SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

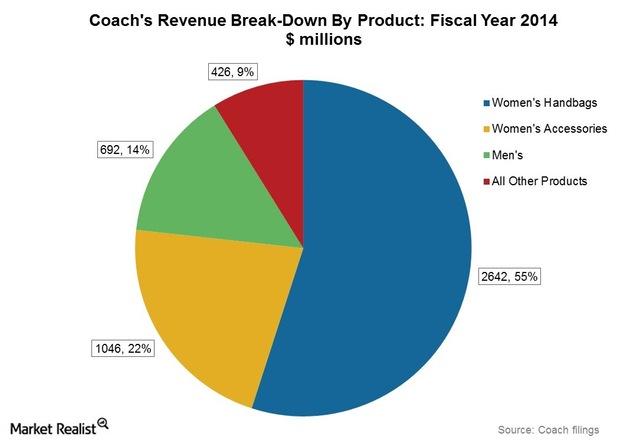

Coach’s Supply Chain And Manufacturing Model

Although the manufacturing process is outsourced, Coach tries to keep a grip on the manufacturing process from design to production.

An Introduction To Luxury Brand Pioneer Coach

Coach is a well-known premium fashion brand. In recent years, Coach has faced increasing competition from newer entrants in the affordable luxury market.

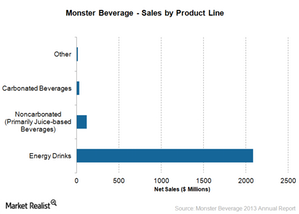

Why Monster Beverage extends its product line

Energy drinks witnessed impressive growth over the past five years. Monster Beverage and its peers—like Red Bull GmbH—are expanding their product lines to capture this growing demand.

Monster Beverage’s bold marketing approach

Monster Beverage’s advertising and marketing efforts are associated with adventure sports and sports personalities. It sponsors extreme sporting events—like Motocross.

Monster Beverage’s extensive line of energy drinks

Monster Beverage Corporation (MNST) emerged as a leader in energy drinks. It has a 14% market share in the world’s energy drink market.

How does coke fit into the steelmaking process?

Iron ore, steel scrap, and met coal are the main raw materials for steelmaking. SunCoke converts met coal to coke by driving out its impurities.

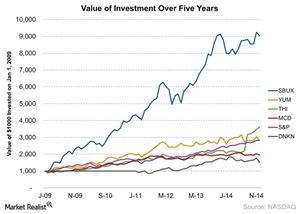

Starbucks’ 5-Year Stock Performance

Now, we’ll discuss SBUX’s stock performance over the past few years. SBUX returned $9,037 on $1,000 invested on January 1, 2009. The fourth quarter earnings announcement is approaching.

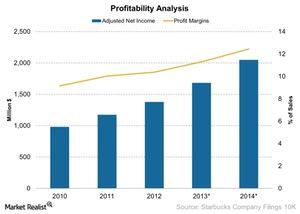

Starbucks’ Net Profit Margins Improve Over 5 Years

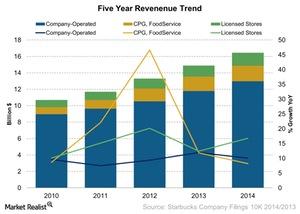

SBUX’s net income and net profit margins have been on an uptrend since 2010. At the end of fiscal year 2014, SBUX’s adjusted net income was $2.05 billion.

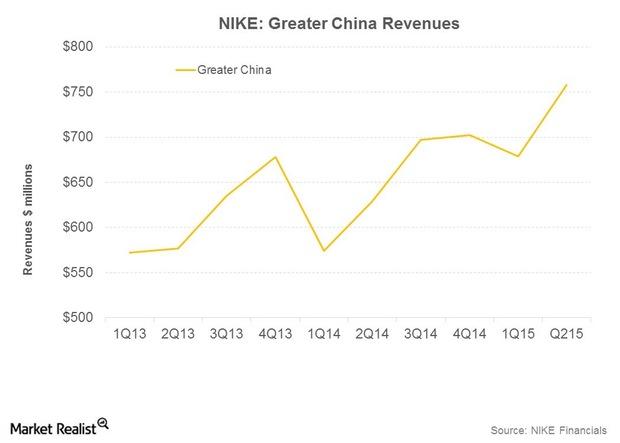

NIKE in Greater China: Strategies That Work

NIKE holds the #1 position for both apparel and footwear in China among sportswear rivals. It plans to leverage the value of its brand among consumers.

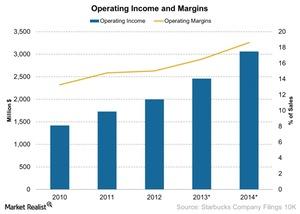

Starbucks’ Operating Profit Margin Increases

At the end of fiscal year 2014, SBUX’s operating income was $3.1 billion. Its operating profit margins increased to 19% in 2014—compared to 17% in 2013.

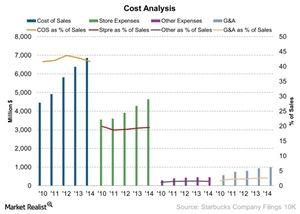

Starbucks’ Key Operating Costs

SBUX wants to grow sales. It’s also important to manage the operating costs. In this part of the series, we’ll take a look at four key operating costs.

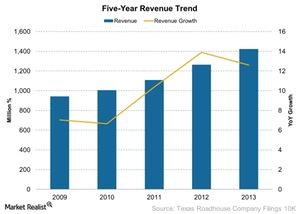

A Must-Read Business Overview Of Texas Roadhouse

In this overview of Texas Roadhouse, we’ll look at the company’s financial performance, value drivers, competition, unit growth, and other key information.

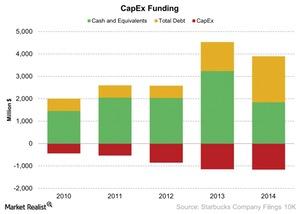

Starbucks Is Expanding By Taking On Debt

SBUX’s total debt increased from $1.3 billion to $2 billion. It issued long-term debts in 4Q13 and 1Q14. This increased the interest expense by $36 million.

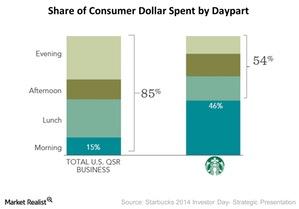

Starbucks Is Expanding Dayparts To Grow Sales

SBUX is also expanding its offerings in different dayparts. The expanded offerings cater to a wider customer base. They increase the wallet share.

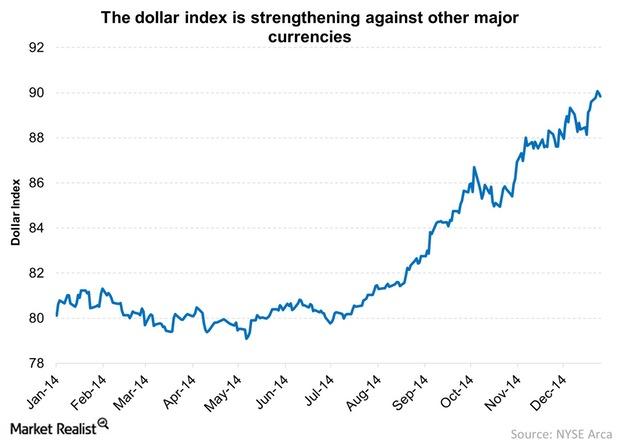

Key Catalysts Behind The US Dollar Rally In 2014

Can the US dollar rally continue? What does this mean for commodities? Russ answers these queries in his latest Ask Russ installment.

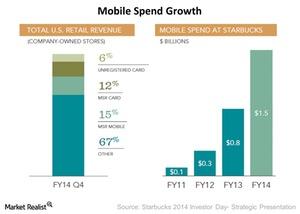

Analyzing Starbucks’ Successful Mobile Ecosystem

Once the card is registered on the Starbucks (SBUX) website, the data is available on other ecosystems—for example, a mobile app. It helps a customer keep track of rewards.

Starbucks Gets Help From Its Rewards Program

One of the ways a customer can become a My Starbucks Rewards member is by using the My Starbucks Rewards card. The card is available at the checkout counter.

Starbucks Has Seven Growth Strategies

SBUX recognizes its limitation in attracting customers. As a result, SBUX is exploring other growth strategies. It’s looking at other beverage businesses.

A Business Overview Of Starbucks Corporation

Starbucks Corporation (SBUX) is a limited-service café. It operates more than 20,000 restaurants across 65 countries around the world. It employs more than 191,000 people.

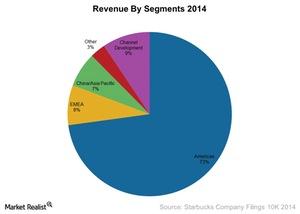

Why The Americas Segment Is Important For Starbucks

The America’s segment includes revenues mainly from the US, Mexico, and Canada. This segment accounted for 73% of SBUX’s revenues in 2014.

Starbucks’ Coffee Has Three Revenue Sources

Consumer packaged goods, or CPG, include the sale of SBUX’s coffee and tea-related products—like single-serve tea and coffee products. It also includes several beverages at retail stores.

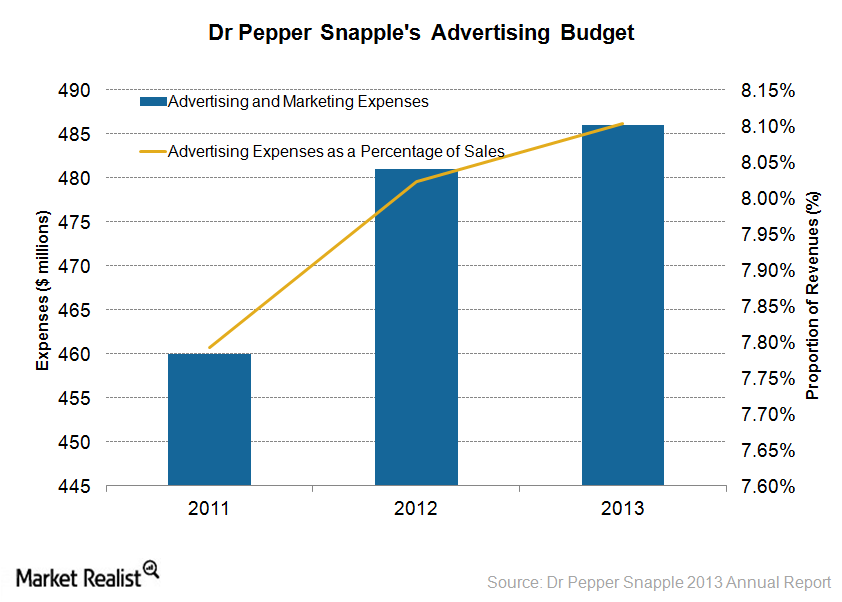

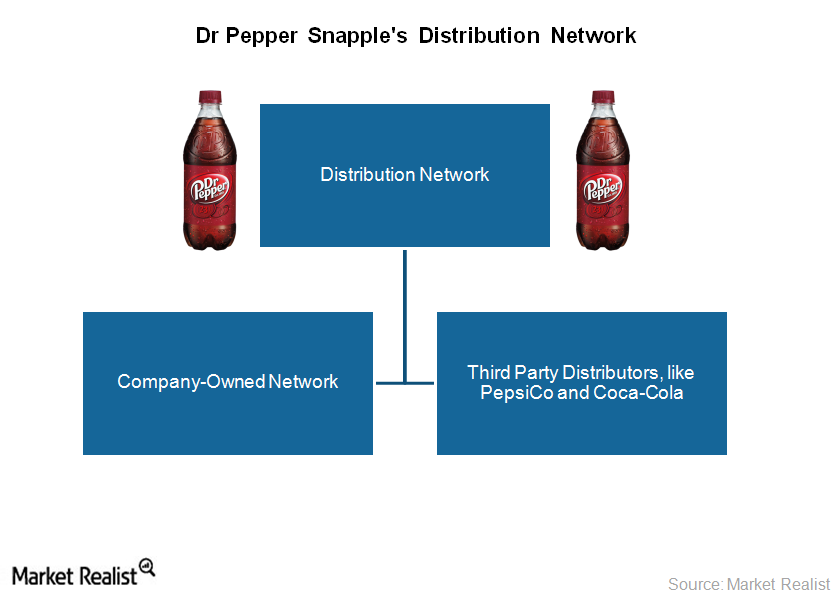

What are Dr Pepper Snapple’s growth strategies?

Dr Pepper Snapple plans to grow into new categories by leveraging its distribution agreements for third-party brands such as Vita Coco coconut water.

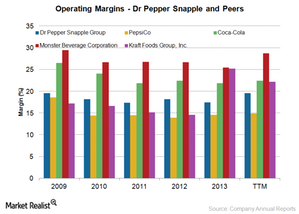

Dr Pepper Snapple makes efforts to improve profitability

Dr Pepper Snapple implemented its rapid continuous improvement (or RCI) in 2011 to simplify processes and address distribution and the availability gap.

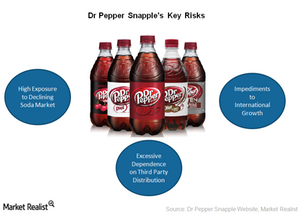

What are Dr Pepper Snapple’s major risks?

Dr Pepper Snapple faces major risks like significant reliance on carbonated soft drinks, limited international growth, and excessive reliance on third-party distribution.

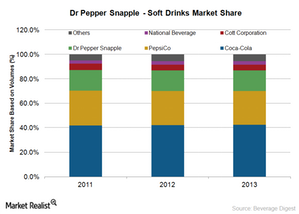

Dr Pepper Snapple is pitted against the soda behemoths

In 2013, Coca-Cola had 42.4% of the market share in the US carbonated soft drink category. PepsiCo had 27.7% and Dr Pepper Snapple 16.9% of the market share.

Understanding Dr Pepper Snapple’s route to market

Dr Pepper Snapple’ beverages reach consumers through the company’s own distribution network, third-party distributors, and direct delivery to customers’ warehouses.

An overview of Dr Pepper Snapple’s key brands

Canada Dry, 7UP, A&W, and Sunkist are Dr Pepper Snapple’s Core 4 brands. Noncarbonated beverages include ready-to-drink tea, juice, juice drinks, and mixers.

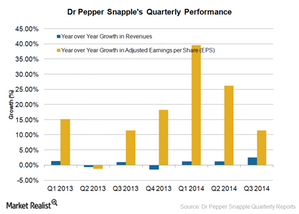

Dr Pepper Snapple’s recent performance and the road ahead

Dr Pepper Snapple expects its fiscal 2014 revenues to increase by 1%. Investors should be cautious since the company expects an impact from higher transportation and marketing costs.

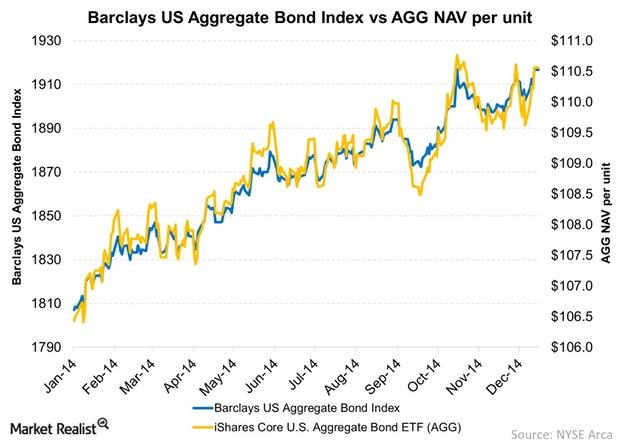

Calculating A Bond ETF’s Underlying Value

The calculation of a bond ETF’s underlying value is going to be less precise than a stock ETF’s underlying value.

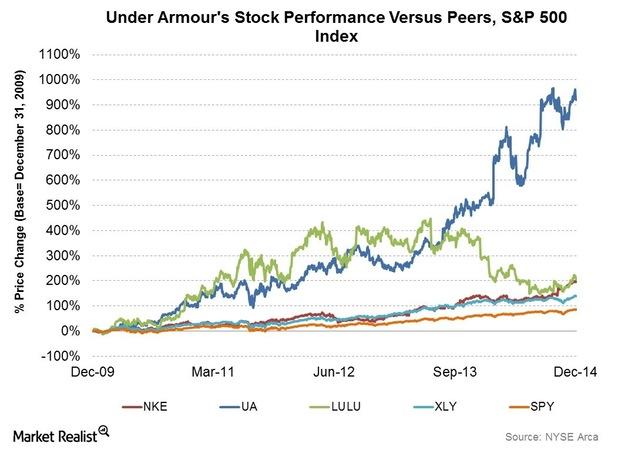

SWOT Analysis: Balancing Under Armour’s Strengths And Weaknesses

How strong is Under Armour’s business model? In the next parts of this series, you’ll read a SWOT analysis—looking at strengths, weaknesses, opportunities, and threats—of Under Armour, Inc. (UA). We’ll also compare the company to rival firms, the overall market, and the consumer discretionary (XLY) sector. In this part, we’ll cover the firm’s key strengths and weaknesses. […]

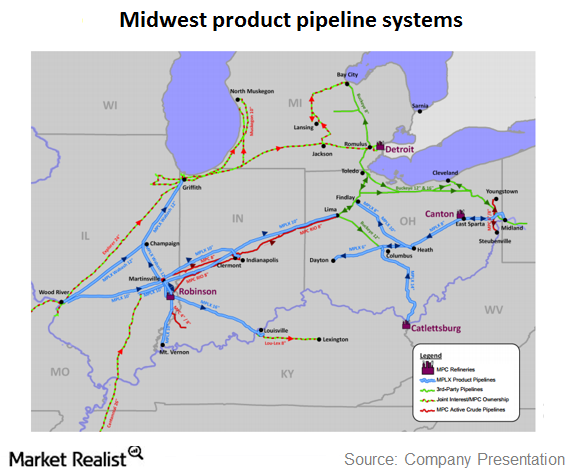

The MPLX Midwest product pipeline systems

Canton to East Sparta consists of two parallel pipelines that connect MPC’s Canton refinery with the MPLX East Sparta, Ohio, breakout tankage and station.

Lululemon Builds Brands Through Unique Marketing Strategies

For relatively new companies competing in an industry with many players, building a well-recognized and reputed brand is essential.

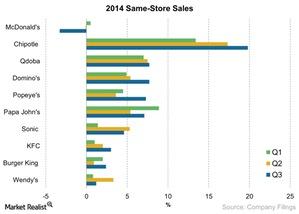

McDonald’s List Of Initiatives That Will Bring A Turnaround

McDonald’s list of initiatives includes simplifying its menu and possibly offering locally relevant menu items. This could be quite a gamble.

McDonald’s Says “Strong Competitive Activity” Impacting Sales

According to McDonald’s management, “strong competitive activity” is affecting its sales. Other fast food chains don’t seem to be feeling the competition.

The Vast Expanse Of The Tyson Foods Product Portfolio

The Tyson Foods product portfolio includes a variety of products such as value-added chicken, beef, and pork, pepperoni, pizza crusts, and much more.

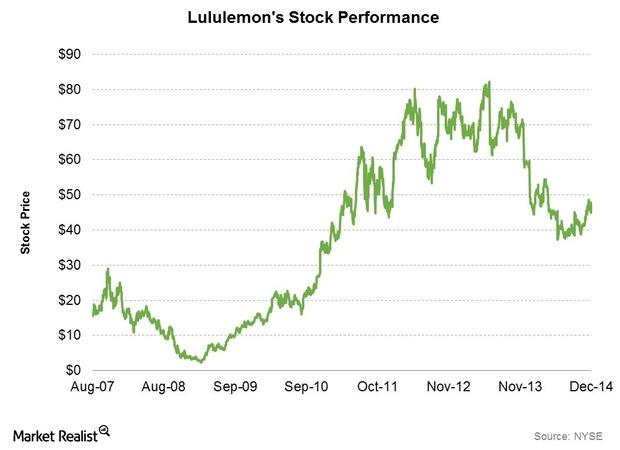

Lululemon Attempts To Reinvigorate Its Interrupted Growth Model

In this series, we’ll provide an overview of Lululemon Athletica, its financials (including its latest quarterly results), and its strategies.

Tyson Foods Commands 24% Of The Beef Market

According to Cattle Buyers Weekly, in 2014, four producers controlled 75% of the market share. Tyson Foods controls 24% of the beef market.

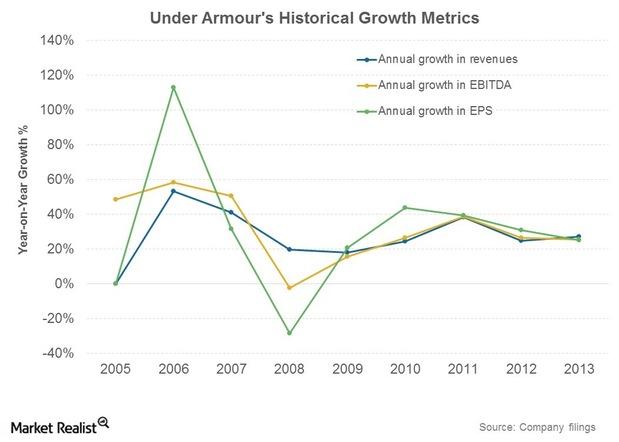

Understanding The Under Armour Growth Story

Under Armour’s stock price growth has been phenomenal—up by over 10x in the last five years. This dwarfs the ~200% increase seen by market leader NIKE.

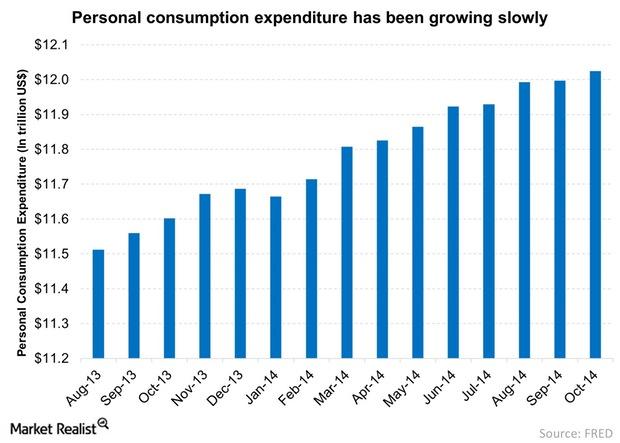

Personal Consumption Expenditure Remains Low

Slow growth in personal consumption expenditure may affect growth. Currently, personal consumer expenditure is $12 trillion. This is ~70% of the GDP.

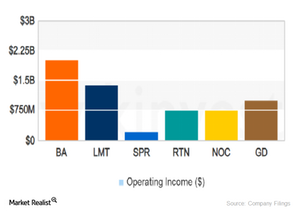

Boeing’s competitive advantages

One of Boeing’s competitive advantages is that it enjoys strong relations with many companies, even its competitors.

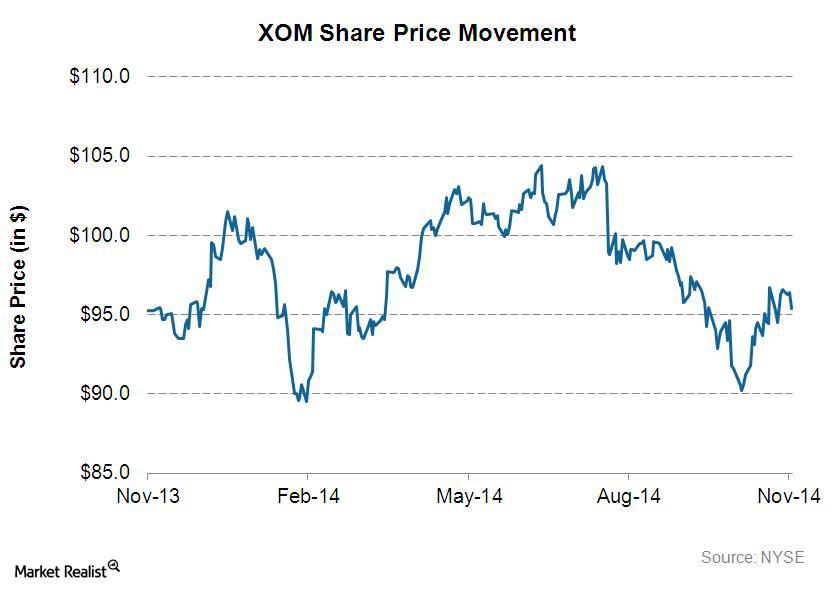

An overview of ExxonMobil

Exxon Mobil’s (XOM) stock price went up 2.4%, to $96.71, on October 31, 2014. Starting in November 2013, Exxon Mobil’s share price went up by 1.5%.Healthcare Must-know: 3 key risks in stock market investing

Know the market and know your own appetite for risk before investing. You can’t eliminate market risk, also called systematic risk, through diversification. You can, however, hedge against market risk.Financials What are the risks associated with short-term wholesale funding?

Short-term wholesale funding refers to a bank’s use of short-term deposits from other financial intermediaries—like pension funds and money market mutual funds. It uses the short-term deposits to invest in longer-term assets—like loans to businesses. Using these short-term funds to invest in longer-term assets causes a timing mismatch between assets and liabilities.Energy & Utilities Overview: Clean Energy Fuels Corp’s operations and financials

As of December 31, 2013, CLNE served ~779 fleet customers operating ~35,240 natural gas vehicles—it also owns and operates 471 natural gas fueling stations.

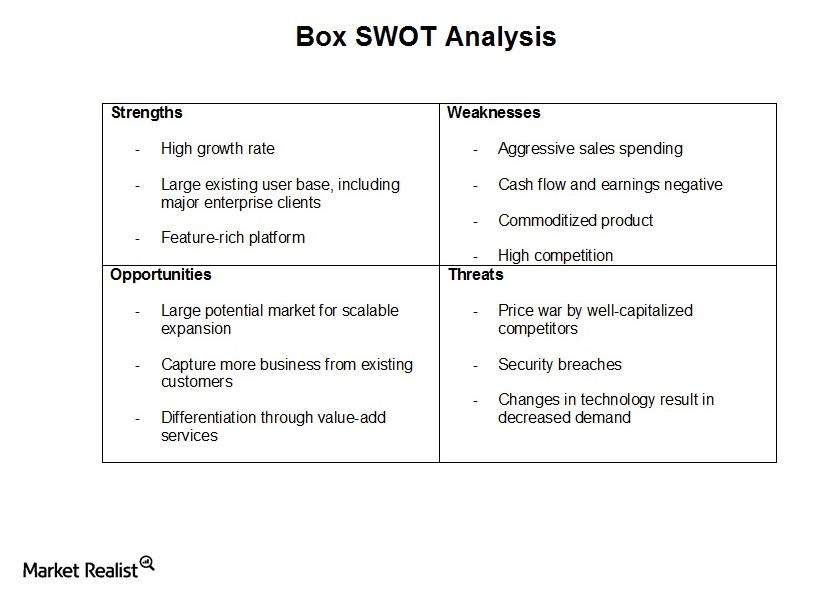

Must-know: An analysis of Box’s threats

Box was created due to changes in the way users store and collaborate on files.

Must-know: An analysis of Box’s weaknesses

There’s no shortage of companies offering services similar to what Box offers.Healthcare Why-high-yield issuers coast on “drive-by” and “add-on” deals

DaVita HealthCare Partners (DVA) and Tenet Healthcare (THC) were among the more prominent HY debt issuers in the week ending June 13.Energy & Utilities Why the Bureau of Labor and Statistics jobs report is important

The employment situation is the primary monthly indicator of aggregate economic activity because it encompasses all major sectors of the economy.

An investor’s guide to cyclical and counter-cyclical industries

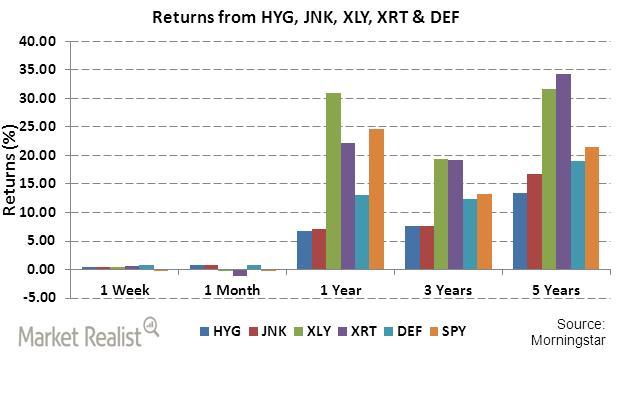

XLY and XRT have performed better in terms of absolute returns over longer periods of three and five years

High yield bond ETFs’ performance compared to cyclical industry ETFs

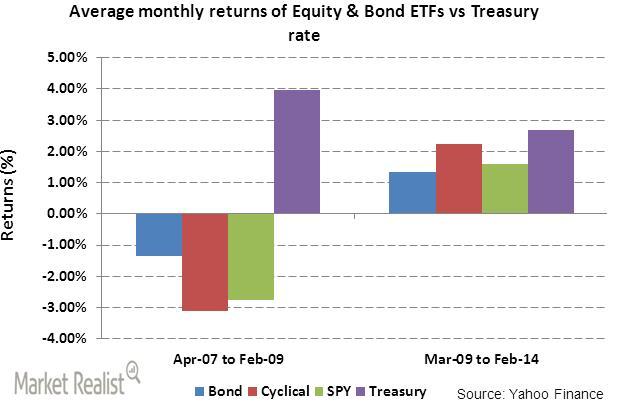

During economic uncertainty, investors want steady, guaranteed returns from the Treasury instead of quick returns from price movements in equity ETFs.