ExxonMobil Focuses on Integrated Growth, Reveals the Path Forward

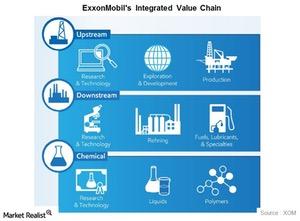

In its latest analyst meeting, ExxonMobil (XOM) announced that it had plans to concentrate on an integrated earnings model, capturing value at every stage of the energy chain.

March 7 2017, Updated 1:50 p.m. ET

ExxonMobil focuses on integrated growth

In its latest analyst meeting, ExxonMobil (XOM) announced that it had plans to concentrate on an integrated earnings model, capturing value at every stage of the energy chain.

The company plans to spend ~$22 billion in capital expenditure (capex) in 2017, ~16% more than its capex in 2016.

The company expects five major projects to start up in 2017 and 2018. These projects are expected to add working interest production of 340,000 boepd (barrels of oil equivalent per day). The Guyana field, in which there was recently a discovery, is expected to start production by 2020. For more information, read Once Again, ExxonMobil Discovers Oil in Guyana.

To prep its upstream portfolio, ExxonMobil recently penned a deal with the Bass family to acquire their prolific oil resources in the Permian Basin. For more information, read What Does ExxonMobil’s Permian Basin Deal Mean? ExxonMobil expects to produce ~4 million–4.4 million boepd until 2020.

In the downstream segment, ExxonMobil’s hydrocracker project at the Rotterdam refinery is expected to yield higher-value refined products. Its chemical segment’s capex is also aimed at producing low-cost, high-value feedstock and chemical products in the United States and Singapore. In fact, in the US Gulf Coast, the company expects to see its integrated model work toward optimizing value in the entire chain, right from the production of oil to the supply of refined and chemical products to the markets.

ExxonMobil plans to invest ~$20 billion in downstream projects at 11 sites in the US Gulf Coast region until 2022. These include projects in refining, chemicals, lubricants, and LNG (liquefied natural gas), which are expected to increase its production capacity and export ability.

The company plans to utilize the ample domestic supply of crude oil and natural gas coupled with low-cost manufacturing to efficiently tap the international market.

A word from management

In the company’s recent analyst meeting, Darren W. Woods, its chair and CEO, stated, “Our job is to compete and succeed in any market, regardless of conditions or price. To do this, we must produce and deliver the highest-value products at the lowest-possible cost through the most-attractive channels in all operating environments.”

Integrated energy majors around the globe are focusing on cutting costs, exiting non-competitive projects, and cutting capex to create competitive, lean models. ExxonMobil’s peers Chevron (CVX), Royal Dutch Shell (RDS.A), and BP (BP) have been working on the same strategic outlines to sustain and grow their businesses in a constantly changing oil price environment.

If you’re looking for exposure to the integrated energy sector, you can consider the SPDR S&P 500 ETF (SPY). The ETF has ~7% exposure to energy sector stocks, including XOM and CVX.

Series outline

In the previous series, Has ExxonMobil Found Solid Ground? we provided you with an update on ExxonMobil’s latest market performance.

In this series, we’ll provide you with an update on ExxonMobil’s financial and operational performances by assessing its capex details, business segment dynamics, and upstream and downstream segment-wise performances. We’ll also analyze XOM’s leverage and cash flow position.

We’ll talk more about ExxonMobil’s capex details in the next article.