Coach Inc

Latest Coach Inc News and Updates

Luxury Brands Dive into NFTs, Coach Will Release an NFT Collection

Coach is joining the NFT space and collaborating with GQLab to create its own NFTs. What other luxury brands have NFTs?

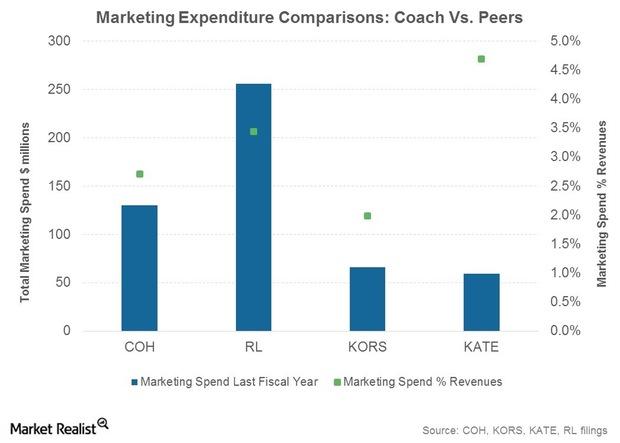

Understanding Coach’s Marketing Strategies

To support its direct marketing initiatives, Coach has a database of 24 million households in North America and 10 million in Asia.

Inside Ralph Lauren’s Key Strengths, Potential Upsides, and Key Risks

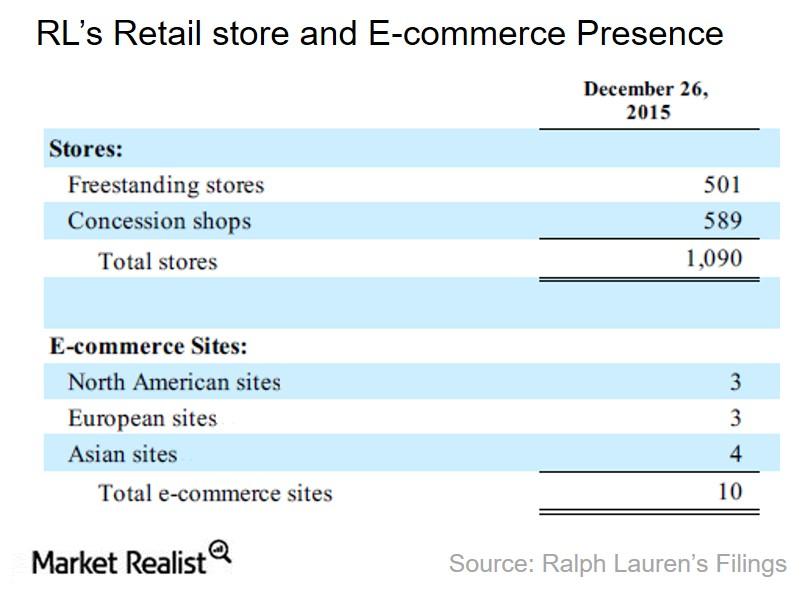

Ralph Lauren’s merchandise is available through ~13,000 wholesale distribution channels, 501 retail stores, 589 shops-within-shops, and ten websites.

Opportunities and Challenges for Coach

Coach expects to realize $160 million in annual savings due to its restructuring initiatives from fiscal 2016 onward. It also expects to maintain its annual dividend of $1.35 per share.

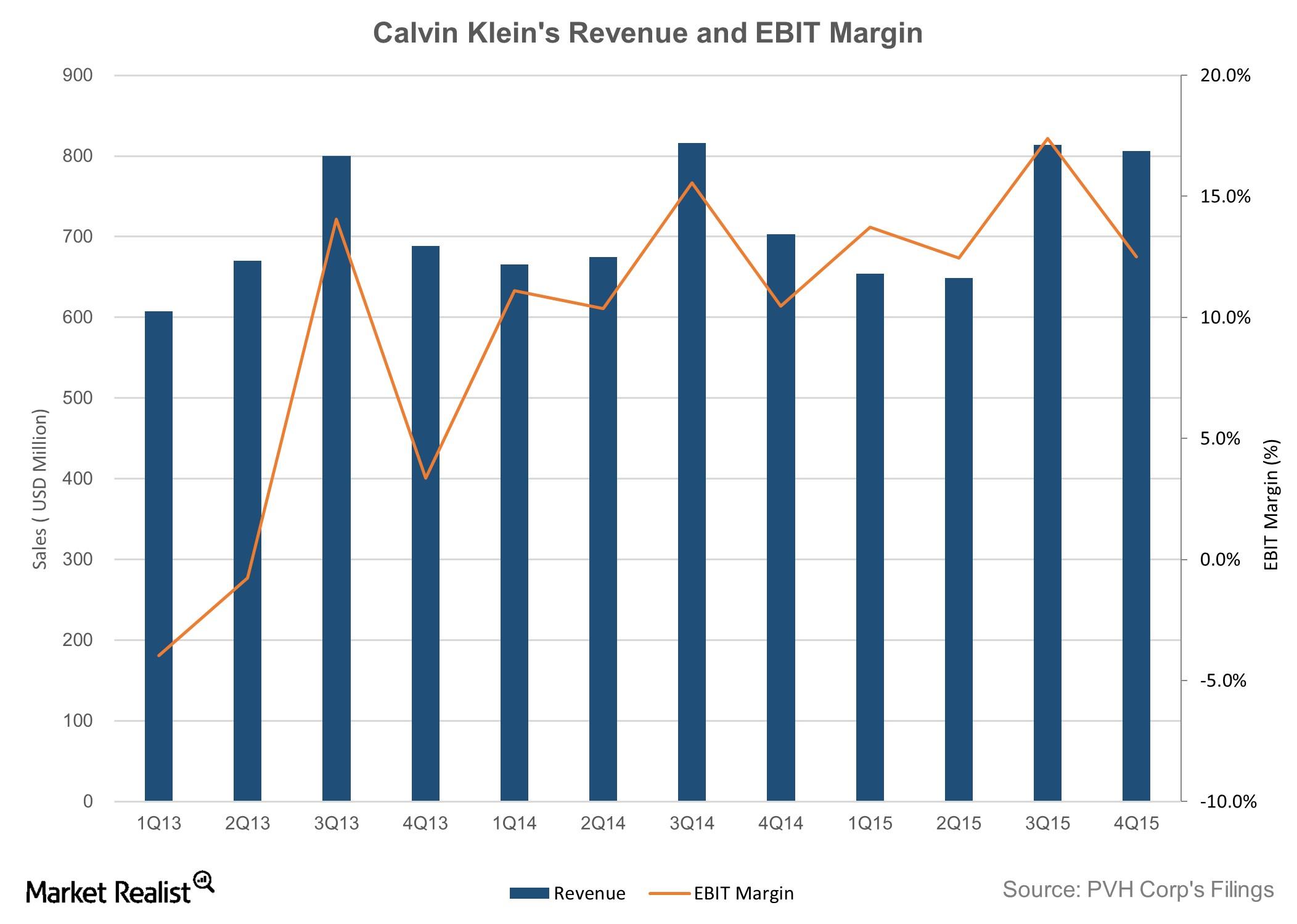

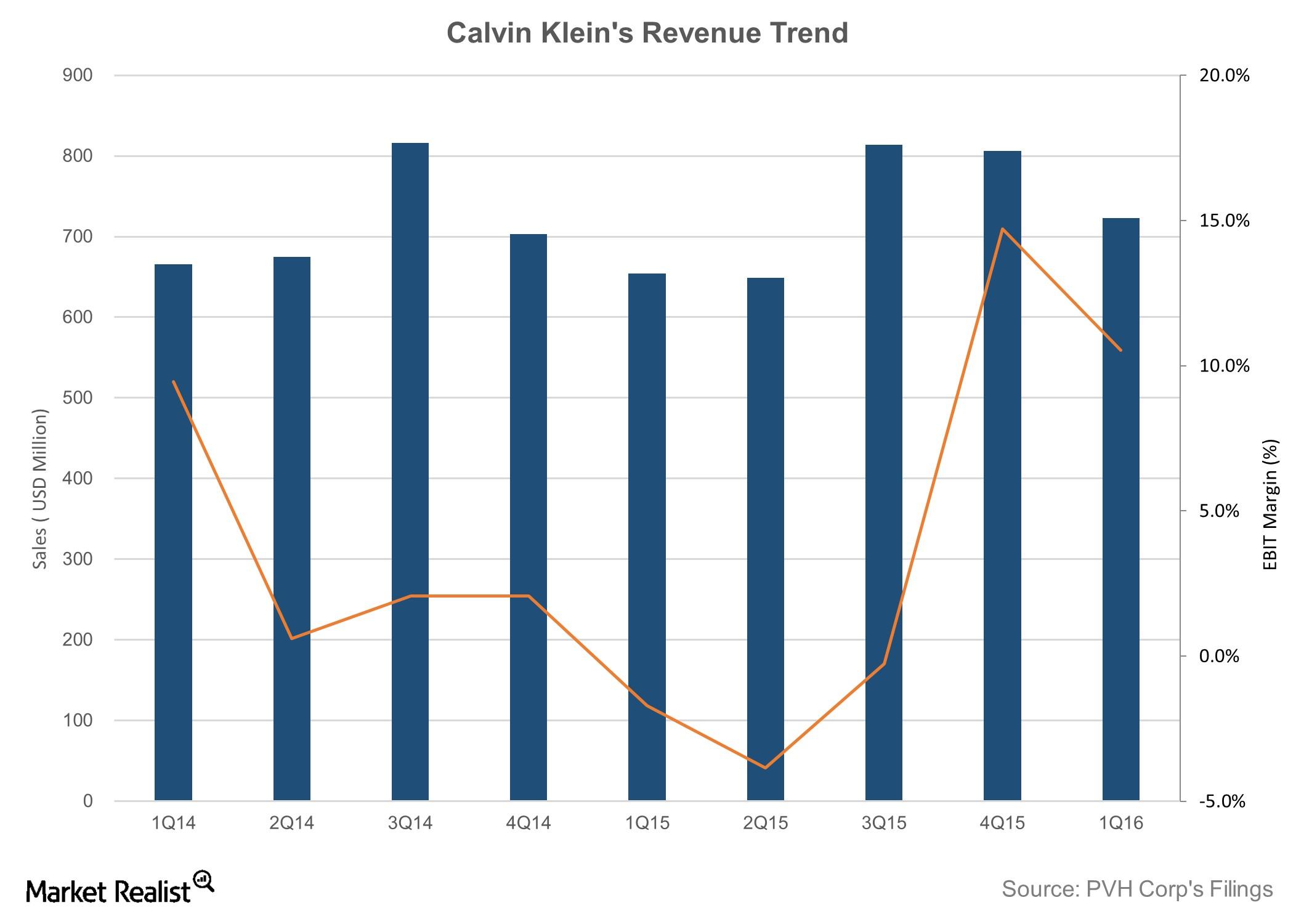

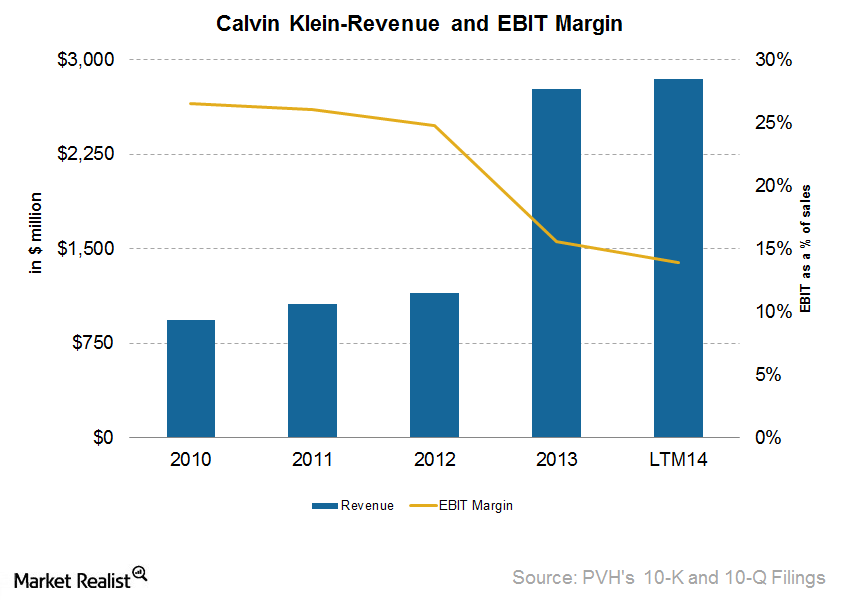

How Calvin Klein Navigated through Tough Macro Conditions

The company derived 46% of its operating income from the Calvin Klein business in fiscal 2015 compared to 37% in fiscal 2014.

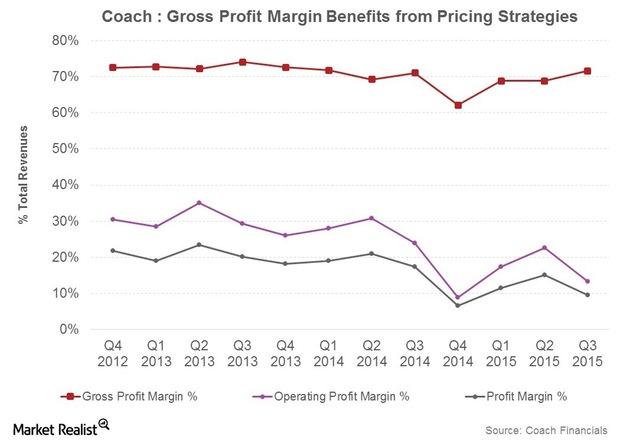

Coach’s Pricing Strategies Benefit Its Margins

Coach’s gross margin expanded to 71.6% in 3Q15 from 71.1% in 3Q14. Coach reduced the frequency of its in-store and online promotions, which should boost its margins.

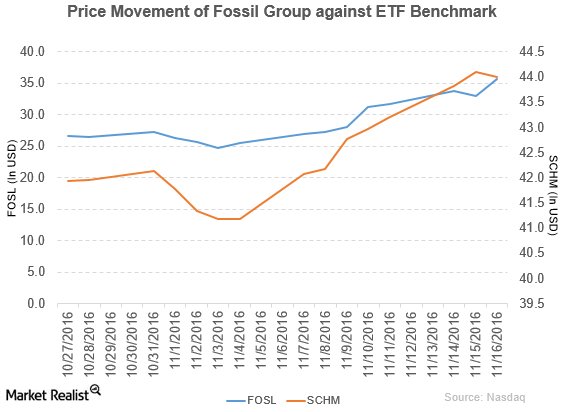

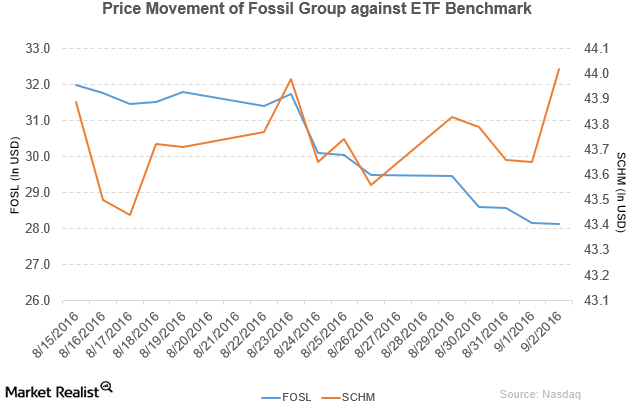

KeyBanc Capital Markets Upgrades Fossil to ‘Overweight’

Fossil Group (FOSL) has a market cap of $1.6 billion. It rose 8.4% to close at $35.70 per share on November 16, 2016.

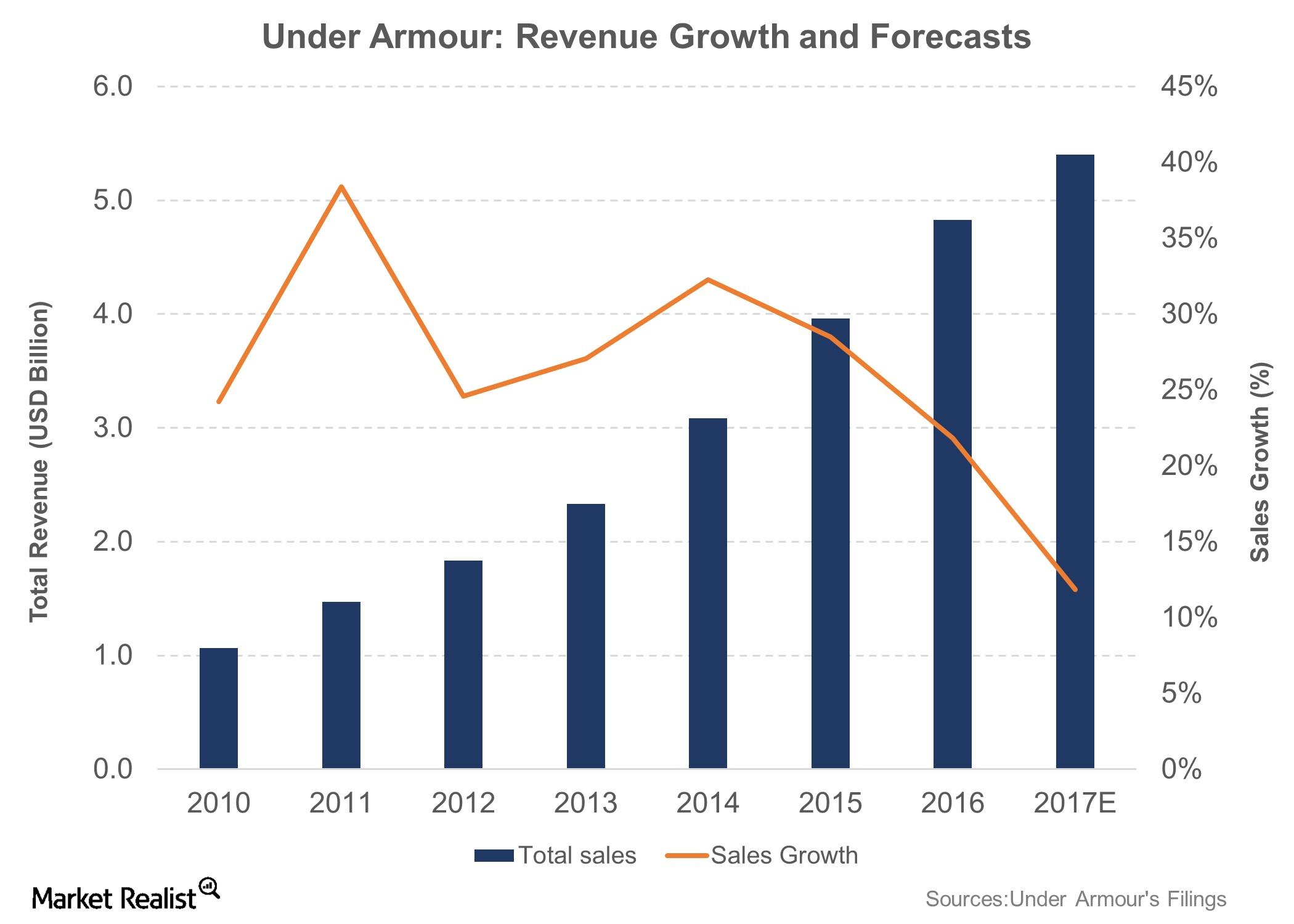

Under Armour’s Bonds Downgraded to Junk Status by S&P Global Ratings

S&P Global Ratings lowered the credit rating of Under Armour (UAA) stock to junk status after the company reported weak 4Q16 results and a gloomy sales outlook. The rating on UAA’s bonds dropped from BBB- to BB+.

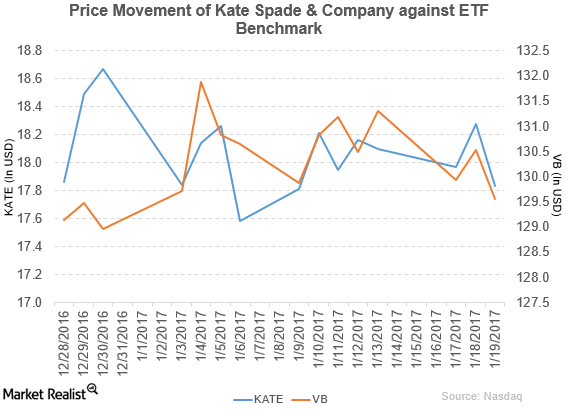

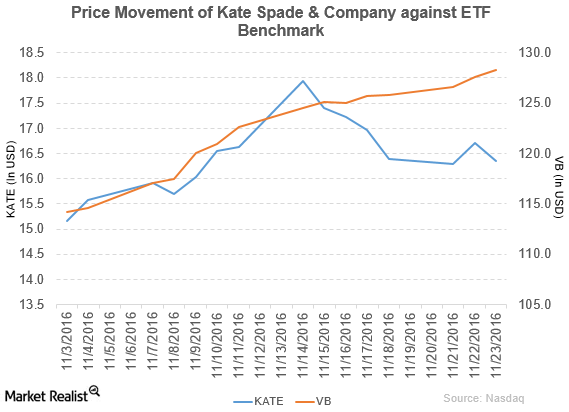

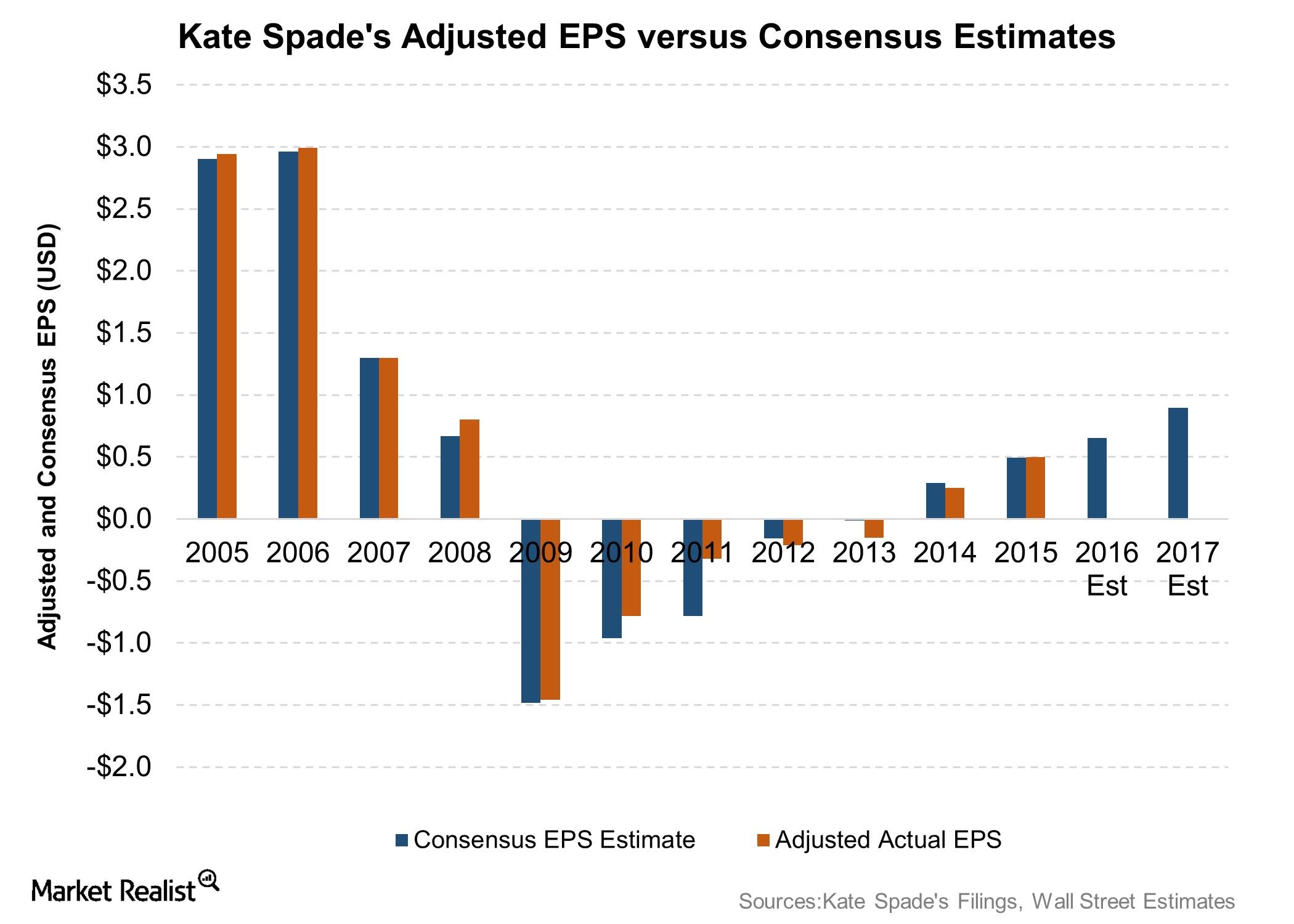

Bank of America/Merrill Lynch Downgrades Kate Spade to ‘Neutral’

Kate Spade (KATE) reported fiscal 3Q16 net sales of $316.5 million—a rise of 14.1% compared to net sales of $277.3 million in fiscal 3Q15.

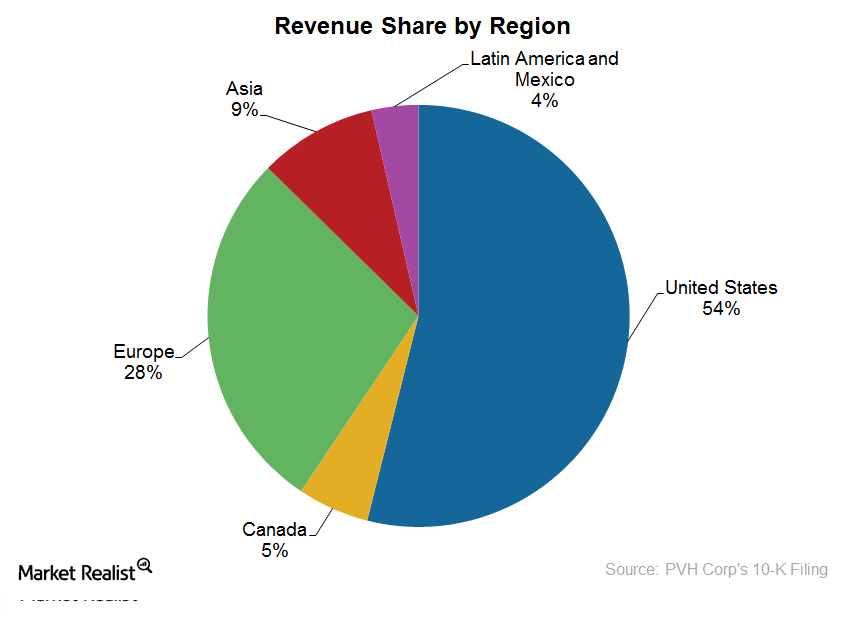

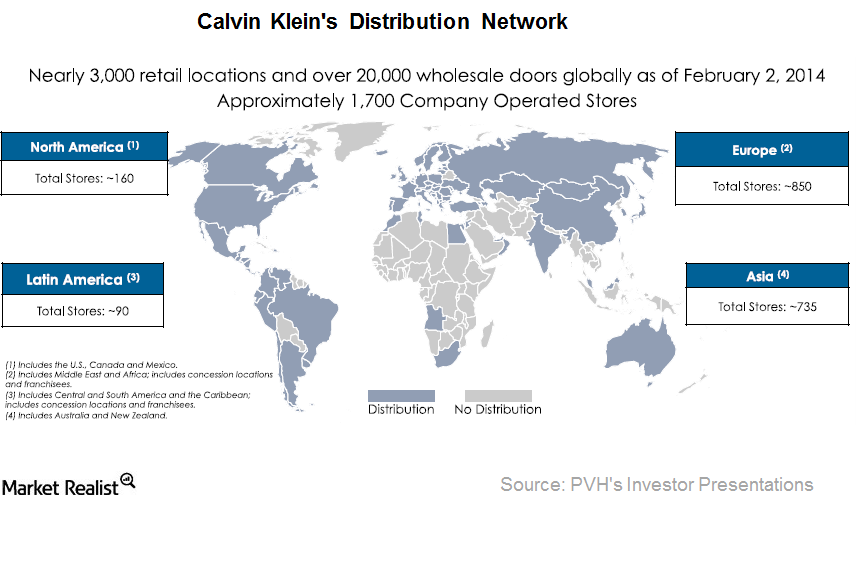

An overview of PVH’s business by geographies

We’ll look at PVH’s operations by geographies. It markets its products in over 100 countries through wholesale partners. It has over 4,700 retail locations.

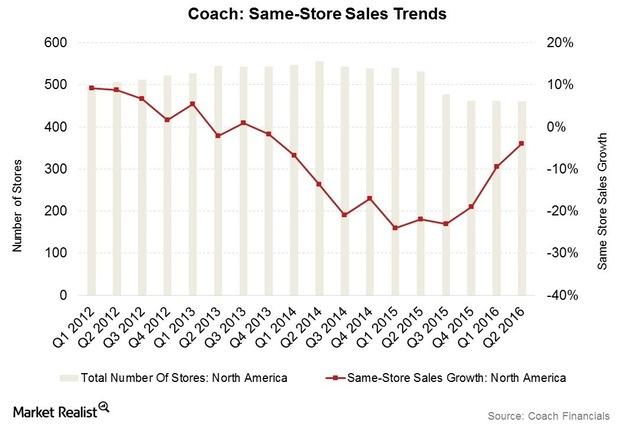

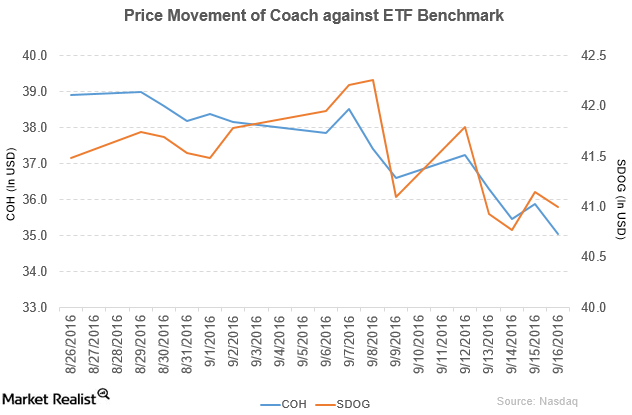

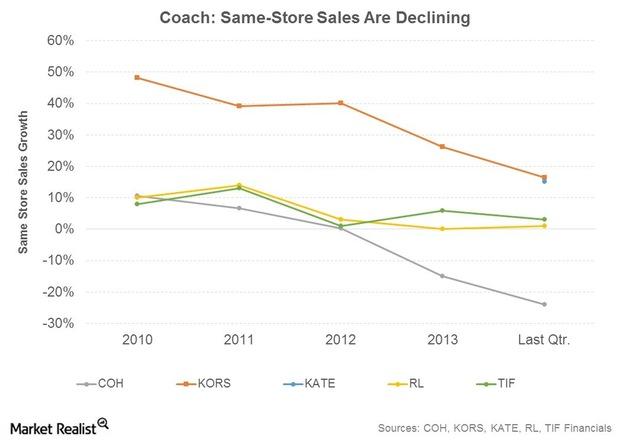

Can Coach Revive North America Same-Store Sales in Fiscal 2016?

Coach’s (COH) performance in North America remained pressured in the quarter, with sales declining 7% in reported terms to $731 million.

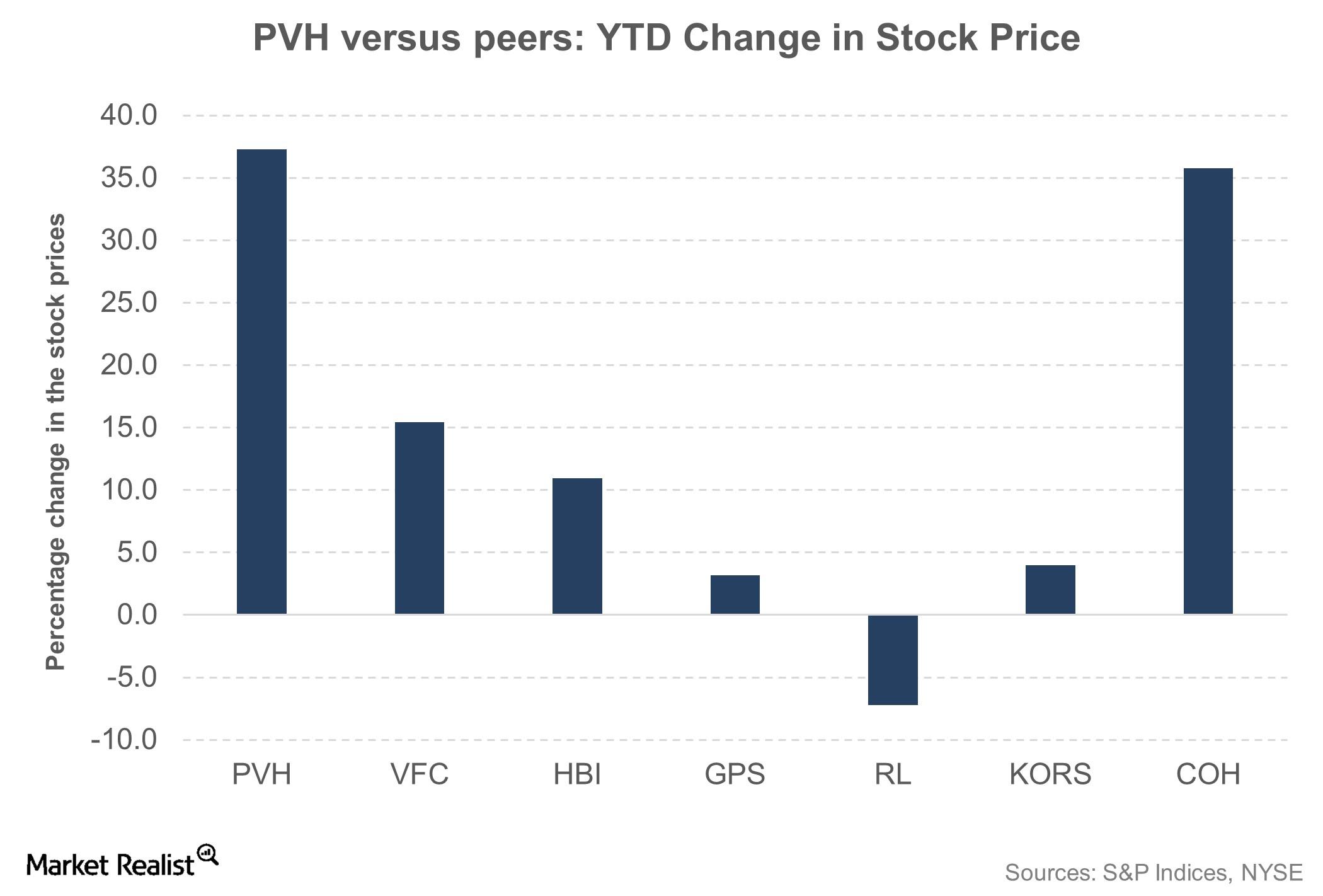

What Wall Street Thinks of PVH Corp Now

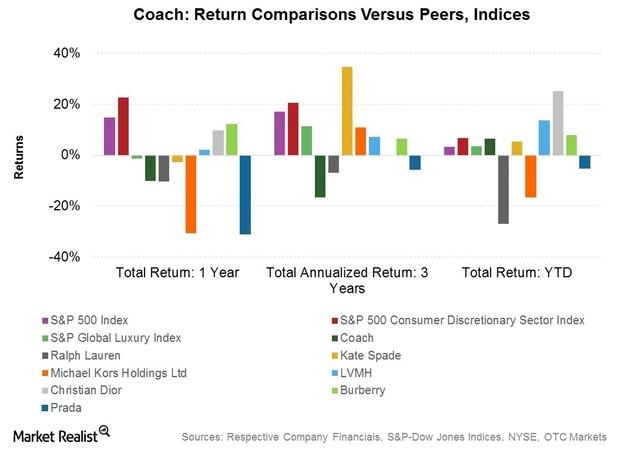

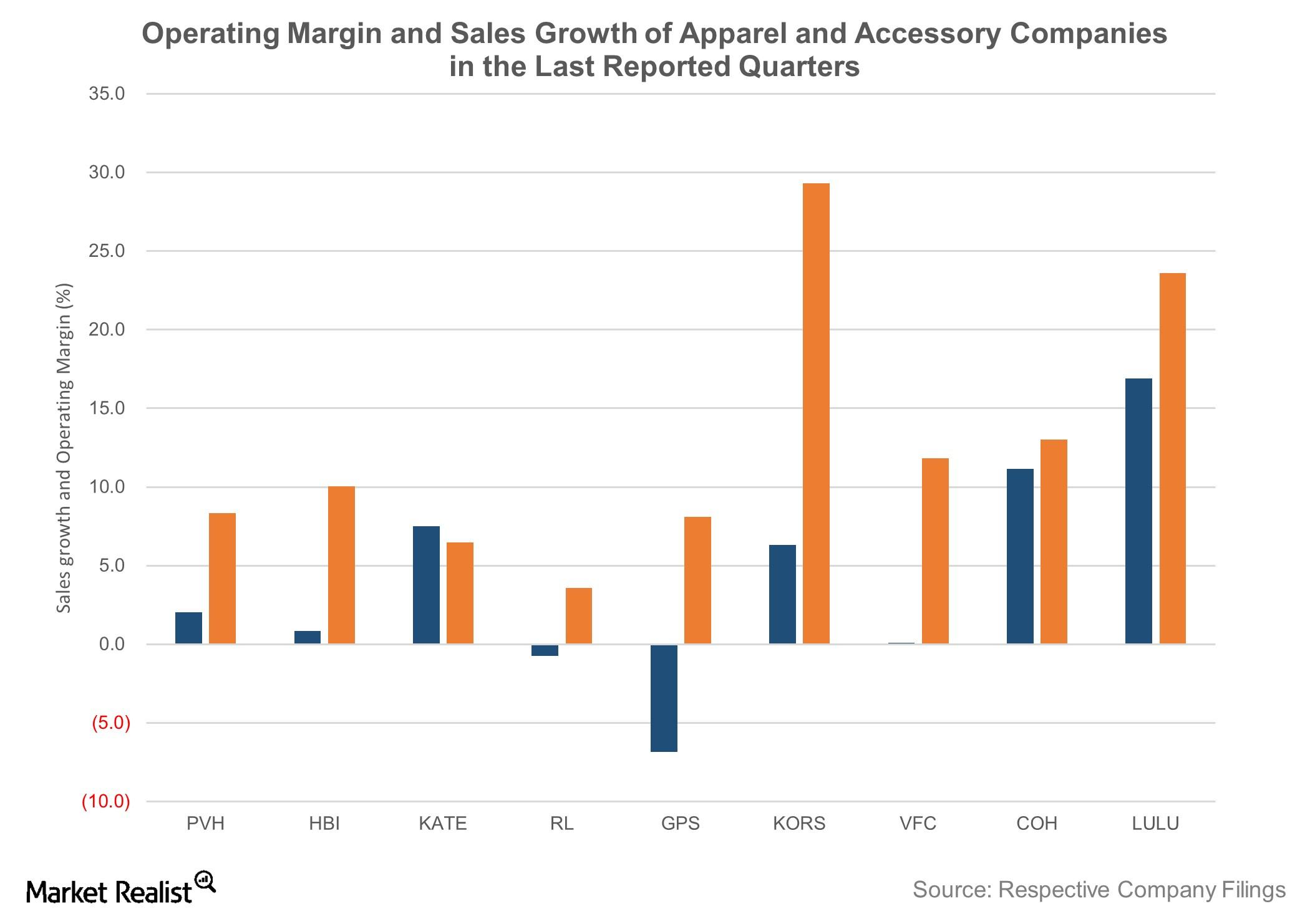

PVH’s YTD gains have outperformed Hanesbrands’ (HBI) 11%, VF Corporation’s (VFC) 15.5%, Michael Kors’s (KORS) 4%, and Ralph Lauren’s (RL) -7.2% gains.

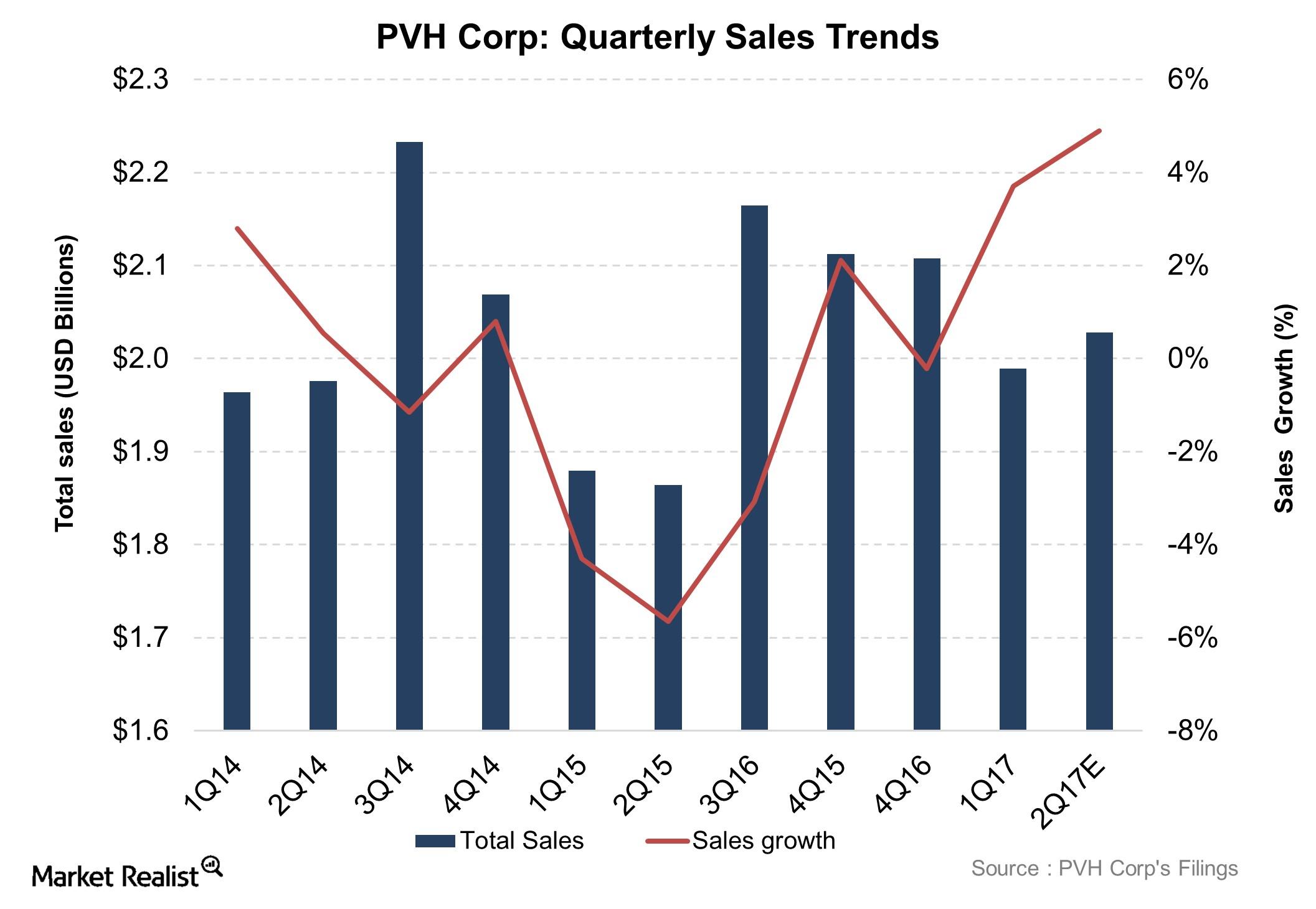

Despite Currency Headwinds, PVH Delivers Better Growth than Peers

PVH Corporation’s (PVH) top line is predicted to grow 4.9% YoY (year-over-year) in 2Q17.

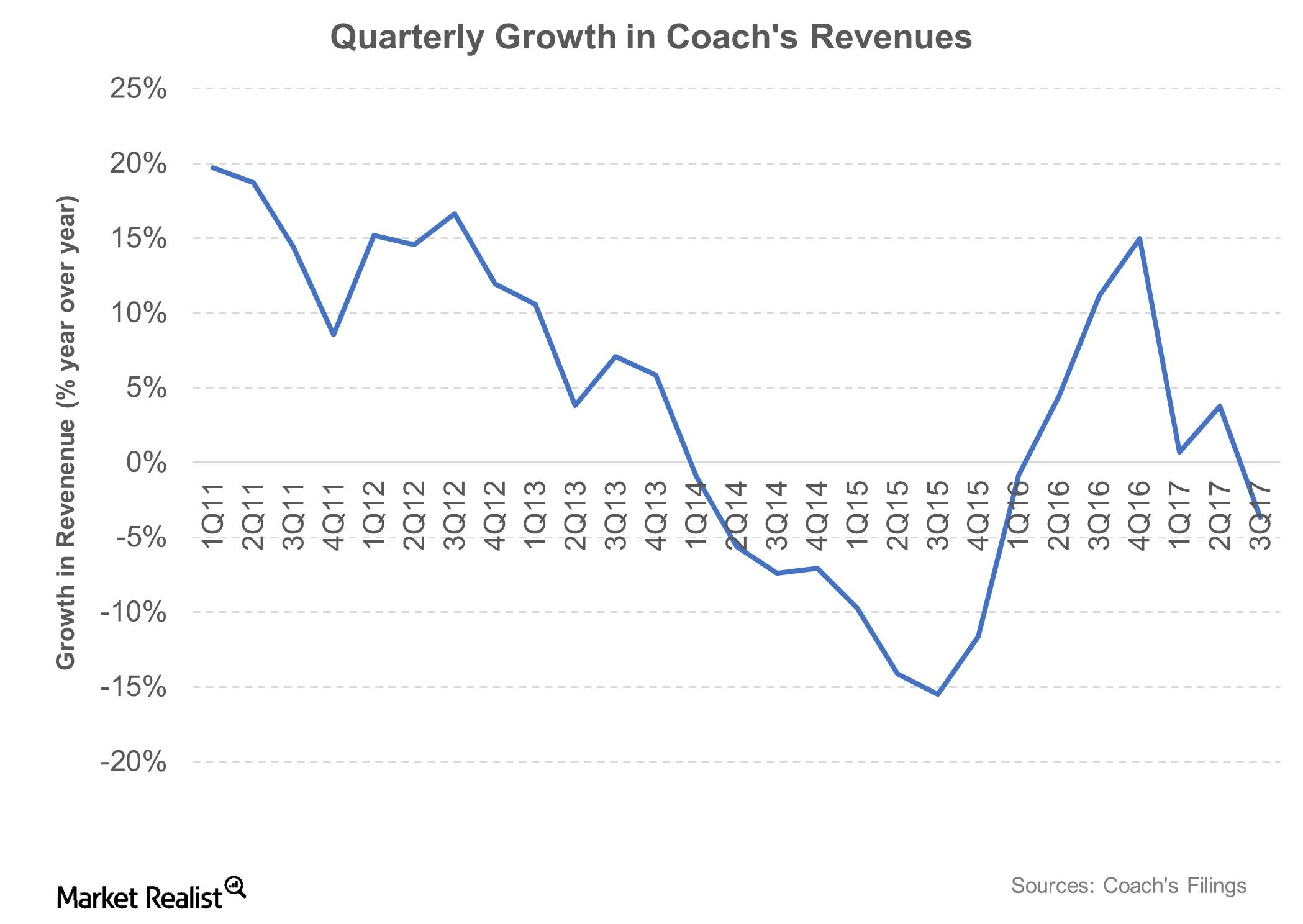

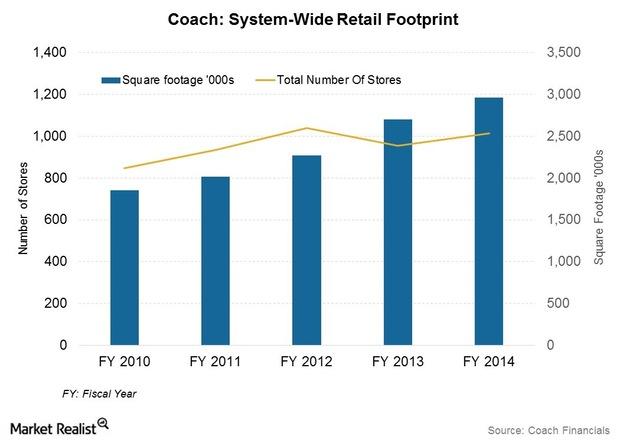

Coach’s Comeback Story and Strategy Change

Coach pulled out of 250 department stores in the US during its last reported quarter, reducing the department store count by ~25% in 2017.

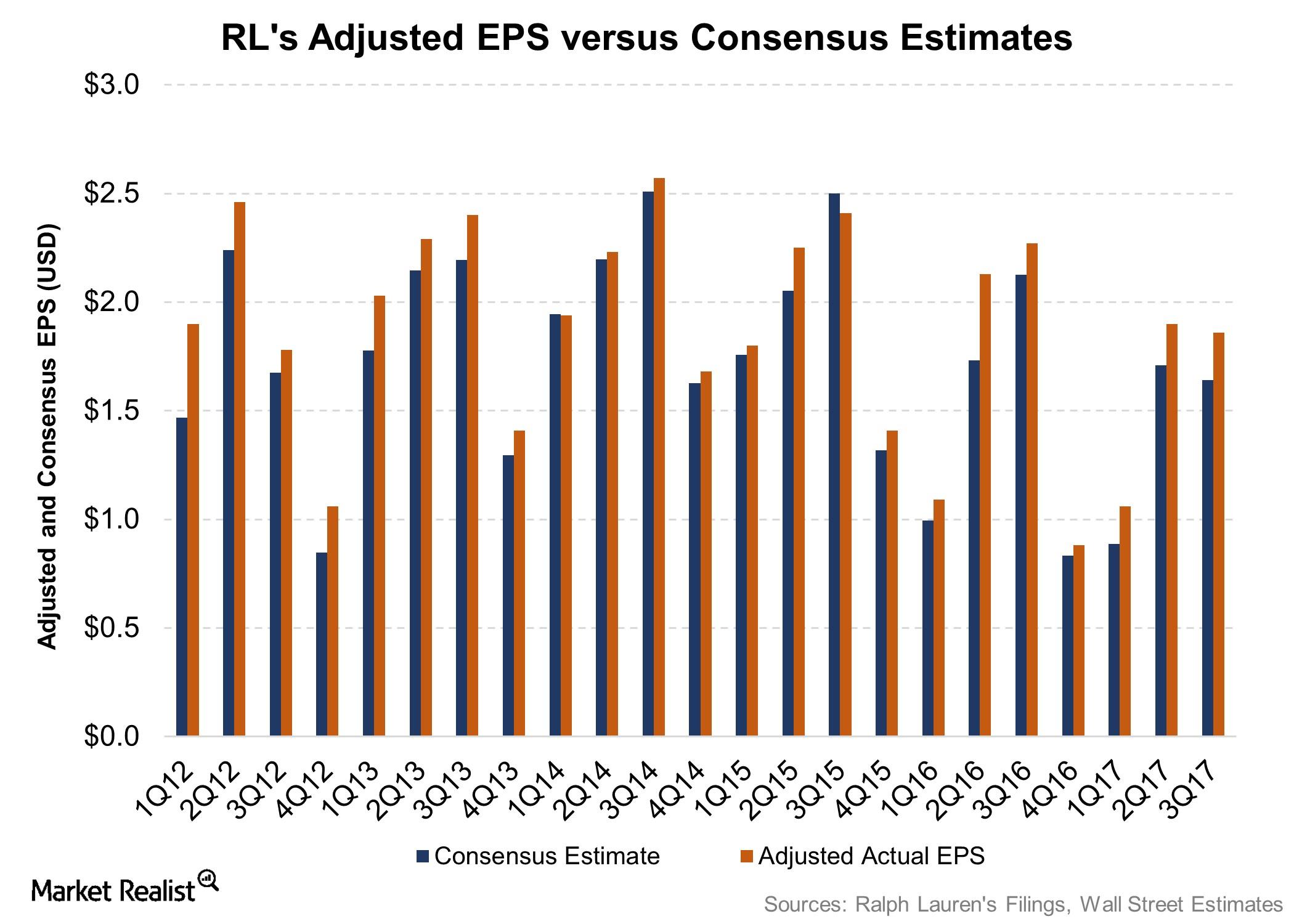

Inside Ralph Lauren’s Fiscal 3Q17 Results

RL delivered better-than-expected earnings and in-line revenues, but its EPS fell 18% YoY to $1.86.

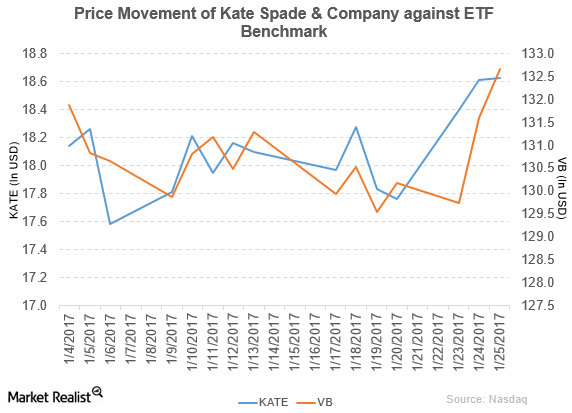

Telsey Downgraded Kate Spade & Company to ‘Market Perform’

On January 25, 2017, Telsey downgraded Kate Spade’s rating to “market perform” from “outperform.” It reported fiscal 3Q16 net sales of $316.5 million.

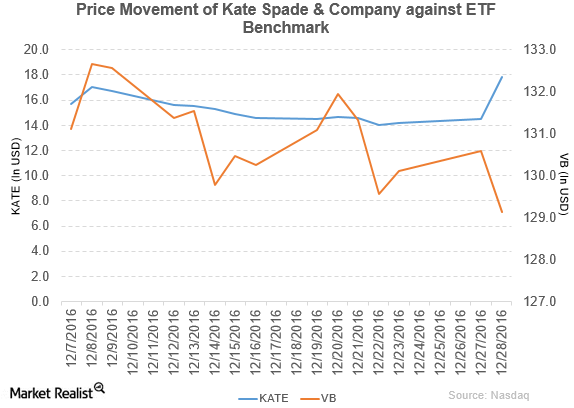

Why Did Kate Spade Stock Rise on December 28?

Kate Spade (KATE) rose more than 23.0% on December 28, 2016, after the report that the company is planning to sell its businesses with the help of investment banker.

Wolfe Research Downgraded Kate Spade to ‘Peer Perform’

On November 23, 2016, Wolfe Research downgraded Kate Spade & Company’s rating to “peer perform” from “outperform.”

How Will Kate Spade’s Fiscal 2016 Performance Shape Up?

As a result of its second quarter headwinds, Kate Spade (KATE) lowered its full fiscal 2016 outlook.

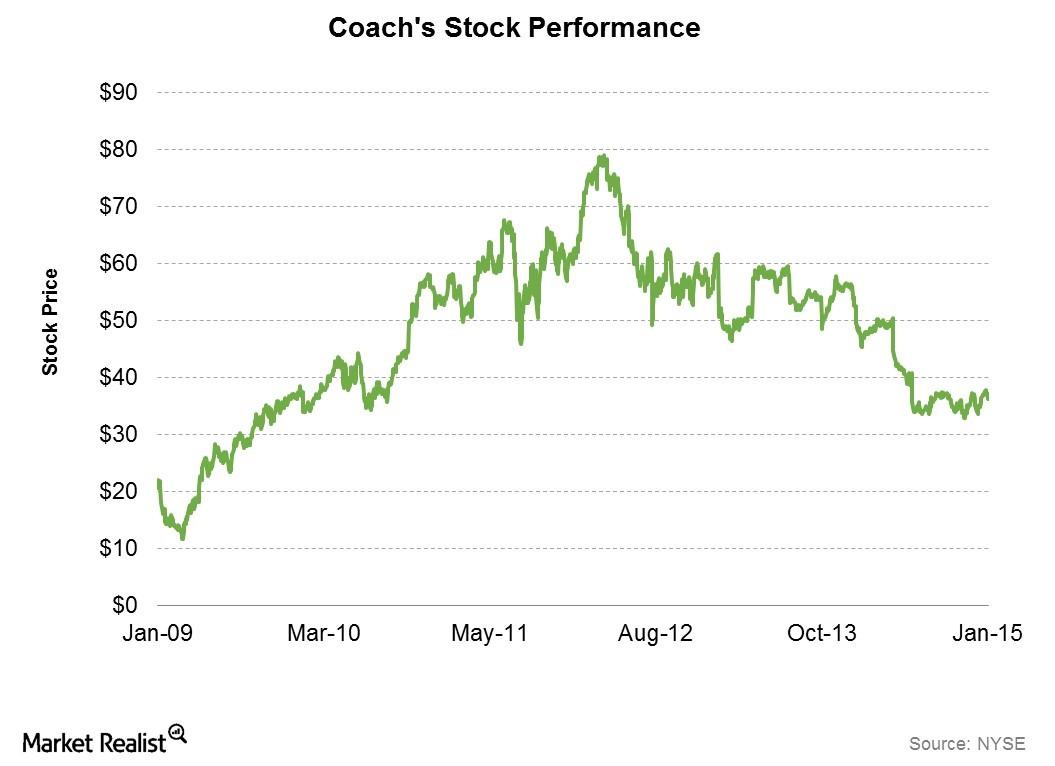

Morgan Stanley Downgrades Coach to ‘Underweight’

Coach (COH) fell 4.2% to close at $35.04 per share during the second week of September 2016.

Fossil Will Ship Smartwatches Based on Qualcomm Technologies

Fossil fell by 4.6% to close at $28.13 per share during the fifth week of August, with weekly, monthly, and YTD price movements of -4.6%, -4.8%, and -23.1%.

Can Calvin Klein Drive PVH’s Sales Growth in 2Q16?

Among PVH’s (PVH) three segments, Calvin Klein has been the best performer. The brand accounts for more than 37% of the company’s total revenue.

Inside Kate Spade’s Key Focus Areas

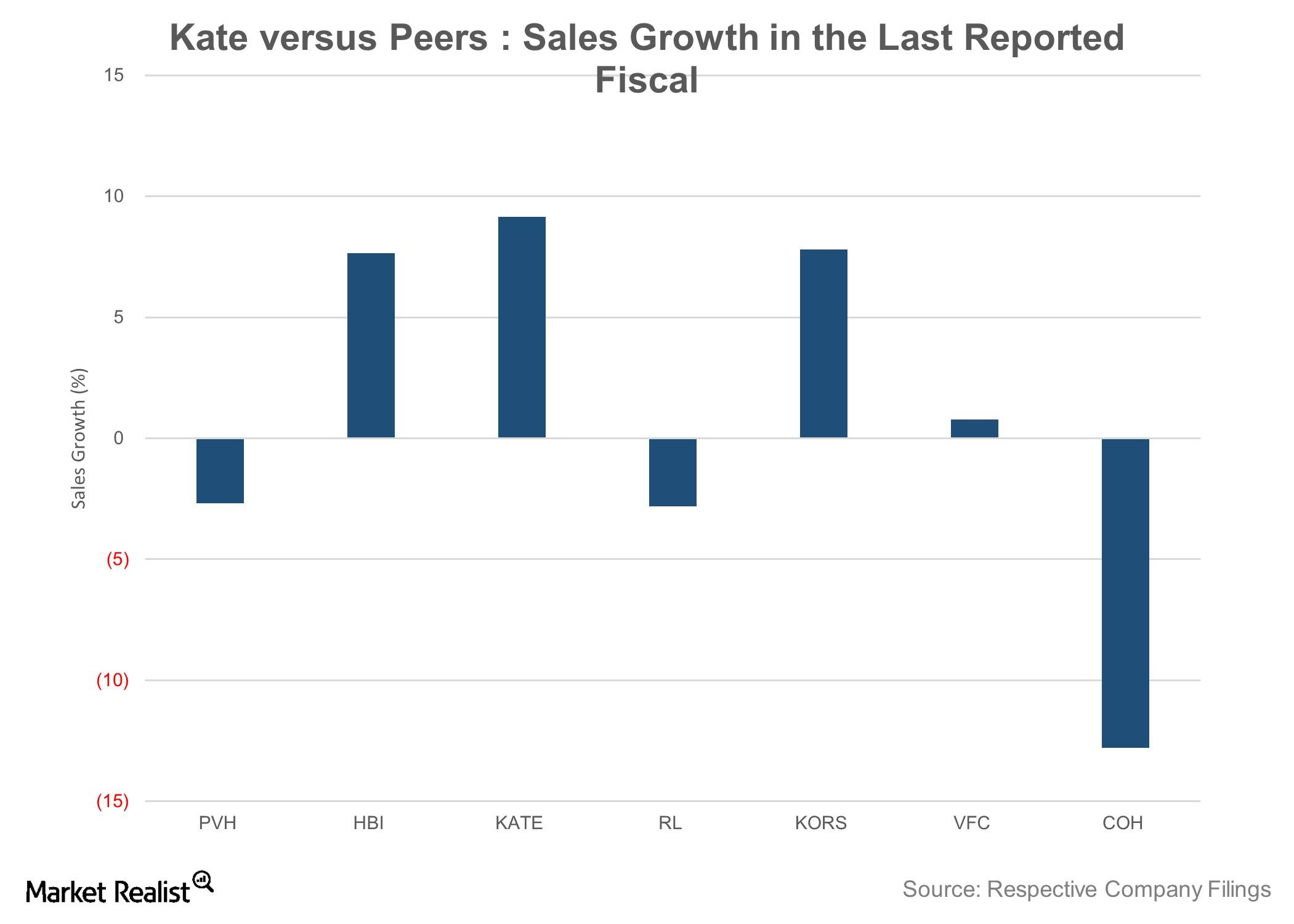

KATE’s top line grew by 9.1% YoY (year-over-year) in fiscal 2015, as compared to a 7.7% YoY increase for Michael Kors and a 12.7% YoY decline for Coach.

How Is Kate Spade Positioned in the American Affordable Luxury Segment?

Kate Spade recorded total sales of $1.3 billion in the past twelve months. Michael Kors and Coach saw sales of $4.7 billion and $4.3 billion, respectively.

How Calvin Klein and Tommy Hilfiger Gave PVH a Strong 1Q16

Phillips-Van Heusen (PVH) posted $1.9 billion in revenue for fiscal 1Q16. That’s a 2.1% YoY increase on a GAAP basis.

Inside Ralph Lauren’s Liquidity Position and Financial Health

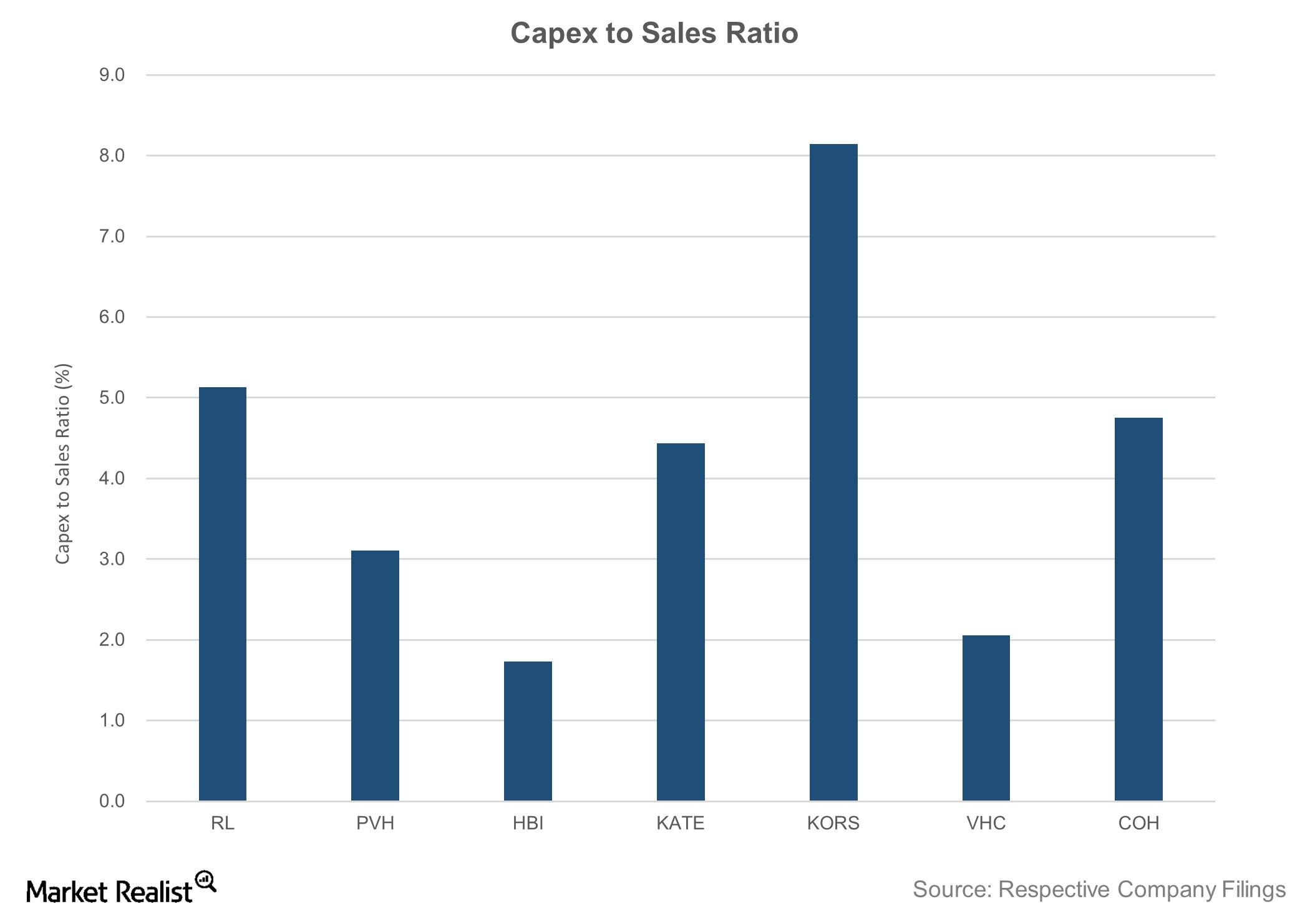

Ralph Lauren has a $1.7 billion capex. Its capex-to-sales ratio of 5.1% (as of March 28, 2015) is among the highest in its fashion and apparel peer group.

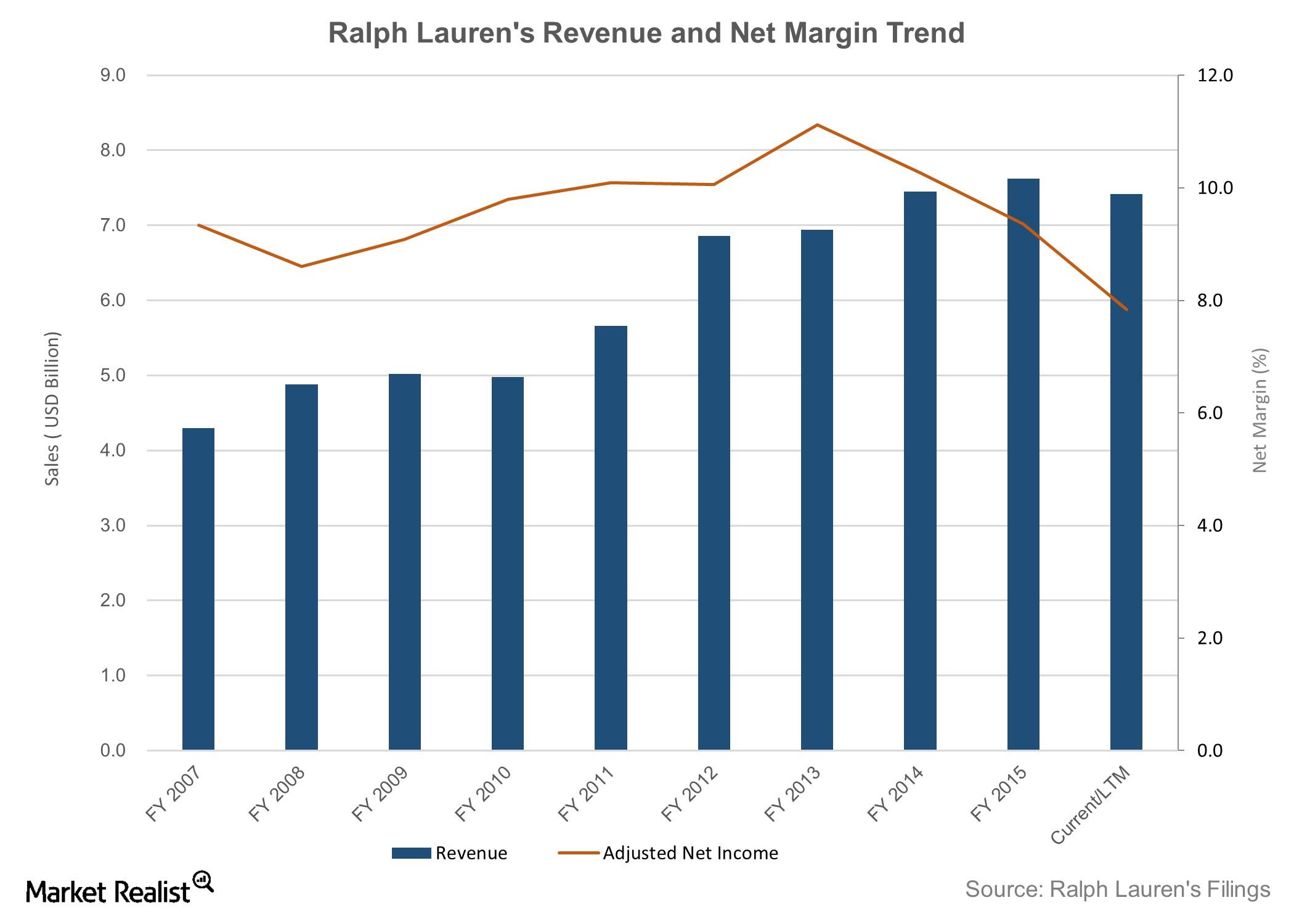

Behind Ralph Lauren’s Historical Financial Performance

Ralph Lauren’s top line has grown by a CAGR of around 9% over the past five fiscal years to reach $7.6 billion in fiscal 2015.

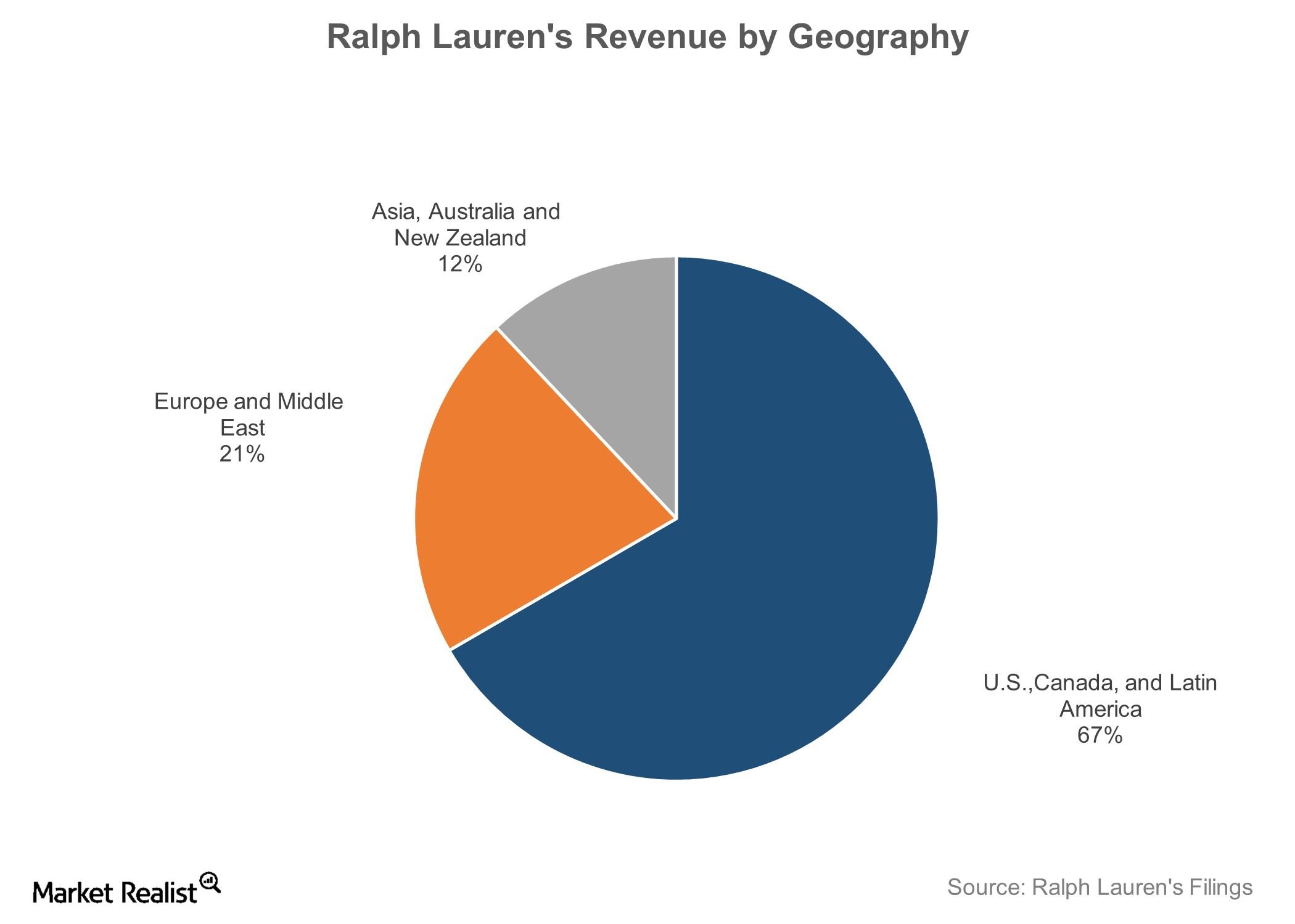

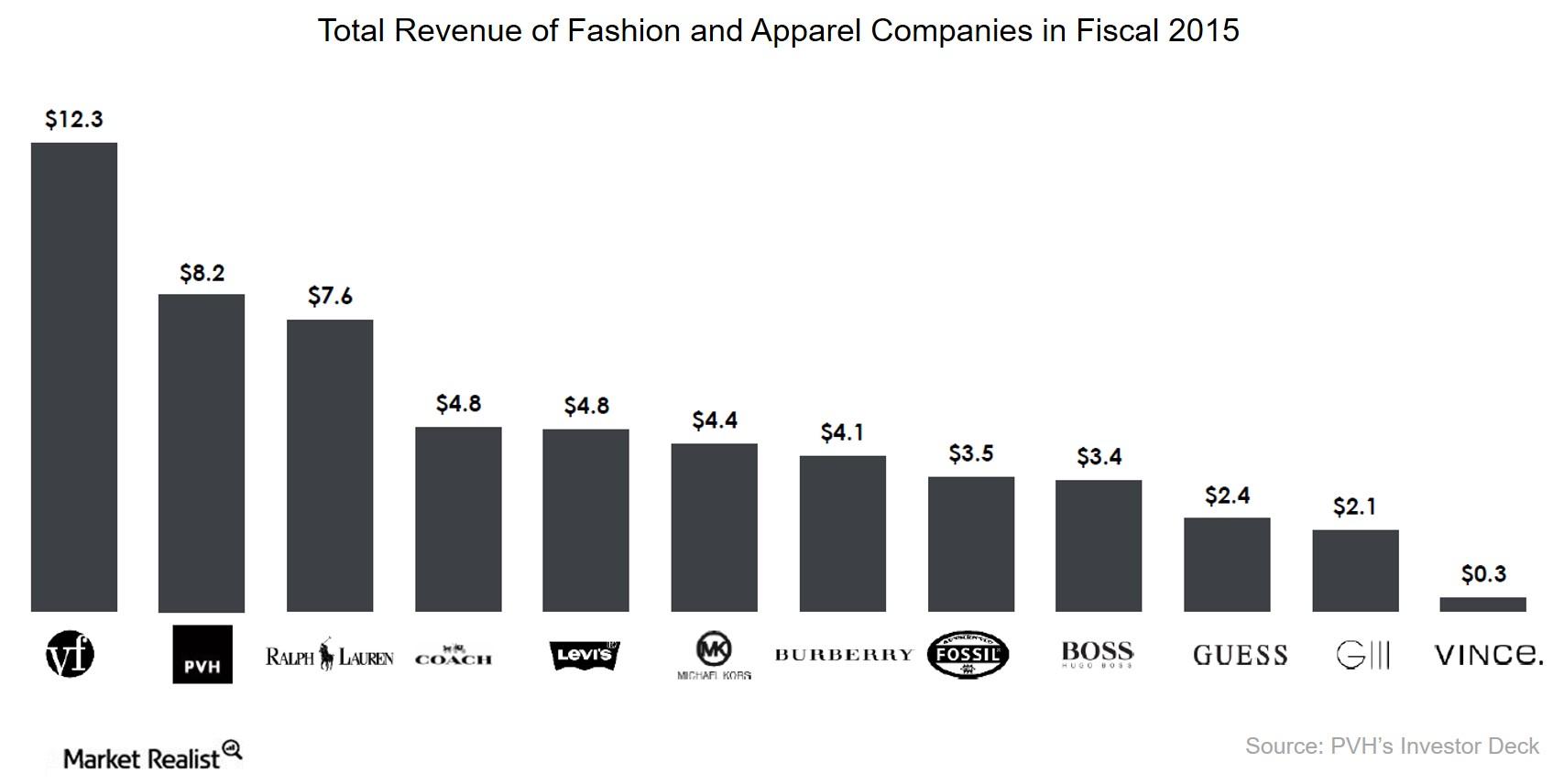

Ralph Lauren: Where It Began, What It Offers, and Who It’s up Against

Ralph Lauren was founded by Ralph Lauren in 1967 and offers apparel, accessories, home products, and fragrances under several well-known brand names.

Introducing Ralph Lauren: Everything You Need to Know at a Glance

Ralph Lauren is the third-largest branded apparel company (by revenue) in the US and has grown at a CAGR of around 9% over the past ten years.

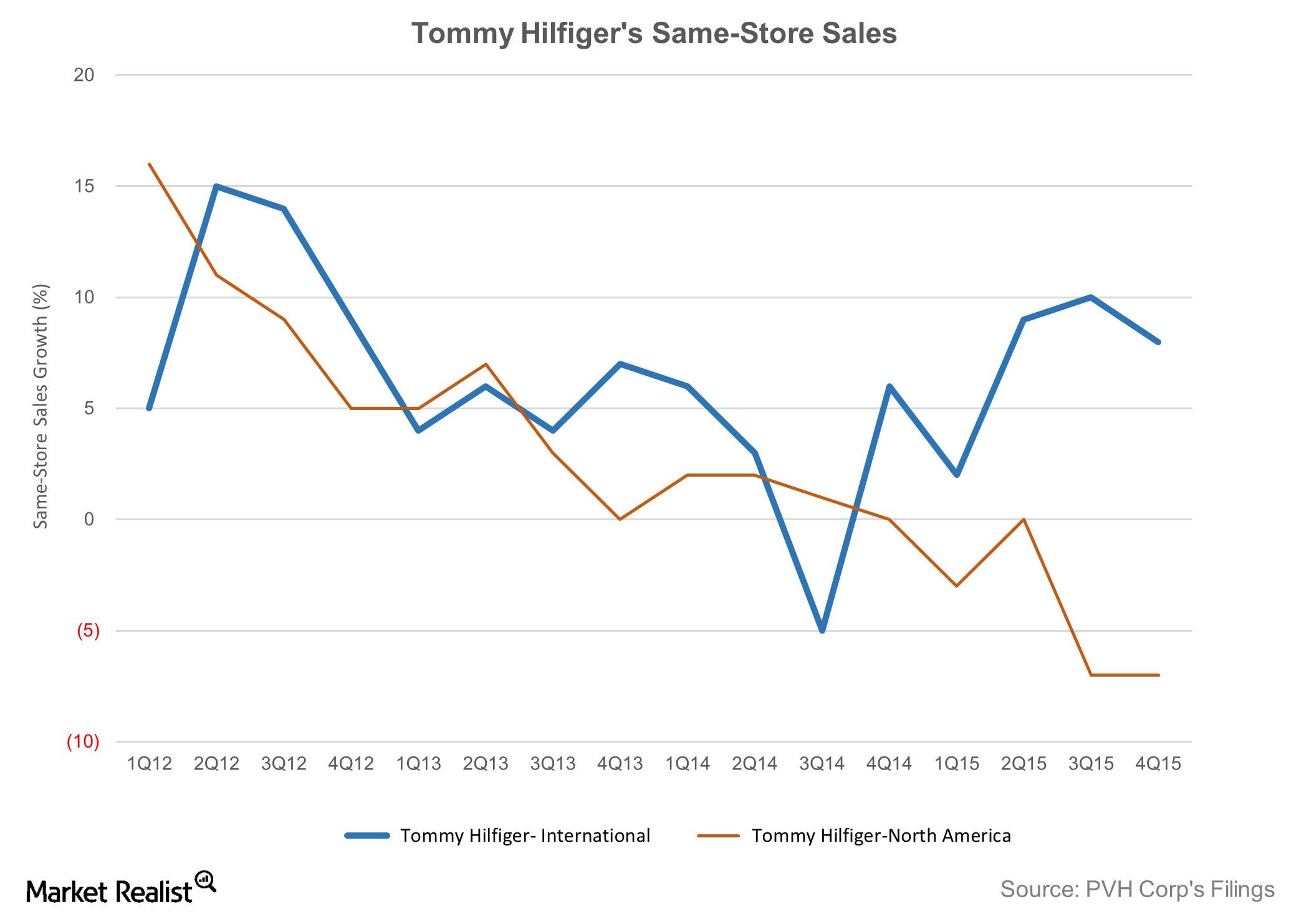

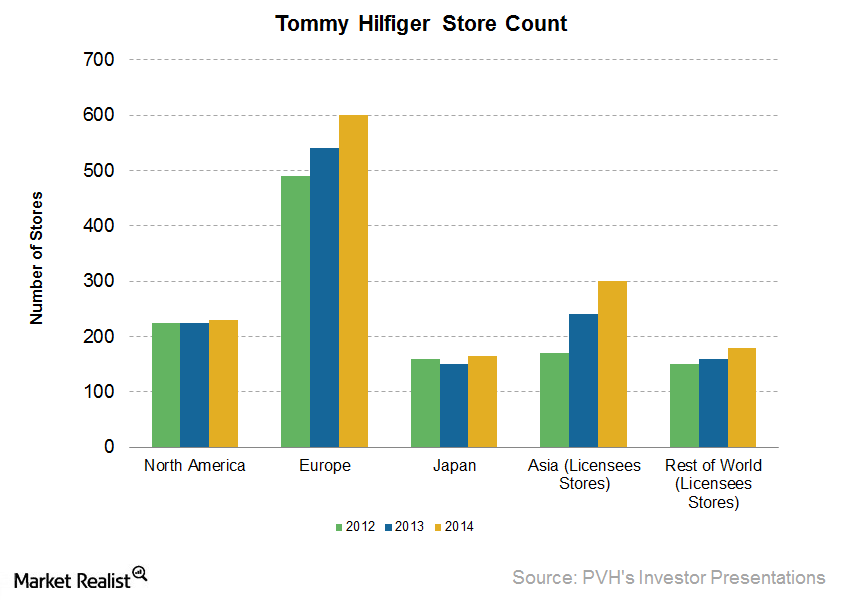

Challenging Apparel Market Dampened Tommy Hilfiger’s Performance

Tommy Hilfiger is one of the world’s leading designer lifestyle brands. PVH reports its business under the North America and International segments.

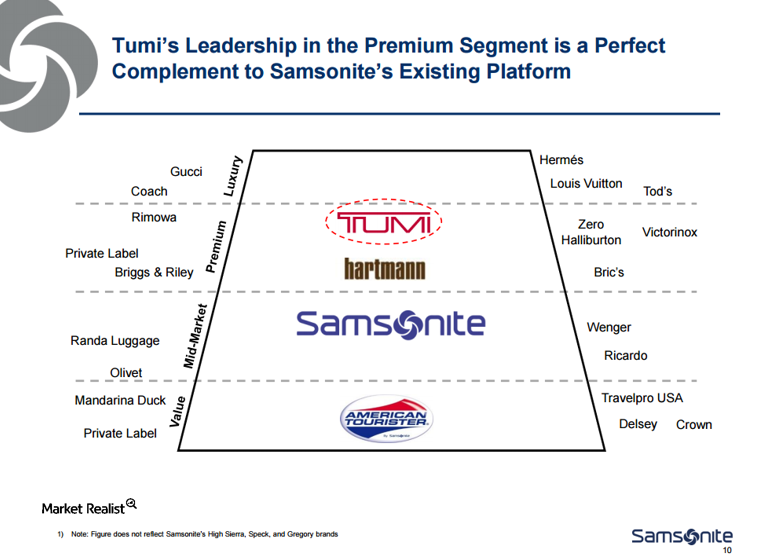

Can the Samsonite-Tumi Merger Get Antitrust Approval?

Samsonite will need to file for merger approval under the Hart-Scott-Rodino Antitrust Improvements Act. The companies will need to file for Canadian antitrust approval.

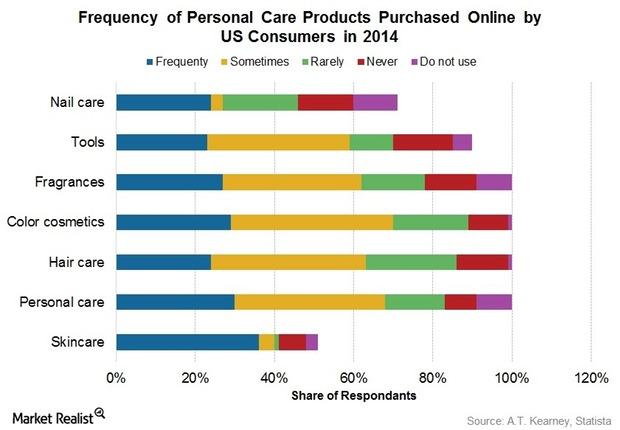

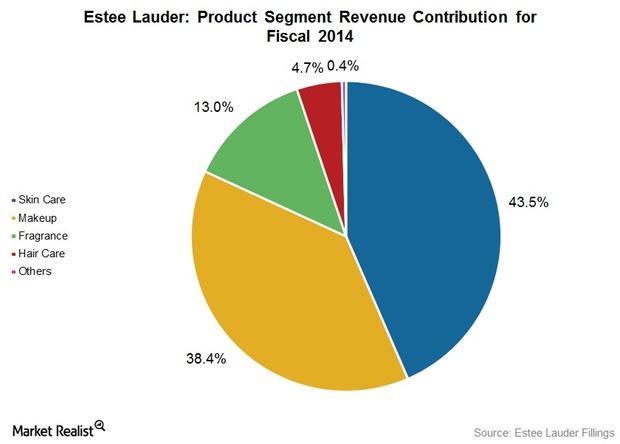

Estée Lauder’s Social and Digital Marketing Strategies

In addition to social media initiatives, Clinique’s “Forecast” mobile application provides weather information and skincare tips related to weather conditions.

Estée Lauder’s Most Promising Brands

Catering to the premium market, Estee Lauder’s heritage brands include Aramis and Designer Fragrances, Clinique, and Origins.

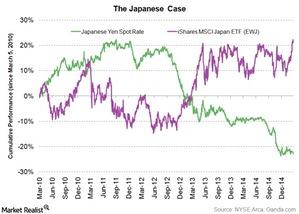

Currency war: Did it boost growth in Japan?

Japan is a classic case of how depreciating currency can boost economic growth. The stimulus package, launched in October 2010, worked over the short term.

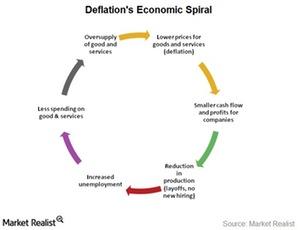

Currency warfare is a way to export deflation

When a country depreciates its currency, its major trading partners depreciate their own currencies. They do this to save their economies from entering into deflation.

Calvin Klein’s financial performance and growth opportunities

Calvin Klein’s North American operations had a 2% increase in same-store sales growth. However, the international operations decreased by 4%.

Tommy Hilfiger—the proven lifestyle brand

Tommy Hilfiger was founded in 1985. Along with Calvin Klein, it’s one of PVH’s two flagship brands. For 2013, Tommy Hilfiger’s global retail sales were $6.4 billion.

Analyzing the Calvin Klein business

Products sold under the Calvin Klein banner had gross revenue of $7.8 billion in 2013. Of the revenue, PVH reported $2.8 billion.

Design And Brand Positioning: Recent Changes At Coach

At Coach (COH), products are conceptualized by its New York-based design team. The team also directs the design of all Coach products.

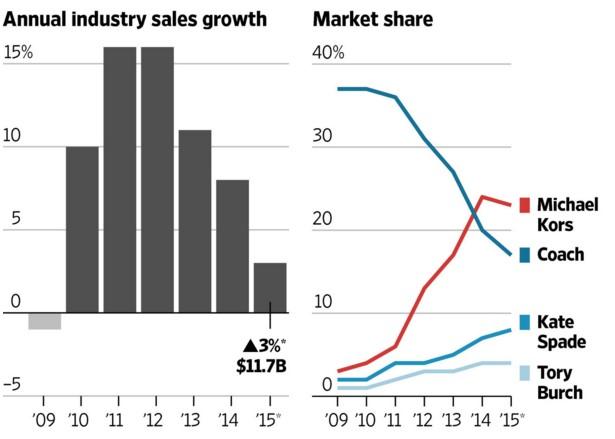

Purse Wars: Coach Seeing Fierce Competition For Market Share

Competition is fierce in all of the affordable luxury industry. And, there are many players, including KORS and KATE.

Coach’s Pricing Strategies And Target Market

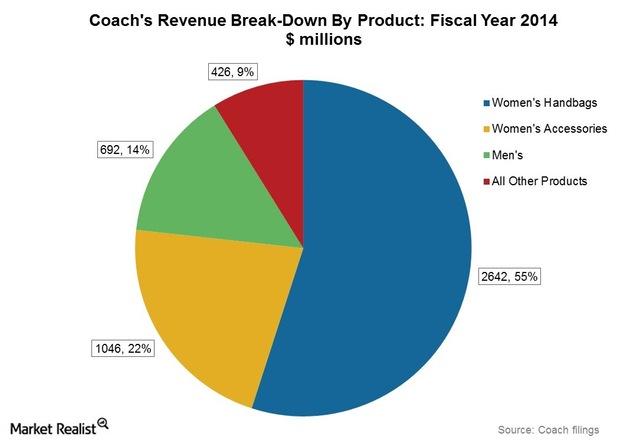

Coach’s pricing is lower than other luxury brands. This appeals to HENRYs, or high-earners, not rich yet, among other markets.

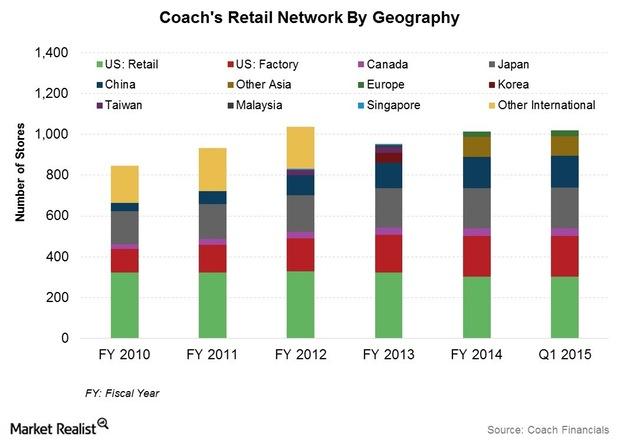

Selling Channels: How Coach Products Reach Customers

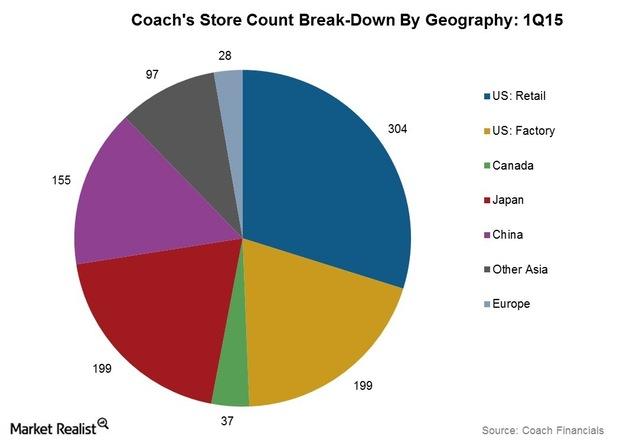

Coach, Inc. (COH) distributes products through wholesale and direct-to-customer channels. It runs wholesale shops-within-shops at major department stores.

Coach’s Supply Chain And Manufacturing Model

Although the manufacturing process is outsourced, Coach tries to keep a grip on the manufacturing process from design to production.

An Introduction To Luxury Brand Pioneer Coach

Coach is a well-known premium fashion brand. In recent years, Coach has faced increasing competition from newer entrants in the affordable luxury market.