SPDR® S&P 500 ETF

Latest SPDR® S&P 500 ETF News and Updates

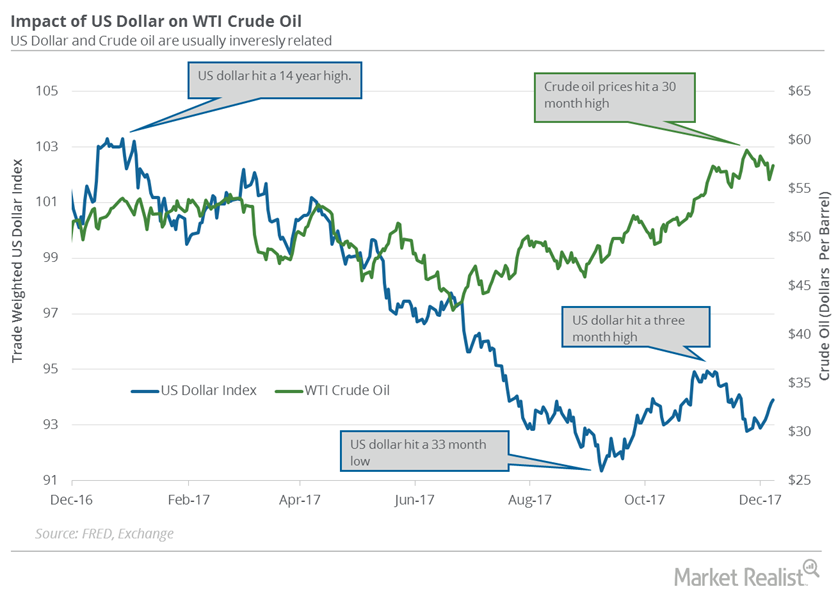

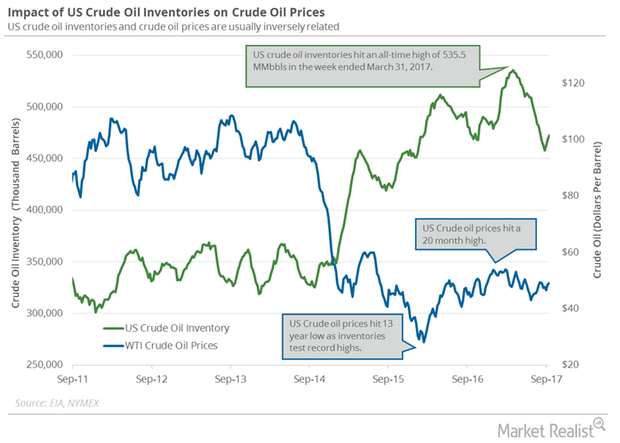

FOMC Meeting Could Surprise Crude Oil Traders

US crude oil (UCO) (USL) futures contracts for January delivery rose 0.7% and were trading at $58.4 per barrel at 1:02 AM EST on December 12, 2017.

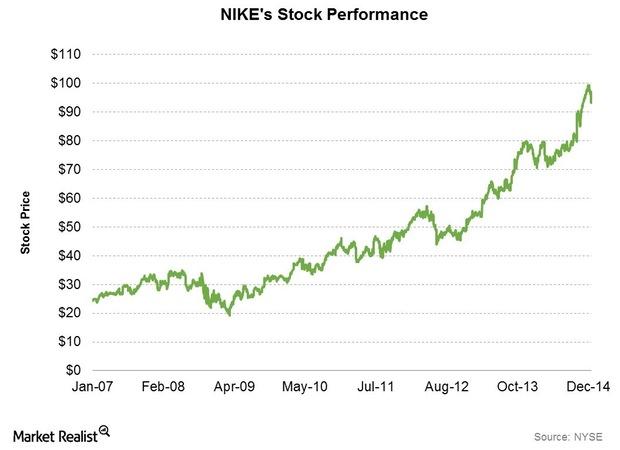

The Growth Factors Spiking NIKE Revenues And Earnings

In this series, we’ll analyze the results of the past quarter and the reasons why NIKE continues to outperform.

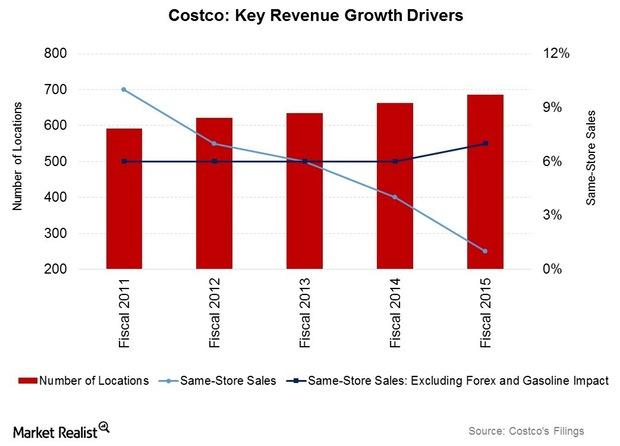

Costco’s Industry Positioning: A Porter’s 5 Force Analysis

Costco’s suppliers include companies like PepsiCo (PEP), Procter & Gamble (PG), and the Kraft Heinz Company (KHC). No single supplier accounts for over 5% of revenue.

Energy Sector and Crude Oil Prices Helped the S&P 500

The S&P 500 rose ~0.7% to 2,733.01 on May 21 due to the rise in industrial stocks and crude oil prices—the highest level in more than two months.

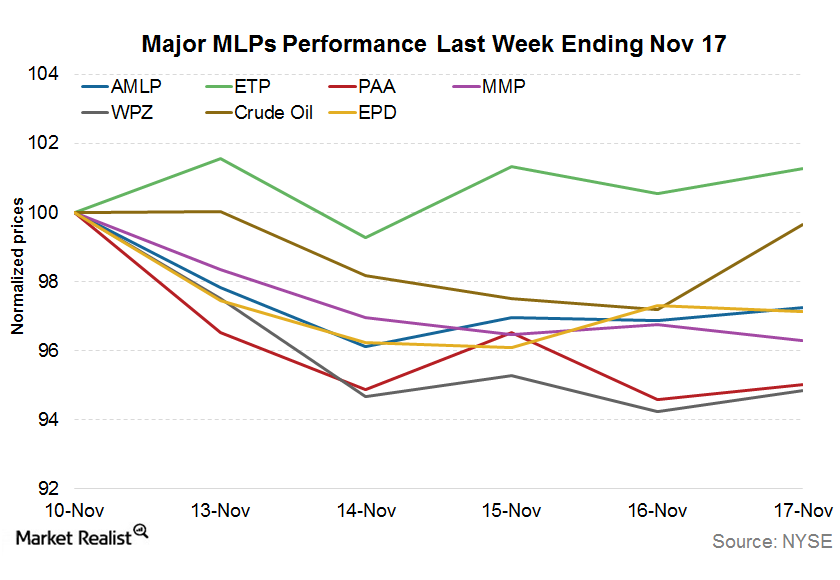

Why MLPs Saw a New 52-Week Low Last Week

MLPs went through some carnage last week. The Alerian MLP Index (^AMZ), which tracks the performance of 50 energy MLPs, saw a new 52-week low of 258.45.

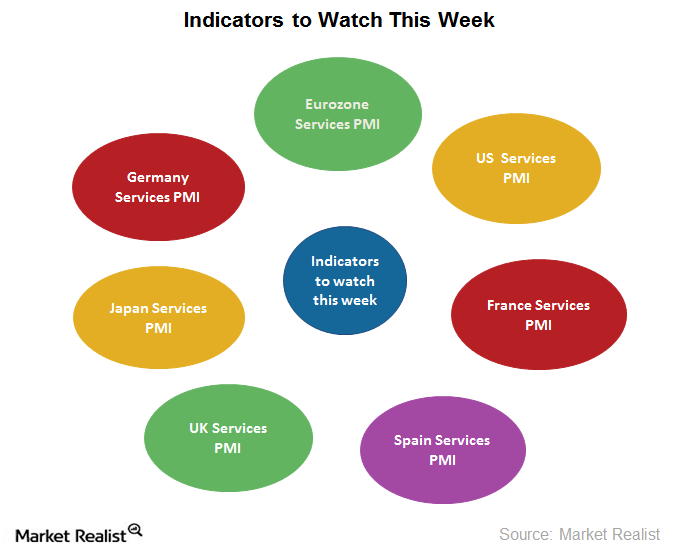

Economic Indicators Investors Should Watch for This Week

Economic indicators Key economic indicators investors should watch for this week are: US (SPY) services PMI data UK (EWU) services PMI data Eurozone (IEV) (VGK) services PMI data German (EWG) services PMI data Spanish services PMI data French (EWQ) services PMI data Japanese services PMI data US ADP employment data US non-farm payroll data Wrapping up […]

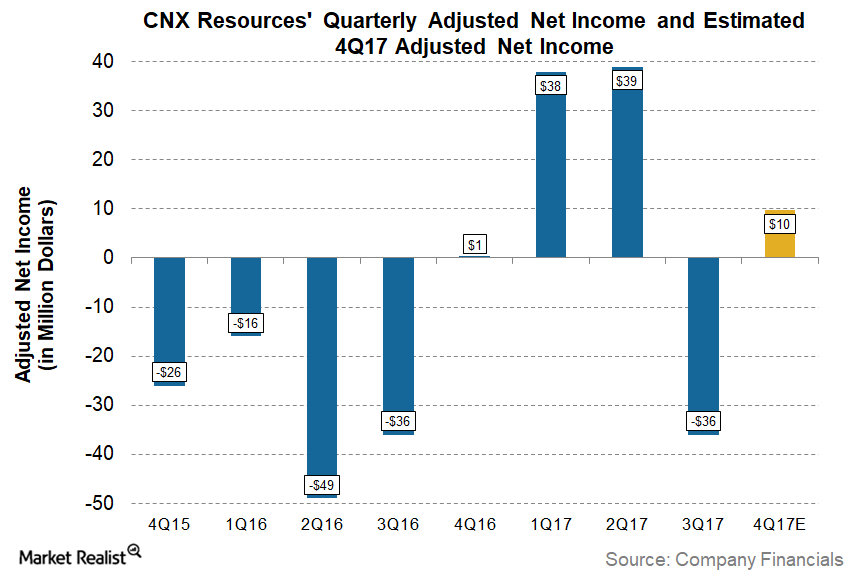

Can CNX Resources Report Higher Profits in 4Q17?

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. CNX is expected to report 1,000% higher profits YoY than 4Q16.

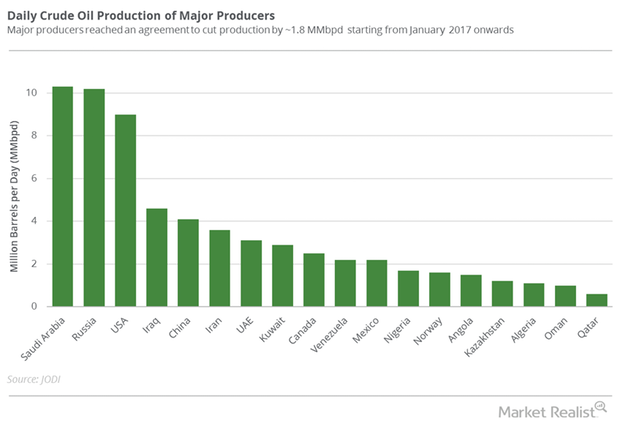

Will the OPEC and Non-OPEC Meeting Drive Crude Oil Futures?

September WTI (West Texas Intermediate) crude oil (RYE) (VDE) (UCO) futures contracts rose 1.1% to $49.58 per barrel on August 4, 2017.

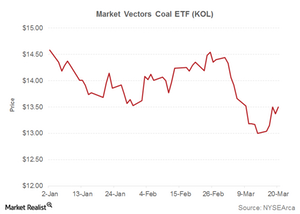

Why Coal and Power Indicators Matter for Long-Term Investing

Why are we combining thermal coal and power indicators? Thermal coal is mostly used for electricity generation.

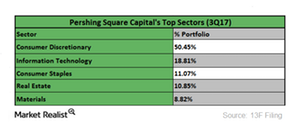

These Were Bill Ackman’s Largest Sector Holdings in 3Q17

Pershing Square Capital Management’s top sectors in 3Q17 were consumer discretionary (XLY), information technology (XLK), consumer staples (XLP), real estate (IYR), and materials (XLB).

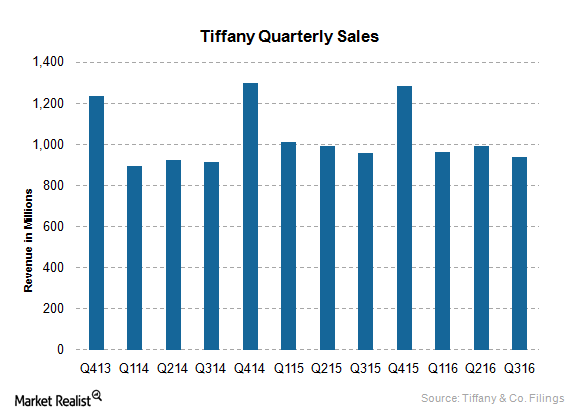

Hurdles in Tiffany’s Growth: Weaknesses and Threats

Since it’s a luxury brand, Tiffany & Co.’s products are priced high, with no promotions. Thus, Tiffany products may be out of reach for many customers.

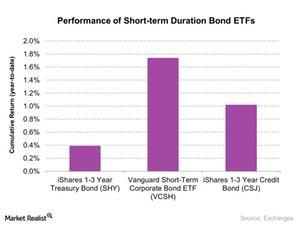

Investment Avenues during the Rise of Short-Term Interest Rates

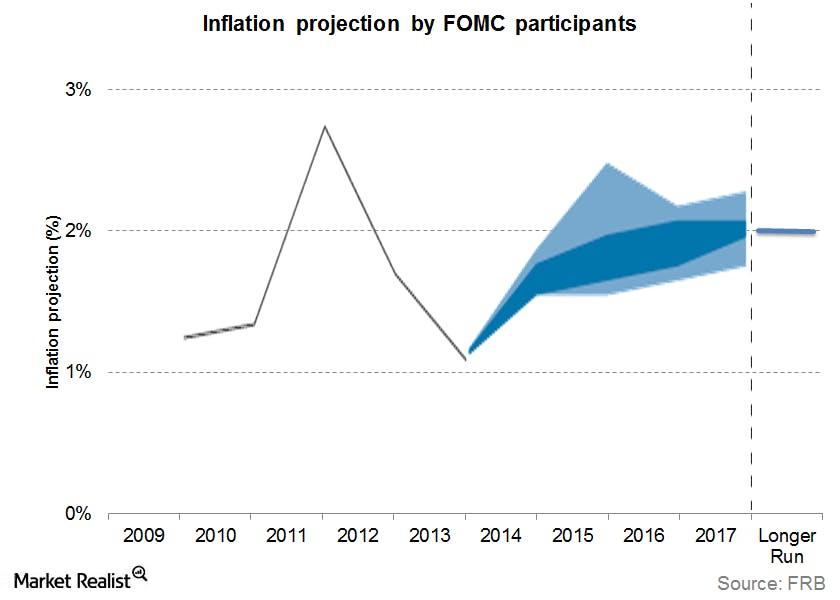

Bill Gross thinks the central banks should implement their strategies very carefully and cautiously in this scenario.Financials Key differences between PCE and CPI as inflation measures

The CPI and PCE are both important indicators of U.S. inflation. CPI is more important from an individual perspective, while PCE is more important for monetary policy.

Could La Niña Save Natural Gas Bulls?

On October 4, 2017, natural gas (UNG) November futures closed at $2.94 per MMBtu (million British thermal units), a rise of 1.6% from the last trading session.

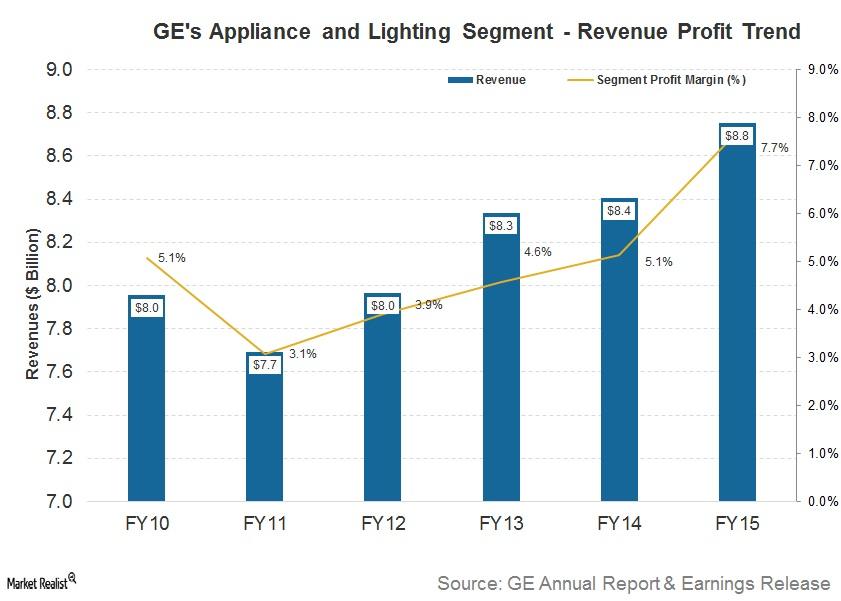

Gauging General Electric’s Appliance Segment

General Electric recently announced that its appliance and lighting division would be sold to Haier.

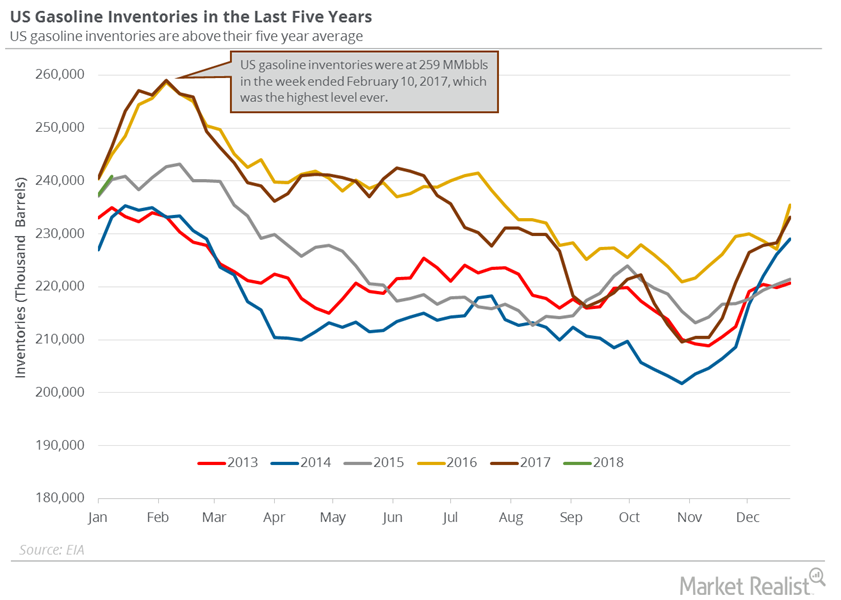

Gasoline Inventories Could Cap the Upside for Oil Prices

On January 23, 2018, the API released its crude oil inventory report. US gasoline inventories increased by 4.1 MMbbls on January 12–19, 2018.

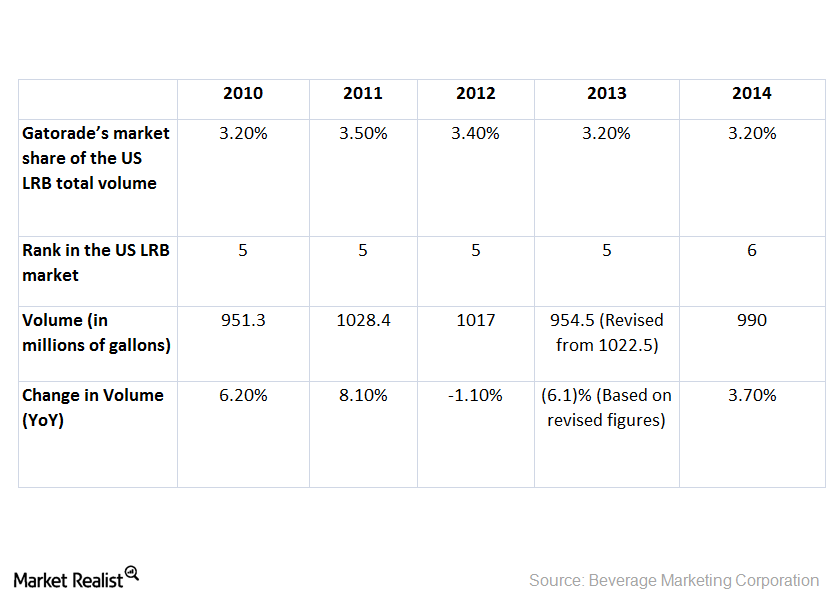

Gatorade’s Position in the Sports Beverage Market

Gatorade’s position and volumes have been impacted by rising competition. It has also felt the effect of the popularity of bottled water, ready-to-drink tea, coffee, and energy drinks.

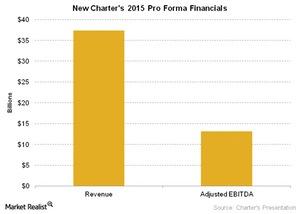

Merger Update: Charter, Bright House, and Time Warner Cable

California is the only state where the merger between Charter Communications, Time Warner Cable, and Bright House Networks has yet to be approved. It could be approved as early as May 12.

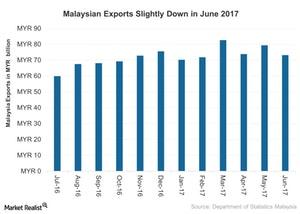

Understanding the Marginal Decline in Malaysian Exports in June

Exports from Malaysia in June 2017 stood at 73.1 billion Malaysian ringgit (MYR) (about $17 billion as of August 11, 2017), or 10% higher YoY.

Are Supply Concerns Pushing Oil Higher?

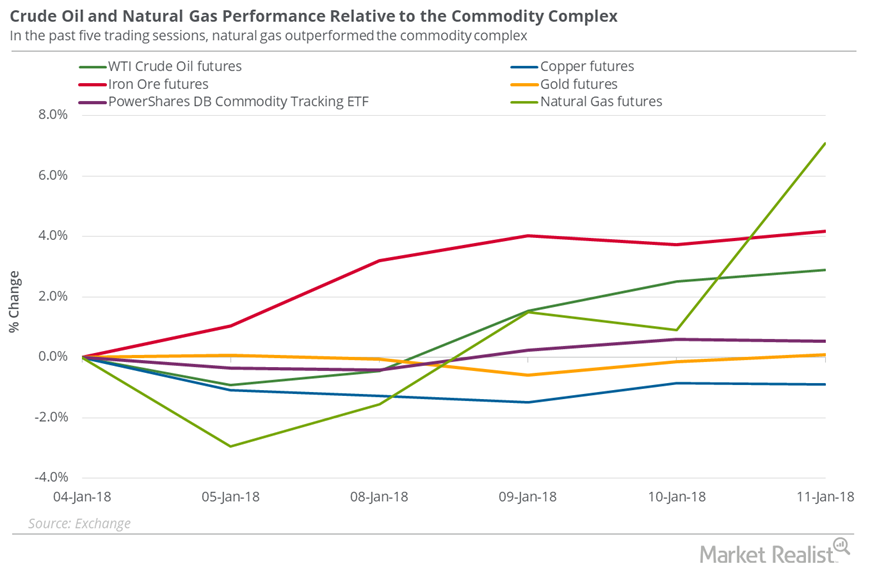

On January 11, 2018, US crude oil’s (USO) (USL) February 2018 futures gained 0.4% and settled at $63.80 per barrel, a new three-year high.

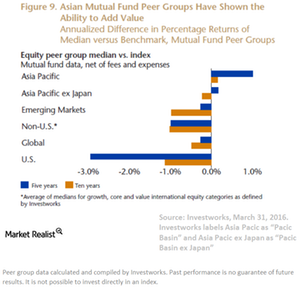

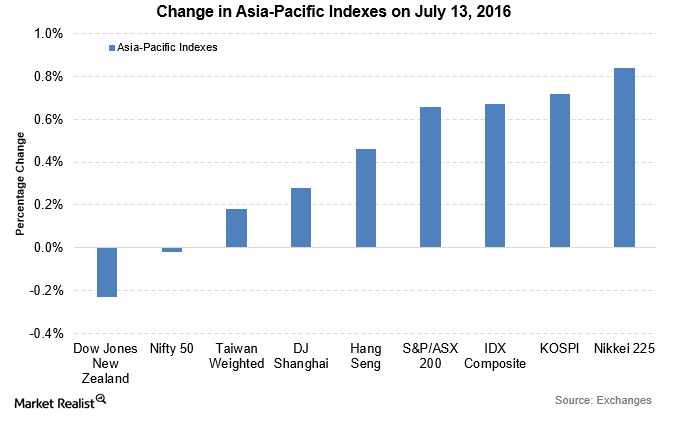

Asian Markets Could Generate Higher Returns

In the short term, Asian benchmarks and ETFs have also performed better than US-focused funds.

Energy Calendar: Analyzing Key Oil and Gas Drivers

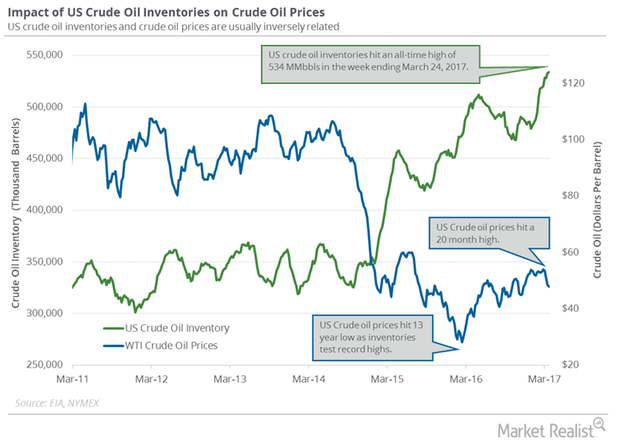

The energy sector contributed to ~6.6% of the S&P 500 on March 31, 2017. Oil and gas producers’ earnings depend on crude oil and natural gas prices.

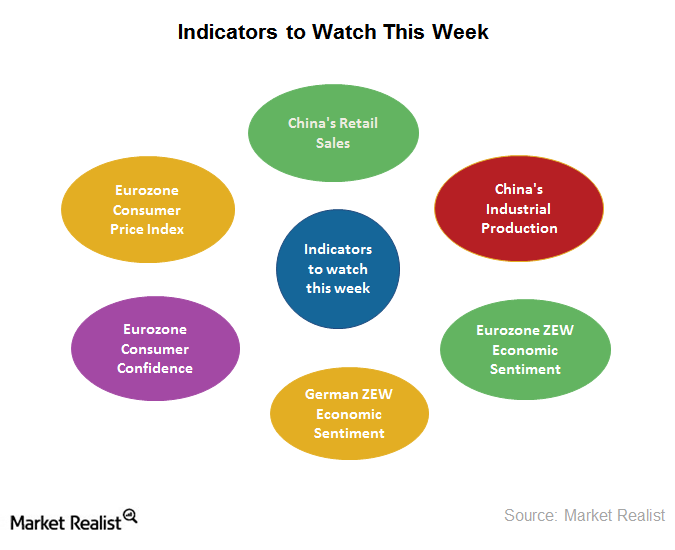

What Indicators Should Investors Watch This Week?

As China is one of the important emerging economies, investors should keep an eye on its important indicators.

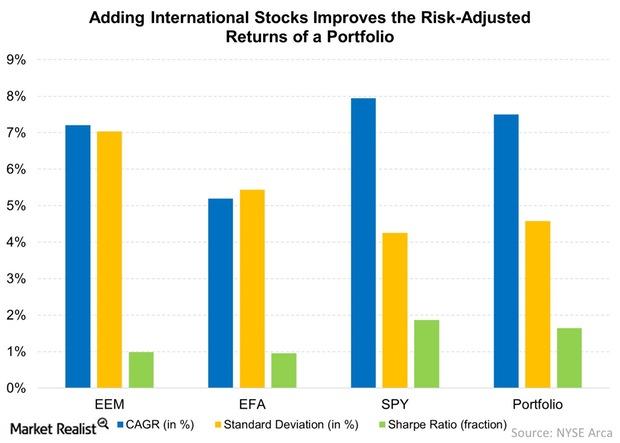

Why Diversification Is More than Just a Buzzword

Diversification is important because a diversified portfolio has higher risk-adjusted returns than a portfolio exposed to only one security.

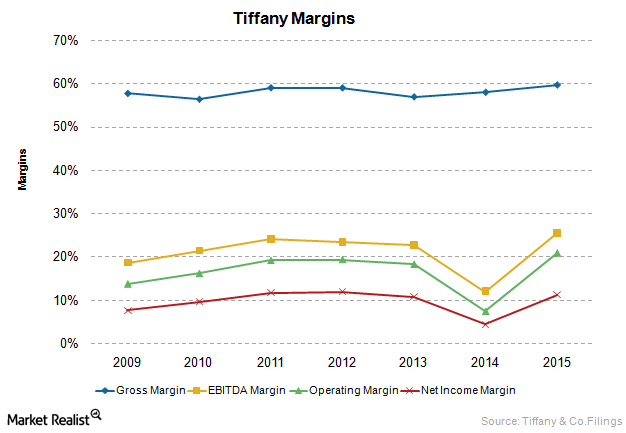

Why Tiffany & Co. Is More Profitable than Its Competitors

Since 2006, Tiffany’s margins have been on the higher side compared to its peers, including Signet Jewelers and Fossil, in the retail jewelry industry.

Is Oil Set to Make Record Highs in 2018?

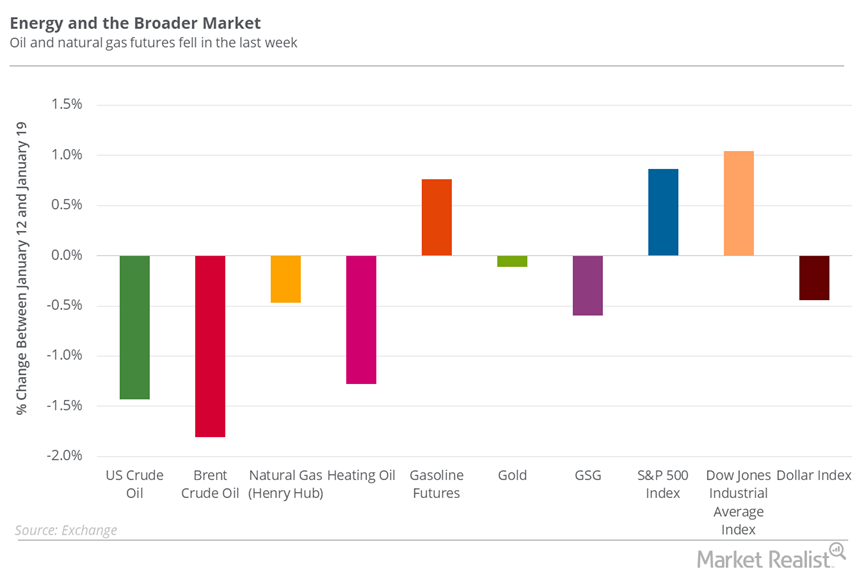

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

Why Are Global Markets Range Bound?

The contrasting movement among the global markets was primarily due to caution ahead of the Bank of England’s monetary policy release on July 14.

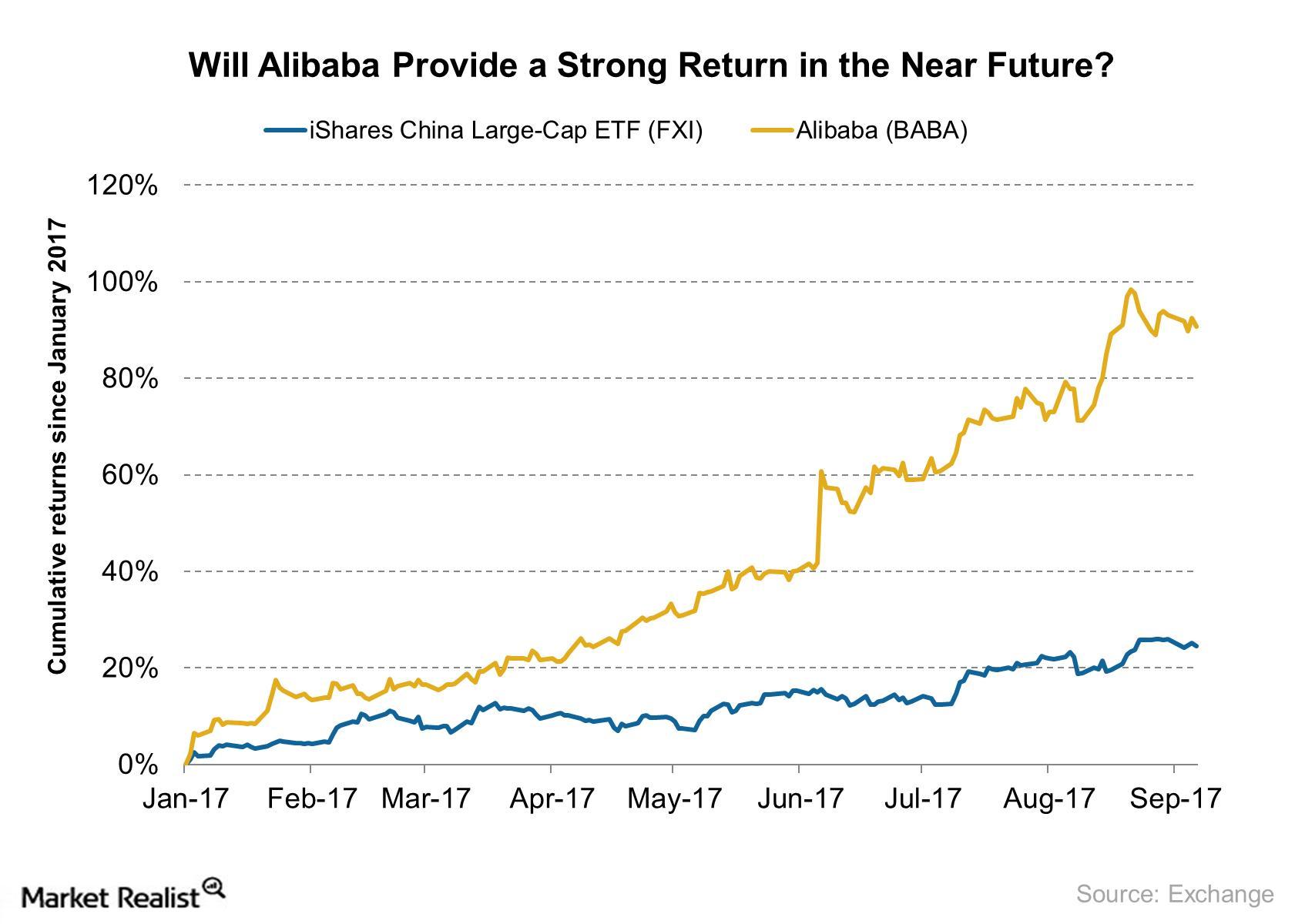

Why Goldman Sachs Is Optimistic about Alibaba

Alibaba was trading at $169 on September 8, 2017. Its 52-week high is $177 and its 52-week low is $86.01.

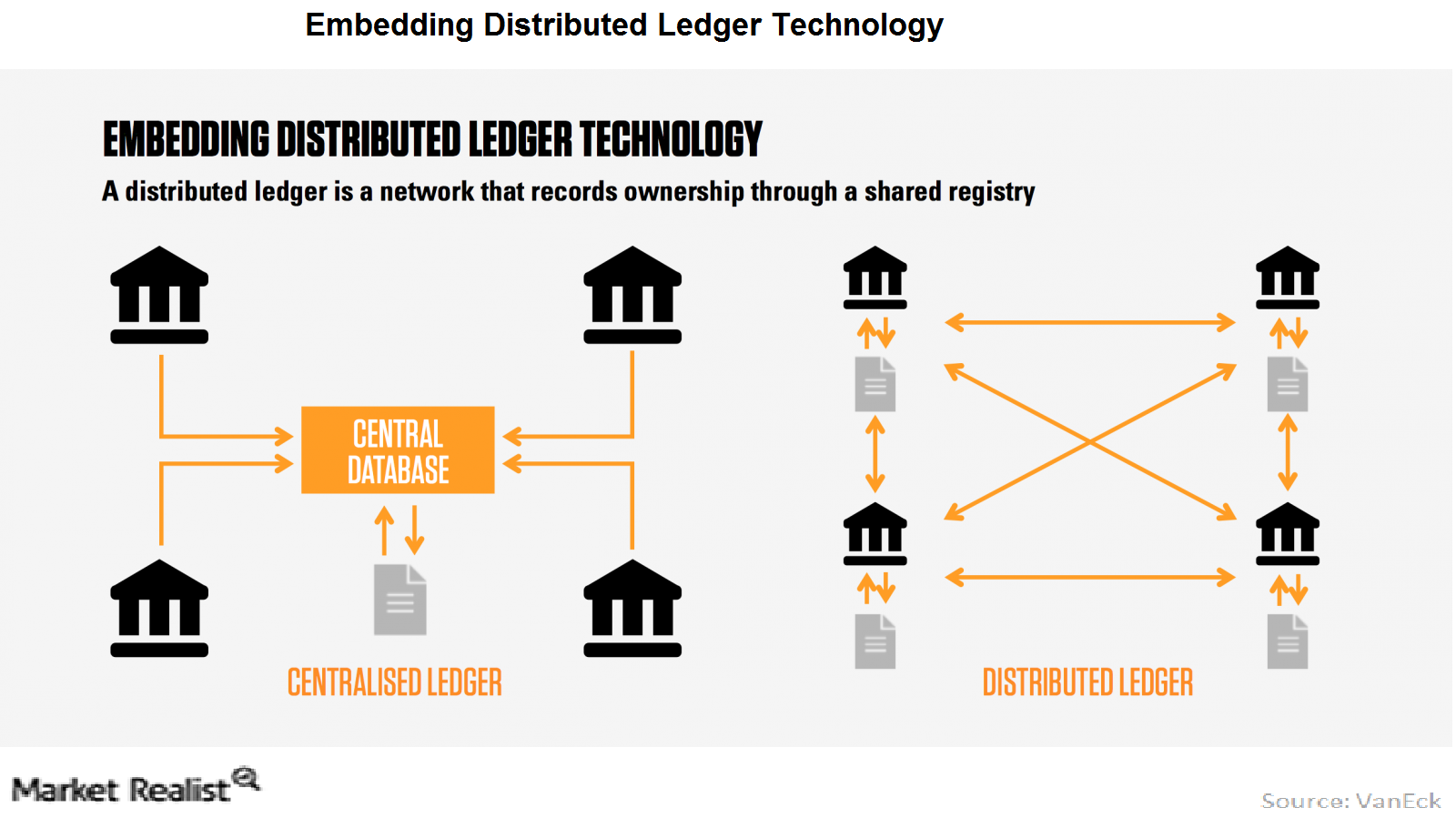

Why Distributed Ledger Technology Is Game Changing

A distributed ledger is a database of transactions held and updated in decentralized form across different locations.

Will OPEC Meeting in Vienna Affect Crude Oil Futures?

November US crude oil (UWT) (SCO) (DBO) futures contracts rose 1.6% and closed at $49.3 per barrel on September 20, 2017.

JPMorgan Chase’s 2020 Market Outlook

On Wednesday, JPMorgan Chase’s strategists discussed the market’s 2020 outlook. These strategists expect stocks to rise next year, while gold could decline.

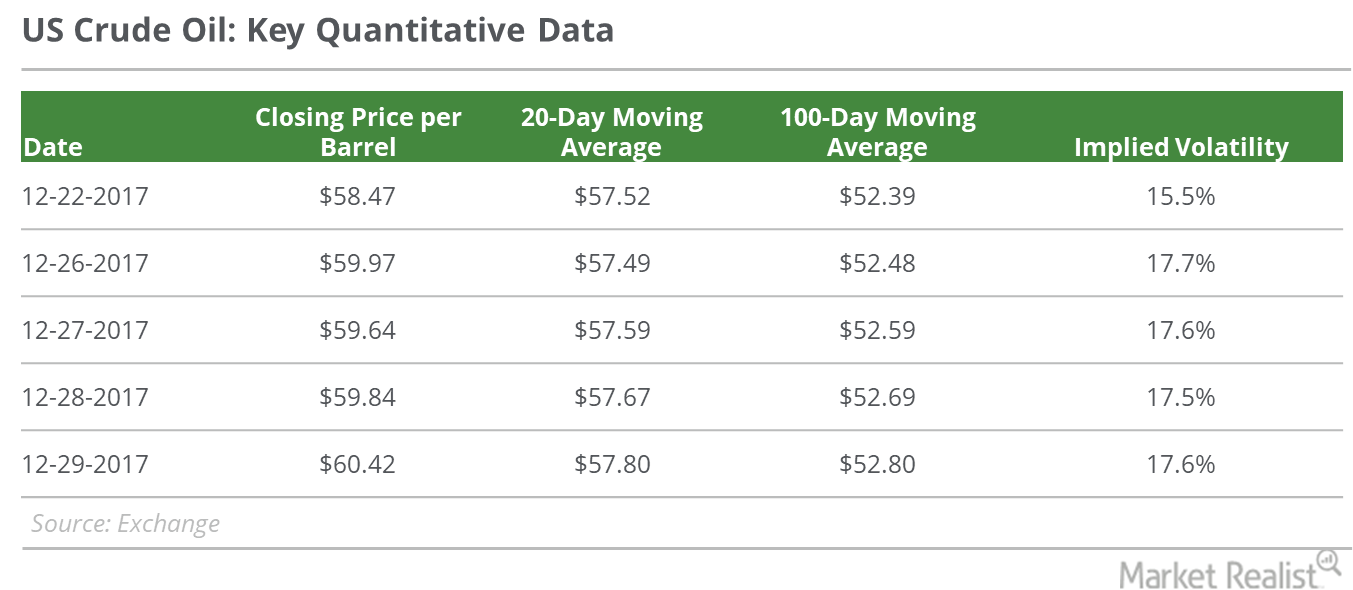

What Could Impact Oil Prices in 2018?

On December 29, 2017, US crude oil’s (USO) (USL) February 2018 futures rose 1% and closed at the 2017 highest closing price of $60.42 per barrel.

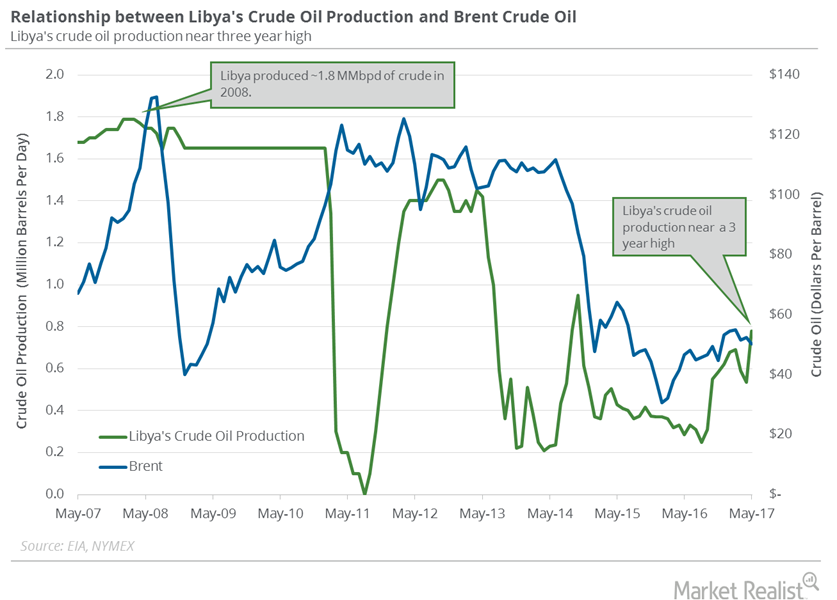

Libya’s Crude Oil Production Is at a 4-Year High

August West Texas Intermediate (or WTI) crude oil futures contracts rose $1.03 per barrel, or 2.2%, and settled at $47.07 per barrel on July 3, 2017.

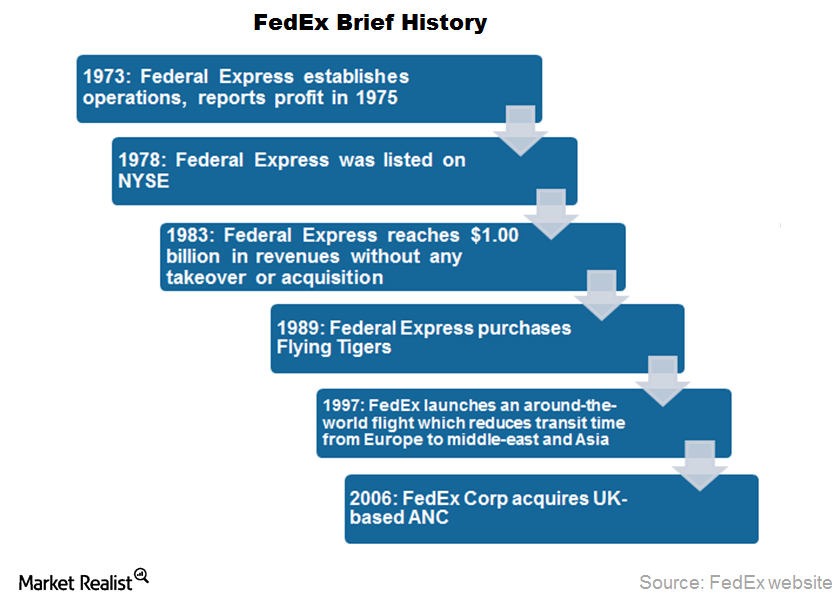

FedEx: A Concept that Blossomed into an Industry

FedEx achieved the distinction of being the first US company to reach $1.0 billion in revenues within the first ten years of operations without a single merger or acquisition.Financials Why unemployment data moves bond yields

Private and government construction both reported declines. The construction value chain has a multiplier effect on other sectors of the economy, and can significantly impact both stock and bond markets.

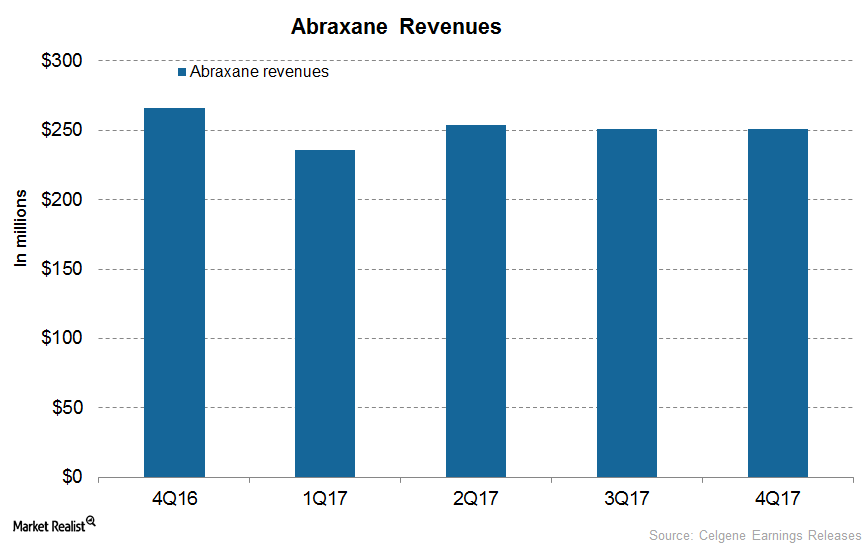

How’s Celgene’s Abraxane Positioned after 4Q17?

In 4Q17, Celgene’s (CELG) Abraxane generated revenues of $251 million, which reflected a decline of ~6% on a YoY (year-over-year) basis.

Why the US Moat Index Beat the S&P 500 Index in July

Domestic moat companies, as represented by the Morningstar® Wide Moat Focus IndexSM (MWMFTR, or “U.S. Moat Index”), once again posted strong results in July.

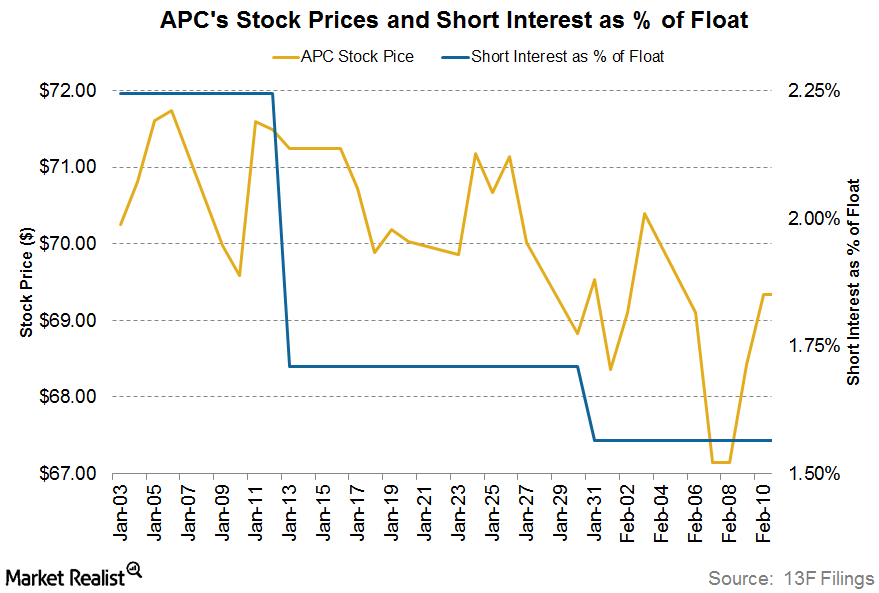

Anadarko Petroleum: Key Short Interest Trends

Anadarko Petroleum’s (APC) short interest ratio on February 10, 2017, was ~1.6%. At the beginning of the year, its short interest ratio was ~2.2%.

How the Boeing 737 Max Crash Could Affect Berkshire Hathaway

Boeing (BA) has been feeling the heat after its 737 Max 8 aircraft crashed on March 10—the second crash in five months.

Is NIO the Next Short-Seller Killer after Tesla and Nikola?

EV maker stocks, including NIO (NYSE:NIO), Tesla (NASDAQ:TSLA), and Nikola (NASDAQ:NKLA), have seen a meteoric rise this year.

Where Are Bond Markets Headed?

Rising US-China trade tensions have caused all assets, and especially bond markets, to move considerably over the last few sessions.

Warren Buffett, Berkshire Hathaway, and the Lost Decade

Several observers have criticized Warren Buffett, arguably the best value investor of all time, for Berkshire Hathaway’s recent underperformance.

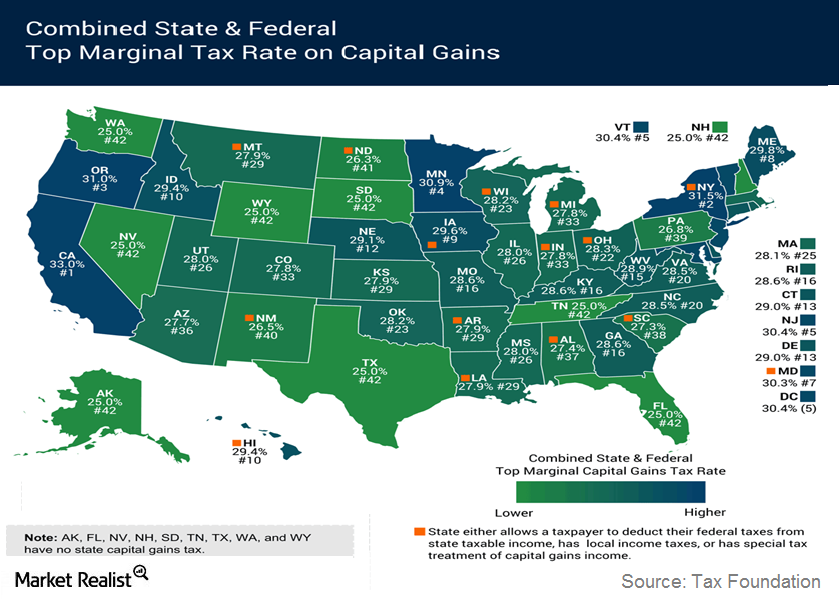

Basics About The Capital Gains Tax

The rates for capital gains tax depend on the asset’s holding period. If the holding period is less than one year, short-term capital gains tax is payable.

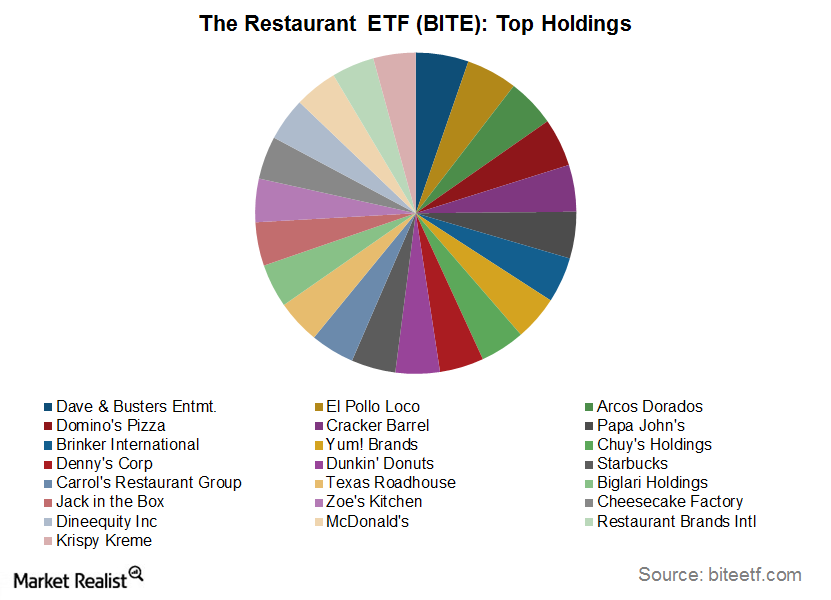

Everything You Need to Know about the BITE ETF

To reap the rewards at both ends of the spectrum, a fund like the Restaurant ETF (BITE) could come in handy!

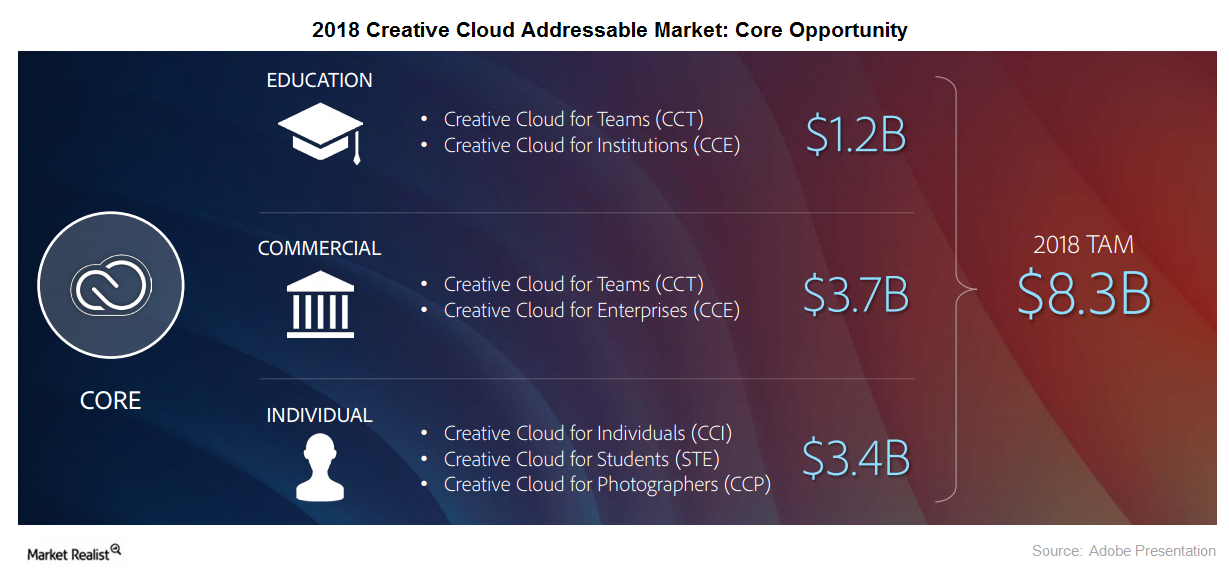

Will Adobe’s Creative Cloud Continue Its Growth in Fiscal 1Q16?

Adobe’s Creative Cloud subscriptions surpassed analyst expectations in fiscal 4Q15, showing that Adobe’s transition towards the subscription model is happening at a faster pace than expected.

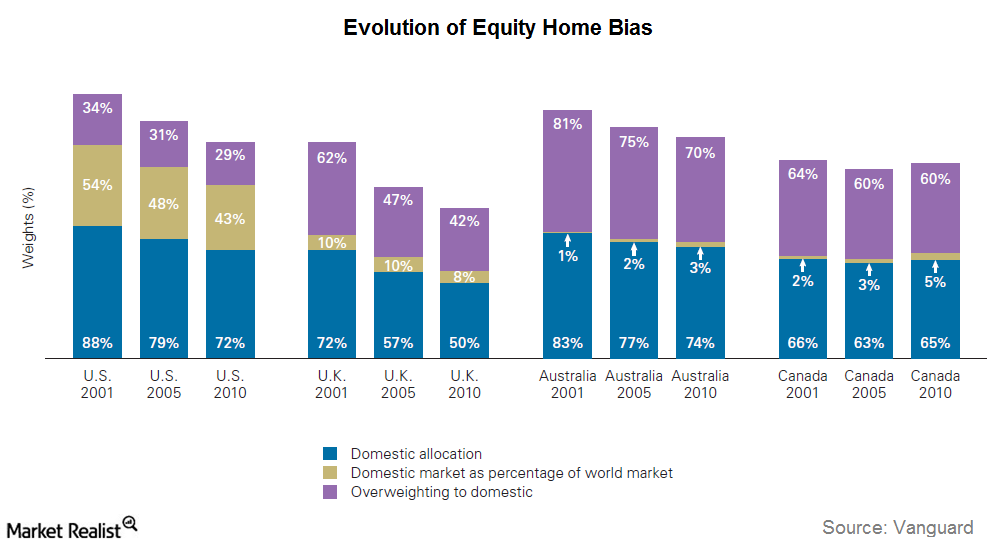

The Equity Home Bias Puzzle

In this series, we’ll look at the prevalence of home bias, the disadvantages of favoring home bias, and the benefits of international diversification.Why US inflation data is important and how we measure it

U.S. inflation is not just a measure of growth and price pressure in the U.S. economy. It has more far-reaching consequences.

Can NIO Stock Recover After Falling into Bear Territory?

NIO stock has closed with losses for two days now and is down 21.2 percent from its high of $16.44 on Monday. Can NIO get out of bear market territory?

Will Fox’s ‘Biggest Story of 2016’ Be Important Driver for 2017?

On Friday, December 30, 2016, Fox Business Network’s David Asman, Dagen McDowell, and Lauren Simonetti talked about the “biggest business story of 2016.”

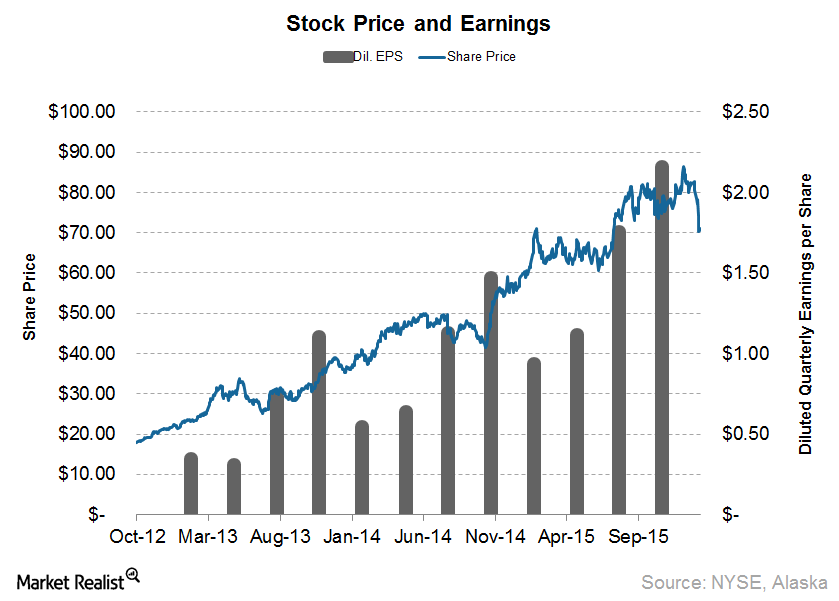

Can Alaska Air Stock Continue Its Stellar Performance in 2016?

Alaska Air Group plans to announce its 4Q15 and 2015 financial results on January 21, 2016. The company had a successful 2014 with record profits of $605 million on revenues of $5.37 billion.