FMSA Holdings Inc

Latest FMSA Holdings Inc News and Updates

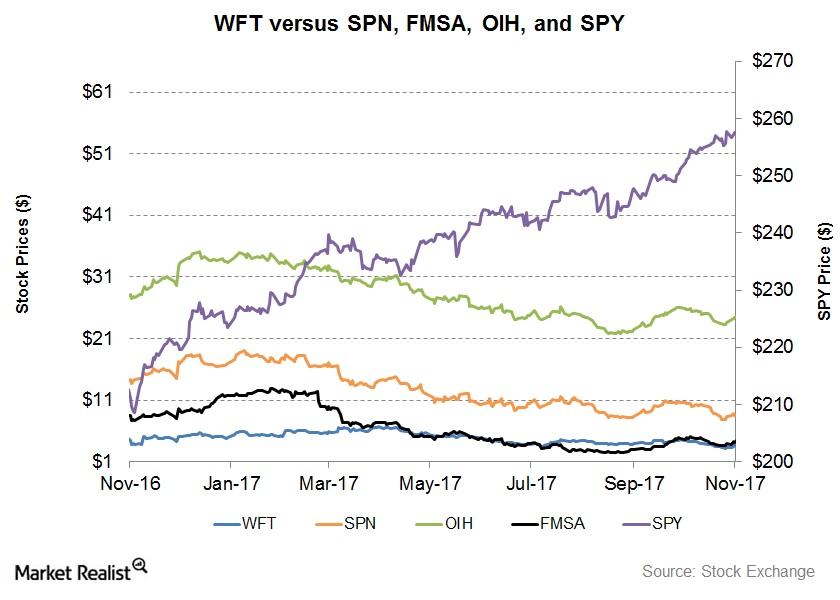

WFT, FMSA, and SPN: Returns and Outlook after 3Q17

WFT, SPN, and FMSA have significantly underperformed the SPDR S&P 500 ETF (SPY), which has produced 23.0% returns since November 3, 2016.

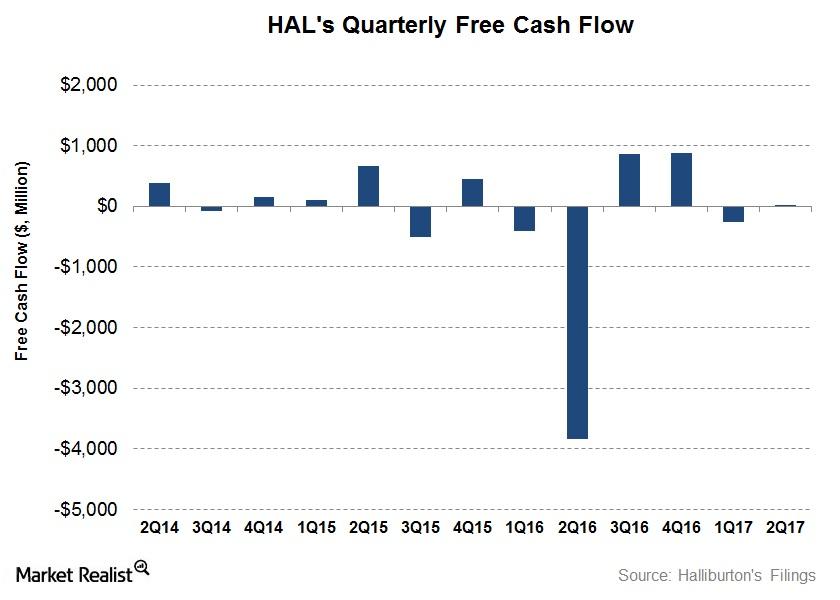

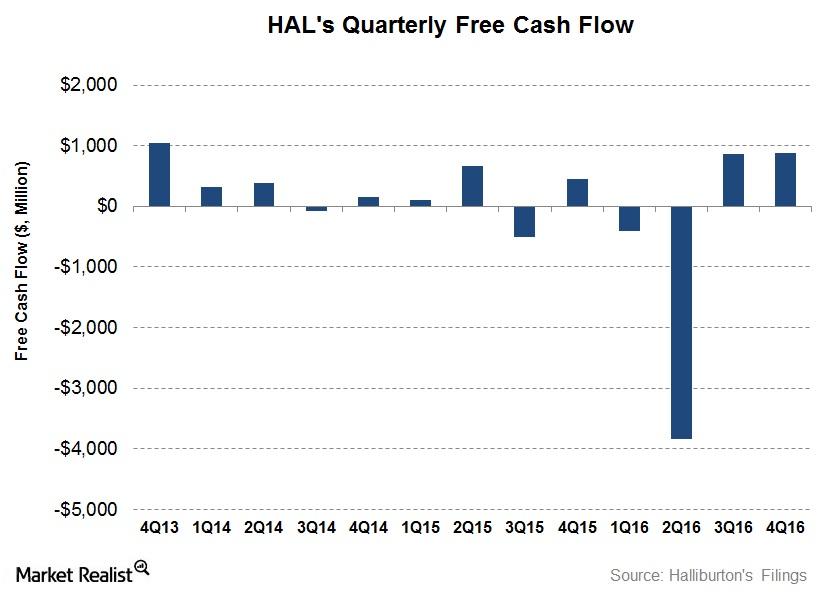

How Halliburton’s Free Cash Flow Turned Around in 2Q17

Halliburton’s (HAL) cash from operating activities (or CFO) in 2Q17 was a huge improvement over 2Q16 as well as an increase over 1Q17.

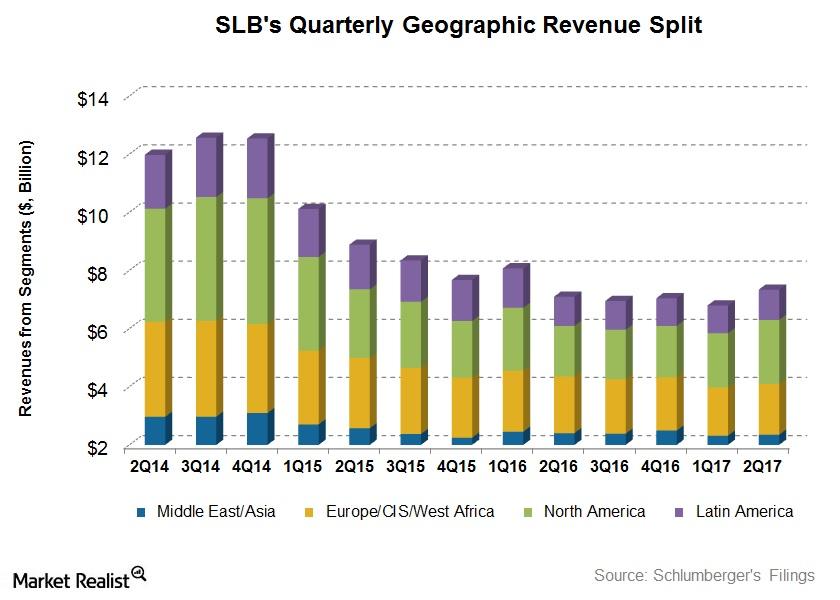

What Were Schlumberger’s Drivers in 2Q17?

In 2Q17, Schlumberger reported a net loss of ~$74 million—a sharp improvement compared to 2Q16 when it reported a net loss of $2.16 billion.

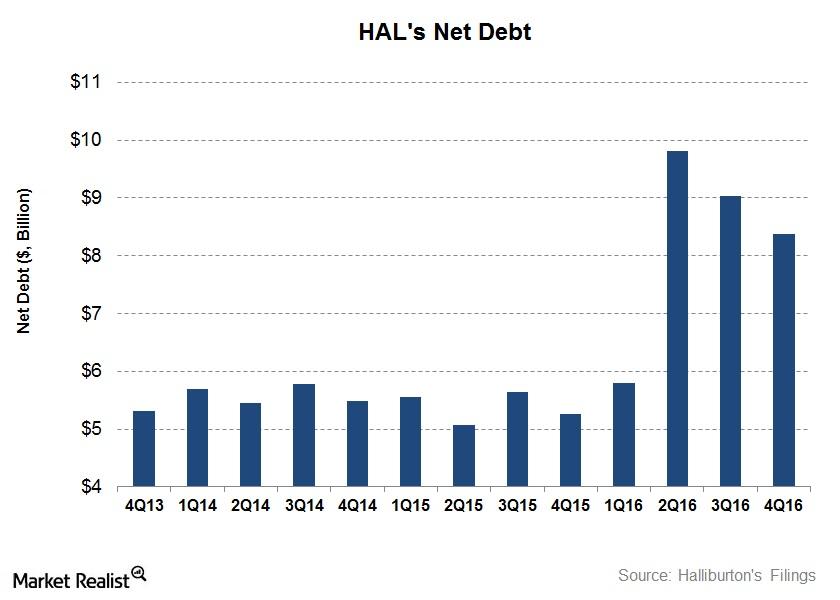

A Look at What’s Happening to Halliburton’s Debt

In 4Q16, Halliburton’s total debt fell 19% compared to a year earlier, and its cash and marketable securities fell 60%. In effect, its net debt rose 59% to ~$8.4 billion as of December 30, 2016.

Ranking OFS Companies by Their Valuation Multiples

Flotek Industries’ (FTK) forward EV-to-EBITDA multiple is at the steepest discount to its current EV-to-EBITDA multiple on March 9, 2018.

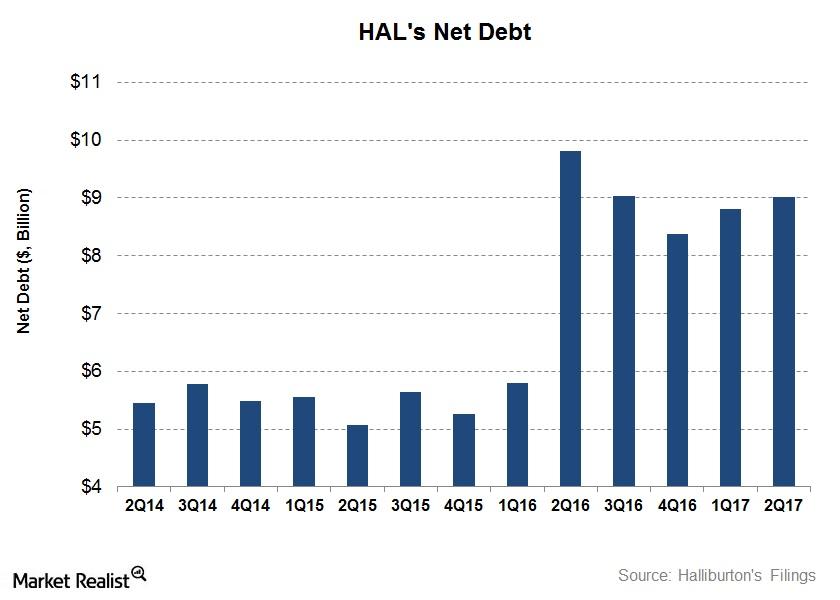

Understanding Halliburton’s Net Debt after 2Q17

In 2Q17, Halliburton’s (HAL) total debt fell 14% from 2Q16, while its cash and marketable securities fell 31%.

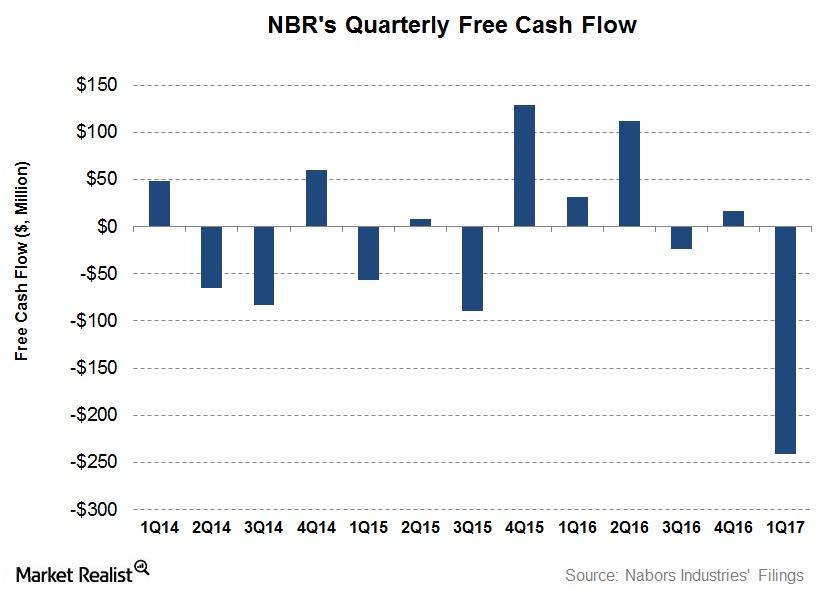

What Are Nabors Industries’ Capex Plans for 2017?

Nabors Industries’ (NBR) cash from operating activities (or CFO) turned negative in 1Q17, compared to its positive CFO a year earlier.

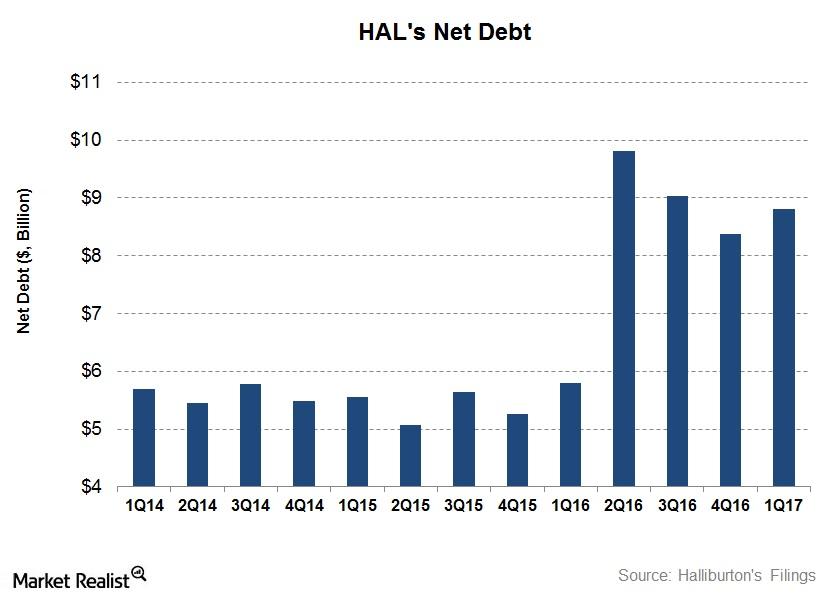

What’s Happening to Halliburton’s Net Debt?

In 1Q17, Halliburton’s (HAL) total debt fell 29% compared to a year earlier, while its cash and marketable securities fell 78%.

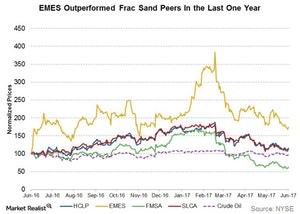

What’s ahead for Frac Sand Producers?

Frac sand producers Emerge Energy Services (EMES) and Hi-Crush Partners (HCLP) rose nearly 44% and 16%, respectively, over the last 12-month period.

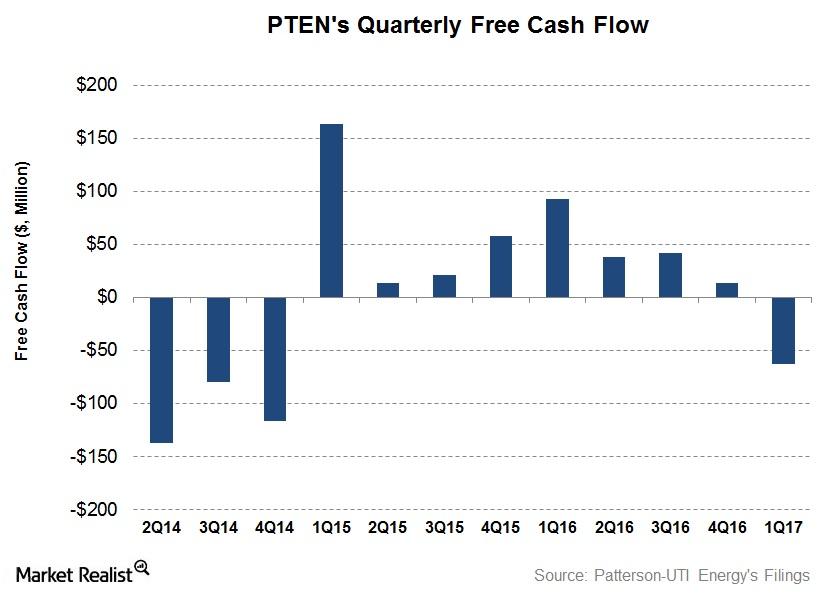

A Look at Patterson-UTI Energy’s Higher 2017 Capex Plan

Patterson-UTI Energy’s capex budget for 2017 is $450.0 million. That’s 275.0% higher than its 2016 capex.

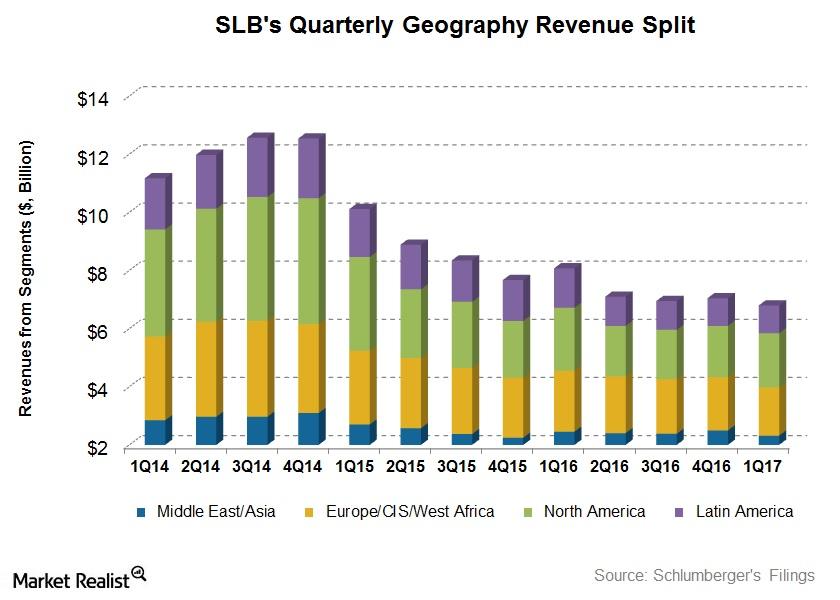

What Were Schlumberger’s Drivers in 1Q17?

Schlumberger’s (SLB) Latin America region witnessed the highest revenue decline (30% fall) in 1Q17—compared to 1Q16.

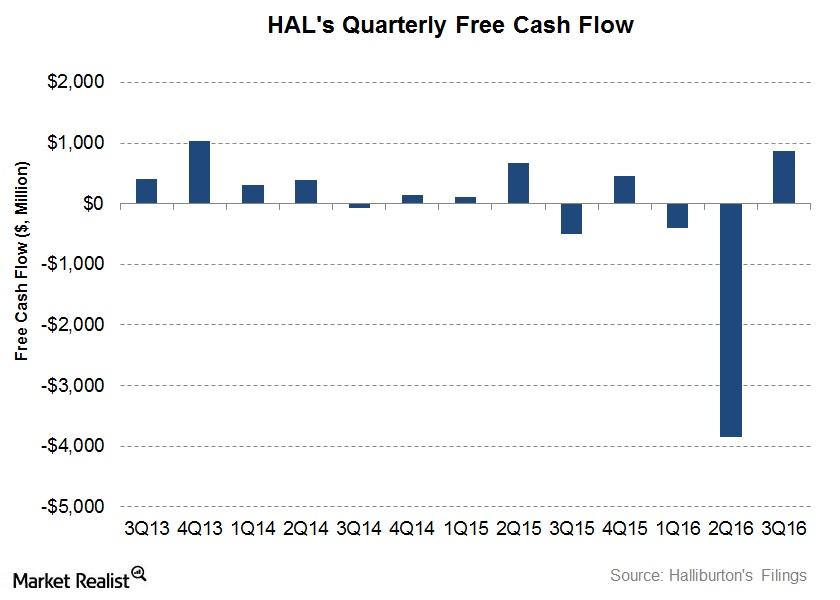

Analyzing Halliburton’s Free Cash Flow and Capex Plan

In this article, we’ll analyze how Halliburton’s (HAL) operating cash flows have trended over the past few quarters. We’ll also discuss its free cash flow (or FCF).

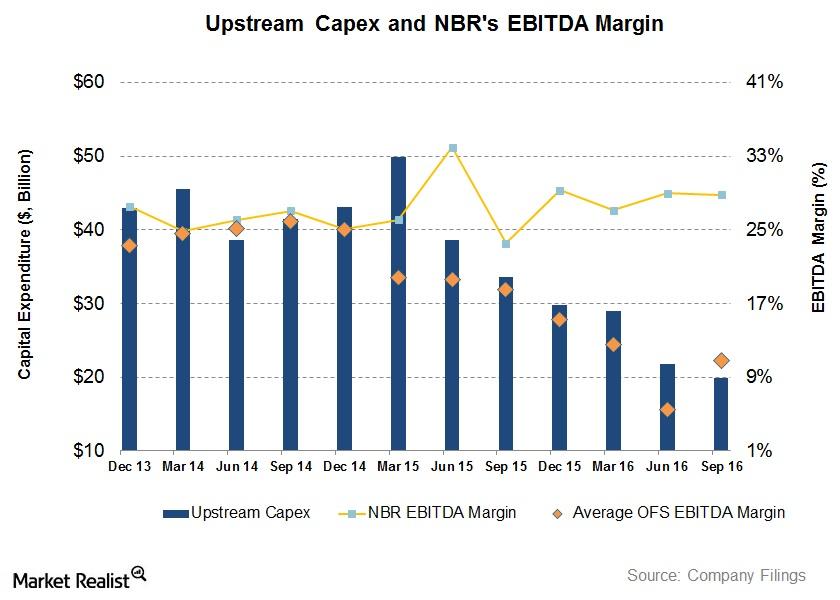

Will Upstream Operators’ Capex Affect Nabors’ 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure following crude oil prices’ sharp decline.

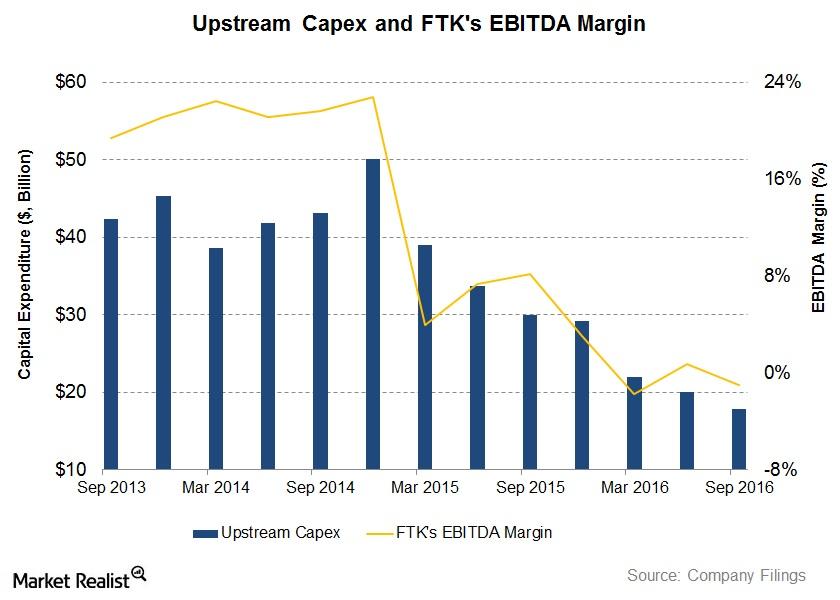

Will Upstream Operators’ Capex Affect Flotek’s 4Q16 Margin?

In the past couple of years, some of the major US upstream and integrated companies have reduced capital expenditure as a result of crude oil’s sharp decline.

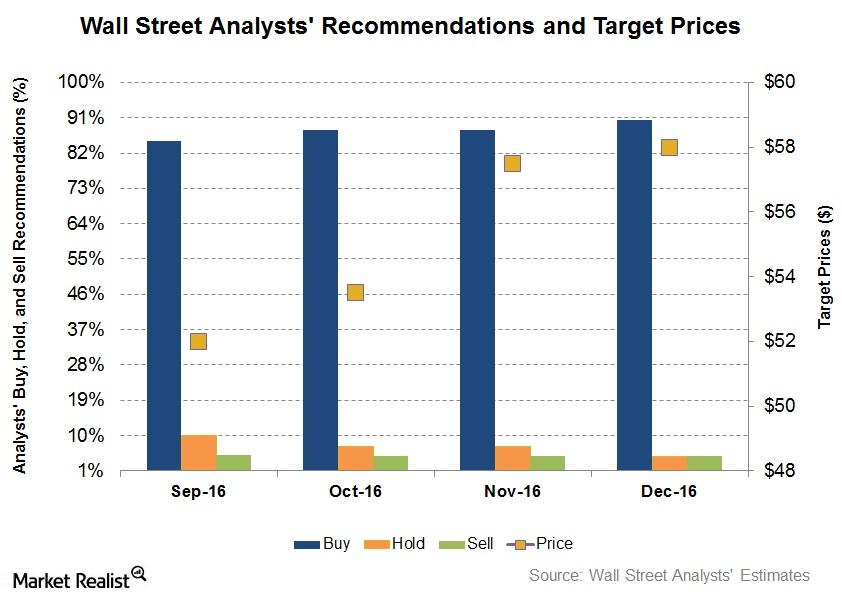

Are Analysts Changing Recommendations for Halliburton?

In December so far, 90% of the analysts tracking Halliburton rated it a “buy” or some equivalent.

Why Did Halliburton’s Free Cash Flow Improve?

Halliburton’s cash from operating activities (or CFO) turned positive in 3Q16.

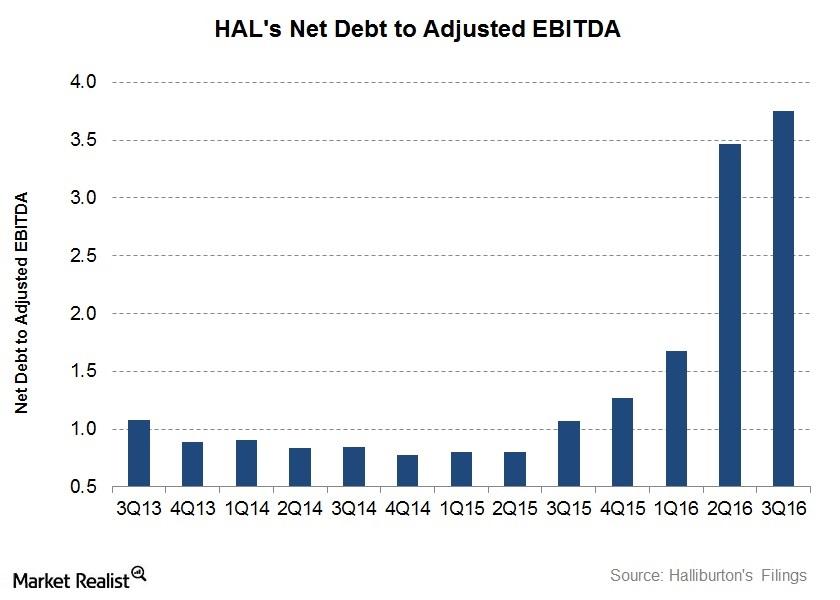

Is Halliburton’s Indebtedness on the Rise?

In 3Q16, Halliburton’s net-debt-to-adjusted-EBITDA multiple was ~3.8x, or 251% higher than it was a year ago.