Margaret Patrick

Margaret Patrick joined Market Realist in September 2014 and has written close to 3,000 articles. She has covered the healthcare sector, which includes pharmaceutical and biotechnology companies, medical device companies, health insurance companies, and hospital companies. Currently, she is following the cannabis sector.

Prior to joining Market Realist, Margaret worked as equity and data analyst at MSCI for a year and as a financial research analyst at Deloitte for two years. She completed her MBA with finance specialization in 2011. She also passed all three CFA levels.

Besides writing on stocks, Margaret loves to read about nutrition, culture, and mythology. She's also fond of traveling to new places.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Margaret Patrick

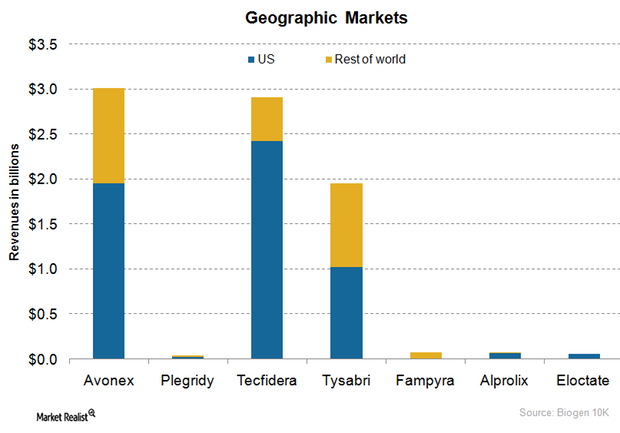

Biogen’s Geographic Market Strategy

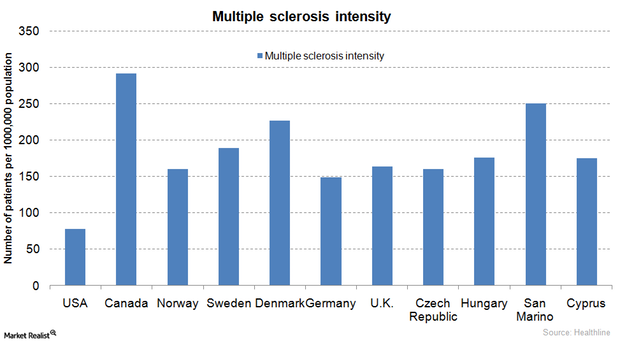

In 2014, Biogen earned about 27% of its total revenues from international markets such as Canada, Europe, and emerging economies.

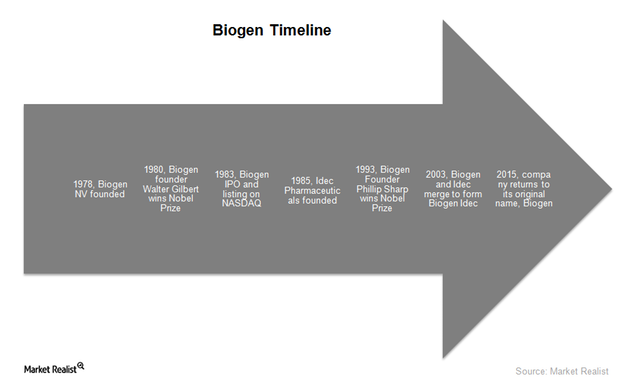

Biogen: An Investor’s Overview to a Leading Biotech Company

One of the world’s leading biotechnology companies, Biogen specializes in manufacturing and marketing therapies to treat serious ailments related to the nervous system, immune system, and blood.

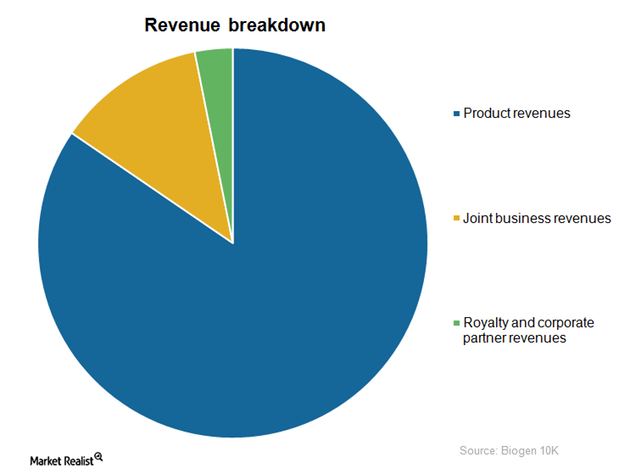

An Overview of Biogen’s Business Model

A leader in the development of multiple sclerosis treatments, Biogen earned 82.5% of its total revenues from its MS drugs in 2014.

Market Entry Strategies for Biotechnology in Europe

When a US biotechnology company uses market entry strategies to launch its drug directly in the European market, it has to bear all the expenses related to the drug approval process in Europe.

Sources of External Capital for the Biotechnology Industry

In the early stages of their life cycles, most biotechnology companies are financed by venture capital, which typically comes from wealthy investors who invest in startup companies.

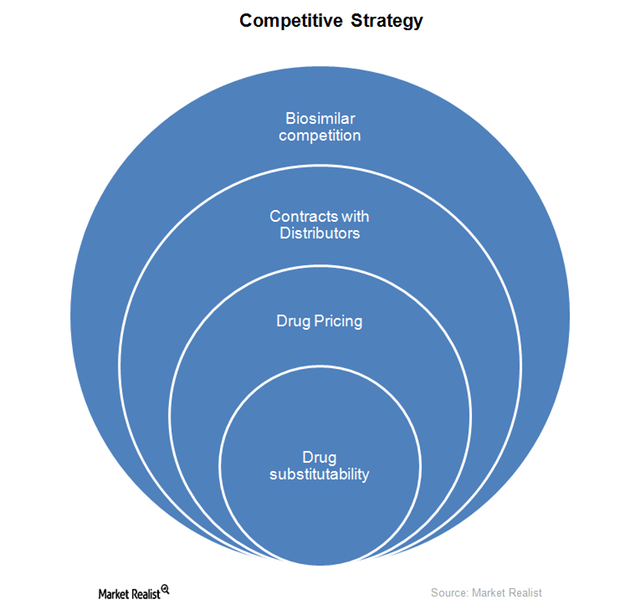

How Does Competition Impact the Biotechnology Industry?

The biotechnology sector is witnessing intense competition with big pharmaceutical companies entering into collaborations and mergers and acquisitions with biotechnology companies.

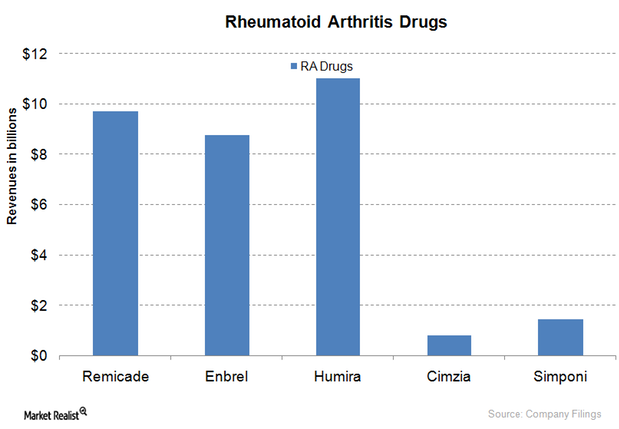

Humira Takes Top Spot for Rheumatoid Arthritis Drugs

There’s no complete cure for rheumatoid arthritis, so most RA drugs are part of disease-management therapy. Humira accounts for 23.5% of the RA market share.

The Biotechnology Industry and Multiple Sclerosis Therapies

Most multiple sclerosis drugs are very costly at about $55,000 per year. The FDA’s April 2015 approval of a generic version of Copaxone is expected to lower the overall price of the therapy.

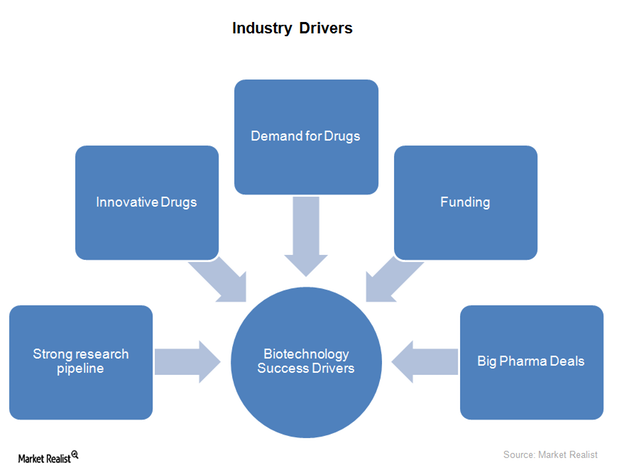

Commercial Growth Drivers of the Biotechnology Industry

After 2012, the biotechnology industry (IBB) had a period of solid growth, mainly driven by novel scientific inventions and aggressive commercial distribution.

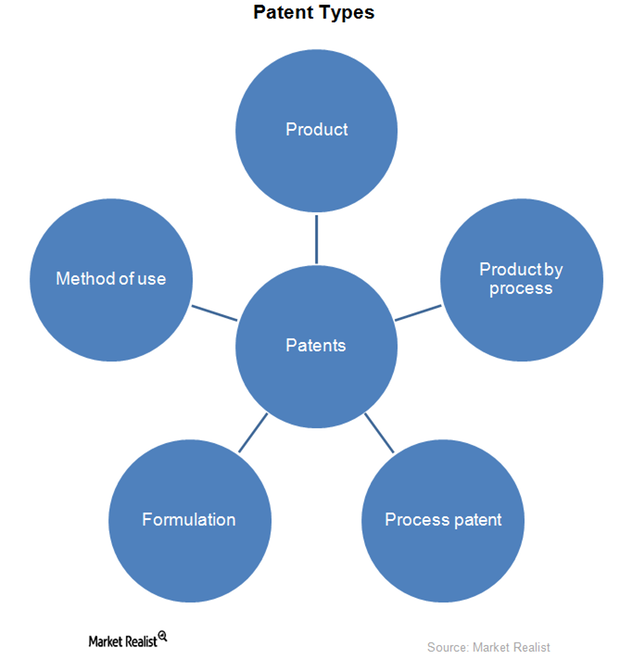

Patents and the Biotechnology Sector

The biotechnology industry will witness 12 blockbuster drugs worth $67 billion in annual revenues lose their patents by 2020. This is the so-called patent cliff.

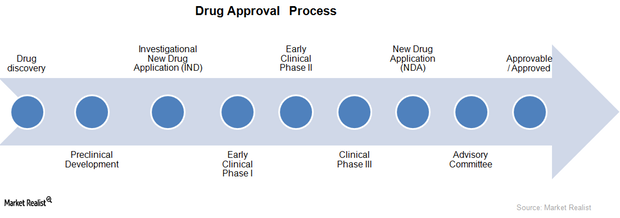

Drug Approval Process in the Biotechnology Industry

A drug approval process is required in order for a new drug to enter the market. Companies with new drugs in later stages of the approval process are more likely to earn a positive cash flow in the next few years.

Social Factors That Impact the Biotechnology Industry

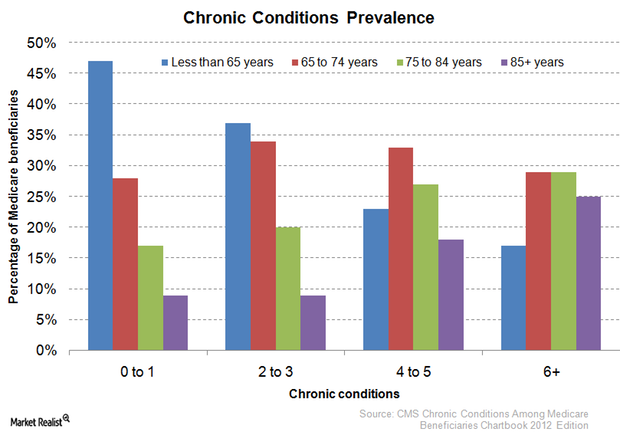

The aging Baby Boomer population in the United States is one of the social factors driving the US healthcare industry. By 2030, Americans over 55 will be 31% of the population.

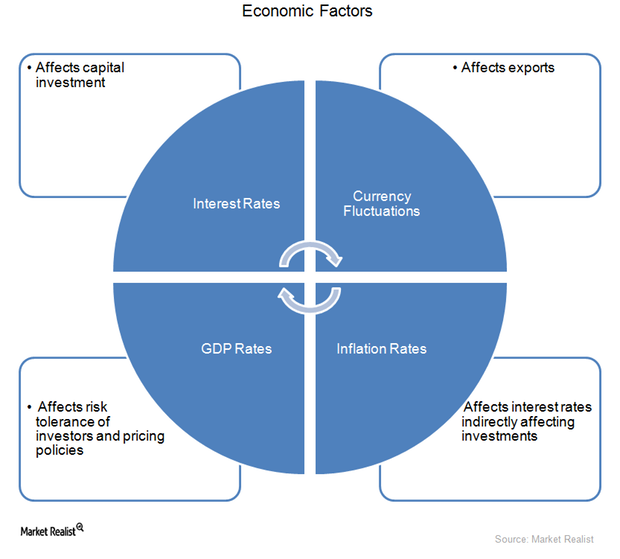

Economic Factors That Affect the Biotechnology Industry

Compared to pure-play pharmaceutical companies, the biotechnology industry is more sensitive to economic factors such as changes in GDP, interest rates, and exchange rates.

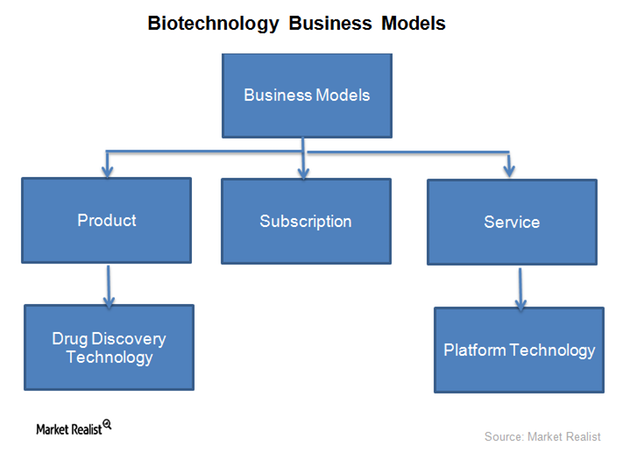

The Business Models of Biotechnology Companies

The type of business model a biotechnology company selects depends on technical capability, availability of resources, and competition in the industry.

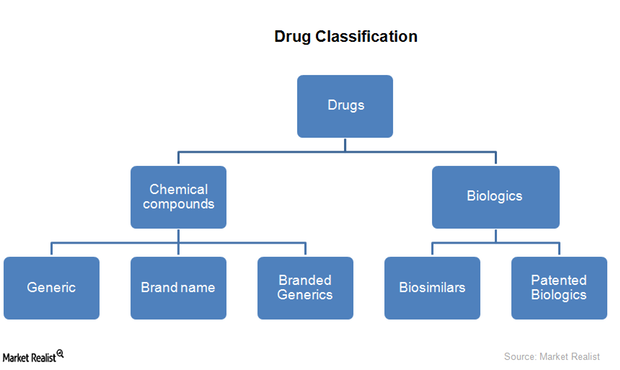

How Are Drugs Classified?

The two main classifications for drugs are chemical compound drugs and biologics. Medicinal drugs are broadly classified as prescription drugs and over-the-counter drugs.

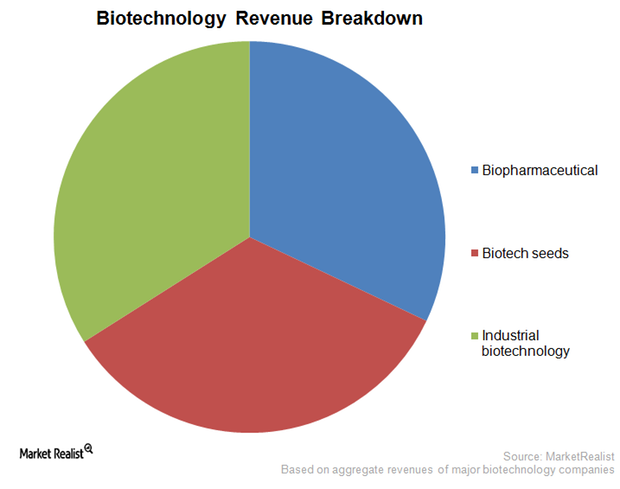

A Must-Read Overview of the US Biotechnology Industry

Biotechnology is simply ‘technology based on biology.’ The biotechnology industry includes food technology, genetic research, healthcare, and environmental technology.

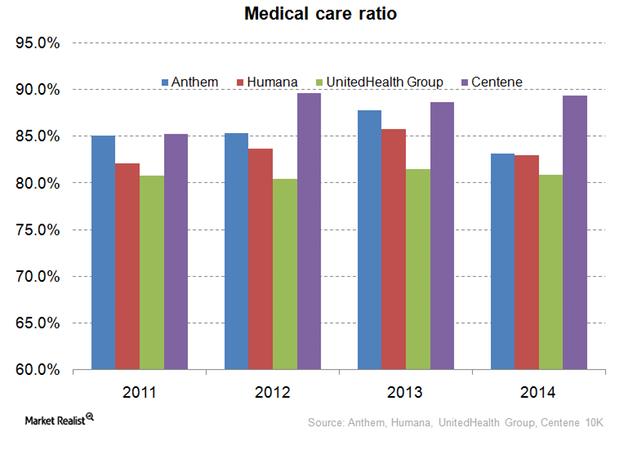

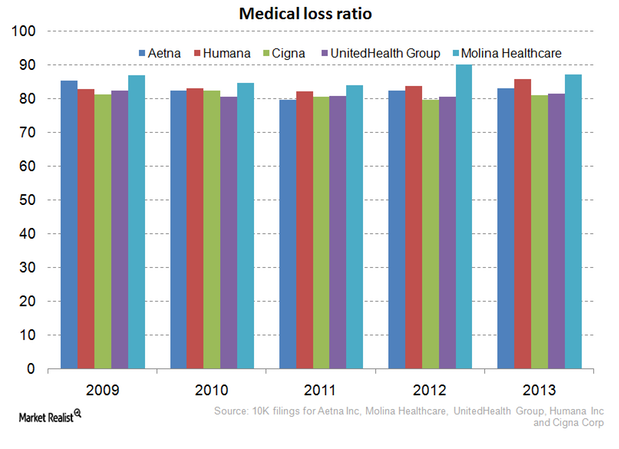

Medical Care Ratio – Centene Compared to Its Peers

For health insurance companies, the medical care ratio is the ratio of total money spent on healthcare claims to premiums earned—adjusted for tax and regulatory expenses.

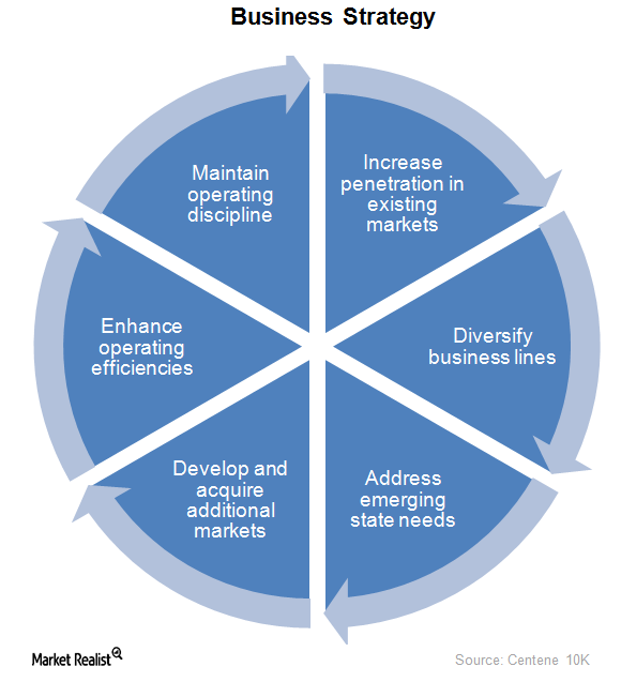

What’s Centene’s Business Strategy?

Centene’s business strategy focuses on improving the quality of its services. It provides services to the uninsured and underinsured population in 22 states in the US.

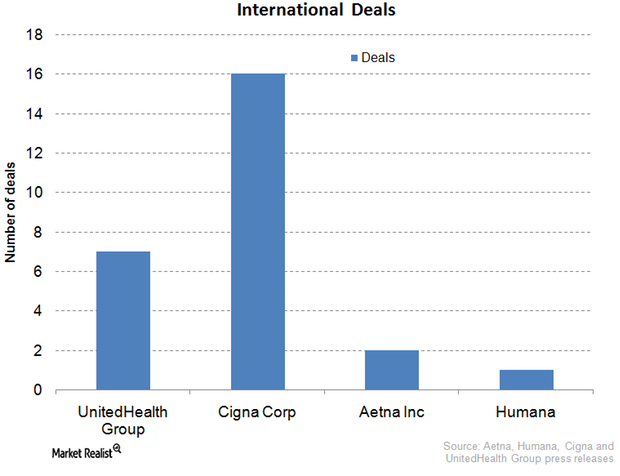

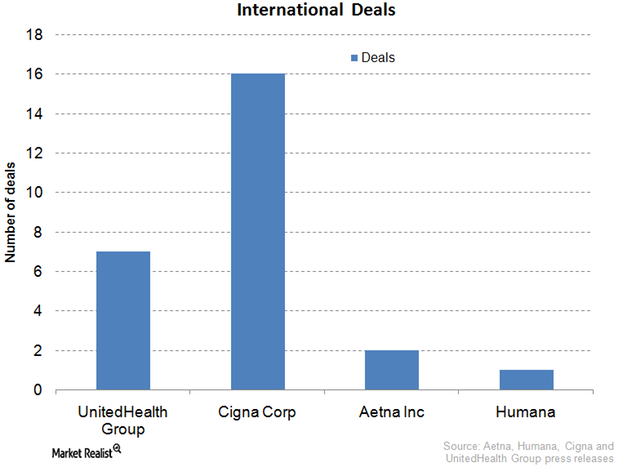

Cigna: International Expansion Key to Growth Strategy

International expansion is a hallmark of Cigna’s business. Cigna has inked deals in Turkey, Belgium, Brazil, Japan, Taiwan, Thailand, et cetera.

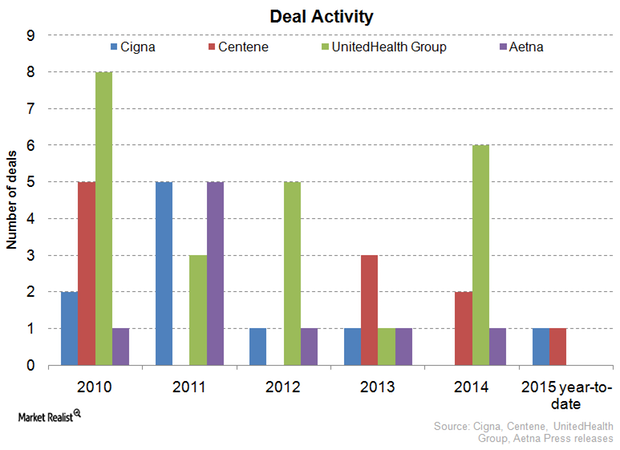

Cigna Diversifies Via Mergers and Acquisitions

Among Cigna’s major strategic mergers and acquisitions was HealthSpring, acquired in 2012 for a consideration of $3.8 billion.

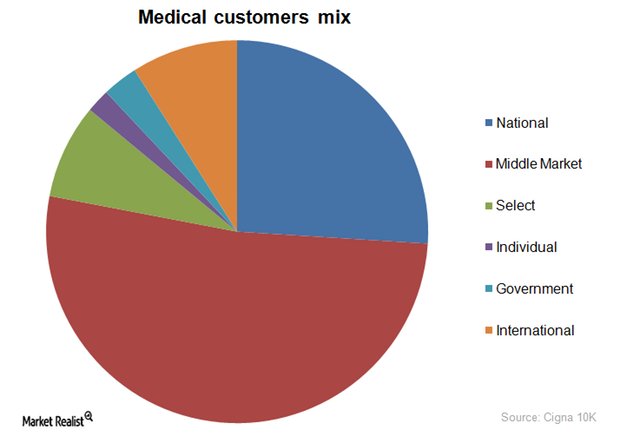

Cigna’s Customer Segments a Healthy Mix

Customer segments The players in the private health insurance industry (IYH) aim for a favorable enrollment mix to reduce taxes and other liabilities while at the same time generating sustainable profits. Accordingly, managed care organizations such as Humana (HUM), Aetna (AET), Anthem, Cigna (CI), and WellCare Health Plans (WCG) are increasingly focusing on government-sponsored and international enrollments to balance […]

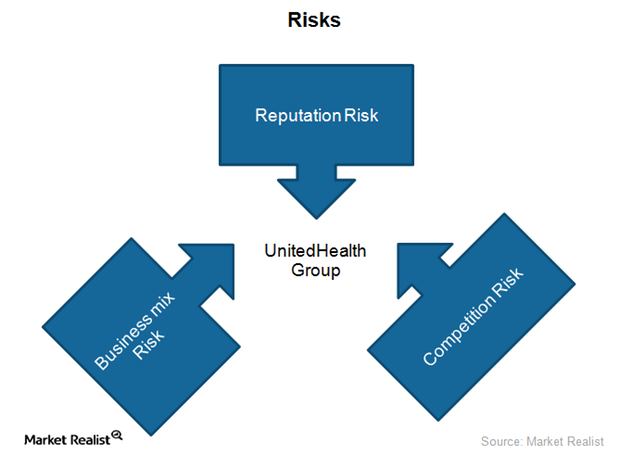

What key risks does UnitedHealth Group face?

UnitedHealth Group (UNH) is a health insurance provider. It faces a unique combination of business risks, including business mix and competition risks.

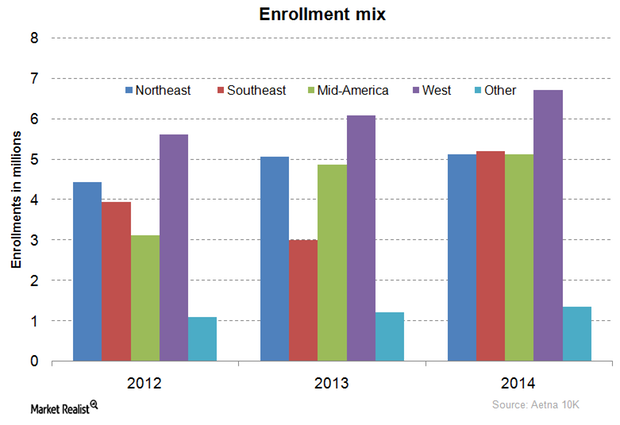

How Is Aetna’s Membership Distributed Across Its Key Markets?

Aetna’s membership is mainly concentrated in the western US, followed by the Southeast, the Northeast, the Mid-US, and finally consolidated international enrollments.

What’s UnitedHealth Group’s strategy for international expansion?

The private health insurance industry in the US has been expanding its footprint in international markets. International markets are less penetrated and competitive.

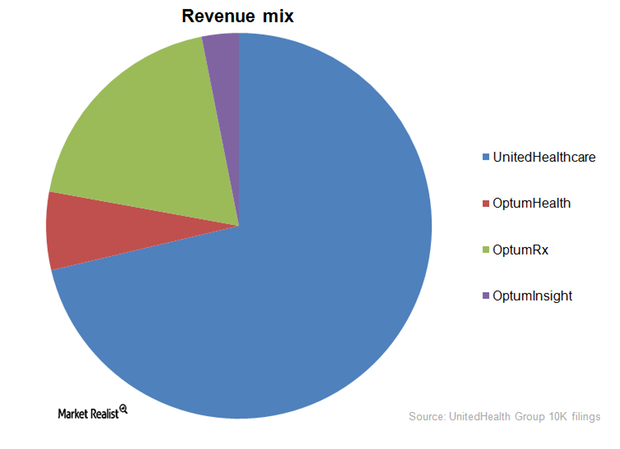

What are UnitedHealth Group’s key business segments?

Out of UnitedHealth Group’s (UNH) four business segments, UnitedHealthcare accounted for 71.3% of the company’s revenue.

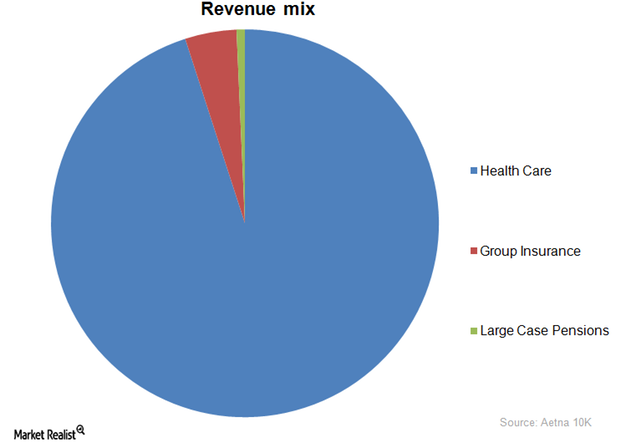

What Are Aetna’s Key Business Segments?

Out of Aetna’s (AET) three business segments, Health Care accounted for 95% of the company’s revenue.

A Key Overview of Aetna, One of the Largest Insurance Providers

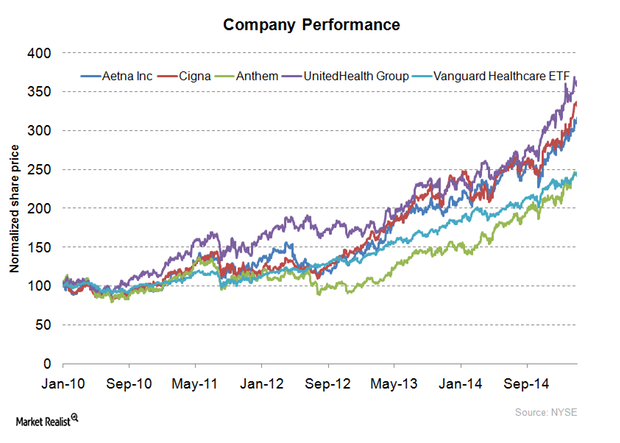

With a market capitalization of $35.1 billion, Aetna (AET) is one of the largest insurance providers in the US.

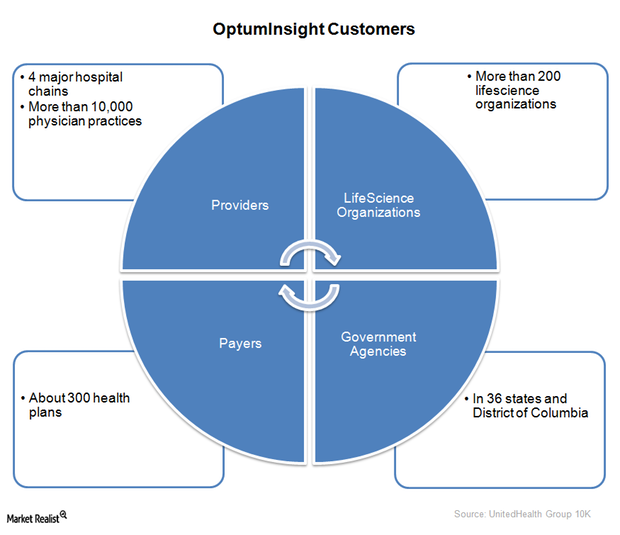

UnitedHealth Group’s OptumInsight – improving medical care

In 2014, OptumInsight released a population health analytics tool—OptumOne. It enables hospitals to improve the quality of care.

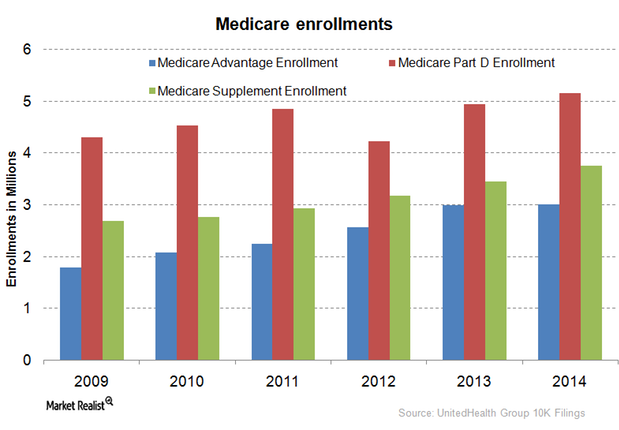

UnitedHealth Group provides services to Medicare beneficiaries

Medicare Part D is a federal government program. It subsidizes prescription drug expenses for Medicare beneficiaries.

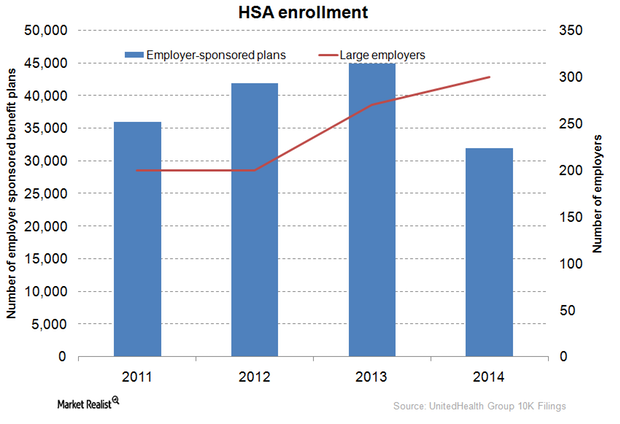

What are UnitedHealth Group’s consumer engagement products?

The private health insurance industry offers a diverse range of products. The products combine health plans with financial accounts to cater to different consumers’ needs.

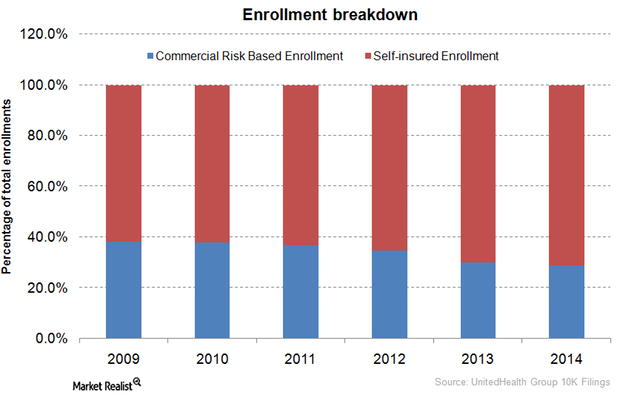

UnitedHealth Group’s employer-sponsored and individual insurance

Employer-sponsored coverage, a major form of insurance, increasingly adopted self-insured plans. They’re more cost-effective and flexible than fully-insured plans.

UnitedHealth Group: The history of a health insurance giant

With a market capitalization of $107.1 billion, UnitedHealth Group is the largest insurance provider in the US. It registered revenue worth $130.5 billion in 2014.

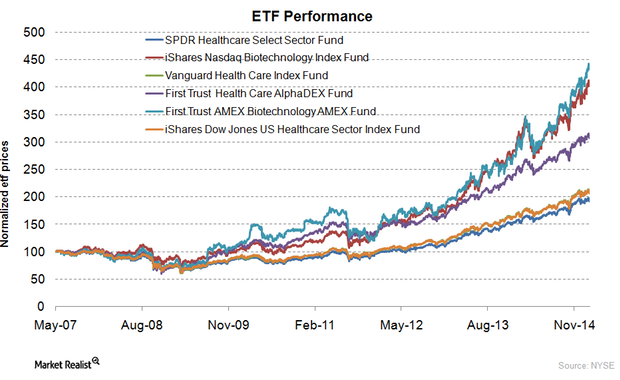

Why should you invest in healthcare ETFs?

Biotechnology funds have performed better than other healthcare ETFs. They invest in companies that use biological processes to produce medical products.

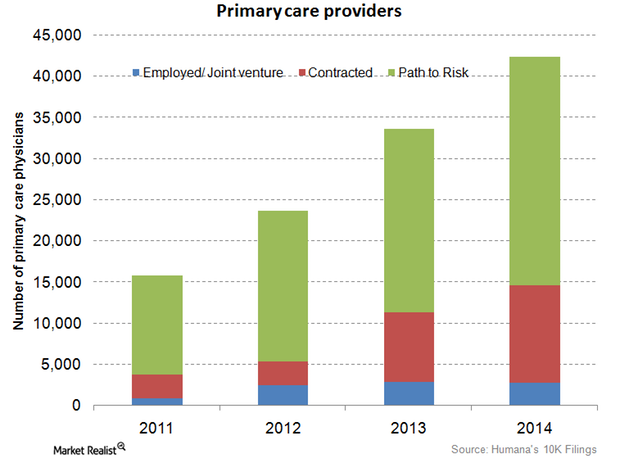

Humana employs and contracts more primary-care physicians in 4Q14

Humana’s employed and contracted primary-care physicians rose by 29.2% from 11,300 in 2013 to 14,600 in 2014.

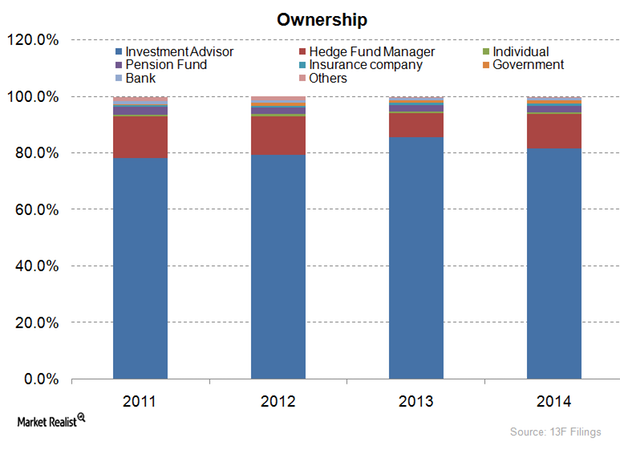

Most Humana stakeholders are mutual funds or advisers

Investment advisers or mutual funds are the main stakeholders in Humana, accounting for about 81.7% of its total ownership picture.

Humana’s Retail Insurance business segment is biggest earner

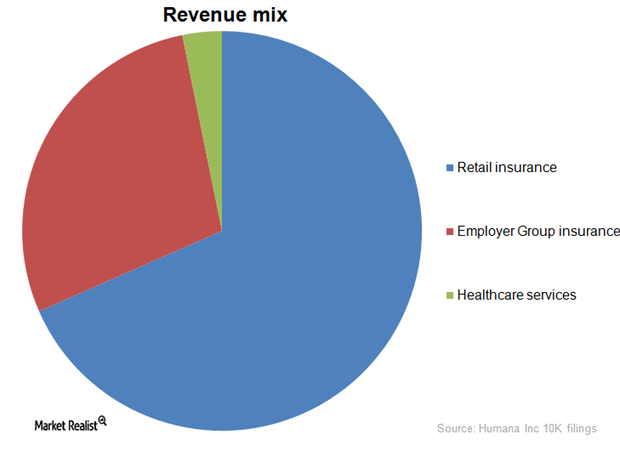

Humana’s retail insurance business segment contributes 66.5% of overall company revenues. Employer-sponsored programs follow with 27.6%.

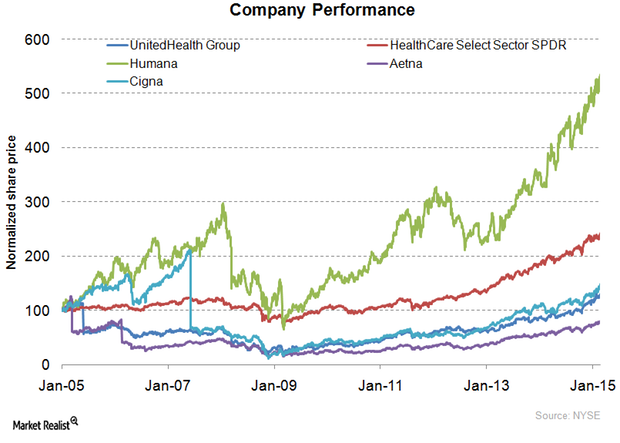

Humana: Unraveling the history of a health insurance giant

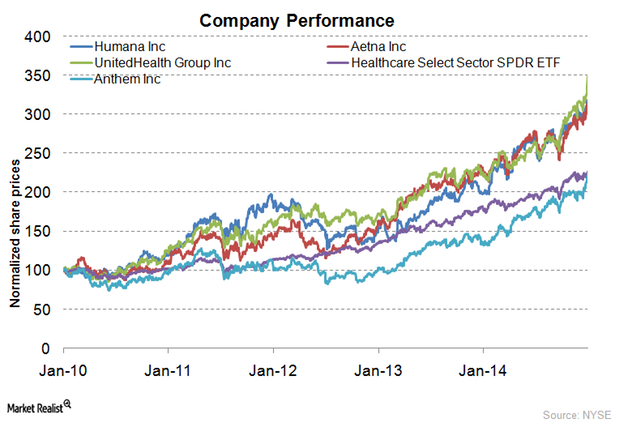

Humana (HUM) is the third-largest health insurance provider in the US, with over 13 million customers. Humana is also 73rd in Fortune 500 rankings.

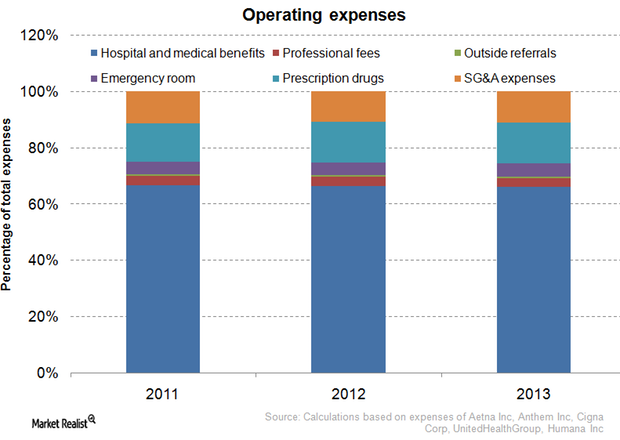

Understanding health insurance companies’ major operating expenses

The operating expenses of the private health insurance industry depend on the design of health plans and on the life history, age, and health of enrollees.

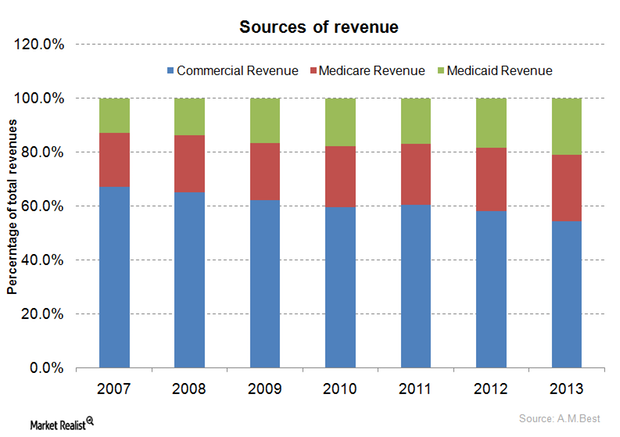

The health insurance industry’s major sources of revenue: A guide

The share of commercial revenues within the private health insurance industry’s total revenues decreased from 67.0% in 2007 to 54.3% in 2013.

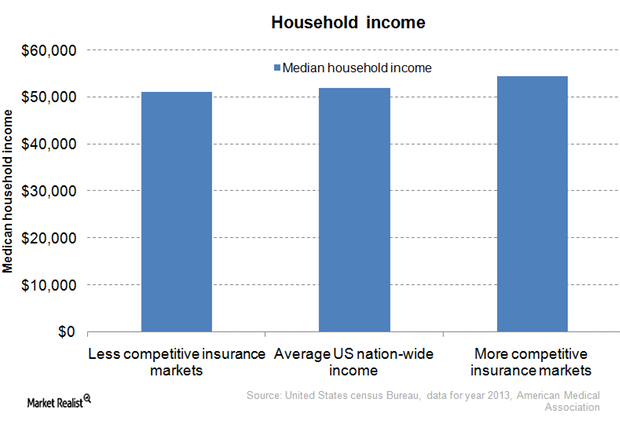

Health insurance monopolies: What you need to know

45 states have only two dominant health insurers accounting for half of the enrollments, giving rise to local market health insurance monopolies.

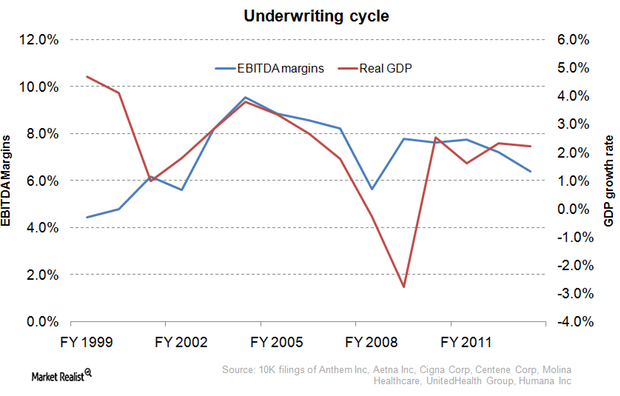

Underwriting cycle: What health insurance investors need to know

The underwriting cycle results from the uncertainty of predicting healthcare expenses and the fluctuating participants in the health insurance industry.

Why the Affordable Care Act hurts the managed care industry

The Affordable Care Act requires health insurers spend at least 80% of premiums on health expenses for small group plans and 85% for large group plans.

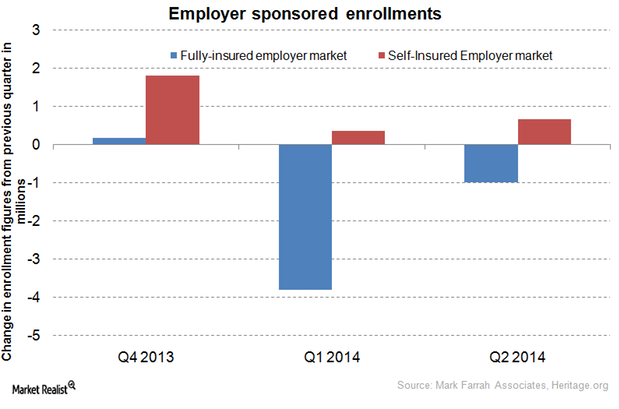

Shift to self-insurance plans affects health insurance stocks

As hospital utilization remains low, more employers are exploring the option of self-insurance to reduce their employee benefit costs.

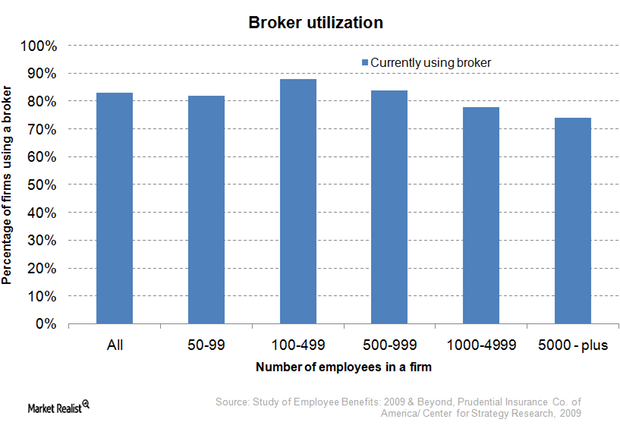

Must-know distribution channels for commercial health plans

The private health insurance industry categorizes commercial health plans as either individual plans, small group plans, or large group plans.

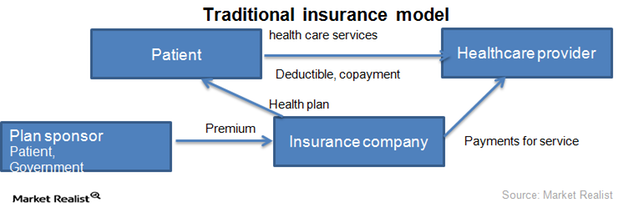

2 key business models of the health insurance industry

The health insurance industry runs on two business models: traditional insurance and managed care organizations.

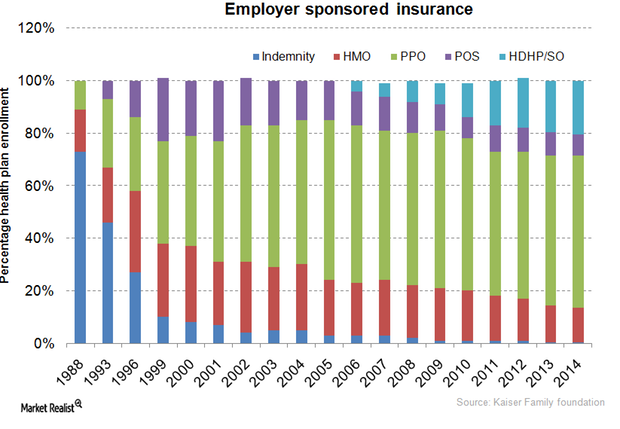

Your must-read guide to health insurance managed care plans

Employer-sponsored coverage is a key factor for nationwide enrollment trends of managed care plans and independent insurance plans.

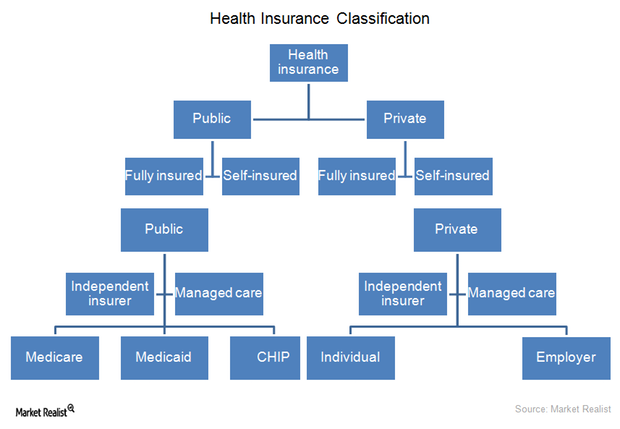

Making sense of health insurance types: An investor’s guide

The health insurance industry operates through two types of organizations: independent insurance companies and managed care organizations.

How the health insurance industry manages risks

The health insurance industry mainly gives individuals a risk management tool. People can’t predict the extent or timing of their their healthcare expenses.

An overview of LifePoint Hospitals

With 67 hospitals, acquisitions continue to strengthen its position in rural markets, especially where LifePoint Hospitals is the sole healthcare provider.

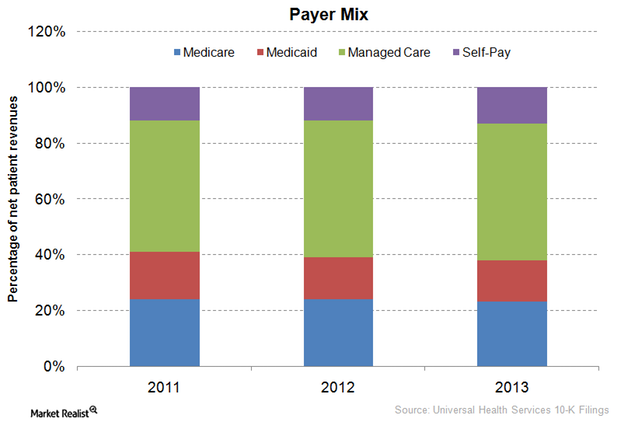

Universal Health Services’ payer mix differs from other companies’

Universal Health Services (UHS) has displayed a trend in payer mix from 2011 to 2013 that differs from other companies in the healthcare industry (XLV).