Puja Tayal

Having joined Market Realist in 2015, Puja has been covering the intricacies of the semiconductor industry. She has 13 years of experience as a financial analyst with a particular focus on the manufacturing sector. Having graduated in commerce (accounting) and completed CFA Level 1, Puja is known for her insightful and well-researched articles. Puja is a tech enthusiast and has an interest in understanding the endless possibilities of technology as the world moves towards AI, 5G, and autonomous cars. In the early days of her career, she worked with a business intelligence firm as a quality analyst and trainer. This experience built on her analytical skills. Puja has also pursued a crash course in business analytics.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Puja Tayal

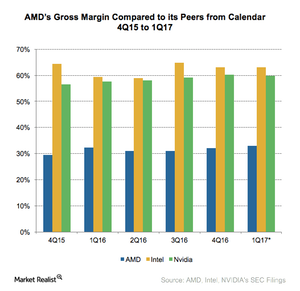

Why Is AMD’s Gross Margin Lower than Its Rivals’?

Advanced Micro Devices (AMD) is looking to improve its gross margin by entering the high-end market and ramping up Global Foundries’ (or GF) 14nm (nanometer) process node.

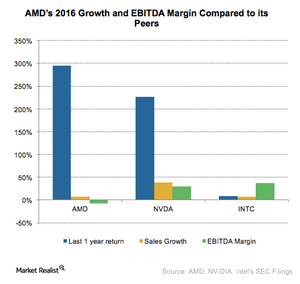

Why Did Goldman Sachs Downgrade AMD to a ‘Sell’?

Advanced Micro Devices (AMD) is growing beyond the game console market toward PC (personal computers), virtual reality, and data center technology with its new Ryzen CPUs.

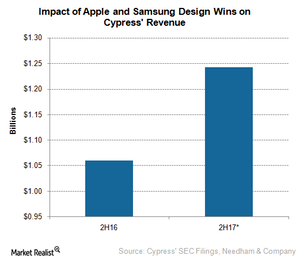

How Much Does Cypress Stand to Benefit from Apple’s and Samsung’s Latest Designs?

Cypress (CY) is rumored to be in the process of securing a smartphone design win for its USB type-C port from Apple (AAPL) and Samsung (SSNLF).

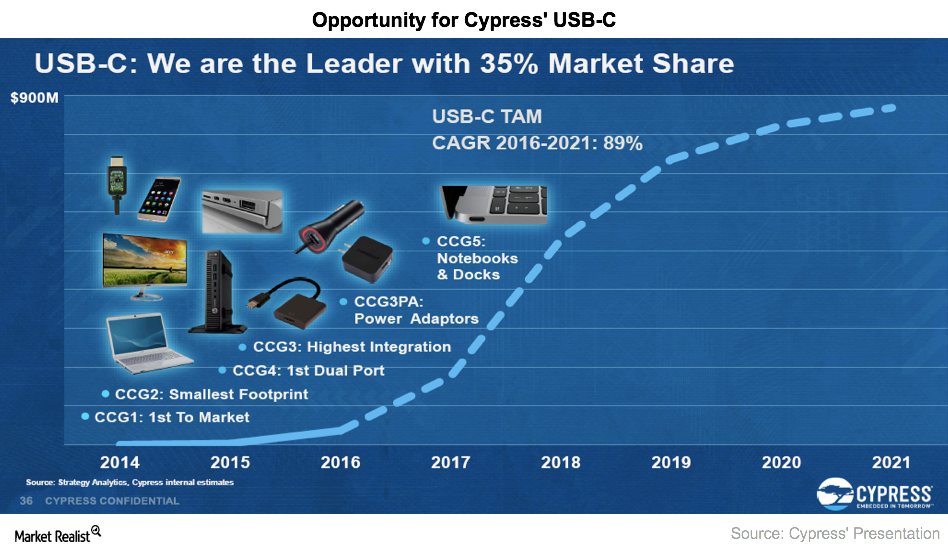

This Is Making Cypress a Market Leader in USB-C

Cypress (CY) is aiming to gain more market share in the USB space with its new USB-C port, a common connector for all electronics devices.

Cypress Semiconductor’s Strategy to Improve Gross Margin

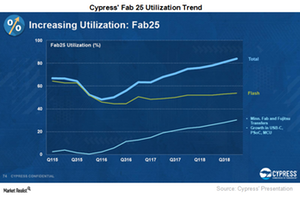

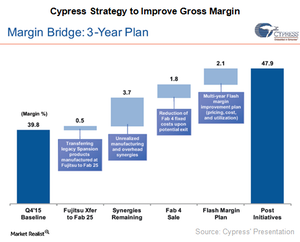

Cypress Semiconductor (CY) aims to increase its gross margin from 40.0% currently to 43.0% by fiscal 4Q17 and 47.9% by fiscal 4Q18.

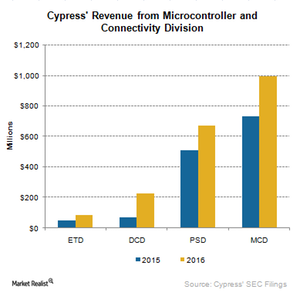

Why Cypress Semiconductor Restructured Its Business Segments

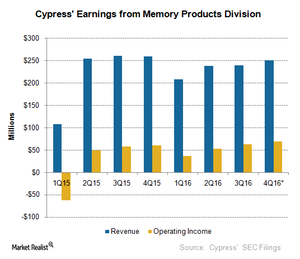

Cypress has combined its four business segments into two: MCD (Microcontroller and Connectivity Division) and MPD (Memory Products Division).

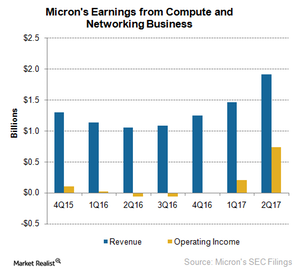

Inside Micron’s CNBU: Key Growth Drivers

The emergence of the data economy is creating new growth drivers for Micron Technology (MU) in every end market.

How Micron Technology Could Benefit from an Early Transition to 3D NAND

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline.

Micron Technology’s 3D NAND Roadmap for 2017

Micron Technology (MU) plans to spend ~$1.8 billion in capex on ramping up the 64-tier 3D NAND and developing the third-generation 3D NAND.

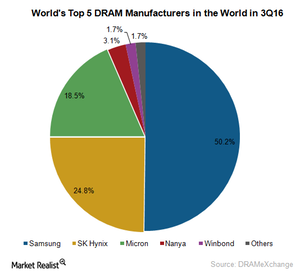

Micron Technology’s Competitive Position in the DRAM Market

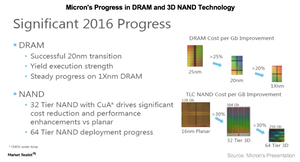

Micron Technology (MU) has achieved a 25% cost reduction by transitioning from 25nm to 20nm.

Micron’s Strategy to Improve Operational Efficiencies

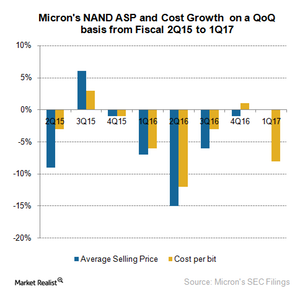

Micron Technology (MU) entered the 3D NAND market earlier than its competitors, as its planar NAND did not deliver good returns.

Could Intel Make the Mobileye Integration a Success?

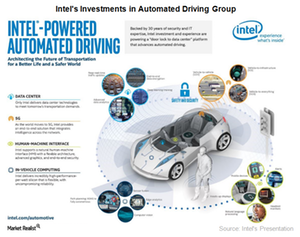

Intel is looking to mitigate the integration risk by integrating its Automated Driving Group with Mobileye instead of integrating Mobileye into its business.

Intel’s History of Failed M&As: The Cause and the Impact

Intel (INTC) missed out on the mobile revolution, so now it’s trying to catch up, investing in areas such as autonomous cars and artificial intelligence.

Is Intel Taking a Huge Risk by Acquiring Mobileye?

The key risk Intel faces with the Mobileye acquisition is that Mobileye could fail to create an autonomous driving solution in time.

How the Mobileye Acquisition Could Impact Intel’s Earnings

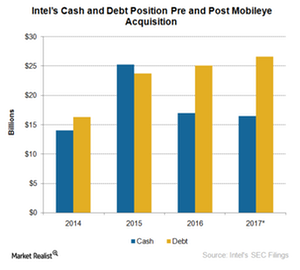

Intel (INTC) is acquiring Mobileye (MBLY) for a hefty premium compared to MBLY’s earnings.

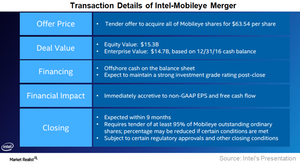

What You Need to Know about the Intel-Mobileye Merger

Analysts are criticizing the Intel-Mobileye deal. They think the acquisition price is too high and the synergies from the merger are too low.

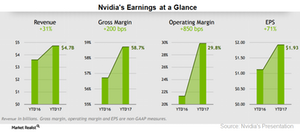

Why Nvidia Stock Is Falling despite Strong Growth Ahead

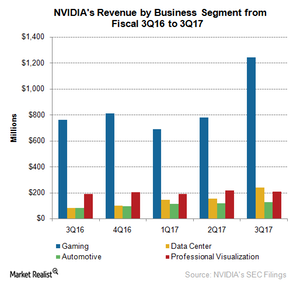

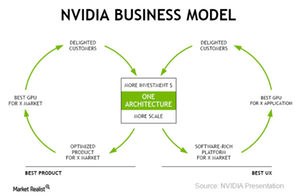

Nvidia’s (NVDA) move from GPUs to a GPU platform-based business model contributed to its exceptional growth in fiscal 2017. Nvidia’s earnings touched new highs as its revenues rose 38% year-over-year.

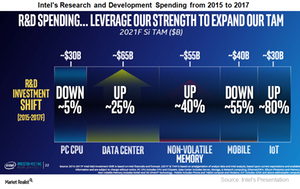

Where Is Intel Channeling Its Research and Development Efforts?

Intel (INTC) is in the midst of a major transformation, which makes Intel the top semiconductor R&D (research and development) spender in the world.

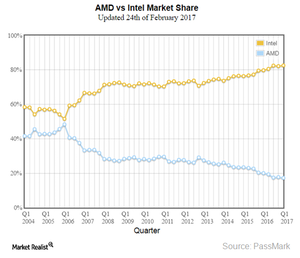

Understanding AMD’s PC Market Growth Strategy

Advanced Micro Devices (AMD) is set to launch its Ryzen desktop processors on March 2, 2017.

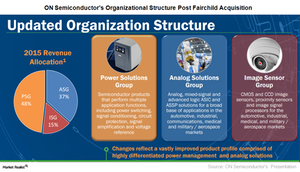

ON Semiconductor’s Revised Organizational Structure

The Power Solutions Group’s revenues rose 34.3% sequentially to $620.3 million in 4Q16. More than $200 million in revenues came from the Fairchild Semiconductor integration.

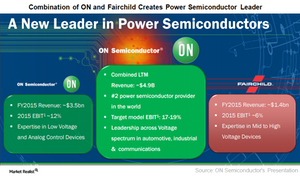

Synergies from the ON–Fairchild Semiconductor Merger

ON Semiconductor (ON) expects the Fairchild Semiconductor merger to bring in annual cost synergies of $225 million by 2019 compared with just $160 million in 2017.

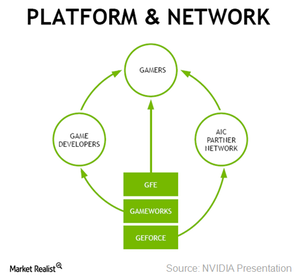

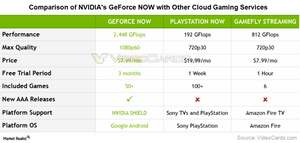

Inside GeForce NOW: Nvidia’s New Gaming Revenue Stream

Nvidia (NVDA) is looking at new revenue streams within the gaming space after dominating the high-end PC gaming market.

What’s Nvidia’s GPU Strategy for 2017 and 2018?

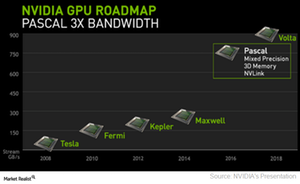

Nvidia (NVDA) has reported strong growth in fiscal 2017, thanks to Pascal GPUs.

Nvidia’s New Revenue Streams—And Why They Matter

Fiscal 2017 was Nvidia’s (NVDA) year, with the company’s stock rising 224% during the period.

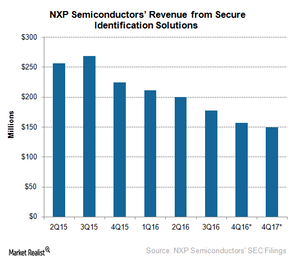

Is Secure Identification Solutions a Dying Segment for NXP?

The SIS segment’s revenues fell 11% sequentially in fiscal 3Q16 and is expected to fall another 14% to 16% in fiscal 4Q16 to ~$151.3 million.

What Is NXP Semiconductors’s Product Roadmap for Automotive?

At CES 2017, NXP Semiconductors (NXPI) demonstrated its RoadLINK platform it developed in collaboration with Delphi (DLPH) and Savari.

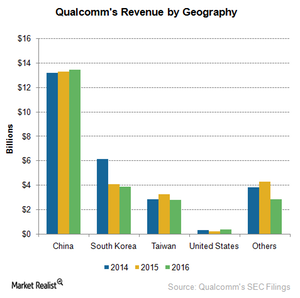

Could China Drive Qualcomm’s Fiscal 2017 Revenue?

Qualcomm (QCOM) now earns 16.6% of its revenues from South Korea.

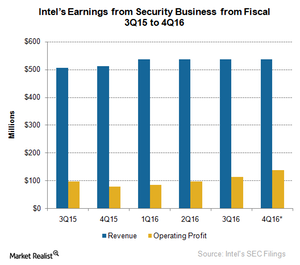

What Does Intel Security Group Have to Offer before Spin-Off?

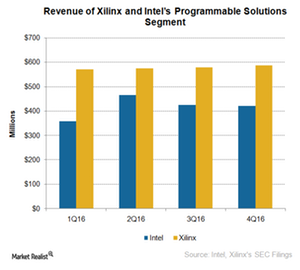

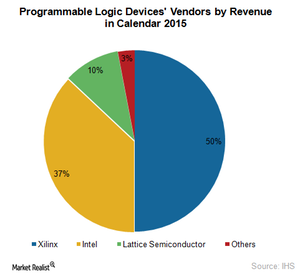

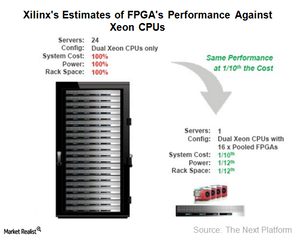

Intel (INTC) is falling behind Xilinx (XLNX) in the programmable solutions market.

Cypress Depends on Memory Business to Improve Profits

Cypress Semiconductor (CY) is becoming a complete embedded solutions provider.

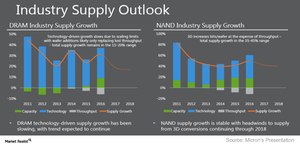

Is Supply Shortage in the NAND Market Good for Micron?

Micron expects the NAND industry’s supply to rise 38.0%–42.0% in 2017 as the transition to 3D brings technological challenges for manufacturers.

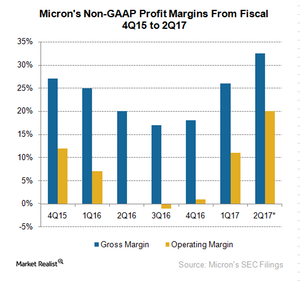

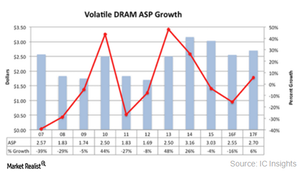

Micron Rebounds to Profits in Fiscal 1Q17

In fiscal 1Q17, Micron’s non-GAAP (generally accepted accounting principles) gross margin was 25.0%, a rise of seven percentage points from fiscal 4Q16.

Does Consolidation in the FPGA Market Make Xilinx an Acquisition Target?

In the past, analysts have named Broadcom (AVGO), Qualcomm (QCOM), and Texas Instruments (TXN) as potential bidders for Xilinx.

Xilinx Prepares Gears up with ARM’s IP

Xilinx (XLNX) is moving ahead of Intel (INTC), not only in FPGA (field programmable gate array) adoption but also in technology node.

How Does Xilinx Plan to Change the Future of Data Center with FPGAs?

Xilinx believes that FPGAs (field programmable gate arrays) can bring more power savings than GPUs while delivering same computing performance.

The Inotera Deal: Micron’s Upcoming Earnings Highlight

The key highlight in Micron’s fiscal 1Q17 earnings will be the integration of Inotera, which should be quickly accretive to its gross margins, EPS, and FCF.

Inside Cypress’s Strategy to Improve Its Gross Margin

Cypress reported strong revenues on the integration of Broadcom’s wireless IoT business, which improved its gross margin until the Spansion merger in 1Q15.

How Is Intel Placed among Competitors in the IoT Space?

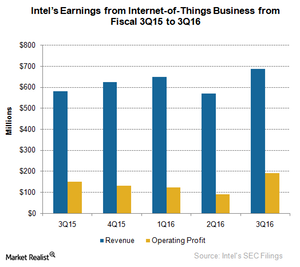

Intel’s IoT group revenues grew 19% year-over-year to $689 million in fiscal 3Q16, driven by strong demand from retail, video, and transportation.

How Might the Inotera Acquisition Impact Micron’s DRAM Earnings?

Micron Technology will have to raise ~$2.5 billion to fund its joint venture acquisition of Inotera, and this move will add to its already high leverage.

What You Need to Know About the Micron-Inotera Deal

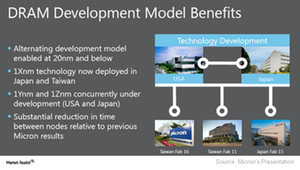

A major part of Micron Technology’s (MU) transition to the 20 nm node involves Taiwan’s (EWT) Inotera and its joint venture with Nanya Technology.

What Is Fueling Nvidia’s Record-Breaking Earnings?

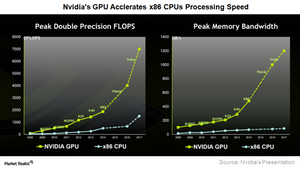

Fiscal 3Q17 was the first full quarter that reflected Nvidia’s (NVDA) Pascal GPU sales. NVDA reported record-high revenue growth in its Gaming segment, which crossed the $1 billion mark for the first time.

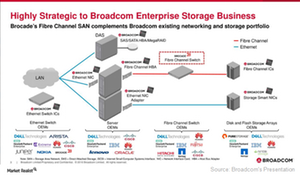

What’s the Strategy behind Broadcom’s Brocade Acquisition?

Broadcom is acquiring Brocade in order to benefit from the latter’s strong cash flow. This raises the question of why Brocade agreed to be acquired if its business was profitable.

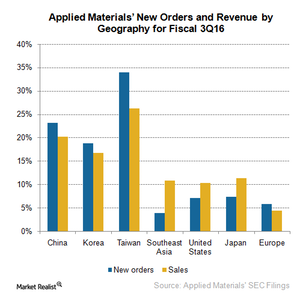

How Will Donald Trump’s Victory Impact AMAT?

AMAT is the world’s largest manufacturer of SME (semiconductor manufacturing equipment) and supplies to chipmakers around the world.

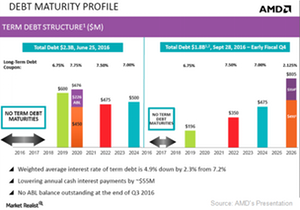

AMD Amazes with Comeback from Near Bankruptcy

As of September 30, 2016, AMD’s cash reserves stood at $1.3 billion as against long-term debt of $1.6 billion.

Nvidia May Accelerate Its GPU Roadmap to Compete with AMD

Nvidia (NVDA) is rushing to launch Volta in early 2017, which is the timeframe when AMD could release its next-generation GPU Vega.

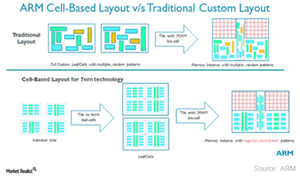

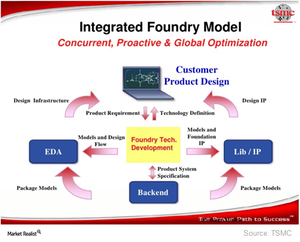

What Is Intel’s Strategy behind Its Foundry Model?

In fiscal 3Q16, Intel (INTC) partnered with ARM Holdings (ARMH) to provide foundry services for ARM-based chips. Intel announced another foundry partnership with Spreadtrum, but it did not identify the products that would be manufactured.

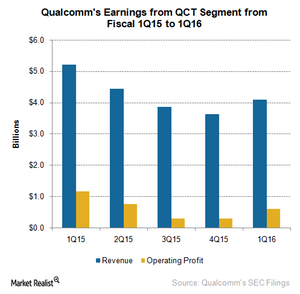

Why Qualcomm’s Revenues Are Unlikely to Improve in Fiscal 2Q16

Qualcomm earns revenue by selling mobile chips and by licensing its technology to other handset makers. Let’s first look at the core business of QCT.

How Will IBM Compete with Intel in the Data Center Space?

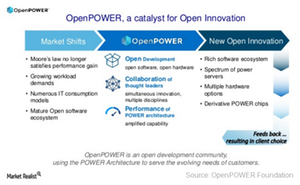

In 2013, IBM decided to make its technology available to third parties and launched the OpenPower Foundation.

NXP Semiconductors Benefiting from Freescale Merger Synergies

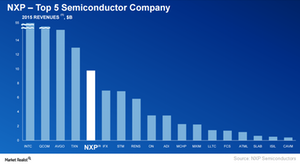

Many Apple (AAPL) suppliers who diversified their revenue streams, especially in the automotive sector, reported strong growth in 2Q16, and NXP Semiconductors (NXPI) was no exception.

Nvidia’s Journey from a Startup to the Fastest-Growing Company

Nvidia (NVDA) is currently in a strong position with little competition to its GPU technology. However, it is at risk of entering into a price war with AMD (AMD), which might affect NVDA’s margins.

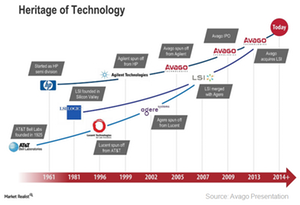

Broadcom: A Product of Several Mergers and Acquisitions

Mergers and acquisitions aren’t new for Broadcom. It has a history of successful M&As, and the most recent Avago-Broadcom merger is its biggest deal to date.