BlackRock

Disclosure: The content Market Realist publishes should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of Blackrock. ©2010-2013 BlackRock. All rights reserved. iShares and BlackRock are registered trademarks of BlackRock. All other marks are the property of their respective owners.

More From BlackRock

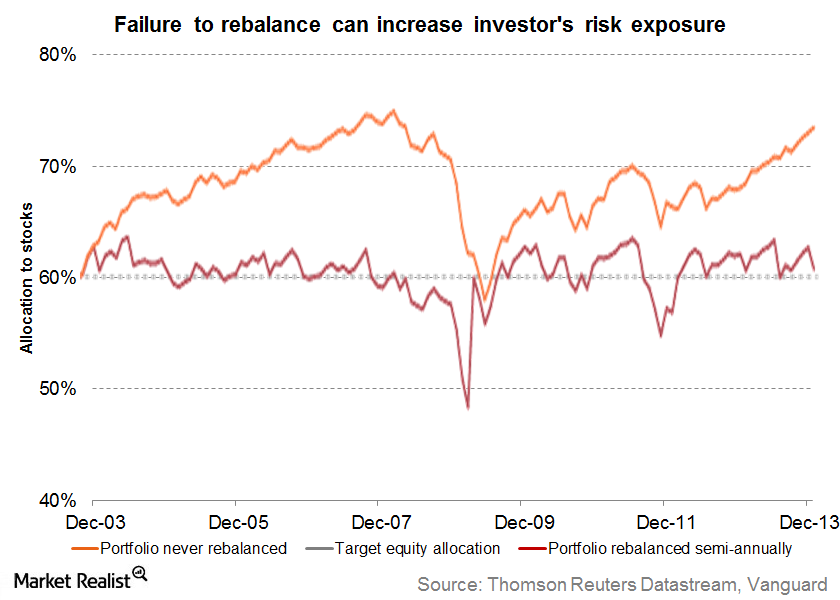

The Importance of Rebalancing Your Portfolio

Rebalancing your portfolio means bringing the portfolio back to the asset allocation levels specified in the financial plan. Not rebalancing can expose you to higher risk.

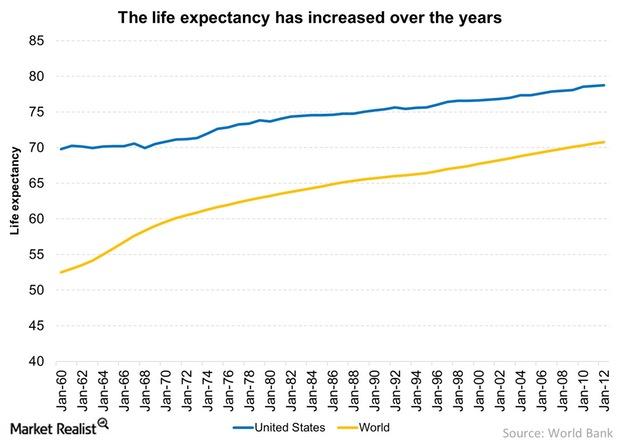

Increased Life Expectancy Means A Longer Investment Horizon

Increased life expectancy means a longer investment horizon. With life expectancy increasing, young investors should invest in equities aggressively.

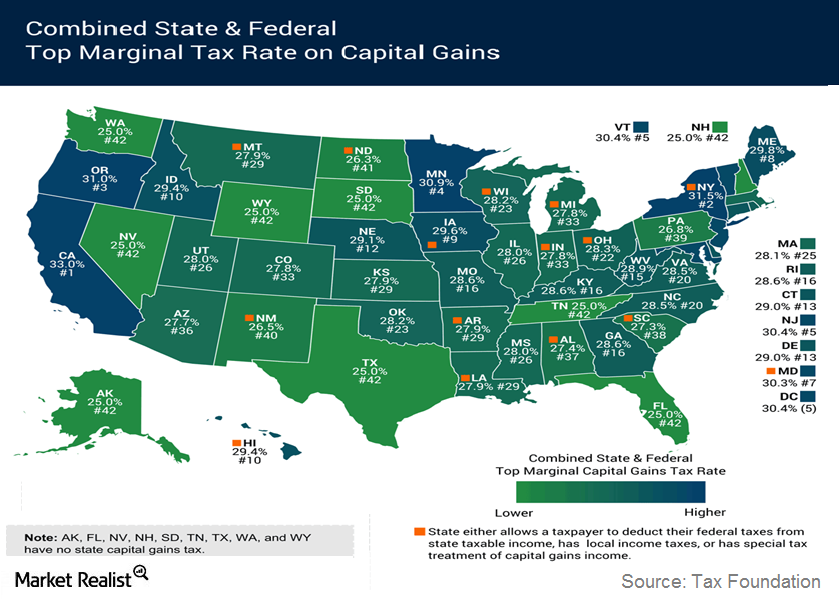

Basics About The Capital Gains Tax

The rates for capital gains tax depend on the asset’s holding period. If the holding period is less than one year, short-term capital gains tax is payable.

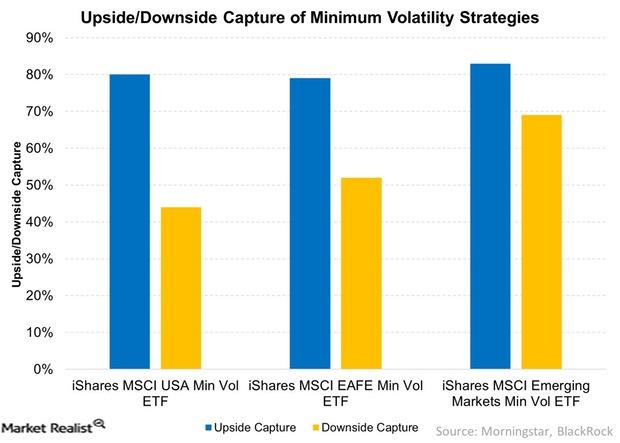

Should Minimum Volatility Be Part of Your Core Holdings?

The minimum volatility strategy has worked very well in the last ten years. It also tends to be a less risky strategy.

What Happens to Minimum Volatility Funds When Volatility Spikes?

The potential for a downside protection and upside participation is how minimum volatility strategies have delivered strong risk-adjusted returns over the long term.

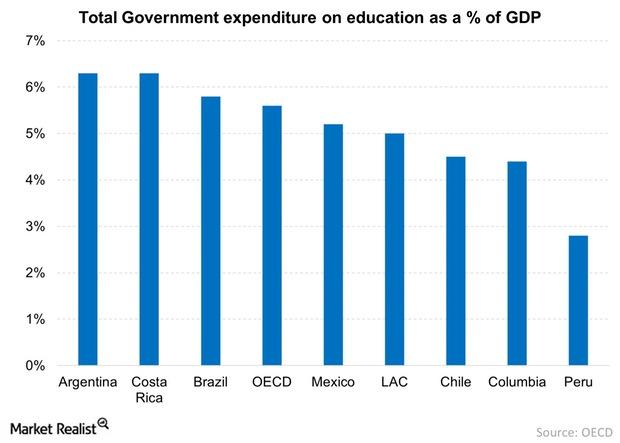

Investing in Education to Reduce Poverty in Latin America

In an effort to reduce inequality and poverty in Latin America, governments there have increased education spending many times over in the last decade or so.