Why Did Baker Hughes Underperform the Industry ETFs?

Oilfield equipment and services companies like Baker Hughes (BHI) are affected by rig counts and energy prices. In the past year, West Texas Intermediate crude oil prices have dropped ~16%.

Aug. 18 2020, Updated 5:28 a.m. ET

Baker Hughes’ returns and key drivers

Oilfield equipment and services (or OFS) companies like Baker Hughes (BHI) are affected by rig counts and energy prices. In the past year, West Texas Intermediate (or WTI) crude oil prices have dropped ~16%.

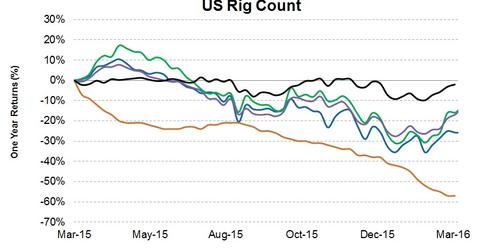

Baker Hughes’ one-year returns—a -26% return net of dividends—is lower than the industry ETF OIH, with a -15% return. BHI comprises 7.2% of OIH. The Energy Select Sector SPDR ETF (XLE), the broader energy industry ETF, has produced a -15.6% return. Baker Hughes has also underperformed the SPDR S&P 500 ETF (SPY), which had -2% returns during the same period. BHI’s peer Noble Corporation (NE) has outperformed BHI, producing a -14% one-year return, net of dividends. BHI significantly outperformed the US rig count, which fell by 57% in one year.

How correlated are Baker Hughes and crude oil prices?

The correlation coefficient between Baker Hughes’ stock price and crude oil prices from March 2015 to the present is 0.59. This indicates a relatively strong degree of correlation between crude oil prices and Baker Hughes’ stock prices.

Analyzing Baker Hughes’ performance and its strategies

Among Baker Hughes’ concerns are lower prices for Baker Hughes’ services in the US, lower drilling activity in Mexico, a higher share of low-margin products in the Middle East/Asia-Pacific, and ongoing energy market uncertainty in North America.

Baker Hughes operates in over 80 countries, which makes it relatively insulated from the energy market downturn in any particular geographic region. Under the terms of the proposed merger transaction with Halliburton (HAL), each BHI stockholder will receive 1.12 HAL shares against one BHI share, plus $19.00 in cash for one BHI share.

BHI’s merger implied price is at a premium to its current price. Despite shrinking income from upstream companies and relatively steady earnings from its Industrial Services segment, which caters to the downstream industry, has helped BHI’s valuation.