iShares MSCI USA Minimum Volatility

Latest iShares MSCI USA Minimum Volatility News and Updates

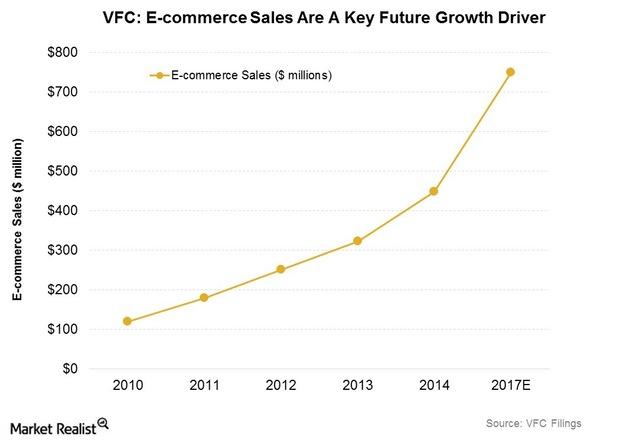

Will VF Corporation’s Vans Brand Spur Higher Growth in 3Q15?

VF Corporation saw sales of $2.5 billion in 2Q15, up 4.7% year-over-year. Its performance was boosted by top brands The North Face, Timberland, and Vans.

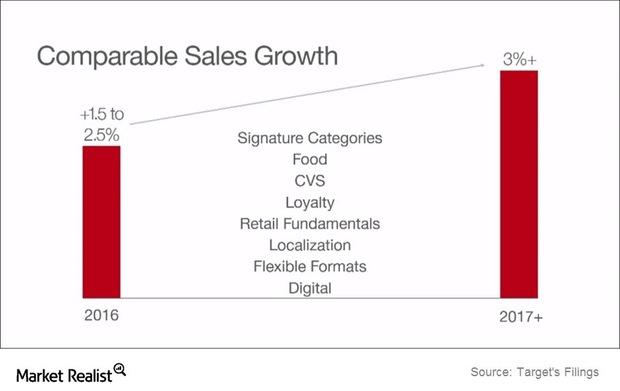

Why Target Is Focusing on Its Signature Categories to Drive Sales

Target has identified four signature categories it’s concentrating on to provide higher store and web traffic and sales: Baby, Style, Wellness, and Kids.

Target’s Strengths and Weaknesses Are Balanced

Target’s business model has been tested over several economic cycles. Even during the recession in 2008–2009, it managed to raise its dividend per share.

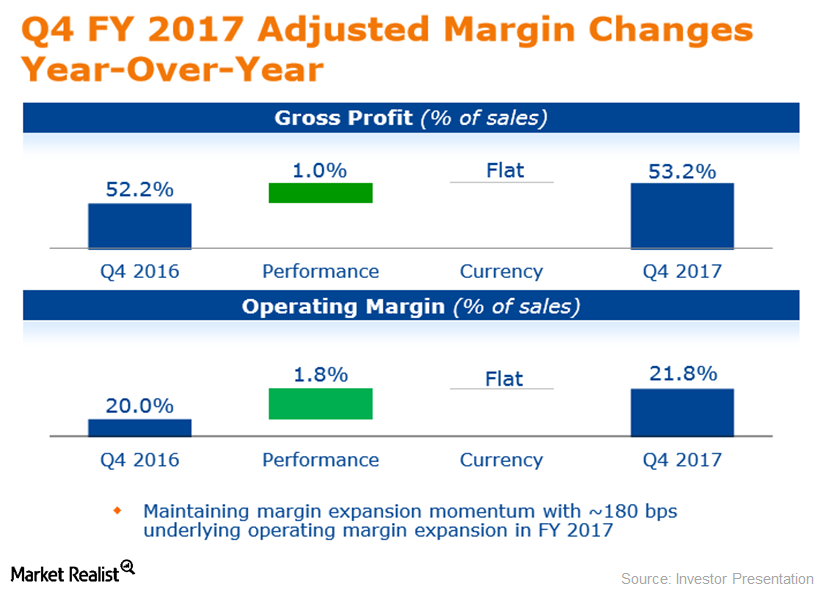

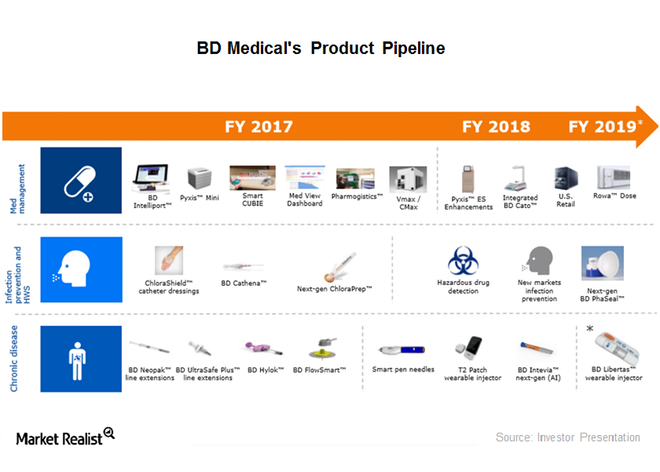

What’s Driving BD’s Operating Margin Expansion

Overview BD (BDX) has registered strong operating margin expansion in recent years. Its margin improved by 100 basis points in fiscal 2015 and 200 basis points in fiscal 2016. In fiscal 2017, BD’s margin expanded by ~180 basis points. In 4Q17, BD’s operating margin grew ~14.6% YoY (year-over-year), limited by 700 basis points due to the divestiture of BD’s […]

What’s BD’s Latest News in the Diabetes Management Market?

On September 19, 2017, Becton, Dickinson, and Company (BDX), or BD, introduced a new pen needle for its pen injection devices.

Management Changes at Baxter International: What You Should Know

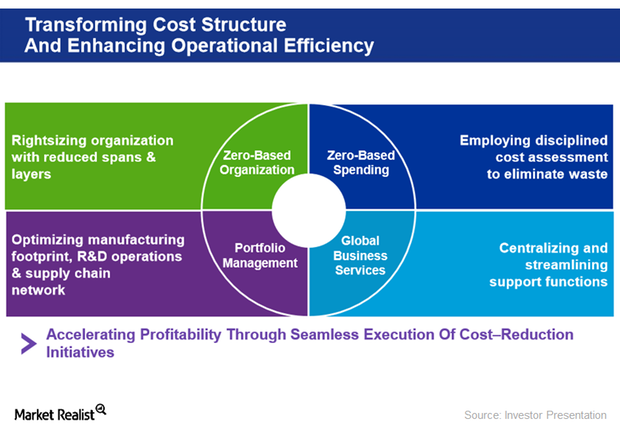

Baxter International (BAX) has been going through a cost transformation and reorganization process for some time. The initiative includes some leadership and management changes.

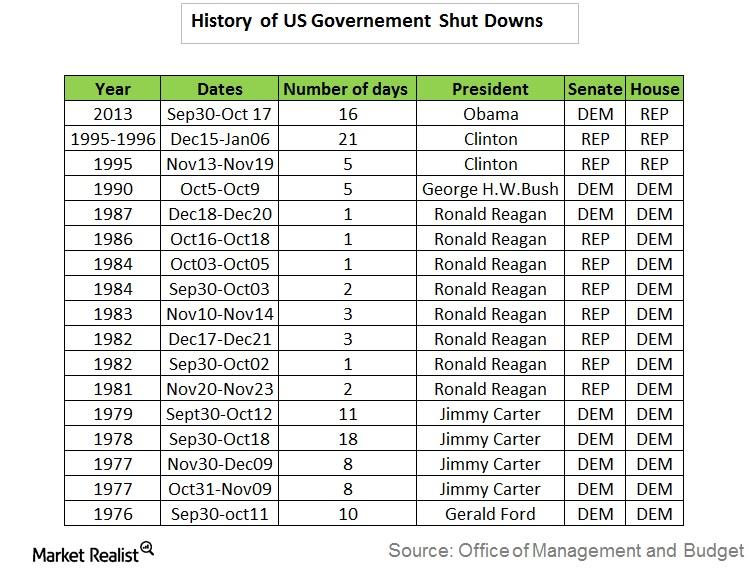

Why the US Government Has Been Shut Down Before

A failure to raise the debt ceiling will likely result in a US government shutdown and a default by the US, which would be catastrophic for the global economy and financial markets (VTI) (USMV).

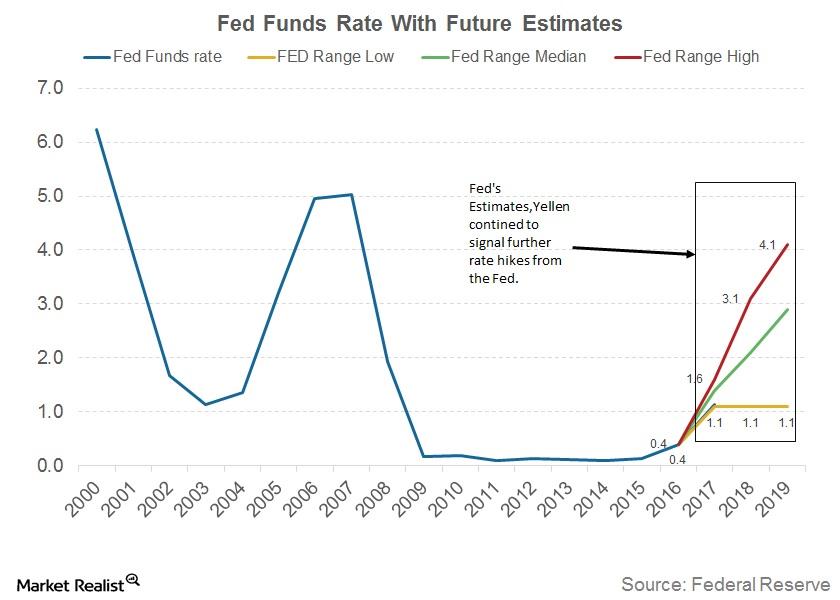

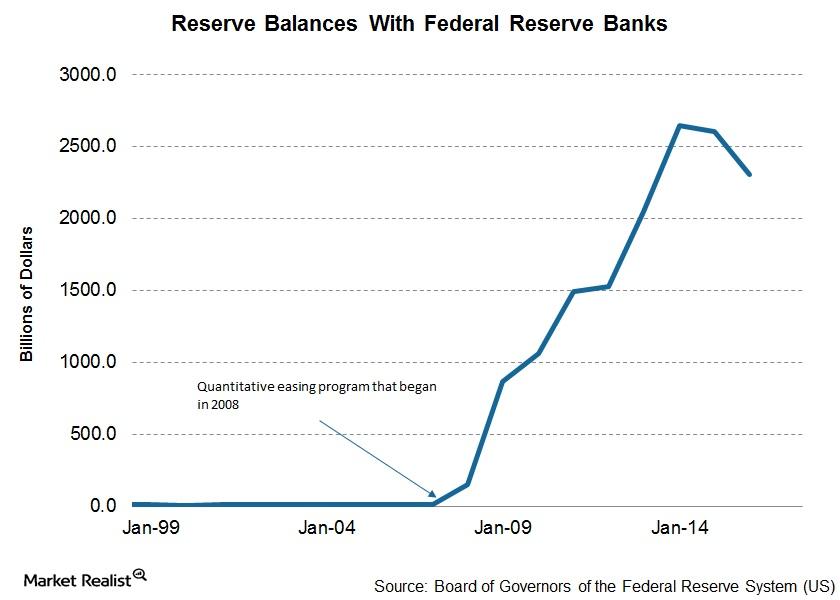

Why Fed’s Yellen Feels Gradual Rate Hikes Are Warranted

The tone of Yellen’s responses before the committee confirmed that the Fed is set to stay its course on monetary tightening, leading to policy normalization.

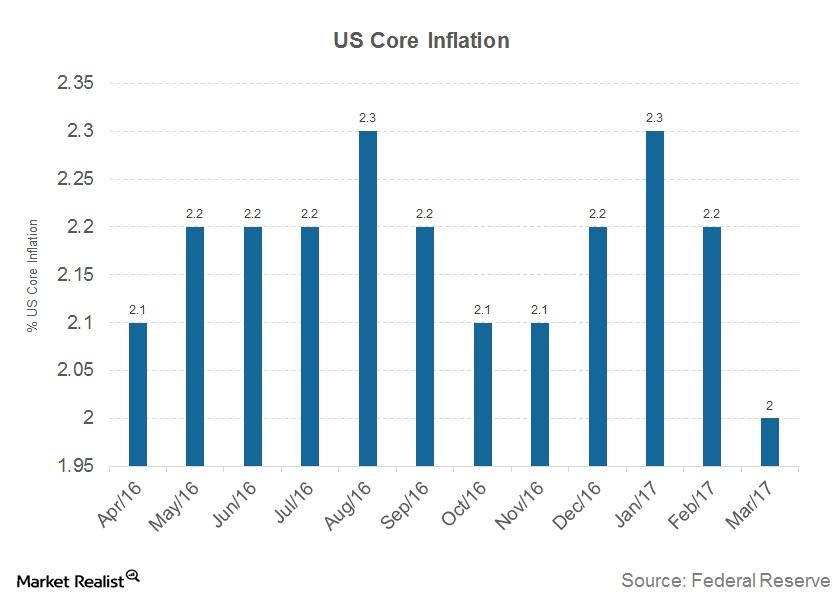

Why Charles Evans Thinks It’s Important to Reach Inflation Goals

Charles L. Evans, president of the Federal Reserve Bank of Chicago, said it’s extremely important that the Fed reach its inflation (VTIP) goal.

Your Update on the FOMC March Meeting Minutes

The minutes from the FOMC meeting on March 14 and 15 were reported on April 5 and revealed the tone of the conversation among members to be hawkish.

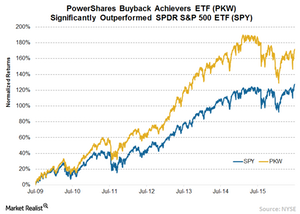

Buyback Achievers Strategy Significantly Outperforms Benchmark

Historically, we have seen Buyback does perform very well across all interest rate environments. Looking at the data back to the mid-80s, it does well.

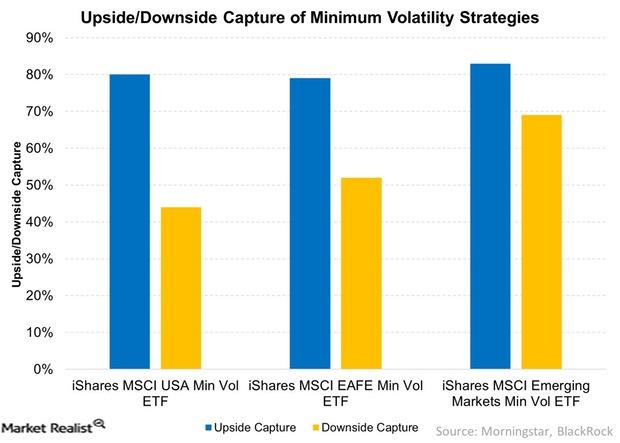

What Happens to Minimum Volatility Funds When Volatility Spikes?

The potential for a downside protection and upside participation is how minimum volatility strategies have delivered strong risk-adjusted returns over the long term.

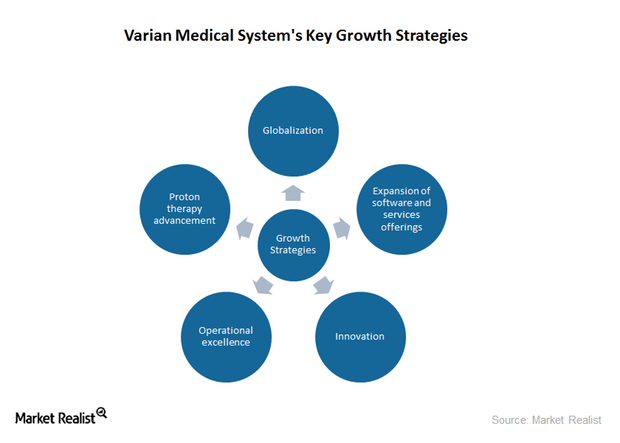

Growth Strategies Driving Varian Medical Systems’ Revenue

Varian Medical Systems has ventured into the proton therapy business and has a huge product pipeline in this area. The company generated approximately $300 million through its proton therapy business in 2015.

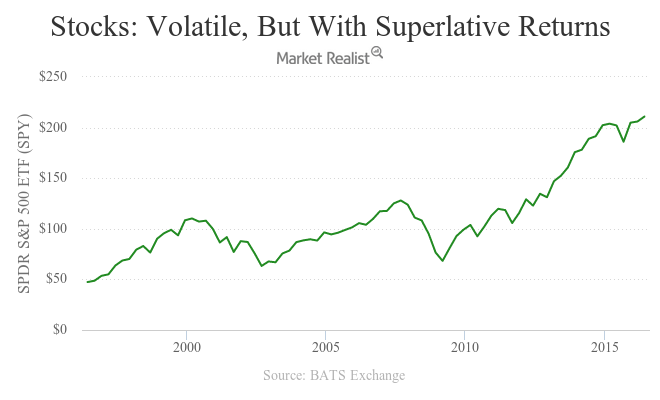

Why Bill Gross Thinks the Era of High Returns Is Over

Bill Gross thinks that the era of double-digit stock returns (SCHB) (USMV) and high single-digit investment-grade bond returns is over.

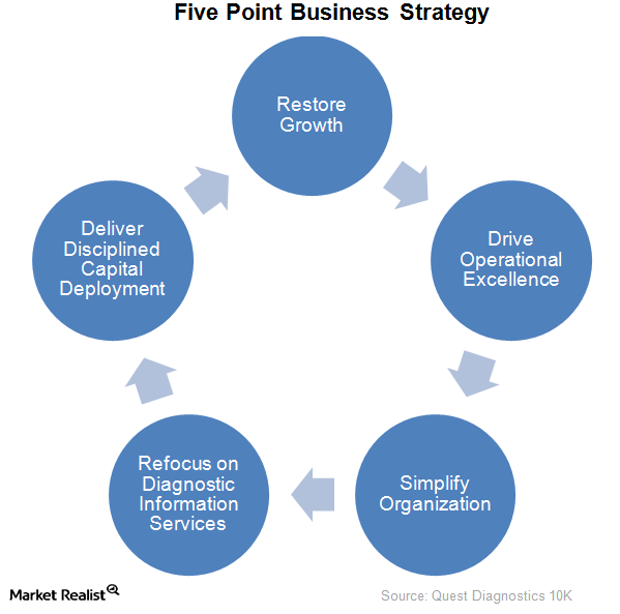

Why Quest Diagnostics’ Five Point Business Strategy Matters in 2016

If Quest Diagnostics succeeds in implementing its five-point business strategy going forward, it should boost the company’s share price and USMV.

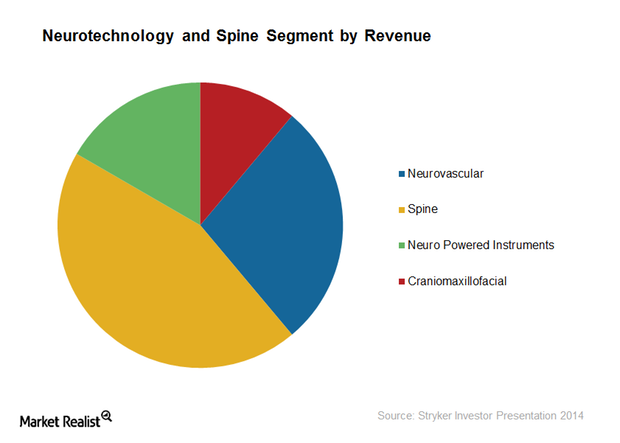

Understanding Stryker’s Neurotechnology and Spine Segment

Stryker’s Neurotechnology and Spine segment reported an increase of 5% in net sales in 2014, driven by increased demand for neurotechnology products.

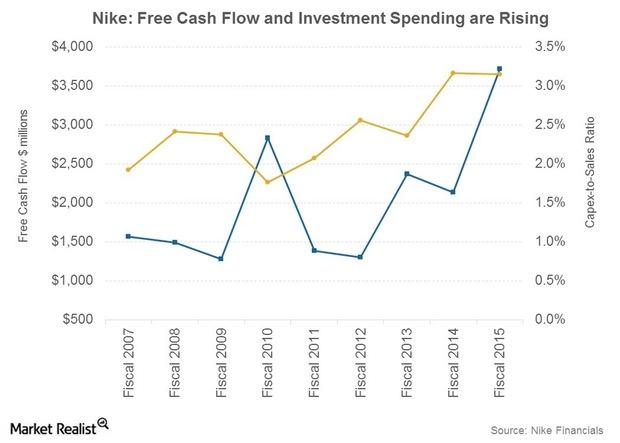

Nike’s Free Cash Flow Outlook and Projected Growth Investments

Nike expects to grow its Free Cash Flow, or FCF, at a faster pace compared to net income over the next five years through fiscal 2020. In fiscal 2015, FCF grew by ~74%.

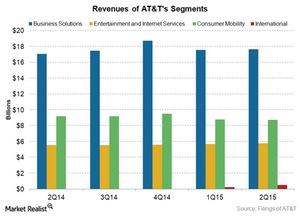

Analyzing AT&T’s New Segment Reporting Structure

AT&T changed its segment reporting structure. Its new segments are Business Solutions, Entertainment and Internet Services, Consumer Mobility, and International.

Verizon Sees Demand for Skinny Bundles

Verizon launched its Custom TV service in April. A skinny bundle service, it gives more choices to customers, allowing them to select their TV channels

AT&T’s All in One Plan Offerings

Since the merger, AT&T has extended bundled video and wireless offerings, such as its All in One Plan, which is being offered to DIRECTV and AT&T customers.