Inside Schlumberger’s 1-Year Returns as of June 16

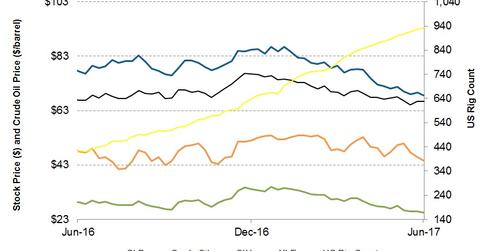

Schlumberger’s trailing-one-year stock price has fallen 12% as of June 16, 2017, while XLE, the broader energy industry ETF, has fallen 3%.

Dec. 4 2020, Updated 10:53 a.m. ET

Schlumberger’s stock price versus industry

Schlumberger’s (SLB) trailing-one-year stock price has fallen 12% as of June 16, 2017. In the past year, the Energy Select Sector SPDR ETF (XLE), the broader energy industry ETF, has returned -3%.

SLB performed nearly in line with the VanEck Vectors Oil Services ETF (OIH), an ETF tracking an index of 25 OFS (oilfield equipment and services) companies. OIH has generated -13% over the past year, while the Dow Jones Industrial Average (DJIA-INDEX) has risen 21%.

The energy sector makes up 6.1% of the DJIA-INDEX. Schlumberger has significantly underperformed the SPDR S&P 500 ETF (SPY), which has returned 17% during the same period.

In the past year, WTI (West Texas Intermediate) crude oil has seen a 7% fall in price. The US rig count has risen 120% in the past year, despite the recent weakness in crude prices.

Recent projects that can affect Schlumberger’s returns

On June 14, 2017, Schlumberger announced a strategic alliance with Seitel. In the alliance, SLB and Seitel will perform reimaging and acquire new geophysical data in Mexico. Seitei provides onshore seismic data to the upstream producers in North America.

Schlumberger has also proposed a partnership with Saudi Aramco. It signed a memorandum of understanding with Saudi Arabia’s state-owned oil company, Saudi Aramco, in May 2017. Schlumberger’s and Weatherford International’s (WFT) proposed JV (joint venture), OneStimSM, was signed in March 2017.

You can read more about how prominent OFS companies like Halliburton (HAL) and Weatherford International have been faring in recent times in Market Realist’s series Weighing SLB, HAL, NOV, and WFT after 1Q17.

Keep reading this series (below) for our analysis of Schlumberger’s stock forecast, investor short interest, and correlations with crude oil.