Michael Kors Holdings Ltd

Latest Michael Kors Holdings Ltd News and Updates

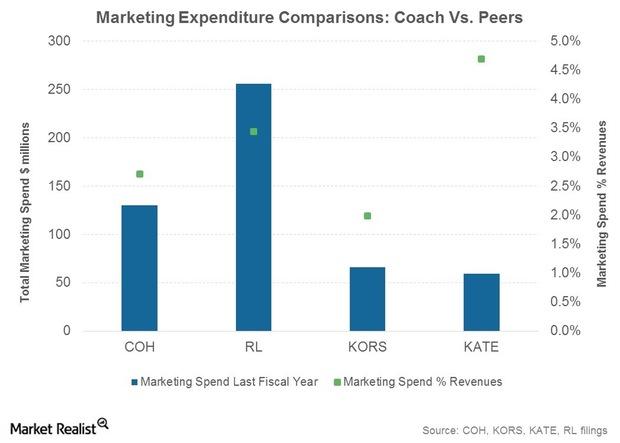

Understanding Coach’s Marketing Strategies

To support its direct marketing initiatives, Coach has a database of 24 million households in North America and 10 million in Asia.

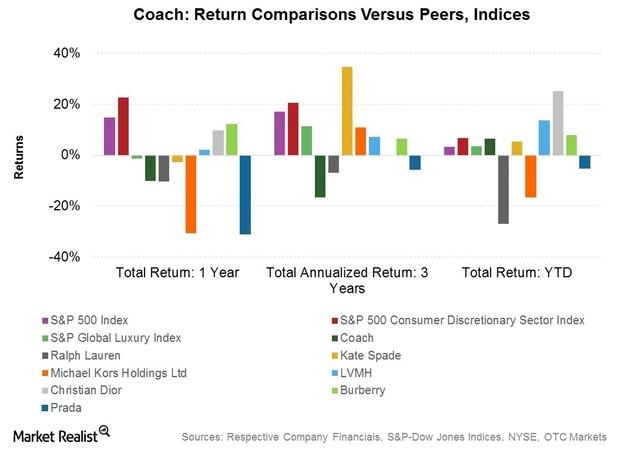

Opportunities and Challenges for Coach

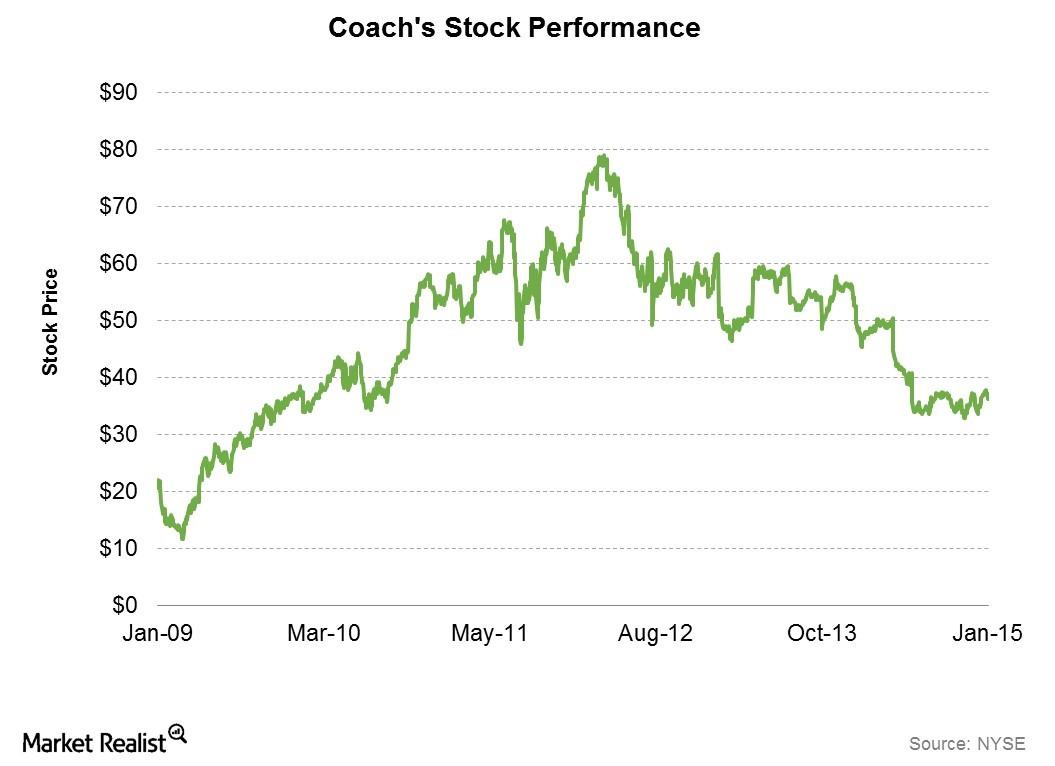

Coach expects to realize $160 million in annual savings due to its restructuring initiatives from fiscal 2016 onward. It also expects to maintain its annual dividend of $1.35 per share.

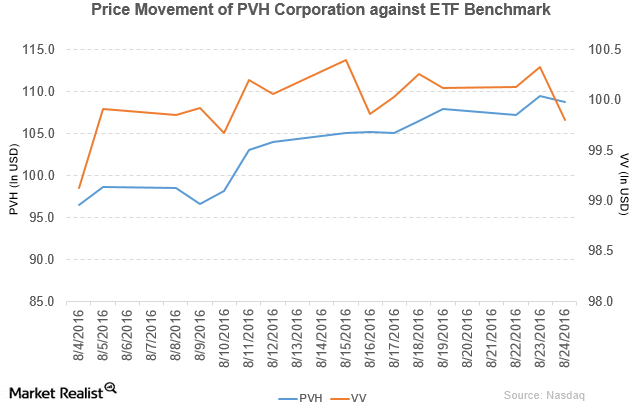

How Did PVH Corporation Perform in 2Q16?

PVH Corporation (PVH) has a market cap of $8.9 billion. It fell by 0.67% to close at $108.82 per share on August 24, 2016.

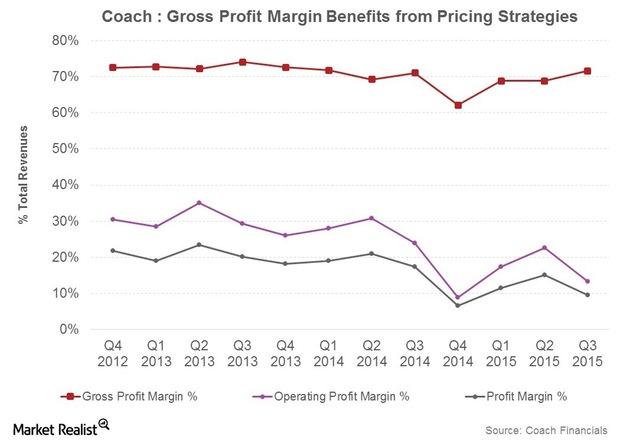

Coach’s Pricing Strategies Benefit Its Margins

Coach’s gross margin expanded to 71.6% in 3Q15 from 71.1% in 3Q14. Coach reduced the frequency of its in-store and online promotions, which should boost its margins.

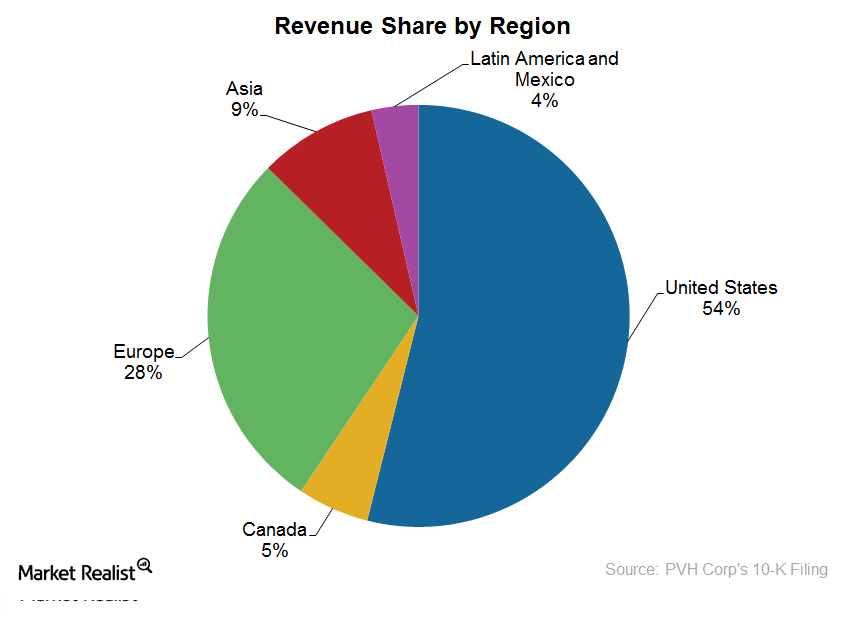

An overview of PVH’s business by geographies

We’ll look at PVH’s operations by geographies. It markets its products in over 100 countries through wholesale partners. It has over 4,700 retail locations.

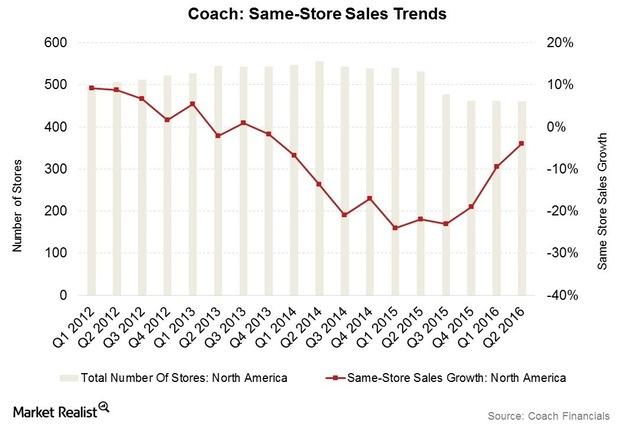

Can Coach Revive North America Same-Store Sales in Fiscal 2016?

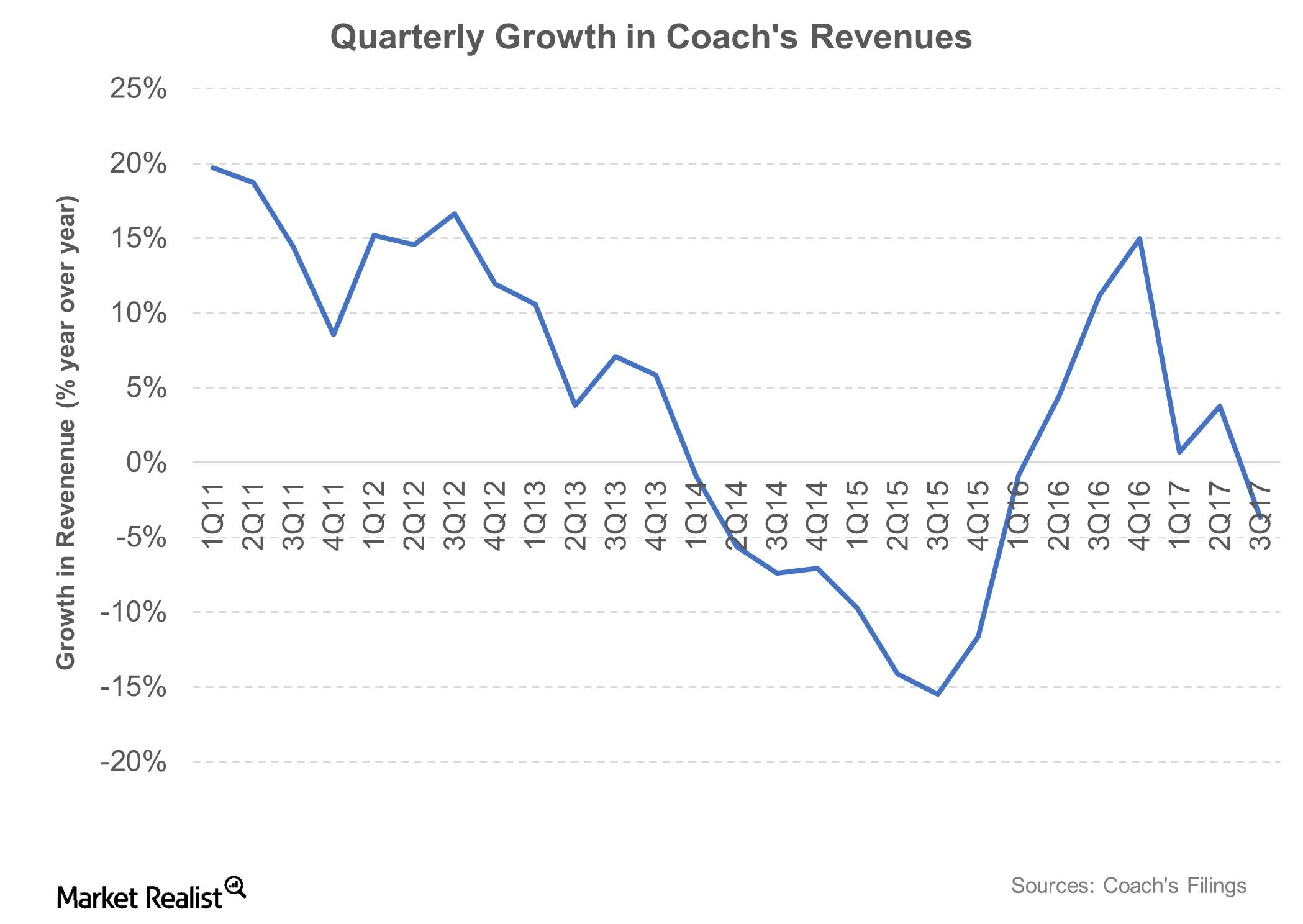

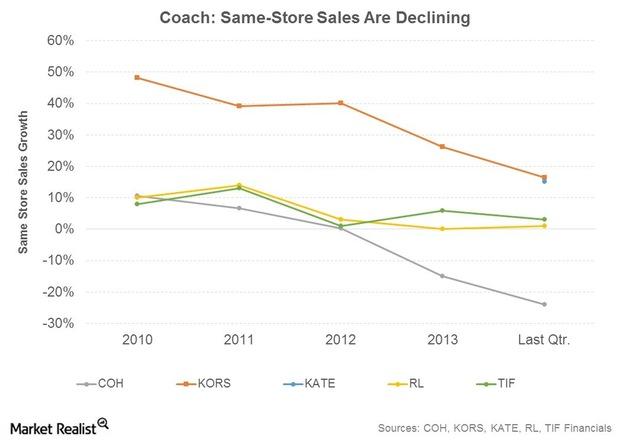

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million.

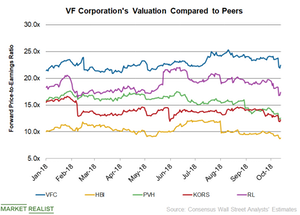

How VFC’s Valuation Compares with Peers

On October 12, VF Corporation’s (VFC) 12-month forward PE (price-to-earnings) ratio was 22.4x.

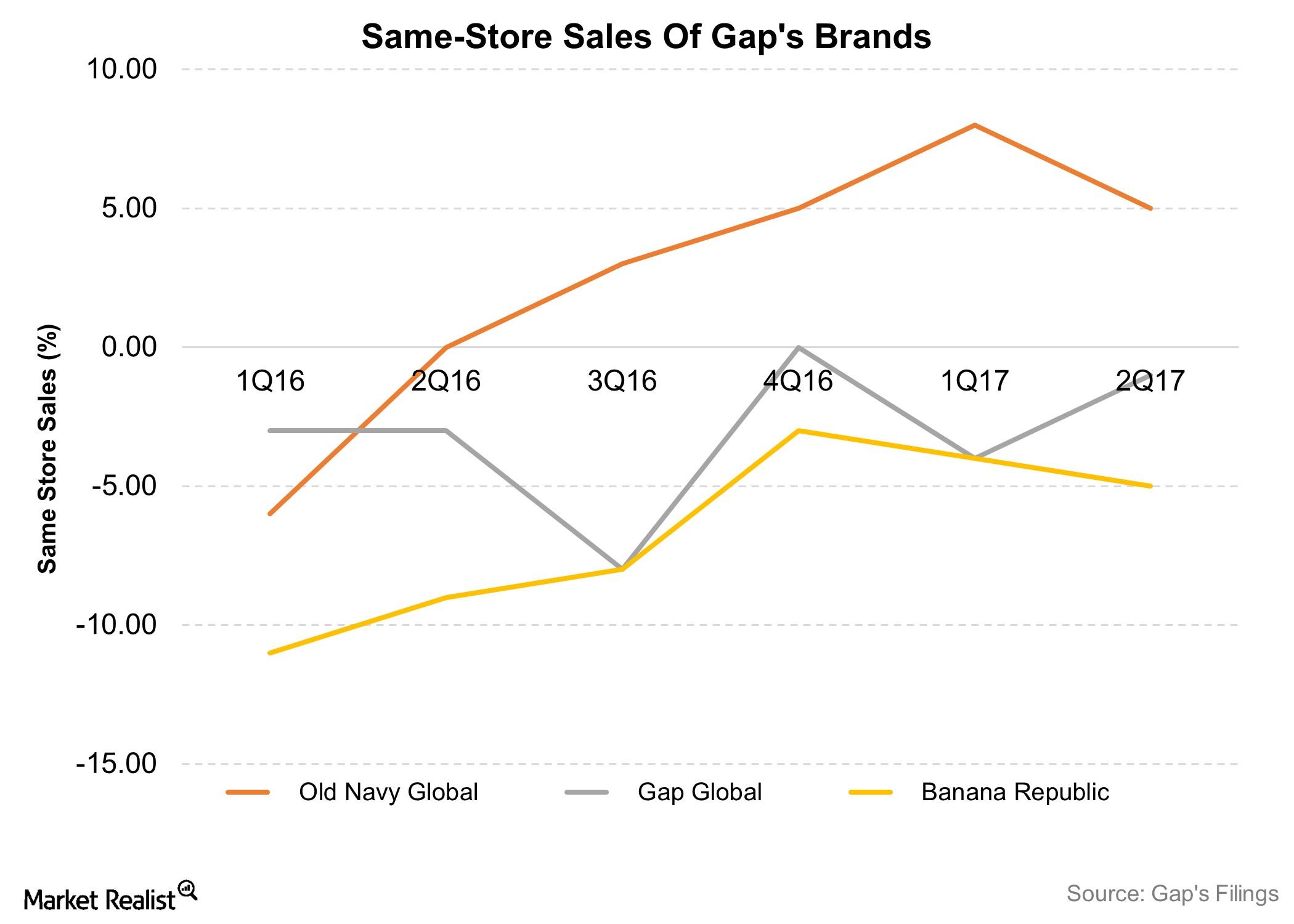

Analyzing Gap’s 2Q17 Top-Line Performance

Gap (GPS) reported total revenues of $3.8 billion in 2Q17 and beat the consensus by $30 million. On a YoY basis, the company’s top line fell 1.4%.

Despite Currency Headwinds, PVH Delivers Better Growth than Peers

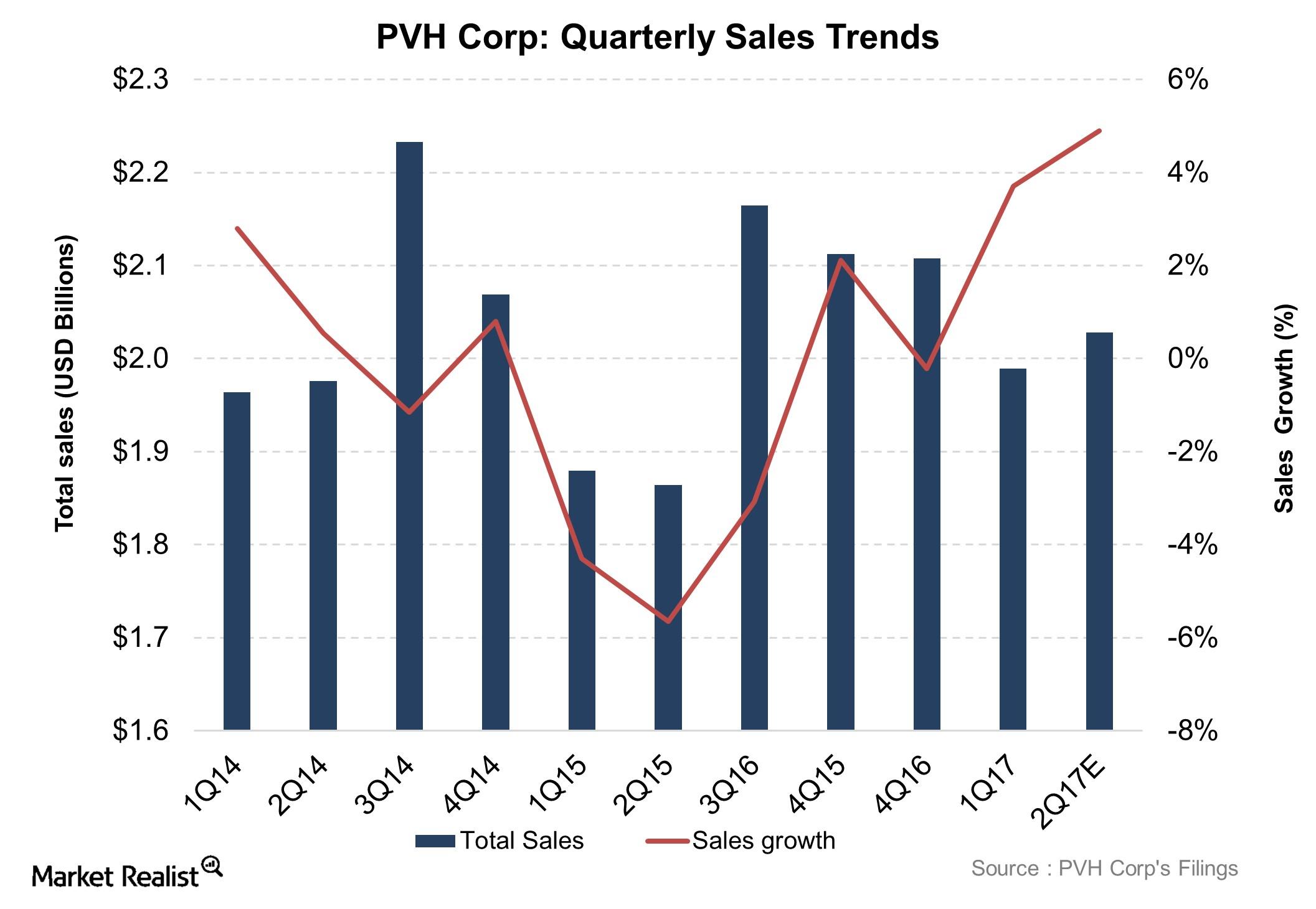

PVH Corporation’s (PVH) top line is predicted to grow 4.9% YoY (year-over-year) in 2Q17.

Coach’s Comeback Story and Strategy Change

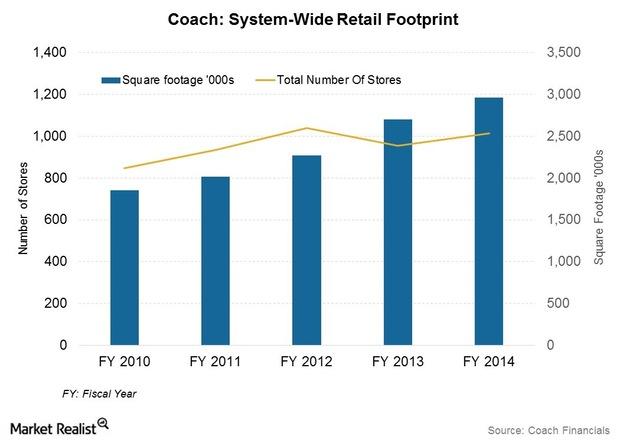

Coach pulled out of 250 department stores in the US during its last reported quarter, reducing the department store count by ~25% in 2017.

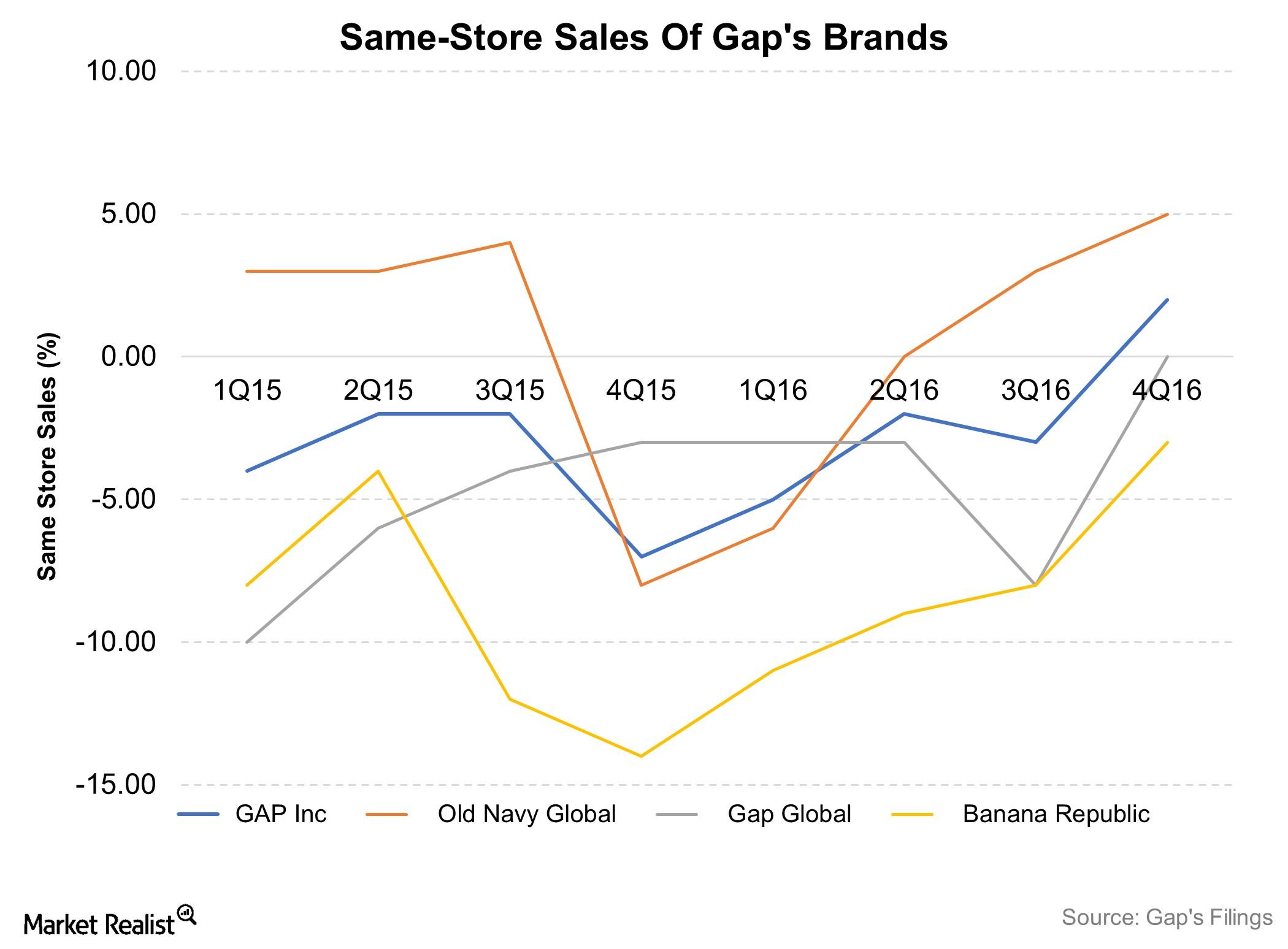

Why Gap’s CEO Is Projecting Optimism after 4Q16

Gap (GPS) reported total revenues of ~$4.4 billion in 4Q16, beating the consensus by $40 million.

What’s the Latest News on PVH Corporation?

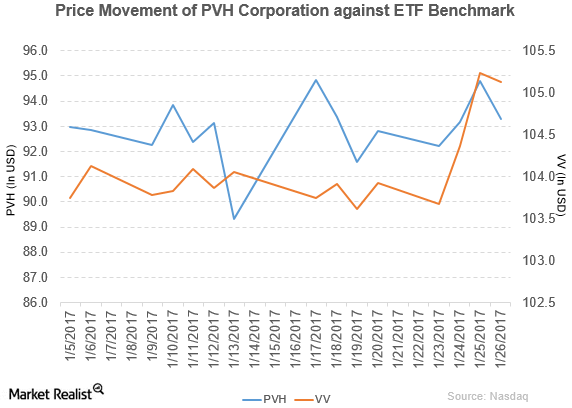

PVH Corporation (PVH) has a market cap of $7.5 billion. It fell 1.6% and closed at $93.30 per share on January 26, 2017.

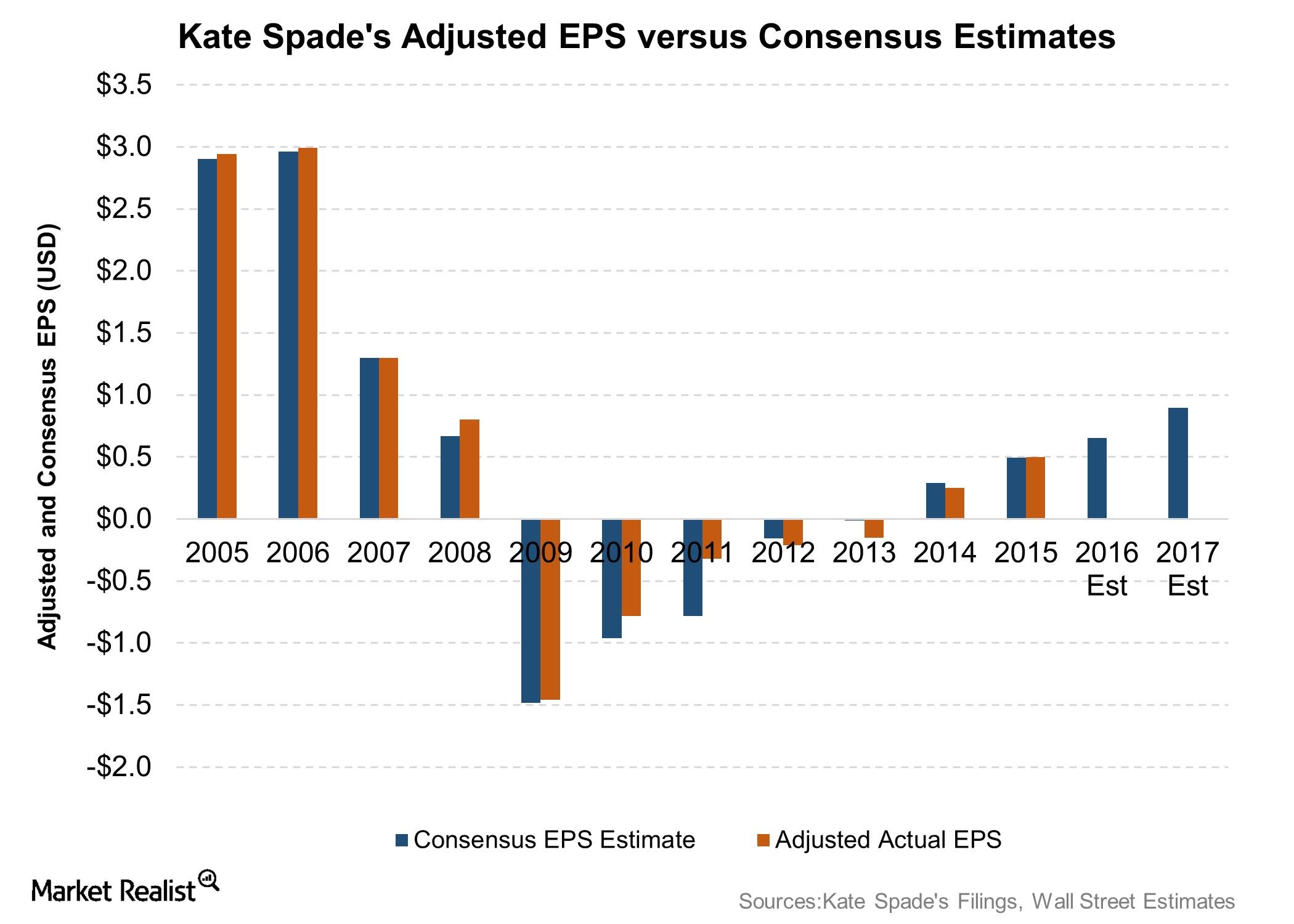

How Will Kate Spade’s Fiscal 2016 Performance Shape Up?

As a result of its second quarter headwinds, Kate Spade (KATE) lowered its full fiscal 2016 outlook.

Guggenheim Has Rated PVH Corporation a ‘Buy’

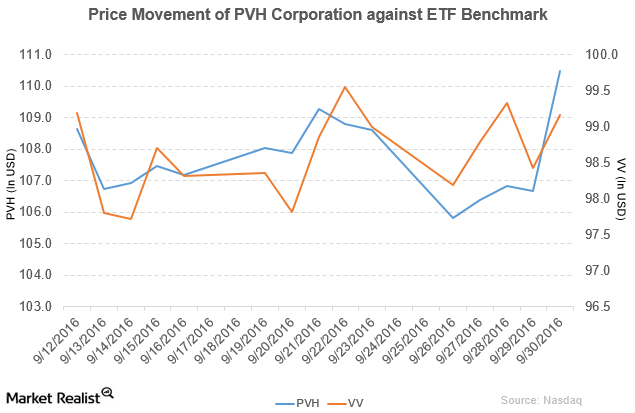

PVH Corporation (PVH) has a market cap of $8.9 billion. It rose 3.6% to close at $110.50 per share on September 30, 2016.

Judith Amanda Sourry Knox Joins PVH’s Board of Directors

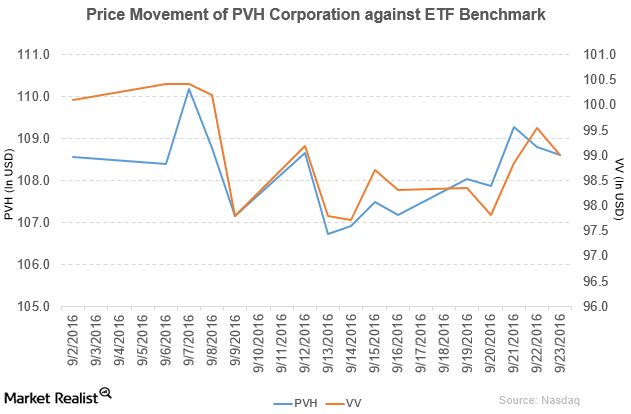

PVH Corporation (PVH) rose 1.3% to close at $108.60 per share during the third week of September 2016.

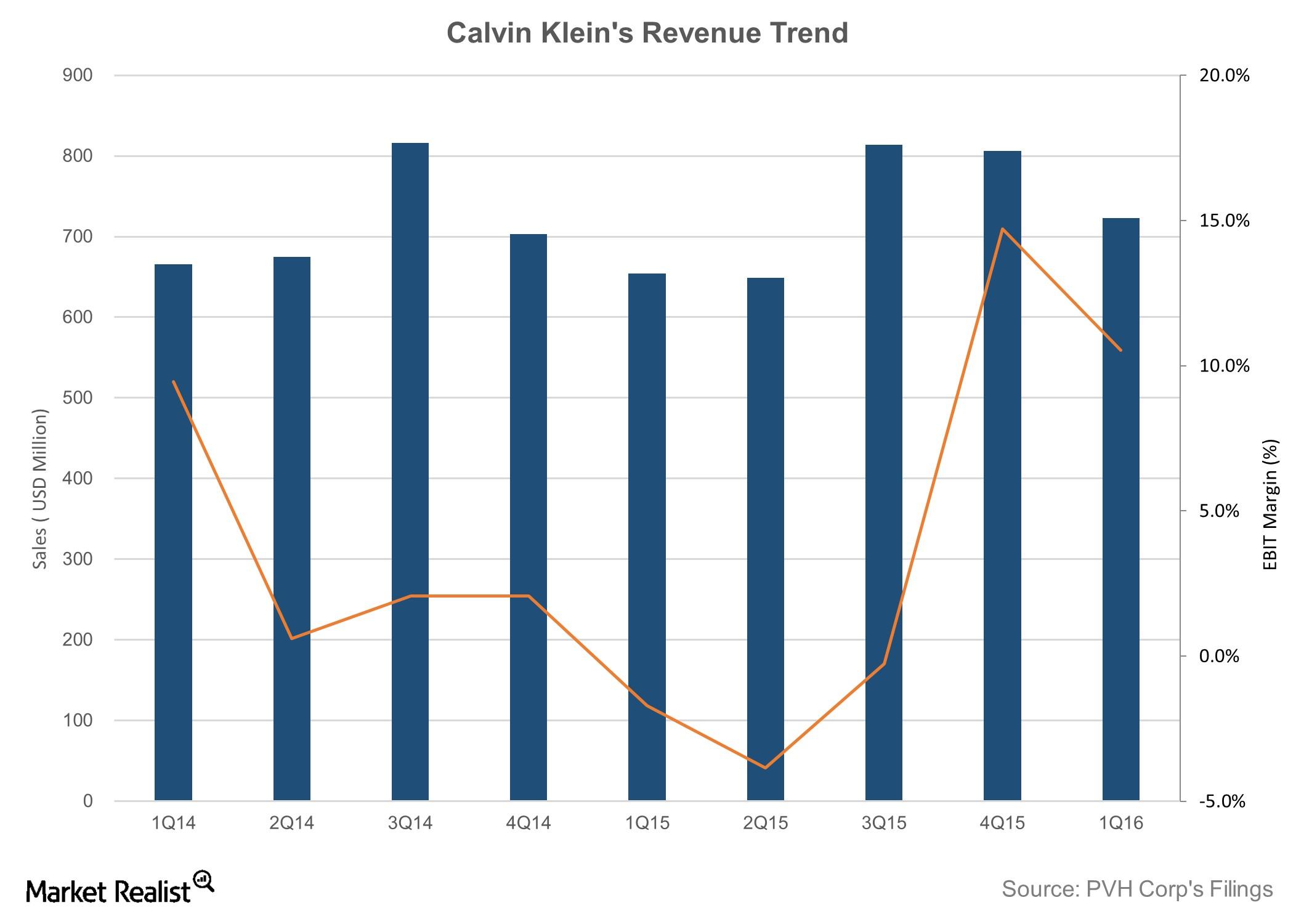

Can Calvin Klein Drive PVH’s Sales Growth in 2Q16?

Among PVH’s (PVH) three segments, Calvin Klein has been the best performer. The brand accounts for more than 37% of the company’s total revenue.

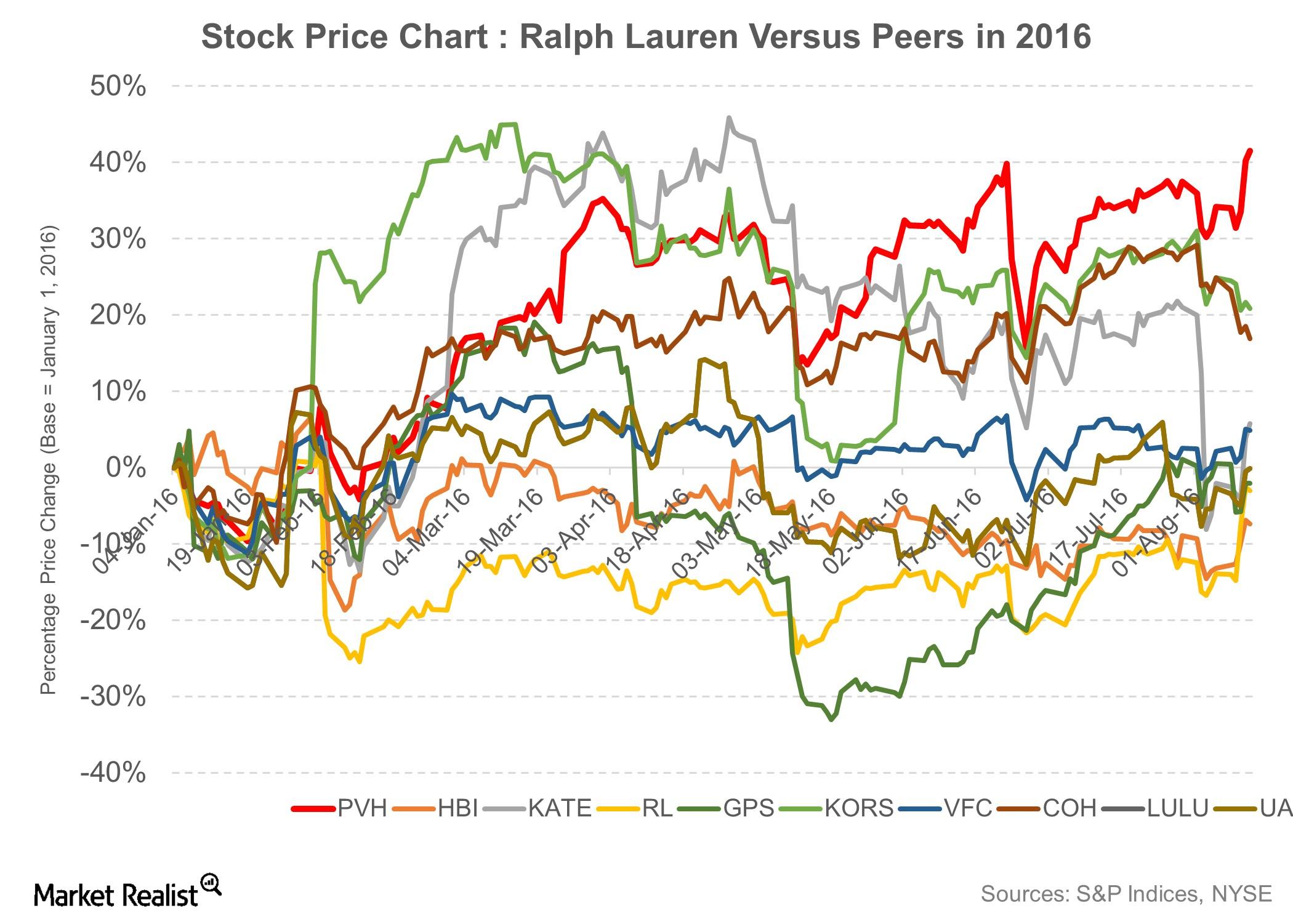

Better-than-Expected Earnings Support Falling Ralph Lauren Stock

Despite a decline in earnings, Ralph Lauren continues to hold $1.2 billion in cash and short-term investments on its balance sheet.

Inside Kate Spade’s Key Focus Areas

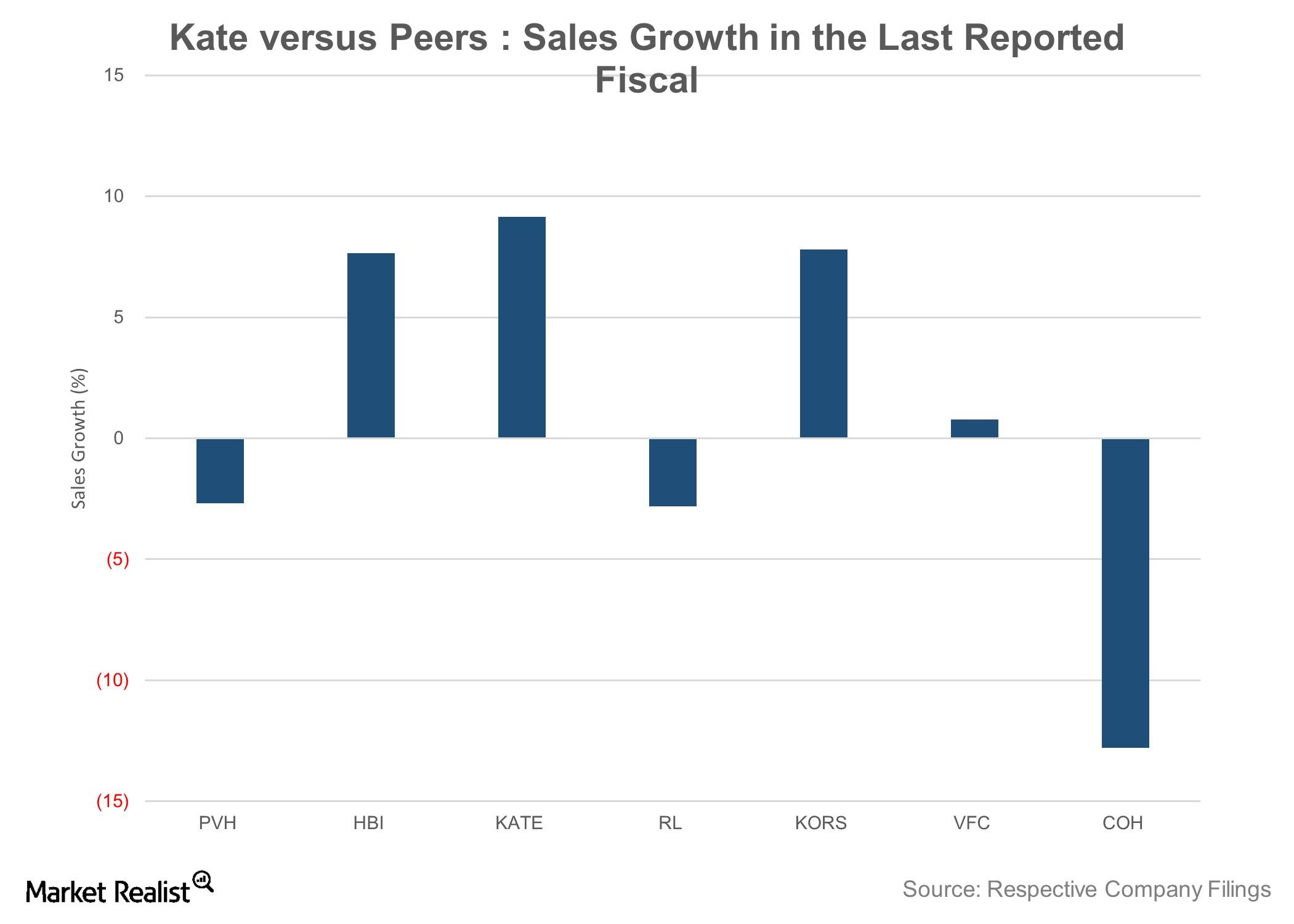

KATE’s top line grew by 9.1% YoY (year-over-year) in fiscal 2015, as compared to a 7.7% YoY increase for Michael Kors and a 12.7% YoY decline for Coach.

How Is Kate Spade Positioned in the American Affordable Luxury Segment?

Kate Spade recorded total sales of $1.3 billion in the past twelve months. Michael Kors and Coach saw sales of $4.7 billion and $4.3 billion, respectively.

Why Did PVH Issue Senior Notes?

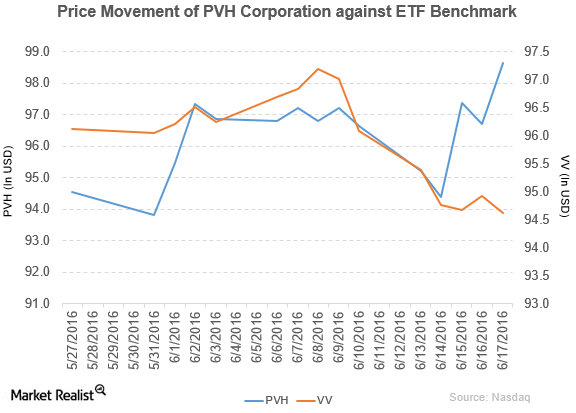

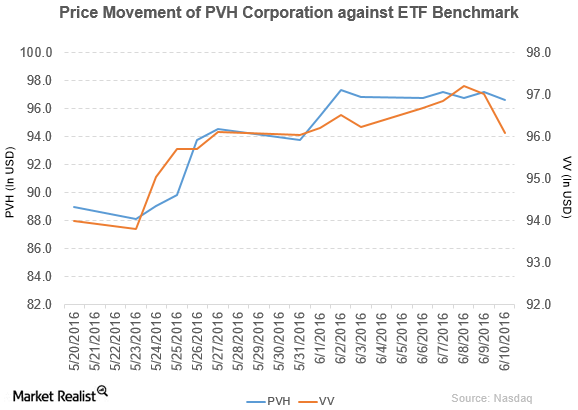

PVH (PVH) rose by 2.1% to close at $98.63 per share at the end of the third week of June 2016.

Why Did PVH Offer Senior Notes?

PVH Corporation (PVH) has a market cap of $7.8 billion. It fell by 0.58% to close at $96.65 per share on June 10, 2016.

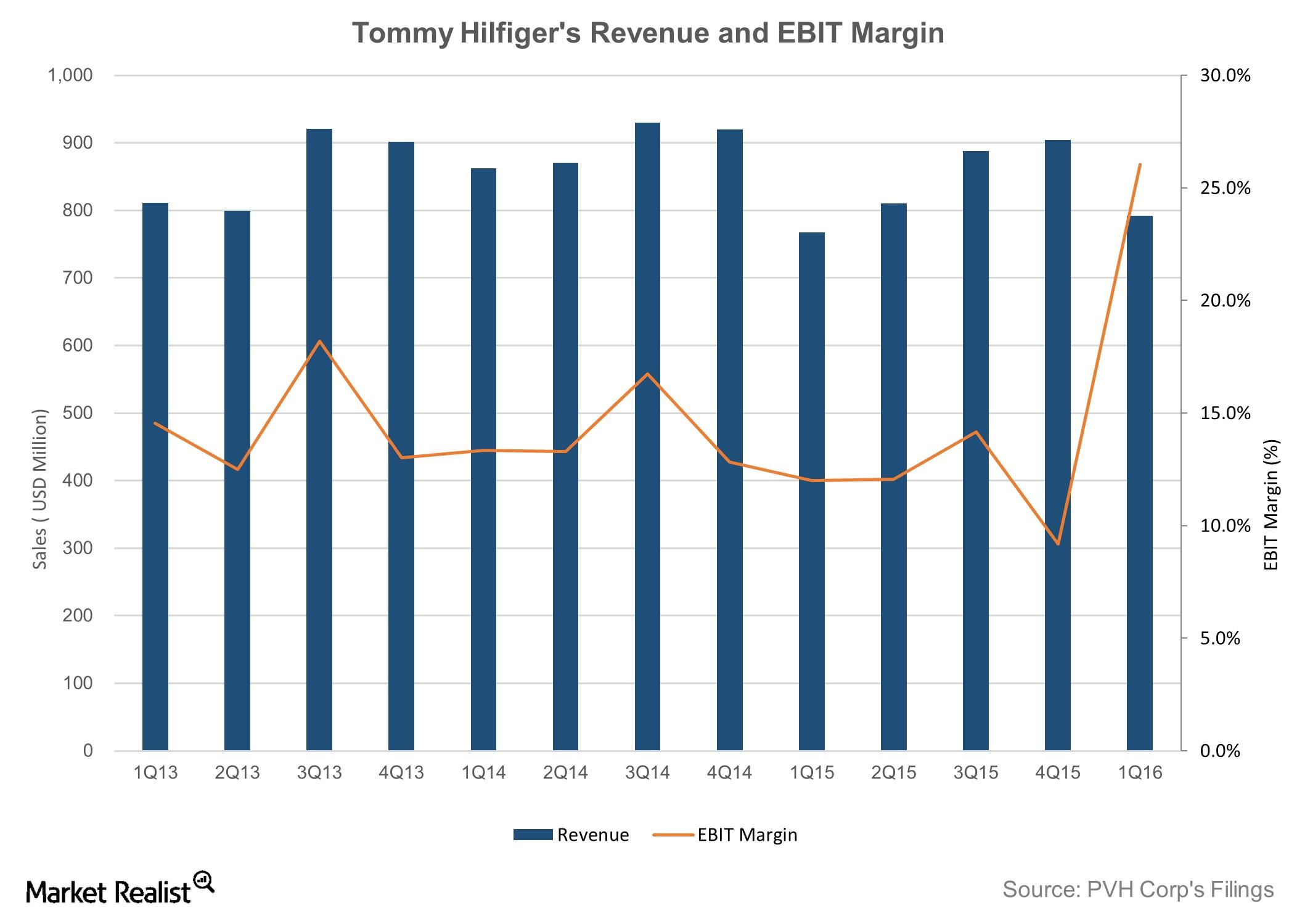

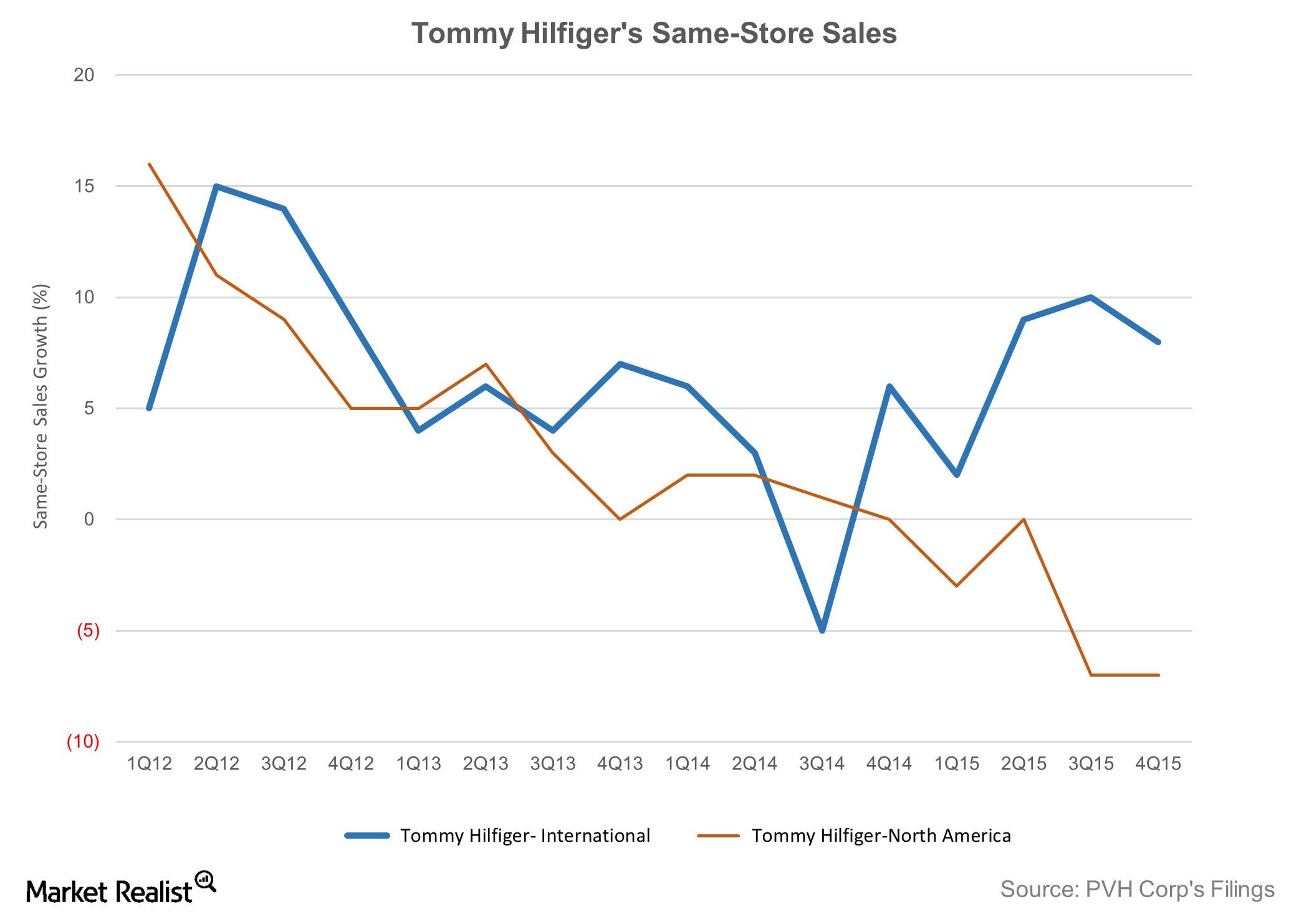

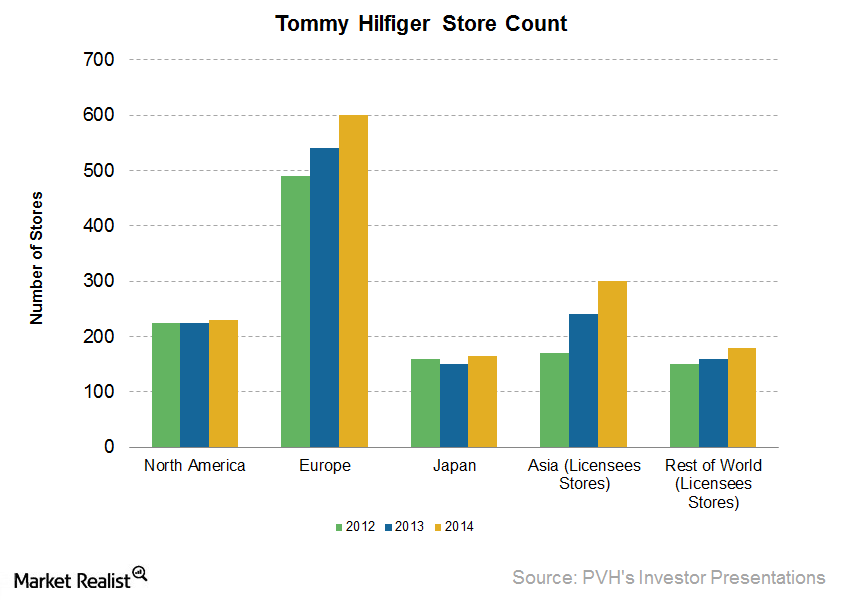

PVH’s Tommy Hilfiger Gets Boost from Strong International Sales

Tommy Hilfiger was acquired by PVH (PVH) in 2010. In fiscal 2015, the Tommy Hilfiger brand accounted for 43.5% of the company’s total revenue and 44% of its operating profit.

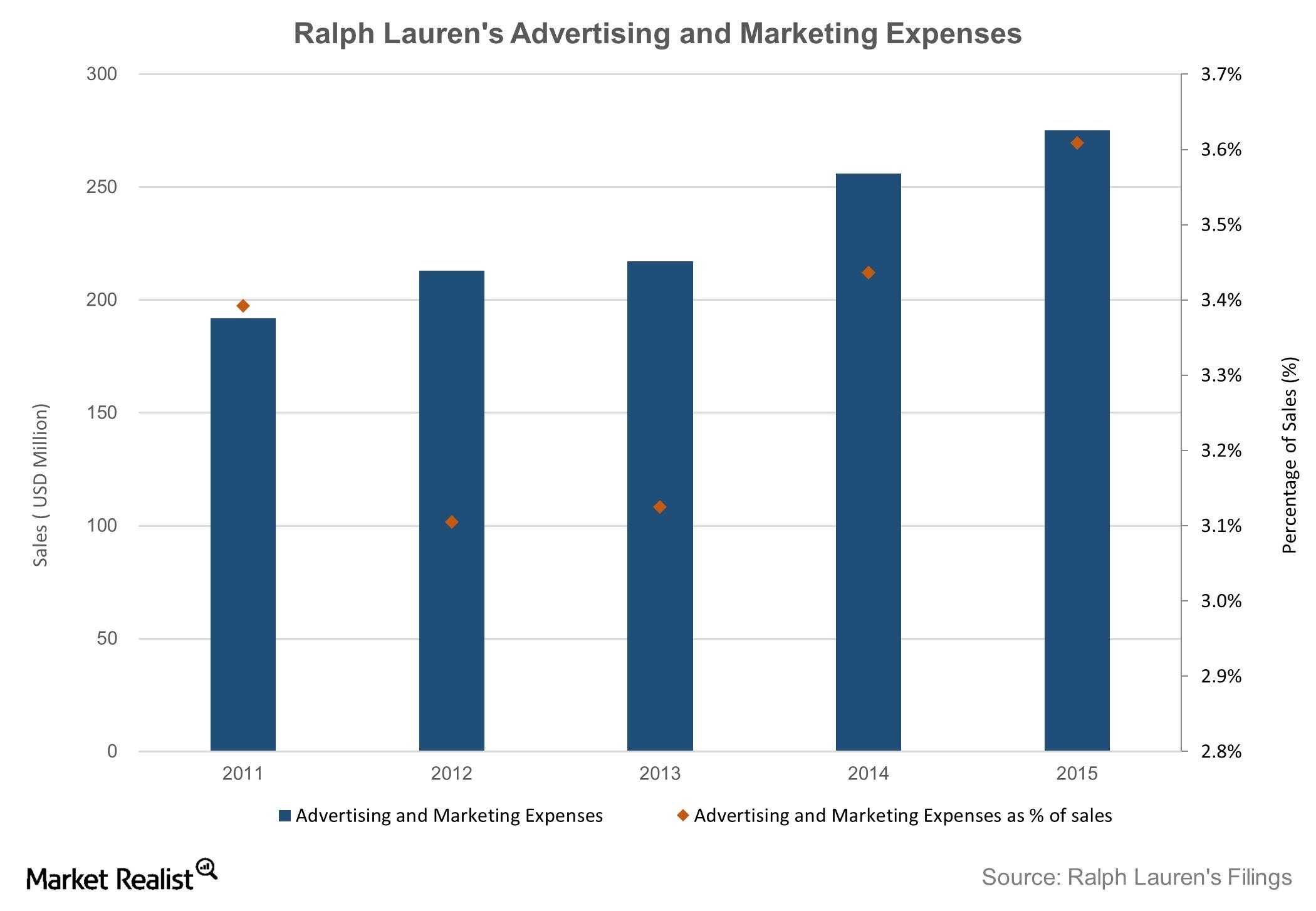

Understanding Ralph Lauren’s Marketing and Advertising Strategy

Ralph Lauren’s (RL) advertising programs are created and executed through the company’s in-house creative and advertising organization.

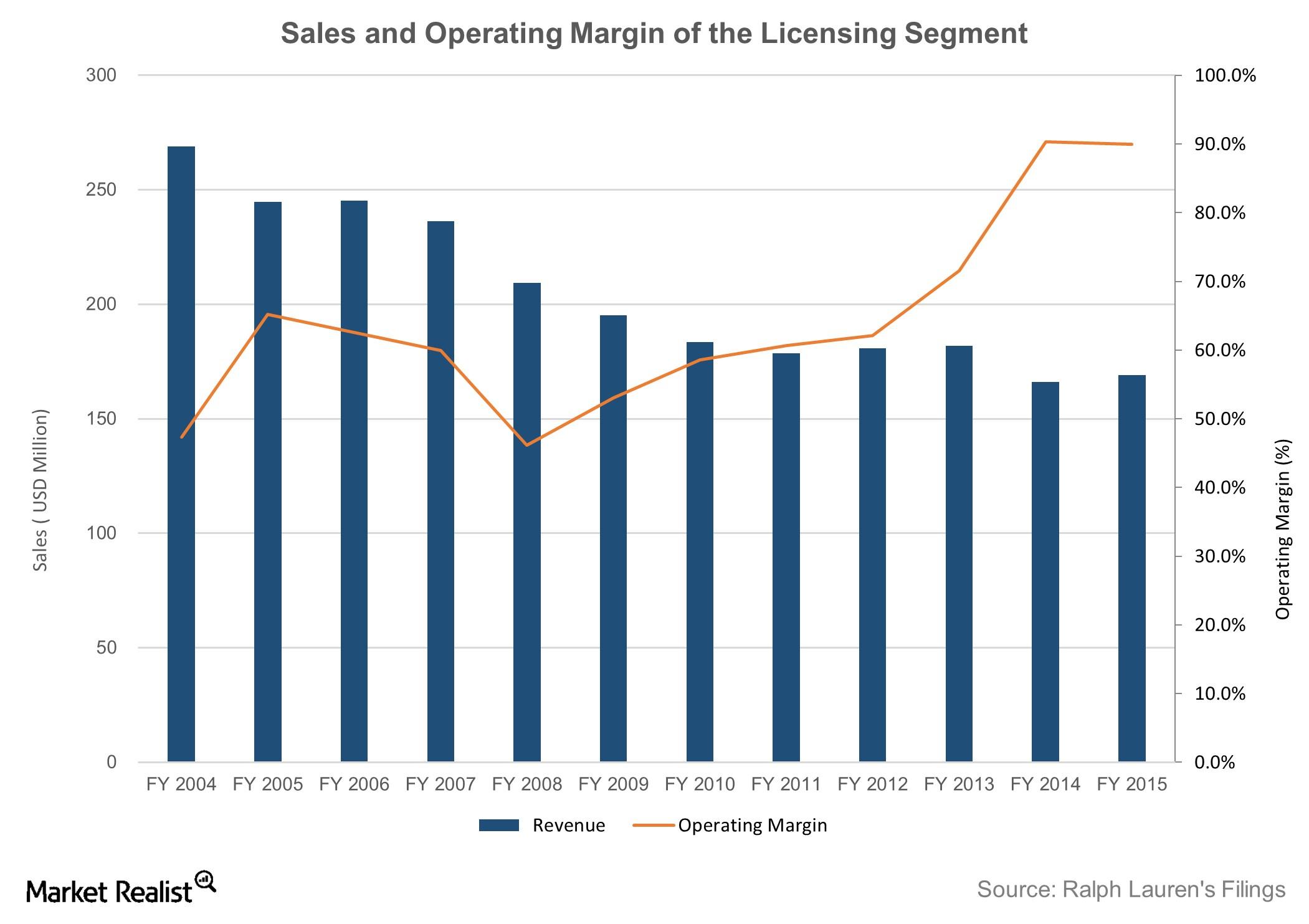

Inside Ralph Lauren’s Licensing Business

Ralph Lauren earns royalties from licensing the use of its trademarks or the right to operate stores to third parties for apparel, eyewear, and fragrances.

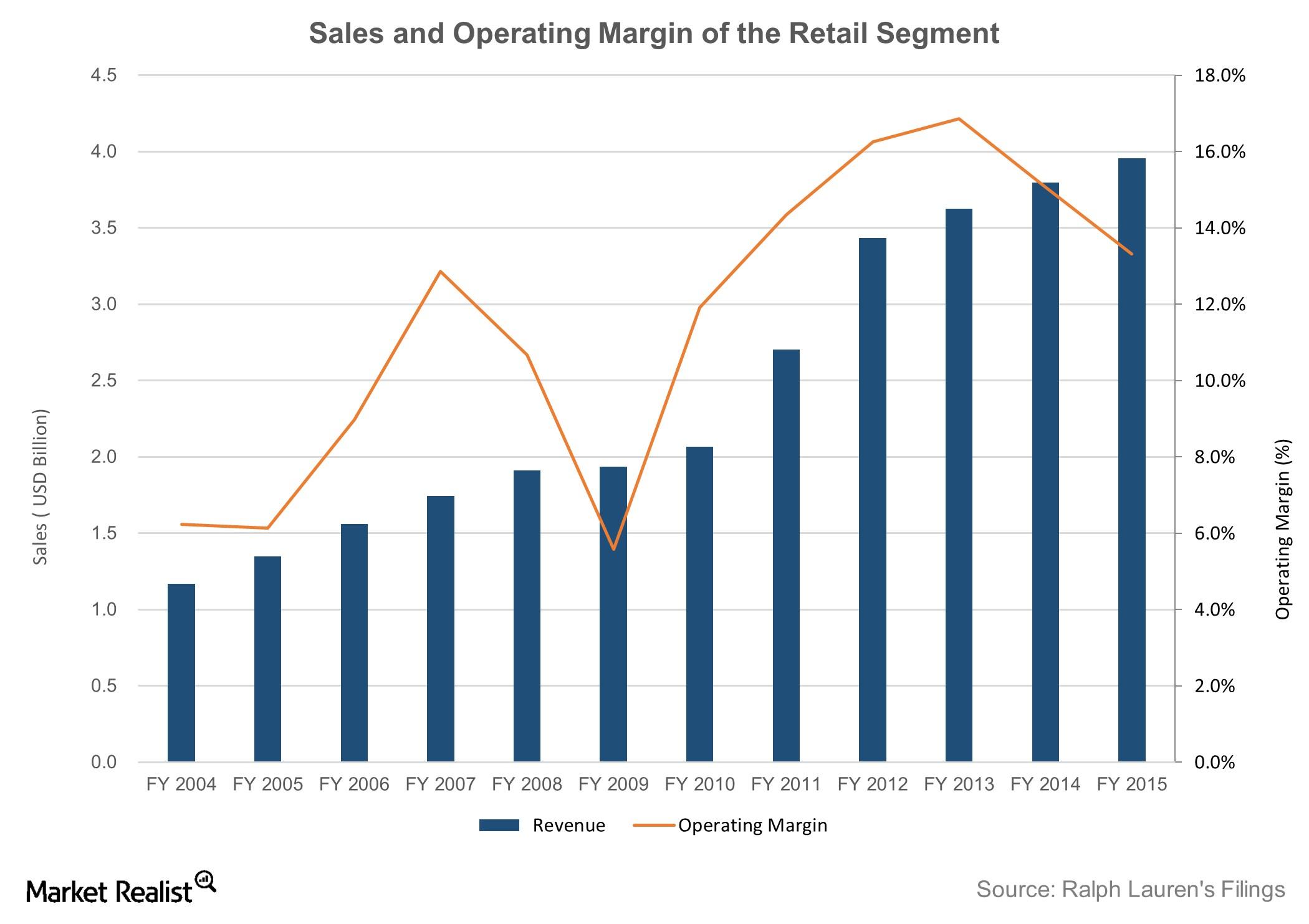

How Ralph Lauren’s Retail Channel Became the Biggest Revenue Generator

In retail, Ralph Lauren operated 143 Ralph Lauren stores, 64 Club Monaco stores, and 259 factory outlets at the end of fiscal 2015.

Challenging Apparel Market Dampened Tommy Hilfiger’s Performance

Tommy Hilfiger is one of the world’s leading designer lifestyle brands. PVH reports its business under the North America and International segments.

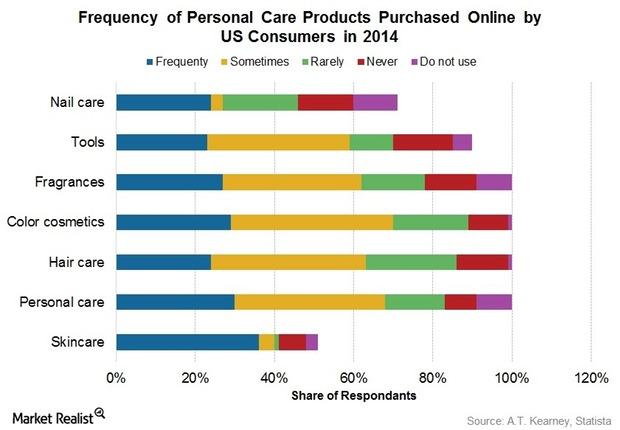

Estée Lauder’s Social and Digital Marketing Strategies

In addition to social media initiatives, Clinique’s “Forecast” mobile application provides weather information and skincare tips related to weather conditions.

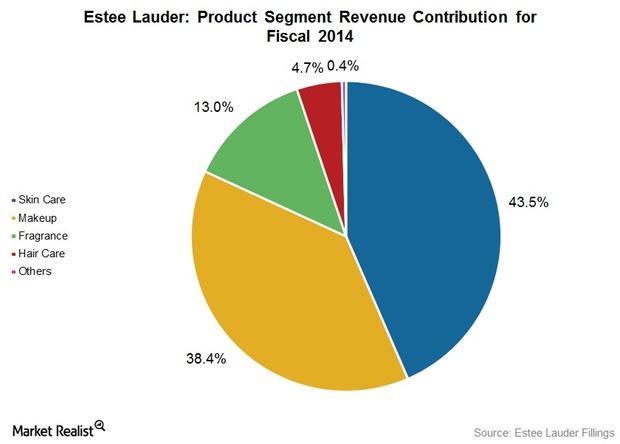

Estée Lauder’s Most Promising Brands

Catering to the premium market, Estee Lauder’s heritage brands include Aramis and Designer Fragrances, Clinique, and Origins.

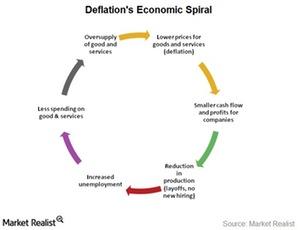

Currency warfare is a way to export deflation

When a country depreciates its currency, its major trading partners depreciate their own currencies. They do this to save their economies from entering into deflation.

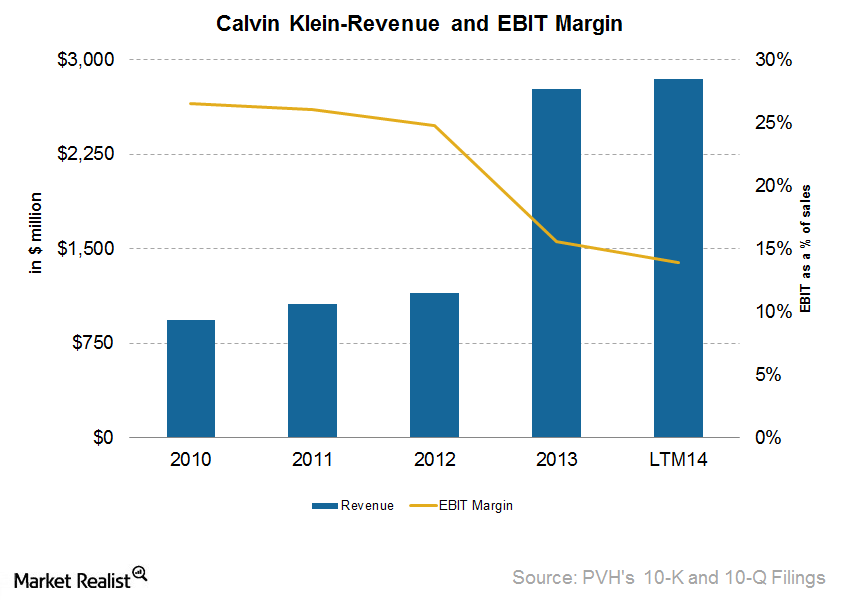

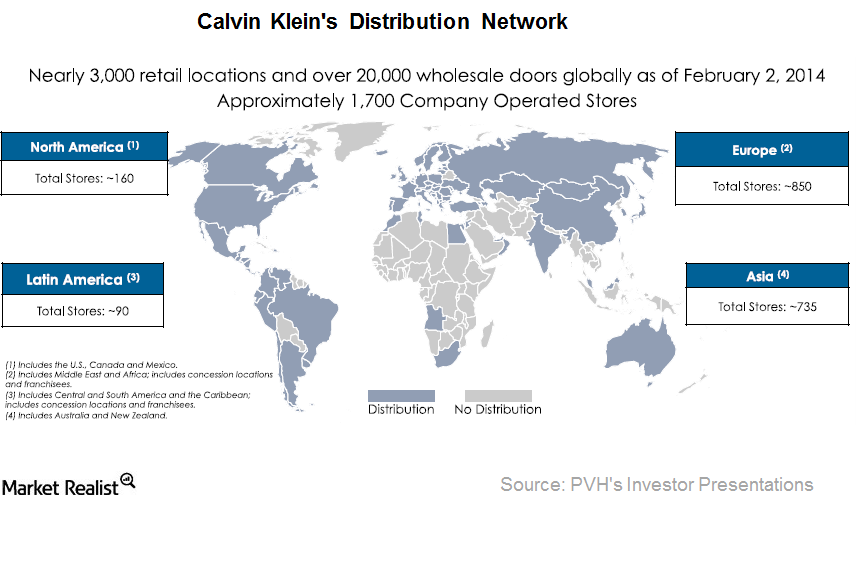

Calvin Klein’s financial performance and growth opportunities

Calvin Klein’s North American operations had a 2% increase in same-store sales growth. However, the international operations decreased by 4%.

Tommy Hilfiger—the proven lifestyle brand

Tommy Hilfiger was founded in 1985. Along with Calvin Klein, it’s one of PVH’s two flagship brands. For 2013, Tommy Hilfiger’s global retail sales were $6.4 billion.

Analyzing the Calvin Klein business

Products sold under the Calvin Klein banner had gross revenue of $7.8 billion in 2013. Of the revenue, PVH reported $2.8 billion.

Design And Brand Positioning: Recent Changes At Coach

At Coach (COH), products are conceptualized by its New York-based design team. The team also directs the design of all Coach products.

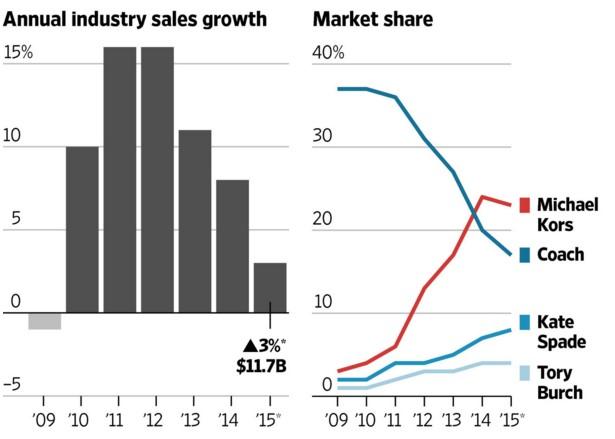

Purse Wars: Coach Seeing Fierce Competition For Market Share

Competition is fierce in all of the affordable luxury industry. And, there are many players, including KORS and KATE.

Coach’s Pricing Strategies And Target Market

Coach’s pricing is lower than other luxury brands. This appeals to HENRYs, or high-earners, not rich yet, among other markets.

An Introduction To Luxury Brand Pioneer Coach

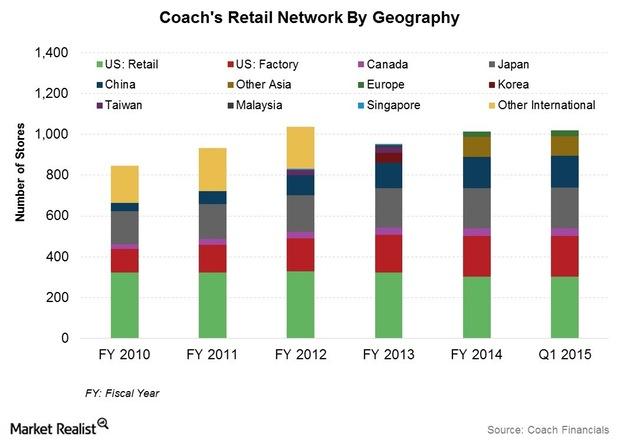

Coach is a well-known premium fashion brand. In recent years, Coach has faced increasing competition from newer entrants in the affordable luxury market.