How Is Kate Spade Positioned in the American Affordable Luxury Segment?

Kate Spade recorded total sales of $1.3 billion in the past twelve months. Michael Kors and Coach saw sales of $4.7 billion and $4.3 billion, respectively.

July 19 2016, Updated 3:06 p.m. ET

Highly competitive industry

Kate Spade competes in a number of retail segments including handbags, accessories, other leather goods, jewelry, and apparel. Its products are generally priced above the average market price and are considered as an “affordable luxury.”

There are a number of players competing in each of these segments, which means limited pricing power in the hands of the retailers. The customer is free to choose among brands without incurring additional costs.

KATE versus KORS versus Coach

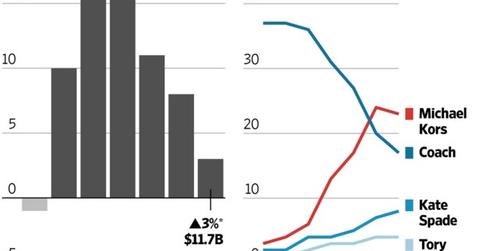

Kate Spade recorded total sales of $1.3 billion over the past twelve months. By comparison, its close competitors Michael Kors (KORS) and Coach (COH) generated sales of $4.7 billion and $4.3 billion, respectively.

Coach operates more than 1,000 stores worldwide. It was established as early as 1941 and pioneered the American affordable luxury industry. However, with increasing competition from new entrants like Michael Kors, Kate Spade, and Tory Burch, the company’s market share eroded, and its same-store sales have gone downhill.

Michael Kors, on the other hand, has been quick in growing its market share. It expanded from about 350 company-operated retail stores at the end of March 2013 to 670 stores at the end of March 2016.

Kate Spade, by comparison, is a much smaller company and operates 260 stores (at the end of April 2016). Its products target Millennials, are typically more colorful and have smaller logos. In recent times, the company has shifted its focus to smaller bags to meet the changing customer preferences.

Coach’s and Kors’s declines

According to a report by Goldman Sachs, Coach and Michael Kors are the most “well-owned” brands among girls and young women in the age group of 13–29. These brands have a vast presence in the department, retail, and outlet stores and are easily accessible to the masses. However, this has resulted in the loss of the “exclusivity factor”—especially for Coach, which has become the most-owned handbag brand. Coach also offers heavy discounts, which has resulted in the erosion of its luxury brand status.

Notably, ETF investors seeking to get exposure to KATE can consider the First Trust Consumer Discretionary AlphaDEX (FXD), which invests 0.27% of its total portfolio in the company.

Continue to the next part for a look at Kate Spade’s key focus areas.