Will OPEC’s Meeting Help Crude Oil Bulls or Bears?

OPEC’s meeting will be held on November 30, 2017. Reuters said that OPEC might extend the production cuts for nine more months.

Nov. 27 2017, Published 9:57 a.m. ET

Crude oil futures

January US crude oil (USL) (DBO) futures contracts fell 0.42% and were trading at $58.70 per barrel in electronic trading at 12:58 AM EST on November 27, 2017. Prices fell due to profit-booking. The E-Mini S&P 500 (SPY) futures contracts for December delivery fell 0.1% to 2,598.50 in electronic exchange at the same time.

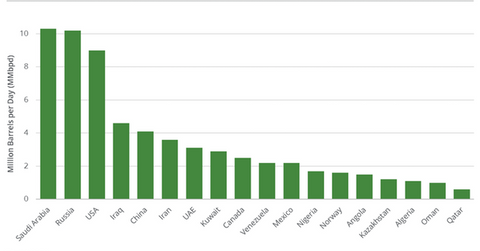

US crude oil (DWT) (UWT) futures are at a 30-month high partially due to ongoing production cuts. High oil prices benefit oil producers (XOP) (VDE) like Rosneft, Chevron (CVX), BP (BP), Saudi Aramco, and Shell (RDS.A).

OPEC’s meeting

OPEC’s meeting will be held on November 30, 2017. On November 24, 2017, Russia said that it would support production cuts. Saudi Arabia, Russia, and many other oil producers have signaled extending the production cuts beyond March 2018.

Reuters said that OPEC might extend the production cuts for nine more months. A Bloomberg poll also suggests the same. Production cuts have been crucial in bringing down global and US oil inventories in the last few months.

Hedge funds

Hedge funds’ net long positions on Brent oil (BNO) futures and options hit a record 543,069 contracts for the week ending November 7, 2017. Similarly, hedge funds’ net long positions in US crude oil (UWT) (UCO) futures and options were at a seven-month high.

Impact

A longer-than-expected extension of production cuts is bullish for oil prices and producers (IEZ) (PXI). However, higher oil prices will drive US crude oil production and non-OPEC production. As a result, major oil producers could lose their market share to the US.

Citigroup thinks that OPEC might delay the decision about prolonging the production cuts until January 2018. Lower-than-expected production cuts or a delay in prolonging the production cuts might pressure oil prices.

Next, we’ll discuss how the US dollar drives oil prices.