Margaret Patrick

Margaret Patrick joined Market Realist in September 2014 and has written close to 3,000 articles. She has covered the healthcare sector, which includes pharmaceutical and biotechnology companies, medical device companies, health insurance companies, and hospital companies. Currently, she is following the cannabis sector.

Prior to joining Market Realist, Margaret worked as equity and data analyst at MSCI for a year and as a financial research analyst at Deloitte for two years. She completed her MBA with finance specialization in 2011. She also passed all three CFA levels.

Besides writing on stocks, Margaret loves to read about nutrition, culture, and mythology. She's also fond of traveling to new places.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Margaret Patrick

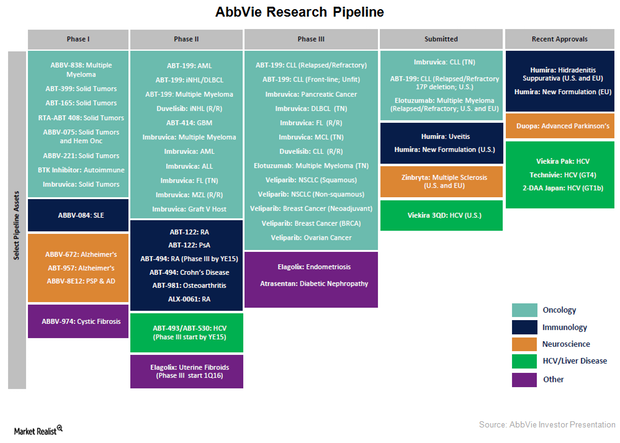

AbbVie’s Late-Stage Research Pipeline Could Boost Future Revenues

In partnership with Bristol-Myers Squibb, AbbVie is exploring elotuzumab to treat relapsed refractory multiple myeloma. The drug also received a breakthrough therapy designation from the FDA on May 19, 2014.

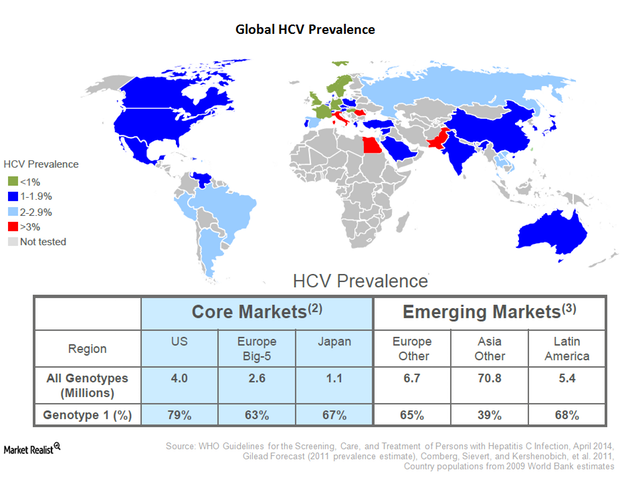

Merck Will Soon See a Decision on Its New Hepatitis C Therapy

The FDA has scheduled the Prescription Drug User Fee Act (or PDUFA) date for Merck’s new hepatitis C combination therapy for January 28, 2016.

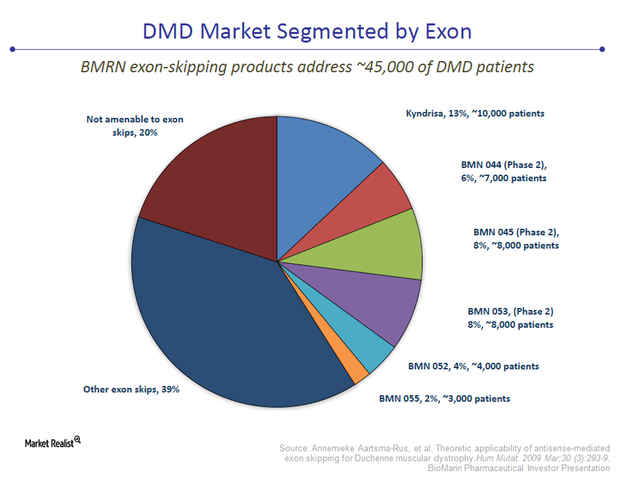

How Would Kyndrisa Treat Duchenne Muscular Dystrophy?

The FDA advisory committee has given an unfavorable opinion to Kyndrisa. But most analysts estimate the probability of FDA approval for the drug to be about 50%.

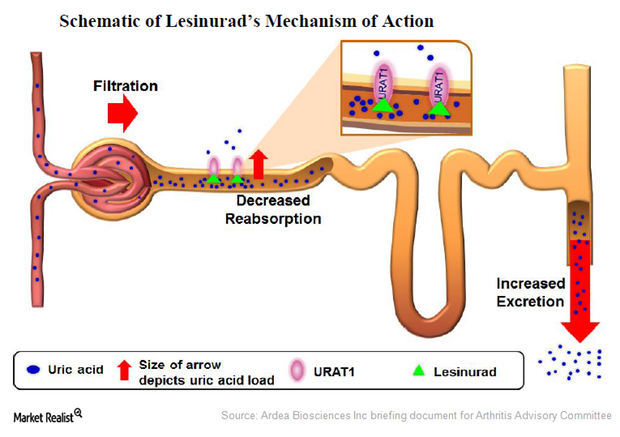

Lesinurad: A Selective Uric Acid Reabsorption Inhibitor for Gout

Lesinurad, originally developed by Ardea Biosciences, was acquired by AstraZeneca through the acquisition of Ardea in June 2012. It works to reduce the uric acid levels in gout patients.

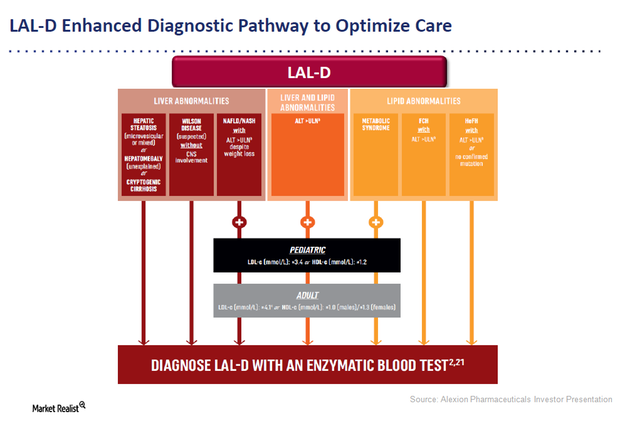

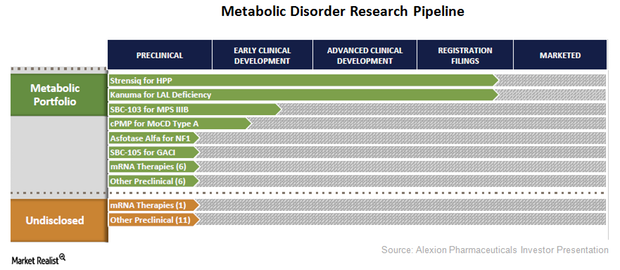

Kanuma: An Innovative Enzyme Replacement Therapy for LAL-D

Alexion Pharmaceuticals’ Kanuma is an innovative enzyme replacement therapy for patients suffering with lysosomal acid lipase deficiency (or LAL-D).

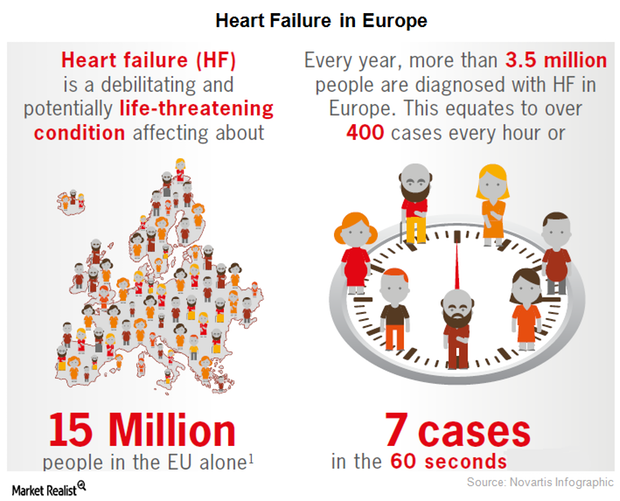

The European Commission Approved Novartis’s Entresto

On November 24, Novartis announced that the European Commission had approved Entresto as a therapy for adult patients suffering from symptomatic chronic heart failure with reduced ejection fraction.

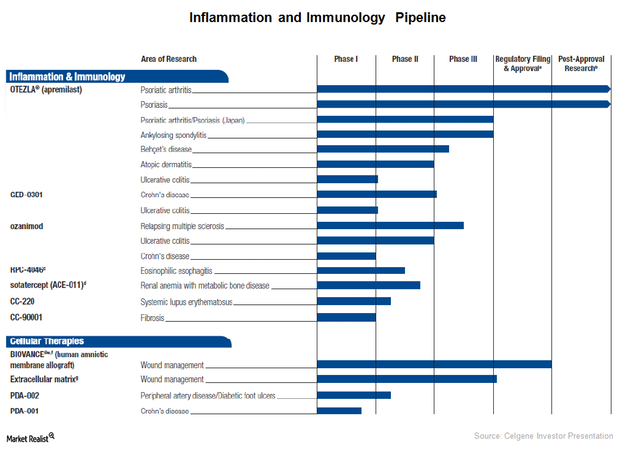

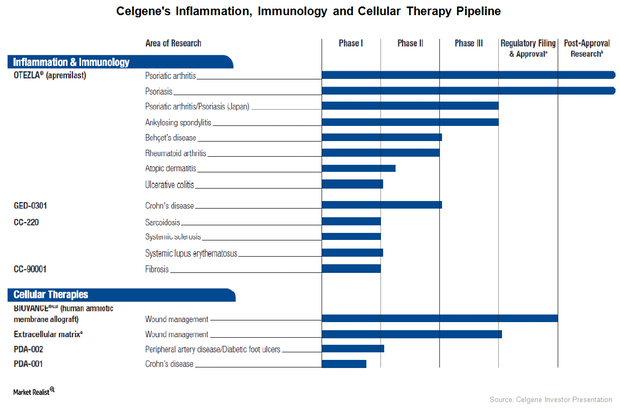

Celgene Has a Strong Inflammation and Immunology Pipeline

In 3Q15, Celgene had a strong inflammation and immunology pipeline. The company witnessed the progress of its key investigational drug GED-0301.

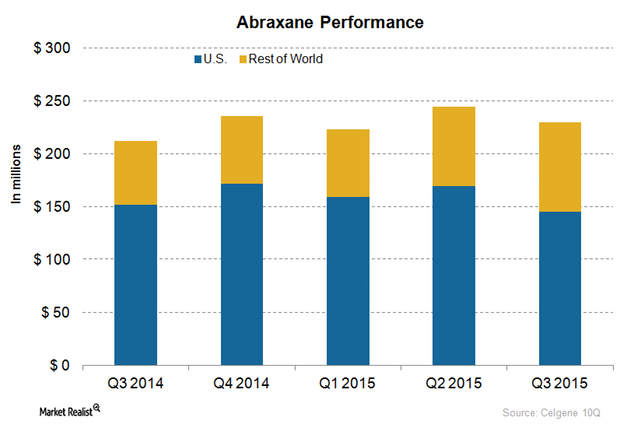

Abraxane Sales Are Lower than Expected in 3Q15

Abraxane’s sales in the US market fell by 4.2% from 3Q14 to 3Q15, while its sales in the rest of the world’s markets rose by 39.7% in the same time period.

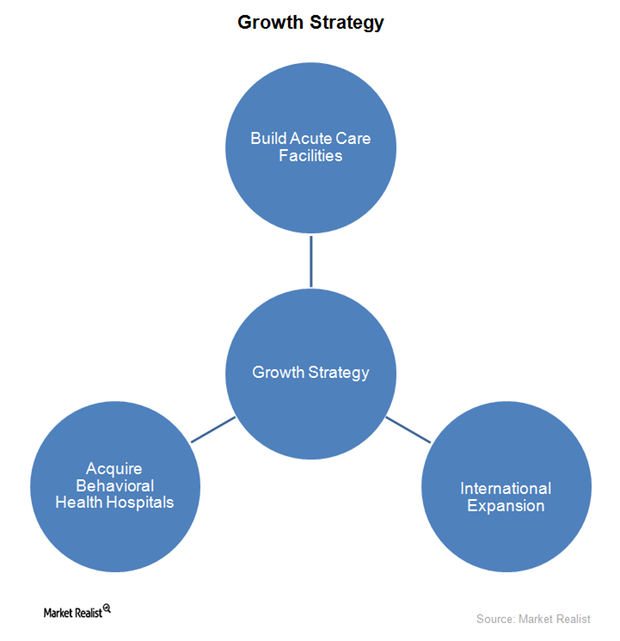

Universal Health Services Explores Growth Opportunities in 3Q15

In 3Q15, Universal Health Services was actively involved in exploring growth opportunities, both in its acute care as well as behavioral health business.

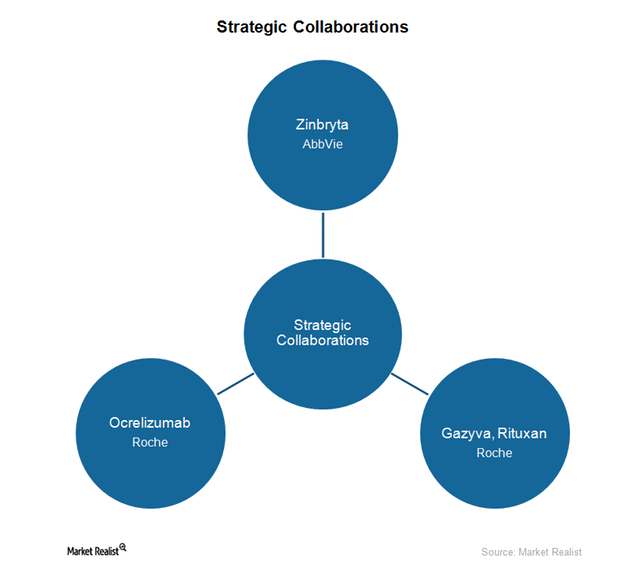

Biogen’s Collaborative Arrangements See Strong Development in 3Q15

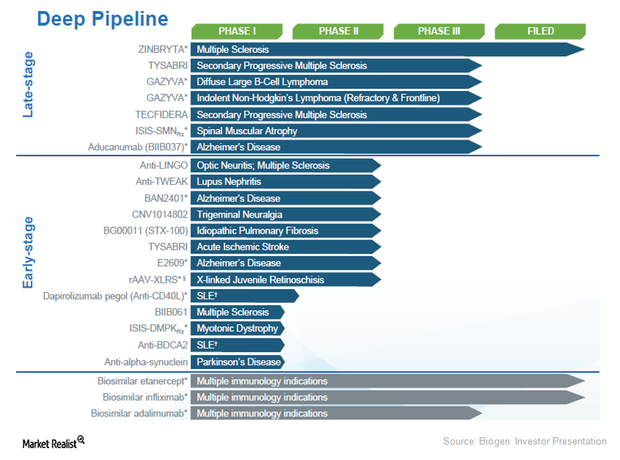

In 3Q15, Biogen saw several positive developments for the drugs developed under its various collaborative arrangements.

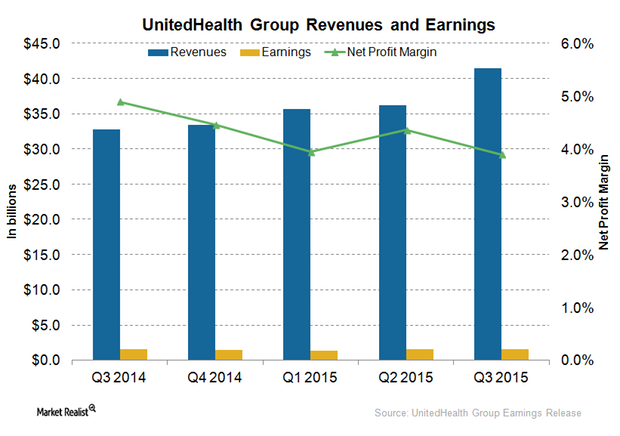

Why UnitedHealth Group’s Net Profit Margins Fell

In 3Q15, despite a rise of total revenues by 27% year-over-year, which includes 10% organic growth, UnitedHealth Group reported a decline of about 1% in net profit margins.

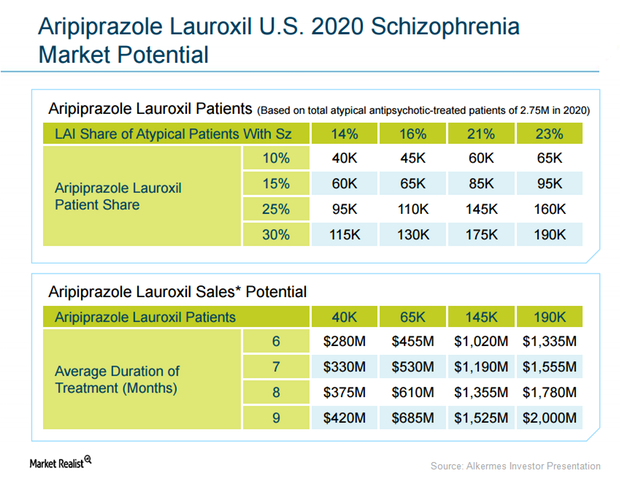

Alkermes’s Aristada and Its FDA Approval for Schizophrenia

Aristada was approved by the FDA and is projected to account for 10% to 30% of the LAI atypical antipsychotic market for schizophrenia patients in the US.

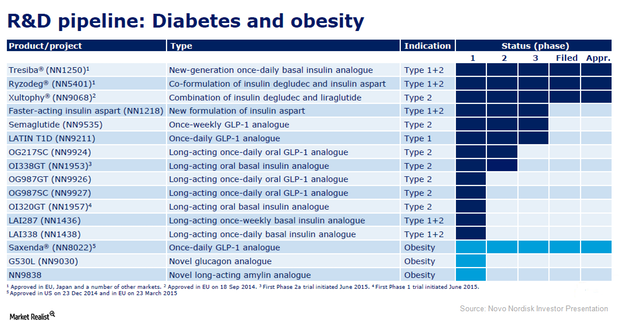

Novo Nordisk’s Innovative Research and Development Pipeline

Novo Nordisk’s research and development pipeline includes three late-stage insulin studies of faster-acting insulin aspart, semaglutide, and LATIN T1D.

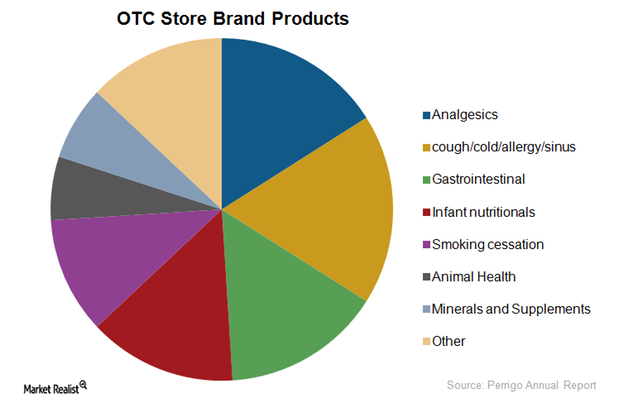

Perrigo Leads the Over-the-Counter Store-Branded Products Market

Perrigo is a market leader in over-the-counter store-branded products. Its leadership position extends to major geographies such as the US, the UK, and Mexico.

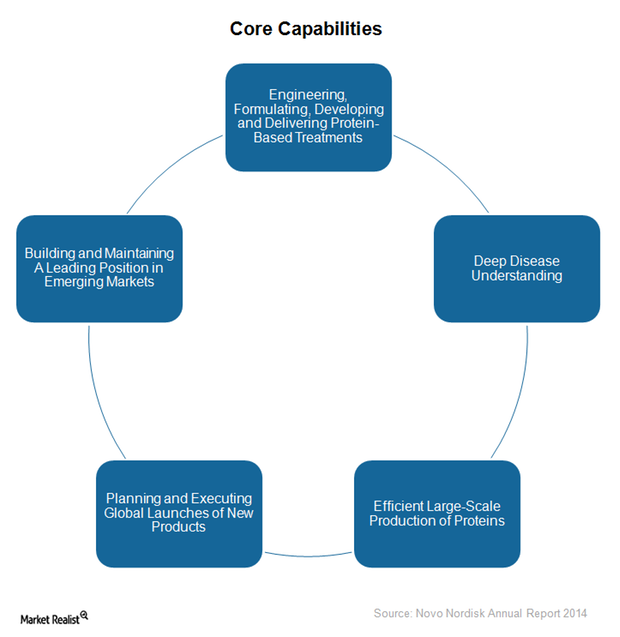

Novo Nordisk: Core Capabilities Differentiate It from Competition

Novo Nordisk has developed certain core capabilities that differentiate the company from its competition. One is establishing local organizations in emerging markets and then growing organically.

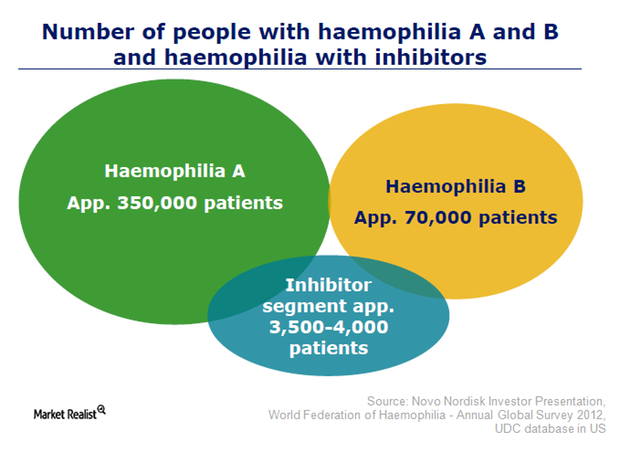

Novo Nordisk Plans to Pursue Leadership in Hemophilia Market

Novo Nordisk is pursuing leadership in the hemophilia market with its new drugs as well as a few investigational hemophilia drugs in its late-stage research pipeline.

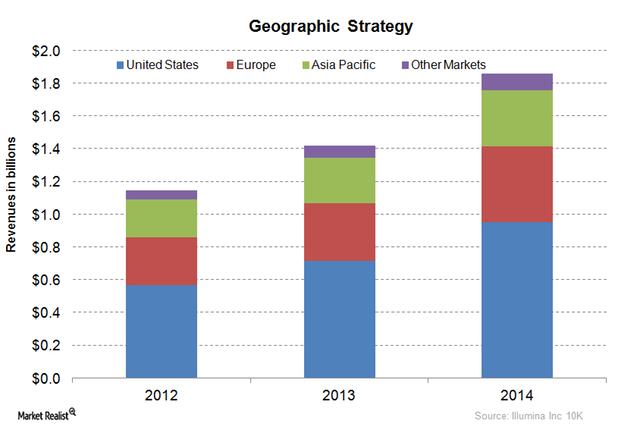

Illumina’s Market Expansion Strategy for Genome Sequencing

Illumina’s Market Expansion Strategy includes targeting the United States, Europe, and China for population sequencing projects.

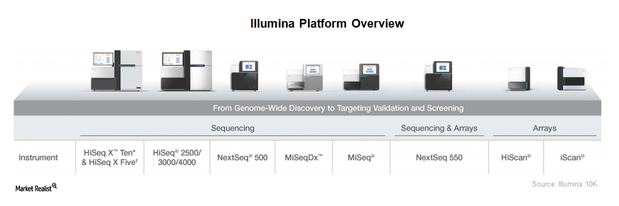

Illumina’s Key Products

Illumina’s key products are based on the company’s NGS (next-generation sequencing) technologies.

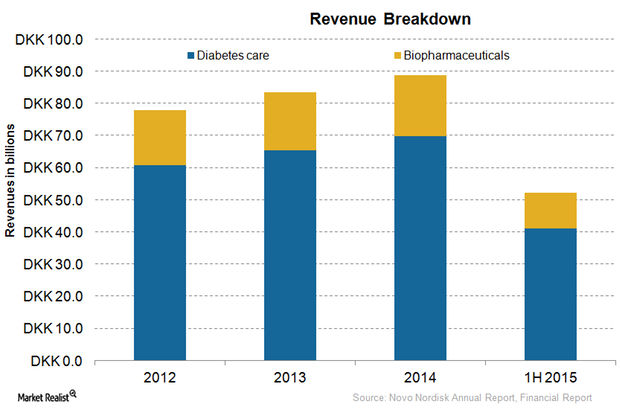

Novo Nordisk’s Business Model: An Overview

Novo Nordisk’s (NVO) business model includes a portfolio in areas such as diabetes, hemophilia, and growth hormones. In the first half of 2015, diabetes care accounted for 78.6% of its total revenues.

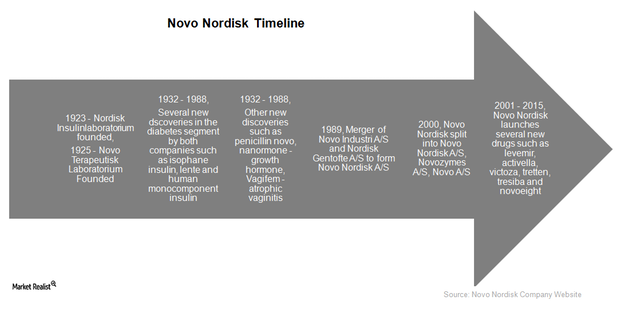

Novo Nordisk: An Investor’s Guide to a Leading Biotech Company

Novo Nordisk (NVO) is a leader in diabetes care with 90 years of experience coupled with a strong workforce of 39,700 in 75 countries around the world.

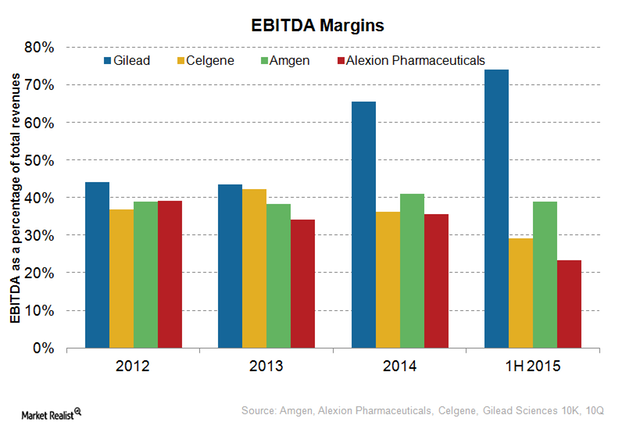

Alexion Pharmaceuticals’ Cost Structure and EBITDA Margins

Mature biotechnology companies generally earn EBITDA margins of about 30% to 40%.

Vertex Pharmaceuticals’ Cost Structure and EBITDA Margins

While mature biotechnology companies with drugs in multiple disease segments earn an average of 30%–40% EBITDA, margins of companies targeting only rare diseases can vary due to unique business models.

Alexion Pharmaceuticals Diversifies Its Research Pipeline

Alexion Pharmaceuticals (ALXN) has strengthened its drug pipeline by diversifying its research programs across the metabolic disorder segment.

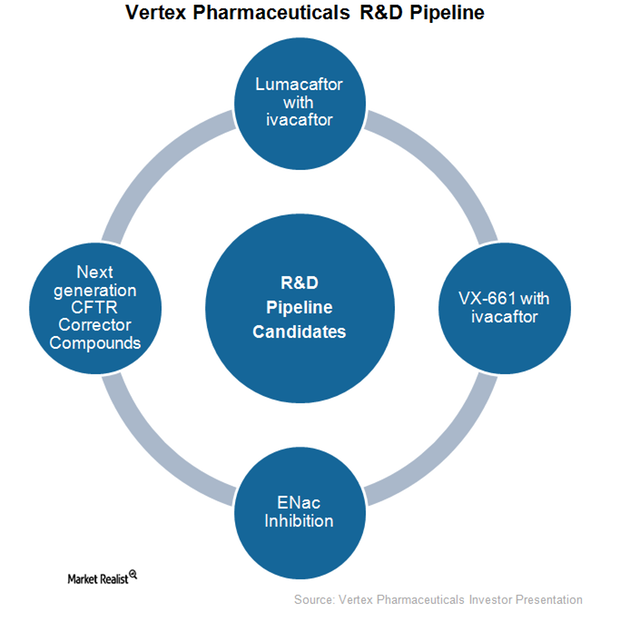

Vertex Has Strong Research and Development Pipeline

As part of its research and development, Vertex Pharmaceuticals (VRTX) has been actively exploring new cystic fibrosis (or CF) drugs as well as other indications for its existing drug Kalydeco.

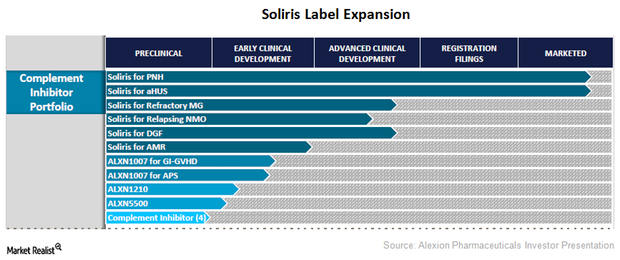

Alexion Pharmaceuticals Expands Soliris Labels

Alexion Pharmaceuticals is actively involved in expanding the approved labels for its flagship product Soliris.

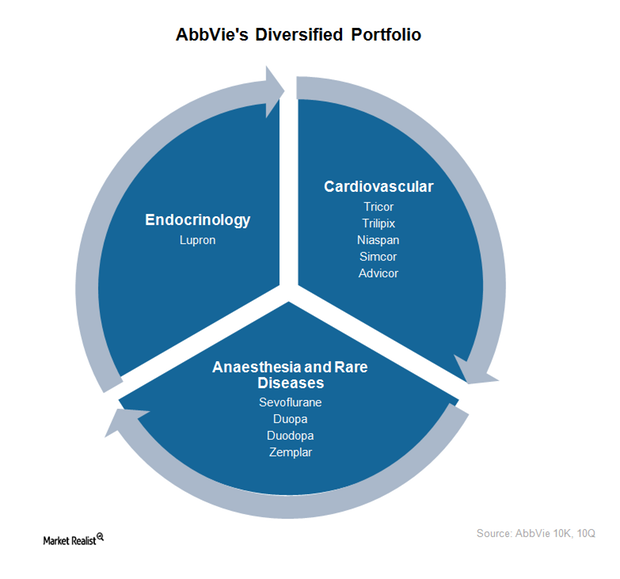

AbbVie’s Endocrinology, Cardiovascular, and Rare Disease Segments

AbbVie has a diversified offering of drugs for the treatment of conditions related to endocrinology, cardiovascular, and rare disease.

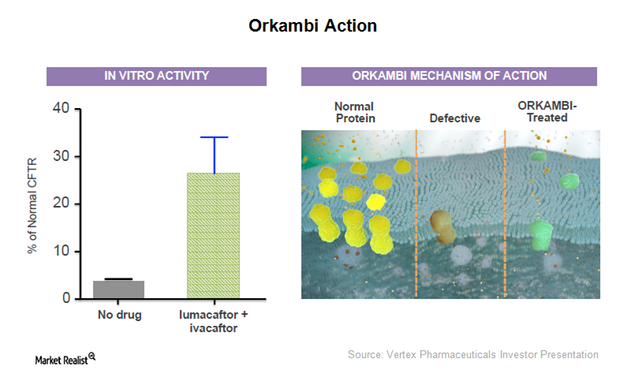

Vertex Pharmaceuticals’ New Drug Orkambi Receives FDA Approval

On July 2, 2015, the FDA (U.S. Food and Drug Administration) approved Orkambi, a combination drug of lumacaftor and ivacaftor, for treating cystic fibrosis (or CF) patients.

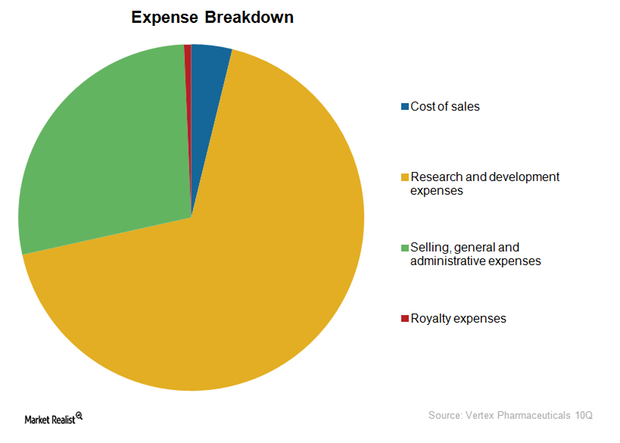

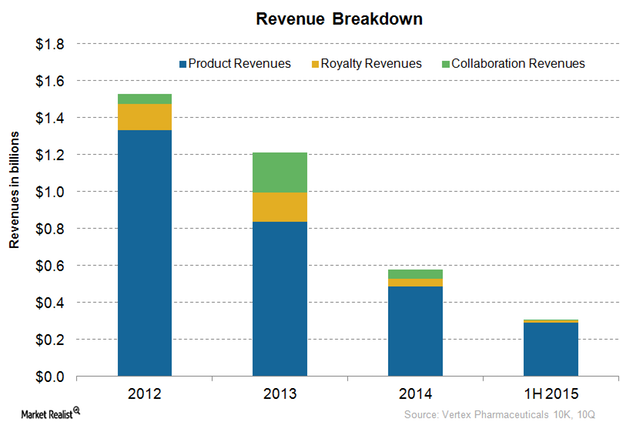

Vertex Pharmaceuticals’ 3-Pronged Business Model

Vertex Pharmaceuticals’ (VRTX) business model includes revenues in three areas: products, royalties, and collaboration. There’s significant variability in royalty and collaboration revenues.

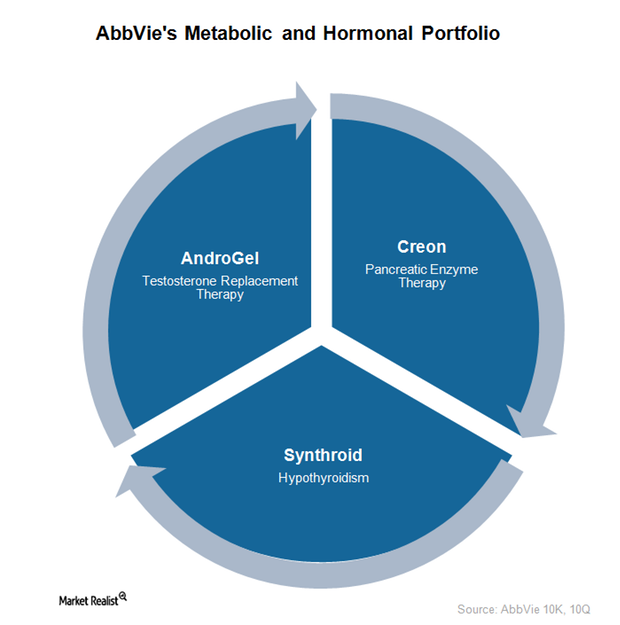

AbbVie Has a Strong Metabolic and Hormonal Portfolio

AbbVie’s metabolic and hormonal portfolio offers drugs such as AndroGel, Creon, and Synthroid to address various medical conditions.

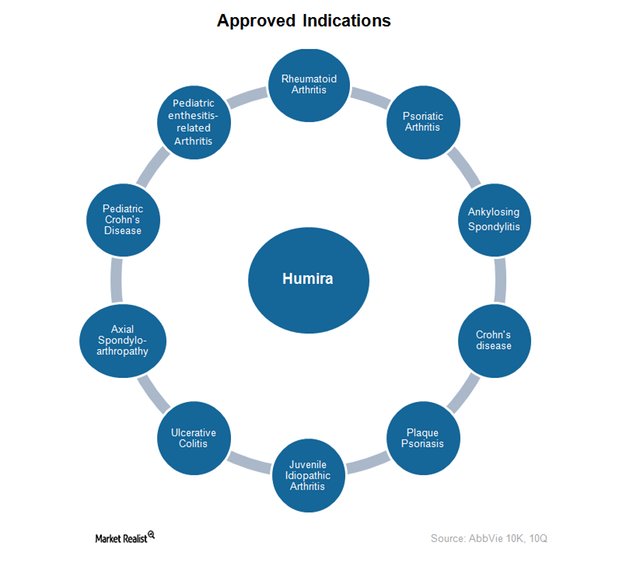

Humira Continues to Dominate AbbVie’s Revenues

Since Humira’s launch in the US market in 2002, Abbott Laboratories and its spin-off AbbVie have aggressively expanded the drug’s approved indications.

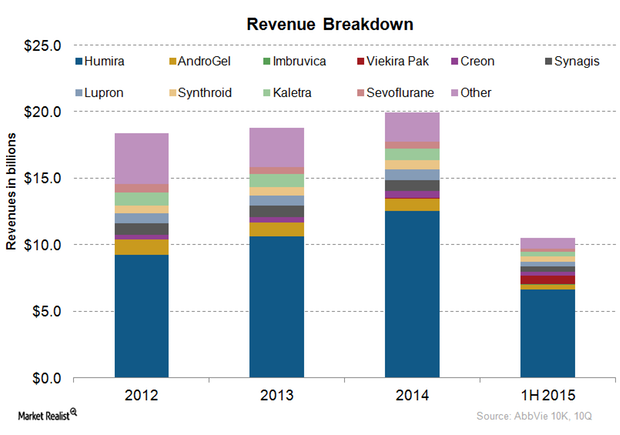

An Overview of AbbVie’s Business Model

AbbVie’s business model involves generating revenues through the sale of pharmaceutical products, which target some of the world’s most serious diseases.

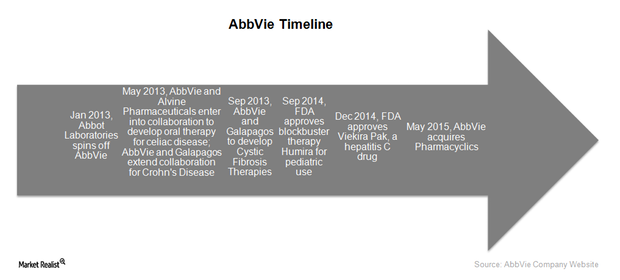

AbbVie: An Investor’s Look at a Leading Biotechnology Company

With a market capitalization of $100.7 billion, AbbVie is a major US biopharmaceutical company. AbbVie competes with Amgen, Gilead Sciences, and Bristol-Myers Squibb .

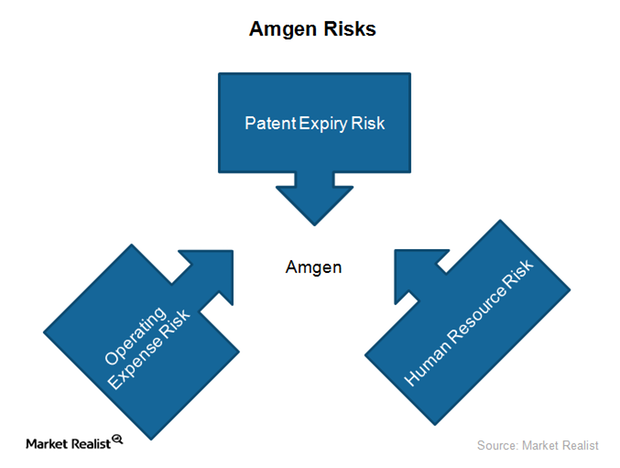

Amgen’s Key Risks

Amgen’s key risks include market erosion due to generic competition for Neulasta and Neupogen. Its restructuring also involves a reduction of about 3,500–4,000 employees.

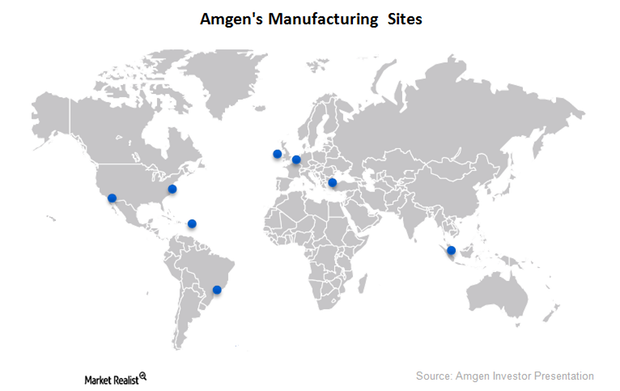

Amgen Develops World-Class Manufacturing Capability

Enhancing its manufacturing capability, Amgen has launched a next-generation bio-manufacturing facility in Singapore and plans to set up more in the coming years.

Amgen’s Presence in the Biosimilar Market

As it is still relatively difficult to introduce biosimilars, Amgen plans to enter the US market by leveraging experience of biosimilars in the European market.

Amgen’s Research and Development Strategy

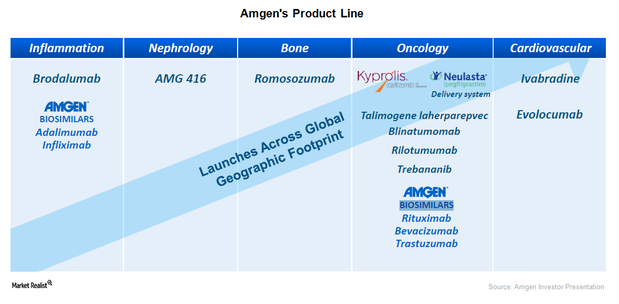

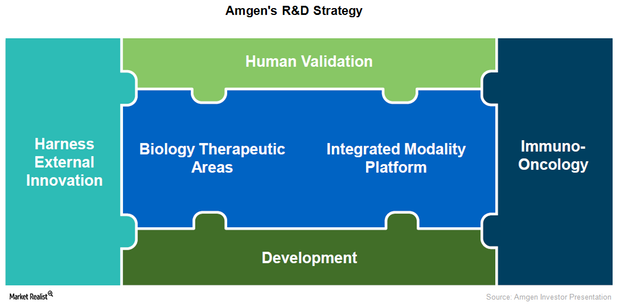

Amgen (AMGN) has adopted a well-structured research and development strategy focused on inflammation, metabolism, bone, and cardiovascular diseases.

Amgen’s Presence in Inflammation, Nephrology, and Bone Segments

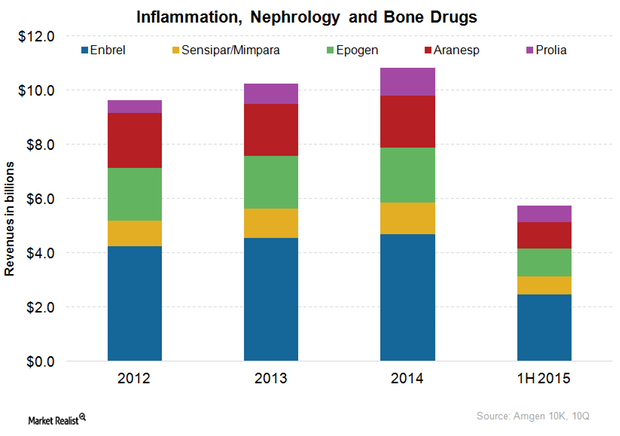

Amgen offers various nephrology drugs such as Epogen, Aranesp, Sensipar, and Mimpara. Both Epogen and Aranesp have been facing squeezed profits from tight competition.

An Overview of Regeneron’s Business Model

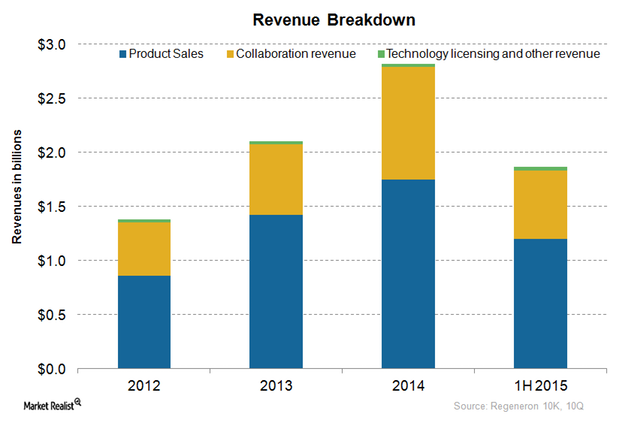

Regeneron generates revenues in three ways: product sales, revenues earned through collaboration arrangements, and revenues earned from licensing proprietary technology.

Regeneron: An Investor’s Overview to a Leading Biotech Company

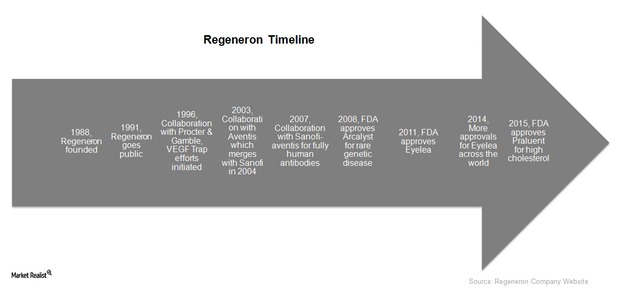

With a market capitalization of $50.7 billion, Regeneron is one of the country’s major biotechnology companies. Its products and pipeline candidates focus on cancer, eye diseases, and cardiovascular diseases.

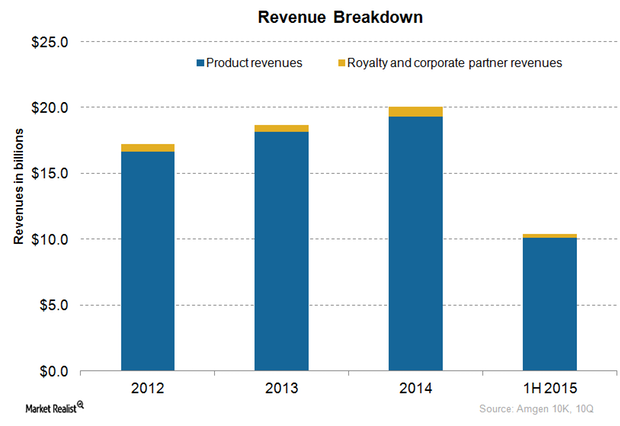

An Overview of Amgen’s Business Model

Amgen’s (AMGN) business model generates revenues in two ways: product sales and other revenues mainly comprised of royalties and corporate partner income.

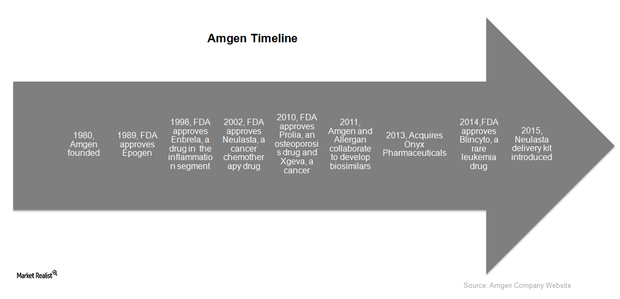

Amgen: An Investor’s Overview to a Leading Biotech Company

An overview of global biotechnology company Amgen shows a market capitalization of $127.2 billion. Headquartered in Thousand Oaks, California, Amgen has a presence in 75 countries.

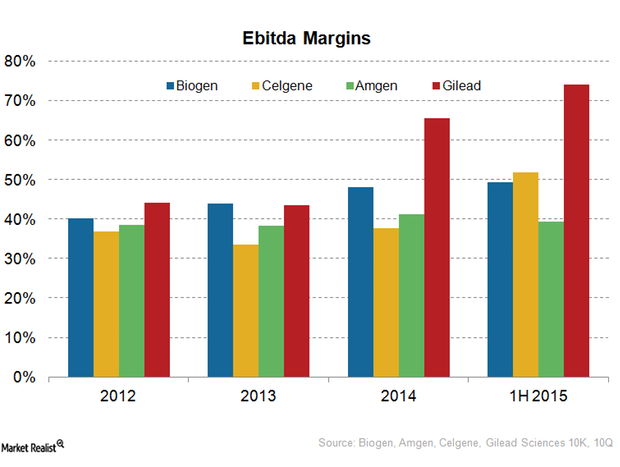

Celgene’s EBITDA Margins Surpass Competitors

Celgene’s EBITDA margins were lower than those of its competitors. Its R&D investment appears to be higher than its peers, and its SG&A expenses have risen.

Celgene’s Growing Inflammation and Immunology Pipeline

Celgene has entered the inflammation and immunology drug market, as well as the cell therapies market, in order to be less dependent on MM drugs.

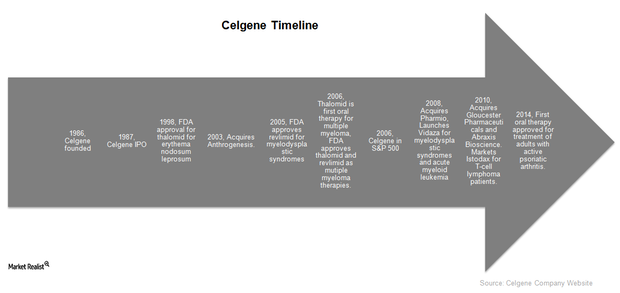

Introducing Celgene, a Leading Biotech Company

Celgene has consistently delivered breakthrough innovations in biotechnology and has as actively pursued acquisitions of companies for access to compounds.

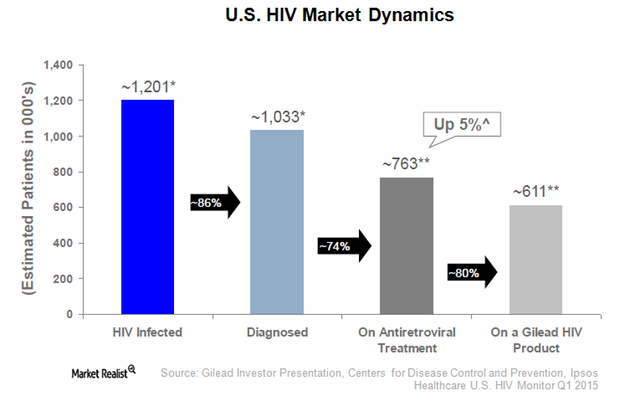

Gilead: Global Leader in the HIV Market

Gilead Sciences (GILD), a biotechnology leader in the human immunodeficiency virus, or HIV, market, offers drugs to eight out of every ten HIV naïve patients in the US.

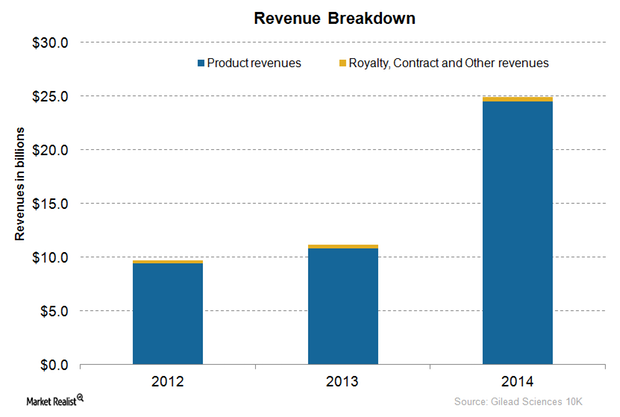

An Overview of Gilead Sciences’ Business Model

Gilead Sciences’ business model consists of product sales in the HIV and HCV markets, as well as royalty, contract, and other revenues.

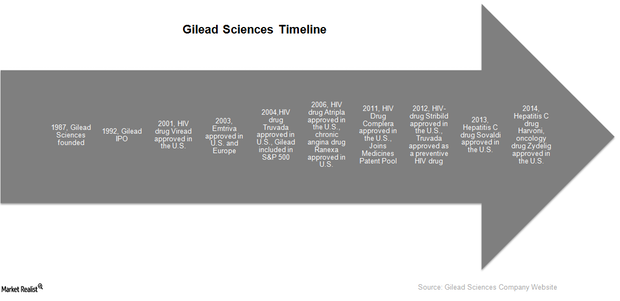

Gilead Sciences: Investor’s Overview of a Leading Biotech Company

The strong leadership of Gilead’s talented scientists has enabled the company to consistently deliver innovative therapies in the market.

Biogen: Positive 2Q15 Results for Multiple Sclerosis Pipeline Drugs

In 2Q15, Biogen (BIIB) posted mixed results for its pipeline drugs. Investor sentiment remained favorable for its innovative multiple sclerosis (or MS) drugs.

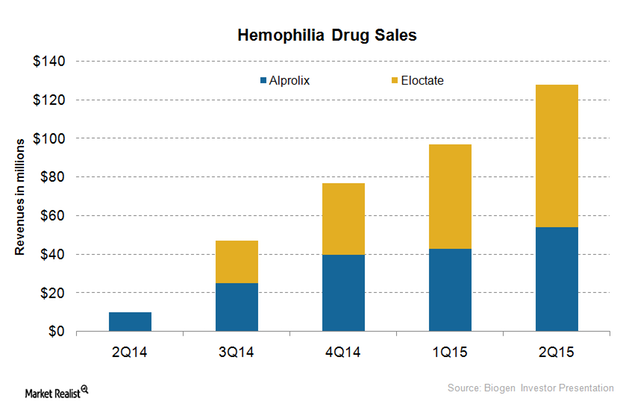

Biogen’s Hemophilia Portfolio: Growing Market Share in 2Q15

Biogen’s (BIIB) hemophilia drugs, Alprolix and Eloctate, continued to gain new patients in 2Q15.

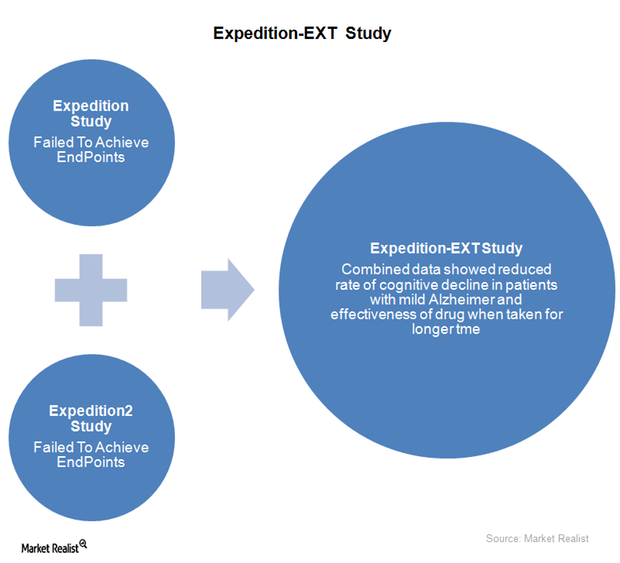

Eli Lilly’s Solanezumab: A Possible Cure for Alzheimer’s?

If approved, solanezumab would be a breakthrough therapy in the Alzheimer’s market. The drug actually seeks to cure the cognitive disease, not simply treat it.