Verizon Beats, AT&T Meets Earnings Expectations in Q4

AT&T (T) posted fourth-quarter EPS of $0.86, in line with analysts’ estimates, on January 30.

Feb. 1 2019, Updated 10:31 a.m. ET

Fourth-quarter takeaways

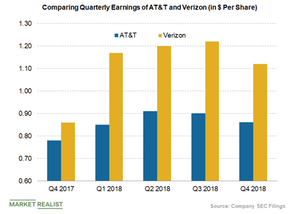

AT&T (T) posted fourth-quarter EPS of $0.86, in line with analysts’ estimates, on January 30. The earnings of the second-largest US (SPY) wireless company also rose 10.3% YoY (year-over-year). Its adjusted EPS were $3.52 in 2018, up 15.4% YoY. The company expects its earnings to rise in the low single digits in 2019. In comparison, analysts expect its EPS to rise 1.2% YoY to $3.59 in 2019.

On the other hand, Verizon (VZ) reported better-than-expected fourth-quarter EPS of $1.12 in the quarter. Its EPS topped analysts’ expectation of $1.09 by 2.8%, whereas it rose 30.2% YoY from the previous year’s EPS of $0.86. Verizon’s adjusted EPS were $4.71 in 2018, up 25.9% YoY. The company expects its 2019 adjusted EPS to be the same as that of its adjusted EPS in 2018. Analysts expect the company’s 2019 EPS to fall 0.6% YoY to $4.68.

What’s driving AT&T’s earnings?

AT&T’s adjusted earnings rose 10.3% YoY in the fourth quarter backed by top line growth and offset by higher operating expenses. Its earnings have risen YoY for the past five straight quarters. Solid performances in AT&T’s WarnerMedia and Mobility segments boosted its earnings in the quarter. Strong growth in the wireless services business also drove its profits in the quarter. The company expects to continue the trend of growing its wireless services revenue in 2019. However, a higher effective tax rate and foreign currency headwinds pressured the company’s earnings in the quarter.

Verizon’s earnings growth drivers

Excluding one-time items, Verizon’s adjusted EPS of $1.12 rose 30.2% YoY. Excluding tax reforms and the impact of new accounting standards, its adjusted EPS rose 4.7% YoY to $0.90. Excluding the items mentioned above, its adjusted EPS rose 3.5% YoY to $3.87. Verizon’s robust growth in postpaid phone subscribers and aggressive investment in 5G services drove its profits.

Like Verizon, rival T-Mobile (TMUS) has rolled out many un-carrier plans to attract customers. Peer Sprint (S) reported EPS of -$0.03 in the third quarter of fiscal 2018, higher than analysts’ estimate of -$0.02.