Understanding Disney’s Digital Distribution Strategy for ESPN

Disney (DIS) has been looking more and more at the distribution of its content in digital format—specifically for ESPN.

May 30 2017, Updated 2:35 p.m. ET

Disney’s digital distribution strategy for ESPN

The Walt Disney Company (DIS) has been looking more and more at the distribution of its content in digital format—specifically for ESPN. This effort has been more evident in recent months with the revamp of ESPN’s popular program SportsCenter and ESPN’s cost-cutting initiatives, namely, the firing of 100 employees.

Disney was asked at the MoffettNathanson Media & Communications Summit earlier this month about how important its global digital distribution rights for sports events on its ESPN network have become. The company noted that while ESPN’s business is primarily in the United States (SPY), it continues to have a strong presence in Latin America as well.

Disney also has a global digital distribution deal with Tencent Holdings (TCEHY) in China (FXI). However, for now, Disney is focused on the American sports market.

In a bid to make Disney’s ESPN more popular among Millennials, the company is increasingly distributing ESPN on skinny bundles priced at $40–$50 per month. The company also said in an earlier earnings call that the popularity of skinny bundles that include ESPN should bode well for Disney’s video services in the future.

ESPN’s direct-to-consumer service

Last year, Disney acquired a minority stake of 33% in BAMTech, a video streaming company formed by the MLB (Major League Baseball). The company will soon launch a direct-to-consumer service for ESPN through its investment in BAMTech later this year. Disney expects that this direct-to-consumer service will boost ESPN’s viewership. Disney also expects that it could use this viewership data to improve advertising revenues for ESPN.

Disney also stated at the MoffettNathanson conference that it won’t be competing with BAMTech for sports rights. Notably, one reason that Disney is likely looking at a direct-to-consumer service platform for ESPN is that video streaming services have recently become increasingly popular.

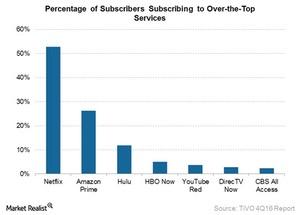

To be sure, according to a Digitalsmiths 4Q16 video trend report, and as indicated by the chart above, Netflix (NFLX) leads the OTT (over-the-top) market with a ~53% share.