SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

Why Most Analysts Rate Chevron a ‘Buy’

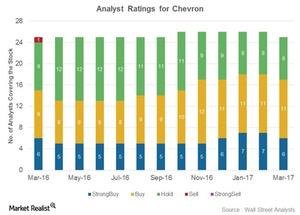

Analyst ratings for Chevron Chevron (CVX) has been rated by 25 analysts. Of the total, 17 analysts have given “buy” or “strong buy” ratings, eight have given “hold” ratings, and none have given “sell” or “strong sell” ratings on the stock. These ratings have improved from March 2016, when Chevron had fewer “buy” ratings, more […]

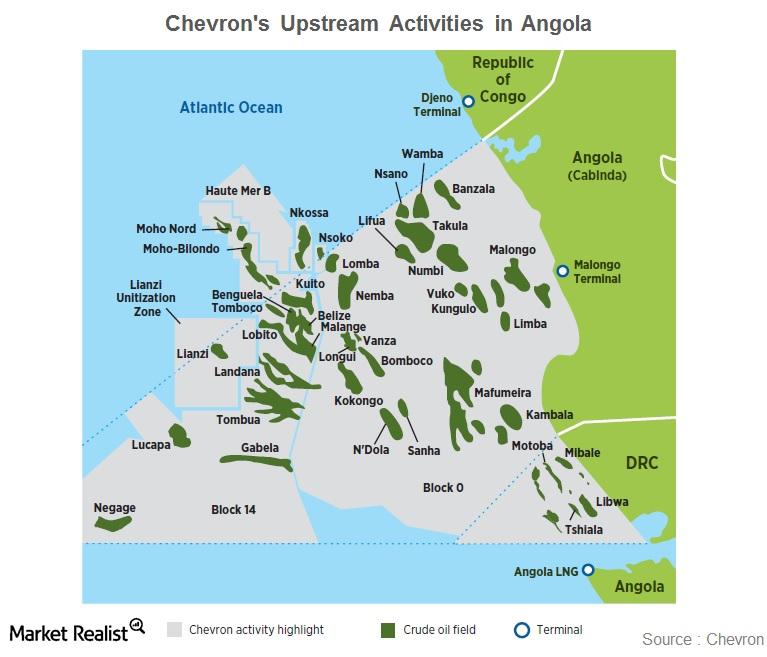

Chevron’s Mafumeira Sul Project Kick-Starts Production

In this series, we’ll provide updates on Chevron’s market performance. We’ll examine CVX’s latest stock performance, analyst ratings, dividend yield, PEG (price-to-earnings-to-growth) ratio, beta, short interest position, institutional ownership status, and implied volatility movement.

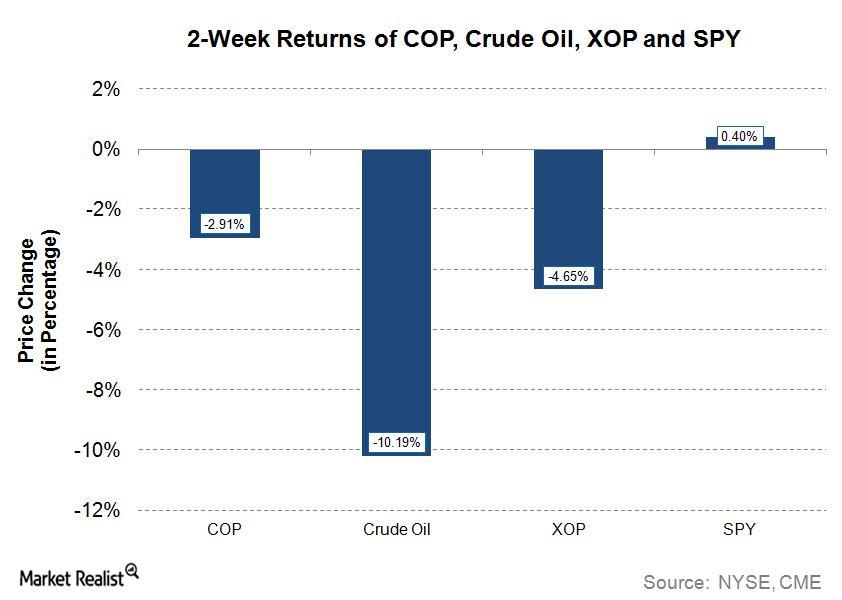

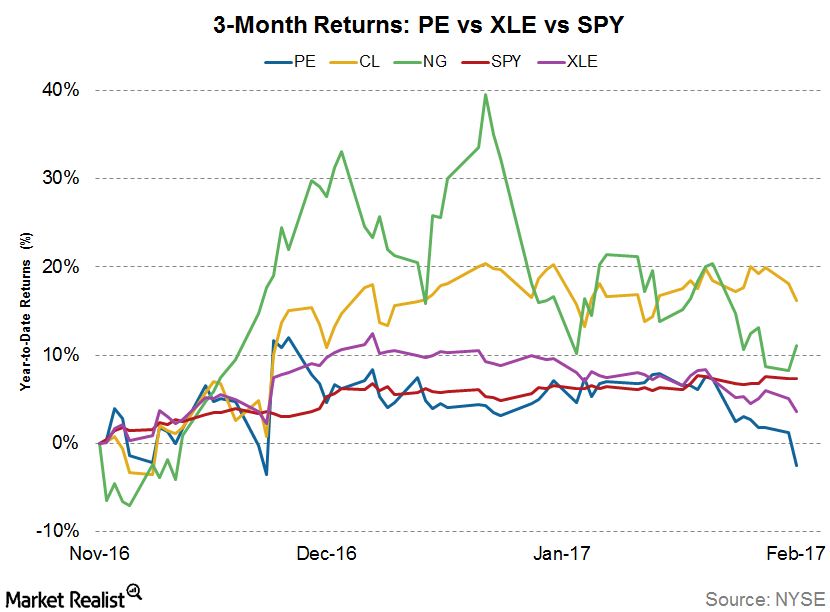

Why ConocoPhillips Stock Is Outperforming Crude Oil and Peers

In the last two weeks, the stock of ConocoPhillips (COP), a crude oil (USO) and natural gas (UNG) producer, has outperformed crude oil prices.

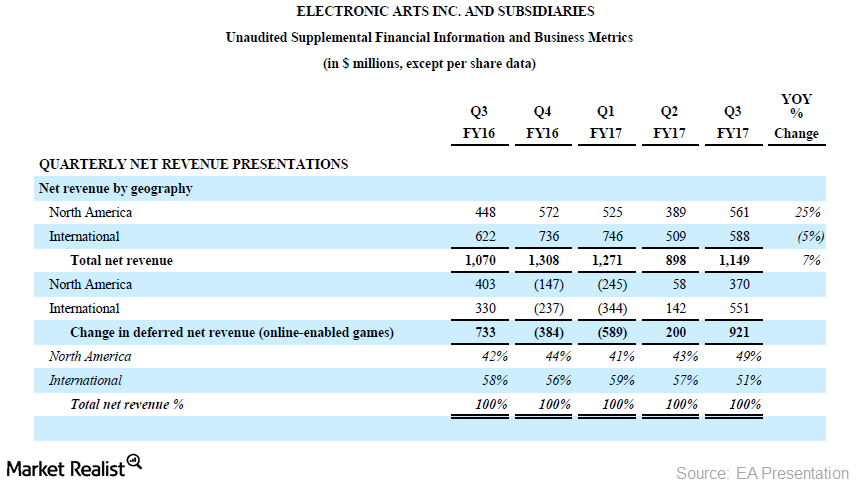

What Electronic Arts’ Key Metrics Indicate

Revenue from EA’s international markets fell 5.0% YoY (year-over-year) from $622.0 million in fiscal 3Q16 to $588.0 million in fiscal 3Q17.

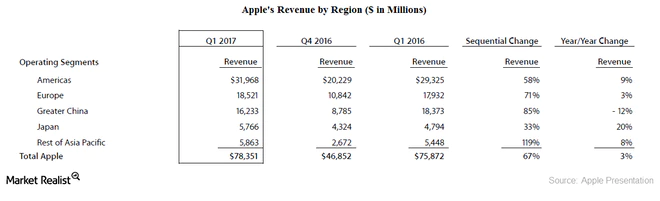

The Outlook for Apple’s Performance in China

Apple’s (AAPL) revenues from Europe rose 3.0% to $10.5 billion, and its revenues from the Asia-Pacific region rose 8.0% to $5.9 billion.

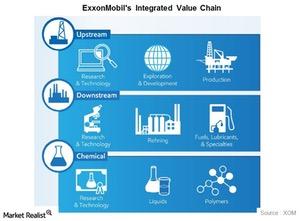

ExxonMobil Focuses on Integrated Growth, Reveals the Path Forward

In its latest analyst meeting, ExxonMobil (XOM) announced that it had plans to concentrate on an integrated earnings model, capturing value at every stage of the energy chain.

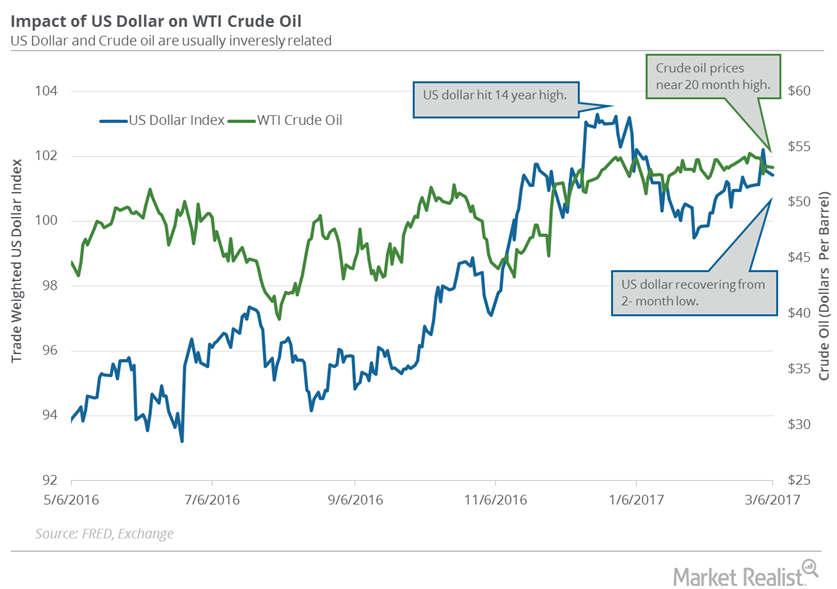

Janet Yellen and the US Dollar Impacted Crude Oil Prices

The US dollar and crude oil (ERY) (ERX) (DIG) (XES) are usually inversely related. A weaker US dollar makes crude oil more affordable for oil importers.

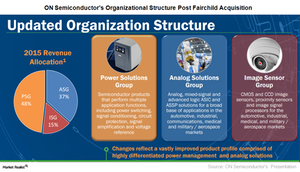

ON Semiconductor’s Revised Organizational Structure

The Power Solutions Group’s revenues rose 34.3% sequentially to $620.3 million in 4Q16. More than $200 million in revenues came from the Fairchild Semiconductor integration.

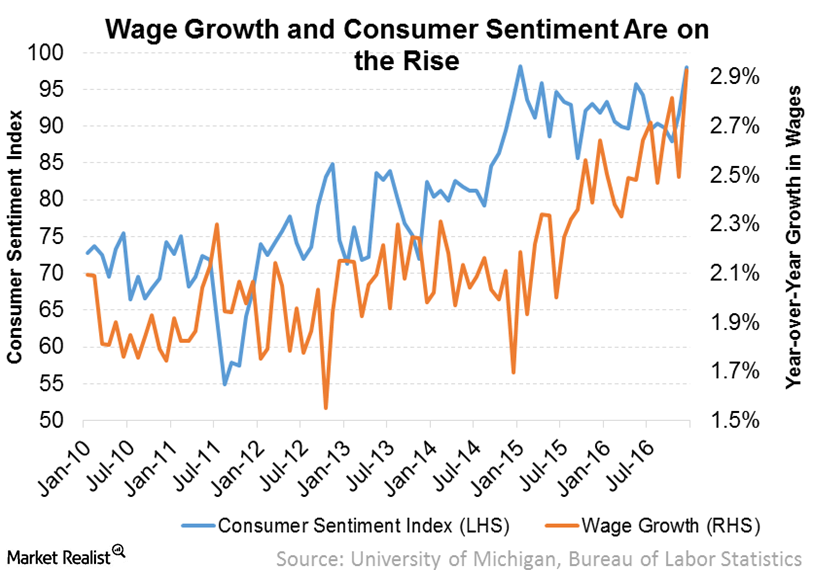

U.S. Economic Drag Is Fading, Upside Surprises Are Possible

OppenheimerFunds The U.S. economy was weaker than expected in 2016, the lagged effect of the Fed’s policy mistake in 2015. In our opinion, the worst is now over for the United States, and economic growth should improve in 2017 and could even surprise to the upside with an appropriate fiscal policy mix from the new […]

The Cycle Continues, but the Risks Are Rising

OppenheimerFunds In response to accusations of flip-flopping, John Maynard Keynes purportedly quipped, “When the facts change, I change my mind. What do you do, sir?” With 2017 in full swing, the facts have changed. Since the financial crisis, the global economy has been mired in a slow growth, disinflationary world. We argued that the weak […]

Synergies from the ON–Fairchild Semiconductor Merger

ON Semiconductor (ON) expects the Fairchild Semiconductor merger to bring in annual cost synergies of $225 million by 2019 compared with just $160 million in 2017.

How Did Parsley Energy’s Stock React to Acquisition News?

Parsley Energy’s (PE) latest acquisition news came after markets closed on February 7, 2017.

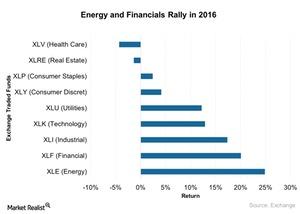

2016 US Sector Performance: Top Performers in Energy and Financials

The US GDP growth outlook is near its potential at ~3%, with increased investment in infrastructure.

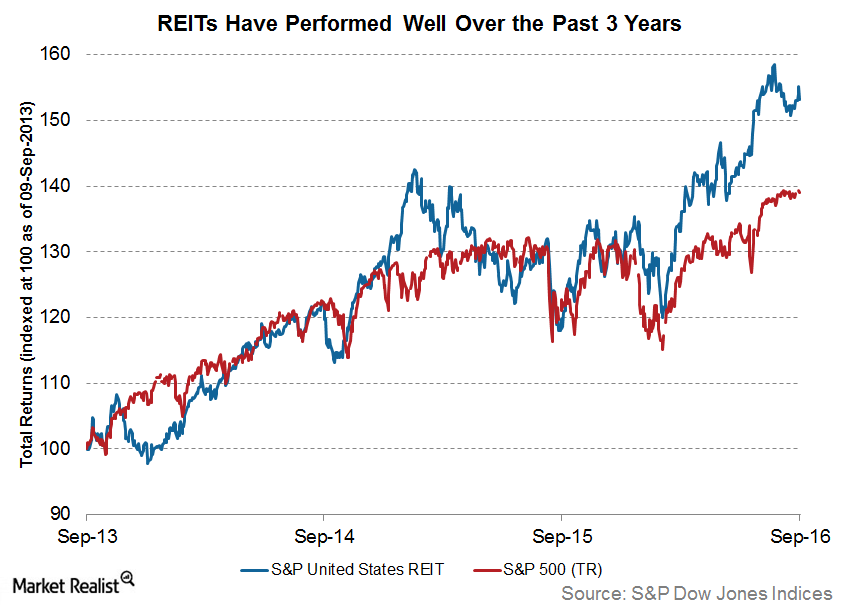

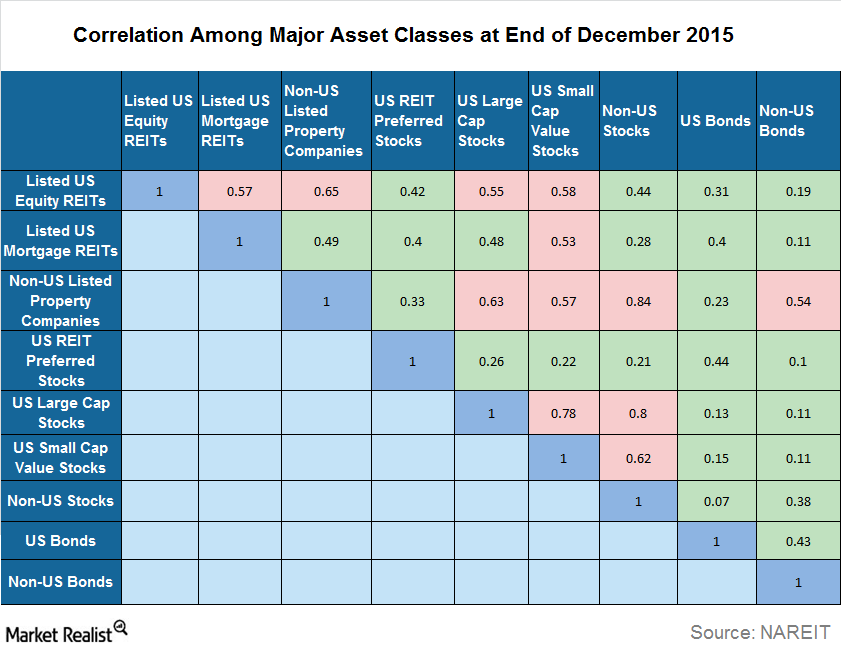

The REIT Advantage: High Return, Low Correlation

RETURNS AND RISKS OF REITS REIT and property stock performance has been relatively strong over the long term, especially when compared with traditional bond and equity indices. Since 1992, the Dow Jones Global Ex-U.S. Select RESI has had an average total return close to 9%, while the Dow Jones U.S. Select REIT Index has had […]

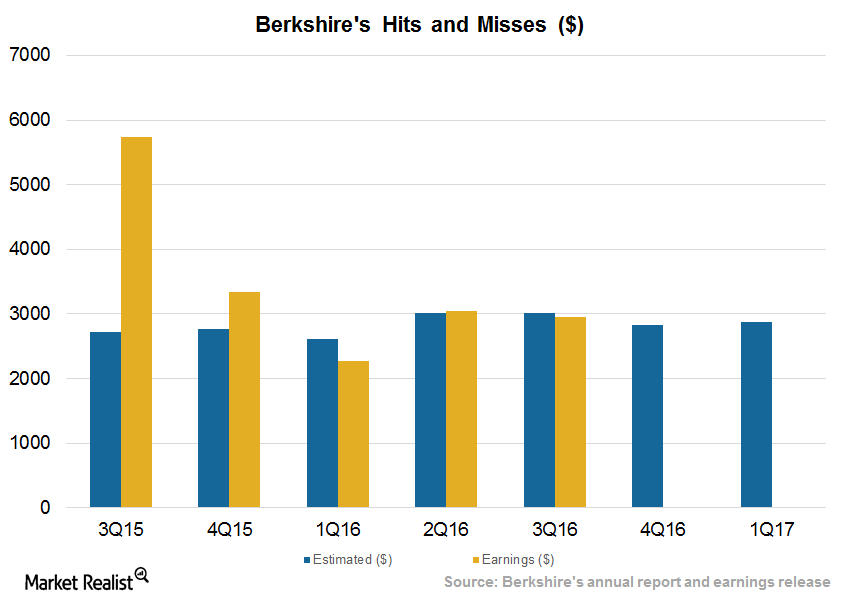

What to Expect from Berkshire Hathaway’s Earnings

Berkshire Hathaway (BRK-B) is expected to post EPS (earnings per share) of $2,829 per share in 4Q16 and $2,880 in 1Q17.

How Did Boeing Stock React?

Immediately after Donald Trump’s tweet, Boeing (BA) stock fell 1%. Other defense contractor stocks also had to bear the brunt.

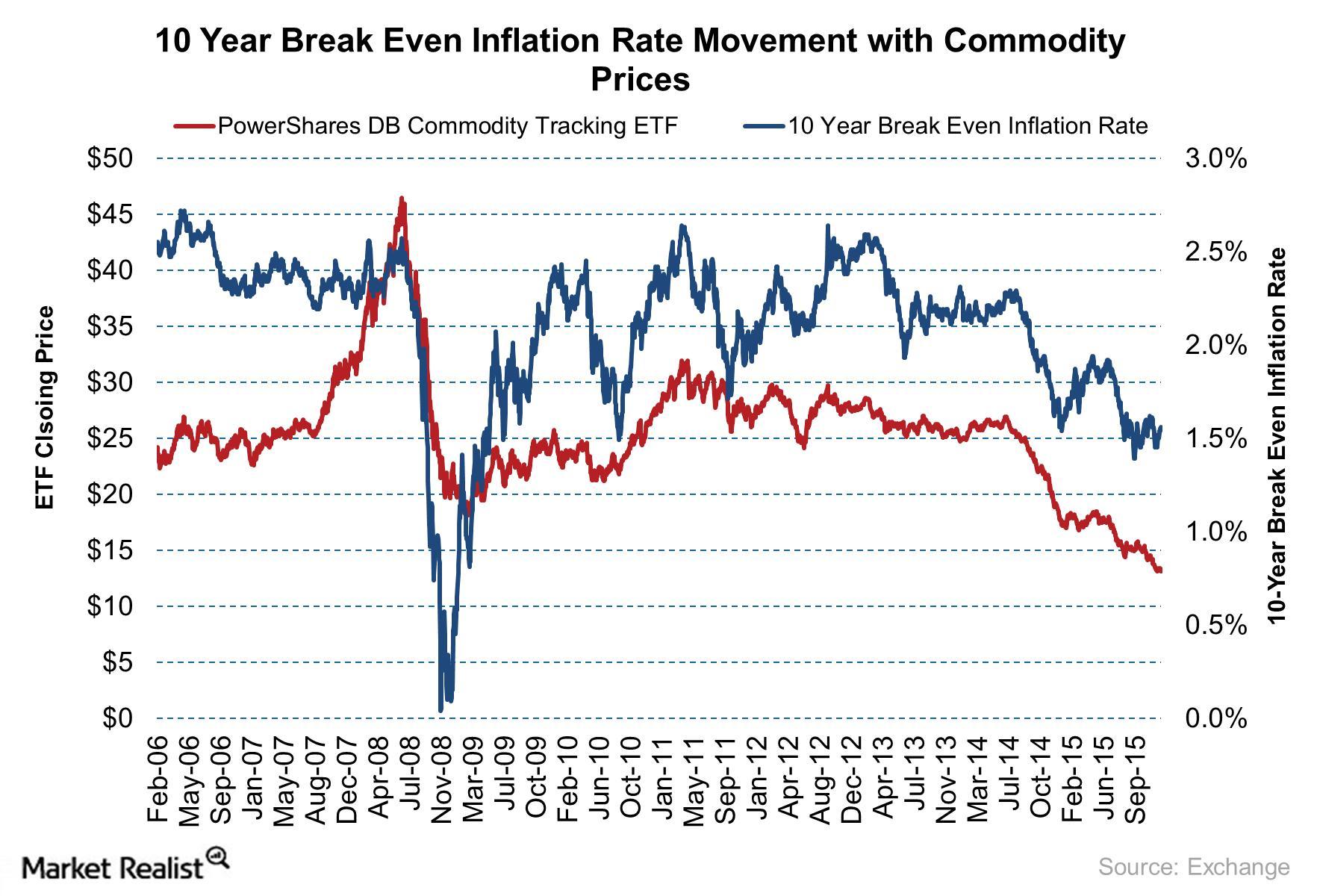

Goldman Sachs Is Long on the 10-Year US Breakeven Inflation Rate

After the announcement of the US election results, the 10-Year US Breakeven Inflation Rate showed an uptick. Goldman Sachs has advised investors to go long on the rate.

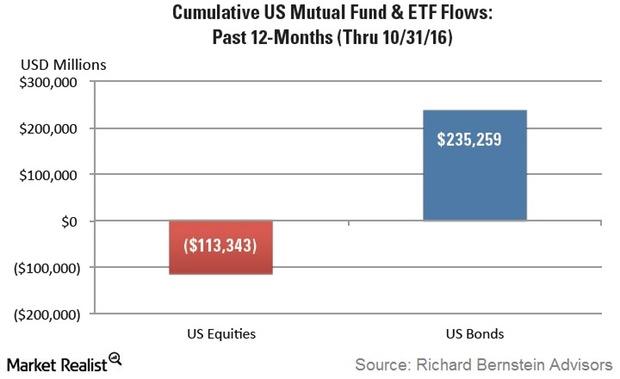

Bernstein: Excess Risk Aversion Has Made Investors ‘Wallflowers’

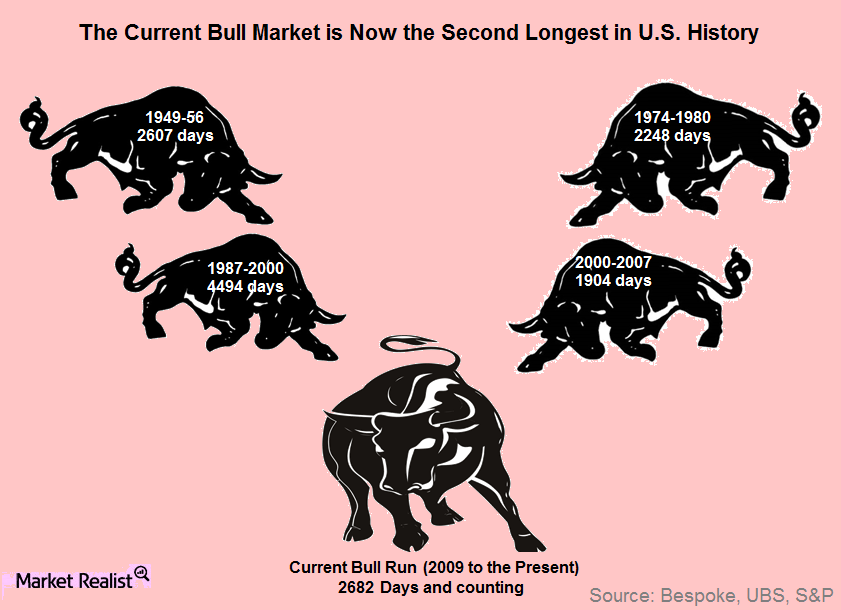

In his November Insights newsletter, Richard Bernstein stated, “It is incredible that investors have basically been wallflowers during the second longest bull market of the post-war period.”

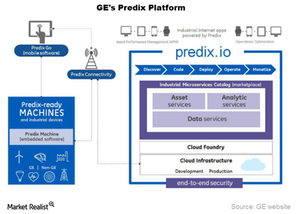

How Useful Will ServiceMax Be in GE Digital’s Industrial Internet Vision?

ServiceMax’s complementary capabilities would help GE Digital develop and expedite the commercialization of its Predix applications.

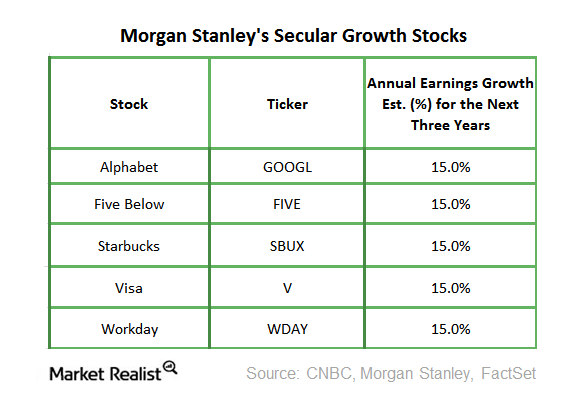

A Look at Morgan Stanley’s Top 5 ‘Secular Growth’ Stock Picks

On Friday, October 14, 2016, Morgan Stanley (MS) released a list of its favorite “secular growth” stock picks. It believes these stocks have long-term growth possibilities.

IMF Warns about 3 Risks to the Global Financial System

The International Monetary Fund (or IMF) warned that there are three major risks to the global financial system in its latest report on global financial stability.

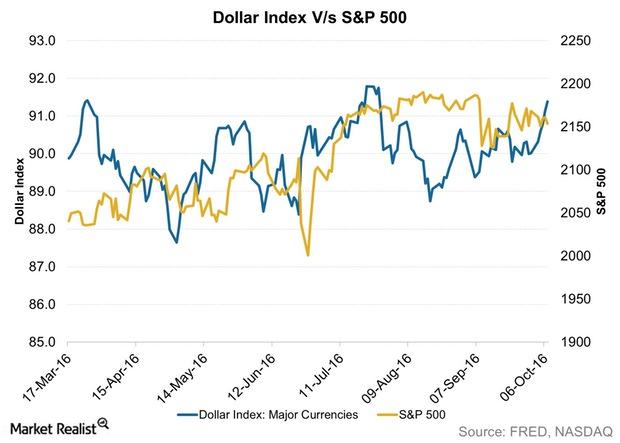

How Does a Strong Dollar Affect Stocks?

The relationship between the US dollar and US stock indexes can be best said to be complex. It’s mostly a change in the greenback that impacts stocks.

Behind the Risks Affecting Global Economic Growth

The IMF cited the “fraying consensus about the benefits of cross-border economic integration” visible in the UK’s Brexit vote as a slowdown factor.

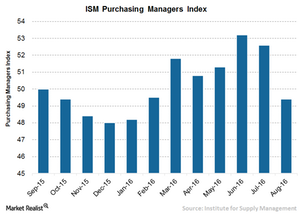

Fed’s Rate Hike Decision to Drive the Markets

In the wake of disappointing economic indicators over the past month, the Federal Reserve kept the interest rate unchanged in its policy meeting this week.

The REIT Advantage: High Returns, Low Correlation

Not only do REITs tend to provide steady and stable returns over the long term, but they also help in diversifying investor portfolios effectively.

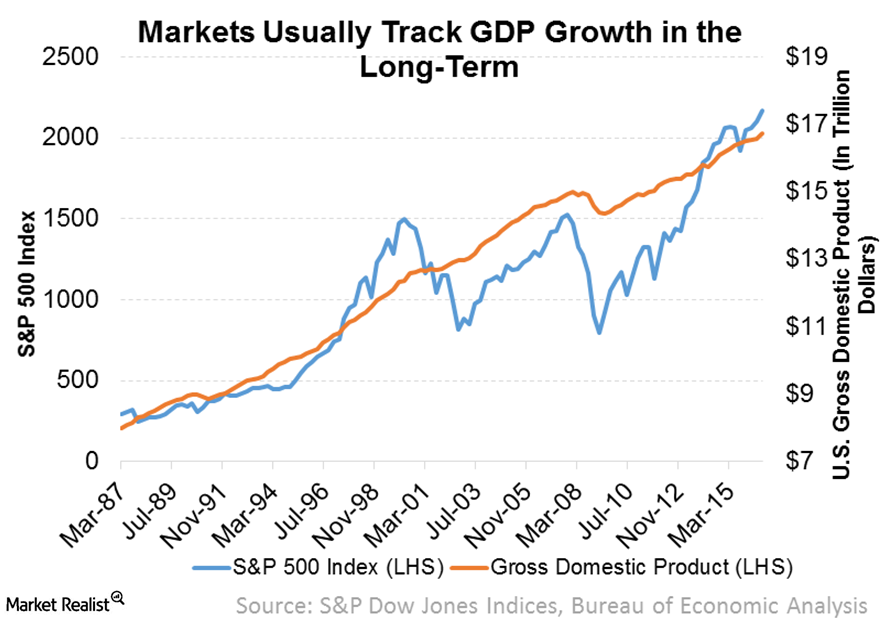

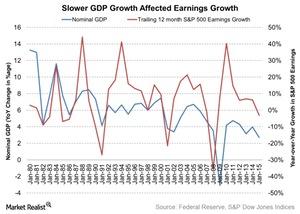

What’s the Primary Driver of Corporate Earnings?

Nominal gross domestic product in the United States is strongly correlated with the trailing-12-month earnings growth of the S&P 500.

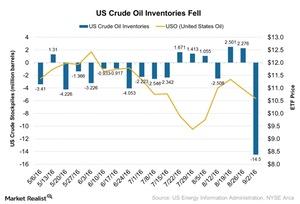

Crude Oil Prices Jumped as Inventories Fell

According to the EIA’s report on September 8, 2016, US crude oil inventories fell by 14.5 MMbbls for the week ended on September 2, 2016.

Investors Are Worried about an Impending Squall

Inverse ETFs can help protect against a squall US stocks bumped up against all-time highs again this year. After hitting a new intraday high of 2,178 on August 1, the S&P 500 was unable to hold onto the gains. Sector performances offer a glimpse of where we are in the market cycle. The top performing […]

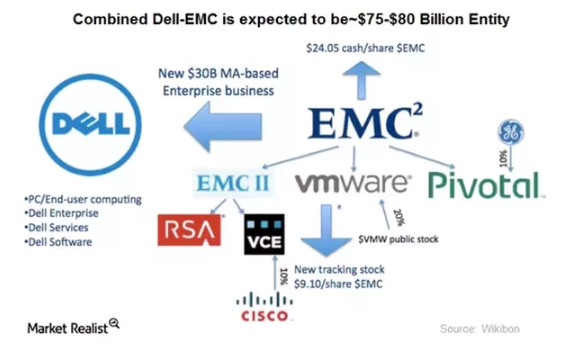

How the Dell-EMC Deal May Affect VMware’s Future

For the past year, uncertainty has been looming over VMware (VMW), primarily due to the impending Dell-EMC deal. EMC has an 80% stake and 97% of the voting rights in VMware.

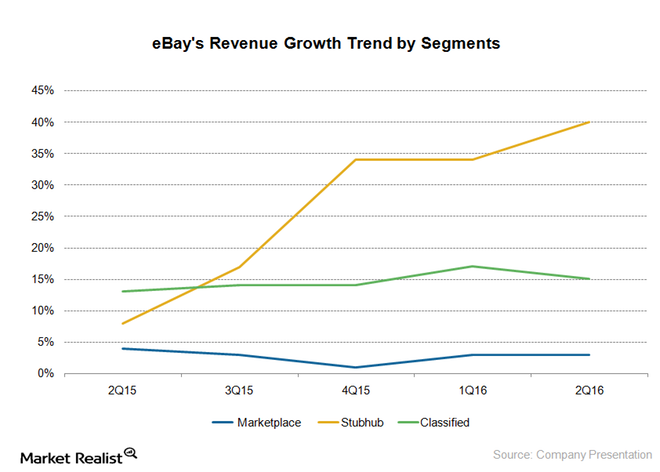

Behind eBay’s Key Revenue Drivers

StubHub is eBay’s fastest-growing business segment, a key driver behind the company’s turnaround story, and the largest ticket marketplace in the US.

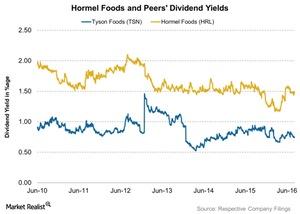

Why Did Hormel Foods Increase Its Fiscal 2016 Guidance?

Hormel Foods (HRL) increased its fiscal 2016 EPS (earnings per share) guidance to $1.60–$1.64. The earlier EPS guidance range was $1.56–$1.60.

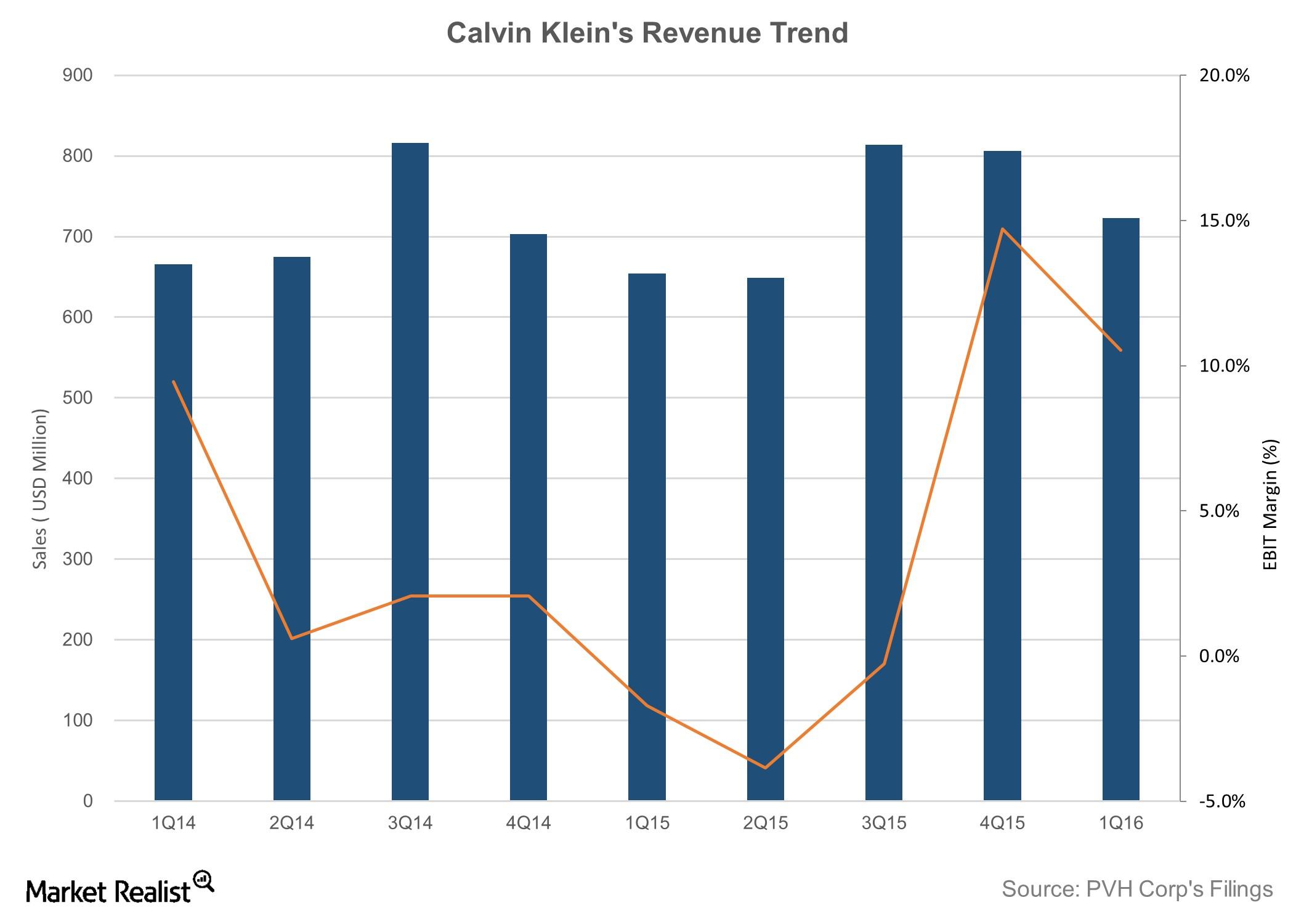

Can Calvin Klein Drive PVH’s Sales Growth in 2Q16?

Among PVH’s (PVH) three segments, Calvin Klein has been the best performer. The brand accounts for more than 37% of the company’s total revenue.

How Range Resources Stock Reacted after Past Earnings Beats

In March 2016, Range Resources stock made a higher high for the first time in almost two years. Since January 2016, Range Resources stock has risen a whopping 112%.

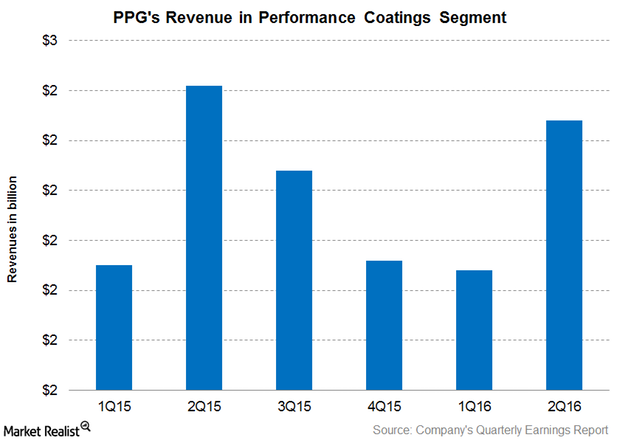

Why PPG Industries’ 2Q16 Revenue from Performance Coatings Fell

In 2Q16, PPG Industries’ Performance Coatings segment, the largest revenue contributor, accounted for approximately 57.5% of PPG’s total revenues.

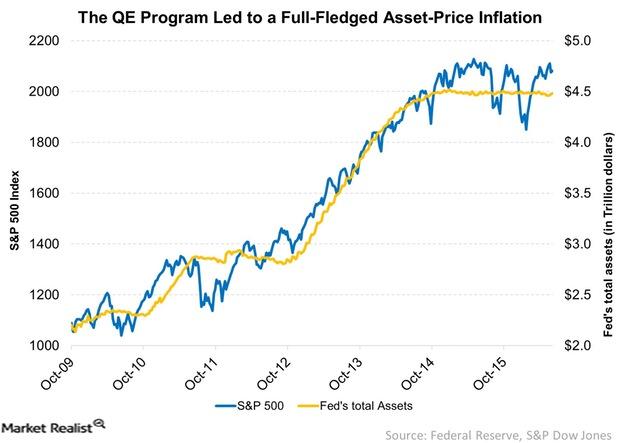

How Central Banks ‘Create’ Inflation

A QE program doesn’t just create inflation; it causes asset prices to rise as well. After the financial crisis of 2008, the Fed resorted to an ultra-accommodative monetary policy.

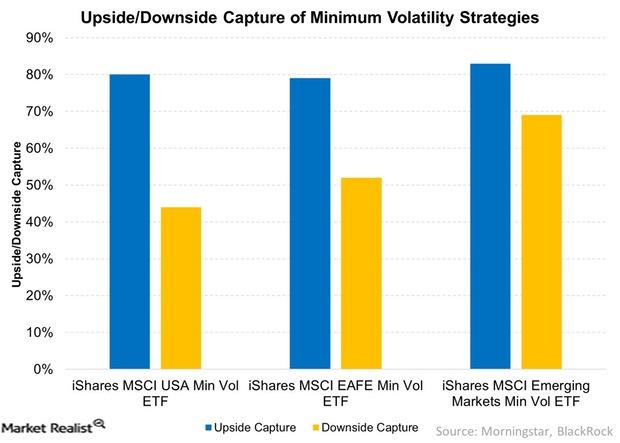

What Happens to Minimum Volatility Funds When Volatility Spikes?

The potential for a downside protection and upside participation is how minimum volatility strategies have delivered strong risk-adjusted returns over the long term.

Goodyear Tire & Rubber Declares Dividend of $0.07 Per Share

Goodyear Tire & Rubber Company (GT) has a market cap of $7.1 billion.

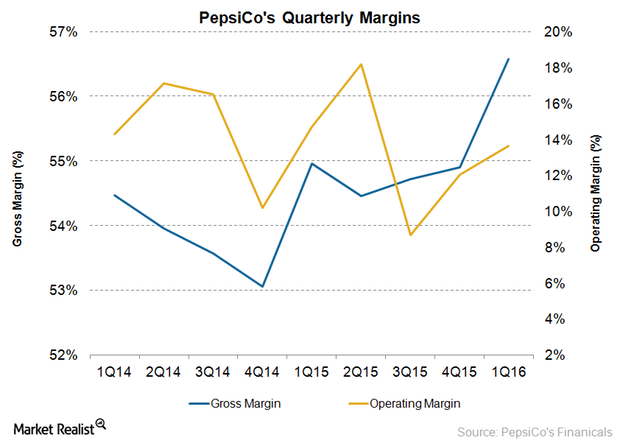

What Drove PepsiCo’s Margin Expansion in 2Q16?

PepsiCo’s gross margin expanded to 55.6% in 2Q16 from 54.5% in 2Q15.

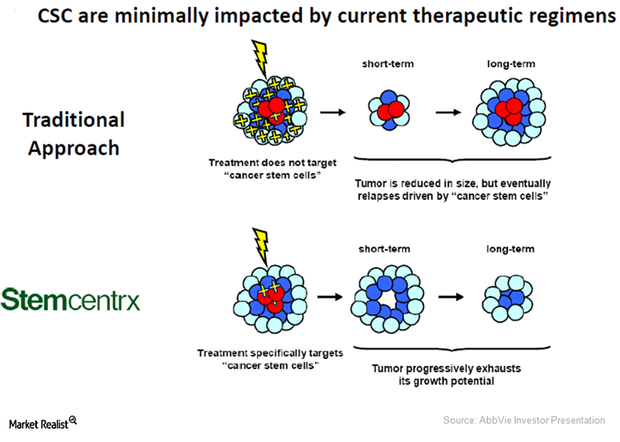

Can Stemcentrx’s Cancer Stem Cell Technology Really Accelerate Innovation for AbbVie?

The acquisition of Stemcentrx has added CSC (cancer stem cell) technology platform to AbbVie’s (ABBV) oncology portfolio.

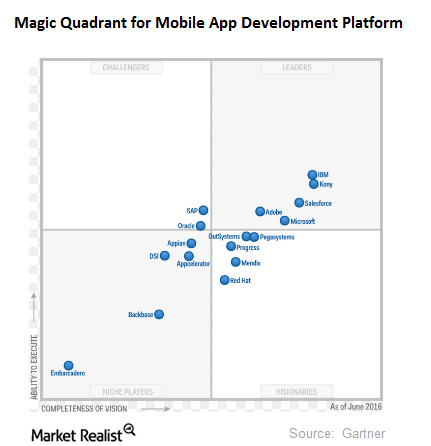

Adobe Is the Leader in Gartner’s Magic Quadrant, Again

On June 20, 2016, Adobe announced it had again been recognized by Gartner as a leader in the 2016 Magic Quadrant for Mobile App Development Platforms research report.

Is the Rebound in Global Markets Sustainable?

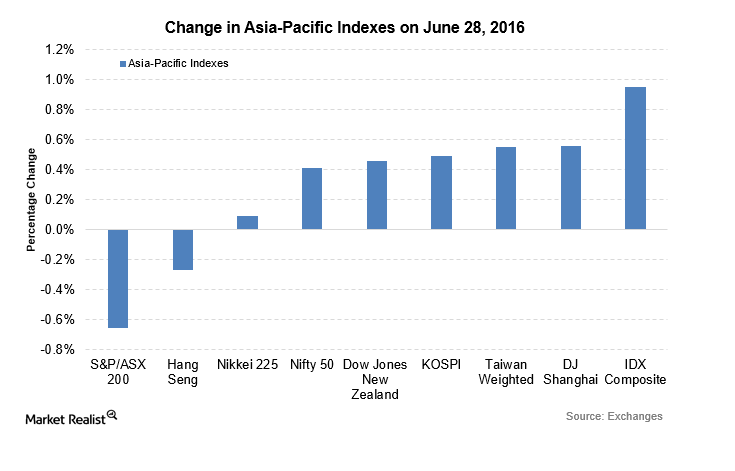

The SPDR Euro STOXX 50 ETF (FEZ) rose by 2.6%. The United Kingdom’s (FKU) FTSE 100 was among the leaders in European markets. It rose by 2.6%.

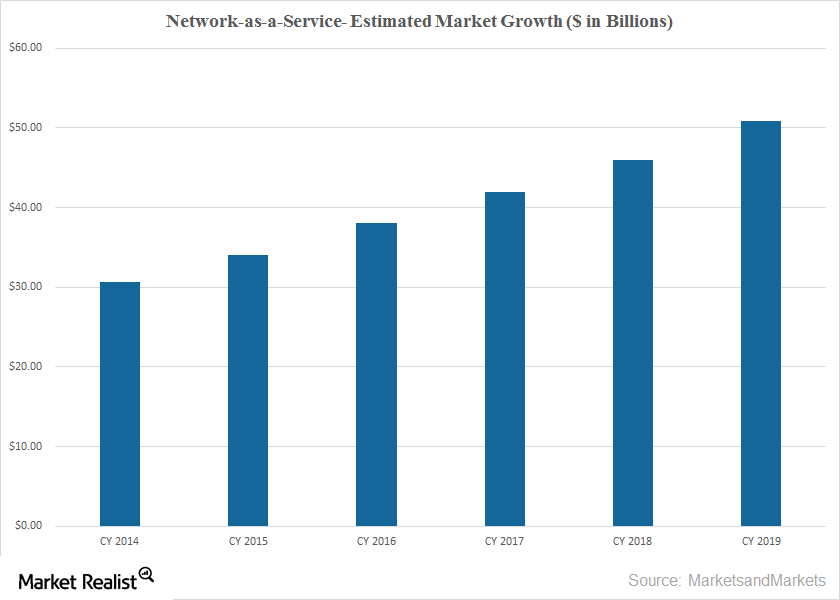

How Is the Network-as-a-Service Business Expected to Grow?

Network-as-a-Service (or NaaS) follows a business model where network services are delivered virtually over the Internet. MarketsandMarkets expects the NaaS market to grow from ~$30.7 billion in 2014 to ~$50.8 billion in 2019.

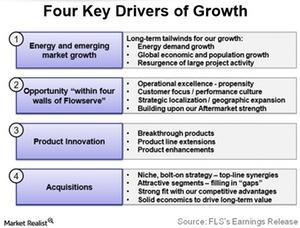

Why Do Customers Buy Flowserve’s Products?

After 4Q15, FLS reported that it controlled a market share of 4% of the $130-billion pump, valve, and seal market in 2015.

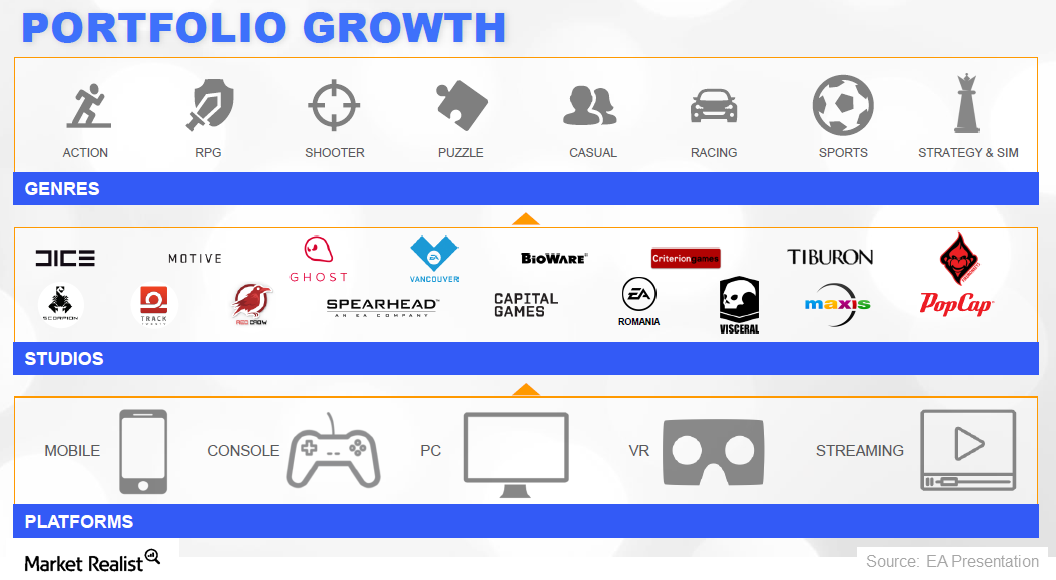

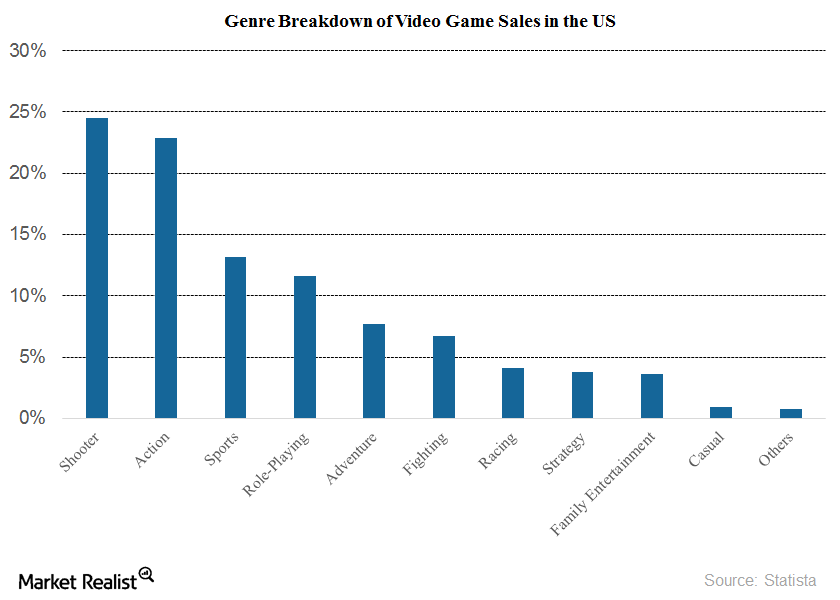

Electronic Arts Has a Gaming Portfolio across Genres

According to Statista, shooter and action games dominate video game sales and account for 24.5% and 22.9% of total sales, respectively, in the United States

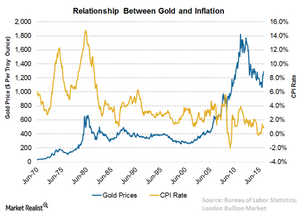

How Inflation Expectations Affect Gold Prices

In the 1990s and 2000s, when gold prices tracked inflation, although the correlation seems to be a bit weak compared to the 1970s and 1980s.

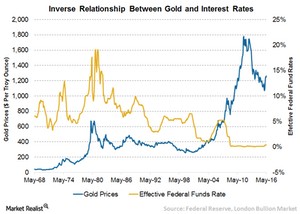

Why Gold Has Performed Better When Interest Rates Are Lower

J.P. Morgan’s analysis states that gold has outperformed equities, bonds, and a broad commodities index in a low interest rate environment.

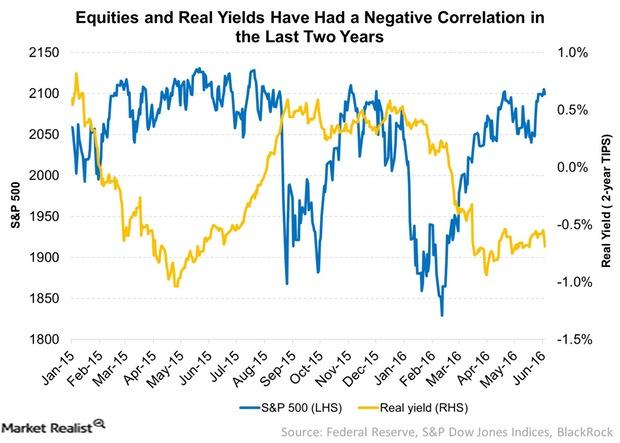

How Rising Real Yields Could Affect Equities

Since the start of 2015, the S&P 500 and real yields have had a high negative correlation. Falling real yields have encouraged investors to take more risk in search of higher returns.

Active Fund Management: Will It Make Passive Attractive?

In recent years, the performance of various mutual funds and hedge funds followed by an active fund management strategy haven’t been so impressive.

Action and Sports Genres Dominate the Video Gaming Space

According to Statista, shooter and action games dominate video game sales and account for 24.5% and 22.9%, respectively, of total sales in the US.

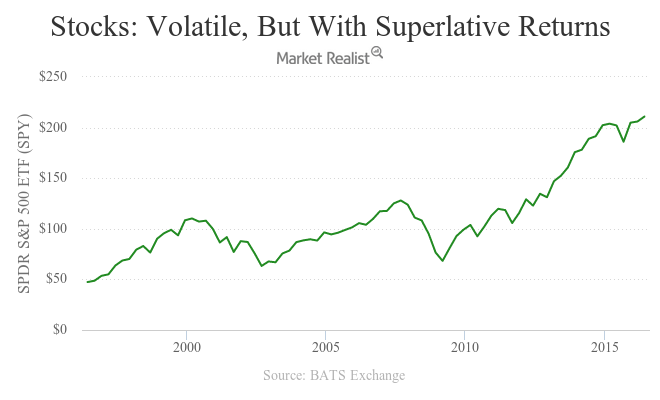

Why Bill Gross Thinks the Era of High Returns Is Over

Bill Gross thinks that the era of double-digit stock returns (SCHB) (USMV) and high single-digit investment-grade bond returns is over.