Puja Tayal

Having joined Market Realist in 2015, Puja has been covering the intricacies of the semiconductor industry. She has 13 years of experience as a financial analyst with a particular focus on the manufacturing sector. Having graduated in commerce (accounting) and completed CFA Level 1, Puja is known for her insightful and well-researched articles. Puja is a tech enthusiast and has an interest in understanding the endless possibilities of technology as the world moves towards AI, 5G, and autonomous cars. In the early days of her career, she worked with a business intelligence firm as a quality analyst and trainer. This experience built on her analytical skills. Puja has also pursued a crash course in business analytics.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Puja Tayal

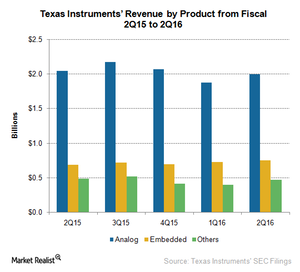

Which Segment Is Most Profitable for Texas Instruments?

Texas Instruments’ Analog segment contributes 62% to the company’s total revenue and is made up of high volume analog and other products.

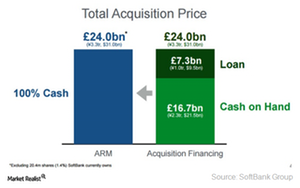

Inside the Key Financials Involved in the SoftBank-ARM Deal

In the biggest YTD semiconductor acquisition of 2016, SoftBank has offered to acquire UK-based designer ARM for a cash consideration of $32 billion.

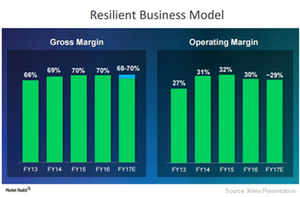

How Does Xilinx’s Fabless Business Model Affect Margins?

Xilinx’s attractive margins and diversified customer base of industrial, automotive, data center, and IoT (Internet of Things) has attracted a lot of attention.

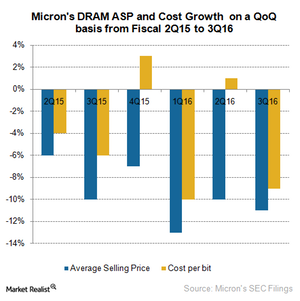

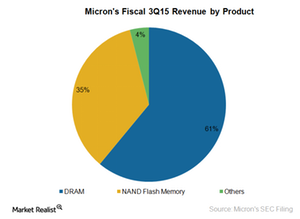

Falling DRAM Prices Reduce Micron’s DRAM Margin

The overall DRAM market is slowing and despite this, Micron increased its exposure in this space from 54% in fiscal 2Q16 to 60% in fiscal 3Q16.

Which Industrial and Macroeconomic Factors Are Influencing Qualcomm’s Growth?

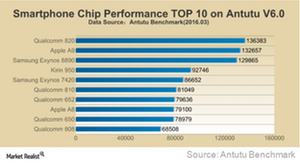

Qualcomm expects its core mobile chip business to grow at a CAGR (compounded annual growth rate) of around 8%–9% between 2015 and 2020.

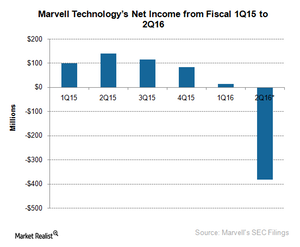

What’s the Root Cause of Marvell’s Problems?

Let’s dig into the cause of Marvell’s accounting issues, see how one thing led to another, and look at how its new management plans to untangle the chaos.

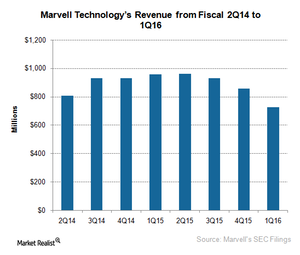

Marvell Hit by Several Internal and External Challenges

Marvell, a supplier of silicon solutions for storage, cloud infrastructure, IoT connectivity, and multimedia, has been making news for all the wrong reasons.

Britain Contributes Little to the Global Semiconductor Industry

Europe accounted for only 10% of global semiconductor sales in April 2016, according to World Semiconductor Trade Statistics.

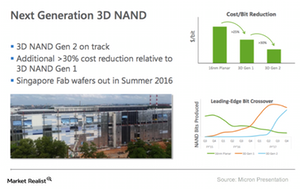

What the Investments of Micron and Other Suppliers in 3D NAND Capacity Could Mean

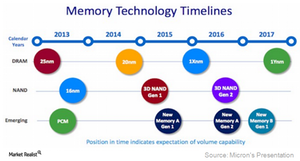

Micron is moving a step further and developing 3D NAND Generation 2 technology. It expects to bring this into production in fiscal 2Q17.

Intel Is a Blend of Acquisitions, Joint Ventures, and Organic Growth

Intel’s acquisitions mostly revolve around vertical integration where it integrates the acquired company’s technology into its microprocessors.

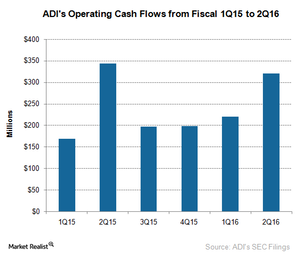

What Is Analog Devices’ Acquisition Strategy?

Analog Devices (ADI) has been using M&A (mergers and acquisitions) to rapidly expand its technology offerings and boost its revenue.

What’s the Latest on Apple’s New iPhone 7?

Several reports have been circulating in China that Apple may launch three models of its new flagship phone: iPhone 7, iPhone 7 Plus, and iPhone 7 Pro/iPhone 7 Plus Premium.

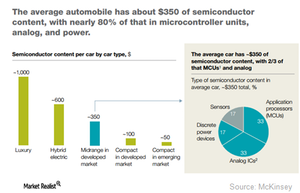

Automotive: The Next Big Thing for Texas Instruments

Texas Instruments (TXN) has increased its exposure in the automotive, industrial, and communications segments, which accounted for 64% of the company’s revenue in fiscal 1Q16.

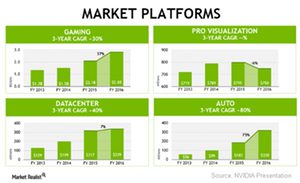

The Past, Present, and Future of NVIDIA

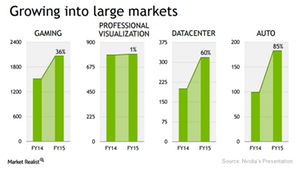

NVIDIA’s growth is likely to increase further as the trends of gaming, VR (virtual reality), deep learning, and self-driving cars pick up pace.

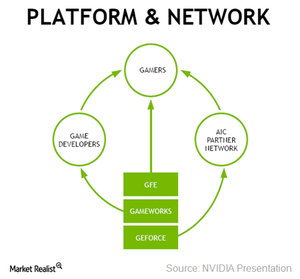

NVIDIA’s Strategy to Reach Out to a Larger User Base

NVIDIA (NVDA) reported a 7% year-over-year revenue growth in 2015, a time when the semiconductor industry revenues fell by 2.3% YoY. At its 2016 Investor Conference, NVIDIA’s executives highlighted the company’s growth opportunities in terms of geography and new technology.

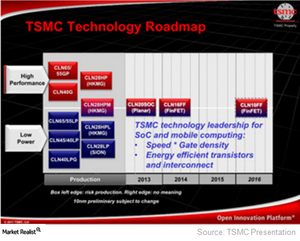

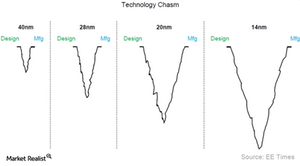

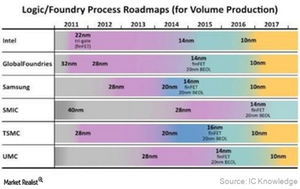

TSMC Has Accelerated Advanced Technology Development

TSMC is currently ramping up production of its 16nm technology. It expects to complete it by the end of fiscal 2Q16.

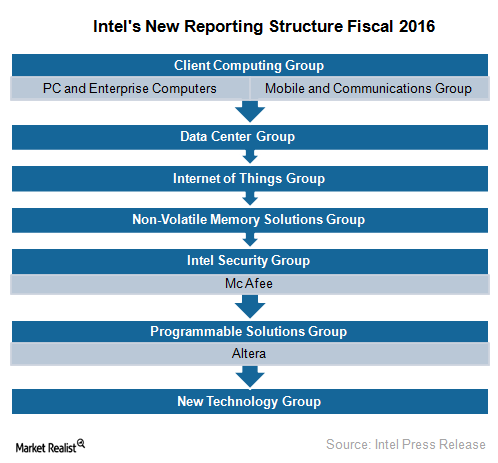

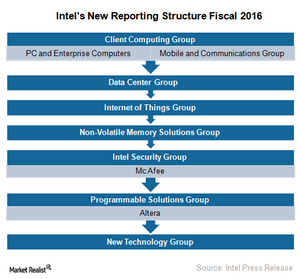

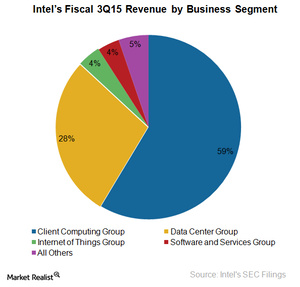

A Look at Intel’s New Reporting Structure

Intel is expanding its product portfolio to offer a comprehensive solution to its cloud customers such as Microsoft (MSFT).

NVIDIA Upgrades Its GPU Portfolio to Capitalize on Future Trends

NVIDIA (NVDA), a popular name among PC gamers, made news at the GTC (GPU Technology Conference) 2016 from April 4 to 7, 2016.

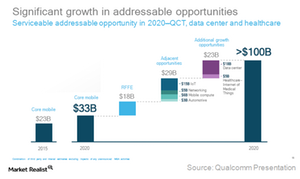

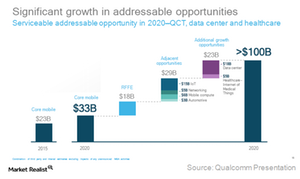

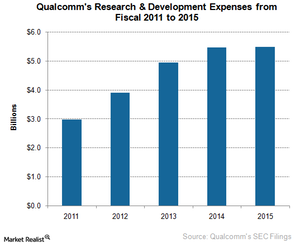

Qualcomm Is Targeting a $100 Billion Market by 2020

Qualcomm (QCOM) has stated that its total SAM (serviceable addressable market) is expected to grow from $23 billion in 2015 to about $100 billion in 2020.

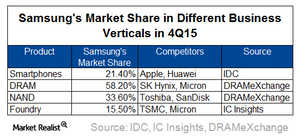

Samsung: A Semiconductor Foundry, Competitor, and Customer

Through its foundry business, Samsung provides chip manufacturing services to companies such as Qualcomm (QCOM), NVIDIA (NVDA), and Apple (AAPL).

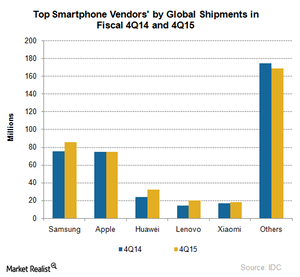

Opportunities and Challenges for Samsung in the Smartphone Market

The slowdown in smartphone sales has impacted the revenues of both Samsung and Apple. Both expect a significant slowdown in smartphone sales in fiscal 2016.

What Is Samsung’s Growth Strategy in the Smartphone Market?

South Korea–based (EWY) Samsung (SSNLF) is making efforts to boost revenue and maintain a double-digit margin amid slowing smartphone sales.

Gauging the Impact of the Microchip-Atmel Merger on Atmel Shareholders

On September 20, 2015, Dialog Semiconductor agreed to buy Atmel for ~$4.6 billion. But in December, Microchip made a competing bid of nearly $3.6 billion.

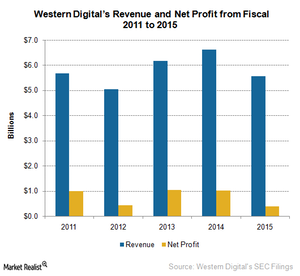

Alken Says $19 Billion Price for SanDisk Is Too High

Alken stated that in light of changing market dynamics and the capital market scenario, the $19 billion price for SanDisk, which has been posting declining earnings in fiscal 2015, is too high.

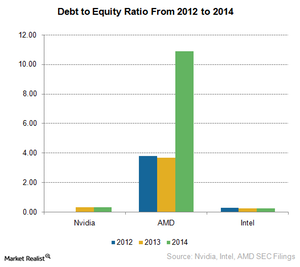

How Is Nvidia’s Capital Structure Compared to Its Rivals’?

Nvidia’s free cash flow to net income ratio indicates that it has a strong capital structure to withstand headwinds and bear significant capital expenditure.

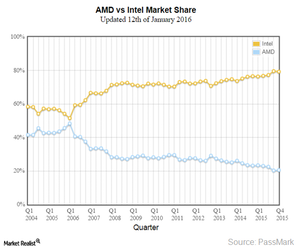

Intel and AMD’s Duopoly in the PC Processor and Server Market

AMD and Intel seem to have a duopoly in the PC processor and server market, with Intel accounting for more than 80% share in the PC processor space and a 99% share in the server space.

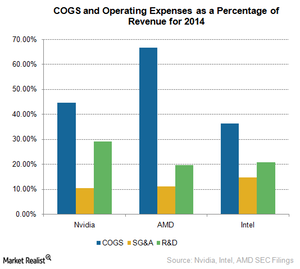

Is Nvidia’s Cost Structure Favorable for Investors?

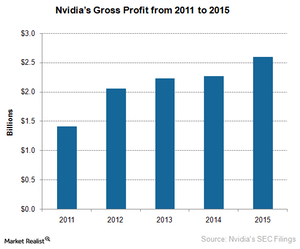

Nvidia’s cost of goods sold is around 40% of its revenue, whereas Advanced Micro Devices’ COGS is more than 65%. Intel’s (INTC) COGS is below 40%.

What External Risks Pose Threats to Nvidia?

Any defects found in Nvidia’s products would incur significant costs. Greater risks would arise if a defect were found after commercial shipment had begun.

How Product Design Wins Impact Nvidia’s Revenues

Nvidia’s revenue depends on design wins. The company maintains strong relationships with customers to assist them in defining their new products.

What Risks Does a Limited Customer Base Pose for Nvidia?

Nvidia is looking to diversify its revenue stream by targeting customers in the automotive market. In fiscal 3Q16, its revenue from automotive rose 52% YoY.

Opportunities and Risks Associated with Nvidia’s Fabless Model

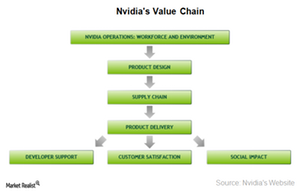

The fabless model allows Nvidia to focus its resources on product design, R&D (research and development), marketing, and customer support.

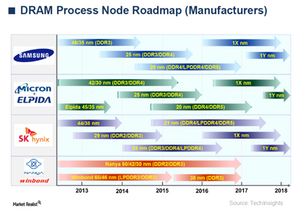

Micron’s Technology Roadmap for 2016 and 2017

Micron’s technology transition will slow down the output and revenue in the short term. The company will be able to meet advanced memory products’ needs.

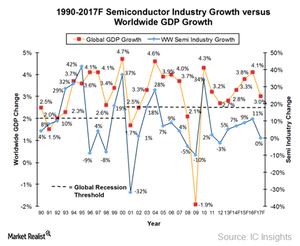

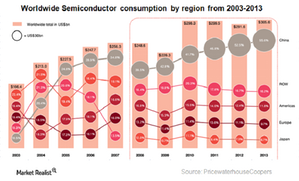

The Macro Trends that Affect the Global Semiconductor Industry

Consumer trends directly impact the semiconductor industry. For instance, consumers shifted from PC to mobile, negatively impacting Intel’s revenue.

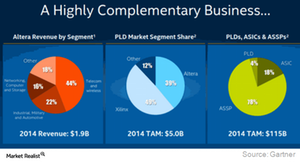

Intel Finalizes Altera Acquisition, Right on Schedule

Intel (INTC) completed its acquisition of Altera on December 28, 2015, for $16.7 billion. The Altera acquisition will make Intel the second largest semiconductor supplier after Texas Instruments.

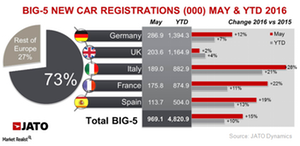

Germany to Drive Growth in European Semiconductor Industry

Despite growth in Europe’s semiconductor industry, it’s unlikely to grow as fast as its Asian counterparts. The EC launched its “10/100/20” strategy in 2013.

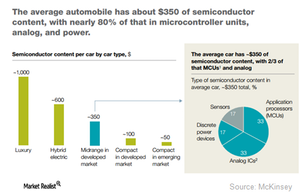

Automotive Segment to Drive Growth in the Semiconductor Market

Automotive semiconductor revenue has grown at a CAGR (compounded annual growth rate) of 8% between 2002 and 2012, according to McKinsey.

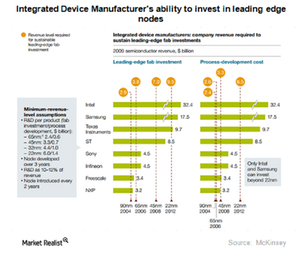

Foundries to Grow Faster than Integrated Circuits in 2016

Taiwan (EWT) is the largest semiconductor manufacturer, housing the world’s top two foundries, namely TSMC (TSM) and UMC (United Microelectronics).

What’s Qualcomm’s Plan for Its QCT Business?

QCT is Qualcomm’s (QCOM) core business, generating close to 67% of revenues in fiscal 2015. But the capital-intensive nature of the business makes it less profitable.

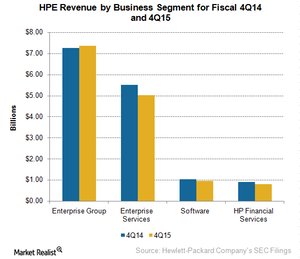

Hewlett Packard Enterprise’s Revenues Continue to Fall

In fiscal 4Q15, Hewlett Packard Enterprise (HPE) revenue fell 4% YoY to $14.1 billion, above analysts’ expectation of $13.5 billion.

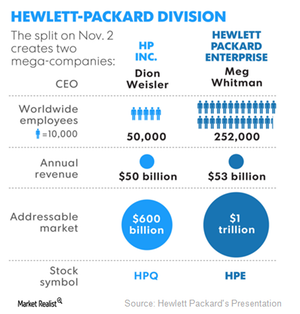

Why Did Hewlett-Packard Split Its Business?

Hewlett-Packard split into HP Inc. and Hewlett Packard Enterprise. On the first day of trading, the companies’ shares moved in opposite directions.

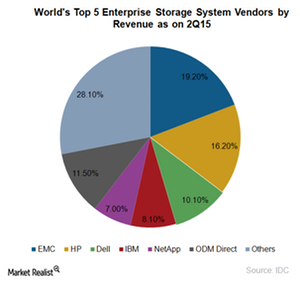

What Synergies Does the Dell-EMC Merger Bring?

The revenue synergies of the Dell-EMC merger are likely to be the result of EMC’s converged infrastructure making use of Dell servers and networking products.

How Did Intel’s Business Segments Perform?

Intel operates through four major business segments—Client Computing Group, Data Center Group, Internet of Things Group, and Software and Services Group.

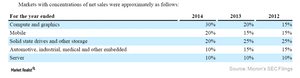

Micron’s Clients and Relationships at a Glance

Micron largely caters to PC and storage manufacturers. Hewlett-Packard (HPQ), Intel Corporation (INTC) and Kingston account for ~30% of Micron’s net sales.

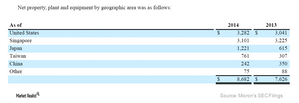

Micron’s Manufacturing Base in the US and Overseas

Micron controls costs by developing a manufacturing base in countries where manufacturing costs are low, but it manufactures most of its chips in the US.

Micron’s Strategy for Coping with Declining DRAM Prices

Micron’s strategy for coping with competition is to reduce its manufacturing costs. It currently has higher manufacturing costs than Samsung and SK Hynix.

Micron’s Product Portfolio at a Glance: Must-Knows

Micron expanded its product portfolio from 64-kilobit DRAM chips in 1980 to NAND Flash Memory devices in 2004, to SSDs in 2007, to NOR Flash Memory in 2011.

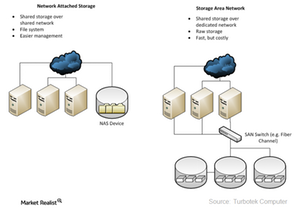

Data Storage Systems Overview

We live in the “Information Age,” where a huge amount of data is generated every second and storage systems are needed to store this data.

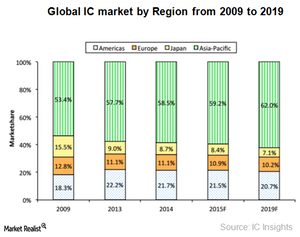

China Emerges as New Competition in Semiconductor Industry

China is looking to reduce its dependence on foreign technology. Its government plans to invest up to $161 billion over the next decade to promote domestic chip manufacturers.

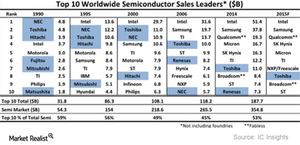

Why Did Japan’s Semiconductor Industry Fall?

In 1990, Japan led the semiconductor industry, with six companies named in the top ten semiconductor sales leaders. In 2014, only two companies made the list.

South Korea: Second Largest Global Semiconductor Manufacturer

After memory chips, LEDs comprise the second most produced semiconductor products in South Korea. The country accounts for ~13% of the global LED market.