SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

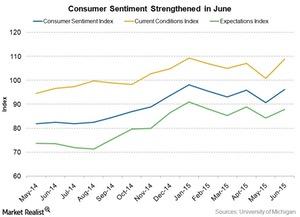

Consumer Sentiment Shines on Wall Street: Upbeat in June

In the US, consumer sentiment rose in June. The Consumer Discretionary Select Sector SPDR ETF (XLY) has gained about 1.22% over the past month.

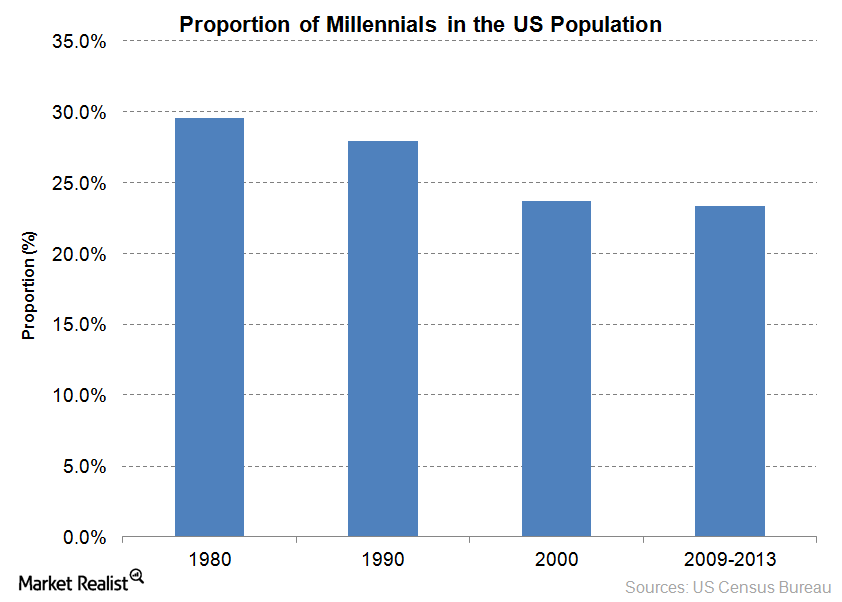

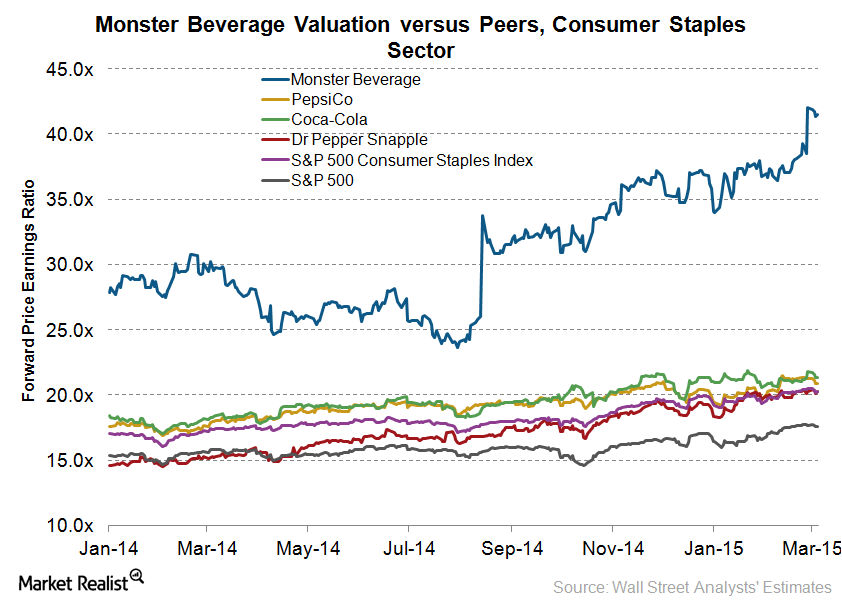

Why Are Millennials a Key Demographic for Monster Beverage?

Millennials are the key consumers of energy drinks and shots. Monster Beverage specifically targets this tech-savvy demographic in its advertisements.

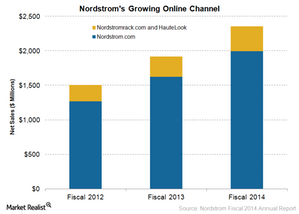

Nordstrom’s Online Channel Fuels Sales Growth in Fiscal 2014

Nordstrom’s online channel has been very instrumental in growing sales. In fiscal 2014 ending January 31, 2015, sales of Nordstrom.com grew 23.0% to $2.0 billion.

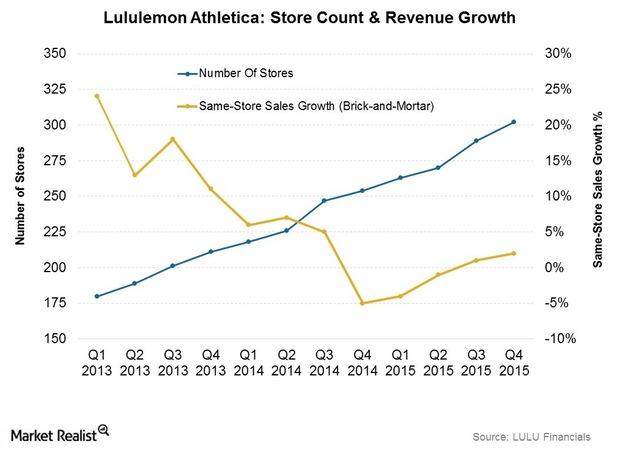

Why Store Expansion is a Critical Driver for Lululemon Athletica

Despite having negative comps in 1H15, Lululemon’s revenue growth for its physical stores was positive at 9.7% year-over-year in fiscal 2015.

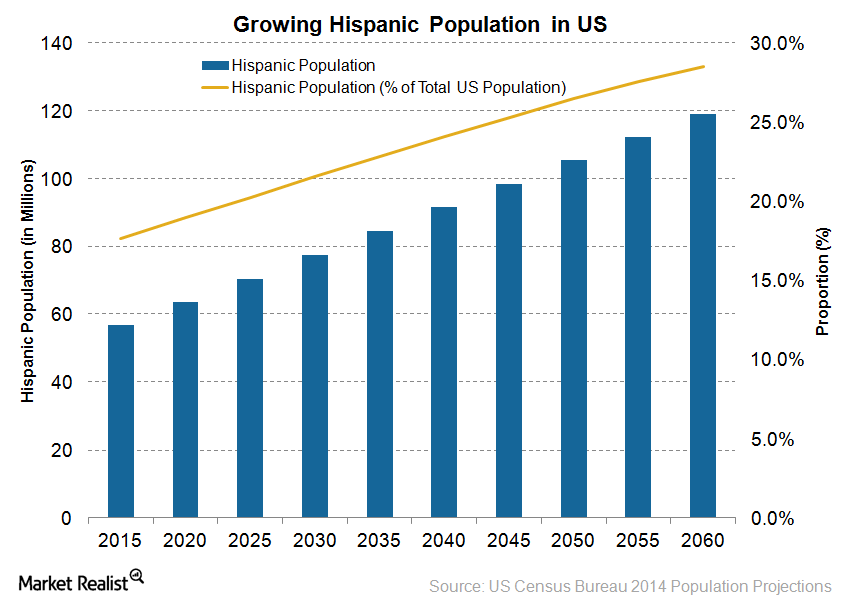

Why PepsiCo and Its Peers Are Focusing on Hispanics in 2015

PepsiCo (PEP) and peers like Coca-Cola and Dr Pepper Snapple have been developing several products based on the tastes and preferences of Hispanics.

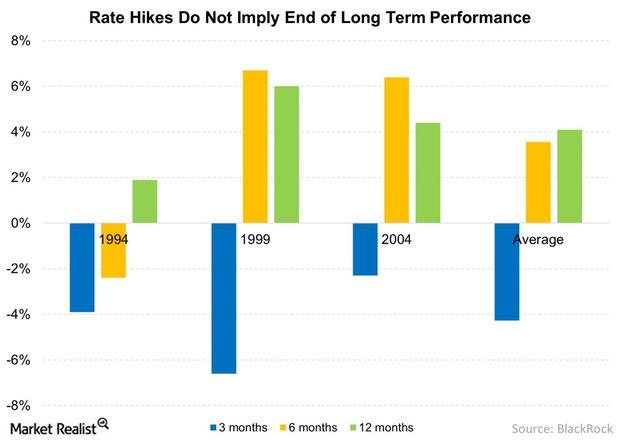

Rate Hikes Historically Lead to Muted Stock Returns

The last three rate hikes have seen negative three-month returns following the initial tightening period. Yet in the subsequent months, the S&P 500 Index rebounded.

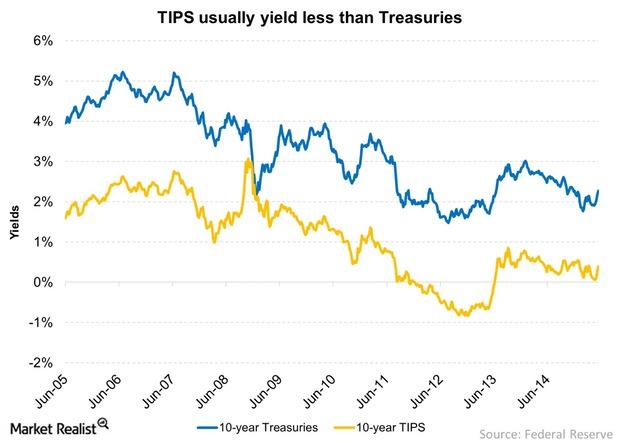

Comparing Treasury Inflation-Protected Securities and Treasuries

Yields on TIPS remain close to 0%, making them unattractive for some. However, considering that inflation rates could go up and remain there, these securities look attractive.

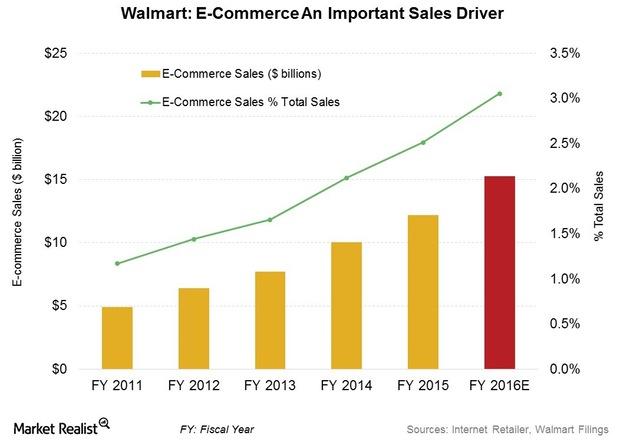

E-Commerce Should Spark Walmart’s Fiscal 1Q16 Performance

Walmart announced it was testing unlimited shipping for $50 per year, presenting significant competition to Amazon’s Prime service.

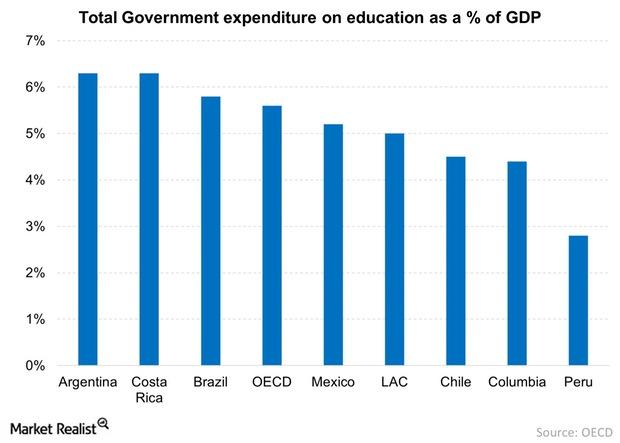

Investing in Education to Reduce Poverty in Latin America

In an effort to reduce inequality and poverty in Latin America, governments there have increased education spending many times over in the last decade or so.

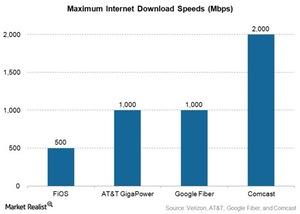

Gigabit Pro: Comcast Internet Offering Delivers up to 2 Gbps

The Gigabit Pro service can provide much faster speeds than those offered by Verizon (VZ) FiOS, AT&T GigaPower, and Google Fiber.

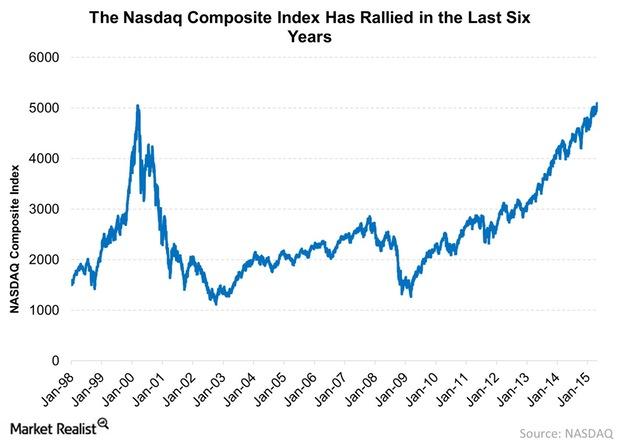

Why the NASDAQ’s 5000 Level Is Not Like the Tech Bubble

The NASDAQ’s 5000 level is not like the tech bubble. Earnings have grown multifold, making current valuations sane.

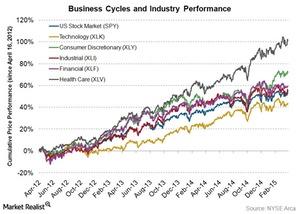

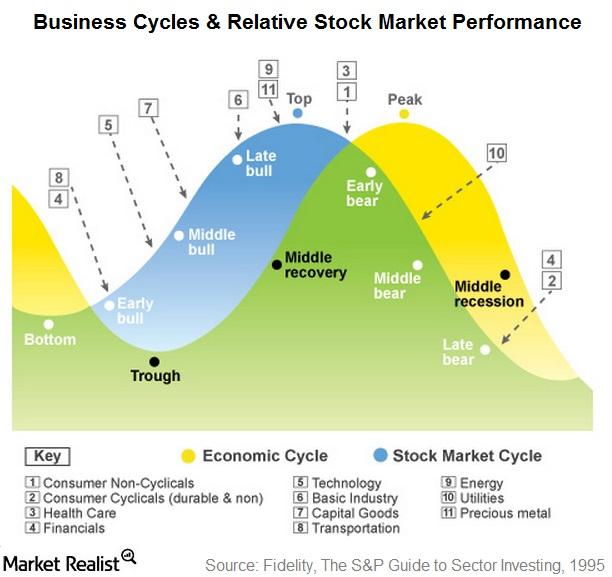

What Stage of the Business Cycle Are We In Now?

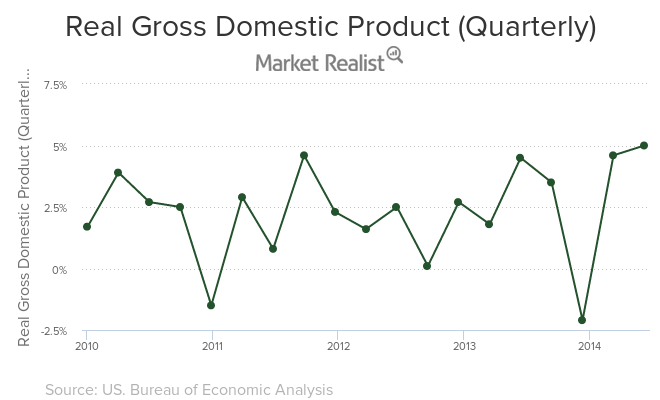

Looking at the US economy for the last three years might help us understand which phase of the business cycle the US economy is in right now.

ETFs That Outperform in Late Stage, Recession, and Trough

Certain industries typically outperform at various phases of business cycles. This provides important clues to investors and helps them manage their portfolios.

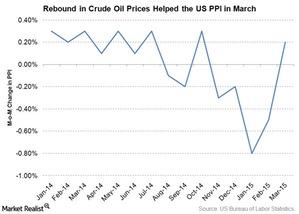

A Rebound in Crude Oil Prices Helped the PPI in March

On Tuesday, April 14, the U.S. Bureau of Labor Statistics released its PPI (Producer Price Index) figures for February. The PPI gained 0.2% in March.

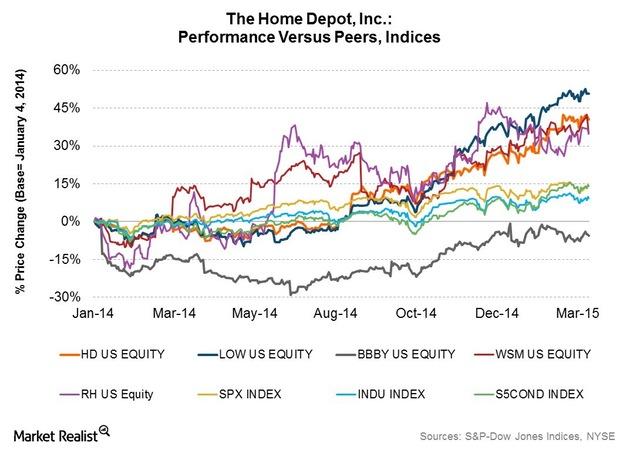

Home Depot Stock Outperforms Peer Group

Home Depot’s (HD) stock has performed well over the past five years. In fact, it’s been the best-performing stock in its peer group.

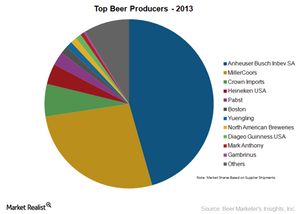

Competitive Forces: Who Rules the US Beer Industry?

Based on the US beer industry shipments of 211.7 million barrels, Anheuser-Busch InBev led the beer industry in 2013 with a 45.6% market share.

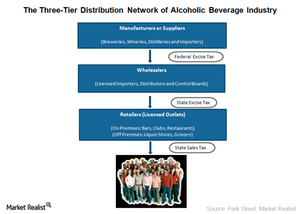

The Three-Tier Distribution of the US Alcoholic Beverage Industry

The three-tier distribution system ensures collection of taxes and prevents control of production, distribution, and selling by a single entity.

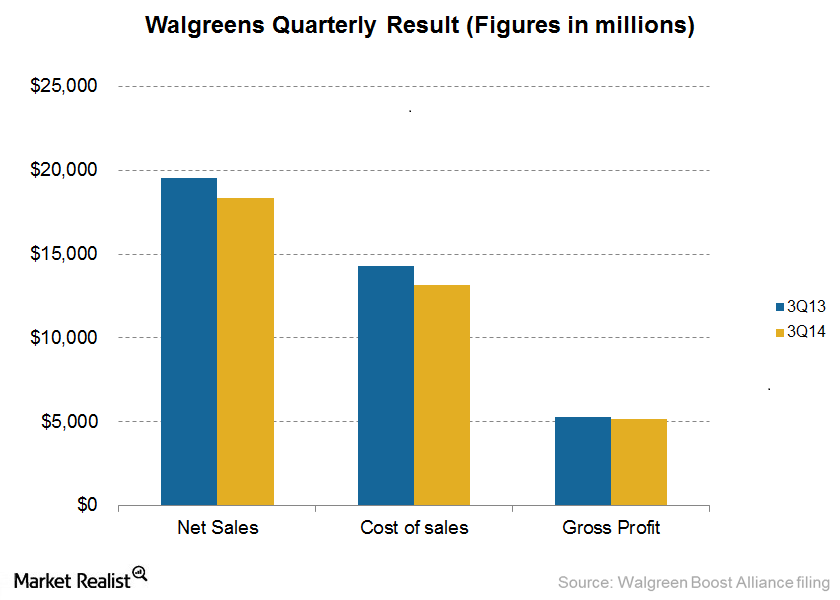

Blue Ridge Capital Opens New Position in Walgreens Boots Alliance

Walgreens Boots Alliance is a firm created by the merger of Walgreens and Alliance Boots in December 2014.

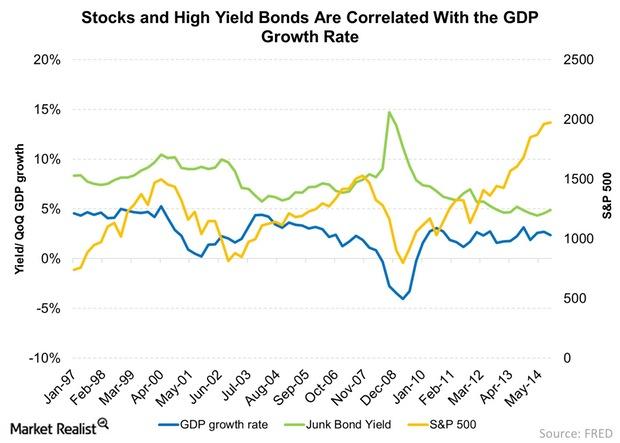

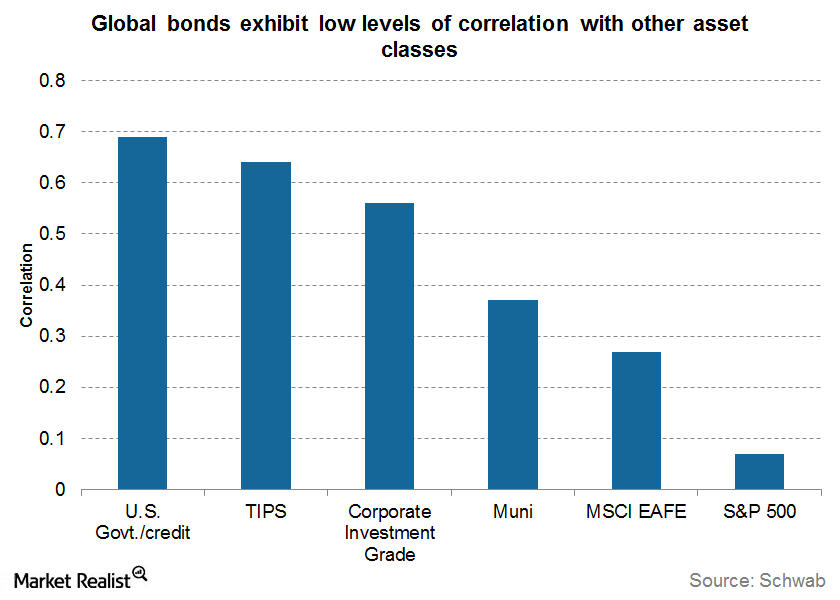

Why Corporate Bonds Correlate to Stocks

Corporate bonds, especially high yield corporate bonds, correlate to equities and hence, so they don’t provide great diversification benefits.

Equity Sub-Asset Class Basics for Retail Investors

Financial engineers are constantly introducing the market to new sub-asset classes, often confusing retail investors in the process.

Cushion Volatility With Bonds

High yield bonds are becoming increasingly correlated with the S&P 500 and might increase your risk exposure instead of giving diversification benefits.

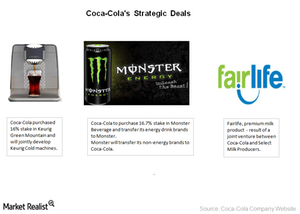

Monster Beverage’s stock outperforms peers

After transferring its non-energy drink brands to Coca-Cola, Monster Beverage can focus on its core energy business and expand its international presence.

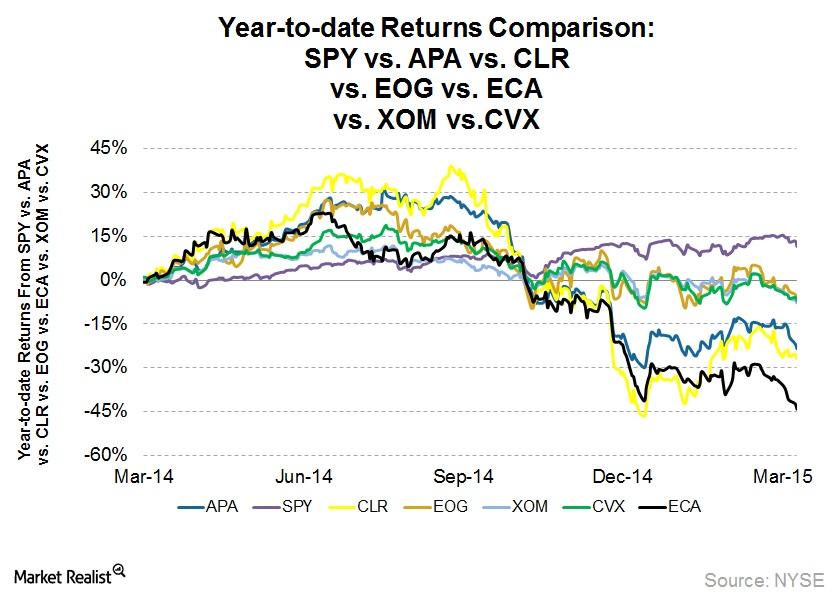

Falling oil prices affect energy upstream and integrated companies

Falling oil prices have started to affect energy upstream companies’ revenues. These companies have resorted to cutting costs and focusing on cash flow.

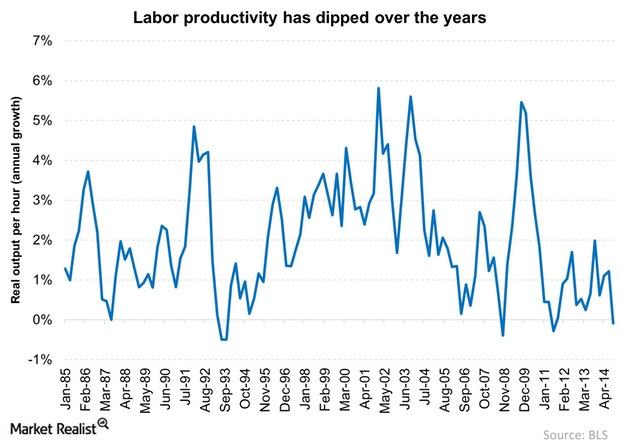

Why Low Labor Productivity Could Affect GDP Growth

Labor productivity growth has slumped to a negative. The 30-year average is 2%. However, this average has been quite volatile.

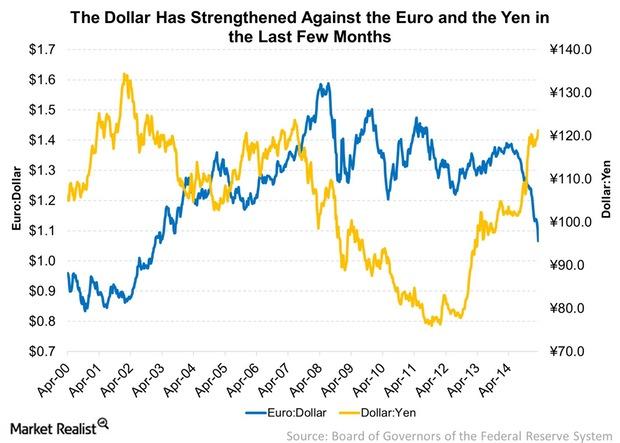

What’s Causing the US Dollar to Strengthen?

The strength in the US dollar is because of divergence in central bank policies. The US dollar is strengthening against most of the major currencies.

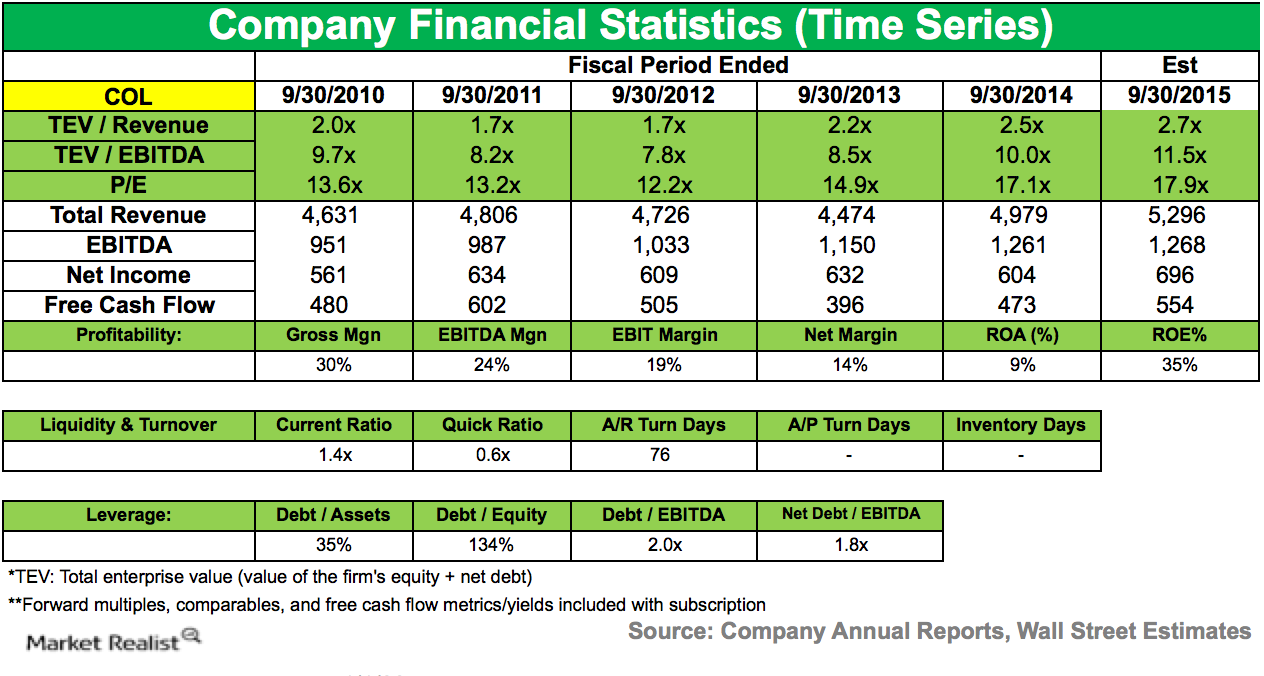

ValueAct Capital Lowers Stake in Rockwell Collins

Rockwell Collins is a leader in the design, production, and support of communications and aviation electronics for commercial and military customers worldwide.

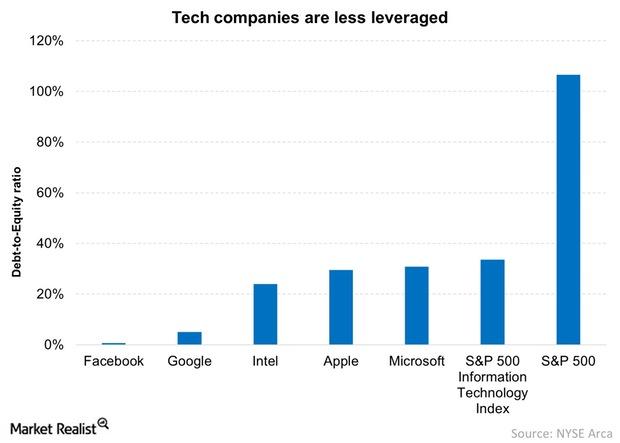

Relatively Low Leverage Gives Tech Companies Flexibility

The debt-to-equity ratios of several top tech companies suggest that the broader markets are much more leveraged than tech stocks.

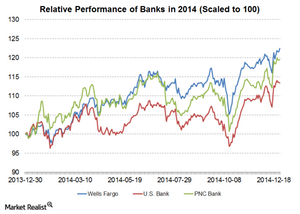

Valuation of PNC Bank is close to historical mean

PNC stock was trading at a PBV ratio of 0.75 in November 2012. Since then, the stock has seen a smart move up and trades at a PBV multiple of ~1.08.

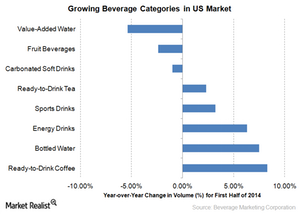

Dr Pepper Snapple pursues non-carbonated beverage growth

Keeping in view declining soda volumes, Dr Pepper Snapple is focusing on expanding its non-carbonated beverage line.

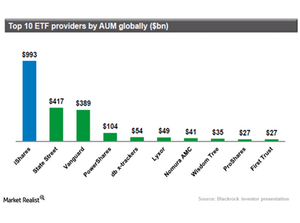

How does BlackRock compare to its peers?

How does BlackRock compare to its peers? BlackRock faces major competition from State Street and Vanguard.

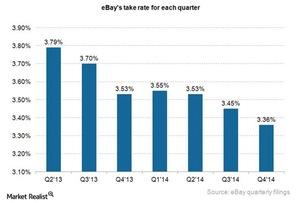

Why eBay isn’t worried about a falling take rate

eBay’s take rate fell from 3.79% in 2Q13 to 3.53% in 2Q14. However, the company isn’t worried about it since take rate is offset by healthy revenue growth.

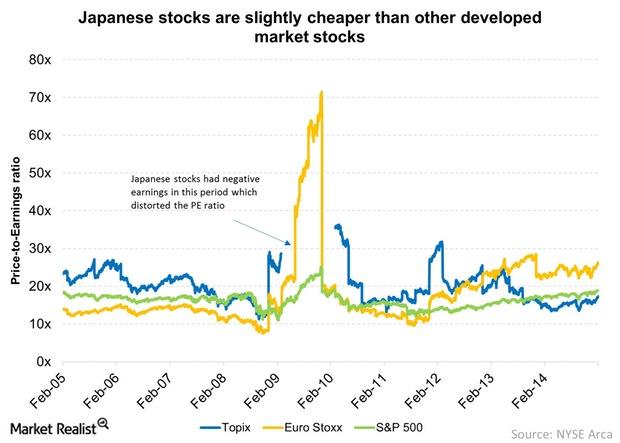

Why Japanese Stock Valuations Could Be Justified

Japan looks cheap compared to other developed markets. Japanese stock valuations can be justified if the “three arrows” are used prudently.

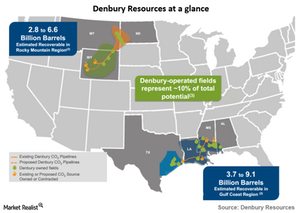

Introducing Denbury Resources

Denbury Resources primarily extracts oil and gas via carbon dioxide–based enhanced oil recovery (or EOR). This is also called tertiary oil recovery.

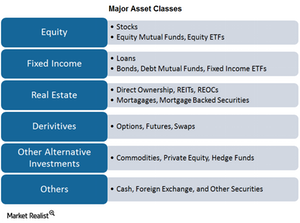

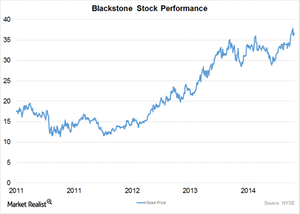

Blackstone Group: The $290 billion alternative investment manager

Alternative investment management attempts to outperform the major indices, instead of replicating returns as is the case in passive fund management.

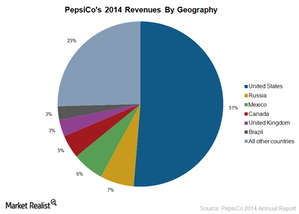

PepsiCo is a leader in the food and beverage spaces

PepsiCo (PEP) is the second largest non-alcoholic beverage maker and the market leader in the snack food space in the US.

Coca-Cola’s joint ventures set the stage for future growth

The company is focused on expanding its product portfolio through strategic deals. Coca-Cola’s joint ventures will set the stage for future growth.

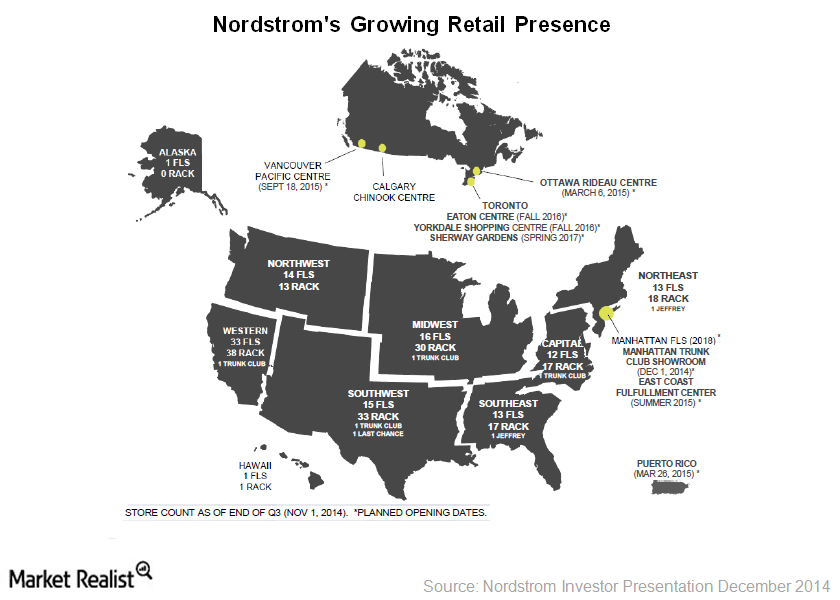

An overview of Nordstrom’s growth story

This article provides a brief overview of Nordstrom’s growth story.

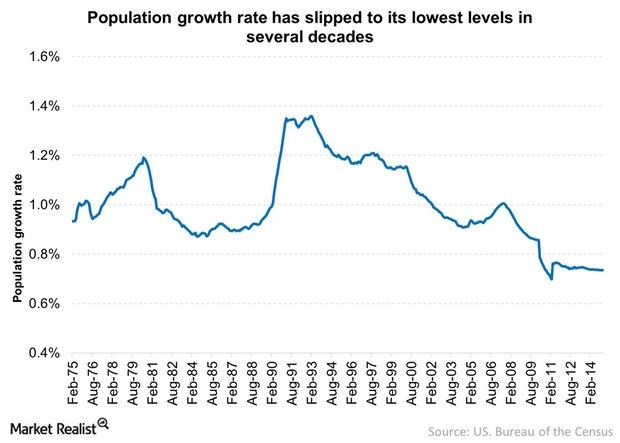

Job Creation Isn’t Matching Population Growth

Job creation isn’t matching population growth. The population growth has been dipping over the last two decades. Currently, it’s 0.7% per year.

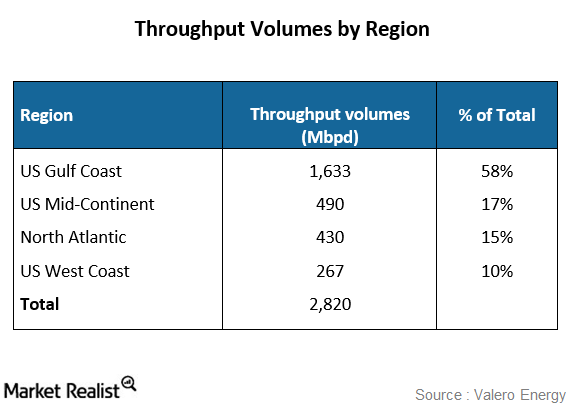

Analyzing Valero Energy’s operational performance in 4Q 2014

Valero Energy’s (VLO) refining segment’s throughput volumes increased by 41,000 barrels a day compared to the previous year’s fourth quarter.

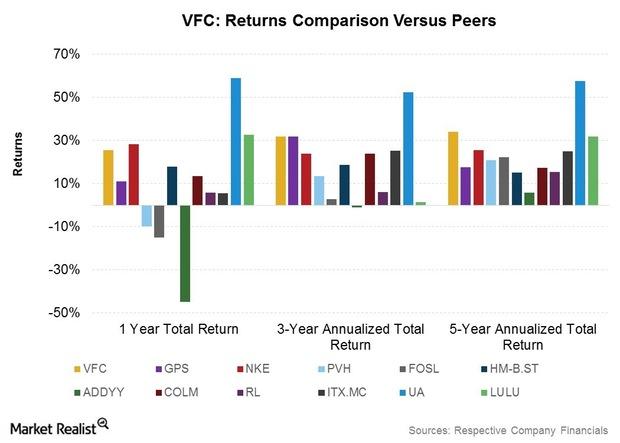

Shareholder Returns Analysis: Where VF Corp. Trumps Competitors

VFC’s total annualized returns to shareholders appear among the most consistent within its peer group for one-year, three-year, and five-year time periods.

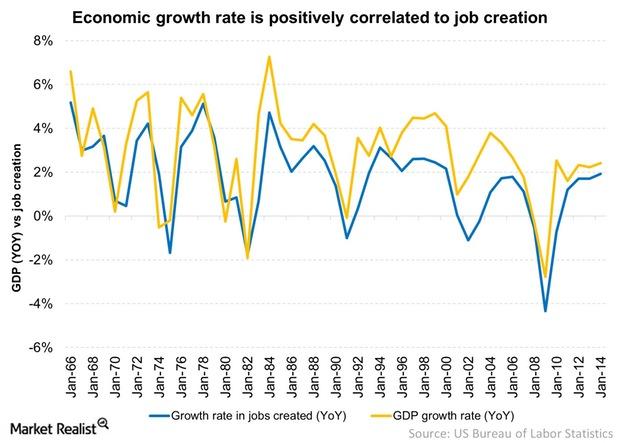

Why Job Creation And GDP Growth Go Hand-In-Hand

Job creation and GDP growth go hand-in-hand. The job markets and the economy tend to move in a similar pattern.

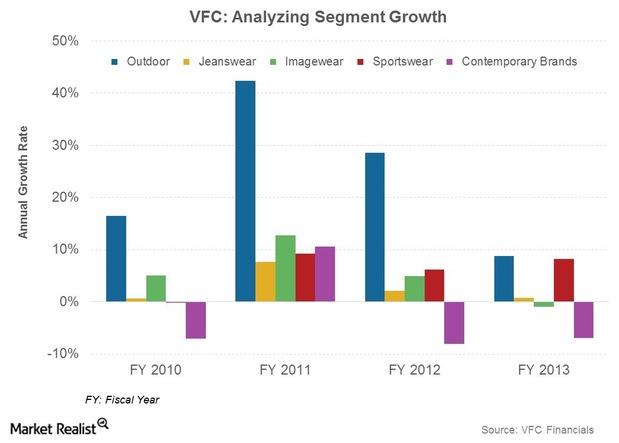

Making It To VF Corp.’s $2-Billion Brand Club

The North Face became VFC’s first brand to achieve $2 billion in sales in 2013. Timberland revenues are expected to come in at ~$1.7 billion in 2014.

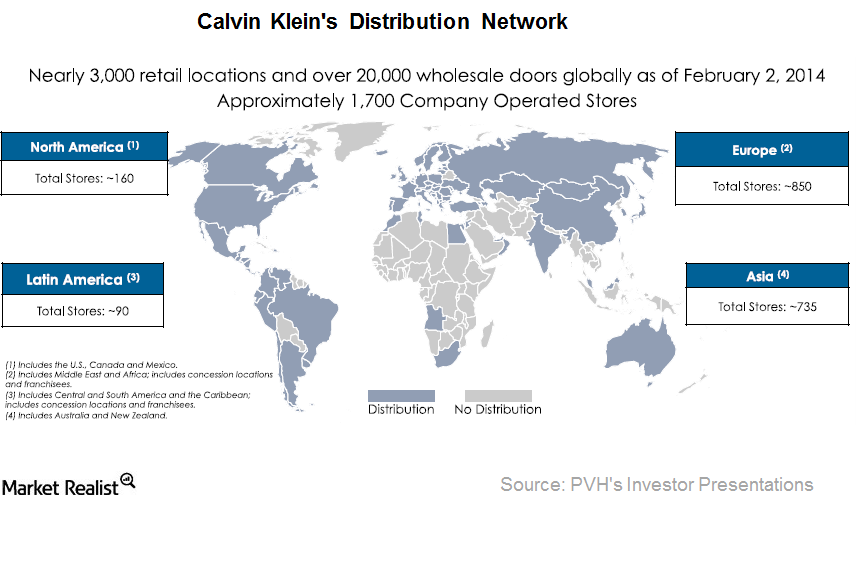

Analyzing the Calvin Klein business

Products sold under the Calvin Klein banner had gross revenue of $7.8 billion in 2013. Of the revenue, PVH reported $2.8 billion.

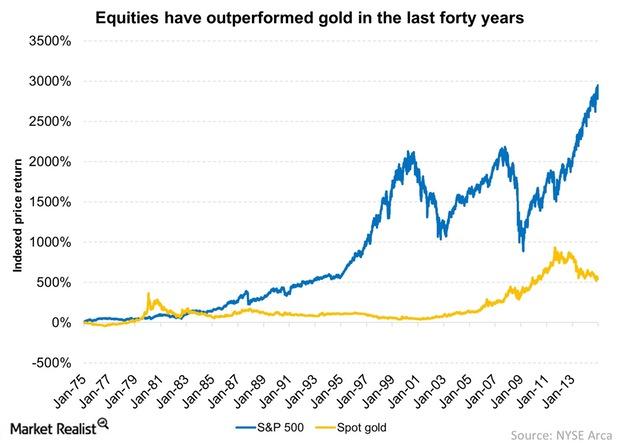

Equities are the best performing asset class in the long term

The CAGR for equity for the last 20 years is 7.8%. Equities outperformed investment-grade corporate bonds. Equities are the best performing asset class.

Best Buy joins forces with key suppliers

Best Buy is building strong relationships with key suppliers to mitigate the impact of heightened competition from suppliers’ retail stores.

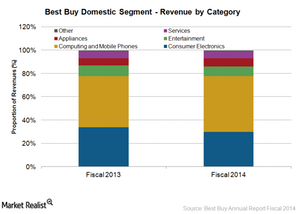

Understanding Best Buy’s revenue mix

The computing and mobile phone category is the largest of Best Buy’s revenue mix, accounting for 48% of the Domestic segment’s fiscal 2014 revenues.

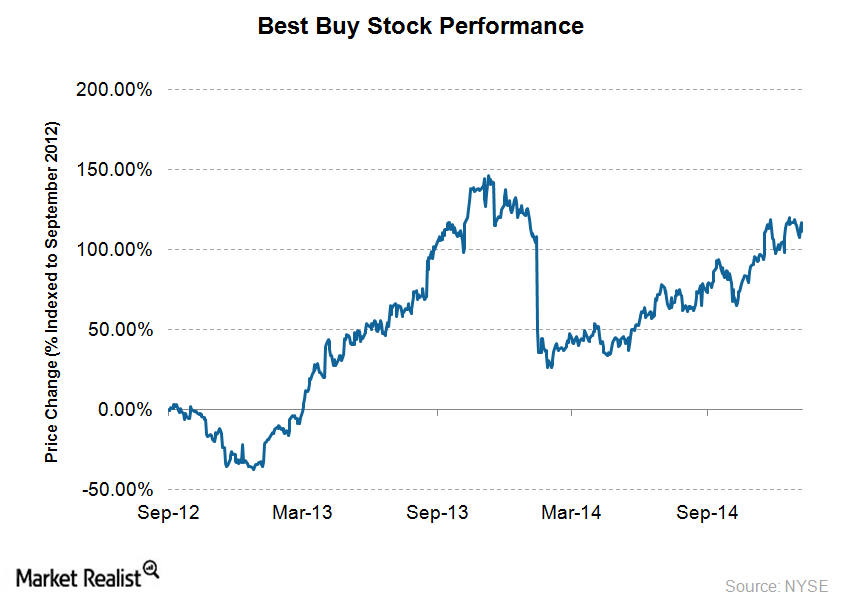

Best Buy CEO transforms the company for the better

Before being appointed Best Buy CEO, Hubert Joly was credited with turning around two other companies. Best Buy’s stock has appreciated by 111% since.

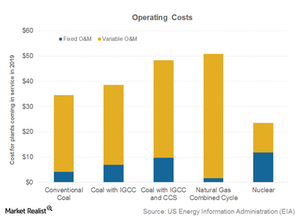

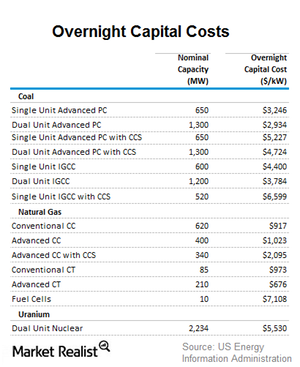

Nuclear power plants are cheaper to operate

Nuclear power plants have the lowest variable costs among the three fuel types, at $11.8 per MWh (for plants coming online in 2019).

Natural gas–fired power plants are cheaper to build

Natural gas–fired power plants are clearly the cheapest to build due to lower land requirements and faster, cheaper construction.

What 2 factors drive real GDP growth?

According to Jeffrey Lacker, two fundamental factors contribute to GDP growth in the long term—population growth and real GDP per worker.