Intel Finalizes Altera Acquisition, Right on Schedule

Intel (INTC) completed its acquisition of Altera on December 28, 2015, for $16.7 billion. The Altera acquisition will make Intel the second largest semiconductor supplier after Texas Instruments.

Dec. 30 2015, Published 11:41 a.m. ET

Altera: Intel’s new business unit

Intel (INTC) completed its biggest acquisition on December 28, 2015. It acquired Altera for $16.7 billion. Intel kept Altera’s business model and made it a separate business unit named PSG (Programmable Solutions Group). PSG is being headed by former Altera vice president Dan McNamara. This is the first major acquisition for Intel vice president Wendell Brooks who joined the company as head of M&A (mergers and acquisitions) in 2014.

The Altera acquisition will make Intel the second largest industrial semiconductor supplier after Texas Instruments (TXN), according to IHS.

What is the end objective of PSG?

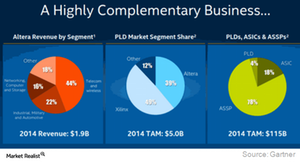

The new PSG unit will work with Intel’s DCG (Data Center Group) and IoT (Internet of Things) to develop customized, integrated products. PSG will transition Altera’s stand-alone FPGA (field-programmable gate array) products to Intel’s leading-edge fabrication plants, thus equipping the former with more resources to take market share from rival Xilinx (XLNX).

The acquisition is a test of Intel’s integration ability

Intel’s growth is largely dependent on technological innovation rather than large acquisitions. The company has had a fair share of failed acquisitions in the past. So its acquisition of Altera is a test of Intel’s integration ability, which will act as a model for future acquisitions.

Among Intel’s failed deals is the McAfee acquisition in 2011 for $7.7 billion. In this deal, Intel wanted to integrate security technology inside the chip, but it took longer than expected to materialize and failed to deliver the desired results. Intel is now selling off parts of McAfee.

Another failed deal was Intel’s $1.4 billion acquisition of the baseband unit of Infineon Technologies in 2010. With this acquisition, Intel intended to integrate the wireless technology into its microprocessors. The technology is still falling behind Qualcomm’s (QCOM) baseband chips.

In the next part of this series, we’ll see how Intel plans to leverage Altera’s FPGA technology and deliver value to shareholders. You can get exposure in all types of semiconductor stocks through the VanEck Vectors Semiconductor ETF (SMH), which has 18.6% exposure in INTC, 8.3% in QCOM, 5.0% in TXN, and 2.3% in XLNX.