Could China Drive Qualcomm’s Fiscal 2017 Revenue?

Qualcomm (QCOM) now earns 16.6% of its revenues from South Korea.

Feb. 2 2017, Updated 9:05 a.m. ET

Qualcomm’s revenue challenges

Qualcomm (QCOM) is reporting declining revenues even in a seasonally strong quarter as the demand shifts from high-end phones to mid-range and low-end phones. Moreover, its large customers such as Samsung (SSNLF), Apple (AAPL), and Huawei are switching to in-house processors, reducing demand for its Snapdragon processors.

Qualcomm’s most profitable licensing business is also facing lawsuits from several jurisdictions. In 2015, it settled an antitrust case with China (FXI) by paying ~$1 billion in fines and agreeing on a royalty on 65% of the selling price of phones sold in China. Despite the revised terms, Qualcomm is witnessing growth in China.

Revenue by geography

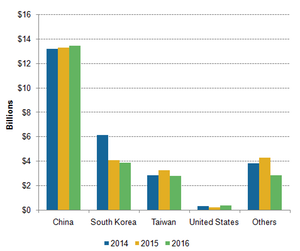

As seen from the above graph, China is Qualcomm’s largest market, where it earns 57% of its revenues. In fiscal 2016, Qualcomm’s revenues from China grew 1.2% while its revenues from the United States grew 57% YoY (year-over-year). The company’s revenues from Taiwan and other markets fell in double digits while revenues from South Korea fell 4.6%.

China

In China, Qualcomm (QCOM) saw an increase in licensing and compliance. Moreover, a shift in consumer demand saw Chinese handset makers report exponential growth. According to IDC (International Data Corporation), three Chinese handset makers Huawei, Oppo, and Vivo together commanded 22.1% market share in 3Q16 compared to just 13.7% in 3Q15, as Oppo and Vivo’s smartphone shipments more than doubled during this period.

Qualcomm not only earns revenues from licensing but also from supplying its Snapdragon processors. More Chinese OEMs[1. original equipment manufacturers] are using Snapdragon in their new phones. With increasing compliance, the end-consumer demand is also increasing, driving growth in this market.

South Korea

However, things aren’t looking as good in South Korea, Qualcomm’s second-largest market. Revenues from South Korea fell 33.5% YoY in fiscal 2015 as Samsung switched to its in-house processor. Revenues further fell 4.6% YoY in fiscal 2016 as Samsung discontinued its Galaxy Note 7 due to overheating issues. Some models of the Note 7 were powered by Snapdragon 820.

Qualcomm (QCOM) now earns 16.6% of its revenues from South Korea. However, some regulators in this market have accused Qualcomm of anti-competitive licensing practices and have imposed a $853 million fine. Qualcomm is challenging these accusations.

However, if the regulators succeed in forcing Qualcomm to alter its licensing terms, it would have a minimal impact on the company’s overall revenues due to its lower exposure in the region.

Although revenues fell in fiscal 1Q and 2Q17, profits are likely to increase as licensing revenue increases. Next, we’ll look at Qualcomm’s profits.