What Does Wall Street Expect from HBI for the Rest of 2016?

Hanesbrands updated its 2016 full-year outlook while reporting its third quarter results.

Nov. 3 2016, Updated 8:05 a.m. ET

HBI lowers fiscal 2016 guidance

Hanesbrands updated its 2016 full-year outlook during its third quarter results. Based on its year-to-date performance, the company narrowed the upper limit of its sales and earnings per share (or EPS) guidance.

The company now expects fiscal 2016 net sales to lie in the $6.15 billion to $6.18 billion range as compared to the $6.15 billion to $6.25 billion guided earlier. At the midpoint, this reflects year-over-year growth of 8%. Adjusted EPS is expected to fall between $1.89 to $1.92 as compared to the earlier expectation of $1.89 to $1.95. These estimates reflect a 10% to 14% growth over the previous fiscal year. “Our business is unfolding as expected this year, and we remain confident in our ability to deliver on our full-year guidance,” said Hanes CEO Gerald Evans.

Wall Street’s view on HBI

Wall Street is expecting HBI’s sales to grow more than 5% to $6.16 billion. Earnings are predicted to rise 13.8% to $1.92, in-line with the company guidance.

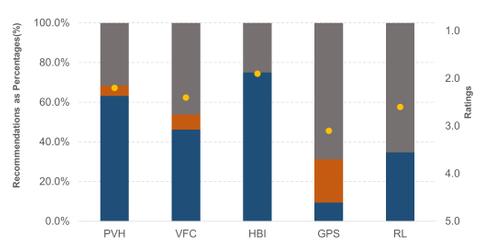

Hanesbrands is covered by 16 Wall Street analysts who have given the company a rating of 1.9 on a scale where one is a strong buy and five is a strong sell. The company has a better rating than apparel players PVH (PVH), Ralph Lauren (RL), VF (VFC), and Gap (GPS).

Wall Street has a bullish outlook on HBI with no “sell” ratings. 75% of analysts recommend buying the stock, while 25% recommend holding it. In comparison, 22%, 8%, and 5% of analysts recommend a “sell” on GPS, VFC, and PVH, respectively.

Comparing valuations

Hanesbrands is currently trading at a one-year forward price-to-earnings ratio of 12.1x, operating close to the lower end of its 52-week PE range of 11.5x–16.5x. The company is trading at a discount to most branded apparel peers. PVH (PVH), VF (VFC), and Ralph Lauren (RL) are currently trading at 15x, 16.4x, and 18.2x, respectively.

ETF investors seeking to add exposure to HBI can consider the SPDR S&P 500 Buyback ETF (SPYB), which invests 1.1% of its portfolio in the company.