Noble Corp PLC

Latest Noble Corp PLC News and Updates

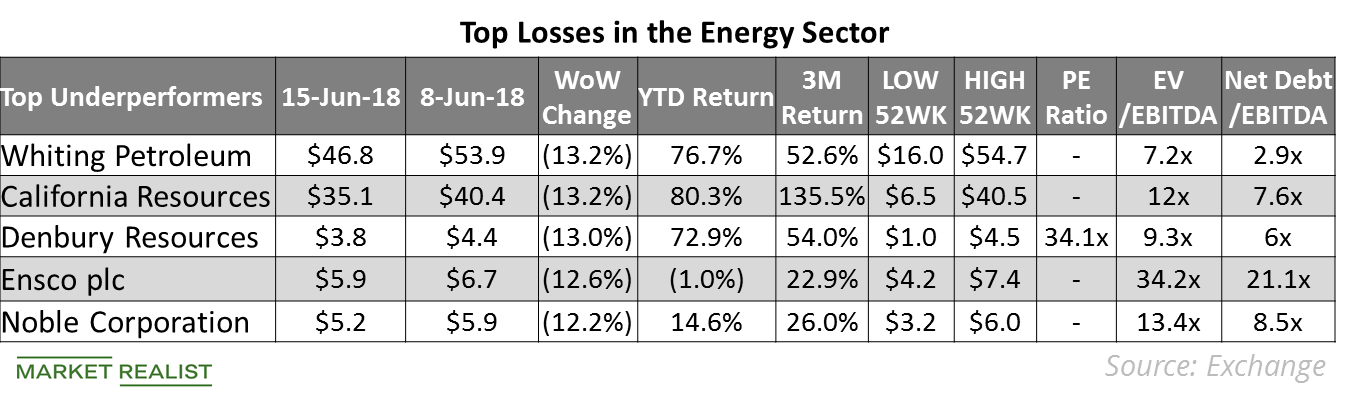

Top Energy Losses Last Week

On June 8–15, Whiting Petroleum (WLL) and California Resources (CRC) fell the most on our list of energy stocks.

Seadrill Stock Rose 98% in Week 20

The offshore drilling industry made headlines last week, especially Seadrill (SDRL), which reached a 52-week high of $0.73.

How Offshore Drilling Stocks Performed Last Week

Most offshore drilling stocks traded in the green in the week ended July 13. The best performer during the week was Noble.

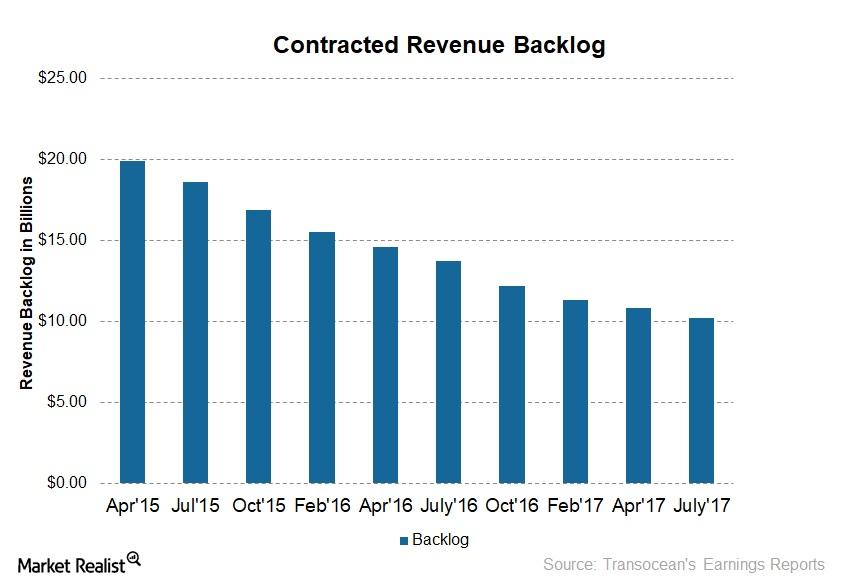

Transocean Secured New Contracts

As of July 25, 2017, Transocean (RIG) had a backlog of $10.2 billion—compared to $10.8 billion in April 2017.

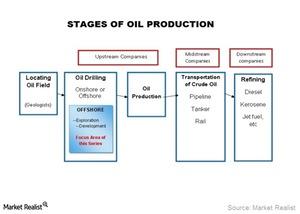

Extracting the Basics: An Introduction to Offshore Drilling

Oil is one of the most important and most frequently traded commodities, and offshore drilling is an integral part of the oil industry.

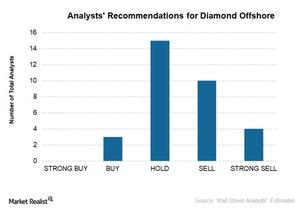

Jefferies Revises Target Prices for Diamond Offshore, Noble

Article focus In this article, we’ll discuss analysts’ target price revisions for offshore drilling companies in Week 8 of 2018 (ended February 23). Revisions in Week 8 Jefferies revised its target prices for two offshore drillers. On February 21, 2018, it reduced the target price for Transocean (RIG) to $12 from 413 and maintained a […]

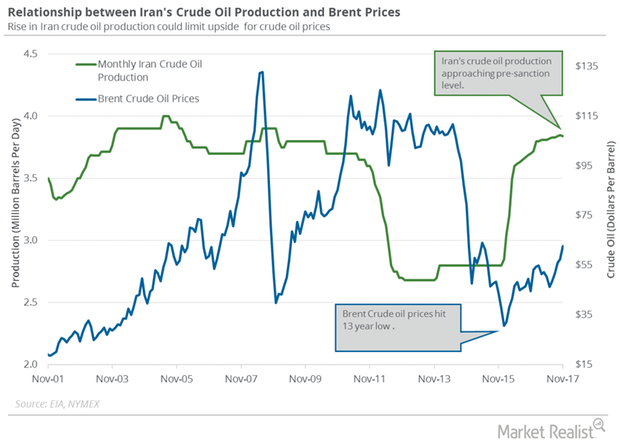

Will Crude Oil Futures and S&P 500 Move in the Same Direction?

February US crude oil (UWT) (USL) futures contracts rose 0.5% to $61.73 per barrel on January 8. Prices are near the highest level since December 2014.

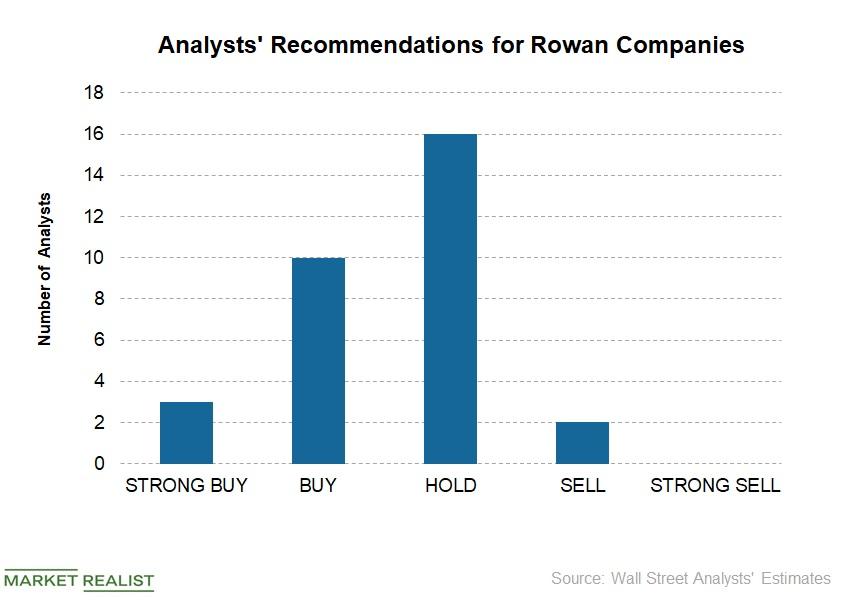

Wells Fargo Upgrades Rowan Companies to ‘Outperform’

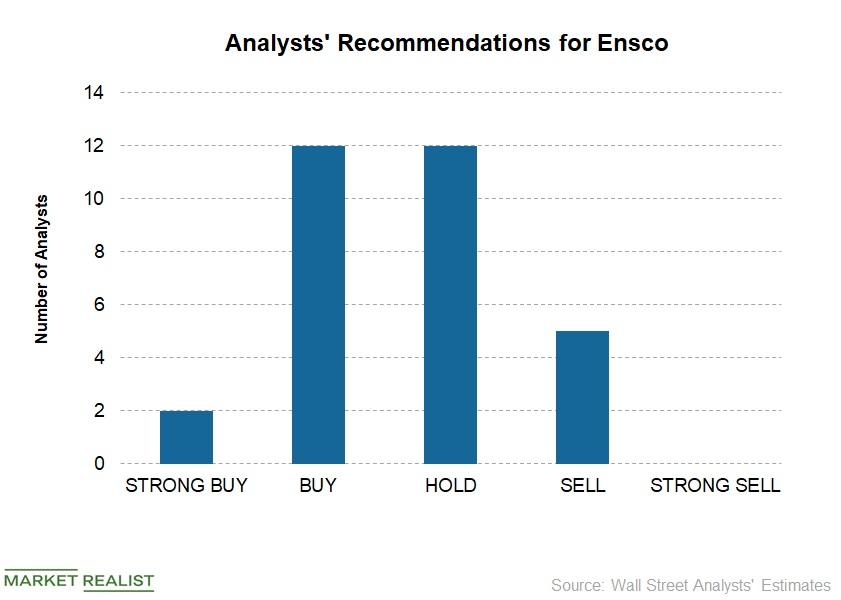

RDC’s analyst recommendations Analysts’ consensus rating for Rowan (RDC) is 2.6, which means a “hold.” Peers Transocean (RIG), Diamond Offshore (DO), Noble (NE), and Ensco (ESV) also have “hold” ratings. Of the 31 analysts covering Rowan (RDC), 39% recommend “buy” or some equivalent, 55% recommend “hold,” and 6% recommend “sell.” Among the top offshore drilling stocks […]

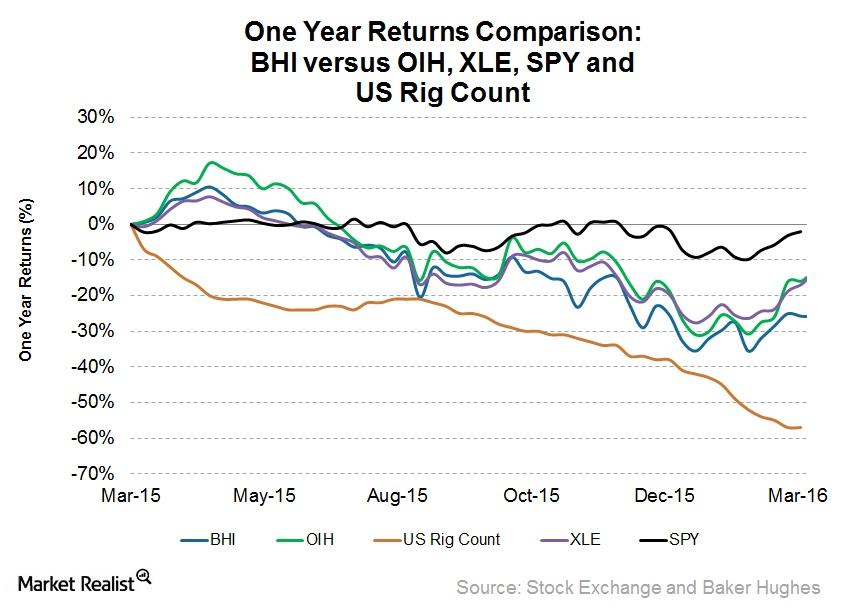

Why Did Baker Hughes Underperform the Industry ETFs?

Oilfield equipment and services companies like Baker Hughes (BHI) are affected by rig counts and energy prices. In the past year, West Texas Intermediate crude oil prices have dropped ~16%.

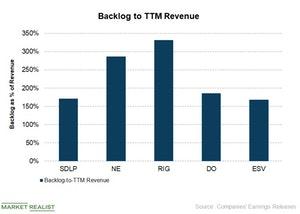

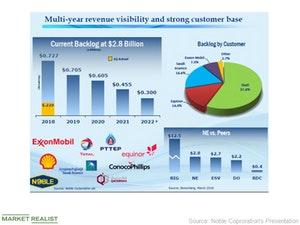

Transocean Has the Highest Backlog among Its Peers

In the last part of this series, we saw which offshore drillers had the highest and lowest falls in their backlogs. In this article, we’ll compare offshore drillers’ backlogs versus their revenues.

Jefferies Revises Ratings and Target Prices for Offshore Drillers

In Week 25, which ended June 22, Jefferies downgraded one offshore driller and revised the target prices for others.

Analyzing Noble’s June Fleet Status Report

On June 7, Noble (NE) released its June fleet status report. Most of the offshore drilling companies don’t publish a monthly fleet status report.

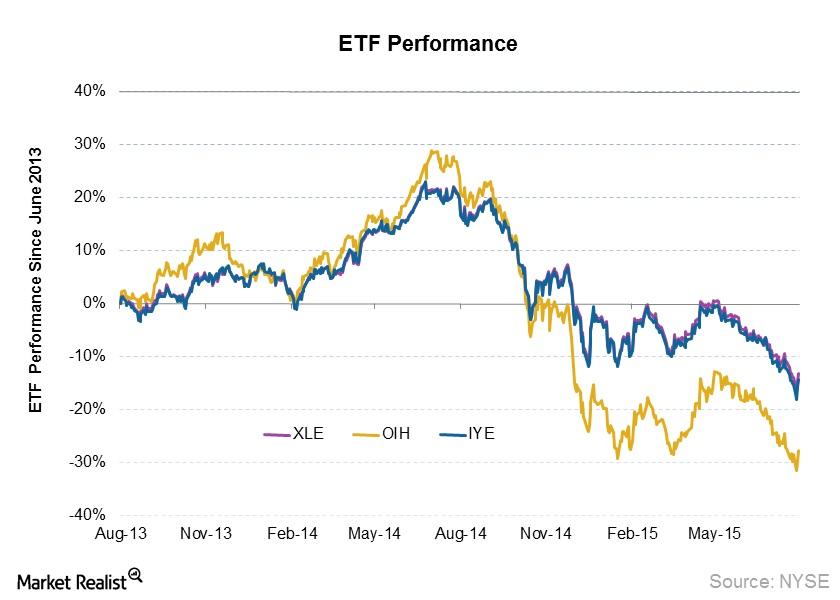

ETF Exposure in the Offshore Drilling Space

Among the biggest ETFs in the offshore drilling space, investors can choose between ETFs like OIH, XLE, and IYE for exposure to offshore drilling.

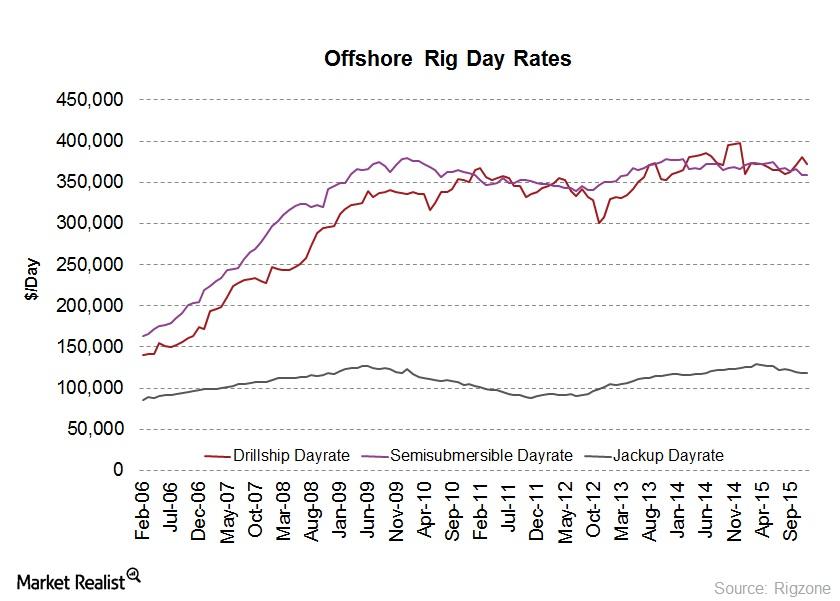

Day Rates and Lifelines of Offshore Drilling Companies

Even in the same category of rigs, different water depth capabilities cause offshore drilling day rates differ. Day rates are also impacted by region.