Inside Ralph Lauren’s Liquidity Position and Financial Health

Ralph Lauren has a $1.7 billion capex. Its capex-to-sales ratio of 5.1% (as of March 28, 2015) is among the highest in its fashion and apparel peer group.

May 3 2016, Updated 1:05 p.m. ET

Ralph Lauren’s capital expenditure support

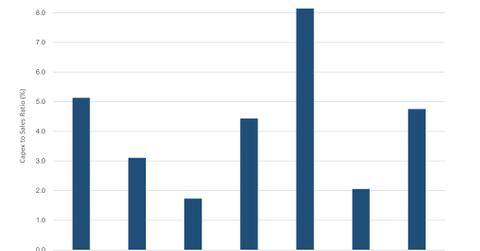

Ralph Lauren (RL) has spent around $1.7 billion in capital expenditure, or capex, over the past five years. The company’s capex-to-sales ratio of 5.1% (as of March 28, 2015) is among the highest in its fashion and apparel peer group. By comparison, Kate Spade (KATE), PVH Corporation (PVH), and HanesBrands (HBI) had capex-to-sales ratios of 4.4%, 3.1%, and 1.7%, respectively, in their last reported fiscal years.

A large part of Ralph Lauren’s capex has been funded through the company’s operating cash flow. Solid cash flow generation has kept the company’s debt levels in check and has enabled it to have a strong balance sheet.

The company’s fiscal 2016 capex is likely to be around $400 million–$500 million to support the company’s global direct-to-consumer and infrastructure investments.

Ralph Lauren has a strong liquidity position

As of December 26, 2016, Ralph Lauren’s balance sheet cash stood at $1.2 billion. In comparison, the company’s total debt stood at $900 million. As a result, RL’s net debt stood at -$315 million at the end of fiscal 3Q16.

The company also has an impressive FCF (free cash flow) coverage of 40% (as measured by FCF-to-total-debt). This means that RL can repay all its debt using its free cash flow in two and a half years.

RL has the lowest debt-to-equity ratio

Ralph Lauren’s debt has increased by more than three times over the last three years. It stood at $900 million at the end of fiscal 3Q16 (which ended December 26, 2015). The company, however, continues to be moderately leveraged, with a debt-to-equity ratio of 23.7%, which is among the lowest in its peer group.

By comparison, Coach (COH), PVH Corporation (PVH), and HanesBrands (HBI) reported debt-to-equity ratios of more than 34%, 70%, and 205%, respectively, in their last reported quarters.

ETF investors looking to add exposure to Ralph Lauren can consider the iShares US Consumer Goods ETF (IYK), which invests 0.25% of its portfolio in the company.

In the next part, we’ll compare stock returns.