KLA-Tencor Corp

Latest KLA-Tencor Corp News and Updates

Can Applied Materials Maintain High Efficiency Ratios in 2019?

In fiscal 2018, AMAT’s revenue rose 19% YoY to $17.25 billion, while its non-GAAP (generally accepted accounting principle) net income rose 29.6% YoY to $4.57 billion.

The Impact of US–China Trade Tensions on Applied Materials Stock

Applied Materials (AMAT) earned 21% of its 2016 revenues and 19% of its 2017 revenues from China. Any major shift in this market could hurt AMAT.

AMAT’s Weak Fiscal Q4 2018 Guidance Makes Investors Cautious

Applied Materials, the world’s largest chip manufacturing equipment vendor, reported strong fiscal Q3 2018 earnings but lowered its fiscal Q4 2018 guidance.

Chip Stocks Fall on Fears of a Two-Year Growth Trend Slowdown

NVIDIA and Applied Materials published their latest earnings results on August 16. Their weaker guidances have spooked investors.

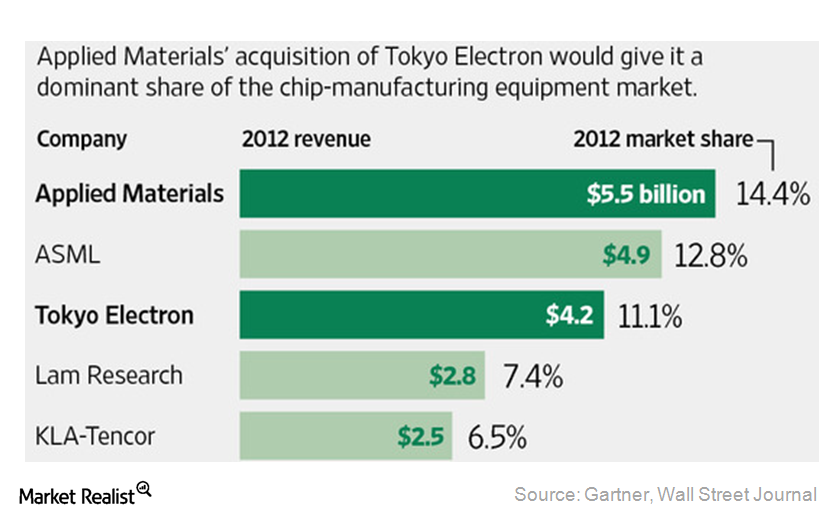

What Tokyo Electron acquisition means for Applied Materials

Applied Materials’s merger with Tokyo Electron is expected to provide Eteris with a 25% market share in the chip manufacturing equipment market.

Micron Stock Fell on Disappointing Guidance

Micron Technology reported upbeat fourth-quarter fiscal 2019 results on September 26 after the market closed. Micron stock fell 1.76% to $48.60 on the day.

Goldman Sachs Turns Bullish on Semiconductor Stocks

The US markets are up today as Wall Street braces for a busy earnings week. The S&P 500 ETF is up 0.3%, and semiconductor stocks lead the market’s gains.

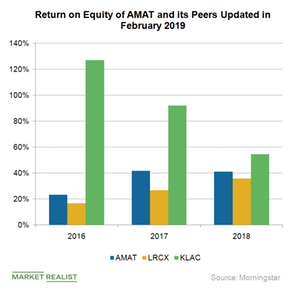

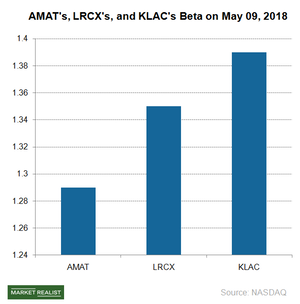

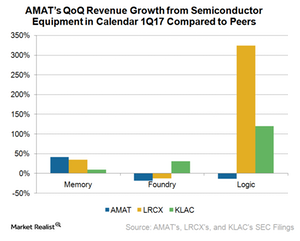

Is AMAT Losing Market Share to Lam Research and KLA-Tencor?

The emergence of the IoT (Internet of Things), self-driving cars, AR/VR (augmented/virtual reality), and AI (artificial intelligence) is driving demand for logic and memory chips.

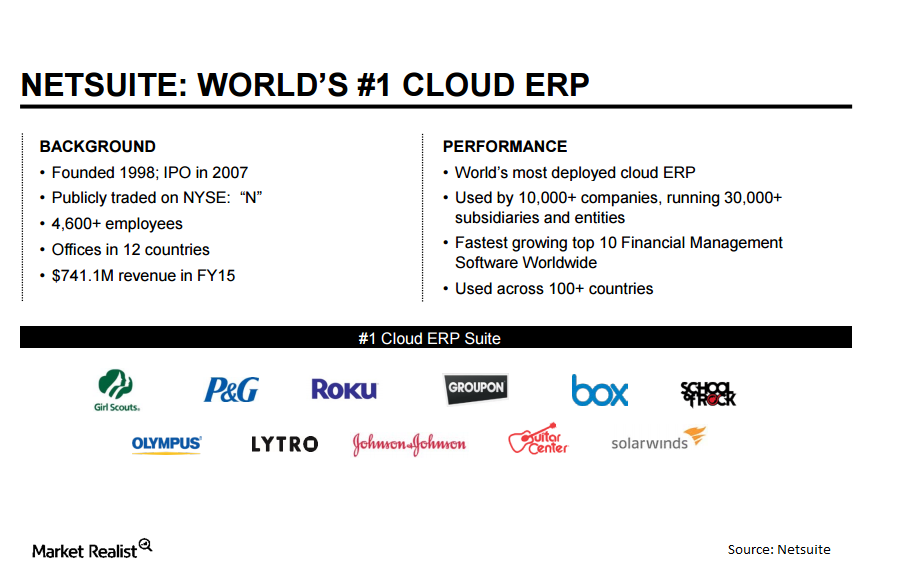

The Oracle-NetSuite Merger: What’s the Rationale?

The relationship between Oracle and NetSuite goes back a long way. Oracle co-founder Larry Ellison and his family own almost half of NetSuite stock.

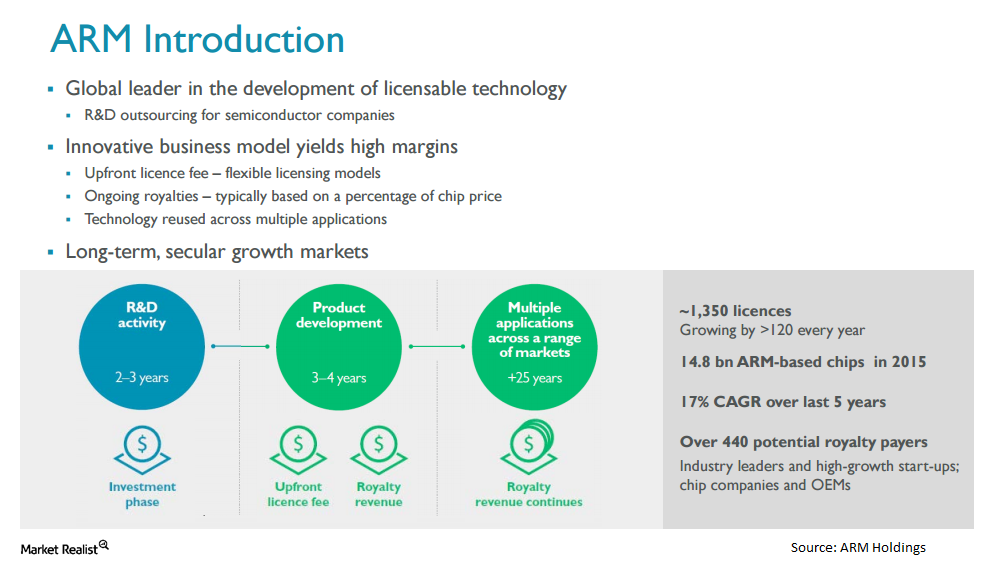

What Are the Conditions for the ARM Holdings-Softbank Merger?

ARM Holdings and Softbank are merging in a cash transaction. In an unusual step, there aren’t regulatory or antitrust conditions to the transaction.

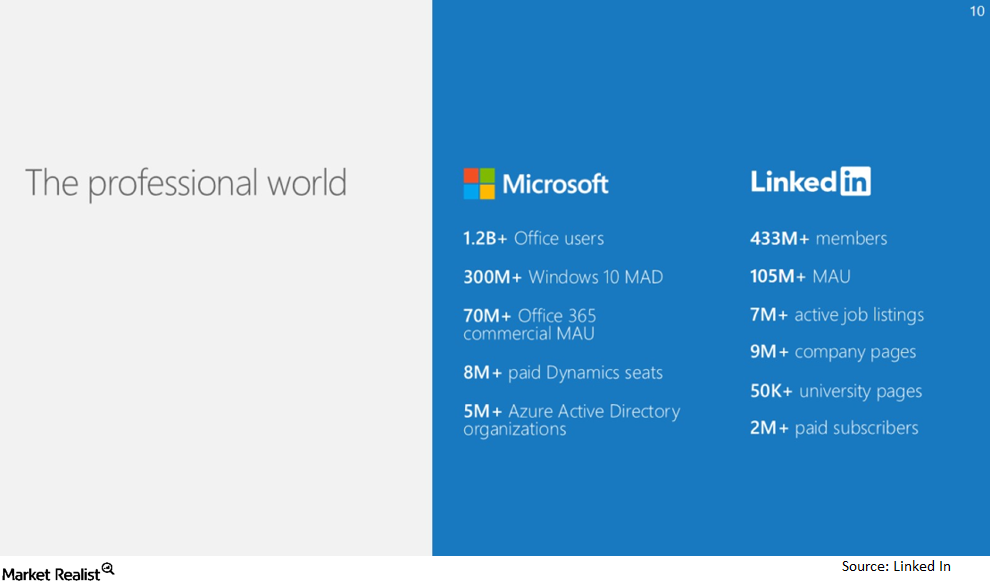

What’s the Rationale for the Microsoft-LinkedIn Merger?

LinkedIn will be a standalone entity within Microsoft. This transaction is part of Microsoft’s plan to focus on cloud-based offerings. It wants to rely less on PCs.

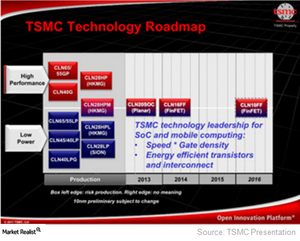

TSMC Has Accelerated Advanced Technology Development

TSMC is currently ramping up production of its 16nm technology. It expects to complete it by the end of fiscal 2Q16.

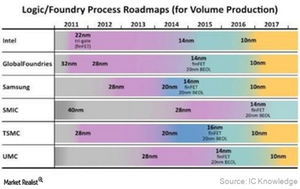

Foundries to Grow Faster than Integrated Circuits in 2016

Taiwan (EWT) is the largest semiconductor manufacturer, housing the world’s top two foundries, namely TSMC (TSM) and UMC (United Microelectronics).