The Inotera Deal: Micron’s Upcoming Earnings Highlight

The key highlight in Micron’s fiscal 1Q17 earnings will be the integration of Inotera, which should be quickly accretive to its gross margins, EPS, and FCF.

Dec. 16 2016, Updated 4:35 p.m. ET

What is Inotera for Micron?

The key highlight in Micron’s (MU) fiscal 1Q17 earnings will be the integration of Inotera, which should be immediately accretive to its gross margins, EPS (earnings per share), and FCF (free cash flow). Micron had previously been in a DRAM (dynamic random access memory) joint venture with Inotera, under which Micron purchased the entire DRAM output of the latter. For this reason, the acquisition will not likely have any immediate impact on Micron’s production.

Micron already owned a 33% share in Inotera and paid $0.94 per share to acquire the remaining stake from Nanya Technology. The deal cost Micron $4 billion after excluding Inotera’s cash and debt. This made the US-based chipmaker the largest foreign investor in Taiwan (EWT). The company produces more than 60% of its DRAM output from Taiwan, of which 35% comes from Inotera.

Micron raised $2.5 billion in new debt to fund the deal. But why did Micron go ahead with this deal when it was already buying the company’s entire DRAM output?

What’s in it for Micron?

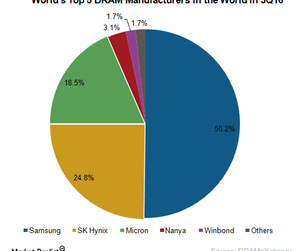

DRAM is a maturing market dominated by three key players: Samsung (SSNLF), SK Hynix, and Micron. In this market, Micron is lagging behind, has the highest costs, and is two years behind Samsung in implementing advanced technology.

The acquisition of Inotera should reduce Micron’s cost of producing DRAM and give it full control of DRAM production. While Inotera’s fabrication plant, or fab, has been doing well, Micron can plug in more operational efficiency and enhance yields. Micron plans to expand its facilities in Taiwan over the next few years, adding 1,000 jobs in the country.

The timing of the acquisition is ideal because the DRAM market is looking favorable, with demand increasing faster than supply. This has pushed up DRAM prices, and the Inotera deal has already reduced DRAM costs for Micron. Micron is thus likely to swing back to profits in fiscal 1Q17.

Notably, if Samsung and SK Hynix look to restart DRAM production, it will take them at least a quarter to do so. Until then, Micron can look to reduce the technology gap and squeeze out a much profit as possible from its existing 20 nm (nanometer) technology.

What’s in it for Nanya?

On the other side of the Inotera deal, Nanya acquired a 5.3% stake in Micron, which has brought a cash inflow of around $1 billion for the latter. The deal also included Nanya getting the license to use Micron’s 1x and 1y DRAM technologies.

We’ll look into the transfer of intellectual property in the next part.