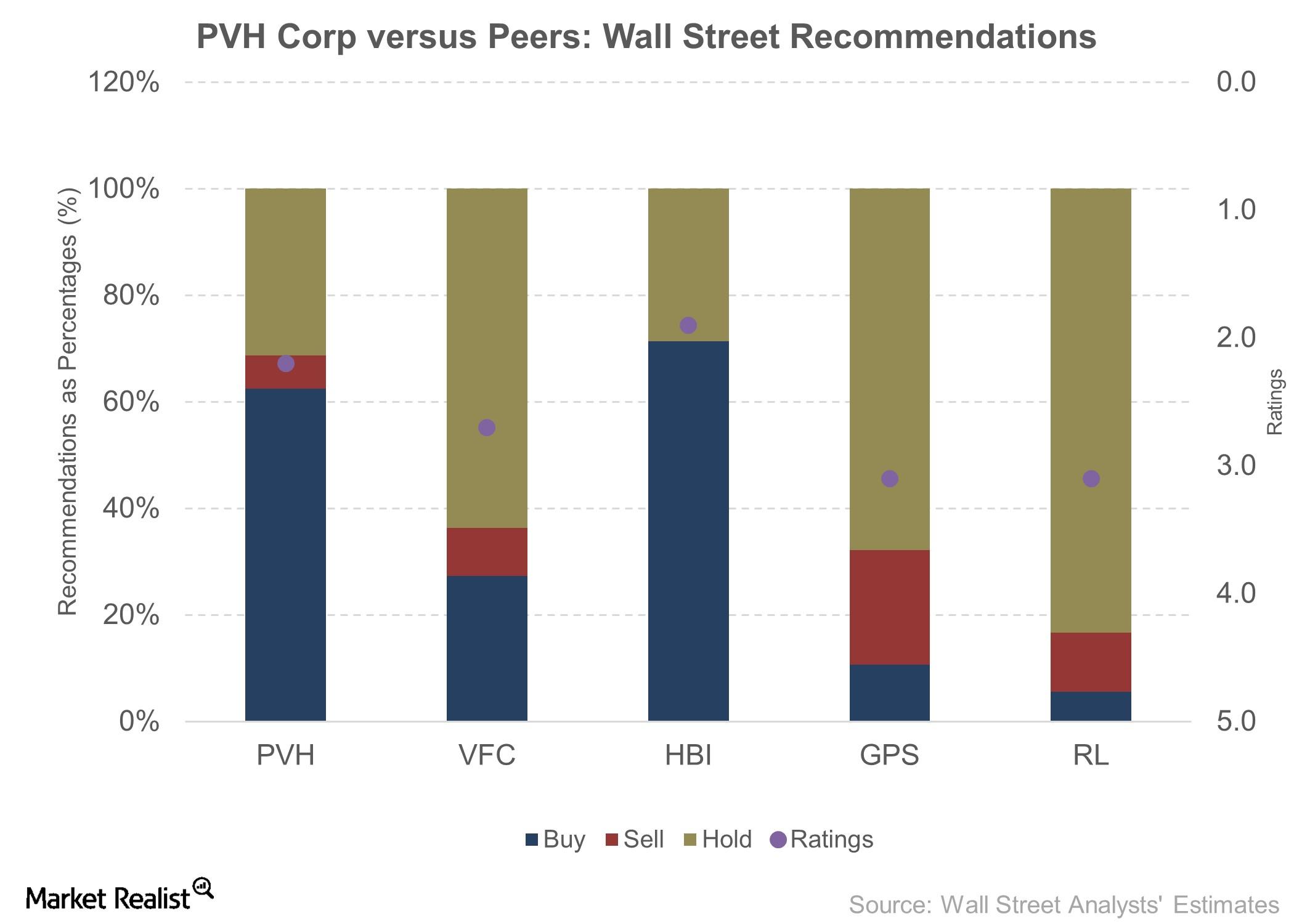

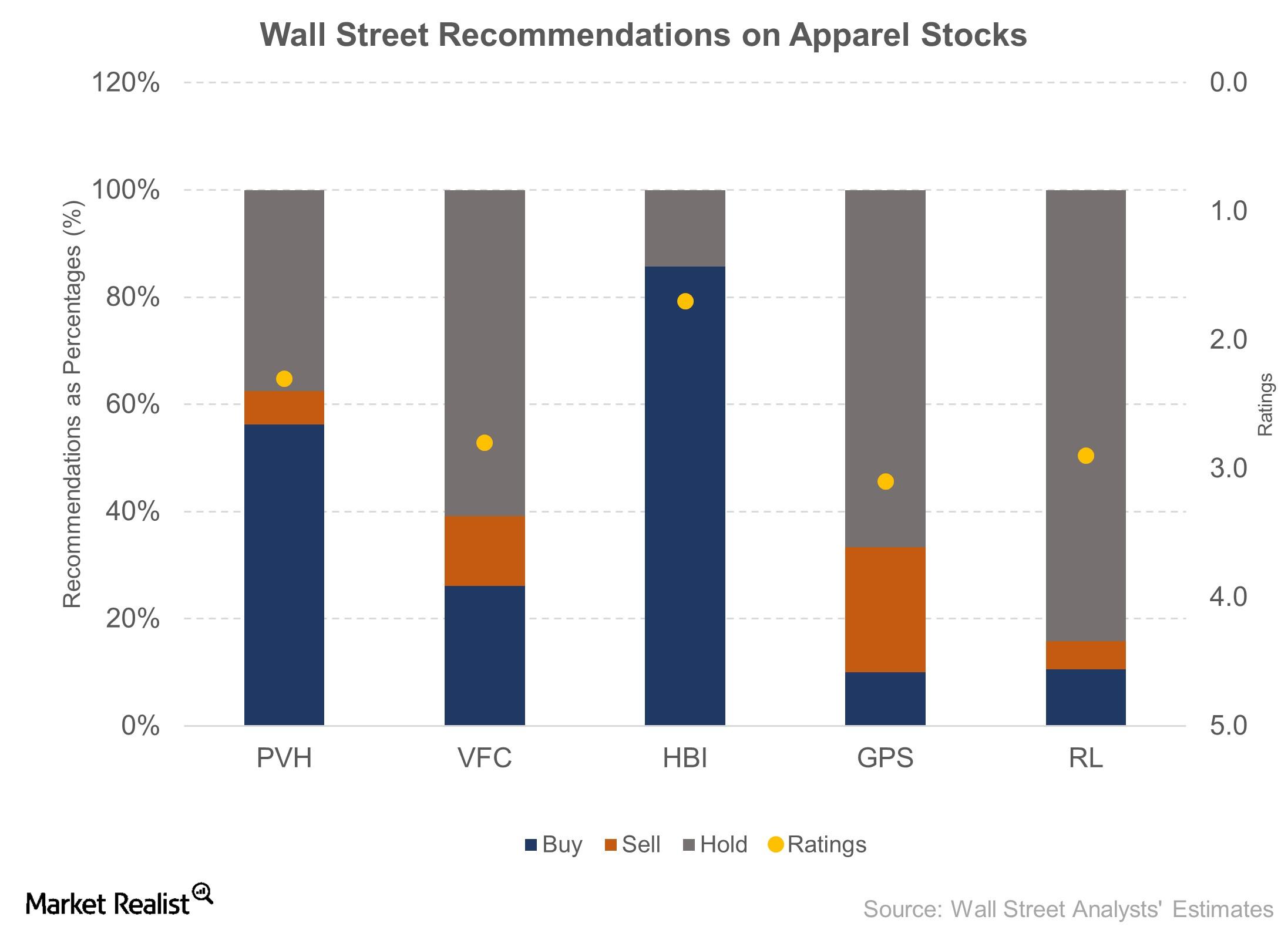

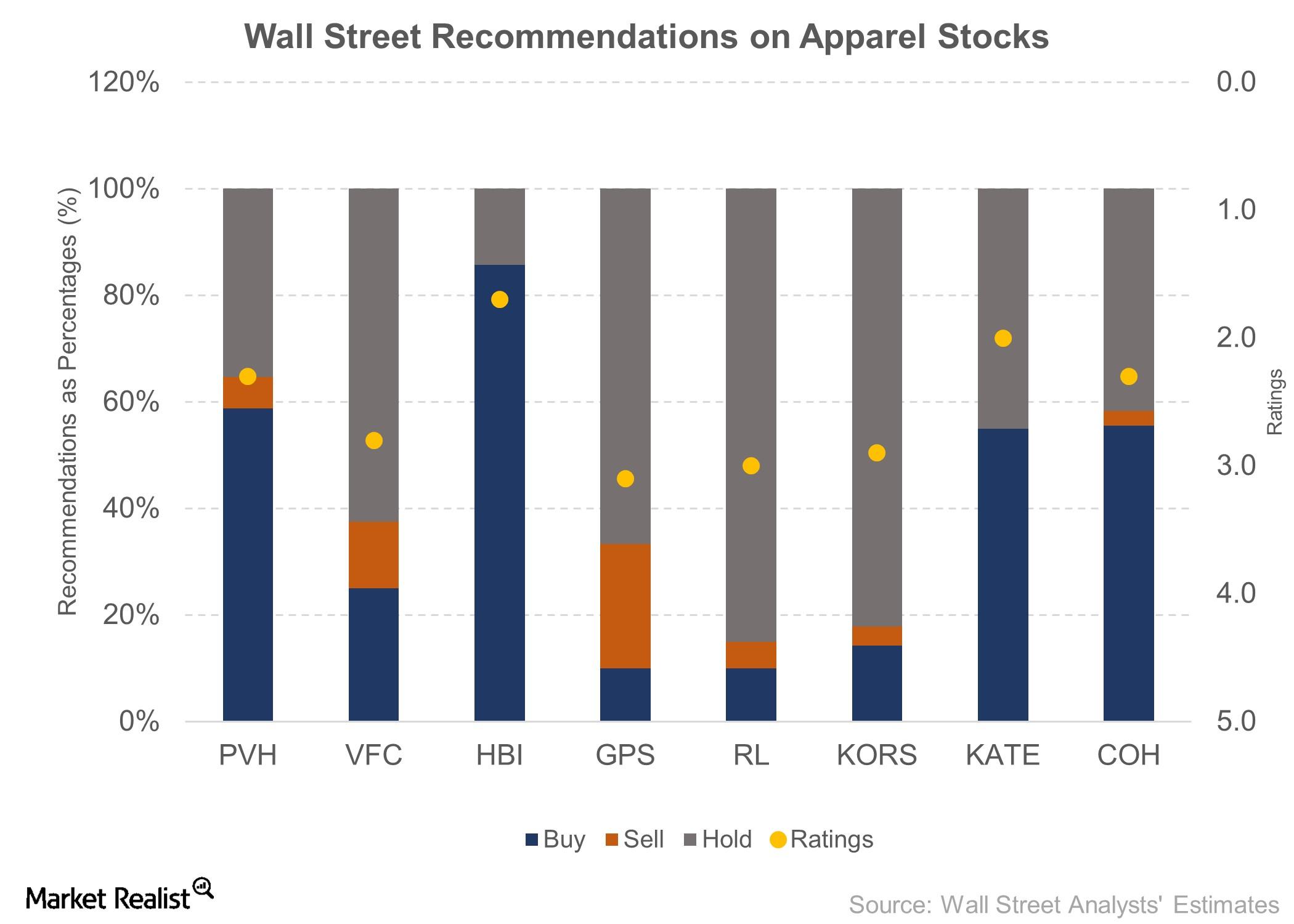

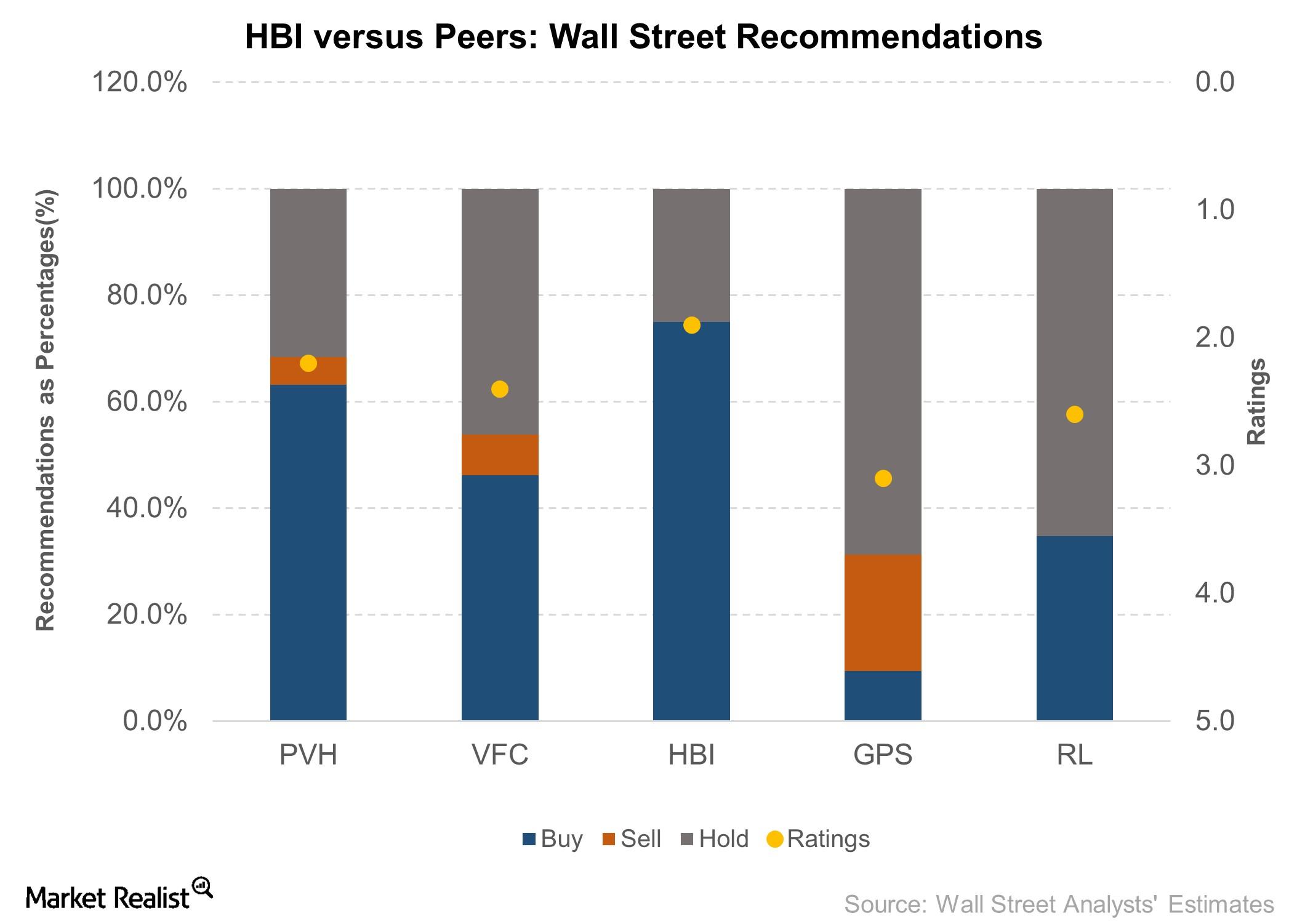

Wall Street Analysts’ View on PVH Corp Is Positive

PVH Corp stock is covered by 16 analysts—63% of the analysts recommended a “buy,” 31% recommended a “hold,” and 6% recommended a “sell.”

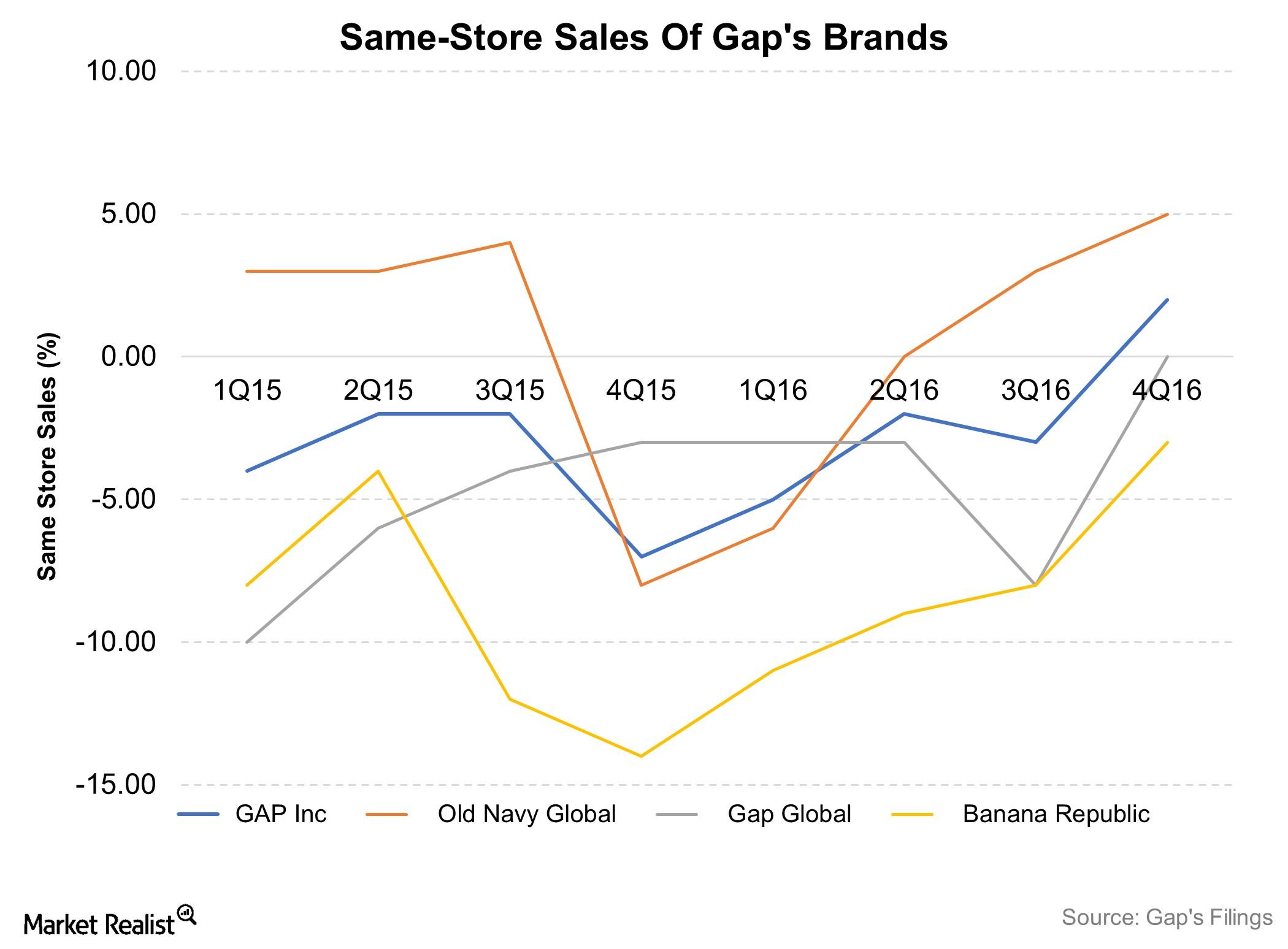

Why Gap’s CEO Is Projecting Optimism after 4Q16

Gap (GPS) reported total revenues of ~$4.4 billion in 4Q16, beating the consensus by $40 million.

Wall Street Sees a 1% Upside on VFC Stock

VFC is covered by 23 Wall Street analysts who have a neutral view on the company. Plus, 26% of these analysts recommended a “buy,” 61% recommended a “hold,” and 13% recommended a “sell” on the stock.

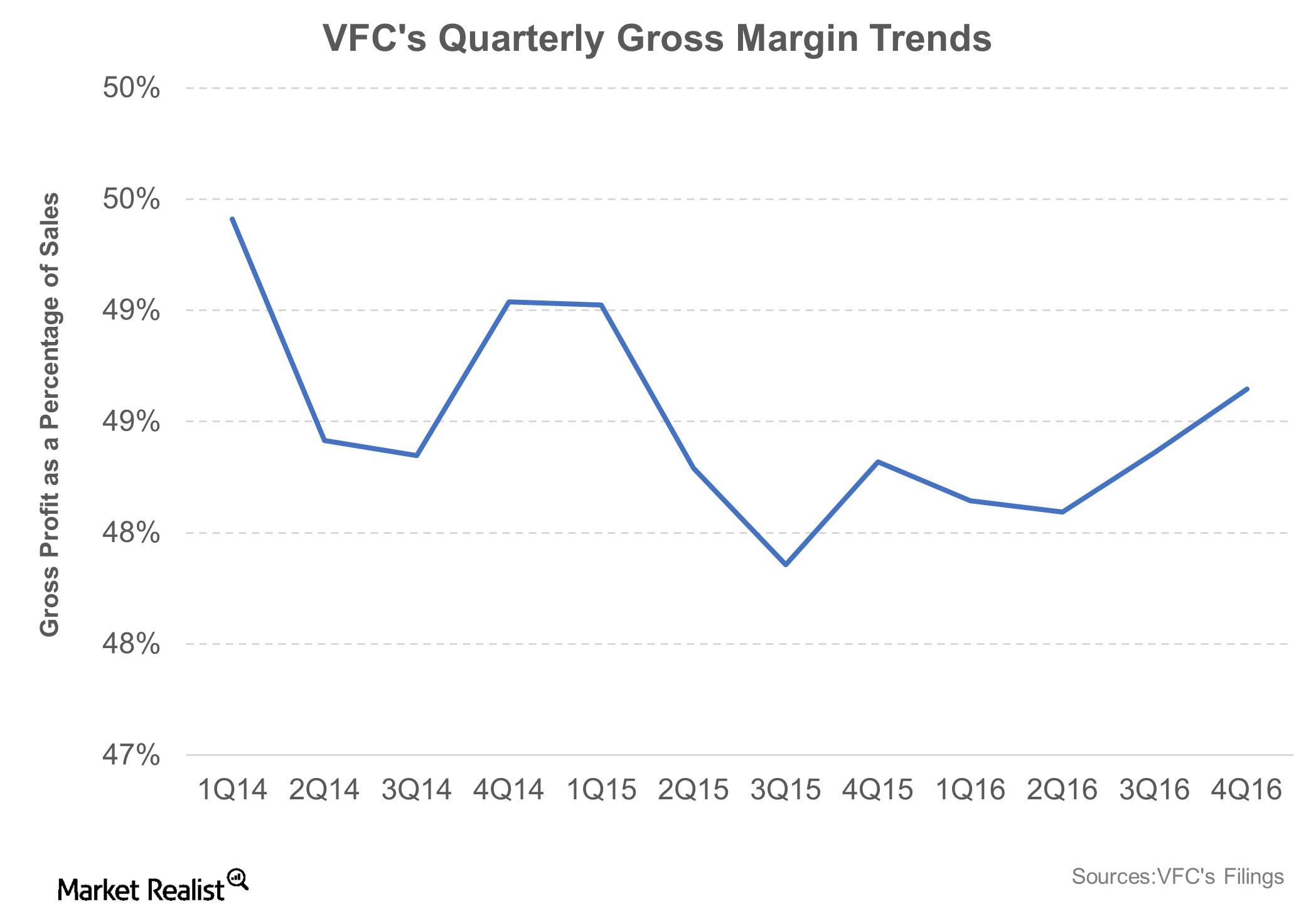

VFC Posts a 2% Jump in Fiscal 2016 EPS despite Forex Headwinds

For fiscal 2016, VFC’s adjusted earnings per share rose 2% to $3.11. On a constant currency basis, the increase was ~7%.

Hanesbrands Stock: Understanding Wall Street’s View

In this part of the series, we’ll look at Wall Street’s recommendation on Hanesbrands (HBI) and discuss Wall Street’s take on the company.

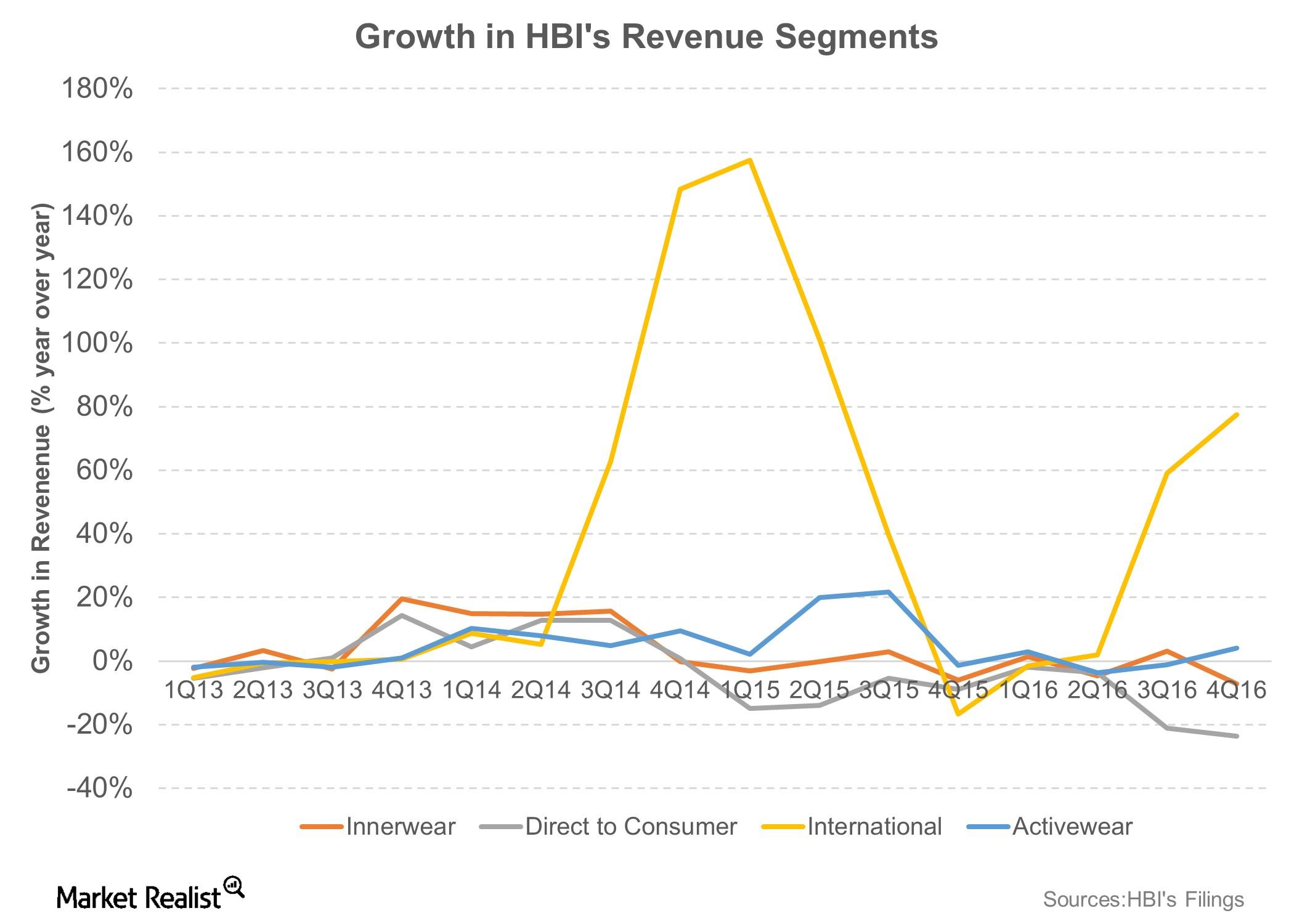

Why Hanesbrands’ Weak Innerwear Sales Drove Its Top Line Miss

With trailing-12-month sales of over $6 billion, Hanesbrands (HBI) is one the largest marketers of basic apparel in the United States.

Hanesbrands Stock Reacts to Weak Results and Gloomy Guidance

Shares of Hanesbrands (HBI) tumbled 16% on Friday, February 3, as the company posted weaker-than-expected fourth quarter results and lackluster guidance.

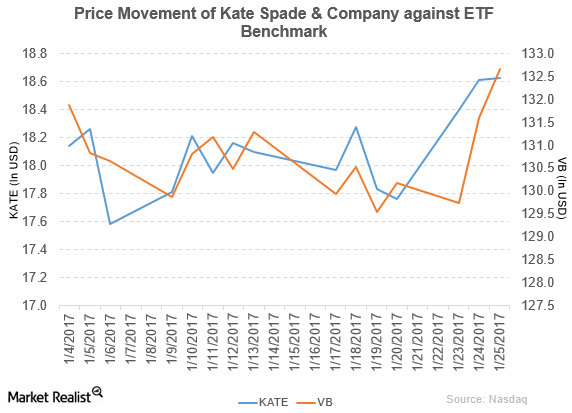

Telsey Downgraded Kate Spade & Company to ‘Market Perform’

On January 25, 2017, Telsey downgraded Kate Spade’s rating to “market perform” from “outperform.” It reported fiscal 3Q16 net sales of $316.5 million.

Ralph Lauren Declares a Dividend

Ralph Lauren declared a regular quarterly dividend of $0.50 per share on its common stock. The dividend will be paid on January 13, 2017, to shareholders.

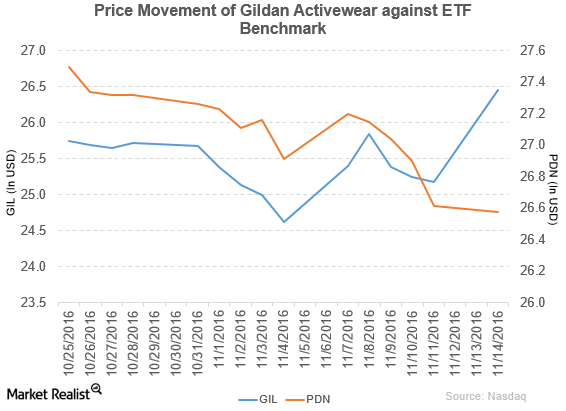

Gildan Activewear Acquires American Apparel for $66 Million

Gildan Activewear (GIL) reported fiscal 3Q16 net sales of $715.0 million, a rise of 6.0% compared to net sales of $674.5 million in fiscal 3Q15.

How Did Ralph Lauren Perform in 2Q17?

Ralph Lauren (RL) reported fiscal 2Q17 net revenues of ~$1.8 billion, a fall of 7.6% compared to net sales of ~$2.0 billion in fiscal 2Q16.

What Does Wall Street Expect from HBI for the Rest of 2016?

Hanesbrands updated its 2016 full-year outlook while reporting its third quarter results.

Weakness in North America Offset VFC’s International Gains

As in the last several quarters, VF’s (VFC) international business remained firm during the third quarter.

Can Calvin Klein Drive PVH’s Sales Growth in 2Q16?

Among PVH’s (PVH) three segments, Calvin Klein has been the best performer. The brand accounts for more than 37% of the company’s total revenue.

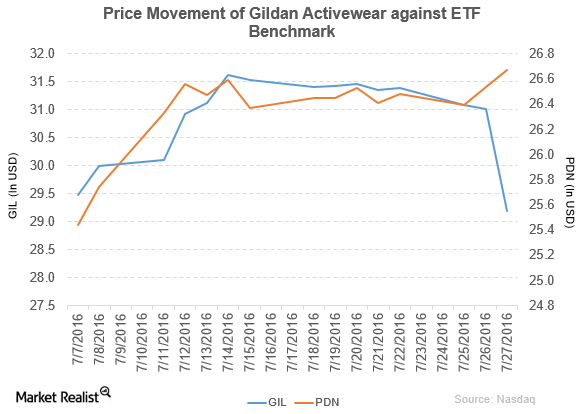

Gildan Activewear Declares Its 2Q16 Results and Dividend

Gildan Activewear (GIL) has a market cap of $6.9 billion. It fell by 5.9% to close at $29.19 per share on July 27, 2016.

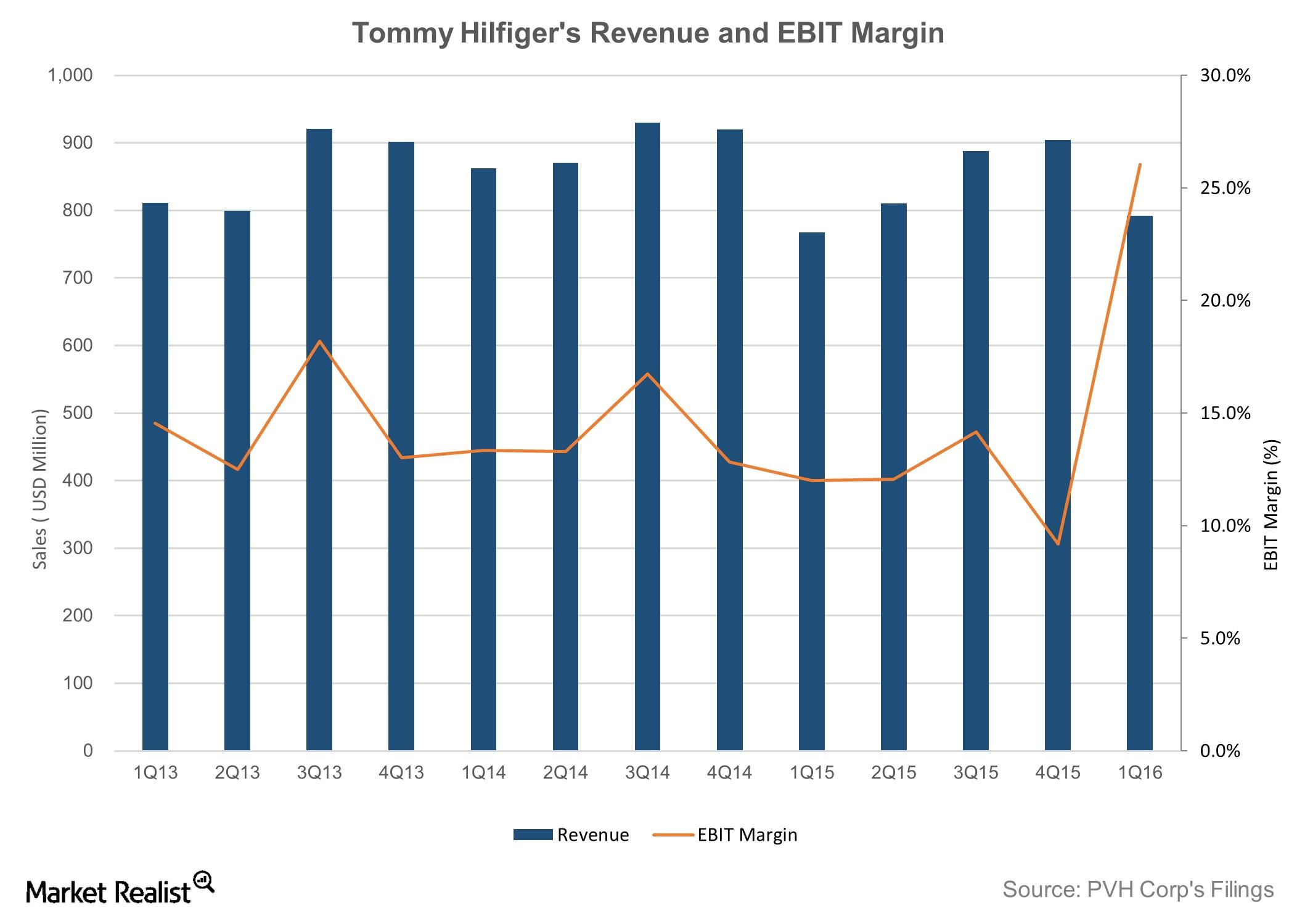

PVH’s Tommy Hilfiger Gets Boost from Strong International Sales

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

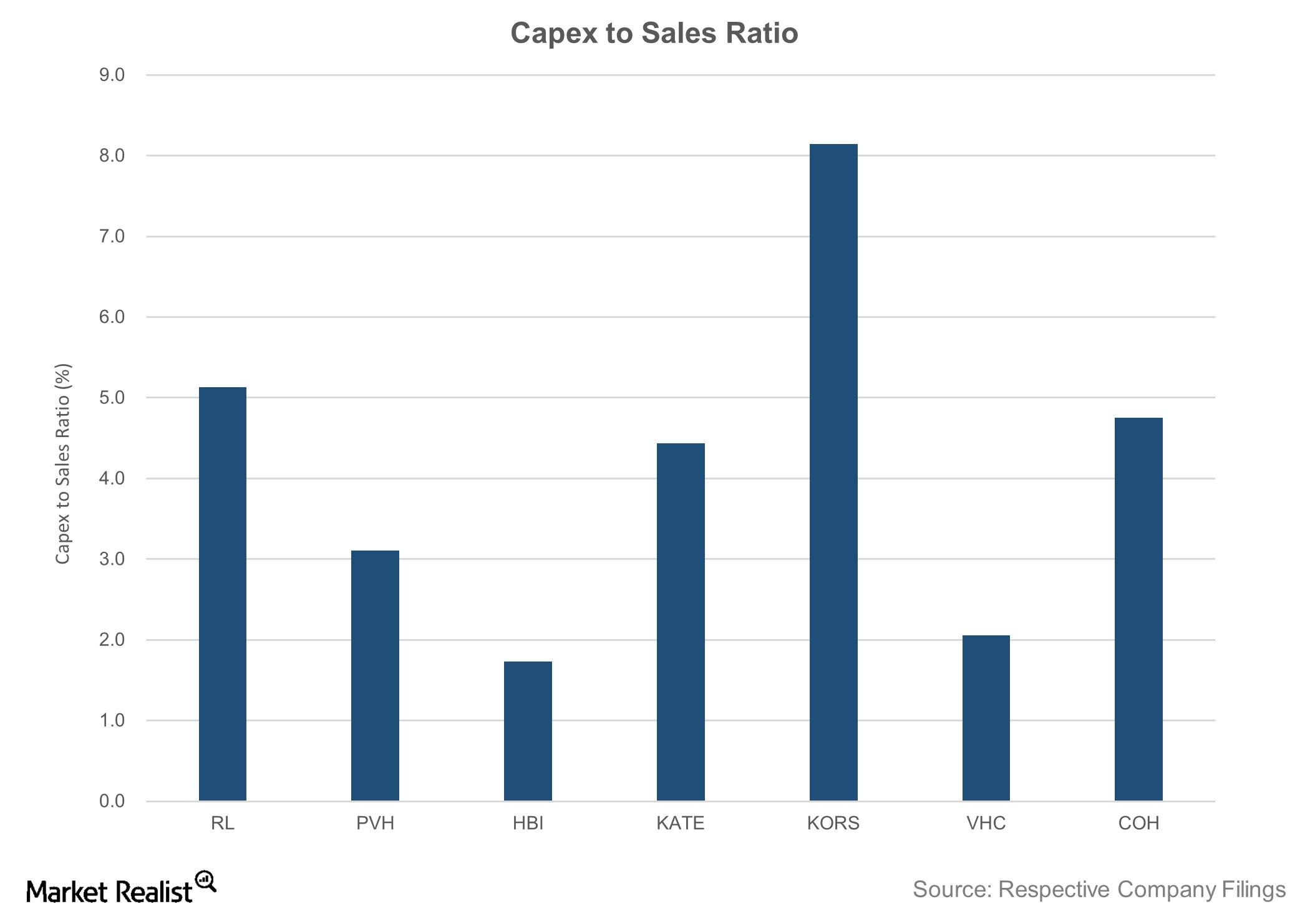

Inside Ralph Lauren’s Liquidity Position and Financial Health

Ralph Lauren has a $1.7 billion capex. Its capex-to-sales ratio of 5.1% (as of March 28, 2015) is among the highest in its fashion and apparel peer group.

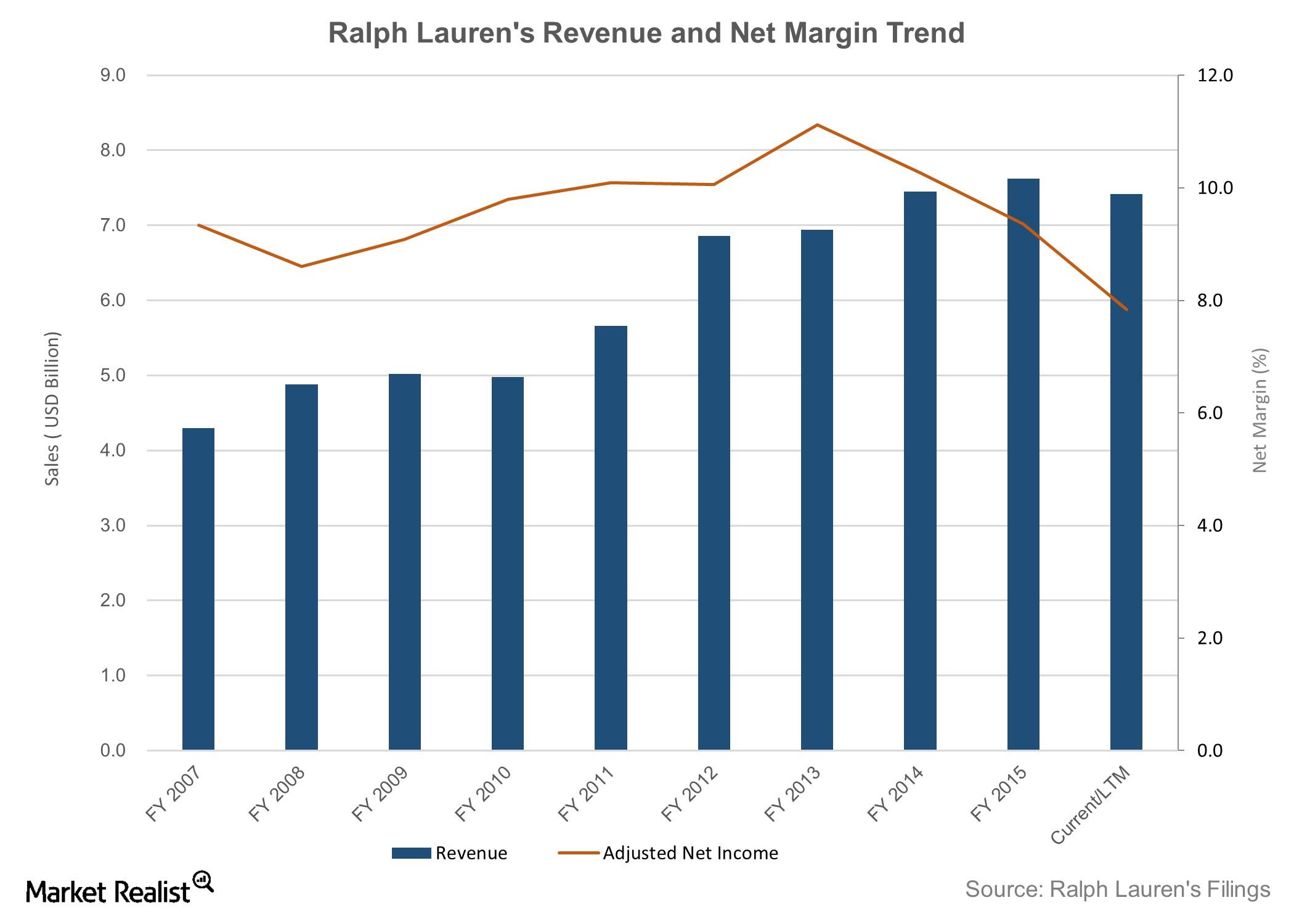

Behind Ralph Lauren’s Historical Financial Performance

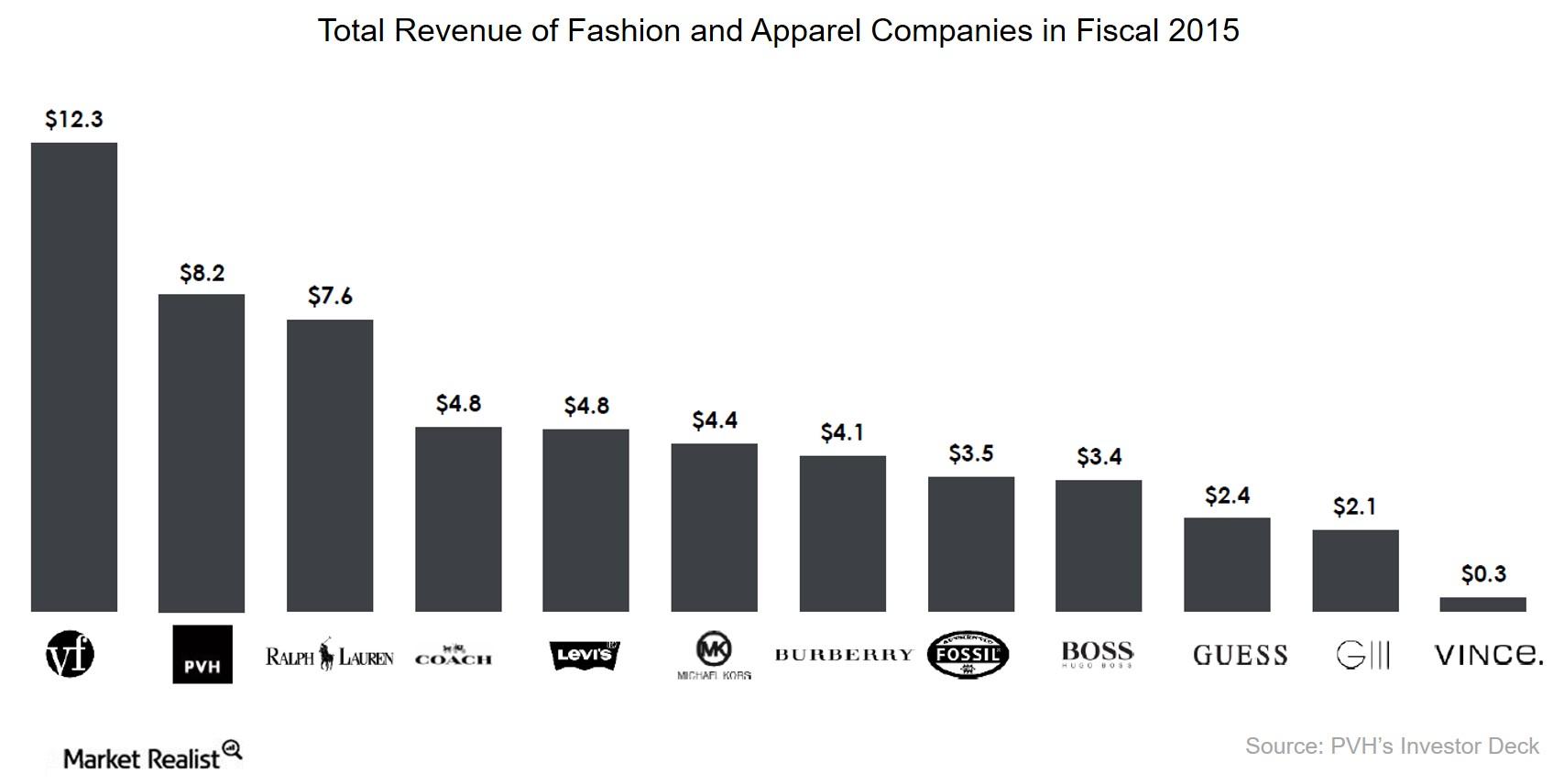

Ralph Lauren’s top line has grown by a CAGR of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015.

Introducing Ralph Lauren: Everything You Need to Know at a Glance

Ralph Lauren is the third-largest branded apparel company (by revenue) in the US and has grown at a CAGR of around 9% over the past ten years.

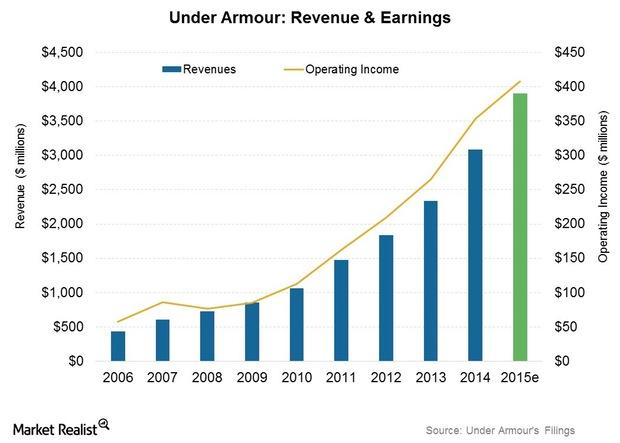

Under Armour Projects a ~26% Revenue Growth Rate for 2015

Under Armour is scheduled to declare its earnings for 4Q15 and full-year 2015 on January 28, 2016. It has projected revenue of $3.9 billion for 2015.

Can Nike Grow North American Sales to $20 Billion by 2020?

Performance for Nike and peers has been strong in North America over the past few years. The sports gear category has benefited from the improving US economy.