Margaret Patrick

Margaret Patrick joined Market Realist in September 2014 and has written close to 3,000 articles. She has covered the healthcare sector, which includes pharmaceutical and biotechnology companies, medical device companies, health insurance companies, and hospital companies. Currently, she is following the cannabis sector.

Prior to joining Market Realist, Margaret worked as equity and data analyst at MSCI for a year and as a financial research analyst at Deloitte for two years. She completed her MBA with finance specialization in 2011. She also passed all three CFA levels.

Besides writing on stocks, Margaret loves to read about nutrition, culture, and mythology. She's also fond of traveling to new places.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Margaret Patrick

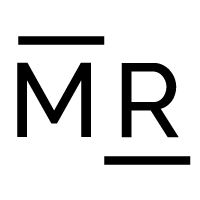

Johnson & Johnson to Focus on Increasing Research and Development

In its fourth-quarter earnings investor presentation, Johnson & Johnson (JNJ) has projected its effective tax rate for fiscal 2019 to fall in the range of 17% to 18%.

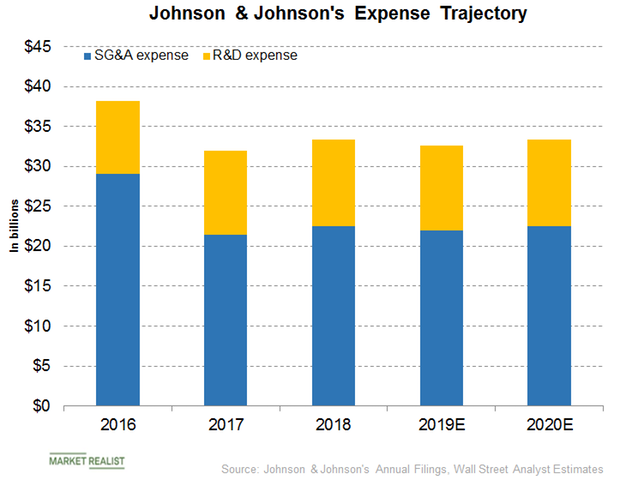

Pfizer’s Expenses Are Expected to Rise in Fiscal 2019

Pfizer expects its adjusted SI&A expenses to fall by $13.5 billion–$14.5 billion in fiscal 2019—a decline of ~$200 million YoY at the midpoint.

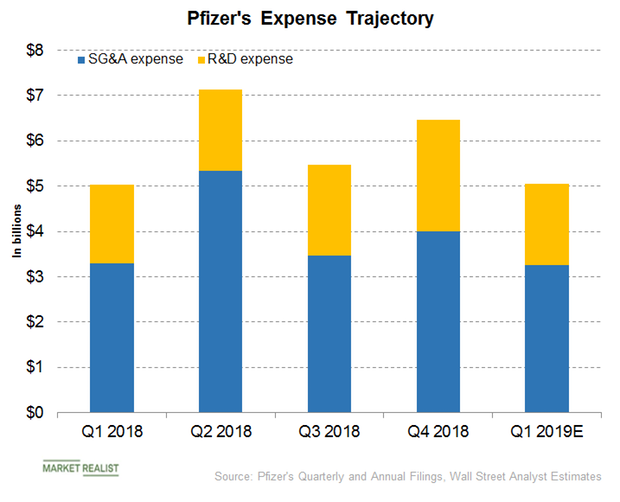

What Do Analysts Recommend for Abbott Laboratories in January?

The 12-month consensus analyst recommendation for Abbott Laboratories on January 18 is a “buy.”

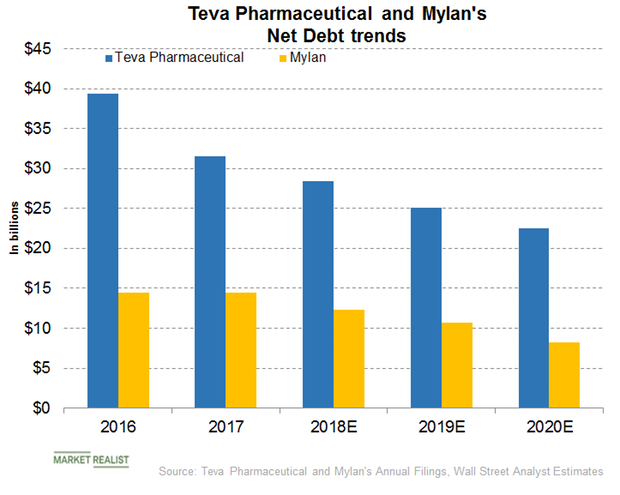

Teva Pharmaceutical or Mylan: Which Has the Better Debt Profile?

In the first nine months of 2018, Teva Pharmaceutical (TEVA) reduced its net debt level by $3.9 billion to $27.6 billion.

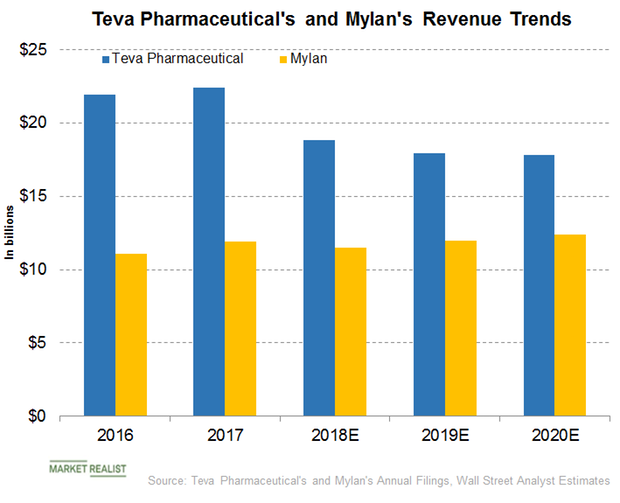

Teva or Mylan: Who Has the More Promising Revenue Trajectory?

In its third-quarter earnings investor presentation, Teva Pharmaceutical (TEVA) forecast total 2018 revenue in the range of $18.6 billion–$19.0 billion.

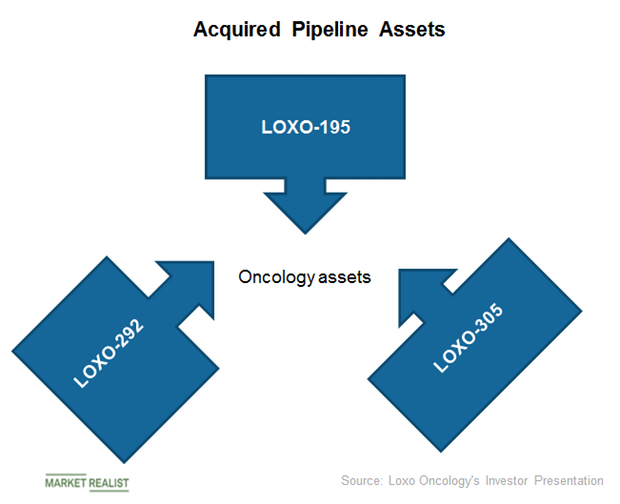

Eli Lilly and Loxo: A Robust Oncology Pipeline for Future Years

Eli Lilly’s acquisition of Loxo has added the FDA approved asset VITRAKVI and the early- and mid-stage oncology pipeline assets LOXO-305, LOXO-195, and LOXO-292.

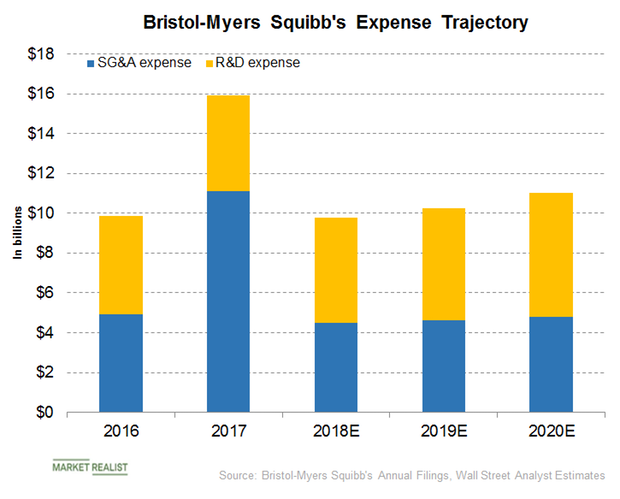

Bristol-Myers Squibbs and Celgene: Cost Synergies for Future Years

According to Bristol-Myers Squibb’s (BMY) press release, the company expects the acquisition of Celgene (CELG) to result in annual cost synergies close to $2.5 billion.

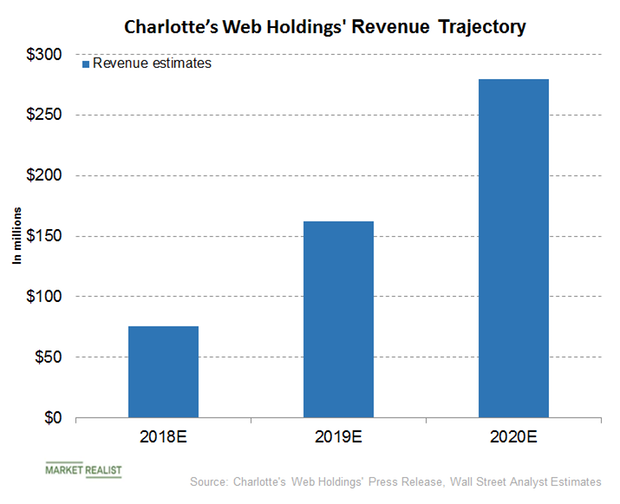

Why Charlotte’s Web Holdings’ Revenue Is Expected to Spike

In the third quarter, Charlotte’s Web Holdings (CWBHF) reported revenues of $17.7 million, which represents YoY organic growth of 57%.

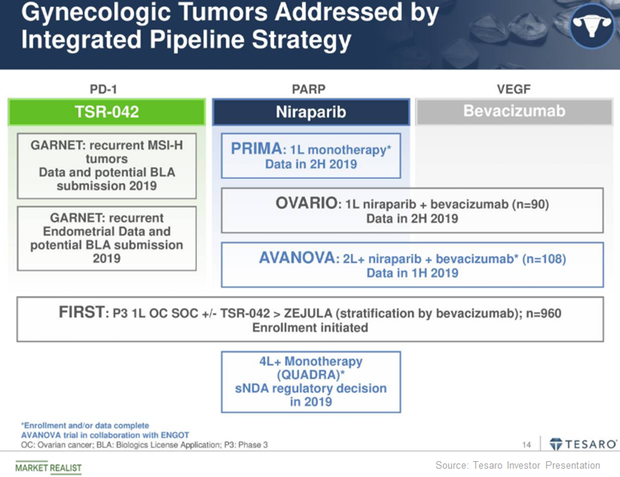

Tesaro Expects These Key Research Pipeline Milestones in 2019

As per Tesaro’s (TSRO) third-quarter earnings conference call, the company is anticipating results from Phase 1/2 trial, AVANOVA.

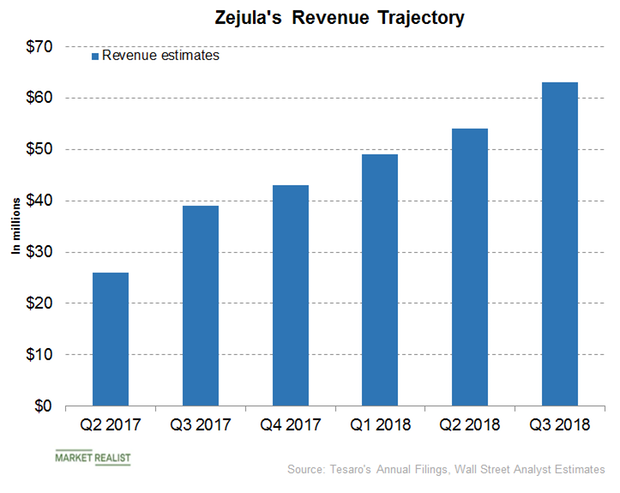

Zejula Is a Major Growth Driver for Tesaro

In its third-quarter earnings conference call, Tesaro (TSRO) has forecasted Zejula’s revenues for fiscal 2018 to fall in the range of $233 million to $238 million.

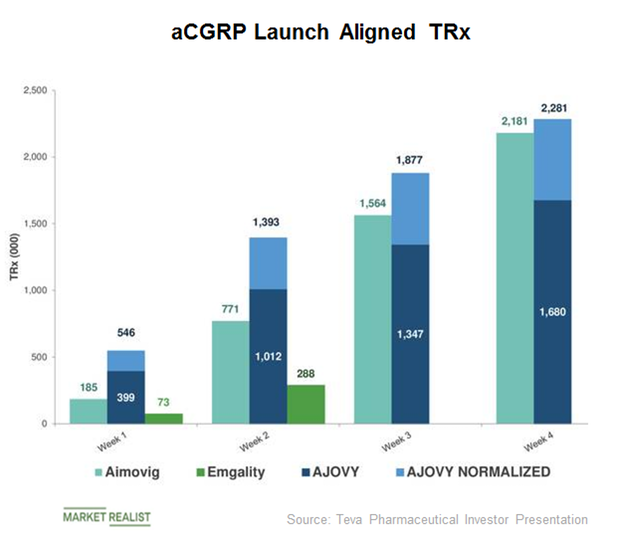

Ajovy Is a New Growth Driver for Teva Pharmaceutical

On September 14, Teva Pharmaceutical (TEVA) issued a press release announcing FDA approval of humanized monoclonal antibody and anti-calcitonin gene-related peptide (or CGRP) therapy.

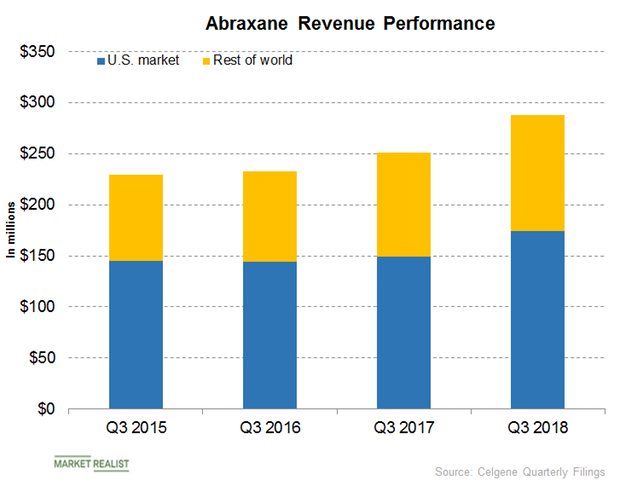

A Look at Abraxane’s Revenue Growth Trajectory in 2018

In its third-quarter earnings conference call, Celgene (CELG) reiterated its expectation for Abraxane’s fiscal 2018 net product sales of around $1.0 billion.

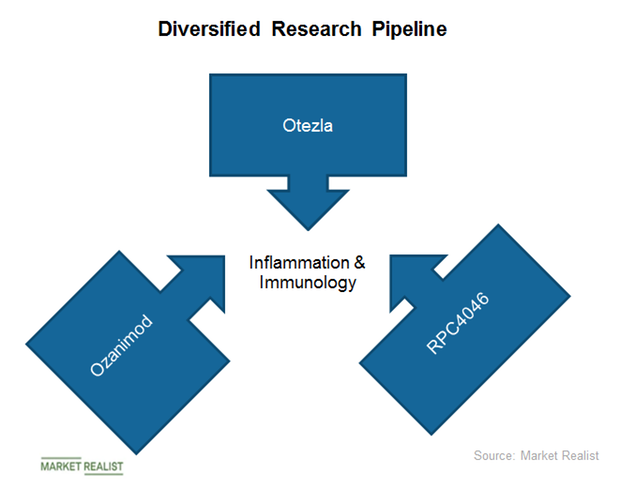

Inflammation and Immunology: Celgene’s Diversified Research Pipeline

Celgene (CELG) is focused on advancing its diversified inflammation and immunology (or I&I) research pipeline in 2018.

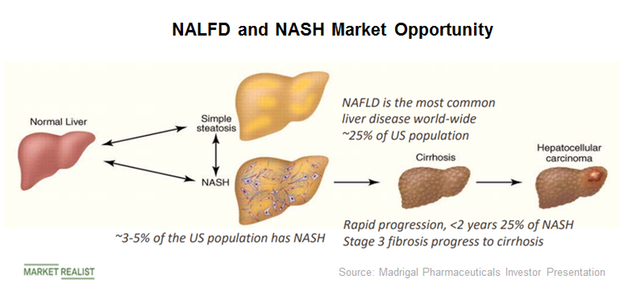

NASH Opportunity Driving Growth for Viking Therapeutics in 2018

On October 8, Viking Therapeutics announced positive data from its in vivo study evaluating VK2809 in glycogen storage disease type la (or GDS la) indication.

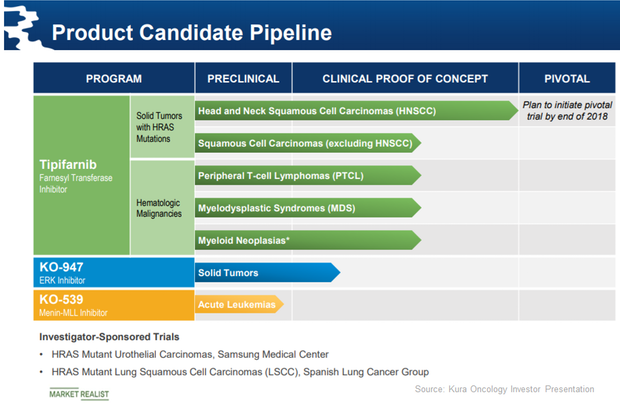

Precision Medicine Oncology Pipeline Is Key for Kura Oncology

Kura Oncology (KURA) is a clinical-stage biopharmaceutical company focused on advancing its research pipeline of precision medicine.

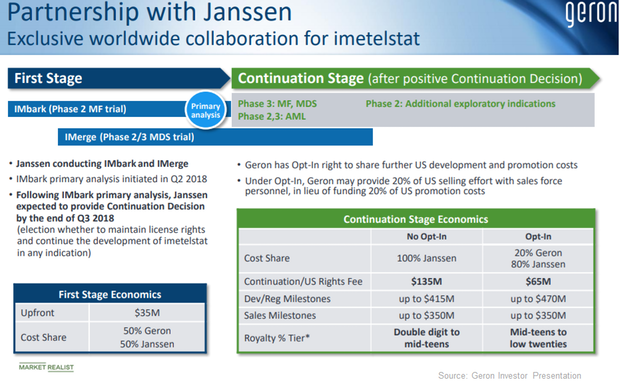

Geron: One of the Best-Performing Biotech Stocks in Past Month

Geron (GERN) has been one of the best-performing biotechnology companies in the last month, rising 67.1% since August 10.

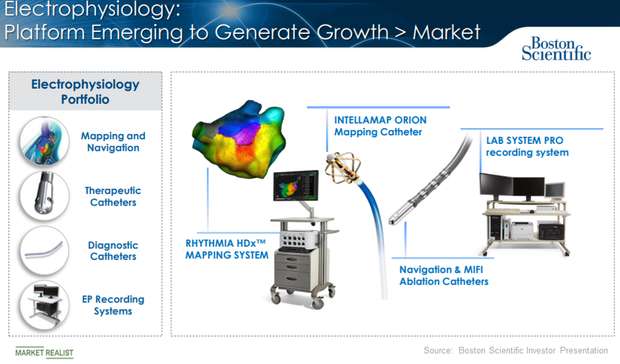

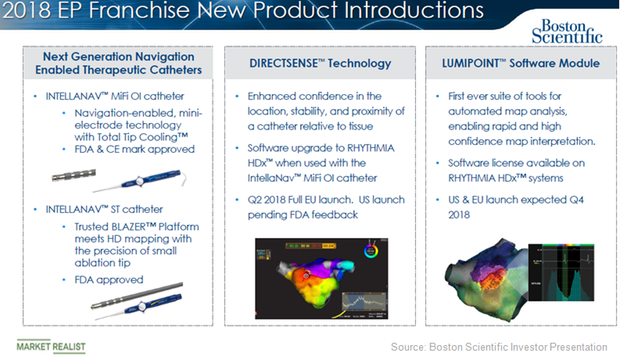

Electrophysiology Is Expected to Be a Major Asset for BSX in 2018

In the second quarter of 2018, Boston Scientific’s (BSX) electrophysiology business reported revenue of close to $79 million.

Electrophysiology Business May Be a Solid Growth Driver for BSX

In the first quarter, Boston Scientific (BSX) reported sales of close to $75 million in its electrophysiology business.

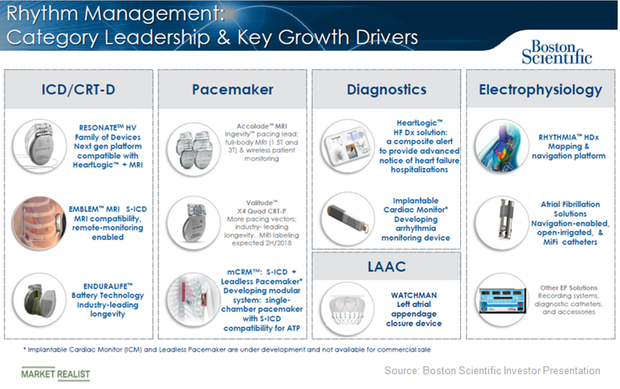

LUX-DX ICM and WATCHMAN LAAC May Prove Solid Drivers for BSX

Boston Scientific (BSX) is preparing to launch the LUX-DX insertable cardiac monitor (or ICM) in both the United States and Europe.

BSX Focuses on Advancing Its Cardiac Rhythm Management Portfolio

Boston Scientific expects the results from its UNTOUCHED trial by 2020.

How BSX Is Set to Benefit from Its nVision Medical Acquisition

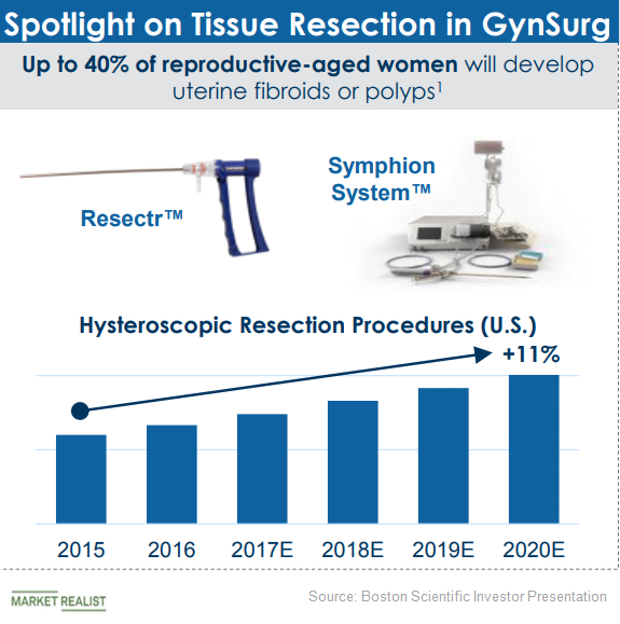

On a reported basis, Boston Scientific’s (BSX) urology and pelvic health sales rose 11.8% YoY (year-over-year) to $293 million in Q1 2018, and 9.2% YoY in constant currency.

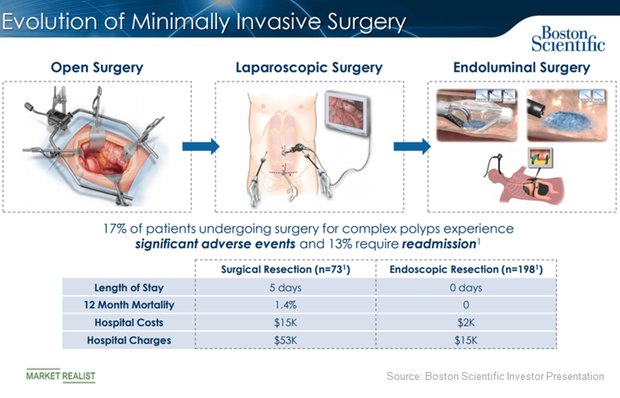

Endoluminal Surgery May Be Opportunity for Boston Scientific

In June, Boston Scientific (BSX) announced the launch of ORISE, its traction solution used in endoluminal surgery.

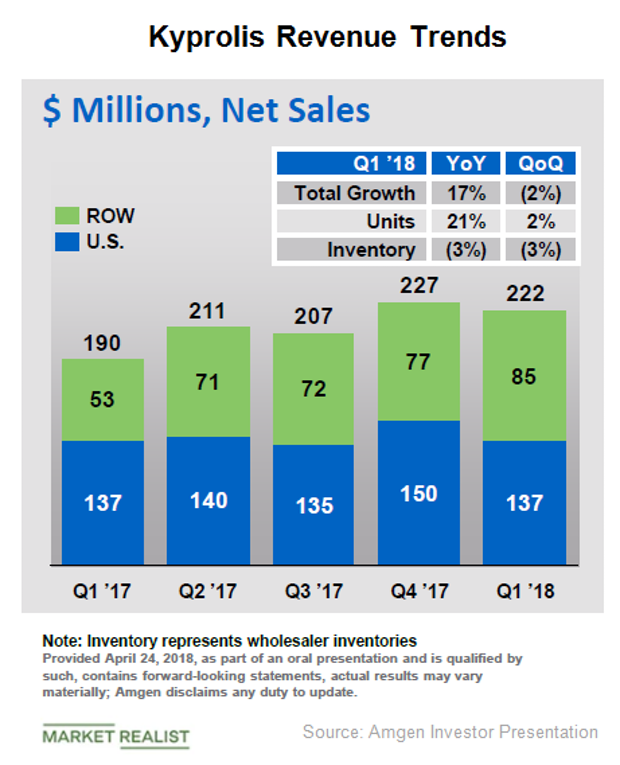

Oncology Portfolio Still a Key Growth Driver for Amgen in 2018

In the first quarter, Amgen’s (AMGN) Kyprolis had a rapid uptake in the non-US markets, taking significant market share from Velcade.

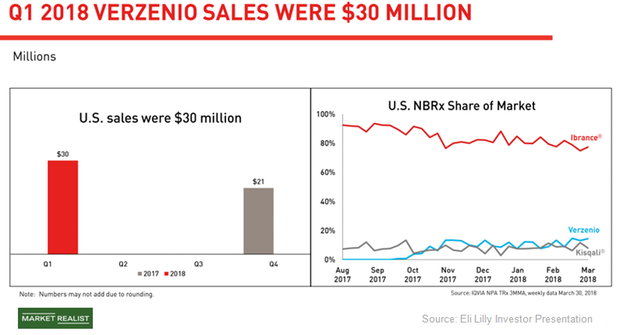

Verzenio: Major CDK4/6 Inhibitor in the Future

Verzenio has demonstrated double-digit growth in new patient usage in patient segments targeted by the drug’s first two approved indications.

Factors that Could Drive Trulicity’s Revenue Growth in 2018

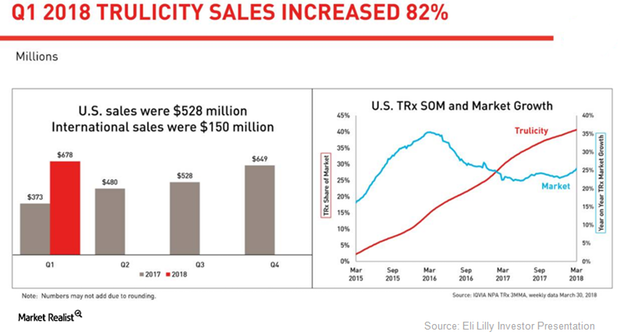

In 1Q18, Trulicity reported $678.3 million in revenues for YoY growth of ~82.0%.

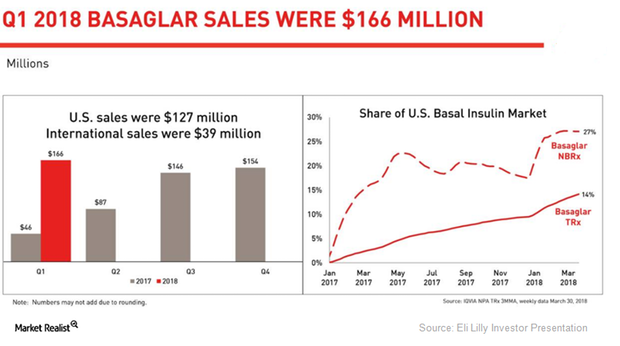

Humalog and Basaglar: Major Growth Drivers for Eli Lilly in 2018

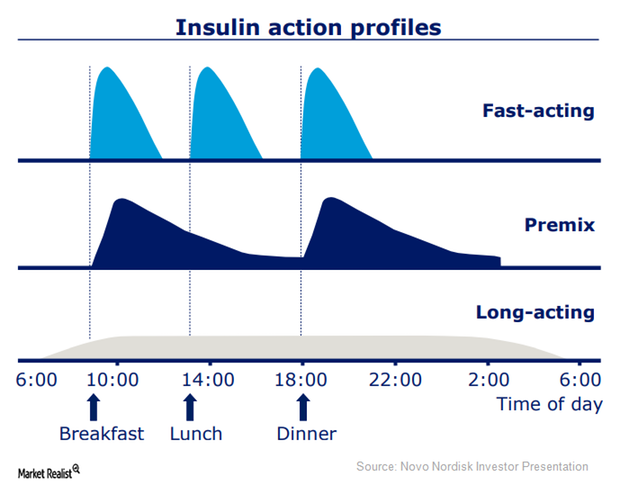

The highest-earning asset in Eli Lilly’s (LLY) portfolio is its fast-acting insulin, Humalog, which reported revenues of ~$791.7 million in 1Q18.

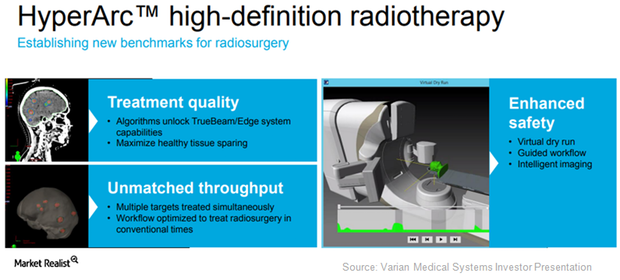

Varian’s HyperArc: Driven by Rising Metastatic Brain Cancer?

Varian Medical Systems’ (VAR) HyperArc is an end-to-end, high-definition, intracranial radiotherapy solution.

Semaglutide May Prove to Be an Effective Anti-Obesity Therapy

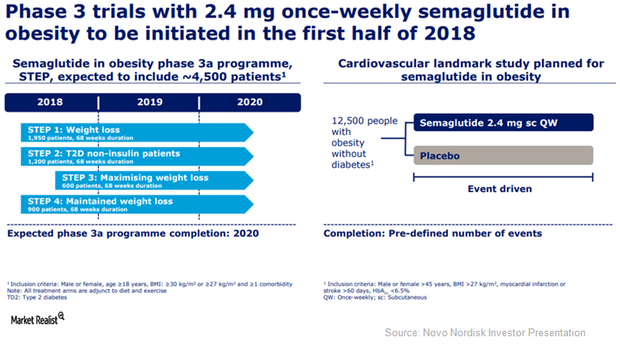

Novo Nordisk plans to initiate its Phase 3a program, STEP, to study the efficacy of 2.4 mg of semaglutide once per week in obesity indications in 1H18.

Label Expansion May Boost Xultophy’s Sales in 2018

In November 2017, Novo Nordisk (NVO) submitted an application to European regulatory authorities to update Xultophy’s label.

Xultophy May Prove a Strong Growth Driver for NVO in 2018

Novo Nordisk’s (NVO) Xultophy reported sales close to 729 million Danish kroner in 2017.

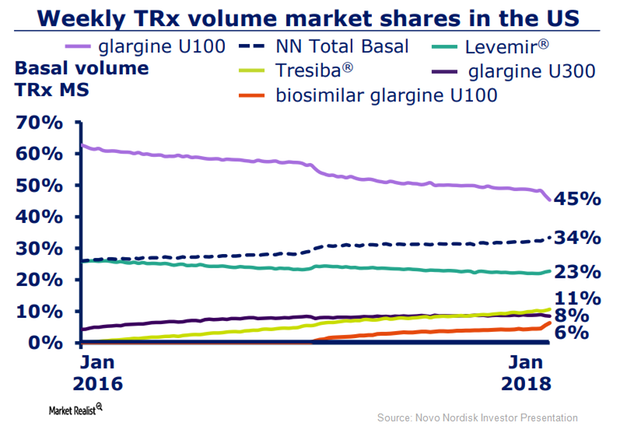

Novo Nordisk Has Developed a Portfolio of New-Generation Insulins

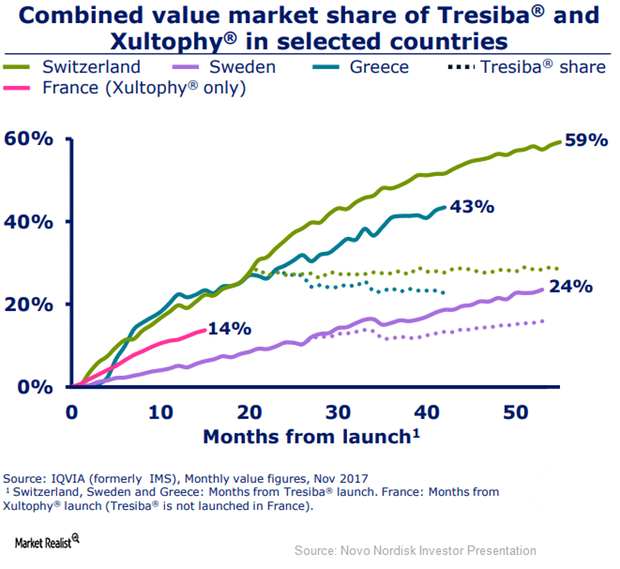

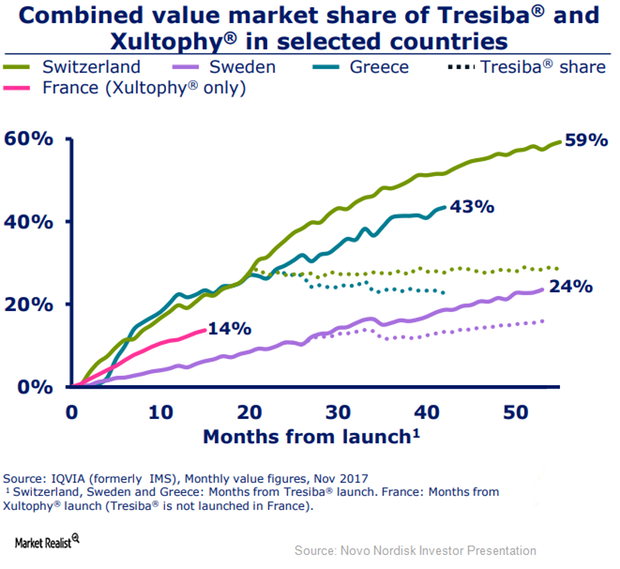

Novo Nordisk has been creating awareness about the risks of hypoglycemia and the benefits of Tresiba among general practitioners and primary care physicians.

Tresiba Emerged as a Blockbuster Therapy in 2017

In 2017, Novo Nordisk’s (NVO) basal insulin therapy, Tresiba, reported revenue of nearly 7.3 billion Danish kroner and attained blockbuster status.

Novo Nordisk Has a Broad Portfolio for Type 2 Diabetes Care

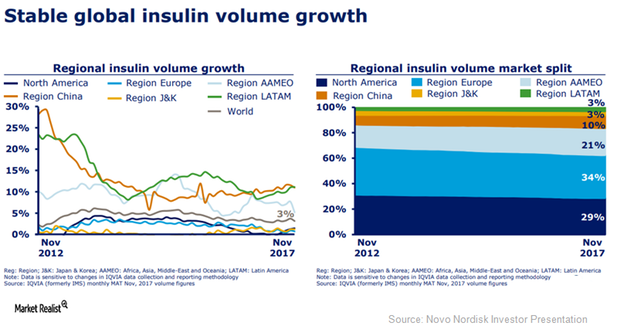

According to IQVIA, the global insulin market value grew at a compound average growth rate (or CAGR) of 16.8% from November 2012 to November 2017.

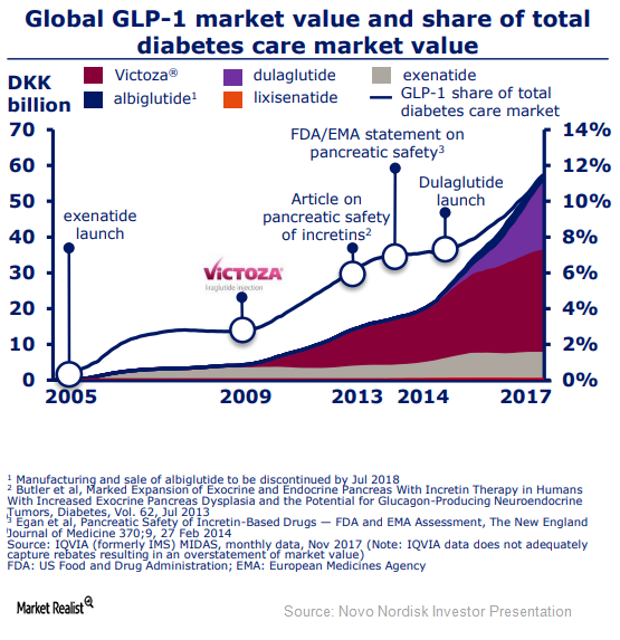

Victoza Continues to Lead in the GLP-1 Segment in 2018

In 3Q17, Novo Nordisk managed to update Victoza’s label in the United States and Europe.

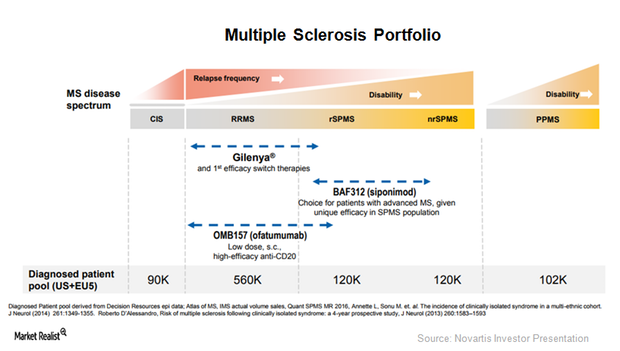

Novartis Plans to Expand its Multiple Sclerosis Portfolio in 2018

Novartis’s (NVS) Gilenya reported sales of $825 .0 million in 4Q17, which is a year-over-year (or YoY) drop of 1.0%.

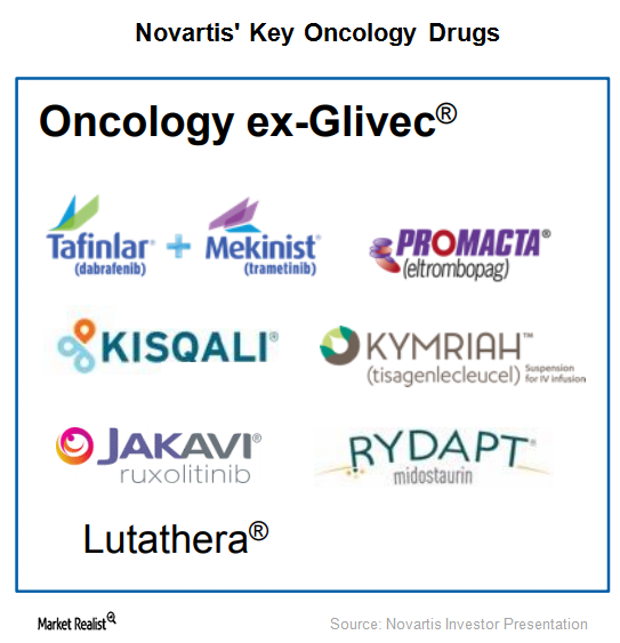

Promacta and Jakavi May Boost Novartis’s Oncology Segment Revenues

Jakavi reported sales of $228.0 million in 4Q17, which is a year-over-year rise of 33.0% on a constant currency basis.

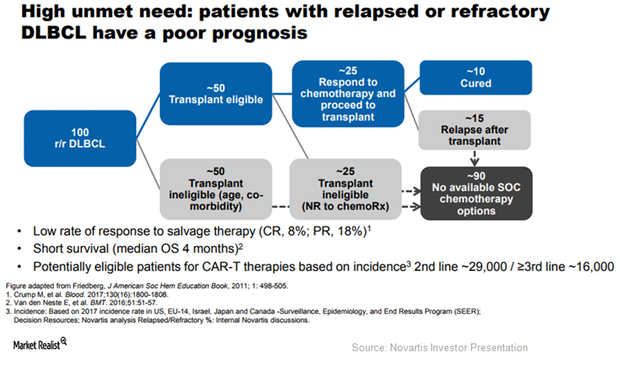

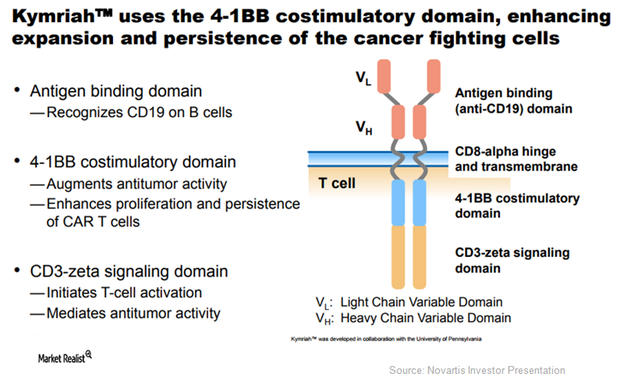

Kymriah May Emerge as a Robust Treatment Option in DLBCL Indication

Kymriah is the first FDA-approved chimeric antigen receptor T cell (or CAR-T) therapy.

Novartis’ Kymriah: The First Gene Therapy to Be Approved in the US

The National Cancer Institute estimates that the incidence of ALL in patients aged 20 or younger is ~3,100 in the US.

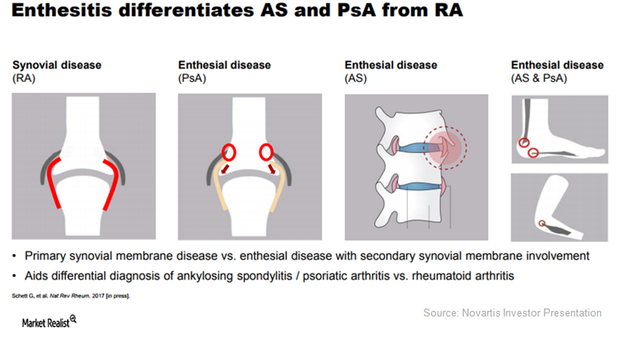

How Cosentyx Resolves Enthesitis in Psoriatic Arthritis Patients

Only 525,000 patients (or 55% of the diagnosed psoriatic arthritis patients) were eligible for treatment with biologics.

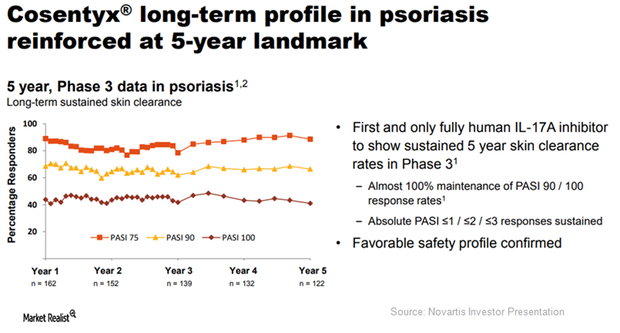

Novartis’s Cosentyx May Emerge as a Leading Psoriasis Drug

According to Novartis’s estimates for the US biologics market in 2016, there were ~8.4 million patients with moderate to severe psoriasis in the US.

GSK Has Emerged as Leading Player in Over-the-Counter Market

GlaxoSmithKline (GSK) is currently the leader in the 135 billion pound consumer healthcare market.

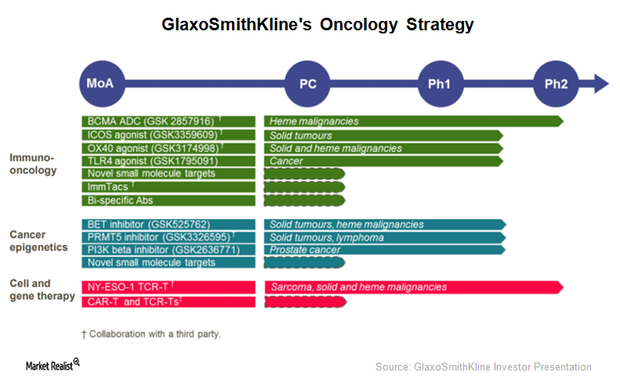

GSK Is Focused on Innovative Assets in Oncology Research Pipeline

In 2018, GlaxoSmithKline aims to initiate a pivotal phase 2 trial to evaluate GSK 916 as monotherapy Darzalex refractory population as the fourth line or the last line of multiple myeloma therapy.

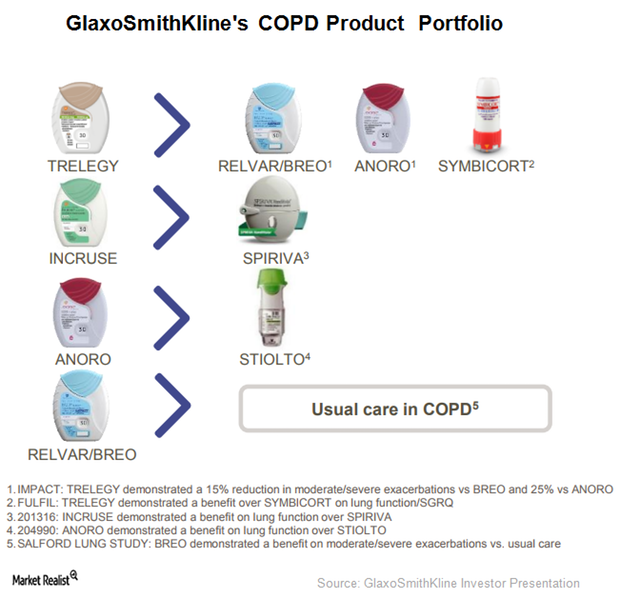

Trelegy Ellipta May Emerge as Major Growth Driver for GlaxoSmithKline

Trelegy Ellipta could enable GlaxoSmithKline to compete aggressively with other respiratory players such as Novartis (NVS).

Anoro Ellipta May Boost GlaxoSmithKline’s Respiratory Franchise Revenues

Anoro Elipta earned revenues of close to 233 million pounds in the first nine months of 2017, which is 77% year-over-year (or YoY) growth on a reported basis and 63% YoY growth on a constant exchange rate (or CER) basis.

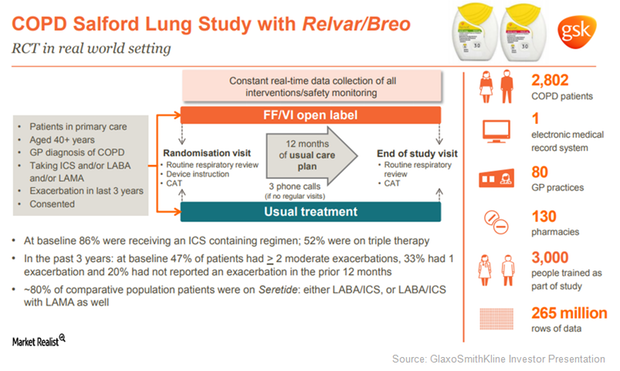

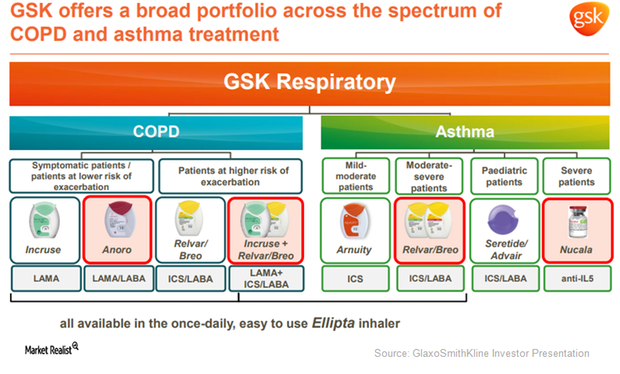

GlaxoSmithKline Is Focused on Maintaining Leadership in This Segment

To maintain its leadership in the chronic obstructive pulmonary disease (or COPD) segment, GlaxoSmithKline (GSK) has focused on shifting patients away from LAMA monotherapy to its LAMA/LABA bronchodilators.

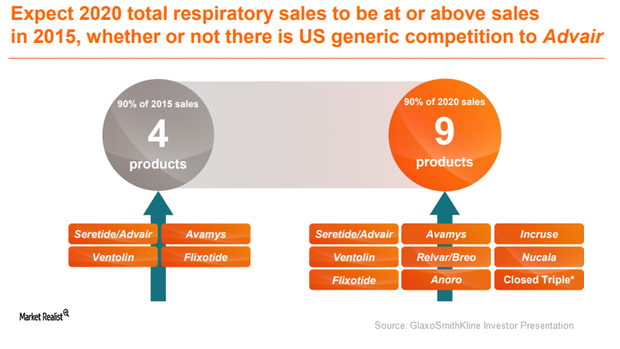

GlaxoSmithKline Has Developed a Broad Respiratory Portfolio

In 3Q17, GlaxoSmithKline (GSK) reported revenues close to 1.6 billion pounds from the sale of its respiratory products, which is year-over-year (or YoY) growth of 1% on a reported basis.

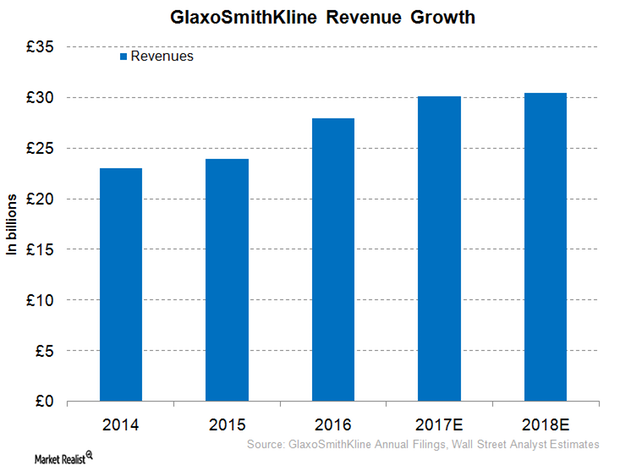

GlaxoSmithKline Could Witness Modest Rise in Revenues in 2017

GlaxoSmithKline (GSK) is a leading player in the global respiratory market with a major focus on the asthma and chronic obstructive pulmonary disease (or COPD) segments.

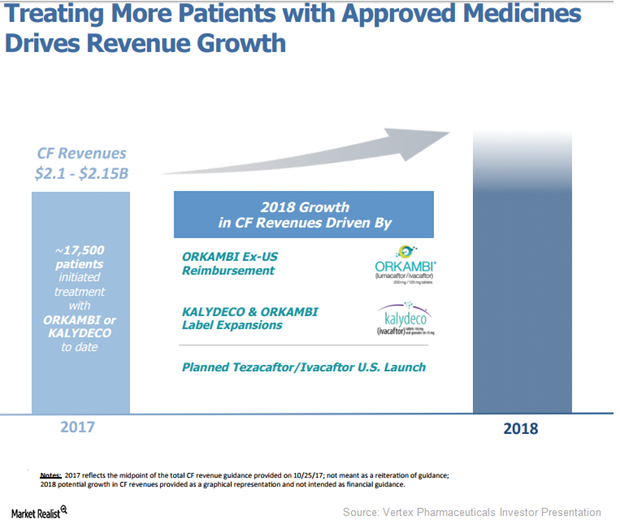

Vertex Pharmaceuticals Has Robust Late-Stage Research Pipeline

On January 10, 2018, Vertex Pharmaceuticals announced that Orkambi has secured regulatory approval from the European Commission to treat CF patients ages six to 11 years.

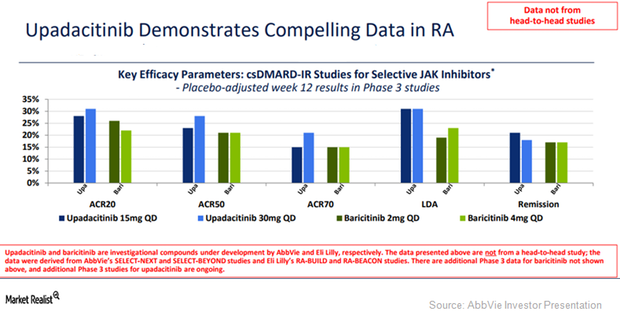

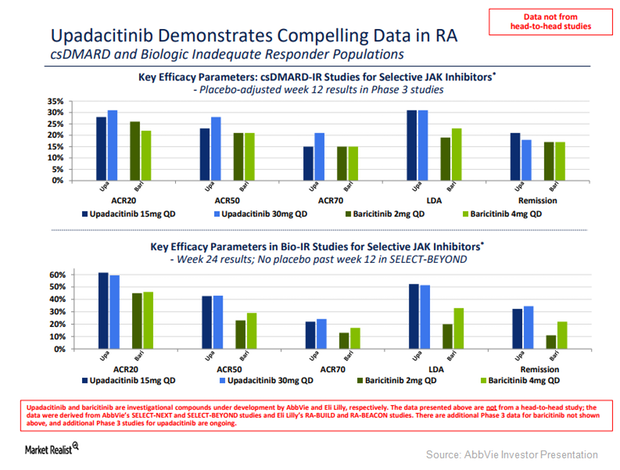

Why AbbVie’s Upadacitinib Keeps Posting Strong Data for Rheumatoid Arthritis

On December 20, 2017, AbbVie (ABBV) reported positive top-line results from its phase-3 trial Select-Monotherapy.

What Upadacitinib Did for AbbVie in 2017

In September 2017, AbbVie’s (ABBV) investigational immunology drug, Upadacitinib (ABT-494), managed to demonstrate its clinical potential.