What Happens to Minimum Volatility Funds When Volatility Spikes?

The potential for a downside protection and upside participation is how minimum volatility strategies have delivered strong risk-adjusted returns over the long term.

July 18 2016, Published 9:12 a.m. ET

Consider a long-term view

Brexit certainly put minimum volatility strategies to the test. But they did what they were designed to do — reduced risk, in accordance to data from Bloomberg. However, minimum volatility funds are intended as long-term investments, so the more important question is this: What was their downside versus broad indexes over longer periods? Here too, minimum volatility strategies lost less than the relative broad market.

Historically, minimum volatility strategies have declined less than the broad indexes during market downtowns, but they also have risen less during rallies. In other words, these funds have captured (considerably) less downside and participated in most of the upside. Given that, some are tempted to just hold minimum volatility funds during times of greater market volatility.

Market Realist – Minimum volatility funds outperform when volatility spikes.

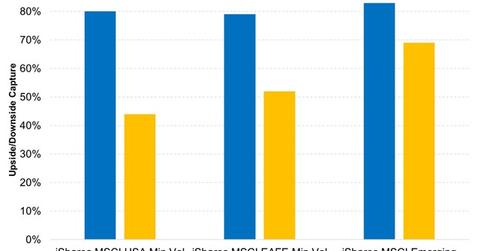

The graph above compares the upside and downside capture of the iShares MSCI USA Minimum Volatility (USMV), the iShares MSCI EAFE Minimum Volatility (EFAV), and the iShares MSCI Emerging Markets Minimum Volatility (EEMV). EFAV is a minimum volatility fund that tracks developed markets. The graph illustrates the asymmetrical behavior.

The upside capture for the three funds is, 80% 79%, and 83%, respectively, while the downside capture is 44%, 52%, and 69%, respectively. This potential for a downside protection and upside participation is how minimum volatility strategies have delivered strong risk-adjusted returns over the long term.

Minimum volatility funds tend to outperform standard indexes when volatility is high. For example, after the Brexit vote on June 23, 2016, volatility spiked with the S&P 500 (SPY) (IVV), falling by 3.6%. USMV fell by only 1.7%, thus providing a cushion to your portfolio when volatility spikes.

There’s another advantage to investing in minimum volatility funds such as the iShares MSCI Emerging Markets Minimum Volatility. An investor with a low-risk profile can invest in riskier markets such as emerging markets without taking extra risk.