Kate Spade & Co

Latest Kate Spade & Co News and Updates

A Tone Deaf Promo Email Has Kate Spade Fans Furious With Retailer Ulta Beauty

Kate Spade fans are furious with Ulta Beauty after a poorly written promo email made its way to customers today. Why are customers mad at Ulta Beauty?

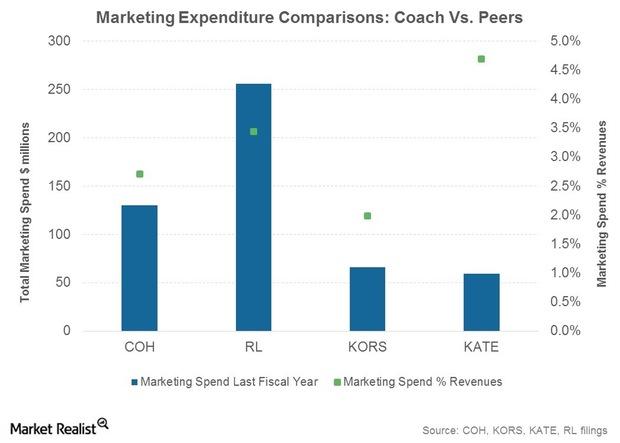

Understanding Coach’s Marketing Strategies

To support its direct marketing initiatives, Coach has a database of 24 million households in North America and 10 million in Asia.

Opportunities and Challenges for Coach

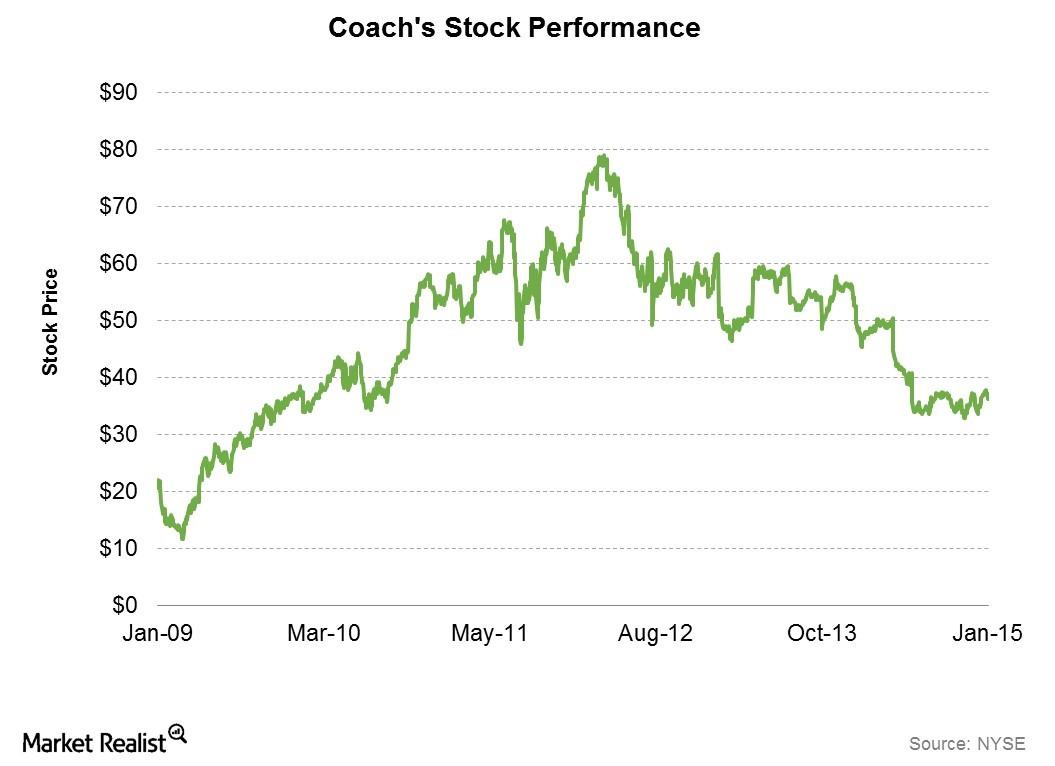

Coach expects to realize $160 million in annual savings due to its restructuring initiatives from fiscal 2016 onward. It also expects to maintain its annual dividend of $1.35 per share.

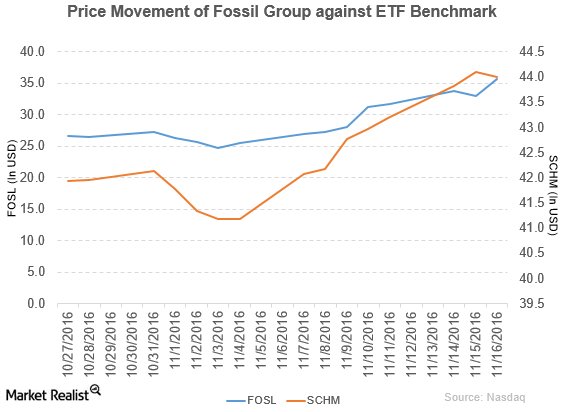

KeyBanc Capital Markets Upgrades Fossil to ‘Overweight’

Fossil Group (FOSL) has a market cap of $1.6 billion. It rose 8.4% to close at $35.70 per share on November 16, 2016.

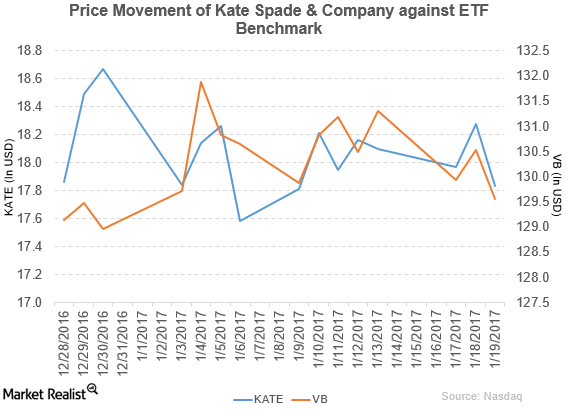

Bank of America/Merrill Lynch Downgrades Kate Spade to ‘Neutral’

Kate Spade (KATE) reported fiscal 3Q16 net sales of $316.5 million—a rise of 14.1% compared to net sales of $277.3 million in fiscal 3Q15.

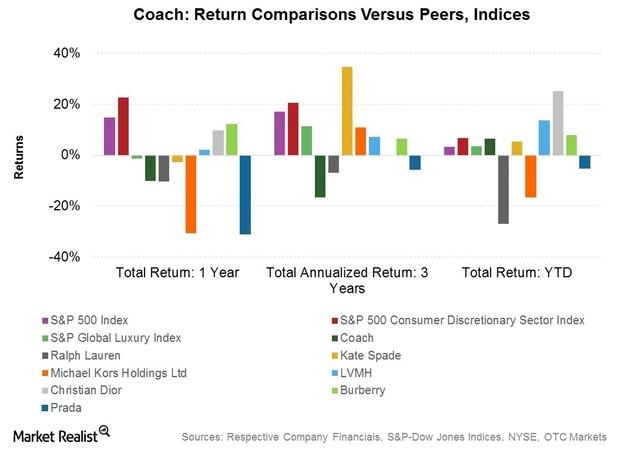

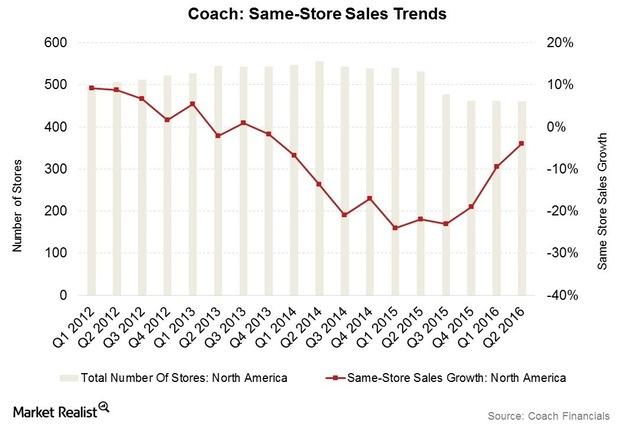

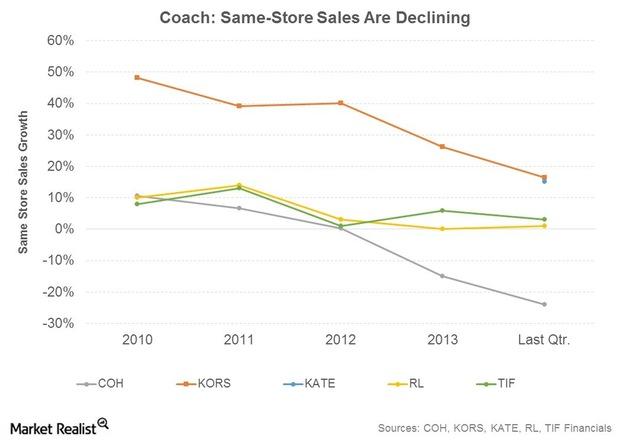

Can Coach Revive North America Same-Store Sales in Fiscal 2016?

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million.

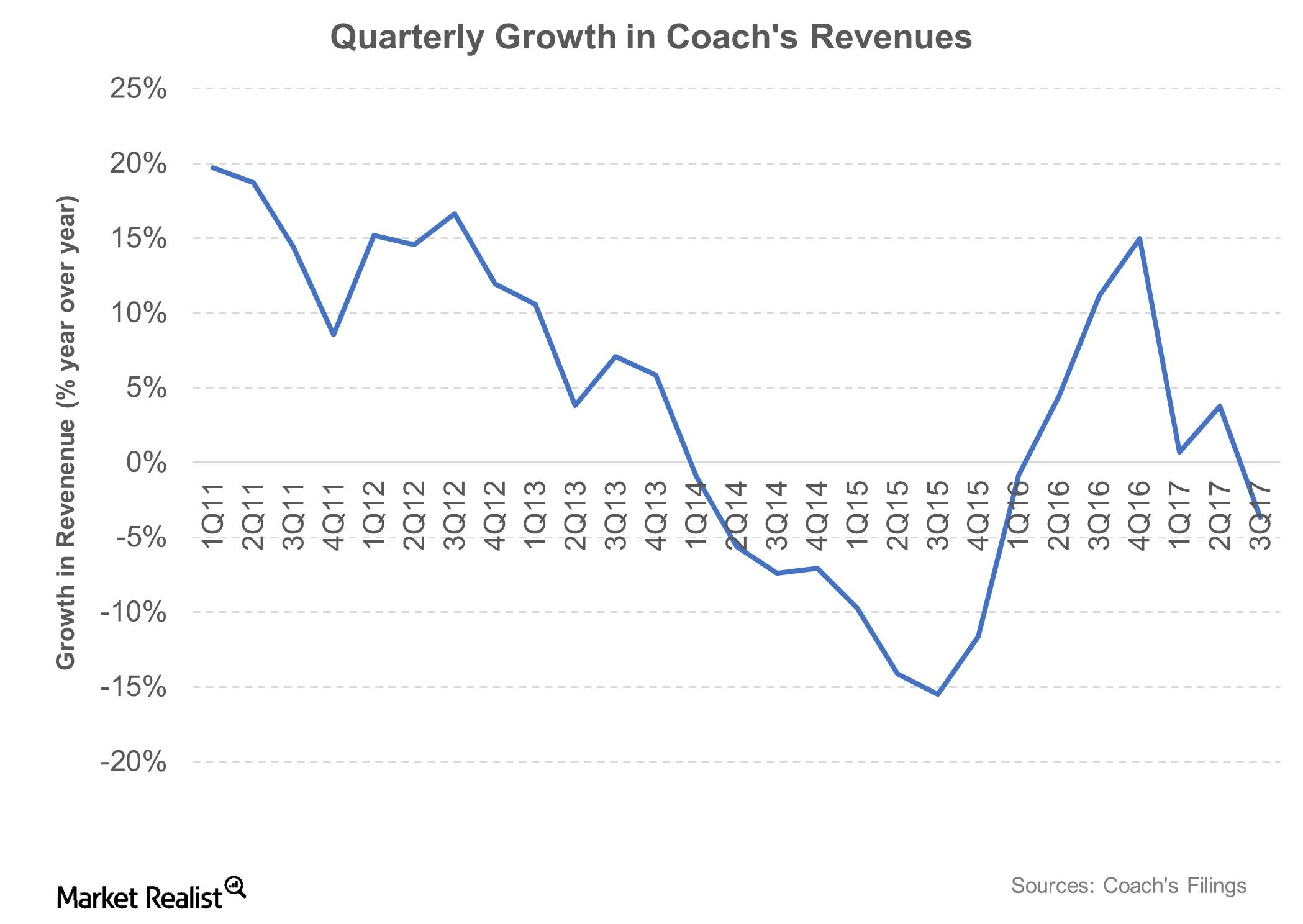

Coach’s Comeback Story and Strategy Change

Coach pulled out of 250 department stores in the US during its last reported quarter, reducing the department store count by ~25% in 2017.

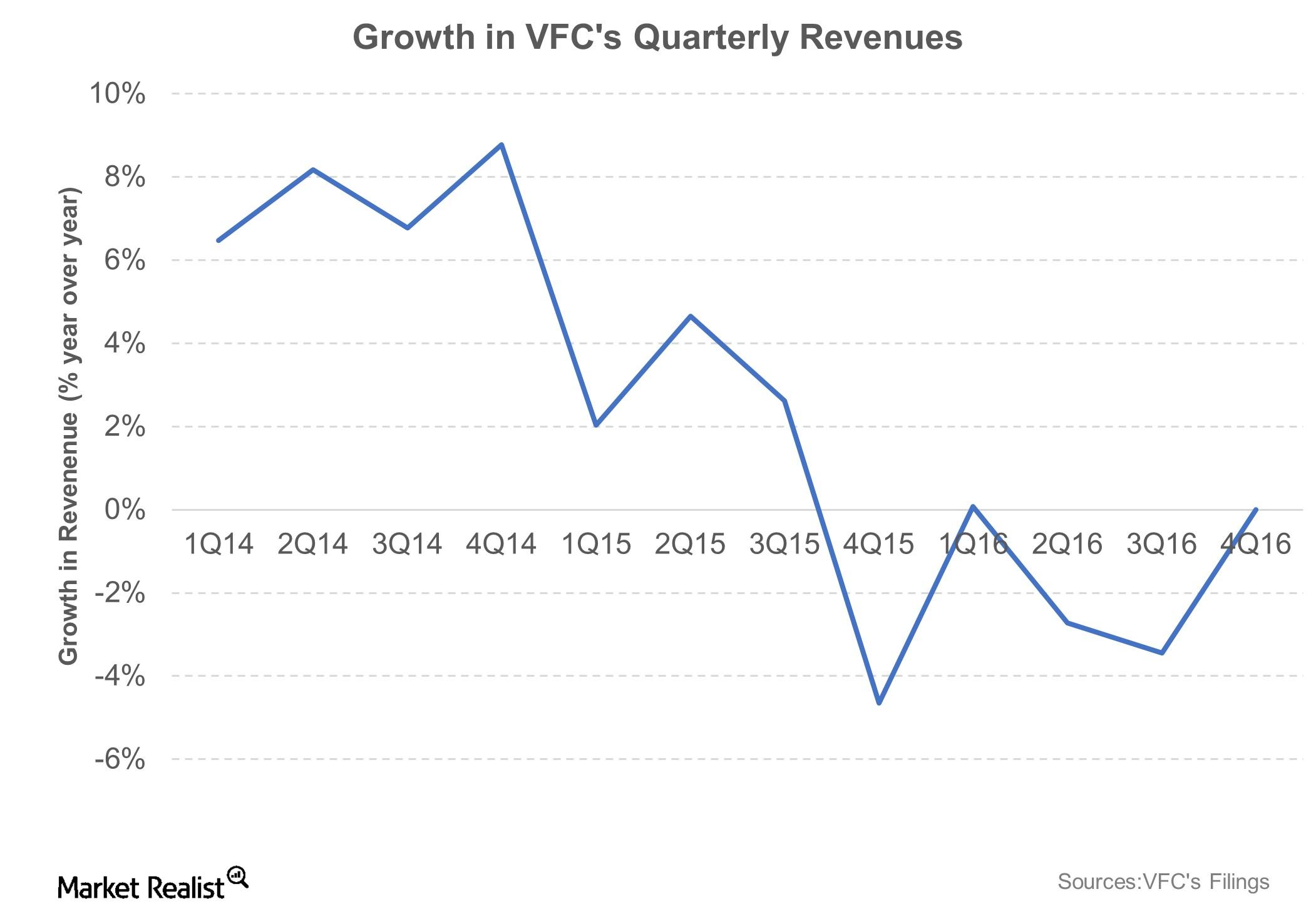

Key Drivers of VF Corporation’s Top Line in Fiscal 4Q16

VF Corporation’s D2C revenues rose 11% YoY, gaining strength from a mid-teen surge in the Outdoor & Action Sports and a low double-digit rise in Jeanswear.

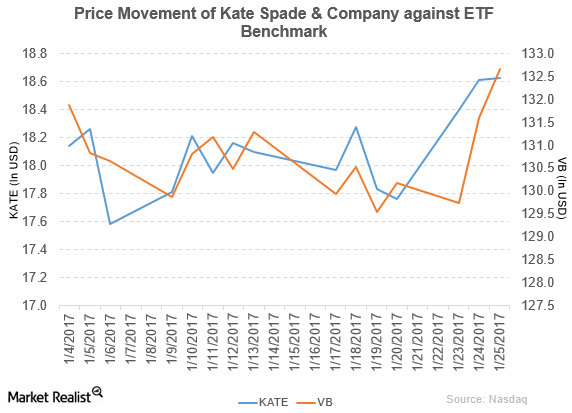

Telsey Downgraded Kate Spade & Company to ‘Market Perform’

On January 25, 2017, Telsey downgraded Kate Spade’s rating to “market perform” from “outperform.” It reported fiscal 3Q16 net sales of $316.5 million.

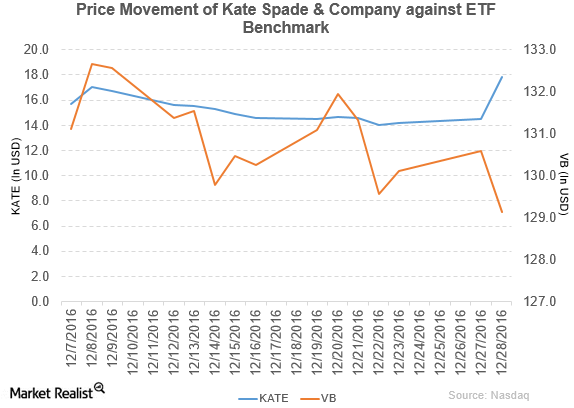

Why Did Kate Spade Stock Rise on December 28?

Kate Spade (KATE) rose more than 23.0% on December 28, 2016, after the report that the company is planning to sell its businesses with the help of investment banker.

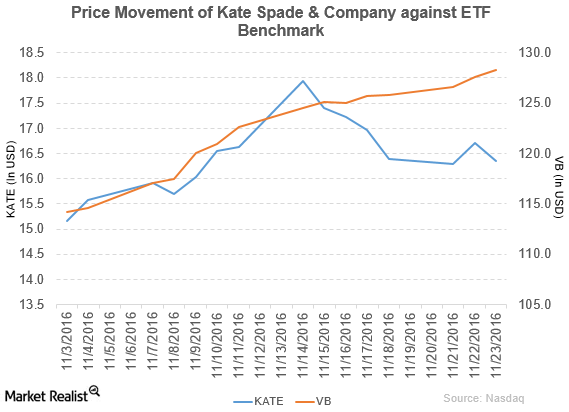

Wolfe Research Downgraded Kate Spade to ‘Peer Perform’

On November 23, 2016, Wolfe Research downgraded Kate Spade & Company’s rating to “peer perform” from “outperform.”

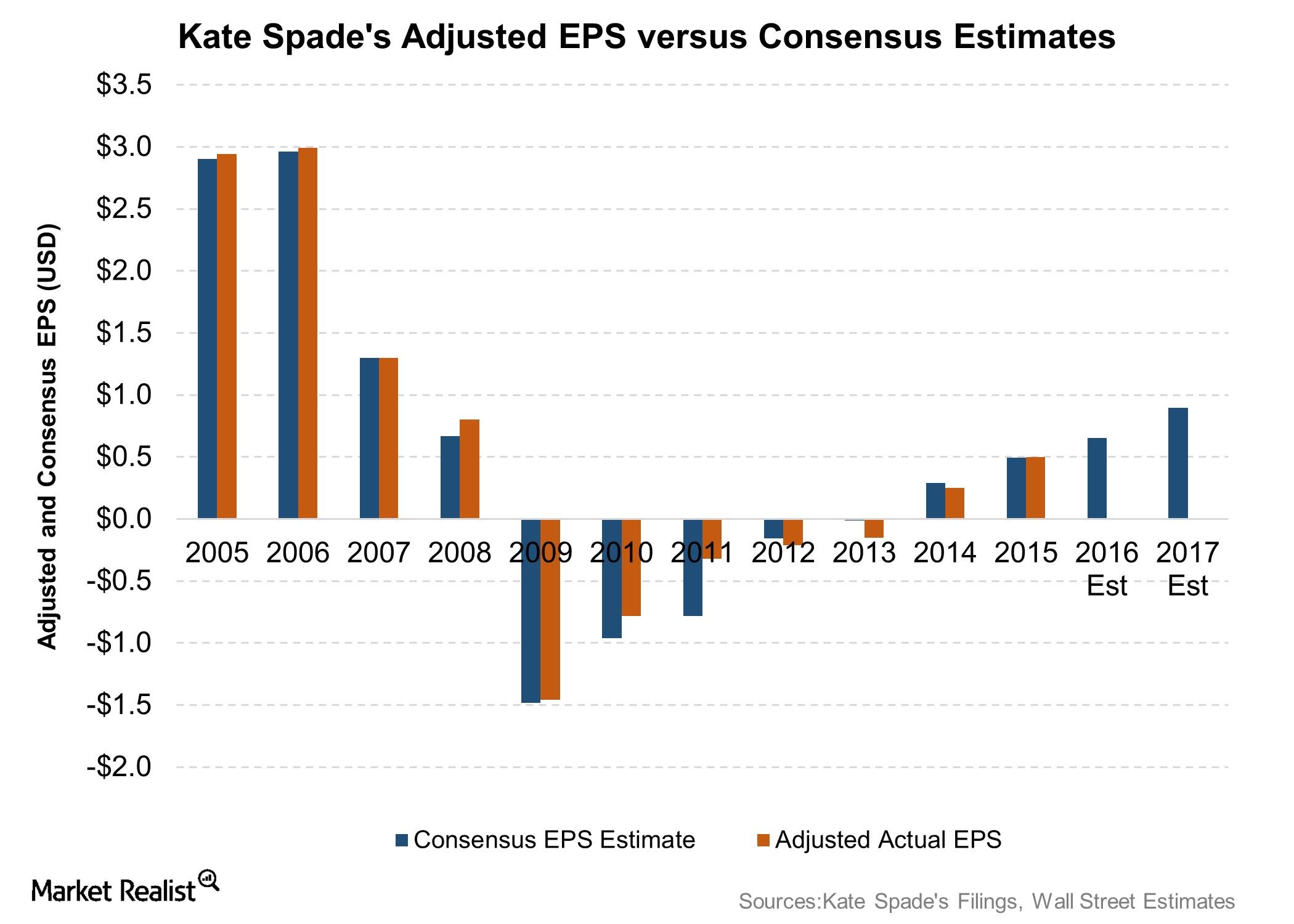

How Will Kate Spade’s Fiscal 2016 Performance Shape Up?

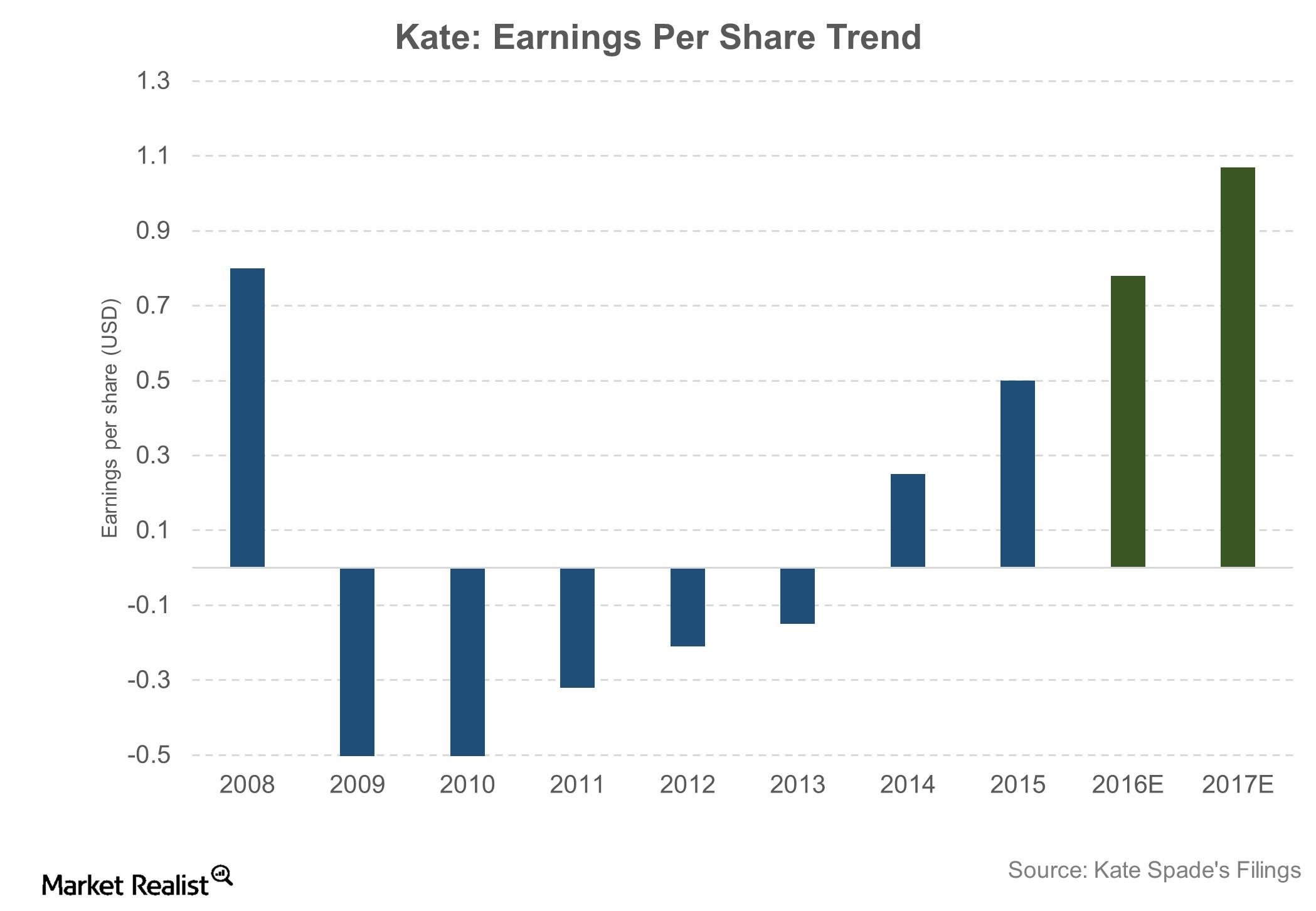

As a result of its second quarter headwinds, Kate Spade (KATE) lowered its full fiscal 2016 outlook.

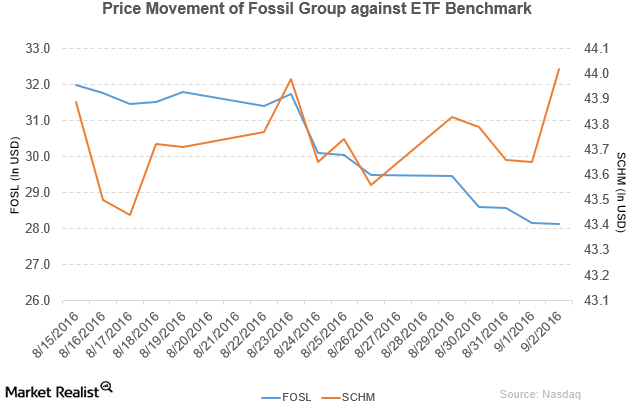

Fossil Will Ship Smartwatches Based on Qualcomm Technologies

Fossil fell by 4.6% to close at $28.13 per share during the fifth week of August, with weekly, monthly, and YTD price movements of -4.6%, -4.8%, and -23.1%.

Inside Kate Spade’s Key Focus Areas

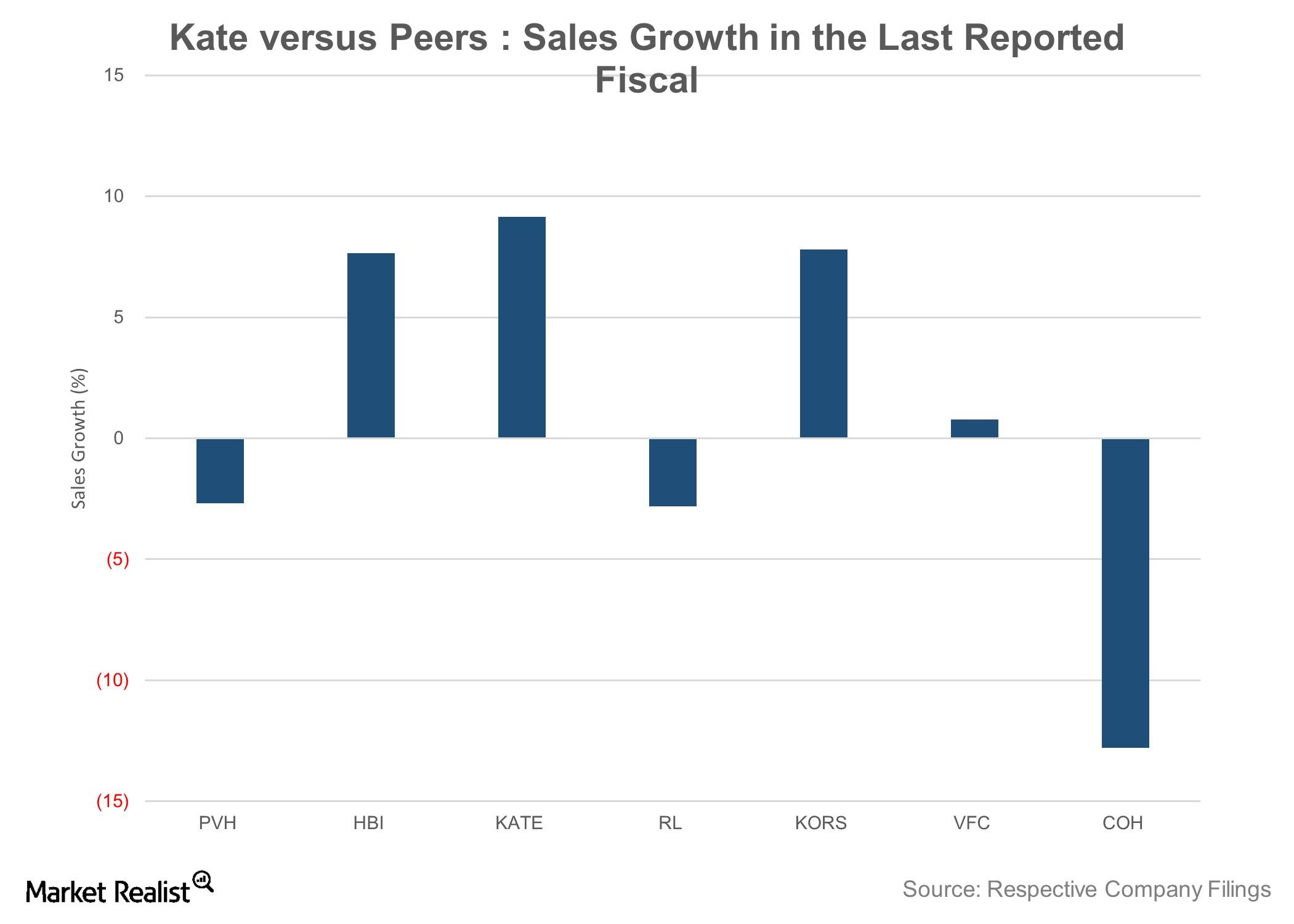

KATE’s top line grew by 9.1% YoY (year-over-year) in fiscal 2015, as compared to a 7.7% YoY increase for Michael Kors and a 12.7% YoY decline for Coach.

What Lies ahead for Kate Spade?

Kate Spade has predicted that its top-line growth will be in the 11.0%–13.5% range in fiscal 2016, which is in line with the consensus average of 13.5%.

How Is Kate Spade Positioned in the American Affordable Luxury Segment?

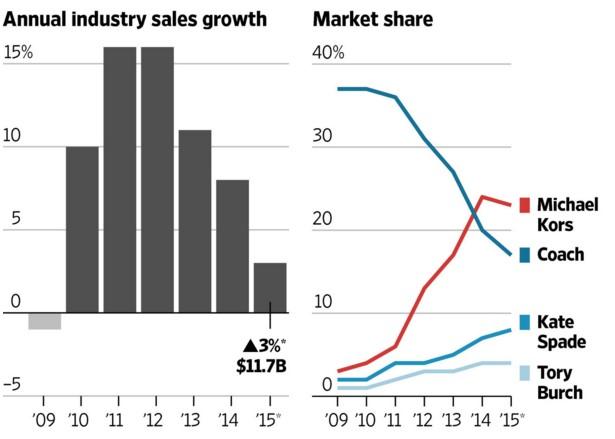

Kate Spade recorded total sales of $1.3 billion in the past twelve months. Michael Kors and Coach saw sales of $4.7 billion and $4.3 billion, respectively.

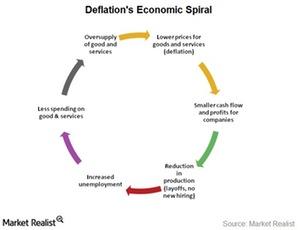

Currency warfare is a way to export deflation

When a country depreciates its currency, its major trading partners depreciate their own currencies. They do this to save their economies from entering into deflation.

Purse Wars: Coach Seeing Fierce Competition For Market Share

Competition is fierce in all of the affordable luxury industry. And, there are many players, including KORS and KATE.

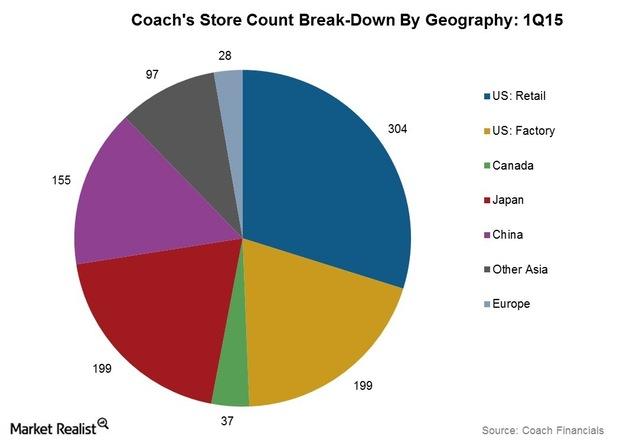

Selling Channels: How Coach Products Reach Customers

Coach, Inc. (COH) distributes products through wholesale and direct-to-customer channels. It runs wholesale shops-within-shops at major department stores.

An Introduction To Luxury Brand Pioneer Coach

Coach is a well-known premium fashion brand. In recent years, Coach has faced increasing competition from newer entrants in the affordable luxury market.