WFT, FMSA, and SPN: Returns and Outlook after 3Q17

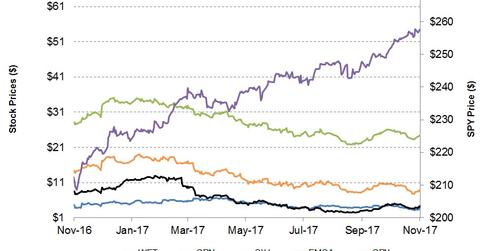

WFT, SPN, and FMSA have significantly underperformed the SPDR S&P 500 ETF (SPY), which has produced 23.0% returns since November 3, 2016.

Dec. 4 2020, Updated 10:53 a.m. ET

Stock price returns against the industry

Since November 3, 2016, Weatherford International’s (WFT) stock price has generated -4.0% returns until November 2, 2017. During this period, WFT has outperformed the VanEck Vectors Oil Services ETF (OIH), which generated -12.0% returns.

Superior Energy Services (SPN) has underperformed WFT during this period. Since November 3, 2016, SPN has produced -39.0% returns. During the same period, Fairmount Santrol Holdings (FMSA) reported -43.0% returns. FMSA has underperformed its oilfield services (or OFS) peers WFT and SPN, as well as OIH.

OFS stocks versus ETFs and crude oil prices

WFT, SPN, and FMSA have significantly underperformed the SPDR S&P 500 ETF (SPY), which has produced 23.0% returns since November 3, 2016. The Dow Jones Industrial Average (DJIA-INDEX) has risen 31.0% year-to-date. The energy sector makes up 6.0% of the DJIA-INDEX.

The West Texas Intermediate (or WTI) crude oil price has increased ~23.0% in the past year. You can read about crude oil price’s movement in Market Realist’s Is It Time for Oil’s Bull Run?

Fairmount Santrol Holdings: Outlook after 3Q17

On Fairmount Santrol Holdings’ 2017 focus and strategies, Jenniffer Deckard, Fairmount Santrol’s CEO, commented in the 3Q17 press release, “We continued to relentlessly implement efficiency initiatives to both maximize the utilization of our asset base and to minimize costs.

“We remain focused on short-term execution, while also prioritizing key strategic investments such as the building out of our Kermit, Texas, facility and enhancing our logistics network.”

What does Weatherford’s management expect?

Weatherford’s management has targeted to generate positive free cash flow and has outlined an action plan to achieve this goal.

In the company’s 3Q17 earnings press release, Mark A. McCollum, WFT’s CEO, commented, “Our highest priority is free cash flow generation. To that end, we have initiated a substantial transformation program targeting improvements in our operating results of approximately $1 billion.

“We are driving this plan on a timeline to achieve these savings over the next 18-24 months. Specific actions to achieve $300 million in cost savings are already underway.”

On March 24, 2017, Schlumberger (SLB) and Weatherford International announced that they would form a joint venture (or JV) named OneStimSM. For more information on this JV, please read What to Expect from Schlumberger Stock after JV with Weatherford. On October 24, WFT announced that it plans to close the JV formation “before year-end.”

What could drive Superior Energy Services in 2017?

We have already discussed SPN’s US onshore operations in 3Q17 in this series. Regarding this, David Dunlap, Superior Energy Services’ CEO, commented in the company’s 3Q17 press release, “Our customers continue to push the technical limits of their well and completion designs, and are also increasing activity levels as oil prices recover.

“It is not surprising that as a result, we began to observe supply chain stress and increased non-productive time as the quarter progressed, particularly in the Permian Basin. I expect these inefficiencies to diminish over time.”

Next, we’ll discuss Wall Street analysts’ recommendations for Fairmount Santrol Holdings (FMSA).