Margaret Patrick

Margaret Patrick joined Market Realist in September 2014 and has written close to 3,000 articles. She has covered the healthcare sector, which includes pharmaceutical and biotechnology companies, medical device companies, health insurance companies, and hospital companies. Currently, she is following the cannabis sector.

Prior to joining Market Realist, Margaret worked as equity and data analyst at MSCI for a year and as a financial research analyst at Deloitte for two years. She completed her MBA with finance specialization in 2011. She also passed all three CFA levels.

Besides writing on stocks, Margaret loves to read about nutrition, culture, and mythology. She's also fond of traveling to new places.

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Margaret Patrick

Healthcare Analyzing hospital expenses: Breaking down the important costs

You can break down average hospital costs into salary expenses, supply expenses, bad debt expenses, and miscellaneous expenses. Labor costs account for about 49% of expenses, and they’re the biggest expenses for hospitals.

Is Amazon Moving into the Cryptocurrency Space?

Investors around the world expect Amazon (AMZN) to join the group of technology giants launching their own cryptocurrencies.

Is Jim Cramer Not a Fan of Cannabis Stocks Anymore?

Jim Cramer expressed disappointment with the cannabis industry, claiming it may not be the “incredible opportunity” he thought it was.Healthcare Overview: Assessing hospital companies’ capital expenditures

Capital projects in the hospital sector include purchasing new facilities, purchasing medical equipment, renovating and replacing existing hospitals, and investing in information systems infrastructure.Healthcare Understanding hospitals’ size, technology, and operating expenses

In the capital-intensive hospital industry, economies of scale offer a competitive advantage by spreading out the high fixed costs, providing for higher margins.

Aurora Cannabis Runs Mexico’s Cannabis Market

Legal cannabis in Mexico is going through several twists and turns. The country first allowed medical marijuana in June 2017.

Charlotte’s Web: November Price Target Update

Charlotte’s Web Holdings has fallen 15.44% on the Toronto Stock Exchange. Its stock has dropped 43.58% on the TSE since its Q2 earnings on August 14.

What Analysts Expect from Canopy Growth’s Revenues

Canopy Growth (CGC) is set to release its fiscal 2020 second-quarter earnings results on November 14. Let’s take a look at the word on Wall Street.

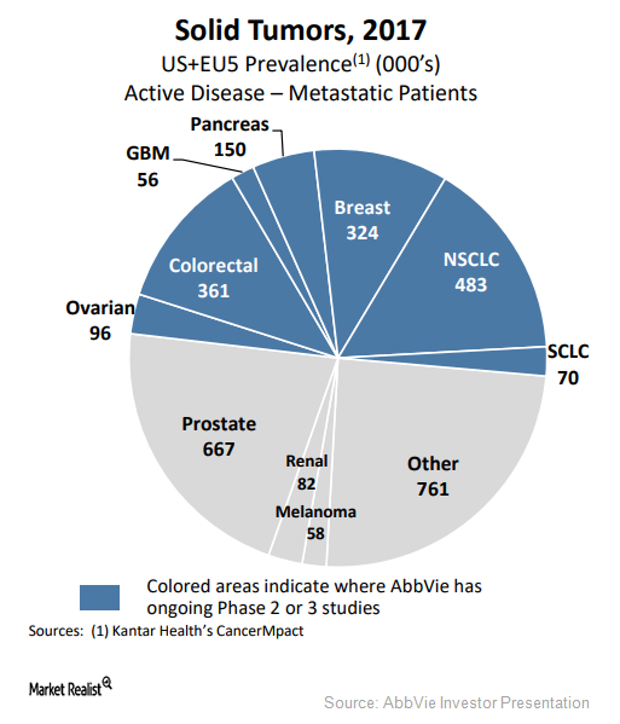

AbbVie Rapidly Advancing Its 2018 Solid Tumor Portfolio

AbbVie (ABBV) is currently evaluating more than 20 investigational therapies targeting solid tumors. Seventeen of them are in Phase 1 trials.

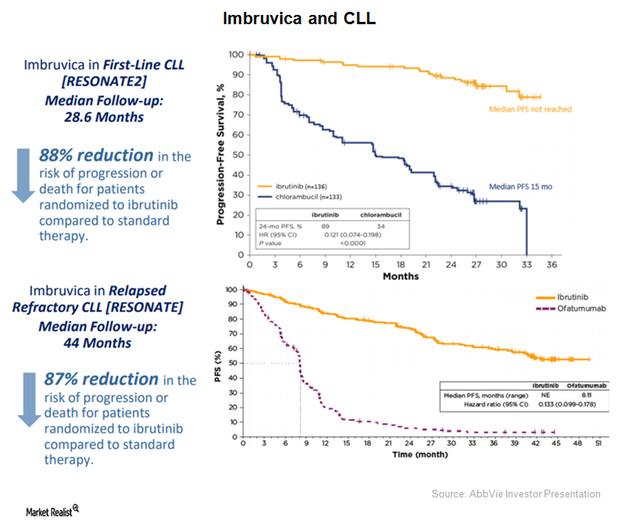

AbbVie Expects Peak Sales of $7 Billion for Imbruvica

AbbVie (ABBV) has projected Imbruvica’s annual revenues to be $5 billion by 2020. That would be driven by a rapid uptake in the first line chronic lymphocytic leukemia (or CLL) segment.

Could Angela Merkel Legalize Cannabis in Germany?

Media reports indicate that Angela Merkel’s party may consider legalizing cannabis in Germany. Medical marijuana has been legal in Germany since 2017.

Curaleaf Comes Out with Cannabis Tablets in Florida

Yesterday, Curaleaf became the first company to launch medical cannabis tablets in Florida. It’s made these tablets available at all state dispensaries.

Amazon Targeting $240 Billion Southeast Asian Market

Amazon’s interest in the promising Southeast Asian Internet market is growing, as shown by its talks to acquire a stake in Indonesia-based Gojek.

Why Is Lannett Company Soaring Today?

Generic pharmaceutical player Lannett Company (LCI) entered into a distribution agreement with China-based specialty pharmaceutical firm Sinotherapeutics.

Why Audible Is Being Sued by Publishers

On August 23, seven prominent members of the Association of American Publishers sued Amazon’s (AMZN) Audible for copyright infringement.

Third-Party Sellers: Opportunity or Threat for Amazon?

At the end of the second quarter, Amazon’s (AMZN) third-party sellers accounted for 54% of the paid units sold on the platform.

Amazon Prime: Integral Part of Amazon’s Success Story

CIRP estimates that Amazon Prime members spend $1,400 per year on Amazon’s e-commerce platform—much higher than non-Prime members’ $600 annual spending.

Amazon Is Targeting a $9 Trillion B2B Opportunity

Amazon Business could tap 5% of the international e-commerce market by 2021. The global B2B e-commerce market could be worth $9 trillion by 2021.

Amazon One-Day Delivery: What to Know

In April, Amazon announced its plan to transform its free two-day shipping program to a free one-day shipping program for its Prime customers.

How Analysts View Arrowhead Pharmaceuticals

In Q2, Arrowhead Pharmaceuticals reported revenues of $48.15 million—a YoY rise of 7,305.95%—ahead of the consensus estimate by $5.19 million.

Why Is Allakos Soaring Today?

Today, Allakos (ALLK) announced favorable results from its Phase 2 trial evaluating investigational therapy AK002.

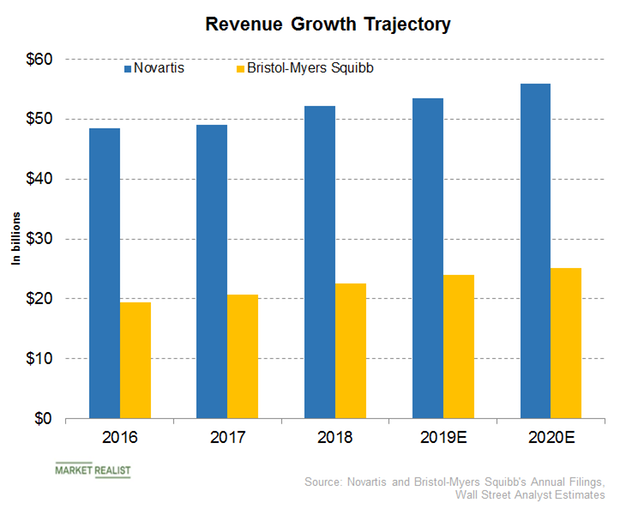

NVS or BMY: Who’s Expected to Post Faster Revenue Growth in 2019?

According to the company’s fourth-quarter earnings conference call, Novartis expects to complete the spin-off of its Alcon business in the second quarter of 2019.

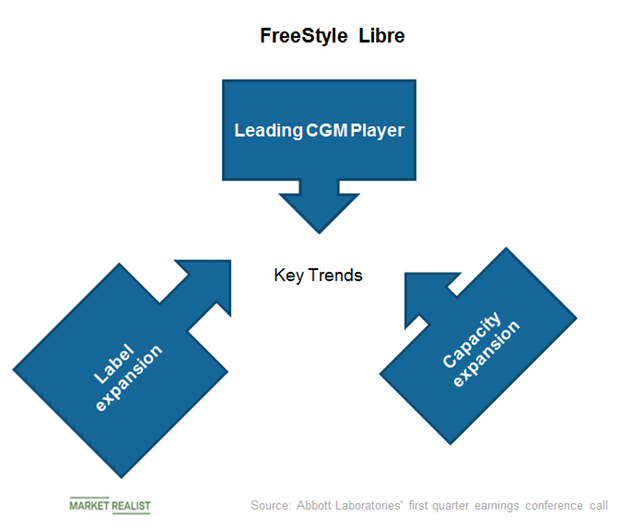

FreeStyle Libre Is Multi-Billion Dollar Opportunity for Abbott

In the first quarter, Abbott Laboratories’ (ABT) Diabetes Care franchise reported worldwide sales of $566 million, a YoY rise of 34.4% on a reported basis.

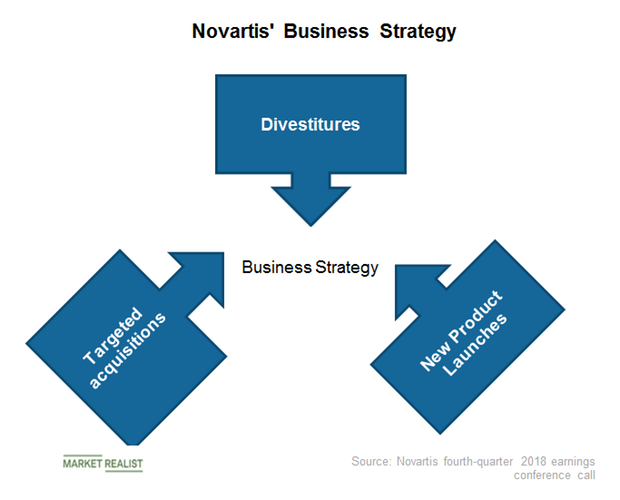

How Novartis Is Transforming Its Structure in 2019

Since fiscal 2018, Novartis (NVS) has been focused on transforming itself into a new focused medicines company.

Why Did Intec Pharma Crash on Monday?

On Monday, Intec Pharma (NTEC) closed at $0.55—81.61% lower than the previous close. The company failed the pivotal Phase 3 ACCORDANCE trial.

What to Expect From Bristol-Myers Squibb in Q2

Bristol-Myers Squibb will release its second-quarter earnings on Thursday. The revenues will likely rise 7.16% YoY to $6.11 billion in the second quarter.

A Look at GSK’s Spending and Earnings in Fiscal 2019

In the first-quarter earnings investor presentation, GlaxoSmithKline (GSK) reaffirmed adjusted EPS guidance of a YoY decline of 5%–9% YoY in fiscal 2019.

How Are AstraZeneca’s Revenues Trending in 2019?

On its first-quarter earnings conference call, AstraZeneca (AZN) guided for year-over-year product sales growth in high-single-digit percentage in 2019. The company, however, expects modest product sales growth in the second half of 2019 due to higher oncology revenue in the previous period.

How Tandem Diabetes Care Is Advancing Its Product Pipeline

Tandem Diabetes Care (TNDM) plans to file an application seeking FDA approval for use of its Control-IQ technology in t: slim X2 insulin pumps for patients aged 14 and above.

Comparing Pfizer’s and Merck’s Vaccines Businesses

In the first quarter, Pfizer’s (PFE) vaccine franchise reported revenue of $1.61 billion, a YoY (year-over-year) rise of 10.18%.

Comparing Pfizer’s and Merck’s 2019 Revenue Growth Trajectories

In its first-quarter earnings investor presentation, Pfizer (PFE) reaffirmed its 2019 revenue guidance of $52.0 billion–$54 billion.

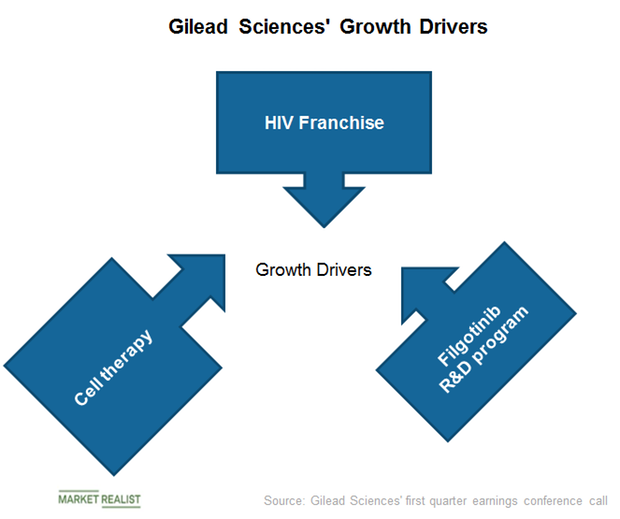

What Are Gilead Sciences’ Key Growth Drivers in 2019?

Since the second quarter of 2016, Gilead Sciences has been reporting major YoY revenue declines, mainly due to its lower HCV franchise sales.

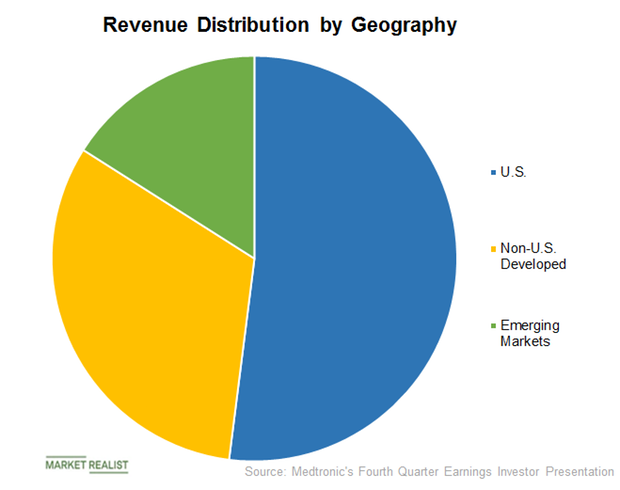

Emerging Markets: Medtronic’s Key Revenue Driver in 2019

In the fourth quarter, Medtronic earned revenue of $4.28 billion in the US market, a YoY (year-over-year) rise of 2.3% on a reported and constant-currency basis.

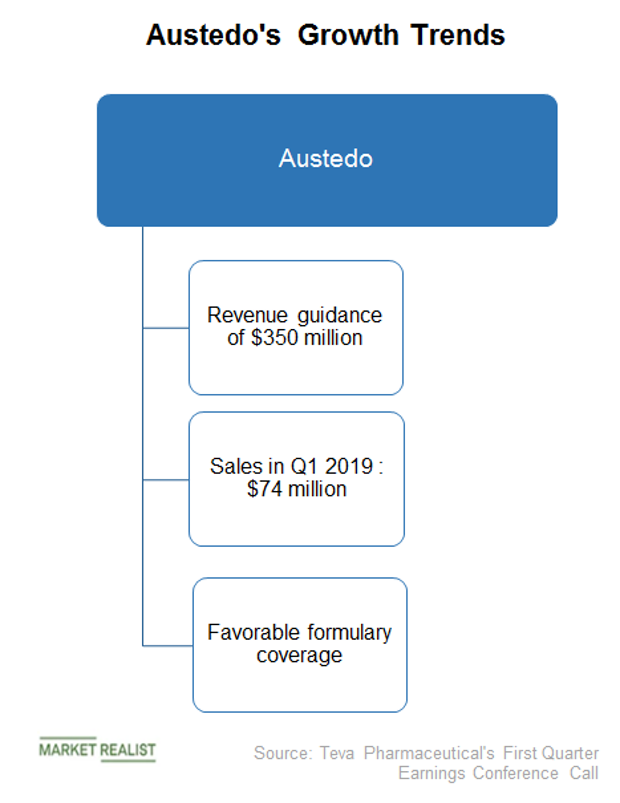

Ajovy and Austedo: Teva Pharmaceutical’s Growth Strategy

On April 2, Teva Pharmaceutical issued a press release announcing the European Union’s approval of its monthly and quarterly dosages of Ajovy for preventing migraines.

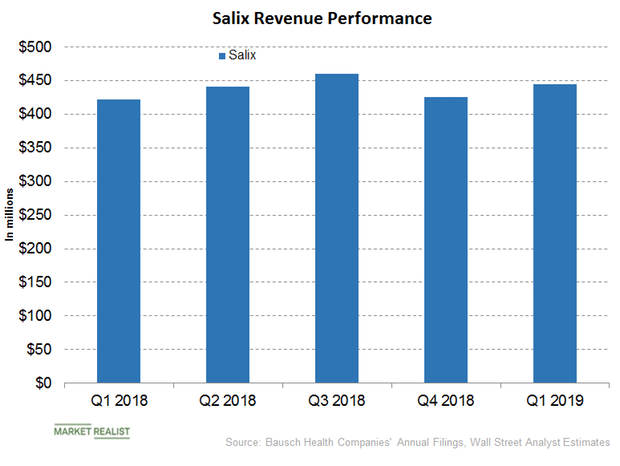

BHC’s Salix Segment: Xifaxan Drove Its Revenues in Q1

In the first quarter, Bausch Health Companies (BHC) reported revenues of $445 million for its Salix segment.

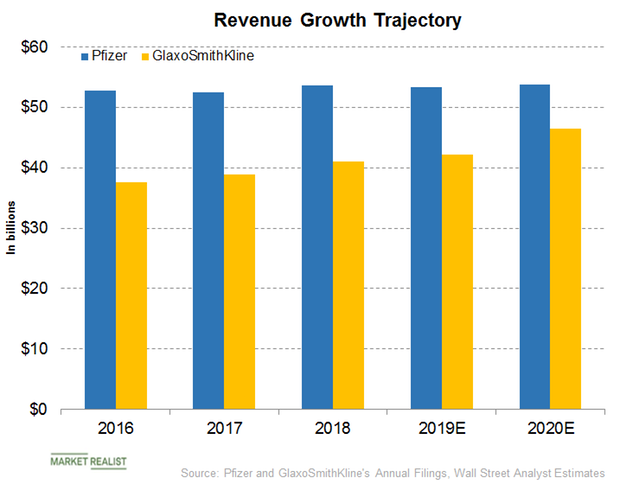

Comparing the Revenue Growth Trajectories of PFE and GSK

On its first-quarter earnings conference call, Pfizer (PFE) maintained its 2019 revenue guidance of $52 billion–$54 billion.

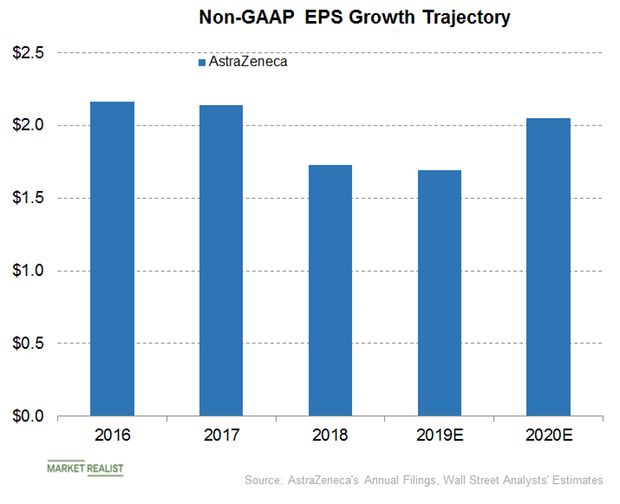

What AstraZeneca Expects for EPS in Fiscal 2019

In its first-quarter press release, AstraZeneca (AZN) reiterated its guidance for core EPS of $3.50–$3.70 in fiscal 2019.

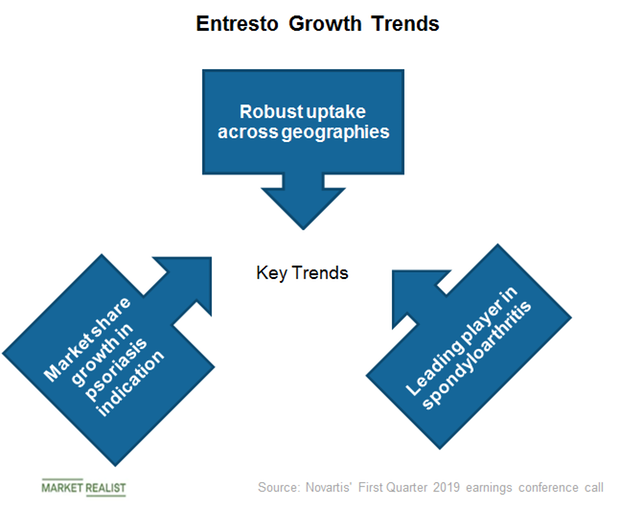

A Look at Cosentyx, Novartis’s Fast-Growing Immunology Drug

In the first quarter, Novartis’s (NVS) Cosentyx reported net sales of $791 million, a YoY (year-over-year) rise of 41% on a constant currency basis.

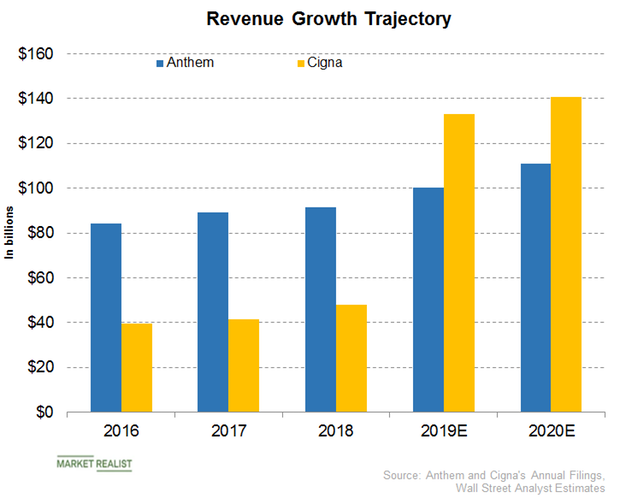

ANTM or CI: Comparing Their Revenue Growth in 2019

In its fourth-quarter earnings press release, Anthem (ANTM) guided for 2019 operating revenue of $100 billion, a YoY (year-over-year) rise of $8.7 billion.

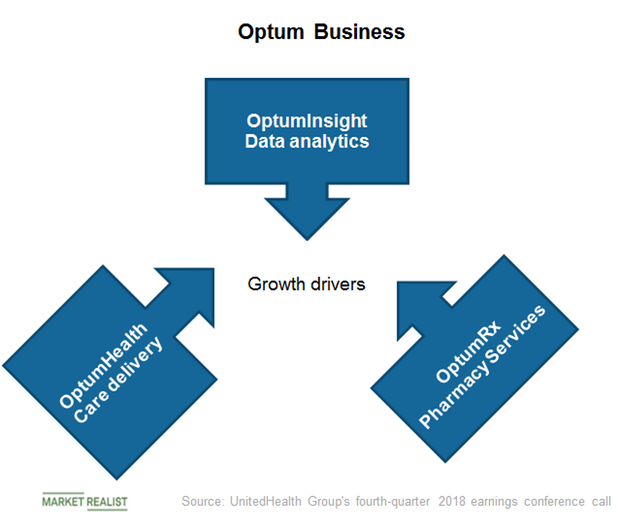

Optum Is a Major Differentiator for UnitedHealth Group

In fiscal 2018, UnitedHealth Group’s (UNH) health services business, Optum, reported revenues of $101.3 billion, a YoY rise of 11.07%.

Analysts Raise Their Target Price for Regeneron in March

Wall Street analysts expect a potential upside of 6.79% for Regeneron Pharmaceuticals based on the company’s closing price on March 27.

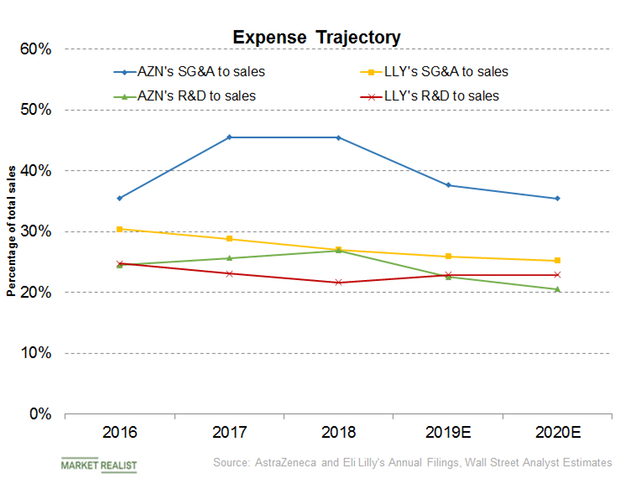

AstraZeneca or Eli Lilly: Which Is Controlling Expenses Better?

In its fourth-quarter earnings press release, AstraZeneca (AZN) guided for a low single-digit YoY (year-over-year) rise in core operating expenses in fiscal 2019.

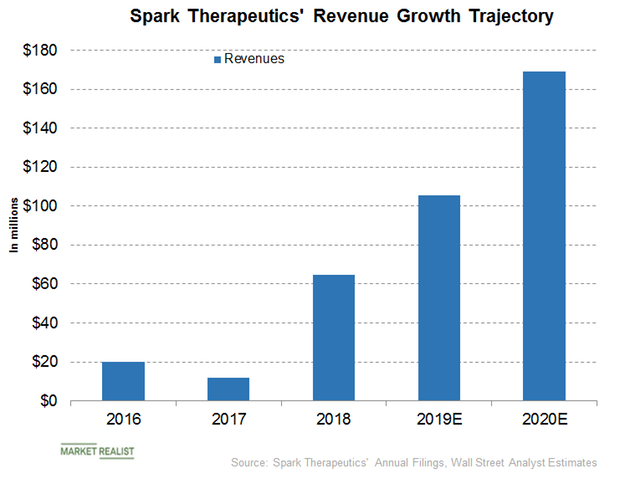

A Look at Spark’s Potential Revenue Contribution to Roche Holdings

Wall Street analysts have projected Spark Therapeutics’ revenues to be $105.64 million, $169.22 million, and $263.76 million for fiscal 2019, fiscal 2020, and fiscal 2021, respectively.

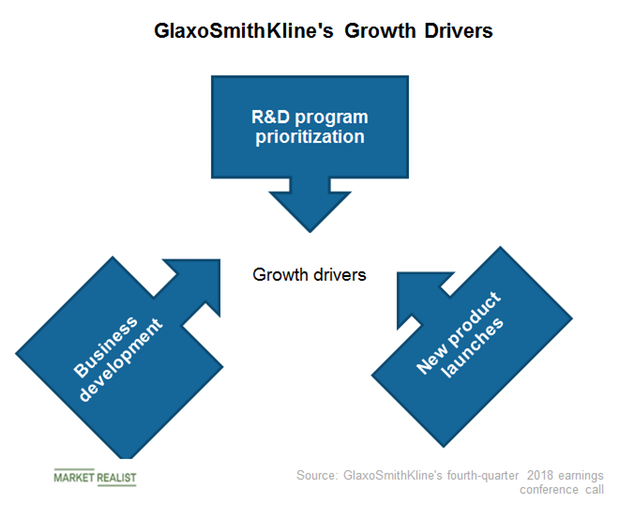

What Are the Key Growth Drivers for GlaxoSmithKline in 2019?

GSK highlighted the prioritization of research and development programs, business development, and new product launches as its key growth drivers in 2018.

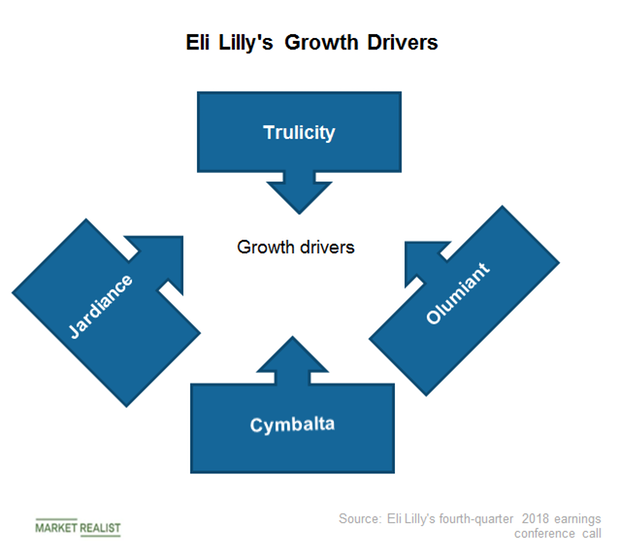

What Are the Key Growth Drivers for Eli Lilly in Fiscal 2019?

In its fourth-quarter earnings investor presentation, Eli Lilly (LLY) highlighted its newer products such as Emgality, Verzenio, Olumiant, Lartruvo, Taltz, Basaglar, Jardiance, Trulicity, and Cyramza as its key drivers.

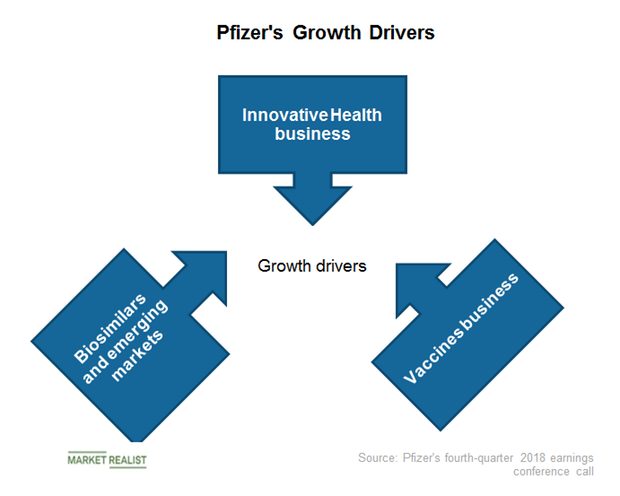

What Are the Key Growth Drivers for Pfizer in Fiscal 2019?

According to Pfizer’s fourth-quarter earnings conference call, Ibrance has managed to report global revenues of $4.1 billion in fiscal 2018.

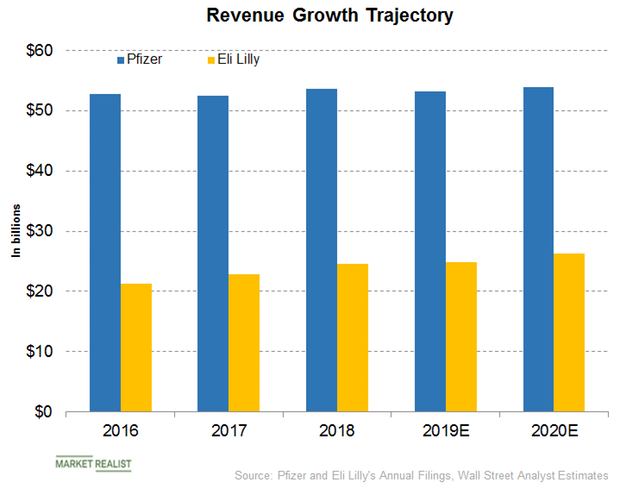

Pfizer or Eli Lilly: Who Will Report Better Revenue Growth?

In its fourth-quarter earnings conference call, Pfizer (PFE) has guided for revenues of $52 billion to $54 billion for fiscal 2019.

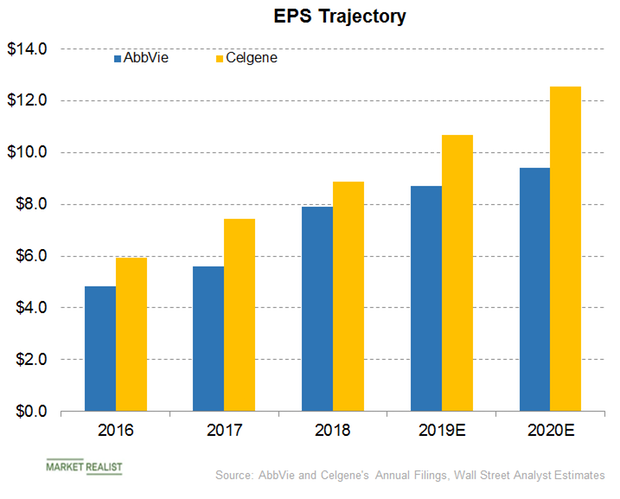

AbbVie or Celgene: Which Is Expected to Report Faster EPS Growth?

On its fourth-quarter earnings conference call, AbbVie (ABBV) guided for an adjusted gross margin of 82.5% in 2019.

What Are Abbott Laboratories’ Key Growth Drivers in 2019?

On its fourth-quarter earnings call, Abbott forecast that its Established Pharmaceuticals segment would grow in the mid- to high single digits YoY in the first quarter.

Here Are Some Possible Headwinds and Tailwinds for JNJ in 2019

In its fourth-quarter earnings investor presentation, Johnson & Johnson (JNJ) highlighted increasing biosimilar and generic competition, pricing pressure, and the strengthening of the US dollar as key challenges for the company in fiscal 2019.